AUD/USD Forex Analysis – Trading Update for March 2025The AUD/USD pair has been exhibiting interesting price action over the past week. Following a strong bullish movement that took place on March 4th, 2025, the pair has entered a wedge formation. This bullish push was triggered by the announcement of tariffs, effective starting on March 3rd, 2025.

Key Price Action:

The high of the bullish move was marked at 0.63640, after which the price retraced to test a previous key support level at 0.62730. This level proved to be significant, as it was tested five separate times.

During the retest, the market formed lower lows and lower highs, indicating a shift in market structure. To visualize this, a bearish trendline was drawn, capturing the declining momentum.

Break and Retest:

The move we were anticipating was a break of the bearish trendline, followed by a retest of this trendline. This occurred on March 13-14, 2025, confirming the bearish structure.

After this retest, the weekly close showed a bullish push back to the 1-hour previous high at 0.63286, indicating some bullish interest around this price level.

Current Market Structure:

The pair is now trading within a defined range:

Low: 0.62582

High: 0.63288

We are monitoring the 0.63000 level closely, as it is a critical point of interest. A breakout above or below one of the boundaries of this range will provide further confirmation on the pair's next move.

Next Steps:

If the market respects the 0.63000 level and remains within the range, we will continue to observe price action for any further setups. A break above 0.63288 or below 0.62582 will offer more clarity on the pair’s next directional move.

Analysis

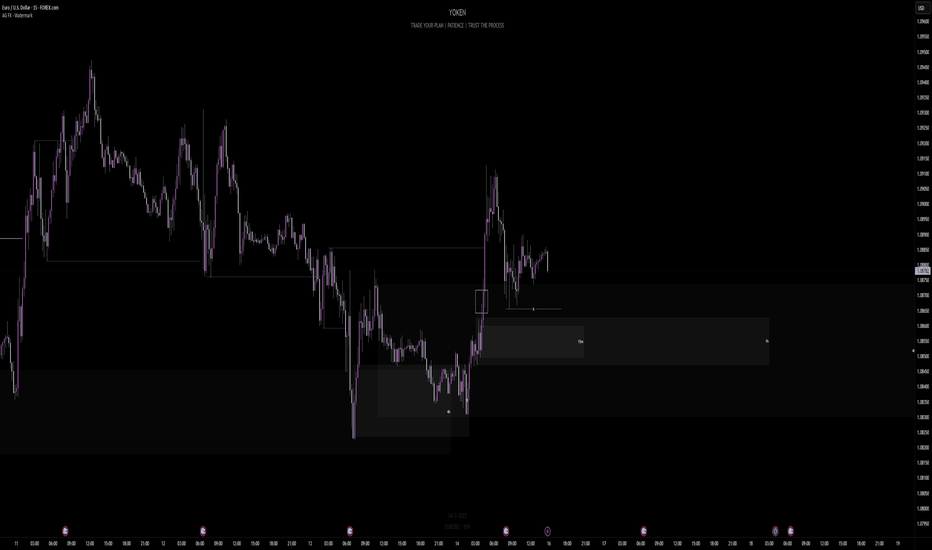

Week of 3/16/25: EURUSD Analysis FIRST VIDEO PUBLISH!First video publish, testing out my recording but also giving my insights for the week ahead. The candle color looks a bit off but hopefully it can be fixed for the next publish.

Pardon the background noise in the first few seconds of the video.

Let me know how the quality and your thoughts/analysis as well!

Happy trading and have a great week traders, let's win.

XRP: The Calm Before the ExplosionXRP has been in strong 100-day accumulation, with a few deviations along the way. Many altcoins have formed reversal patterns, and XRP is setting up for a sharp move upwards. Expecting a breakout from this consolidation phase, potentially propelling XRP to #2 in market cap. The stage is set for a major run!

Entry: NOW

TP: 4

BNB: 380 Days of Accumulation – Big Move Ahead?For over a year, BNB has been in a steady accumulation phase, holding strong while most alts dropped 80-90%. Its resilience in bear markets signals strength and stability, making it a solid contender for the next bull run. A breakout from this range could bring significant upside.

Entry: NOW

TP: 2000

Why DCA Does Not Work For Short-Term TradersIn this video I go through why DCA (Dollar Cost Averaging) does not work for short-term traders and is more suitable for investors. I go through the pitfalls than come through such techniques, as well as explain how trading should really be approached. Which at it's cost should be based on having a positive edge and using the power of compounding to grow your wealth.

I hope this video was insightful, and gives hope to those trying to make it as a trader. Believe me, it's possible.

- R2F Trading

My take on XRP for Vecino Peache.XRP is currently testing the 50 EMA on the daily time frame, a strong resistance level. Throughout February, it made multiple attempts to break above but failed. This suggests a possible correction. A confirmed break below the 200 EMA on the daily chart would further validate this bearish outlook.

My take; I have an OTZ (Optimal Trade Zone) on the 4-hour time frame, which acts as a strong support level. If price breaks below this zone, it signals a potential shift in market direction. As long as XRP respects this support, I will trade it conservatively.

Let me know what are your thoughts on my take.

#ATOM #ATOMUSDT #COSMOS #Analysis #Eddy#ATOM #ATOMUSDT #COSMOS #Analysis #Eddy

It is never too late to buy and invest. Do not rush and do not be fooled by the positive movements and reactions of the market. Wait for the price to reach its valuable areas. In the analysis of the Atom currency, as you can see, there is a strong demand area that is intact. Be patient until the price falls from the decision or extreme flips to the green area of the important demand area. Be sure to check this currency in your monthly time frame and draw the areas. Then refer to the weekly, daily and four-hour time frames and draw the lower time areas and look for confirmation for volatility.

Do not rush to invest and buy spot and let the price reach the support area.

Important areas are drawn and labeled so you can make informed decisions.

Good luck.

XAU/USD Bullish Outlook: Wyckoff Accumulation & Breakout PotentXAU/USD (Gold) - 2H Chart Analysis 🏆📈

🔹 Wyckoff Structure Insight

The chart shows signs of a Wyckoff Accumulation phase.

UTAD (Upthrust After Distribution) at the previous highs suggests a liquidity grab.

Test of the resistance level before a strong rejection downward.

SOW (Sign of Weakness) was observed, but buyers regained control.

🔹 Key Technical Levels

Fair Value Range marked below, showing a potential area of demand.

Unfilled Imbalance (EMB unfilled) signals an area where price might revisit before continuing upward.

Gap below indicates a previous liquidity sweep before the bullish reversal.

🔹 Trend & Price Action

The 200 EMA (red line) is holding as dynamic support.

Current price action is showing higher lows and bullish structure development.

Projected bullish move 📈 is expected to test the $2,940+ region.

🔹 Trading Bias: Bullish ✅

A retracement to the EMA or minor pullback could offer re-entry opportunities.

Invalidation level: Below $2,900, where momentum could shift bearish.

🚀 Gold remains strong; watch for breakouts above $2,940!

Silver Is Eyeing 34-35 Area; Intraday Elliott Wave AnalysisSilver made a three-wave abc correction in wave 4 which can now extend the rally for wave 5 within a new five-wave bullish cycle towards 34-35 area. After recent five-wave impulse into wave "i", followed by an abc corrective setback in wave "ii", it formed a nice intraday bullish setup. Seems like it's now ready for a bullish resumption within wave "iii", so more upside is expected, especially if breaks above trendline and 32.66 level, just watch out on short-term pullbacks.

Fundamental Market Analysis for March 14, 2025 GBPUSDThe GBP/USD pair continues to decline for the second consecutive session, trading near 1.29400 during the Asian session on Friday. The pair faces challenges as the Pound Sterling (GBP) struggles amid weakening risk sentiment, exacerbated by concerns over global trade after US President Donald Trump threatened to impose 200% tariffs on European wines and champagne, which worried markets.

Traders are now awaiting the UK's monthly gross domestic product (GDP) and factory data for January, which will be released on Friday. Investors will be keeping a close eye on the UK GDP data as the Bank of England (BoE) has expressed concerns about the outlook for the economy. At its February meeting, the Bank of England revised its GDP growth forecast for the year to 0.75%, up from the 1.5% projected in November.

The US Dollar (USD) is appreciating amid growing concerns about a slowdown in the global economy, with traders' attention focused on Friday's Michigan Consumer Sentiment Index data. The US Dollar Index (DXY), which tracks the dollar against six major currencies, strengthened after Thursday's positive jobless claims report and weaker-than-expected Producer Price Index (PPI) data. At the time of writing, the DXY is trading near 104.00.

U.S. initial jobless claims for the week ended March 7 came in at 220,000, below the 225,000 expected. Jobless claims fell to 1.87 million, below the forecast of 1.90 million, indicating a resilient U.S. labor market.

Inflationary pressures in the US showed signs of easing. The producer price index rose 3.2% year-on-year in February, down from 3.7% in January and below the market forecast of 3.3%. The core producer price index, which excludes food and energy, rose 3.4% on a year-over-year basis, up from 3.8% in January. On a monthly basis, the core price index was unchanged, while the underlying price index declined 0.1%.

Trading recommendation: SELL 1.29400, SL 1.29900, TP 1.28600

GBP/USD Channel Breakout (14.03.2025)The GBP/USD Pair on the M30 timeframe presents a Potential Selling Opportunity due to a recent Formation of a Channel Pattern. This suggests a shift in momentum towards the downside in the coming hours.

Possible Short Trade:

Entry: Consider Entering A Short Position around Trendline Of The Pattern.

Target Levels:

1st Support – 1.2890

2nd Support – 1.2862

🎁 Please hit the like button and

🎁 Leave a comment to support for My Post !

Your likes and comments are incredibly motivating and will encourage me to share more analysis with you.

Best Regards, KABHI_TA_TRADING

Thank you.

GBP/USD Trade Analysis**GBP/USD Trade Analysis**

📊 **Current Price:** 1.29300

📈 **Bullish Scenario:**

- **Buy above:** 1.29400

- **Target 1:** 1.29600

- **Target 2:** 1.29800

- **Stop Loss:** 1.29150

📉 **Bearish Scenario:**

- **Sell below:** 1.29150

- **Target 1:** 1.29000

- **Target 2:** 1.28800

- **Stop Loss:** 1.29400

📌 **Key Levels:**

- **Resistance:** 1.29450 - 1.29800

- **Support:** 1.29000 - 1.28600

📢 **Risk Management:** Keep SL in place and watch for volume confirmation. 🚀

Booze Wars... How DAX could react?Now it's time for US and EU to have their public tariff battle. Given that wine, champagne and beer are a huge part of EU export into the US, there might be some pain felt among the MARKETSCOM:DE30 bulls. Let's dig in.

XETR:DAX

Let us know what you think in the comments below.

Thank you.

74.2% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money. Past performance is not necessarily indicative of future results. The value of investments may fall as well as rise and the investor may not get back the amount initially invested. This content is not intended for nor applicable to residents of the UK. Cryptocurrency CFDs and spread bets are restricted in the UK for all retail clients.

GBP/CHF Channel Pattern (13.03.25)The GBP/CHF pair on the M30 timeframe presents a Potential Buying Opportunity due to a recent Formation of a Channel Pattern. This suggests a shift in momentum towards the upside and a higher likelihood of further advances in the coming hours.

Possible Long Trade:

Entry: Consider Entering A Long Position around Trendline Of The Pattern.

Target Levels:

1st Resistance – 1.1490

2nd Resistance – 1.1540

🎁 Please hit the like button and

🎁 Leave a comment to support for My Post !

Your likes and comments are incredibly motivating and will encourage me to share more analysis with you.

Best Regards, KABHI_TA_TRADING

Thank you.

EUR/USD Triangle Pattern (13.3.25)The EUR/USD Pair on the M30 timeframe presents a Potential Selling Opportunity due to a recent Formation of a Triangle Pattern. This suggests a shift in momentum towards the downside in the coming hours.

Possible Short Trade:

Entry: Consider Entering A Short Position around Trendline Of The Pattern.

Target Levels:

1st Support – 1.0805

2nd Support – 1.0771

🎁 Please hit the like button and

🎁 Leave a comment to support for My Post !

Your likes and comments are incredibly motivating and will encourage me to share more analysis with you.

Best Regards, KABHI_TA_TRADING

Thank you.

XAG/USD (Silver) Wedge Pattern (13.03.2025)The XAG/USD Pair on the M30 timeframe presents a Potential Selling Opportunity due to a recent Formation of a Wedge Pattern. This suggests a shift in momentum towards the downside in the coming hours.

Possible Short Trade:

Entry: Consider Entering A Short Position around Trendline Of The Pattern.

Target Levels:

1st Support – 32.45

2nd Support – 32.00

🎁 Please hit the like button and

🎁 Leave a comment to support for My Post !

Your likes and comments are incredibly motivating and will encourage me to share more analysis with you.

Best Regards, KABHI_TA_TRADING

Thank you.

#BANANAUSDT maintains bearish momentum📉 Short BYBIT:BANANAUSDT.P from $14.905

🛡 Stop loss $15.490

🕒 1H Timeframe

⚡️ Overview:

➡️ The main POC (Point of Control) is at 16.112, indicating the area with the highest trading volume.

➡️ The 15.490 level acts as a local resistance, as the price previously faced selling pressure there.

➡️ The volume and market profile highlight areas of high trader activity, especially in the 14.250 – 15.500 range.

➡️ The chart shows a potential decline after an impulse move and profit-taking.

🎯 TP Targets:

💎 TP 1: $14.580

💎 TP 2: $14.250

💎 TP 3: $13.920

📢 Monitor key levels before entering the trade!

📢 If 15.490 is broken upward, the trade may be invalidated.

📢 If the price continues to decline and breaks through TP 1, the downside potential remains.

BYBIT:BANANAUSDT.P maintains bearish momentum — expecting further downside movement!

XAG/USD Bearish Reversal Incoming? | Silver 4H Analysis📉 XAG/USD (Silver) 4H Chart Analysis – Bearish Setup 🚨

🔍 Key Observations:

Supply Zone (POI - Point of Interest) 🟪: The price is approaching a strong resistance area around $33.23 - $33.50.

Liquidity Grab (LQ) & Rejection Expected ❌: The previous major liquidity zone (LQ) suggests a possible fake breakout or rejection.

Bearish Projection ⬇️: The chart outlines a potential reversal after reaching resistance, leading to a drop towards $31.00 - $30.50.

📌 Trading Plan:

Short Entry 🎯: Around $33.20 - $33.50 (if price rejects this area).

Target 🎯: Major demand zone at $31.00.

Stop Loss 🚨: Above $33.60 (to avoid fakeouts).

Confirmation Needed 📊: Look for bearish candlestick patterns (e.g., engulfing, wicks, or double top formations).

⚠️ Final Thoughts:

Bearish Bias ⚠️ unless price breaks and holds above $33.50.

Monitor market conditions 🧐—news and fundamentals could shift momentum.

🔥 Trade smart! What do you think?

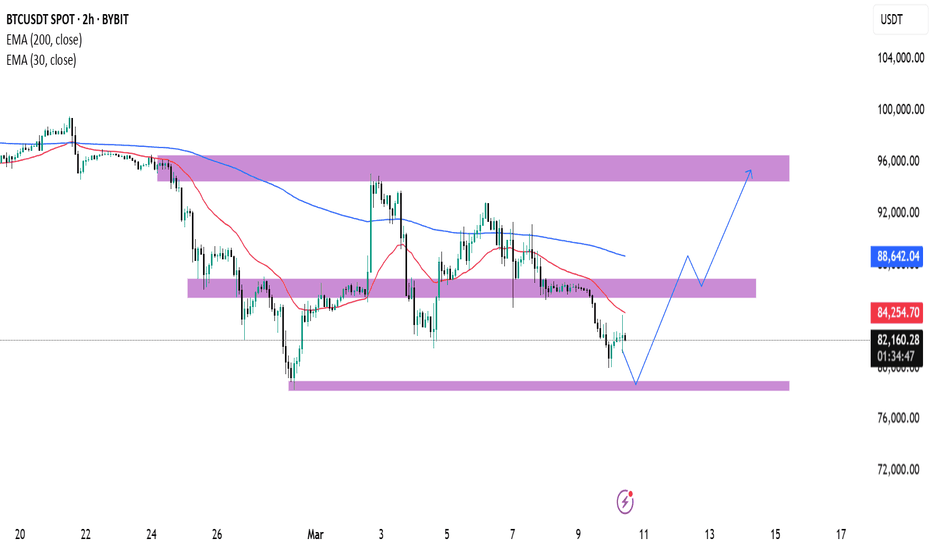

BTC/USDT Price Analysis: Reversal or More Downside?:

📊 BTC/USDT 2-Hour Chart Analysis

🔻 Current Trend:

BTC is in a downtrend 📉, trading below the 30 EMA (🔴 84,270 USDT) and 200 EMA (🔵 88,644 USDT).

The price is currently 82,406 USDT and approaching a key support zone (🟣 ~80,000 USDT).

Support & Resistance Levels

🟣 Support Zone (~80,000 USDT) – Possible bounce area ⬆️

🟣 Mid-Resistance (~86,000–88,000 USDT) – First hurdle 🚧

🟣 Major Resistance (~96,000 USDT) – Final target 🎯

Possible Price Movement (🔵 Blue Line Projection)

✅ Bullish Case:

If BTC bounces off support 🏋️, it could move towards 88,000 USDT 🚀 and then 96,000 USDT 🎯.

❌ Bearish Case:

If BTC breaks below 80,000 USDT, we might see more downside ⚠️.

💡 Trading Tip:

Watch price action 📊 at support & resistance.

Look for confirmation signals ✅ before entering trades.

🚀 Are you bullish or bearish on BTC? 🔥

Fundamental Market Analysis for March 12, 2025 USDJPYThe Japanese yen (JPY) continued to lose ground against its US counterpart for the second day in a row and moved away from the highest level since October, reached the previous day. Fears that US President Donald Trump may impose new tariffs against Japan have proved to be key factors undermining the safe-haven yen. Nevertheless, a significant Yen depreciation still seems unlikely amid hawkish expectations from the Bank of Japan (BoJ).

Data released today showed that Japan's annual wholesale inflation, the Producer Price Index (PPI), rose by 4.0% in February, indicating that inflationary pressures are intensifying. In addition, hopes that the sharp wage increases seen last year will continue into this year support the market's growing confidence that the Bank of Japan will raise interest rates further. This, should serve as a tailwind for the low-yielding yen and help limit losses.

In addition, lingering concerns over the possible economic consequences of Trump's trade policies and a global trade war should support the JPY. The US Dollar (USD), on the other hand, is near multi-month lows amid expectations that a tariff-induced slowdown in the US economy will force the Federal Reserve (Fed) to cut borrowing costs several times this year. This should help limit the USD/JPY pair's rise.

Trade recommendation: SELL 148.35, SL 148.95, TP 147.35