GOLD Explosive Bull Run or Setup for a Historic Short?📌 XAU/USD Outlook: Explosive Bull Run or Setup for a Historic Short? 💥📈

✨ Market Overview:

Gold (XAU/USD) has entered an exceptionally volatile phase, with price swings exceeding $100 per day. After dropping from 3,280 to 3,080, gold has roared back to a new all-time high at 3,200 in just two sessions — raising the critical question: Is this a true recovery wave, or merely a bull trap ahead of a potential historic short?

A surge of capital has flooded into financial markets, aggressively buying the dip across multiple asset classes. Investor psychology is now at the forefront, driving gold into extreme territory.

🌍 Fundamental Outlook:

Recent U.S. economic data came in weaker than expected, supporting the bullish momentum in gold. If history repeats itself, we could witness similar outcomes with the upcoming CPI and PPI releases — both of which are forecast to remain soft, potentially weakening the USD and further lifting gold.

Short-term: U.S. consumer demand appears weaker, pressuring USD.

Medium-to-long term: These weak data points may be laying the groundwork for a massive short on gold once the Fed initiates its expected rate cuts — potentially as early as June.

📊 Technical Outlook:

Gold’s price action is becoming increasingly difficult to predict. It took a full week for gold to fall $200 — but only two days to fully reclaim that ground and establish a new ATH.

Today, the market may continue this bullish surge, particularly if the PPI data surprises to the downside.

Key Support Levels:

3,200

3,188

3,174

3,157

3,130

3,120

Key Resistance Levels:

3,265

3,302

🧭 Trading Plan:

BUY Zone (High Probability):

Entry: 3,175 – 3,173

Stop Loss: 3,168

Take Profit: 3,180 | 3,184 | 3,188 | 3,192 | 3,196 | 3,200 | Open

SELL Zone (Aggressive Counter-Play)

Entry: 3,301 – 3,303

Stop Loss: 3,308

Take Profit: 3,296 | 3,292 | 3,288 | 3,284 | 3,280 | 3,270 | Open

⚠️ Risk Management Advisory:

Price action is extremely volatile — trade setups should be chosen carefully. Ensure proper stop-loss and take-profit are in place for every trade. Avoid emotional entries and respect risk-to-reward principles to protect your capital.

💡 Conclusion:

Gold is in a critical zone. With macro sentiment, news flow, and technicals all aligned, traders must stay alert. In the short term, the FOMO-driven rally looks likely to continue — but remain vigilant for signs of a reversal that could usher in a massive short wave.

🗨️ Share Your View:

Do you see gold continuing this bullish run — or is this the calm before a historic dump? Share your thoughts and strategies below! 💬👇

Analysis

AUD/USD - Sellers remain in control!The AUD/USD pair has been in a clear and consistent downtrend on both the 4-hour and daily timeframes. Sellers have maintained firm control over price action, driving the pair lower while it continues to respect the prevailing bearish market structure. Each failed bullish attempt further validates the dominance of the bears, reinforcing the narrative that the path of least resistance remains to the downside.

Recently, however, the 4-hour chart witnessed a sharp move to the upside, tapping into and filling a previously unmitigated 4H Fair Value Gap (FVG). Despite this temporary rally, the broader structure remains bearish, with the market still printing lower highs and lower lows, a classic hallmark of a sustained downtrend. As such, the current momentum favors a continuation lower, potentially targeting the green imbalance/FVG zone on the 4H timeframe, which aligns with the next logical area of liquidity.

This green FVG also coincides with the golden pocket retracement zone (61.8%–65%), adding confluence and strengthening its validity as a potential support area. A reaction here could provide an opportunity for a short-term bullish correction or even the start of a larger reversal, depending on how price behaves around this level.

That said, a bullish scenario is not entirely off the table. Should price decisively break above the red FVG to the upside, and ideally close above it with conviction, it may signal a potential shift in market sentiment. This would be the first sign of buyers regaining control, suggesting a possible trend reversal or at least a deeper retracement toward higher time frame resistance zones.

Until such confirmation is seen, however, bearish momentum prevails. Traders can continue to favor short setups, with particular interest around premium zones on the 4H chart. Any bullish setups should be approached cautiously and ideally considered only at key areas of support like the green FVG, especially where it aligns with high-probability fib levels.

Thanks for your support.

- Make sure to follow me so you don't miss out on the next analysis!

- Drop a like and leave a comment!

HelenP. I Euro will decline to support zone, breaking trend lineHi folks today I'm prepared for you Euro analytics. After breaking out from a long consolidation phase, the Euro entered a strong upward trend supported by a clearly defined trend line. This breakout was backed by strong momentum, allowing the price to push above Support 1 and climb rapidly. However, after reaching the 1.1450 area, bullish strength started fading. The market printed a sharp rejection from the highs, and soon after, the price broke back below the trend line. This breakdown signals a shift in sentiment. The price is now approaching the previous support zone between 1.1160 and 1.1120 points, which acted as a key accumulation area during the bullish move. The reaction from this zone will be crucial, but considering the breakdown from the trend line and the aggressive rejection from the top, sellers now appear to be in control. Currently, EUR is trading below the broken trend line, and bearish pressure continues to build. Given the rejection from higher levels, structure break, and weak recovery attempts, I expect EURUSD to decline toward my current goal at 1.1160 points. If you like my analytics you may support me with your like/comment ❤️

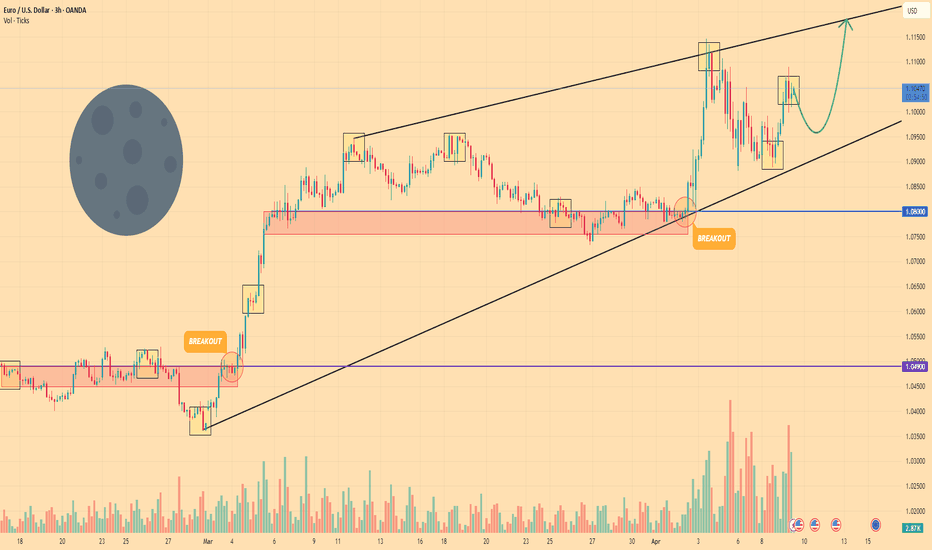

EURO - Price can make correction and then continue to move upHi guys, this is my overview for EURUSD, feel free to check it and write your feedback in comments👊

Some days ago price broke resistance and started a strong upward impulse, exiting from a flat accumulation zone.

After this breakout, the Euro made a sharp rise and formed a rising wedge pattern.

Then price reached the upper boundary of a wedge and bounced down, testing the support line of the pattern.

Recently, it touched the support zone near the $1.0800 level and then bounced with recovery toward resistance.

Now price trades inside wedge, holding above support line and forming bullish continuation structure.

In my opinion, Euro can continue to grow and reach $1.1185 resistance line of the wedge soon.

If this post is useful to you, you can support me with like/boost and advice in comments❤️

Fundamental Market Analysis for April 11, 2025 EURUSDEUR/USD hit its highest levels in nearly two years on Thursday, breaking through and closing above 1.1200 for the first time in 21 months. Market tensions continue to ease after the Trump administration dropped its own tariffs at the last minute, causing a general weakening in US Dollar flows.

US consumer price index (CPI) inflation fell significantly short of forecasts in March. The core CPI fell to 2.8 per cent year-on-year, a four-year low after nearly eight months above 3.0 per cent. Core CPI inflation also fell to 2.4 per cent year-on-year. Investment markets will face a major challenge if the tariffs reverse the Federal Reserve's (Fed) multi-year efforts to curb inflation.

On Friday, the week will conclude with the release of the University of Michigan (UoM) Consumer Sentiment Index survey. The University of Michigan's consumer sentiment index is expected to decline again in April as consumers feel the pressure of the Trump administration's tariff and trade policies, and is likely to fall to a near three-year low of 54.5. In addition, expected consumer inflation data will be released on Friday, with UoM's 1-year and 5-year expected consumer inflation previously standing at 5% and 4.1% respectively.

Trade recommendation: SELL 1.1305, SL 1.1380, TP 1.1150

USD/JPY(20250411)Today's AnalysisMarket news:

The annual rate of the US CPI in March was 2.4%, a six-month low, lower than the market expectation of 2.6%. The market almost fully priced in the Fed's interest rate cut in June. Trump said inflation has fallen.

Technical analysis:

Today's long-short boundary:

145.38

Support and resistance levels:

149.05

147.68

146.79

143.97

143.08

141.71

Trading strategy:

If the price breaks through 145.38, consider buying, the first target price is 146.79

If the price breaks through 143.97, consider selling, the first target price is 143.08

GBP/JPY Triangle Breakout (11.04.2025)The GBP/JPY Pair on the M30 timeframe presents a Potential Selling Opportunity due to a recent Formation of a Triangle Breakout Pattern. This suggests a shift in momentum towards the downside in the coming hours.

Possible Short Trade:

Entry: Consider Entering A Short Position around Trendline Of The Pattern.

Target Levels:

1st Support – 184.40

2nd Support – 182.60

🎁 Please hit the like button and

🎁 Leave a comment to support for My Post !

Your likes and comments are incredibly motivating and will encourage me to share more analysis with you.

Best Regards, KABHI_TA_TRADING

Thank you.

AUDUSD Long – Fair Value Gap + Macro Confluence + Bullish LEI AUDUSD Swing Long Setup – Technical + Macro Confluence

✅ Bias: Long AUD/SD

Based on a multi-factor thesis:

Macro: RBA steady; AUD LEI rising steadily (87 → 96), Endogenous improving

USD Weakness: Fed dovish + GDP downgraded = downside pressure

Seasonality: USD historically weak entire April

Pre-Market Analysis – CAD/CHF1️⃣ The price has broken below the previous support zone, which had held multiple times in the past. This area is now likely to act as a new resistance.

2️⃣ The bottom boundary of the descending channel has been touched, signaling a potential reaction or short-term bounce from this level.

3️⃣ It’s quite probable that the price retraces back to the midline of the channel before continuing its downward move. This would be a classic pullback within a bearish channel structure.

📉 If price fails to reclaim the broken support and reacts bearishly near the resistance-turned zone or the channel’s midline, it could provide a solid continuation setup to the downside.

ETH — Still Lagging Behind. Two Levels That MatterETH continues to underperform the market — and it's not just about Ethereum. Most alts showed weakness after yesterday’s front-running impulse ended in today’s fade-out.

Let’s see how they behave on BTC’s next leg up.

As for ETH — only two levels matter for now:

1689 to the upside, and 1485.7 to the downside.

I’ll take action only after a confirmed breakout and hold above or below one of these zones. Until then — just observing.

Euro may continue to move up inside upward channelHello traders, I want share with you my opinion about Euro. We can see how the pair spent a long time inside a wide range, repeatedly testing the buyer zone between 1.0365 - 1.0400 points. After multiple rebounds and false breakouts, Euro finally broke through the resistance and started forming a strong upward channel. The bullish structure was further confirmed when the price respected the support line of the channel and created a new higher low near 1.0885, which now acts as the current support level. This level also coincides with the bottom of the seller zone, which was recently flipped into support. Price reacted with a sharp impulse up, breaking the consolidation range and confirming continued bullish pressure. Now Euro is approaching the middle of the channel and gaining strength again. I expect the pair to make a slight pull-back to the support area, followed by a continuation of the upward trend toward TP1 - 1.1250 points, which aligns with the upper boundary of the channel. As long as EUR remains above 1.0885 points and respects the bullish structure, I’m looking for another leg higher. The chart structure supports the bullish case, and the upward momentum is clearly in play. Please share this idea with your friends and click Boost 🚀

HelenP. I Gold may drop to trend line, breaking support levelHi folks today I'm prepared for you Gold analytics. A few days ago price rebounded from the trend line and started to grow inside the upward channel. In this channel, the price rose to support 2, which coincided with the support zone and soon broke this area. Then it continued to move up and rose to resistance line of channel, but soon it turned around and made small movement below, after which continued to grow near this line little below. Later, Gold made a correction movement to support 2, which coincided with the trend line and then continued to move up inside the channel. In a short time later it reached support 1, which coincided with one more support zone and also broke this level too. Price some time traded near this level and later made impulse up, exiting from channel pattern and then it at once turned around and made correction movement to support 1. Gold even declined a little below this level, but a not long time ago, it backed up. Now, I expect that XAUUSD will start to decline to the trend line, thereby breaking the support level. That's why I set my goal at 2965 points. If you like my analytics you may support me with your like/comment ❤️

NZDUSD Long Setup – FVG + Order Block + Macro Bullish BiasI'm looking to go long on NZDUSD based on a strong confluence of fundamentals, seasonal trends, and technical structure.

🔹 Macro bias: USD weakening as Fed leans dovish, while NZD is gaining momentum from rate cuts and improving LEI.

🔹 Seasonality: Historically, NZD shows strength in the first half of April, while USD tends to weaken mid-to-late April.

🔹 Technical setup:

Price left a Fair Value Gap (FVG) on the 4H chart

Pullback into a bullish Order Block (OB)

Entry within imbalance

XAU/USD Outlook: Gold's Bullish Momentum Strengthens 📌 XAU/USD Analysis: Gold on a Strong Bullish Momentum Amid Economic Optimism 📈💰

✨ Overview:

Gold (XAU/USD) is currently demonstrating significant bullish momentum, driven by improved global economic sentiment. The recent 90-day tariff suspension among major global economies and hints from the recent FOMC meeting about potential rate cuts later this year are fueling investor optimism.

📊 Technical Analysis:

🔹 Key Resistance Levels:

3,146

3,162

3,168

🔸 Key Support Levels:

3,096

3,078

3,066

3,052

📈 Moving Averages Analysis:

MA 13 (Short-term): Clearly supports bullish momentum, offering buy signals as price sustains above this MA.

MA 34 (Medium-term): Supporting bullish sentiment with prices comfortably above.

MA 200 (Long-term): Reinforces the robust long-term bullish outlook with price consistently trading above this level.

🚀 Trading Strategy & Recommendations:

BUY Strategy (Preferred Scenario):

Entry Zone: 3,094 – 3,096

Stop Loss: 3,090

Take Profit Levels: 3,100 | 3,104 | 3,108 | 3,112 | 3,116 | 3,120

SELL Strategy (Cautious Approach):

Entry Zone: 3,164 – 3,166

Stop Loss: 3,170

Take Profit Levels: 3,160 | 3,156 | 3,152 | 3,148 | 3,144 | 3,140

🌍 Fundamental Context:

Positive Market Sentiment: The global economic outlook has turned favorable due to tariff suspensions and strong performance in equity markets.

Interest Rate Outlook: Recent signals from the FOMC regarding possible interest rate cuts are providing further support for gold’s upward trajectory.

⚠️ Risk Management:

Emphasize caution when engaging in short positions, given the prevailing bullish conditions.

Always implement strict stop-loss measures and maintain risk-to-reward ratios of at least 1:2.

Avoid over-leverage and ensure trades are sized appropriately.

💡 Conclusion & Final Thoughts:

Gold remains strongly bullish, backed by both technical indicators and a positive fundamental backdrop. Traders are encouraged to focus primarily on buy opportunities near significant support levels and remain alert to potential trend reversals at key resistance zones.

🗨️ Engage with Us:

What are your current strategies for gold? Share your insights and views in the comments section below! 💬👇

Fundamental Market Analysis for April 10, 2025 USDJPYThe Japanese yen (JPY) showed strength during the Asian trading session on Thursday, reacting to the release of producer price index (PPI) data that exceeded market expectations. This macroeconomic signal reinforced speculation about possible further monetary policy tightening by the Bank of Japan (BoJ), keeping the probability of an interest rate hike in the future. Additional support for the yen was provided by positive expectations of a potential trade agreement between Japan and the United States.

Amid the weakening of the US dollar (USD), the USD/JPY pair showed a pullback and fell below the psychologically important level of 147.000, which was also supported by a limited correction of the US currency amid a general recovery in market confidence.

The divergence in monetary expectations between the Bank of Japan and the Federal Reserve remains significant. While Japan is increasingly likely to tighten monetary policy, markets in the US are pricing in a scenario of multiple cuts in the Fed's key interest rate in 2025. This discrepancy has prevented the US dollar from maintaining momentum after an overnight recovery from a weekly low, prompting a reallocation of capital in favor of the more stable yen despite its status as a low-yielding currency.

Improved global risk sentiment, driven by US President Donald Trump's announcement of a temporary suspension of retaliatory tariffs against key trading partners, may also help strengthen the yen as a safe haven asset, especially amid continued uncertainty in international markets.

Trade recommendation: SELL 146.800, SL 147.400, TP 145.400

USD/JPY(20250410)Today's AnalysisToday's buying and selling boundaries:

146.66

Support and resistance levels:

150.90

149.32

148.29

145.03

144.01

142.42

Trading strategy:

If the price breaks through 148.29, consider buying, the first target price is 149.32

If the price breaks through 146.66, consider selling, the first target price is 145.03

S&P - What will happen next for the S&P?The S&P 500 has been dropping quickly after Trump's tariff policies were announced. It fell from 5750 to 4900, and is now at 5053, all in just a few days. This is a sharp decline, and sellers are clearly in control right now.

However, after such a big drop, it's common to see a short-term bounce before the market continues to fall. There is strong resistance between 5400 and 5500, which lines up with the golden pocket (a key level in technical analysis). This could make it harder for the S&P to rise past these levels.

Looking further down, there is another strong support area between 4500 and 4600. This level also matches the golden pocket on the daily chart, making it an important point for potential support. If the market keeps falling, we could see this area tested before any significant recovery.

Right now, it seems likely that the market will keep going lower. My main expectation is that we’ll get a small rally first, which could trick some traders into thinking the market is recovering, before continuing down. However, with all the uncertainty around the news and policies right now, it's also possible the market could keep dropping sharply without much of a rally.

Keep a close eye on the markets and stick to good risk management practices. If you don’t, it could really hurt your portfolio. Stay alert and adjust your strategy as things change.

Thanks for your support.

- Make sure to follow me so you don't miss out on the next analysis!

- Drop a like and leave a comment!

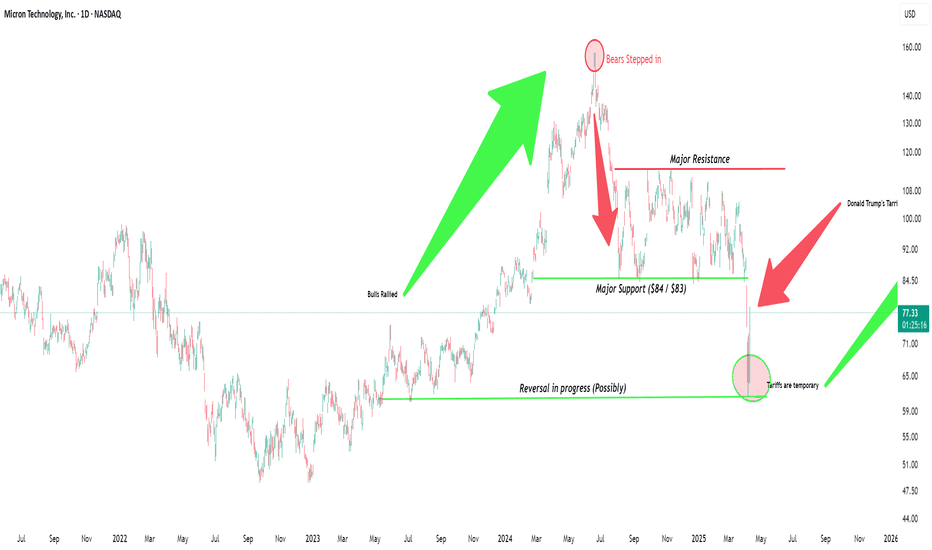

Micron's Time to Be THAT Semiconductor is coming and FastNASDAQ:MU is extremely undervalued, I produced this chart last night. Its time that the market appreciates this monster with such solid fundamentals. Micron since 2022 has been working hard to become a major producer in the United States. I believe that Trump and his government could get behind the only major memory company to be based in the United States.

-----------------------

Balance Sheet:

Cash: $8.22b

Debt: $11.54b

Equity: $48.63b

Total Liabilities: $24.42b

Total Assets: $73.05b

All Stated in $ USD

-----------------------

Valuation:

Price To Sales: 2.72

Price To Earnings: 18.30

Forward Price To Earnings: 6.84

-----------------------

CADJPY: Bullish Setup Building — Fundamental AnalysisCADJPY is approaching a major support zone with a strong macro and seasonal backdrop favoring a bullish reversal.

Macro scores (LEI, endogenous) show consistent strength

Seasonality supports upside from late April into May

JPY is overbought per COT data

🔁 However, price structure remains bearish on 4H and Daily, so we are waiting for a confirmed CHoCH and HL before executing a swing long.

This idea is a "watch & prepare" setup — get ready to strike once structure flips.

USDCAD Downtrend Hinges on This SupportFenzoFx—USD/CAD is trading bearishly and failed to form a new higher high above the 1.4297 resistance. A new bearish wave could be triggered if selling pressure drives the price below the 1.4143 support level.

In this scenario, the next bearish target will likely be 1.4028. Please note that the bearish outlook should be invalidated if USD/CAD exceeds 1.4297.

>>> Trade USDCAT at FenzoFx Decentralized Forex Broker

HelenP. I Bitcoin may rebound from resistance zone and fall moreHi folks today I'm prepared for you Bitcoin analytics. After a strong rejection from the second resistance zone between 86700 and 87900 points, Bitcoin lost its bullish momentum. The price attempted to hold within the range but failed to break above the trend line, which has consistently acted as dynamic resistance. This trend line marked the turning point once again, pushing BTC down with increased selling pressure. The price then sharply declined, breaking below the first resistance zone between 78200 and 79500, which is now acting as resistance. This level was previously tested multiple times, making it a key barrier. After breaching this zone, the price dropped even lower and reached the 77000 area, where it found temporary support and began a minor bounce. Currently, Bitcoin is trading just below the resistance zone and remains under the trend line. Sellers are still in control, and the recent bounce looks weak compared to the prior impulse down. Given the rejection from resistance, the position relative to the trend line, and continued bearish pressure, I expect BTC to resume its decline toward 70000 points, which is also my goal. If you like my analytics you may support me with your like/comment ❤️

Euro will break current support level and drop to 1.0735 levelHello traders, I want share with you my opinion about Euro. Recently, the price completed a pennant pattern, which resulted in a breakout to the upside. This breakout, however, didn’t gain much ground - the movement quickly lost momentum inside the resistance area between 1.0955 - 1.0985 points, where Euro sharply turned around. The reversal from this zone wasn’t unexpected, considering this level had already acted as resistance earlier. What followed was a clean break below the current support level at 1.0955 points, which shifted the market structure back to bearish. Now the price is trading lower, and the bearish impulse looks set to continue. My expectation is a further decline toward the support level at 1.0735, which also aligns with the buyer zone between 1.0695 - 1.0735 points. This level may act as the next potential area of interest where buyers could attempt a defence. The invalidation of local support, weakness after the breakout, and strong supply reaction from resistance all point to a high probability of continuation down toward TP 1 - 1.0735 level. Please share this idea with your friends and click Boost 🚀