Gold (XAU/USD) Technical Analysis – March 11, 2025Gold is currently trading near 2920 , showing bullish momentum after a strong recovery from recent lows. Price action suggests buyers are in control, but key levels must hold for continued upside.

🔍 Key Observations:

✅ Bullish Structure: The price has formed a bullish flag , signaling potential continuation toward liquidity above 2930.3 (swing high).

✅ Fair Value Gap (FVG) 2907 - 2900: This zone should act as support. If price stays above it, we could see bullish continuation.

✅ Bullish Order Block (OB) 2891 - 2880: If price retraces, this area could serve as a high-probability buy zone for another push higher.

📈 Key Levels to Watch:

🔹 Support Zones:

2907 - 2900 (FVG, 4H) – Ideal for bullish continuation.

2891 - 2880 (OB, 4H) – Stronger demand zone if a pullback occurs.

🔹 Resistance & Targets:

2930.3 (Swing High) – Liquidity target for buyers.

A breakout above 2930 could trigger further bullish momentum.

⚠️ Possible Scenarios:

📌 Bullish: A break above 2920-2925 could send price toward 2930+ liquidity.

📌 Bearish Pullback: A drop into 2907-2900 may present a buying opportunity before moving higher.

🛑 Final Thoughts:

The trend remains bullish , and as long as price stays above key FVG and OB zones, further upside is likely. Keep an eye on these levels for potential trade setups!

Analysis

DXY (U.S. Dollar Index) Bearish Outlook – Key Levels & PredictioDXY (U.S. Dollar Index) Analysis – Daily Chart

🔹 Recent Downtrend:

The DXY has been in a strong decline ⬇️ after breaking key support around 104.5 📉.

The price dropped sharply, showing bearish momentum 🚨.

🔹 Key Zones Identified:

Resistance Zone (104.0 – 105.0) ❌📊 (Previously support, now acting as resistance)

Support Zone (100.5 – 101.0) ✅📉 (Potential target for further downside)

🔹 Expected Price Movement:

A possible short-term bounce 🔄 back toward the 104.0 - 104.5 resistance ⚠️.

If rejected ❌, the downtrend may continue toward the 100.5 – 101.0 level 🎯📉.

🔎 Conclusion:

✅ Bearish Bias – Trend favors further downside unless the price reclaims 105.0.

📌 Watch for a retracement before another drop 📉.

📊 Key Levels:

Resistance: 104.0 – 105.0 🚧

Support: 100.5 – 101.0 🛑

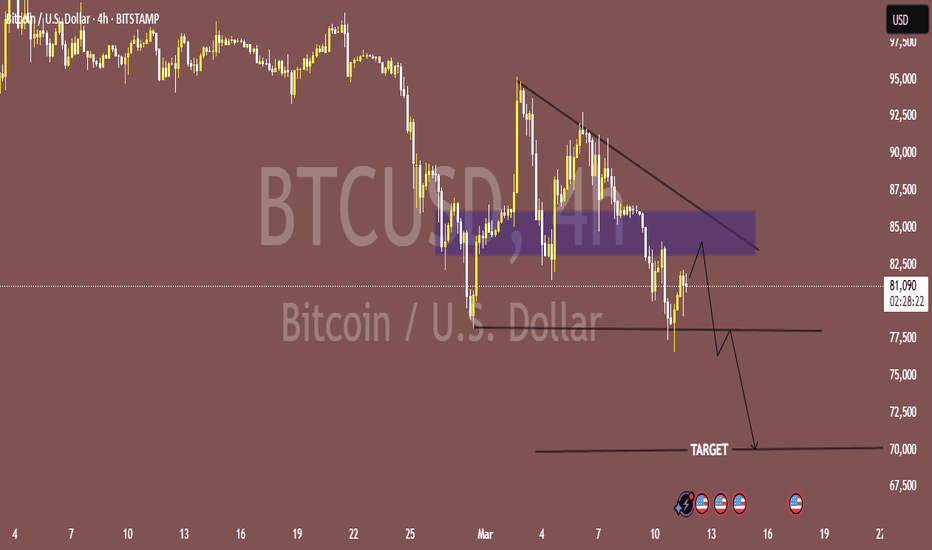

BTC/USD Breakdown? Bearish Target at $70K!🔥

📉 Bitcoin Downtrend Alert! 🚨

📊 BTC/USD (4H Chart) - BITSTAMP

🔻 Bearish Structure!

📉 Lower highs & lower lows – trend is down!

📏 Descending trendline keeping price under pressure.

📌 Resistance Zone (~ FWB:83K - $85K)

🛑 Price struggling to break past strong supply area (purple box).

📉 Support Levels:

🟡 $77,500 🏗️ – Weak support? Possible break!

🔴 Target: $70,000 🎯 – Major support level ahead!

🛠️ Possible Price Action:

1️⃣ Retest resistance 🚀?

2️⃣ Rejection & drop to $77,500 ❌

3️⃣ Break below = CRASH to $70K 💥

⚠️ Warning: Bulls need to reclaim trendline for reversal! Otherwise, bears in control! 🐻💪

📢 Conclusion:

Trend = BEARISH! Until a breakout happens, shorting may be the best play! 🎯

🔥 What do you think? Bullish or Bearish? 🤔👇 #BTC #Crypto

Financial Apocalypse? Markets Crash as Billions Flow into Cash –A New Wave of Market Turbulence: How Trade Wars and Uncertainty Affect Investors

The US stock market is currently undergoing a massive sell-off, which analysts compare to previous financial crises. Both institutional and retail investors are actively exiting equities and high-risk instruments, including cryptocurrencies. The accumulated anxiety is driven not only by the global economic cycle but also by specific political decisions: trade wars and protectionist measures are putting significant pressure on corporate earnings and market expectations.

Early Signs: Tariffs and Escalation

When Donald Trump announced increased tariffs on imports from China a few years ago, the stock market reacted sharply but briefly. Many analysts hoped the tensions would turn out to be short-lived negotiating tactics. Ultimately, however, the trade confrontation evolved into a prolonged phase, affecting not only the US and China but also European partners.

Today we see a continuation of this policy, where new restrictions and tariff threats have been added to the previously introduced measures. This has prompted capital outflows and increased uncertainty, as global supply chains have come under question, and the prospects for global trade recovery are murky.

Parallels with the 2008 Crisis

Comparisons to 2008 are inevitable due to the scope and speed of the drop in stock prices. However, while the primary trigger in 2008 was the collapse of the subprime mortgage market and the banking sector, the current negative factors lie in the realm of trade and geopolitical tensions.

Leading companies' financial results are declining because of rising costs for raw materials and logistics due to mutual tariffs. Global demand is weakening, and heightened instability is causing management teams to cut back on investment programs. All this is reflected in stock market indices, which continue to lose several percentage points in a single trading session.

Buffett’s Role and the Cash Accumulation Strategy

Warren Buffett, one of the largest and most conservative investors, prepared for such a scenario by amassing an unprecedented amount of cash. Buffett’s approach does not involve “catching a falling knife” at the peak of panic, but as soon as the situation stabilizes or compelling long-term opportunities arise, he will likely begin buying undervalued assets.

This strategy is typical for major players who focus on fundamental indicators. They are not looking at short-term fluctuations but rather the potential gains when the market recovers and prices return to fair value.

Cryptocurrencies: Expectations vs. Reality

Many assumed that cryptocurrencies would serve as a haven during crises. However, experience shows that in periods of global uncertainty, risk-averse investors exit digital assets alongside everything else. Bitcoin and Ethereum have lost 20–30% since the latest “flare-ups” began, and even statements about a “national bitcoin strategy” have so far failed to influence their prices.

Meanwhile, fundamental factors—limited supply, the development of blockchain technology, and IT-sector interest—have not disappeared. These arguments gain traction when investors’ risk appetite returns. But when the market is dominated by fear of further declines, they tend to avoid risky trades and prefer liquid, proven instruments.

Where the Money Goes

Unlike previous downturns, capital has not rushed into gold. While gold prices reached their peak a few weeks ago, their growth has since slowed, as some investors opt to keep their funds in cash, considered the safest choice.

Such behavior may suggest that the sell-off is nearing its climax: when capital remains “on the sidelines,” it eventually starts seeking new opportunities—whether in bargain-priced shares of large industrial giants, the tech sector, or even the cryptocurrency market with its depressed valuations. The volume of outflows from the US stock market is colossal; over the last couple of weeks, the total market cap of leading indexes has fallen by several trillion dollars. It is expected that a substantial portion of this money will re-enter the market, though likely redistributed among different asset classes.

Medium- and Long-Term Outlook

Investors with a six-month or longer horizon often see the current levels as potential entry points. Historically, global conflicts and economic crises end sooner or later, opening opportunities for those who can tolerate temporary volatility.

However, short-term trading remains extremely risky: as uncertainty persists, we may see more waves of sell-offs that knock out speculators with weak nerves or insufficient liquidity. During such moments, those who remain disciplined and steadfast can find profitable opportunities.

Conclusion

Today’s financial market conditions stem from a convergence of factors: aggressive trade policies, geopolitical risks, and the natural winding down of certain economic cycles. The mass sell-off of stocks and cryptocurrencies indicates that investors are unwilling to take on new risks until tariff disputes calm down, a clearer picture emerges for corporate profits, and major economic centers reach some form of agreement.

Nevertheless, the market retains its cyclical nature: historical parallels show that after the steepest drops, recovery periods often follow. The only question is when the turnaround will occur and who will be the first to capitalize on it.

U.S. Dollar Index (DXY) – Key Technical Levels & Market OutlookU.S. Dollar Index (DXY) Monthly Chart Analysis 📊💵

The U.S. Dollar Index (DXY) is currently navigating a critical price structure, with key supply and demand zones influencing market direction. Here’s a professional breakdown of the chart’s technical outlook:

📍 Key Technical Insights

✅ Supply & Demand Zones

Supply Zone (Resistance): 109 - 114 📈 – A key area where selling pressure has historically emerged. A decisive breakout above this level could signal further upside potential.

Demand Zone (Support): 100 - 103 📉 – A strong accumulation zone where buyers have stepped in previously. A breakdown below could indicate a shift in market sentiment.

✅ Market Structure & Momentum

A Break of Structure (BOSS) has been identified, signaling a shift in trend dynamics.

The market is currently ranging between major resistance (~109) and support (~100).

✅ 200-Month Moving Average 📊

The long-term moving average (red line) is acting as dynamic support, reinforcing the bullish bias unless decisively breached.

📊 Potential Scenarios

🔹 Bullish Outlook: If DXY maintains support above 100-103 and breaks past 109, the index could aim for 114+ in the coming months. 🚀

🔹 Bearish Risk: A sustained drop below 100 may open the door for further downside towards 95-89, signaling a broader correction. ⚠️

📌 Conclusion

The DXY remains in a consolidation phase, with key inflection points around 103 (support) and 109 (resistance). A breakout or breakdown from this range will determine the next major trend. Traders should monitor these levels closely for potential trading opportunities.

Gold (XAU/USD) Bullish Breakout – Targeting $2,960:

📊 Gold (XAU/USD) 4H Chart Analysis

🚀 Bullish Momentum: The price is currently at $2,912.80, showing signs of an upward breakout.

📈 EMA Support:

🔴 30 EMA (short-term) at $2,905.06 is acting as support.

🔵 200 EMA (long-term) at $2,862.78 suggests an overall uptrend.

🟣 Key Zones:

🛑 Resistance: Around $2,930 - $2,960 (Target Zone 🎯).

✅ Support: $2,900 (Previously tested and held).

⚡ Trade Setup:

📌 Possible pullback to the VG (Fair Value Gap) before pushing higher.

💡 If price holds above $2,905, it could rally to $2,950-$2,960.

🔥 Conclusion:

📢 Bulls are in control! Watch for confirmation above resistance before entering trades. 🚀💰

GOLD sell target in new week As of March 9, 2025, gold is trading at approximately $2,919.80 per troy ounce.

Forecasts for the upcoming week (March 10–14, 2025) suggest a potential decline in gold prices. Predictions indicate that gold may reach around $2,789 on March 12 and $2,784 on March 13, with a slight rebound to $2,825 by March 14.

Technical analysis indicates that gold prices have experienced a slight decline recently, with spot gold falling by 0.1% to $2,892.00 per ounce on March 4, 2025.

Given these projections and technical insights, setting sell targets at $2,860 and $2,850 for the upcoming week aligns with the anticipated market trend. However, it's essential to consider that gold's long-term outlook remains bullish, with forecasts predicting prices could reach $3,265 in 2025 and $3,805 in 2026.

Please note that market conditions can change rapidly, and it's advisable to stay updated with the latest analyses and forecasts before making any trading decisions.

Fundamental Market Analysis for March 11, 2025 GBPUSDThe GBP/USD pair is recovering the previous session's losses, trading near 1.28900 during Asian hours on Tuesday. The pair is rising on the back of a weaker US dollar amid concerns that tariff policy uncertainty could lead the US economy into recession.

Weaker-than-expected U.S. employment data for February reinforced expectations of multiple rate cuts by the Federal Reserve (Fed) this year. LSEG data shows that traders now expect a total of 75 basis points (bps) in rate cuts, with the June rate cut already fully priced in.

However, Fed Chairman Jerome Powell reassured markets that the central bank sees no immediate need to adjust monetary policy despite growing uncertainty. San Francisco Fed Chair Mary Daly supported that view on Sunday, noting that rising uncertainty in the business environment may reduce demand but is not a reason to change the interest rate.

As the Federal Reserve enters the black period ahead of its March 19 meeting, the central bank's comments this week will be limited. Investors now await the release of the February Consumer Price Index (CPI) on Wednesday to get further insight into inflation trends.

Trading recommendation: SELL 1.28900, SL 1.29500, TP 1.27800

GBP/USD Double Top (11.03.2025)The GBP/USD Pair on the M30 timeframe presents a Potential Selling Opportunity due to a recent Formation of a Double Top Pattern. This suggests a shift in momentum towards the downside in the coming hours.

Possible Short Trade:

Entry: Consider Entering A Short Position around Trendline Of The Pattern.

Target Levels:

1st Support – 1.2784

2nd Support – 1.2724

🎁 Please hit the like button and

🎁 Leave a comment to support for My Post !

Your likes and comments are incredibly motivating and will encourage me to share more analysis with you.

Best Regards, KABHI_TA_TRADING

Thank you.

Gold (XAU/USD) – Bearish Momentum Towards Key SupportGold (XAU/USD) Technical Analysis – 1H Chart 🏆📉

🔹 Overview:

The chart shows Gold (XAU/USD) in a downtrend after failing to break above resistance.

Key zones are marked: Resistance (~$2,920 - $2,960) and Support (~$2,840 - $2,860).

A potential bearish move is suggested towards the support area.

📌 Resistance Zone (~$2,920 - $2,960) 🚧

Price has struggled to break this level multiple times, leading to rejection.

Sellers are likely in control, pushing the price lower.

📌 Support Zone (~$2,840 - $2,860) 🛡️

This area has historically acted as a strong demand zone.

Possible price reaction here, with a bounce back up if buyers step in.

📉 Bearish Scenario:

A retest of minor resistance (~$2,900) before continuing downward.

If price reaches support, a reversal or further breakdown could occur.

📈 Bullish Recovery?

Only a strong breakout above $2,920 would shift momentum to bullish.

🔥 Conclusion:

Short-term bias: Bearish 📉

Key watch: Price action at support (~$2,840) for possible bounce 📊

$BTC: Key Levels to Watch in the MarketKey Levels to Watch in the Market

📉 Bybit hack aftermath:

Destroyed market sentiment

Shook institutional confidence

Killed the national reserve idea (US states considering Bitcoin reserves have now canceled their votes)

🚀 The last push to $99K was all Michael Saylor, spending SEED_TVCODER77_ETHBTCDATA:2B alone.

Is he insane? Buying at the top of the market?

Painful Consolidation Ahead?

We’re sitting at $91K—a crucial support. If Bitcoin fails to hold this level, expect a freefall to $85K, then possibly $81K (major support zones).

From there, Bitcoin can either:

✅ Bounce into a relief rally

❌ Break down into a full bear market if it falls below Support 3

Tough Times for Crypto

Meme coin frenzy scared off retail investors after massive losses.

Presidents rugging people doesn’t help trust in the industry.

Trump’s tariff policies could push inflation up, forcing the FED to hike interest rates.

Any Good News? Nope.

📉 SPX500 is also dropping.

🔍 TruthLabs warns that if a bear market starts, most exchanges and DeFi protocols won’t survive —they aren’t backed 1:1. This could trigger the worst bear market ever.

(See their warning here: x.com)

Final Thoughts

⚠️ Watch $91K—if it breaks, exit the market and wait. No need to get rekt in this toxic environment.

And pray that Tether has enough liquidity to handle the mass exodus. Put your funds on Binance or another reputable exchange.

🔍 DYOR

AMAZON at important support. Positive days coming?AMZN looking at good support. We can see positive days if it works.

Many cryptocurrency dominance charts, as well as Nasdaq and other stock charts too, showing the same pattern. Is the reversal starting? Check my other analysis too.

We’ll see.

This is not investment advice. Please do your own research.

Wishing you best.

-YusufDeli

Biggest support at ETHBTC, the end of the fall? Will Ethereum end its downtrend? Ethereum has been quite weak for a long time and is currently at an important support level. If it breaks down further, a sharp decline may continue, but if it holds the support, the upcoming period could be more positive.

2018 and 2021 crypto rally started from this support. Will be again?

Many cryptocurrency dominance charts, as well as Nasdaq and stock charts too, showing the same pattern. Is the reversal starting?

We’ll see.

This is not investment advice. Please do your own research.

Wishing you best.

-YusufDeli

OTHERS.D at important support, crypto rally coming?Upcoming period could be more positive?

Many cryptocurrency dominance charts, as well as Nasdaq and stock charts too, showing the same pattern. Is the reversal starting? Check my other analysis too.

We’ll see.

This is not investment advice. Please do your own research.

Wishing you best.

-YusufDeli

TOTAL Marketcap at important support?Upcoming period could be more positive?

Many cryptocurrency dominance charts, as well as Nasdaq and stock charts too, showing the same pattern. Is the reversal starting?

We’ll see.

This is not investment advice. Please do your own research.

Wishing you best.

-YusufDeli

USDT.D dominance at important resistance? Crypto rally coming?BTC and ETH coming to an important support level. And USDT dominance at the big resistance.

Many cryptocurrency dominance charts, as well as Nasdaq and stock charts at support too.

Is the reversal starting?

We’ll see.

This is not investment advice. Please do your own research.

Wishing you best.

-YusufDeli

Support Retest / PullbackSupport Retest / Pullback

- The price recently bounced from around **1.28970 (black EMA).

- If it holds above this level, the uptrend may continue.

- A break below **1.28950 might indicate further downside.

### **📌 Trading Strategy**

✔️ **Bullish Bias:** Buy if price breaks above **1.29200, targets **1.29400 - 1.29600.

✔️ **Bearish Confirmation:** Sell if price closes below **1.28950, targets **1.28600 - 1.28400.

✔️ **Use Risk Management:** Set stop-losses to minimize risk. 🚀

Tesla I Tipping Point: Short Opportunity with Head & Shoulders Short opportunity on Tesla

Based on Technical + Fundamental View

-market structure

-Head and shoulder pattern

-Double top

-Currently trading at supply zone which was a recent support and now an ideal place for a reversal to create the right shoulder of the bigger head and shoulder pattern - Daily time frame

-Product Development Delays

-Margin Pressure

-Decreased average selling price

- Increased Competition

- Flat /Declining Sales

- Leadership Concerns: Elon Musk's polarizing political activities and his divided attention between Tesla and other ventures (such as his involvement with OpenAI) have raised concerns among investors. Some analysts suggest that Musk's public perception may negatively impact consumer sentiment towards Tesla, leading to decreased sales and loyalty among customers.

Technical view

Double top

Unlike the classic double top, where the second peak reaches or exceeds the height of the first peak, the Type III double top fails to reach the previous high. This failure signifies a significant shift in market sentiment and an increase in selling pressure than usal.

Head and shoulder pattern - Pretty visible. Right shoulder is yet to be formed, Which makes an ideal place to SELL with a Risk Reward ratio. (Approx 1:6.4)

Pro Tip

Wait for a bearish candle stick pattern to execute trades on end of the day keeping stop loss somewhere above the supply zone.

Target 1 - 307$

Target 2 - 271$

Target 3 - 237$

Stop Loss - 380.21$

Fundamental View

Valuation Concerns: Tesla's stock is currently viewed as significantly overvalued, with a fair value estimate of $210 per share according to multiple analysts, including Morningstar and Firstrade. This valuation reflects a substantial premium over its current trading price, indicating potential downside risk for investors.

Earnings Performance: Tesla's Q4 2024 earnings are anticipated to show continued improvement, with expectations of gross profit margins exceeding 20%. Analysts believe that the automotive segment's performance has stabilized after a challenging first half of the year, driven by increased deliveries and lower production costs.

Market Dynamics: Despite strong demand for Tesla's vehicles, the company faces pressures from declining average selling prices due to price cuts implemented in 2023. This trend is expected to continue as competition intensifies in the electric vehicle (EV) market.

Product Development: Tesla is set to launch new models, including an affordable SUV (Model Q) aimed at increasing market share in the lower-priced vehicle segment. Additionally, advancements in autonomous driving technology are critical for future growth, with plans to roll out Level 3 Full Self-Driving software in select states and regions.

Analyst Ratings: The consensus among analysts remains mixed, with a combination of "buy," "hold," and "sell" ratings. The average price target reflects a cautious outlook, suggesting that while there is potential for upside, significant risks remain due to valuation concerns and competitive pressures.

Not an investment Advise

NZD/CAD Triangle BreakoutThe NZD/CAD pair on the M30 timeframe presents a Potential Buying Opportunity due to a recent Formation of a Triangle Pattern. This suggests a shift in momentum towards the upside and a higher likelihood of further advances in the coming hours.

Possible Long Trade:

Entry: Consider Entering A Long Position around Trendline Of The Pattern.

Target Levels:

1st Resistance – 0.8268

2nd Resistance – 0.8301

🎁 Please hit the like button and

🎁 Leave a comment to support for My Post !

Your likes and comments are incredibly motivating and will encourage me to share more analysis with you.

Best Regards, KABHI_TA_TRADING

Thank you.

XAU/USD 4H Analysis: Key Support, Resistance & Breakout TargetsKey Levels Identified:

Support Zone (~2,875-2,885) 🟣

This is a strong area where price previously bounced.

If price falls below this level, it could drop further toward the next support.

Resistance Zone (~2,915-2,925) 🟣

Price is currently consolidating around this level.

A breakout above resistance could push the price toward the target.

Target (~2,950) 🎯

If the price breaks above resistance, the next key level is around 2,950.

Potential Scenarios:

📈 Bullish Scenario:

If price breaks above resistance, expect an upward move toward the target (2,950).

Confirmation would come with strong volume and bullish candlestick patterns.

📉 Bearish Scenario:

If price fails to hold above support, a drop toward 2,825-2,835 is possible.

A strong bearish candle closing below support would confirm this move.

Current Trend:

The price has been moving in a sideways consolidation between support and resistance.

Watch for a breakout in either direction for the next big move.

XAU/USD (Gold) Trendline Breakout (10.03.2025)The XAU/USD Pair on the M30 timeframe presents a Potential Selling Opportunity due to a recent Formation of a Trendline Breakout Pattern. This suggests a shift in momentum towards the downside in the coming hours.

Possible Short Trade:

Entry: Consider Entering A Short Position around Trendline Of The Pattern.

Target Levels:

1st Support – 2877

2nd Support – 2860

🎁 Please hit the like button and

🎁 Leave a comment to support for My Post !

Your likes and comments are incredibly motivating and will encourage me to share more analysis with you.

Best Regards, KABHI_TA_TRADING

Thank you.

Hedge against the Bears by buying Agnic Eagle Mines LimitedWatch the video, I basically used technical analysis of MA, RSI and TTM Squuze to determine that the direction is bullish on the daily, weekly, and monthly charts. Then coupled that with a 1.66 R:R ratio according to Gabriel's Kelly-based Risk to Reward Ratio. You can use levearge here such as option since the Implied Volatility is still around the 30% level, for futures you could use 2x etf if there is one I haven't check. Seasonality supports AEM until May 8 so there is a wind to fall back out if it falls with a bullish engulfing candle this Monday.