AMAZON ARE WE HEADING TO $258 ? HERE IS THE FULL ANALYSIS Hi Trading fam

So we have Amazon and based on what we are seeing we see two scenarios playing out:

Bullish:

If we can break and hold above 219 then we can see levels of : 235,241,and 258 being hit

Bearish:

If break the low of 210 then we hit 207,204, 199, 190 and then 185

Trade Smarter Live Better

Kris

AMZN

AMZN Amazon Options Ahead of EarningsIf you ahven`t bought the recent dip on AMZN:

Now analyzing the options chain and the chart patterns of AMZN Amazon prior to the earnings report this week,

I would consider purchasing the 245usd strike price Calls with

an expiration date of 2025-9-19,

for a premium of approximately $7.02.

If these options prove to be profitable prior to the earnings release, I would sell at least half of them.

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

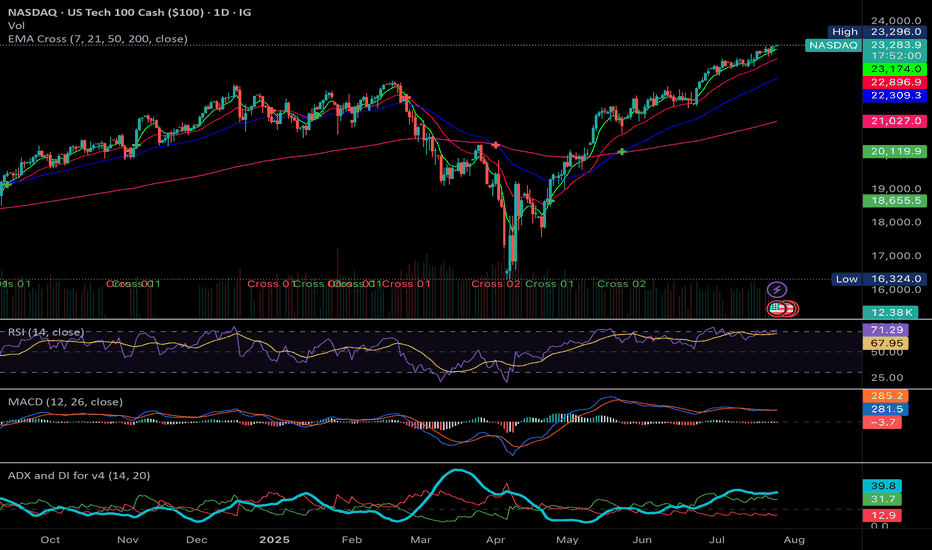

NASDAQ100 continue its strength due to the strong earning seasonFundamental:

USTEC (NASDAQ100) continues its strength, propelled by robust Alphabet (GOOG) earnings that buoyed technology companies. Cloud services recorded the largest growth at 32% YoY, primarily driven by AI. Concurrently, the company plans to allocate $85 bln to capital expenditure in 2025 for AI, an increase from $75 bln, signaling continued surging demand for AI infrastructure.

In addition, recent US economic data indicated strong consumption and optimism, with the July Services PMI expanding to 55.2 from 52.9 in the previous month. Initial Jobless Claims also fell to 217k, the lowest in 14 weeks, reinforcing optimism regarding the labor market, alongside stronger-than-expected Nonfarm Payrolls from early July.

Inflation data showed a minor impact from tariffs, and tariff negotiations have progressed favorably. Trade deals have been secured with Vietnam, Indonesia, Japan, and the Philippines, and potential trade agreements with the Eurozone and India are anticipated before the deadline.

Major earnings releases are slated for next week, including MSFT, META, and QCOM on July 30. AMZN and APPL's results the following day could provide a clearer picture of USTEC's overall earnings.

Meanwhile, USTEC's forward P/E currently stands at 27x, aligning with its 5-year average despite reaching a new record high, suggesting further upside potential.

Technical:

The index is trading above its EMAs, which are extending, signaling a continuation of the rally.

If USTEC sustains its momentum, the index may reach 24000 upon breaking above the potential resistance at 23400.

Conversely, a pullback near the swing high may suggest a retest of the support at 23000.

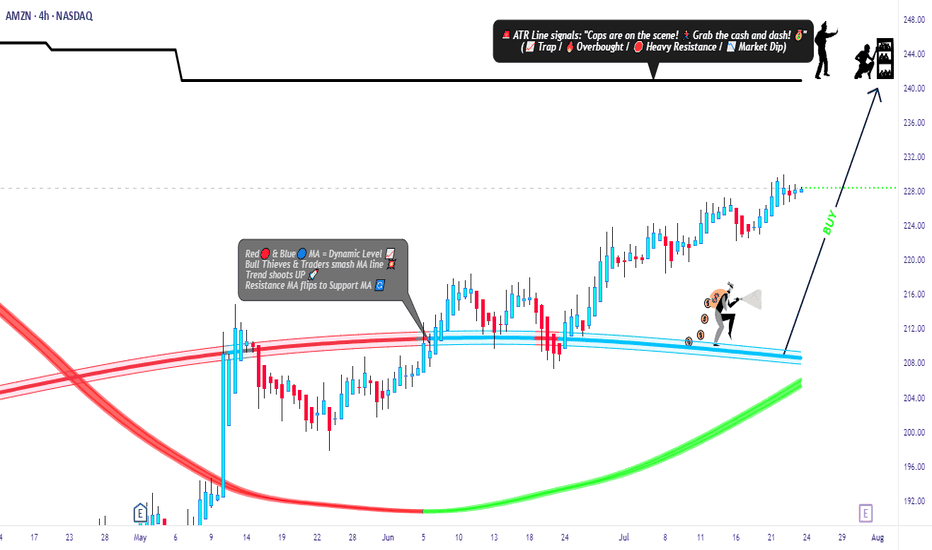

Amazon Market Robbery Blueprint – Swing/Scalp Long Setup🟨💣 “AMZN Market Heist Blueprint – Bullish Robbery in Progress 🚨💼💸” 💣🟨

By Thief Trader – Rob the Market with Precision

🌍 Hello World! Hi, Hola, Ola, Bonjour, Hallo, Marhaba!

🤑💰 Calling all Money Makers & Market Robbers – get ready to execute the next bullish heist on AMAZON.COM, INC (NASDAQ: AMZN), powered by our signature Thief Trading Style™ – where technical precision meets psychological warfare.

🔥 Plan Summary:

Based on our fundamental & technical intel, we’re eyeing a long entry into AMZN. The target? 💥The High-Risk ATR Police Barricade Zone – a zone flooded with liquidity, overbought conditions, fakeouts, and bear traps. It's where most traders get caught – but we walk in with a blueprint.

🟩 Entry Zone – “The Vault Is Wide Open!” 💼📈

🕰 Entry timeframe: 15min / 30min (preferably after confirmation or rejection wick)

💵 Buy Limit Orders: Place multiple layered entries (DCA-style) near recent swing lows/highs. Wait for breakout confirmation; no blind orders before breakout!

Thief Note: This isn’t spray-and-pray – this is sniper-mode. Scope, place, execute.🎯

🛑 Stop Loss – “SL is the Escape Route!”

📍 SL below recent 4H candle wick swing low (around 219.00 – adjust based on your risk/margin size).

Important: Only place SL after breakout; not before. Risk per order must match your lot strategy.

🎯 Target – “Grab the Bag or Escape Before the Alarms!”

💸 Target Zone: 240.00

🧠 Smart robbers know when to bail early – use a trailing SL to lock gains. Exit before reversal or heavy volume shift.

👀 Scalper Alert – “Only One Way – LONG!”

If you’re a quick thief with a fat bag, hit-and-run with a Long scalp. If you’re running lean, swing with the crew. Watch the PA and news timing. Trailing SL = insurance policy.

📊 Why Bullish? Here’s the Background:

🔍 Macro Drivers

💼 COT Report

🌍 Geo-political Influences

🧠 Sentiment Score

📈 Index Correlation

🔮 Intermarket Signals

💹 Institutional Positioning

All lights flashing green for short-to-midterm bullishness, but keep checking real-time updates.

⚠️ Risk Alert – News Triggers Can Blow Your Cover 🚨

🗞 Avoid trading near major news releases – they cause volatility spikes.

🧲 Always protect gains with trailing stops and don’t over-leverage your ammo.

💖 Support the Robbery – Hit BOOST 🔥

Smash that 💥BOOST💥 button if you ride with the Thief Trading Crew!

Let’s build this into the #1 robbery squad on TradingView.

Make money. Protect profits. Trade like a bandit – with a plan. 💼📈🏆

🔔 Stay Tuned for the Next Robbery Mission 🔔

Another heist plan dropping soon. Until then, rob smart, rob safe, and rob rich.

– Thief Trader™ | Rob The Market. Not Your Wallet.

AMAZON STRONG UPTREND|LONG|

✅AMAZON is going up

Now and the stock made a bullish

Breakout of the key horizontal

Level of 220$ and the breakout

Is confirmed so we are bullish

Biased and we will be expecting

A further bullish move up

LONG🚀

✅Like and subscribe to never miss a new idea!✅

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

AMAZON Will Keep Growing! Buy!

Hello,Traders!

AMAZON is trading in an

Uptrend and the stock made

A breakout and retest of the

Key horizontal support

Of 218$ and is going up again

So we are bullish biased

And we will be expecting

A further bullish move up

Buy!

Comment and subscribe to help us grow!

Check out other forecasts below too!

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

AMAZON Local Short! Sell!

Hello,Traders!

AMAZON made a retest

Of the horizontal resistance

Around 219$ and the stock

Is already making a local

Bearish pullback so a further

Bearish correction

Is to be expected

Sell!

Comment and subscribe to help us grow!

Check out other forecasts below too!

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

Amazon: Continuing to RiseWith Amazon’s recent climb, prices are edging closer to the top of wave (1) in magenta. However, there is still a bit of upside potential in the short term before wave (2) makes its corrective move. Our primary scenario does not anticipate a new low below $160.50. Instead, we expect wave (3) in magenta to eventually surpass resistance at $242.52. Under our alternative scenario, there is a 30% chance we could see new lows below $160.50. In this case, wave alt.B in beige would have peaked at $242.52, prompting us to focus on a magenta downward impulse.

📈 Over 190 precise analyses, clear entry points, and defined Target Zones - that's what we do.

Shoulders to the Sky: Amazon’s Breakout Journey BeginsOverview

Name: Amazon.com, Inc

Ticker Symbol: AMZN

Exchange: NASDAQ

Founded: 1994

Headquarters: Seattle, Washington, USA

CEO: Andy Jassy (as of 2025)

Sector: Consumer Discretionary / E-commerce & Cloud Computing

About

Amazon is a global e-commerce and cloud services powerhouse. It dominates online retail while also operating AWS (Amazon Web Services), one of the world’s leading cloud computing platforms. Other segments include advertising, logistics, streaming, AI hardware (Alexa), and physical retail.

Fundamentals

Earnings: Amazon has consistently beaten revenue expectations with strong growth in AWS and advertising segments.Revenue: Q1 2025 revenue topped $154.8B, up 13% YoY, with solid margins.Outlook: Management has raised guidance for Q2 citing AI integration in AWS and retail efficiency gains.

Technicals

Inverted Head and Shoulders Pattern confirmed on the daily chart — a strong bullish reversal signal.

Price has broken above the neckline (~$213–$215) with volume confirmation.

Golden Cross forming on short-term MAs — bullish signal.

RSI is around 64, suggesting momentum remains but is nearing overbought.

MACD is bullish with widening divergence — supports potential continuation.

📌 Support Zones: $202, $199

📈 Resistance / Target Zones: $217 (short-term), $235 (TP), $242 (extension)

💡 My Take

AMZN is showing bullish continuation out of a textbook inverted head and shoulders — typically a strong reversal setup after a downtrend. We’ve seen the neckline break with follow-through, and volume patterns support the move.

While the RSI shows slight overbought conditions, this could lead to a short consolidation before another leg up toward $235–$242. With macro tailwinds from cloud and advertising sectors, AMZN is positioned well for a strong Q3 rally.

Position

Type: AMZN 235 Call

Expiry: July 11, 2025

Quantity: 7

Average Cost Basis: $1.00

Last Price: $0.69

Purchase Date: June 12, 2025

Total % Gain/Loss: –30%

Despite current drawdown, I remain optimistic about AMZN's momentum. The technical setup is strong, and short-term weakness is likely just healthy consolidation. I'm holding through July with my eyes on the $235 target.

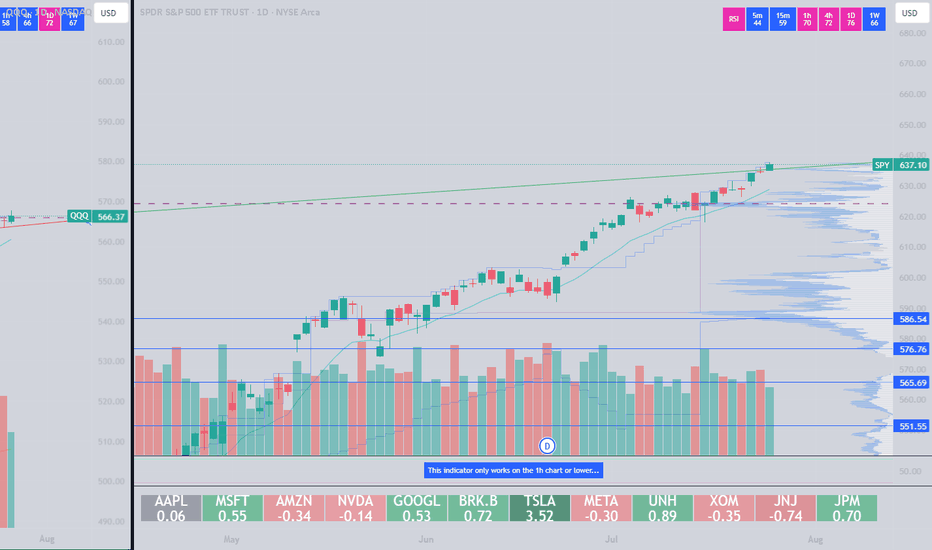

SPY & MegaCap strengthSPY saw a very strong gap up, negating most of the selling from last week.

despite rising tensions in the middle east - investors have shrugged off volatility and bought the initial dip.

This may be proving that "war" is good for stocks.

we observed a very close correlation between the indices and oil today.

As oil reversed higher - markets saw a bit of weakness. As oil fell markets rallied.

TSLA trying to break a 4 hour bullish pattern

META new Smart Glasses release causing a surge.

MSFT new all time high tap

NVDA firm with ripping semiconductors

GOOGL looking strong for continuation

AMZN moving nicely off support

AAPL lagging the mega's but positive

AMZN — Accumulation Zone or Just a Healthy Pullback?📦Amazon (AMZN) is offering an interesting opportunity after a healthy correction from its 2025 highs. With continued AWS expansion and aggressive investment in AI infrastructure, the fundamentals remain solid — but short-term volatility opens the door for strategic entries.

🎯 Entry Points

🔹 $194 – First key support, ideal for early buyers

🔹 $187 – Strong technical congestion zone

🔹 $169 – Deep value zone with higher risk/reward potential

💰 Profit Targets

✅ TP1: $210 – First resistance and psychological level

✅ TP2: $227 – Last swing high area

✅ TP3: $241+ – Full recovery path if momentum holds

🧠 Strategy Insight

This setup suits a swing trade horizon (30–60 days). Scaling into the position and adjusting stops under $160 offers a risk-managed approach. The upcoming earnings on July 31, 2025 could be the trigger for a major move — watch AWS growth numbers and forward guidance closely.

⚠️ Disclaimer: This analysis is for educational purposes only. It is not financial advice. Always do your own research and manage risk accordingly.

AMZN Struggles at Trend-Barrier and ResistancePrice is still in upward mode.

Why am I bearish?

1. Rejection in the Resistance Zone

2. Second Hagopian

3. Close below the Red Forks 1/4 Line

PTG1 is the Center-Line.

Potential further PTG's below at the 1/4 Line and then of course the L-MLH.

Playing it with Options which give me much more leeway. For a hard Stop I would put it right behind the last high above the TB.

AMZN: Watch for a Break Above 218.00If NASDAQ:AMZN manages to push above 217.85 , there's a strong chance we’ll see a move toward 219.96 . However, caution is advised around the 218.00 level – both premarket and postmarket sessions showed hesitation and failed to hold above that resistance.

A more conservative approach would be to wait for a clean break above 218.00 before entering.

🔍 Context:

We’re currently in a solid uptrend. On the daily chart, we’ve seen a rejection of the downside, marked by an inside bullish candle with a notable wick – suggesting upward pressure that the market may try to release. Given recent premarket activity, the 218.00 area remains a key battleground for bulls and bears alike.

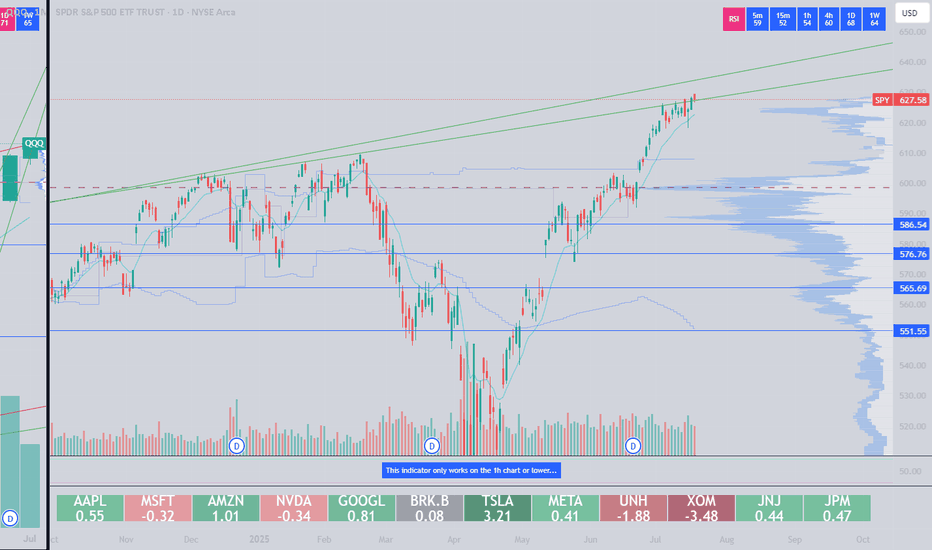

SPX 500 to 17,000 in 7 years.This chart represents the S&P 500, showcasing its performance over time, including quarterly data.

It captures everything.

Every recession.

Every war.

Every president.

Every variation of the monetary base as superpowers rise and fall.

Whenever I hear a bear in the stock market declare that THE TOP has been reached, and we are about to CRASH -50% to -90%

I find myself drawn to these comprehensive long term charts.

If the bulls are genuinely in control and we have merely undergone an intermediate-term correction, then the long-term bull market that commenced at the 2009 low remains robust, with many more years ahead.

The chart also illustrates that the three significant bull market phases typically last around 18-20 years following a major breakout.

And they yield a comparable number of X's.

It's all quite fascinating, if you ask me.

See you in the future!