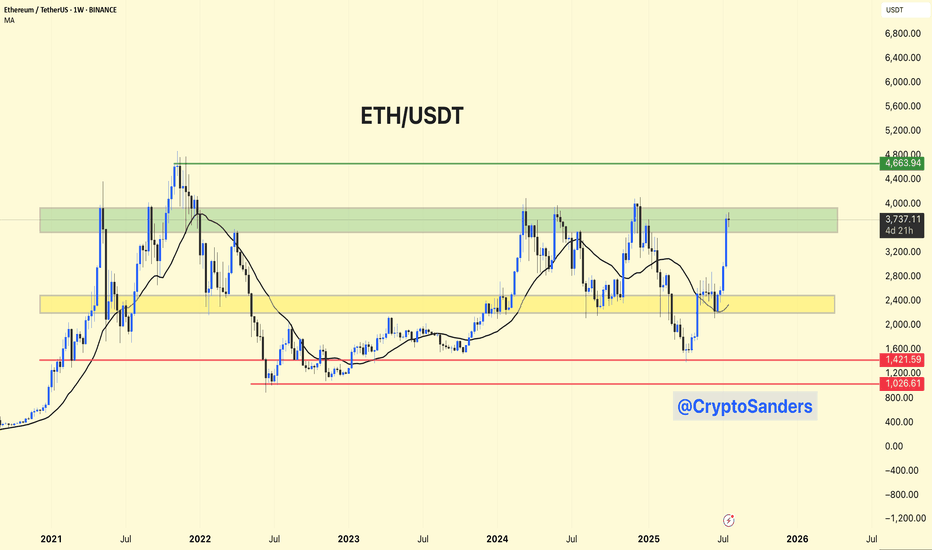

ETH/USDT – Weekly Chart Analysis !! ETH/USDT – Weekly Chart Analysis

ETH is testing a major historical resistance between $3,700 – $4,000 (highlighted green zone).

A clean breakout above this level could push price toward the next key resistance at ~$4,660.

Previous accumulation zone around $2,400 – $2,800 (yellow box) now acts as strong support.

Long-term floor at $1,420 and $1,025, though currently far below.

Bullish Breakout Potential: If ETH sustains above the green resistance, it may retest $4,660+.

A failure to break above $4K could lead to a healthy pullback toward the yellow zone (~$2,800).

Stay updated and manage your risk accordingly.

DYOR | NFA

Analiysis

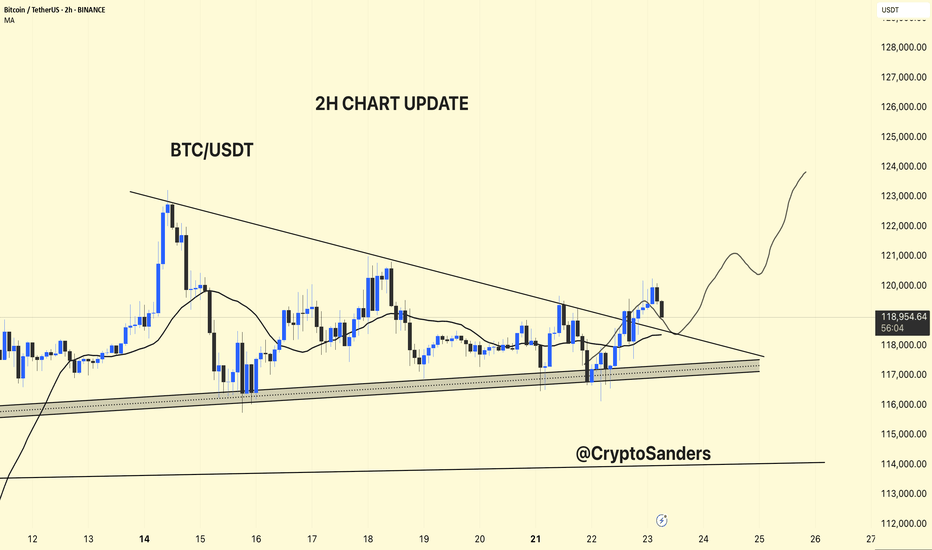

BTC/USDT – 2H Chart Update!!BTC/USDT – 2H Chart Update

Breakout Confirmed:

BTC has broken above the descending trendline but is currently facing resistance at around $ 119,500.

Support Zone:

Strong ascending support between $ 117,000 and $ 118,000 remains intact.

Moving Average:

Price is currently testing the 2H MA (~$118.3). Holding above this could confirm bullish continuation.

Outlook:

If BTC holds above $ 118,000, a move toward $ 123,000–$ 125,000 is likely.

Failure to hold may retest $117K support.

Bias: Short-term bullish unless price breaks below ascending trendline.

Thanks for your support!

DYOR. NFA

Can Potentially move upwards from here?Bitcoin just created an inducement and it has been hunted. Now the structure is also broken and the inducement is also taken out. The market is in a discount zone, and there's an overlap of a Breaker Block and FVG (Fair Value Gap), which indicates that the market can potentially move upwards from here.

Wait for bullish confirmations here, such as MSS (Market Structure Shift), CISD (Change in Character/Continuation of Internal Structure Dynamics), and failed selling PD Arrays!

Do Your Own Research (DYOR)! This is not financial advice.

BTC/USDT Chart Analysis.

BTC has been in an uptrend since early April 2025, breaking above a strong horizontal resistance line (visible in the chart).

However, we can now observe a descending channel (falling wedge) after the peak, indicating a potential pullback.

Support Levels:

The price has tested the 50-day SMA (red) and is approaching the 200-day SMA (green), which is a strong dynamic support (around $94,740–$98,000).

Horizontal support lines are around the $103,000 and $100,000 levels, acting as immediate support.

Price Pattern:

The pattern resembles a bullish flag or descending wedge, suggesting a possible continuation of the previous upward move if a breakout occurs.

Before a bullish reversal, a retest of support levels (highlighted in the blue circle) near the moving averages is possible.

Future Path (as drawn on the chart):

Possible pullback to around $100,000–$98,000 levels.

Reversal and breakout are expected to be between $112,000 and $115,000 initially, and possibly higher to $125,000–$130,000.

Volume & Momentum:

No volume data is shown, but the price action indicates a correction with weakening momentum.

Trend lines are sloping upwards, indicating underlying strength despite the correction.

Trade Setup Based on This Analysis

Entry Zone: Around $100,000–$98,000 (if price tests support and forms reversal patterns like a bullish engulfing or hammer).

Stop-Loss: Below $94,000 (below the 200 SMA and the trendline support).

Short-Term Target: $112,000–$115,000.

Mid-Term Target: $125,000–$130,000.

Risk Considerations

If BTC breaks below the 200 SMA and horizontal support near $94,000, the trend may weaken.

Thanks for your support!

DYOR. NFA

ETH/USDT 4HOUR CHART UPDATE !! ETH/USDT Chart Analysis

Ascending channel: Price is moving within a rising channel, with higher highs and higher lows, indicating bullish momentum.

Strong support area (~$2,600): Price repeatedly bounced off this level, reinforcing it as a key support zone.

Immediate resistance: Price is testing the upper boundary of the channel around $2,800–$2,850.

The 50-day MA (red) and 200-day MA (green) are trending upward, supporting the bullish structure.

A breakout above the channel’s resistance (above $2,800) could trigger a move toward $3,000–$3,200.

Failure at resistance might lead to a retest of support around $2,600, and a break below that could send the price back to the yellow zone (~$2,200).

Conclusion:

Bullish above $2,600, especially if $2,800–$2,850 is cleared with volume.

Bearish risk if price breaks below the channel, especially under $2,600.

Thanks for your support!

DYOR. NFA

BTC/USDT 1DAY CHART UPDATE !!BTC/USDT Chart Analysis

The price has broken above a key resistance area (~$104,000–$105,000) and is now retesting it as support.

The 50-day (red) and 200-day (green) moving averages slope upward, indicating bullish momentum.

Price activity consolidates just above the key resistance-to-support area, indicating accumulation ahead of a potential breakout.

If the price sustains above $104,000, we could see continuation towards $120,000–$125,000.

A break below $104,000 could see the price retest lower support areas near $100,000 or even $97,000–$98,000.

Conclusion:

Bullish bias above $104,000.

If support fails, a bearish move is possible, but momentum is in the bulls’ favor right now.

Stay tuned for updates and key levels to watch!

Thanks for your support!

DYOR. NFA

BTC Preparing for A Move Towards $110k Are You Ready?Bitcoin Market Update: BTC Preparing for a Move Towards 109,200 and 110,000 Levels

Bitcoin (BTC) appears to be gearing up for a potential upward move targeting the 109,200 to 110,000 price range. Over the past several days, Bitcoin has been consolidating within a tight range, indicating accumulation and market indecision. However, the latest price action has shown a strong bullish breakout, confirmed by a solid bullish candle, followed by a healthy retest of the breakout zone.

This retest suggests that Bitcoin may now be preparing for its next leg upward. The current price area presents a possible buying opportunity, especially as we approach the key black-marked zones on the chart. These levels are significant because they hold pending liquidity from previous days’ highs and also correspond to notable swing highs—areas where the market previously reversed.

Traders should remain alert and not miss this potential opportunity. It's crucial to monitor the market closely for any structural shifts or additional confirmation signals, such as bullish patterns, increased volume, or momentum indicators aligning with the upward trend.

As always, conduct your own research (DYOR) before making any trading decisions. Market conditions can change rapidly, and informed decisions backed by solid analysis are essential for successful trading.

BTC/USDT 4-Hour Chart Analysis. The chart shows Bitcoin (BTC) previously trading within an ascending channel (marked by two parallel black lines).

Recently, BTC broke below this channel, signaling a bearish shift in momentum.

BTC is currently attempting to retest the lower boundary of the broken channel.

This is critical—if BTC fails to reclaim the channel, it could confirm a downtrend continuation.

The chart suggests a possible short-term bounce toward resistance around $85,000-$86,000.

However, after this retest, BTC is expected to drop sharply toward $79,000 - $78,400 (green support zone).

$79,059 & $78,424 are identified as key support zones.

If BTC reaches these levels and holds, a rebound is possible.

If broken, BTC could see a deeper decline toward lower levels.

Breakout invalidation: If BTC breaks above $86,000 with strong volume, it could regain bullish momentum and move higher.

If you found this analysis helpful, hit the Like button and share your thoughts or questions in the comments below. Your feedback matters!

Thanks for your support!

DYOR. NFA

Bitcoin (BTC/USDT) 4H Chart Update. BTC has broken out of a descending triangle, leading to a strong upside.

Currently trading inside an ascending channel, facing resistance near $90,000.

Bullish Scenario:

If BTC holds above $87,000-$88,000, a continuation toward $92,000-$95,000 is possible.

A strong breakout from this channel could lead to an attempt at $100,000.

Bearish Scenario:

A rejection at the channel's top may push BTC back to the $84,000-$85,000 support level.

If the support breaks, BTC could drop to $79,000-$78,400

Resistance: $90,000, $92,000, $95,000

Support: $85,000, $84,000, $79,000

If you found this analysis helpful, hit the Like button and share your thoughts or questions in the comments below. Your feedback matters!

Thanks for your support!

DYOR. NFA

Bitcoin (BTC/USDT) 4-hour chart.

Price: Currently around $82,753.16, showing a slight increase of +0.05%.

Trend line: A descending trend line is visible, indicating potential resistance. If the price breaks above this line, it could signal a bullish reversal.

Support level: There is a strong support level at $78,424.30, which has been tested multiple times.

Indicators: The price is currently in the cloud, indicating a state of indecision. The green cloud above indicates potential resistance, while the red cloud below indicates previous bearish momentum.

Resistance: Keep an eye on the descending trend line and the upper edge of the cloud.

Support: The $78,424 level acts as a crucial support area.

Monitor breakouts: A breakout above the trend line may indicate an uptrend, while a breakdown below the support level may signal a further decline.

Volume analysis: Monitor trading volume to confirm breakouts.

If you found this analysis helpful, hit the Like button and share your thoughts or questions in the comments below. Your feedback matters!

Thanks for your support!

DYOR. NFA

ETH/USDT Weekly Chart Analysis. The Ethereum (ETH/USDT) weekly chart suggests a potential bullish reversal from a key support area. Here are the details of the analysis:

Support area: Around $1,750 – $1,830, where the price recently rebounded.

Resistance levels:

First target: $4,015

Key resistance: $4,663, which marks a key breakout level.

ETH has bounced off historical support levels, indicating potential accumulation.

If the price sustains above $1,800, the next target is $4,015, followed by $4,663 if the momentum continues.

A break below $1,747 – $1,700 could lead to further declines, with the next strong support near $1,053.

Look for a confirmation of a breakout above $2,000 to confirm a strong uptrend.

Keep an eye on volume and indicators (RSI, MACD) for further confirmation of momentum.

Risk management is important in volatile market conditions.

If you found this analysis helpful, hit the Like button and share your thoughts or questions in the comments below. Your feedback matters!

Thanks for your support!

DYOR. NFA

BTC/USDT 4HOUR CHART UPDATE !!The BTC/USDT 4-hour chart suggests a descending channel pattern, indicating a possible continuation of the bearish trend until a breakout occurs.

Descending Channel:

Price activity remains within a downward-sloping channel, with lower highs and lower lows.

The upper trendline acts as resistance, while the lower trendline provides dynamic support.

Resistance: Near $85,000 to $87,500, aligned with the upper trendline.

Support: Around $78,424, the lower limit extending to $72,000 if a breakdown occurs.

(Red Arrow):

If BTC fails to break the resistance, it could drop towards $78,424 and possibly lower.

(Blue Arrow):

A breakout above the descending channel (~$87,500) could trigger a bullish run towards $90,000+.

If you found this analysis helpful, hit the Like button and share your thoughts or questions in the comments below. Your feedback matters!

Thanks for your support!

DYOR. NFA

BTC/USDT weekly chart shows a classic technical analysis patternThe BTC/USDT weekly chart shows a classic technical analysis pattern

Support and resistance levels:

There is clear horizontal resistance around $83,000, represented by the green line.

The potential support level is marked around $78,000.

The chart shows a “cup and handle” structure, which could indicate bullish potential if the price breaks above the resistance.

An upward trend line is also present, reinforcing bullish sentiment as long as the price remains above it.

Currently trading around $83,436, noticeable price action reflects market sentiment towards potential future highs.

Keep an eye on breakouts above resistance for bullish signals or declines below support levels for potential bearish sentiment.

Always consider market volatility and use risk management strategies when trading.

If you found this analysis helpful, hit the Like button and share your thoughts or questions in the comments below. Your feedback matters!

Thanks for your support!

DYOR. NFA

Here is a brief analysis of the BTC/USDT chart: 92,500 USDT, represented by the black horizontal line.

Support level: Close to 78,254.38 USDT, represented by the green horizontal line.

A descending trend line indicates potential bearish trends.

An ascending trend line suggests the formation of a potential support level.

Bullish recovery: If the price respects the support line, it may reach the resistance level.

Bearish breakdown: A break below the support may lead to further declines.

If you found this analysis helpful, hit the Like button and share your thoughts or questions in the comments below. Your feedback matters!

Thanks for your support!

DYOR. NFA

4-hour Bitcoin (BTC/USDT) chart. Some key points to consider:Descending Triangle Formation: The price action appears to be forming a descending triangle, with lower highs represented by the upper trendline and potential support levels represented by the lower trendline.

Support Level: The green horizontal line around $78,254 acts as a crucial support area. A break below this level could signal further bearish moves.

Resistance Level: The resistance level at $91,205 indicates that the price may face challenges moving higher.

Current Price: The most recent price is around $80,023, indicating some volatility and the possibility of an upward movement or a test of support.

The chart shows the projection of the potential price movement, indicating potential upward movement after bouncing off the support before facing resistance.

Watch for breakouts: Keep an eye on support and resistance levels. A breakout above resistance could lead to a bullish trend, while a breakdown below support could lead to further declines.

Use volume indicators: Consider looking at trading volume for confirmation of price action, especially during key levels.

Stay updated: It is important to monitor market news or important events that impact Bitcoin prices.

If you have specific questions or need further analysis, feel free to ask!

If you found this analysis helpful, hit the Like button and share your thoughts or questions in the comments below. Your feedback matters!

Thanks for your support!

DYOR. NFA

BTC/USDT 4HOUR UPDATE !!The price action appears to be contained within a symmetrical triangle pattern. Black lines appear, they mark the upper and lower trendlines. Currently, the price is around 81,842.67. It seems that the price remains above the lower trendline.

If you found this analysis helpful, hit the Like button and share your thoughts or questions in the comments below. Your feedback matters!

Thanks for your support!

DYOR. NFA

BNB/USDT weekly chart indicates a few key points for analysis:As of the latest update, BNB is trading around $614.87.

Strong resistance is visible around $663.27.

Key support levels are highlighted around $478.30 and $205.25.

The chart shows a potential cup-and-handle formation, suggesting a bullish outlook if the price breaks above the resistance level.

Recent price action indicates a potential consolidation period, with movement occurring between established support and resistance.

For a more detailed analysis, consider factors such as trading volume, market news, and overall trends in the cryptocurrency market. Always exercise caution and do further research before making any trading decisions.

If you found this analysis helpful, hit the Like button and share your thoughts or questions in the comments below. Your feedback matters!

Thanks for your support!

DYOR. NFA

weekly chart for ETH/USDT. The weekly chart for ETH/USDT shows Ethereum trading within a descending triangle structure, with the lower support trend line indicating potential price stability around the $2,400 level. The upper resistance line is seen near $3,600.

Currently, the price is at around $2,445, having recently declined by around 2.89%. The chart suggests potential upward movement if the price breaks above the resistance line, which could test the previous highs.

Key Levels to Keep an Eye on: If Ethereum can break the resistance, the bullish momentum could strengthen; conversely, a drop below the support could indicate a bearish trend ahead. It will be important to monitor volume and market sentiment for the next action.

If you found this analysis helpful, hit the Like button and share your thoughts or questions in the comments below. Your feedback matters!

Thanks for your support!

DYOR. NFA

BTC/USDT weekly chart displays an important pattern. Current Price Action: Bitcoin is trading around $92,766.71, a notable position just below the recent highs.

Resistance Area: A clear resistance level is represented by the horizontal line near $100,000. This level has proven difficult to break, and price action will soon determine if it can reclaim this area.

Cup and Handle Pattern: The chart shows a potential cup and handle formation, which could indicate bullish sentiment if the price breaks above resistance. This pattern has a rounded bottom formed in early 2022 and late 2023.

Volume Analysis: It is important to analyze volume alongside price moves. A breakout above resistance will ideally be supported by high volume to confirm strength.

Potential Support Level: If the price pulls back, the green highlighted area provides support, which traders could view as a buying opportunity.

If you found this analysis helpful, hit the Like button and share your thoughts or questions in the comments below. Your feedback matters!

Thanks for your support!

DYOR. NFA

BTC/USDT 4HOUR CHART UPDATE !!The BTC/USDT chart shows a symmetrical triangle structure, indicating a period of consolidation. The price is around 99,098.28 USDT, and it appears to be approaching the triangle's upper trendline.

The lower trendline suggests a support level near 94,000 USDT.

The upper trendline acts as resistance, around 100,000 USDT.

Possible Movement: A breakout above the resistance could lead to upward momentum, while a drop below the support could indicate a bearish trend.

Monitor the trading volume during these breakout attempts to confirm the direction!

If you found this analysis helpful, hit the Like button and share your thoughts or questions in the comments below. Your feedback matters!

Thanks for your support!

DYOR. NFA

BTC/USDT Chart Analysis.

Bitcoin recently tested the previous trendline resistance (now acting as support) and bounced back.

The price briefly dropped into the green demand zone (support zone around $92,000-$95,000) but quickly recovered.

100-day MA (purple line): Provided strong support.

Holding this level is a bullish signal indicating buyers are coming forward.

BTC is now trading slightly above $97,000 and must stay above the trendline for a confirmed bullish reversal.

A close above $100,000 would strengthen the case for upward continuation.

Support: $92,000 – $95,000 (green zone).

Resistance: $100,000 then $104,000 – $108,000 range.

If you found this analysis helpful, hit the Like button and share your thoughts or questions in the comments below. Your feedback matters!

Thanks for your support!

DYOR. NFA

BTC/USDT – chart analysis. BTC is testing a crucial descending trendline that has acted as resistance over the past several weeks.

The 21 EMA (black) is above the 50 EMA (red), indicating short-term bullish momentum.

Price action near the moving averages suggests a potential breakout or rejection scenario.

$100,000 – $102,000: Immediate resistance zone aligned with the descending trendline.

A breakout above this zone could trigger a rally towards $110,000 – $114,000.

$97,000 – $95,000: Strong demand zone. BTC needs to hold above this zone to maintain the bullish momentum.

Below $94,000, BTC could revisit the crucial support zone of $92,000 – $90,000 (highlighted in green).

A confirmed breakout above $100,000 with strong volume could take BTC towards $110,000 – $114,000, invalidating the downtrend.

If BTC gets rejected at the descending trendline, it could retest the $95,000 level. A break below this level could push BTC towards $92,000.

Volume Profile: Increased volume near the resistance trendline is crucial for a breakout.

RSI (not visible on the chart): Monitor overbought or oversold conditions for additional confirmation.

Breakout Entry: Enter a long position above $100,000, target $110,000 - $114,000. Stop-loss below $98,000.

Rejection Short: If BTC rejects $100,000, enter a short position, target near $95,000 - $92,000.

Let me know if you’d like further assistance or adjustments!

DYOR. NFA