Reliance Head and Shoulder Pattern Hourly ChartHead and Shoulders Pattern: This is a popular chart pattern in technical analysis that can indicate a potential trend reversal. It consists of three peaks: a higher peak (head) between two lower peaks (shoulders). It suggests that the stock's price might change direction from an upward trend to a downward one.

Left Shoulder, Head, and Right Shoulder: These refer to the three peaks in the pattern. The left shoulder has a high of 2543, the head has a high of 2630, and the right shoulder has a high of 2559. The head is the highest point among the three.

Breakdown Target: In a head and shoulders pattern, analysts often measure the potential downward movement after the pattern completes. The "height of the head" is the vertical distance from the head's high to the neckline (more on this in the next point). In this case, the height of the head is 2630-2473=2316.

Neckline: The neckline is a support level that connects the lowest points of the two troughs between the peaks (shoulders) in the pattern. In this case, it seems like the neckline is at a value of Rs. 2473.

Breakdown of the Neckline: A significant event occurs when the stock's price breaks below the neckline. This is seen as a confirmation of the pattern and a potential signal for a trend reversal. In this scenario, if Reliance's stock price drops below Rs. 2473 (the neckline), it suggests a potential further decline in price.

Downside Target: The "156 point downside in reliance" refers to the expected price movement if the breakdown occurs. It's calculated by taking the "height of the head" (difference between head high and neckline) and subtracting it from the neckline value. So, 2630 - 2473 = 156.

In summary, the analysis suggests that if Reliance's stock price breaks below the neckline value of Rs. 2473, there could be a potential downward movement of 156 points in the stock, based on the head and shoulders pattern on the hourly time frame. This type of analysis is used by traders and investors to make informed decisions about buying or selling stocks.

The information provided here is for educational and informational purposes only. It does not constitute financial advice, and I am not a financial advisor.

Disclaimer: Trading stocks and making investment decisions involves inherent risks, and you should always conduct thorough research and consider seeking advice from qualified professionals before making any financial decisions. The analysis presented, including the target price calculation, is based on technical patterns and historical data, which may not accurately predict future price movements. The actual performance of stocks can vary widely from any analysis or prediction. Always exercise caution and due diligence when making investment choices.

Thank you.

AND

Predicting a Downward Movement for BTCI've been closely observing the BTC/USDT Perpetual Contracts on Binance and after an extensive 4-hour timeframe technical analysis, I am predicting a potential downward movement for Bitcoin.

The key indicators I've used for my analysis are trends, a unique indicator called "Price Action - Support & Resistance by DGT" (source), and two Fibonacci Retracement for two distinct waves.

Firstly, the trend analysis on the 4-hour chart shows that Bitcoin has been consistently making lower highs, indicative of a bearish market. The "Price Action - Support & Resistance by DGT" also backs up this bearish outlook, displaying key areas of resistance that Bitcoin is currently struggling to overcome.

Moreover, by analyzing two significant price waves using Fibonacci Retracement, we can see that Bitcoin's price is rejecting at key Fib levels. The consistency of these rejections at similar Fib levels further cements my belief in an impending downward move.

Based on my analysis, I am predicting a potential fall in Bitcoin's value to 28022 USDT, which would constitute a 4.31% decrease from entry price level.

In terms of risk management, I would recommend setting a stop loss level at 30200 USDT. This level is selected as it is a key resistance point which if broken, would invalidate the current bearish trend.

As always, risk management is crucial. I would advise not to risk more than 1-2% of your portfolio on any single trade, including this one.

It's important to note that while my analysis is thorough and based on key indicators, trading always carries risk. Be aware of the potential risks and always make sure to trade responsibly.

Head and shoulder pattern breakout in SIEMENSSIEMENS INDIA LTD

Key highlights: 💡⚡️

✅On 1Hour Time Frame Stock Showing Breakout of head and shoulder pattern.

✅ Strong Bullish Candlestick Form on this timeframe.

✅It can give movement up to the Breakout target of 3858+.

✅Can Go short in this stock by placing a stop loss above 3695-

Polygon MATIC potential rally with the Stock MarketCryptocurrencies were left behind by the recent Stock Market rally.

With the arrival of new BTC Bitcoin ETFs, I expect the Crypto Market to follow!

MATIC/USDT long:

Entry Range: $0.60 - 0.65

Take Profit 1: $0.70

Take Profit 2: $0.82

Take Profit 3: $0.93

Stop Loss: $0.51

GBPUSD - DON'T GET DISTRACTED BY THE SELL Hello traders, have a similar bias on GBPUSD? This week we've seen quite sell on GBPUSD which even took out the PWL (Previous Week Low) but does that mean we are currently bearish? Of course NO.

GBPUSD is still very much Bullish according to Higher Timeframe narrative. We are currently in Premium so begin preparing for more BUYS immediately price sells to Discount.

Externally, we've established we're still bullish so we expect Internal Structure to work in line with that. Internally, we see price has taken out IRL (Internal Range Liquidity) meaning it's likely to buy massively from the 4h Imbalance marked out or from the Order block (which is my preferred entry.

Targets: Price will most certainly head towards the previous week high to clear it and give us another BOS (Break of Structure) which will indicate the continuation of the Bullish trend.

If this post was useful to you, please do not forget to like and comment❤️.

3 categories for Strategy RulesToday we’re going to be looking at three categories for strategy rules .

This is very critical because the most important concept before we enter into a trade is to have it already pre-set in our mind where we’re going to enter and how we’re going to exit. It’s all got to be totally predetermined and you have to visualise your whole trade set-up, your trade management and your trade exit. All these three things must be very clear within you and you must already have spelled it out with clear rules so that’s its very clear in your mind. Clarity leads to conviction. Finally that gives you courage to pull through any kind of loss cluster or drawdowns.

Let’s take a look at these three categories for strategy rules. The first one is about entry rules . These tie in with what your trade set-up should look like. So when should you enter a trade? The last thing you want to do Traders is to enter a trade just out of emotional impulse. Once you’ve entered a trade by emotional impulse, when you come out of it you’ll think ‘Oh no, why did I do that?’ and that hurts so many traders. Many of the over 20,000 traders that we’ve coached so far and talked to at seminars have told us that they’ve made this mistake. One of the ways to stop that and nip that mistake in the bud is by making the rules really clear and so straight forward that you know how to follow them and can repeat them again and again.

The entry rules can be sub-categorised into pre-entry rules and post-entry rules. Pre-entry rules basically means before you enter the trade what are the criteria for you that must set-up for you to enter and then to trade that price or that instrument? If you do get stopped out, what are the rules for you to then re-enter back into that trade. Some tools that you can use to formulate your entry rules are:

Price action – be very clear on how the price action should be before you enter into a trade. For example, if you want to buy into a position has there got to be two seller bars and one buyer bar or has there got to be some kind of momentum decline which you also need to quantify so that emotional trading doesn’t come in. That’s all to do with price action.

Time frame correlation – as I have explained in other videos, if you’re an end of day trader you’ve got to correlate with a higher time frame. We usually recommend three time frames.

Indicators – there are thousands of them and you’d know about them.

Cycles and phases – you can incorporate rules about cycles and phases into your strategy.

Support and resistance rules – where you can enter into the market based on supply and demand.

News – think about how long before news comes out do you want to enter? For example, if news comes out in the next 30 minutes, do you want to enter a trade even before, say 30 or 40 minutes before news comes out?

All these things you need to include in your entry rules and as good criteria you need to at least include three or four of them. We call it degrees of freedom and you need to have at least three to four of them, ideally four, minimum three in your strategy. Of course as I’ve mentioned before in other talks, you need to choose and mix and match these rules according to the concept and objective of your strategy.

The second thing, after the entry rules, we’re looking at stop loss rules . Stop loss can be further sub-categorised into initial stop loss rules and trailing stop loss rules. Before you even enter the trade you should know where the stop loss is going to go which is the initial stop loss. Once you enter into the trade you need to then know how you’re going to manage your trade and then to trail that stop loss progressively. This is critical. You need to know this before you enter the trade.

Finally, our target rules . Where are we going to get out, what is our target? In terms of target rules we’re looking at pre-target, that is, before we enter the trade we should already know where we’re going to get out. And the intra-target as well, for example, you might be familiar with the USD and Swiss Franc – it was crazy, a price shock as we call it, a price adverse move of 5000 pips in just one day. When price adverse shocks like that happen suddenly in the market, you must have plans to get out. That’s what we call intra-target rules.

Those are the three categories that you definitely must have in your strategy rules so as to consistently execute and also to remove doubt and emotion you need to quantify those rules. That will really help towards your consistent execution.

In summary, they are entry rules, stop loss rules and target rules. The objective of writing all those rules, Traders, is so that you really get clear in your mind how the trade should look. You should have predetermined everything and you should be able to visualise how everything should be before you get into the trade, while you are in the trade and how you should get out of the trade – trade entry, trade management and trade exit.

I believe this has been very useful. Do some research on your strategies and you’ll clearly see how much clarity and conviction you’ll have in your strategy and how it will help you with your execution and strategy forms. Until the next time, as we always say, stay disciplined, follow your trading plan and keep Trading Like a Master.

🔥 Bitcoin Bullish Cup & Handle Pattern: Wait For Confirmation!BTC saw two huge bearish and bullish moves over the last two days. This morning, BTC found resistance around the most recent local top around 27.5k and corrected downwards.

Assuming that the most recent minor low of 26.4k is going to hold, a bullish cup & handle pattern will likely form on the chart. Keep in mind that this pattern has not yet been confirmed. It will be confirmed once the price will break through 27.5k, will will also activate the trade.

Target placed at the 2023 top area of 31k for a decent 2.9 risk-reward ratio.

bitcoin long setup Hello Traders, here is the full analysis for this pair, let me know in the comment section below if you have any questions, the entry will be taken only if all rules of the strategies will be satisfied. I suggest you keep this pair on your watchlist and see if the rules of your strategy are satisfied. Please also refer to the Important Risk Notice linked below.

APE AND AMC, THE END GAME, TRADE OF A LIFETIME, COME MAKE $not financial advice, but this is the money maker!

#amc

🔥 Bitcoin Cup & Handle: Patience For Break Out ☕BTC has been forming a cup & handle pattern over the last couple of days. Note that the pattern is not finished yet, so we can't be certain whether it's really a cup & handle, but we can at least prepare for it.

I'm waiting for BTC to break through the top yellow resistance area. A break out through there will confirm the pattern and will likely result in a bullish break out.

31k is my short-term target. Patience is key.

Technical Pull back Buy the DIP!The slight gross margin decrease of 4.8% was enough to resume the HS pattern on the chart executing a normal pullback- relative to the "neckline" where HS patterns are confirmed with some other criterion. Despite the quarterly margin contraction, expected cost reductions should start to materialize in 2024. Everything on the income statement is trending in the right direction. If TSLA really does hit the pattern target of HKEX:80 , a 50% further decrease from current SP, which is based on a formula of probabilities for this specific pattern, then it will be 62% undervalued.

At SP of 80, subtracting the 5.14 of Cash per share, and using current TTM, the PE would be 21! Even with a PE of 49 GAAP TTM , the difference to sector is 222% and FWD PE of 50.5. However several different metrics between growth and profitability could easily justify it where its at now. EBITDA growth YoY 3,607% diff to sector,/ FWD 690% diff to sector; Rev Growth Fwd 393%. EV/EBIDTA FWD 180 % diff to sector. Net Income Margin TTM 247% diff to sector. ROC TTM 193 and ROA TTM 289% differences to sector... Easily justified.. Rarely are you able to purchase growth companies at a PE of 21... Buy the DIP!

AMC BIG MOVES COMINGThis chart provides a view at the possible 100% run-up followed by the some 80-90% crash. If it gaps up tomorrow, it probably hits HKEX:10 within a few days, if it decides to drop, I'd definitely buy if it bounces 4.03.

I think the big money on this play is going to be the short position after it tops.

Bitcoin Analyze (Short Term, 15-minute Time Frame,31/3/2023)!!!I expect Bitcoin to reach at least the 🟢support zone (27800)🟢 again finally.

Bitcoin Analyze ( BTCUSDT ), 15-minute time frame ⏰.

Do not forget to put Stop loss for your positions (For every position you want to open).

Please follow your strategy, this is just my Idea, and I will be glad to see your ideas in this post.

Please do not forget the ✅' like'✅ button 🙏😊 & Share it with your friends; thanks, and Trade safe.

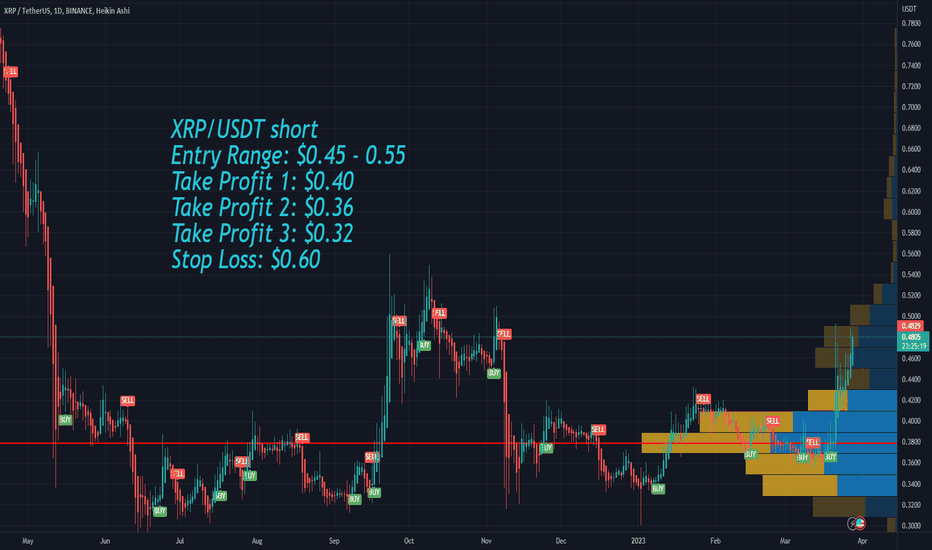

XRP Price Target after the U.S. CFTC sued BinanceBinance and its CEO, CZ, are being sued in the US by Commodity Market Regulators in a complaint that claims the defendants committed “wilful evasion of US law”.

This comes after the SEC Charged Crypto Entrepreneur Justin Sun and his Companies for Fraud and Other Securities Law Violations last week.

Binance is responsible for 61.8% of the global crypto trading. Its Market Share is Huge!

I assume we are about to witness a major selloff in the crypto industry.

My XRP Price Targets:

XRP/USDT short

Entry Range: $0.45 - 0.55

Take Profit 1: $0.40

Take Profit 2: $0.36

Take Profit 3: $0.32

Stop Loss: $0.60