Amazon (AMZN) Shares Rise Ahead of Earnings ReportAmazon (AMZN) Shares Rise Ahead of Earnings Report

Today, 31 July, Amazon is set to release its quarterly earnings after the close of the regular trading session. Available data show that Amazon (AMZN) shares are exhibiting bullish momentum, reflecting positive market expectations:

→ In July, AMZN shares have outperformed the S&P 500 index (US SPX 500 mini on FXOpen);

→ Yesterday, following the end of the regular session, AMZN shares surged by approximately 3% in after-hours trading.

The rise in AMZN comes amid strong earnings reports from other tech giants, such as Microsoft (MSFT) and Meta Platforms (META). For example, MSFT shares rose by more than 8% in post-market trading. Their success has likely fuelled optimism that Amazon’s upcoming report will also impress.

All of this has brought noticeable changes to the technical outlook for the AMZN stock price.

Technical Analysis of the Amazon (AMZN) Chart

Following the release of the previous earnings report, price movements have formed an upward channel, as indicated by the Regression Trend tool. However, in recent days, a series of bearish signals emerged:

→ On Thursday, AMZN broke above the $230 level (marked by an upward arrow), but the session closed well below the highs – a sign of selling pressure;

→ Friday and Monday’s sessions produced candles with small bodies, indicating market indecision;

→ On Tuesday, bears took the lead (marked by a downward arrow), with a relatively long candle closing near the session low.

Thus, the chart gave reason to assume that optimistic sentiments were waning. However, today’s session is likely to open near the $237.30 level, effectively negating the bearish interpretation of the previous five candles and shifting momentum back in favour of the bulls.

In this context:

→ Support could be provided by the $230 level as well as the median of the Regression Trend channel;

→ Key resistance could be found at the previous high of $242.23 and the psychological level of $250.

Whether AMZN can surge to a new all-time high will largely depend on the company’s performance in AI – a theme that remains highly relevant in 2025.

This article represents the opinion of the Companies operating under the FXOpen brand only. It is not to be construed as an offer, solicitation, or recommendation with respect to products and services provided by the Companies operating under the FXOpen brand, nor is it to be considered financial advice.

Amzntrade

AMZN Earnings Play — July 30 (AMC)

## 🚀 AMZN Earnings Play — July 30 (AMC)

**💵 High Conviction Call Trade | 85% Confidence**

📈 **Amazon (AMZN)** — Cloud + Consumer Power Combo

🧠 Setup driven by earnings momentum, bullish flow, and macro strength.

---

### 🔍 FUNDAMENTALS SNAPSHOT

✅ **Revenue Growth**: +8.6% TTM

✅ **Margins**: Profit 10.1%, Op 11.8%, Gross 49.2%

🎯 **EPS Beat Streak**: 8/8 with avg. surprise of +34.7%

🔮 **Consensus Target**: \$252.03 (+9.4% upside)

📌 AWS + AI + Cost control = 🔥 upside setup

🟢 **Score: 9/10**

---

### 📊 OPTIONS FLOW SIGNAL

💰 **High OI**: \$232.50, \$240, \$247.50 calls

📈 **Call/Put Ratio**: Bullish Skew

🛡️ **Put Hedging** ≠ Bearishness

📉 Expected Move: \~5%

⚖️ **Gamma Bias**: Bullish above \$240

🟢 **Score: 8/10**

---

### 📉 TECHNICAL SETUP

📍 Price: \$231.01

📈 20D MA: \$226.21 (Support)

📉 RSI: 66.71 (momentum building)

🔒 Resistance: \$242.52 (watch for breakout)

🟢 **Score: 8/10**

---

### 🌐 MACRO TAILWINDS

🧠 AI & Cloud Momentum 🚀

💹 Consumer spending rebound

🔧 Regulatory risk mitigated via diversification

🟢 **Score: 8/10**

---

## 🎯 TRADE IDEA

🟩 **AMZN 08/01 \$247.50 Call**

💸 Entry: \$0.86

🎯 Target: \$2.58 (200%)

🛑 Stop: \$0.43 (50% loss)

⏰ Entry: **July 30 — Pre-close**

📏 Max Risk: \$86

💰 Max Reward: \$258

🧠 IV Crush Defense: Exit 2H post-ER

---

## ⚡️ WHY THIS WORKS

✅ 8-straight beat streak

✅ Fundamentals + Technicals = aligned

✅ Flow + Macro confirm direction

📈 Setup = asymmetrical upside

---

🎯 Tag your earnings sniper crew

📈 #AMZN #EarningsTrade #OptionsFlow #AmazonStock #CloudAI #OptionsStrategy #EarningsPlays #TradingView #SwingTrade #CallOptions #VolatilityTrade #EarningsMomentum

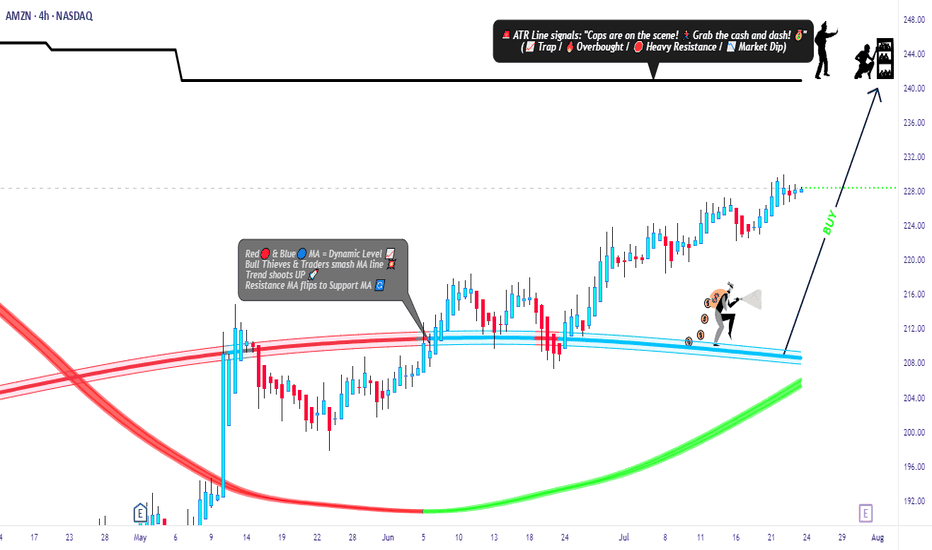

Amazon Market Robbery Blueprint – Swing/Scalp Long Setup🟨💣 “AMZN Market Heist Blueprint – Bullish Robbery in Progress 🚨💼💸” 💣🟨

By Thief Trader – Rob the Market with Precision

🌍 Hello World! Hi, Hola, Ola, Bonjour, Hallo, Marhaba!

🤑💰 Calling all Money Makers & Market Robbers – get ready to execute the next bullish heist on AMAZON.COM, INC (NASDAQ: AMZN), powered by our signature Thief Trading Style™ – where technical precision meets psychological warfare.

🔥 Plan Summary:

Based on our fundamental & technical intel, we’re eyeing a long entry into AMZN. The target? 💥The High-Risk ATR Police Barricade Zone – a zone flooded with liquidity, overbought conditions, fakeouts, and bear traps. It's where most traders get caught – but we walk in with a blueprint.

🟩 Entry Zone – “The Vault Is Wide Open!” 💼📈

🕰 Entry timeframe: 15min / 30min (preferably after confirmation or rejection wick)

💵 Buy Limit Orders: Place multiple layered entries (DCA-style) near recent swing lows/highs. Wait for breakout confirmation; no blind orders before breakout!

Thief Note: This isn’t spray-and-pray – this is sniper-mode. Scope, place, execute.🎯

🛑 Stop Loss – “SL is the Escape Route!”

📍 SL below recent 4H candle wick swing low (around 219.00 – adjust based on your risk/margin size).

Important: Only place SL after breakout; not before. Risk per order must match your lot strategy.

🎯 Target – “Grab the Bag or Escape Before the Alarms!”

💸 Target Zone: 240.00

🧠 Smart robbers know when to bail early – use a trailing SL to lock gains. Exit before reversal or heavy volume shift.

👀 Scalper Alert – “Only One Way – LONG!”

If you’re a quick thief with a fat bag, hit-and-run with a Long scalp. If you’re running lean, swing with the crew. Watch the PA and news timing. Trailing SL = insurance policy.

📊 Why Bullish? Here’s the Background:

🔍 Macro Drivers

💼 COT Report

🌍 Geo-political Influences

🧠 Sentiment Score

📈 Index Correlation

🔮 Intermarket Signals

💹 Institutional Positioning

All lights flashing green for short-to-midterm bullishness, but keep checking real-time updates.

⚠️ Risk Alert – News Triggers Can Blow Your Cover 🚨

🗞 Avoid trading near major news releases – they cause volatility spikes.

🧲 Always protect gains with trailing stops and don’t over-leverage your ammo.

💖 Support the Robbery – Hit BOOST 🔥

Smash that 💥BOOST💥 button if you ride with the Thief Trading Crew!

Let’s build this into the #1 robbery squad on TradingView.

Make money. Protect profits. Trade like a bandit – with a plan. 💼📈🏆

🔔 Stay Tuned for the Next Robbery Mission 🔔

Another heist plan dropping soon. Until then, rob smart, rob safe, and rob rich.

– Thief Trader™ | Rob The Market. Not Your Wallet.

AMZN: A Power Move for the Smart Trader | The Rebound Play?🚀 AMZN 2025 Trade Plan

After an early 2025 rally to $240+, Amazon (AMZN) has pulled back sharply to around $167, opening the door to what could be one of the most attractive rebound setups of the year.

With AWS still growing strong and net income nearly doubling in 2024, the fundamentals are on Amazon’s side. Add to that bullish analyst outlooks pointing to $226–$253 this year, and we might just be looking at a golden entry zone.

📌 Entry Points:

Start building a position at $167

Add more if it dips toward $160 or $151 (52-week low)

🎯 Profit Targets for 2025:

First stop: $210

Next: $226

Final push? $240+

This setup blends technical recovery with strong financials and long-term bullish sentiment. Patience, discipline, and solid risk management are key as AMZN finds its footing.

⚠️ Disclaimer: This is not financial advice. All trading involves risk. Always do your own research and consult with a licensed financial advisor before investing.

AMZN at an all-time high: To be continued?AMZN reaches a new all-time high of $225.8, positioning itself at the upper boundary of an ascending channel that began on January 6, 2023, when it hit a low of $83.07. This channel, nearing its two-year milestone, has developed in five waves, as outlined by the Elliott Wave Theory:

Wave 1

Period: January 4, 2023 - September 14, 2023

Movement: $81.43 to $145.86 (+79%)

Wave 2

Period: September 14, 2023 - October 26, 2023

Movement: $145.86 to $118.35 (-19%)

Wave 3

Period: October 26, 2023 - July 8, 2024

Movement: $118.35 to $201.20 (+70%)

Wave 4

Period: July 8, 2024 - August 5, 2024

Movement: $201.20 to $151.61 (-25%)

Wave 5 (in progress)

Estimated period: August 5, 2024, to today

Projected movement: $151.61 to a range of $226.00 - $231.85 (+49% to +53% projected)

Key Questions for Caution on AMZN

Will it surpass the channel's upper boundary, setting new all-time highs?

Will it retrace to a dynamic support level within the channel (ranging between $201 and $195)?

Will it break below the ascending channel, signaling the start of a higher-degree correction?

Our opinion is for educational purposes only and should not be considered a recommendation to buy or sell. Before making any investment, consult with your financial advisor.

BEZOS AND EX-BEZOS ARE GIVING YOU A EARLY GIFT ON AMAZON!BEZOS AND EX-BEZOS ARE GIVING YOU A EARLY GIFT ON AMAZON! NASDAQ:AMZN

- HIGHFIVESETUP still intact

- Creating Support on Wr%

- Retesting Ascending triangle and CupnHandle breakout

- Measure move on both is to $300+

- Cheap on a DFCF model

Have you been buying more Amazon?

NFA

$AMZN IS ABOUT TO EXPLODE! BUY NOW OR FOMO LATERNASDAQ:AMZN

💥 NASDAQ:AMZN IS ABOUT TO EXPLODE! 💥

I first called out NASDAQ:AMZN on October 21st as it was setting up for a huge move and CupnHandle breakout. Here's 3 reasons to not miss this investing or trading opportunity. Price targets at the end.

1.) HIGH FIVE SETUP (Check the numbers below and you will see. 1-Breaking out of cupnhandle & symmetrical triangle pattern. 2-Volume profile gap from a volume shelf. 3-Uptrending MACD. 4-Higher Highs on RSI. 5-Uptrending Stoch. (trend).

2.) #Amazon margins and FCF are growing rapidly and will continue this uptrend heading into the holiday season with a RESILIENT AMERICAN CONSUMER.

3.) It's a BUY according to the fundamentals especially when valuing this company according to it's Discounted Cash Flow (DCF).

Intrinsic Value: $250

🎯PT1: $231 (Symmetrical triangle measured move)

🎯PT2: $310 (Multi-year CupnHandle Measure Move)

Are you a shareholder? or Are you trading this name?

I'm done for the day! Going to be with my wife on her birthday and go trick or treating with my boys. Thanks for all the support, much love!

LIKE l FOLLOW l SHARE

HAPPY HALLOWEEN!

#Earnings

NFA

AMZN 50%+ UPSIDE!!! CUP N HANDLE PATTERN! BREAKDOWN BELOW:NASDAQ:AMZN #Earnings #BlackFriday

I PRESENT TO YOU: 🎁

🔜 THE NEXT 3T MKT CAP COMPANY

Behold the beautiful CUP 🍵& Handle 👌#chartpatterns #trading #tradingstrategy #Stock

This tea is going to taste delicious when we finally break over $201.20. NASDAQ:AMZN has been a laggard and it's time for them to play a little catch up! 🧧

Not much explaining needed with this one...Cup n Handle breakout means we are going to the measured move destination of...🥁🥁🥁....$310.69 ‼️‼️‼️

CATALYST: 😼

✔️Continued AWS growth and dominance!

✔️Stellar holiday quarter (best quarter of ea. year)

✔️MONEY PRINTER (ATH Free Cash Flows (FCF)

✔️Better margins and #3 player in Ad space!

NASDAQ:AMZN is a 17% in my LT portfolio. Also, I have several options plays on this name. Gonna be a fun ride! 🎢

Like and follow for more great charting and stock talk!

Not financial advice 🖖 NASDAQ:QQQ AMEX:SPY AMEX:IWM NASDAQ:BIVI

AMZN ( Amazon.com, Inc. ) BUY TF H1 TP = 180.18On the H1 chart the trend started on Aug. 06 (linear regression channel).

There is a high probability of profit taking. Possible take profit level is 180.18

Using a trailing stop is also a good idea!

Please leave your feedback, your opinion. I am very interested in it. Thank you!

Good luck!

Regards, WeBelievelnTrading

Sharing AMZN chart from the TTR We are short as of high of the Sharing AMZN chart from the TTR

We are short as of high of the day

AMZN reports after the close

The price has re-tested the broken ending diagonal channel from below, a bearish signal by itself.

I will take one lotto put. Implied volatility for AMZN stock is about 8% in either direction

🌟📈 AMZN: Amazon on Olympus's Peak!Traders, brace yourselves for an epic showdown with Amazon! 🌟📈

🔍 Critical Juncture:

We're witnessing a pivotal moment as Amazon stands at the summit of Olympus. The level at $188.11 has proven its mettle twice before. Will lightning strike thrice? The stakes have never been higher!

💡 Adventure in the Jungle:

Embark on a thrilling journey through the Amazonian jungle of trading! With a potential 27% journey to the first buy zone, are you ready for the wild ride ahead?

🔥 Join the Expedition:

Venture forth and share your thoughts on this daring expedition! Are you prepared to navigate the treacherous terrain of the market? The jungle drums are beating, and the adventure awaits!

💬 Your Quest Awaits:

What's your strategy for tackling this Amazonian challenge? Share your insights and embark on this exhilarating quest with fellow traders! The path to glory awaits those bold enough to seize it!

🎁 Discover the Treasure:

Remember, the most insightful comment could unlock a treasure trove of prizes! So don't hesitate—join the expedition and stake your claim to riches in the jungle of trading! 🏆💰

Amazon (AMZN) Technical Analysis and Trade Idea#AMZN has demonstrated a robust bullish trend, recently leaving a notable price gap between 167 and 162. Given the extended move, a retracement back into this gap appears likely as the market seeks equilibrium before March.

Potential Trade Setup:

- Entry: Consider a short position near the current range high.

- Stop Loss: Employ a stop loss 1.5x the Average True Range (ATR) on the daily (1D) timeframe.

- Rationale: This setup targets potential overextension and aligns with the anticipated price rebalancing.

Important Disclaimer:

This analysis reflects my personal market interpretation and does not constitute financial advice. Always conduct your own independent research and thorough risk assessment before making any trading decisions.

Amazon is an opportunity to buyHello traders. There is a great investment opportunity in Amazon shares. With a downtrend break. And break the ascending triangle pattern. Likewise, breaking the resistance at level 104. These are all factors confirming the strong entry of buyers into this giant stock .Note: If you like this analysis, please give your opinion on it. in the comments. I will be happy to share ideas. Like and click to get free content. Thank you

AMZN is Still in a WXY Correction StructureAs we can see in the chart, Amazon(AMZN) WXY correction is in blue and we expect more downside to around $60 only when the wave (Y) in blue and Wave ((II)) in black are complete.

Technical Analysis:

- H1 & H4 Right Side are Turning Down

- Technically AMZN has now 5 waves down and has a strong correlation with NASDAQ - that's why we expect that it extends lower to around $60 where smart buyers will must appear and we'll like to do an edging buy.

Amazon -> Kind Of Left BehindHello Traders,

welcome to this free and educational multi-timeframe technical analysis .

Just recently Amazon stock perfectly retested and also rejected a quite obvious previous weekly support zone which was turned very strong support again.

After this first initial bounce, Amazon stock then created a rejection of a long term downtrend-line and is once again approaching the weekly support area from which I do expect another rejection towards the upside.

On the daily timeframe I am now just waiting for the market to retest the previous support area and if we then have some bullish confirmation on the lower timeframes, it is quite likely that we will see at least a short term rejection towards the upside.

Thank you for watching and I will see you tomorrow!

You can also check out my previous analysis of this asset:

Amazon -> Bullish Scenario Playing OutHello Traders,

welcome to this free and educational multi-timeframe technical analysis .

From a weekly perspective Amazon recently tested a quite obvious previous weekly support area from which we started a quite nice rally towards the upside.

Considering the fact that Amazon also broke above a key weekly downtrend-line, I think that we have some more overall upside potential.

From a daily timeframe we are currently retesting previous resistance which is now turned strong support, so if we see some more bullish confirmation inside of this zone, there is a high chance that we will actually see the continuation towards the upside.

Thank you for watching and I will see you tomorrow!

You can also check out my previous analysis of this asset:

AMZN Price may move up to weekly resistance in coming weeksPrice trading inside 3M resistance zone. However there are still 2 months to go to close the 3M candle. Therefore price can be a bit insensitive towards that resistance and continue to move higher.

However, the weekly resistance above definitely going to pose challenge for the price. This also coincides with the downward trend line the price has been push against since the downward movement in the end of 2021 started.

Amazon Analysis 10.01.2023Hello Traders,

welcome to this free and educational analysis.

I am going to explain where I think this asset is going to go over the next few days and weeks and where I would look for trading opportunities.

If you have any questions or suggestions which asset I should analyse tomorrow, please leave a comment below.

I will personally reply to every single comment!

If you enjoyed this analysis, I would definitely appreciate it, if you smash that like button and maybe consider following my channel.

Thank you for watching and I will see you tomorrow!

AAPL - Price Targets & Stop Loss📈 What’s up investors! 📉

Welcome back to another one of

💡“Mike’s Ideas”.💡

I post as I find signals… these signals are based on the personal rules I have built and follow in order to make up what I call the “SST Strategy”. Follow for more ideas in the future!!

I have 4 levels marked and colour coded on the Chart.

These levels are:

⚪ White = Entry Point

🔴 Red = Stop Loss

🟢 Green = 1.2:1 Risk Reward Ratio

🟡 Yellow = 1.5:1 Risk Reward Ratio

🔵 Blue = 2:1 Risk Reward Ratio

👀 So what are we looking at today…!!!

🚨( AAPL ) Apple Inc..🚨

Apple Inc. designs, manufactures, and markets smartphones, personal computers, tablets, wearables, and accessories worldwide. It also sells various related services. In addition, the company offers iPhone, a line of smartphones; Mac, a line of personal computers; iPad, a line of multi-purpose tablets; and wearables, home, and accessories comprising AirPods, Apple TV, Apple Watch, Beats products, and HomePod. Further, it provides AppleCare support and cloud services store services; and operates various platforms, including the App Store that allow customers to discover and download applications and digital content, such as books, music, video, games, and podcasts. Additionally, the company offers various services, such as Apple Arcade, a game subscription service; Apple Fitness+, a personalized fitness service; Apple Music, which offers users a curated listening experience with on-demand radio stations; Apple News+, a subscription news and magazine service; Apple TV+, which offers exclusive original content; Apple Card, a co-branded credit card; and Apple Pay, a cashless payment service, as well as licenses its intellectual property. The company serves consumers, and small and mid-sized businesses; and the education, enterprise, and government markets. It distributes third-party applications for its products through the App Store. The company also sells its products through its retail and online stores, and direct sales force; and third-party cellular network carriers, wholesalers, retailers, and resellers. Apple Inc. was incorporated in 1977 and is headquartered in Cupertino, California.