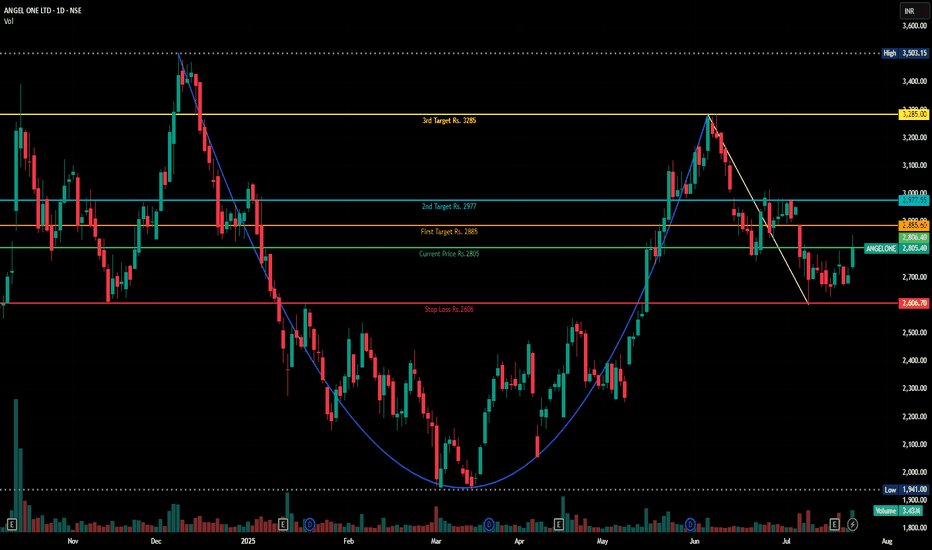

Cup and Handle Formation in Angelone ChartDisclaimer : Do your own research before investing. This is just a chart analysis for education purpose only. No recommendation to buy and sell.

In Dec 2024, AngelOne made high of Rs.3500 and pull back to level of Rs.1941 in March 2025.

After touching level of Rs. 3288 , its now trading at Rs. 2805.

I can see a cup and handle chart pattern formation in this stock. to me , it will be bullish in near to long term.

I have mentioned my targets along with stop loss.

ANGELONE

ANGELONE Breakout Trade Setup – Weekly Chart TargetsAngel One Ltd (BSE: ANGELONE) – Breakout Setup with Bullish Price Targets

The stock has broken out of a long-term descending trendline resistance on the weekly chart, signaling a potential trend reversal. The breakout is supported by strong bullish momentum and volume, indicating growing buyer interest.

💡 Technical Highlights:

Clear breakout from descending trendline.

Strong weekly candle with over 13% gain, confirming bullish sentiment.

Price has surpassed key horizontal resistance near ₹3,150–₹3,200 zone.

🎯 Targets:

First Target: ₹4,165.25 (Upside of ~34.39%)

Second Target: ₹4,897.90 (Upside of ~41.28%)

This setup offers a strong risk-reward opportunity for swing traders and position traders, provided the breakout sustains. Keep an eye on retest levels around ₹3,150 for potential entries.

📅 Chart Timeframe: Weekly

📈 Trend: Bullish

🔎 Watch Levels: ₹3,150 (support), ₹4,165 / ₹4,897 (resistance/targets)

Angel One: Watch for Breakout or Pullback!Current Price: ₹2866

Resistance: ₹3000 🔼

Support: ₹2578 🔽

📊 Technical Snapshot:

Angel One is hovering near the crucial ₹2866 level. With resistance at ₹3000, a break above could signal a strong bullish breakout. On the flip side, if rejected, we may revisit the ₹2578 support zone for a possible bounce.

📌 Trade Ideas:

Bullish: Entry above ₹2900 with a target of ₹3000–₹3050. SL: ₹2840

Bearish: Short near ₹2990 with tight SL above ₹3010. Target: ₹2750–₹2600

🔍 What to Watch:

Volume near ₹3000

Price action around ₹2578 if correction sets in

RSI/Daily trend for momentum confirmation

💬 Your View? Are you bullish or bearish on Angel One this week?

#AngelOne #TradingView #StockAnalysis #AngelOneShare #TechnicalAnalysis #NSEStocks #BreakoutAlert #SupportAndResistance #SwingTrade #DayTradingIdeas

Angel one A bullish move can be expected if the symmetrical triangle pattern is broken.

If you find this helpful and want more FREE forecasts in TradingView, Hit the 'BOOST' button

Drop some feedback in the comments below! (e.g., What did you find most useful? How can we improve?)

Your support is appreciated!

Now, it's your turn!

Be sure to leave a comment; let us know how you see this opportunity and forecast.

Have a successful week

DISCLAIMER: I am NOT a SEBI registered advisor or a financial adviser. All the views are for educational purpose only

Angel One (ANGELONE) Set to Soar: Key Technicals Align for Major🚀 Angel One (ANGELONE) Set to Soar: Key Technicals Align for Major Upside! 📈

Why You Should Care: Angel One Ltd is on a bullish trajectory, and everything from price action to technical indicators is screaming buy! If you’re looking for a stock with explosive potential in the short term, this is one you don’t want to miss. The chart is telling a story of momentum, and the technicals back it up.

🔥 Key Technicals:

Bullish Marubozu on both weekly and monthly charts—strong momentum!

RSI has just broken key resistance, signaling unstoppable strength.

Volume breakout confirms sustainability of the price rise.

Donchian Bands and Bollinger Bands are signaling a breakout is just around the corner.

Stochastic reading of 98 and CCI at 136—bullish indicators all the way!

🚀 Why It’s a Game-Changer: This stock is screaming for attention—bullish candles, RSI breakouts, and a strong volume surge make Angel One a solid pick for a swing trade or BTST play. With the momentum backing it up, there’s significant upside potential in the short term!

💥 Take Action NOW: Don't miss out on this opportunity! Keep a close eye on ANGELONE—if the momentum continues, you could see some solid returns.

👉 Add ANGELONE to your watchlist and stay ahead of the trend!

🔔 Set your alerts and make sure you're ready to act when the breakout happens!

Possible levels to watch: 3340 - 3590 - 3850 - 4105

Angel One Breaking Key Resistance Level Amid Leadership ChangeAngel One Ltd (NSE: ANGELONE) has witnessed a sharp upward movement, with today’s price action breaking past the key Fibonacci retracement level of ₹2,968 (61.8%) after bouncing off the support near ₹2,600. The recent appointment of Arief Mohamad as the Chief Business Officer - Direct Business could be a key factor boosting investor confidence, triggering this strong bullish momentum.

Key observations:

The stock is trading above its 20-day, 50-day, and 200-day moving averages , indicating strong bullish sentiment.

Immediate resistance is seen around ₹3,187 (next Fibonacci level) , while strong support rests at ₹2,749 (38.2% retracement level).

RSI is hovering near 70, showing an overbought condition. A pullback may be expected, but if momentum continues, a breakout toward ₹3,400 is possible.

This move shows the potential for further upside, though caution is advised with the RSI entering overbought territory. Traders might want to watch closely for a potential pullback or consolidation in the near term.

Angel One : So Close.Here is all you need to know about Angel One:

- With Financial services gaining momentum, Angel One is definitely a good bet

- It consolidated for good 2 years in which it trapped bulls once, only to get back in the zone

- It recently gave in a breakout and sustained above the resistance zone

- BUT, Today NSE barred it from onboarding any new APs for a period of 6 months which made the stock bleed red for 7%

- APs are basically sub-brokers associated with a broker who brings in more clients and thus more business

- With the stock market on a bull run, the funds are flowing in and the inability to onboard new APs will definitely affect its growth in a short run

- Don't let the analysis end here! Give us a boost if you find it helpful

- The long run will still be dictated by its strong fundamentals and growth.

Below are some interesting stats:

- Profit growth of 52.2% CAGR over the last 5 years

- return on equity (ROE) track record: 3 Years ROE 44.1%

- Sales growth (5Y) - 31%

- Profit growth (5Y) - 52%

What are your thoughts? Feel free to comment :)

⚠️Disclaimer: We are not registered advisors. The views expressed here are merely personal opinions. Irrespective of the language used, Nothing mentioned here should be considered as advice or recommendation. Please consult with your financial advisors before making any investment decisions. Like everybody else, we too can be wrong at times ✌🏻

Angel One wants to fly like an Angel. Angel One Ltd. operates as a financial services company. It engages in the full-service retail broking house. The firm also offers broking and advisory services, margin funding, loans against shares, and financial products distribution.

Angel One Ltd CMP is 2664.50. The positive aspects of the company are Company with Zero Promoter Pledge, Growth in Net Profit with increasing Profit Margin, FII / FPI or Institutions increasing their shareholding and MFs increased their shareholding. The Negative aspects of the company are PE higher than Industry PE, Low durability companies, Promoter holding decreased by more than -2% QoQ and Stocks with Expensive Valuations .

Entry can be taken after closing above 2662. Targets in the stock will be 2700 and 2779. Long term targets will be 2927 and 3099+. Stop loss in the stock should be maintained at Closing below 2600.

The above information is provided for educational purpose, analysis and paper trading only. Please don't treat this as a buy or sell recommendation for the stock. We do not guarantee any success in highly volatile market or otherwise. Stock market investment is subject to market risks which include global and regional risks. We will not be responsible for any Profit or loss that may occur due to any financial decision taken based on any data provided in this message.

Angelone - Played out to the T, now correcting.This one played out very nicely. Actually to the T since my last update on 2nd January, 2024.

Turned up in a very impulsive manner (as a wave 3 does) with very shallow pullbacks, hardly giving any chance to ride the train.

For now Wave 3 seems to be complete and wave 4 correction is in progress.

You know what's next if you understand Elliott Wave Principle.

Will update later as the price develops.

Thanks for reading!

Beautifully played out4 months since I first shared my Elliott wave count on Angel One.

The price has since moved beautifully in an impulsive manner clearly suggesting the presence of wave 3.

In my opinion, blue wave (iii) is still in progress but may end soon (350 points more maybe) and the price may go sideways to consolidate in wave four.

Thanks for reading!

ANGELONE - Stock Analysis**ANGELONE - A Lucrative Opportunity Unveiled**

📈 **Market Insight:**

In the recent sessions, AngelOne has been on a remarkable ascent, witnessing a surge in both price and volume. Notably, it has achieved a new one-year high and is actively trading with substantial volume, signaling robust market interest. The Bollinger Bands have experienced a positive breakout, affirming a bullish momentum. Supported by a very strong uptrend, as indicated by the ADX, AngelOne presents a compelling case for potential gains.

🕯️ **Candlestick Patterns:**

A bullish gap-up candlestick pattern at a notably high level further accentuates the momentum, and the bullish continuation Heikin Ashi pattern adds another layer of confirmation.

📊 **Trade Recommendation:**

To capitalize on this promising scenario, consider going long above ₹3035.10. For risk management, a strategically placed stop loss below ₹2498.40 ensures a prudent approach.

💼 **Why Now?**

This isn't just a trade; it's an invitation to participate in a strong uptrend with a stock that has not only reached new heights but is backed by solid volume and technical indicators. Seize the opportunity with AngelOne and ride the wave of potential profits! 🚀💰

📈📉 #StockMarket #TradingOpportunity #AngelOne #BullishTrend #FinancialMarkets #ProfitPotential 📊💹

ANGELONE - Stock Analysis**Technical Analysis:**

Angel One Ltd exhibits several strong technical signals that suggest a bullish trend. The price volume has shown a "Strong Bullish" indication, with the stock's price trending nicely while accompanied by rising trading volumes. HighLow is also "Strong Bullish," as the company has recently reached a one-year high and is trading with substantial volume support. The One Day signal is "Strong Bullish" as well, indicating a recent strong price rise supported by healthy trading volume.

Additionally, various technical indicators are sending positive signals. The Keltner Band, MACD, Donchian Band, MA Envelope Band, HighLow Band, MA Channel Band, and BOLLINGER all show "Strong Bullish" signals, with positive breakouts and consistent trends. The Awesome Oscillator is "Bullish" after a recent bullish reversal, and the Aroon Indicator indicates a "Strong Bullish" trend with bulls in control. The ADX confirms a "Strong Bullish" signal, suggesting a very strong uptrend.

However, it's important to note that the Slow StoChastic, despite being in the overbought level, is weakening, indicating a "Bearish" signal. Meanwhile, the Rsi Smooth, though in a textbook overbought level, shows a "Bullish" signal due to a strong uptrend.

**Candlestick / Heikin Ashi Patterns:**

The daily and weekly candlestick patterns are both "Bullish," indicating a continuation of the bullish trend. However, the monthly candlestick pattern shows a "Neutral" signal, with a "Three Outside Up" formation accompanied by weak volume. This may not be a very strong signal, so it's worth considering the time frame.

**Fundamental Metrics:**

Angel One Ltd presents impressive fundamental metrics. There has been a tremendous increase in book value over the last three years, and it boasts a Piotroski F Score of 7.0, signifying good value. The company has achieved significant growth in net profit over the same period and has consistently demonstrated an incredible return on equity (ROE).

Quarter-over-quarter (QoQ) EPS growth is excellent, and over the past twelve months, the company has shown a strong Return On Equity of 47.63% and a Net Margin of 30.01%. Furthermore, all key trailing twelve months margins have been growing by 15%, and the company's net profit and profit before tax are increasing steadily for the last five quarters. EBITDA has been continuously on the rise for the past three years, and there's a steady growth in EPS over the last four quarters. The Return On Capital Employed (ROCE) stands at a commendable 21.16%.

**Sales and Debt:**

The company has witnessed a tremendous increasing trend in total sales over the past three years, with quarterly sales trending upwards for the last five years. Moreover, there has been a steady increase in total assets over the past three years. The company's efforts to pay off more than 50% of its debt demonstrate its commitment to becoming debt-free. The debt-to-equity ratio has decreased and is now at its lowest level in the past three years, reflecting a sound financial position.

Based on the analysis, the recommendation for potential investors is to "Go Long" on Angel One Ltd above the 2850 mark, with a suggested stop loss set at 2454. However, always exercise caution and consider other market conditions and your personal financial goals before making any investment decisions.

Angel One - long term bullish caseWith the recent break of red wave iii high, the pattern seems to be a 5 wave move up from March, 2023 lows.

Also patten preceding the impulse wave seems to be in 3 wave (zig-zag correction) hence adding more conviction my current wave count.

A break of all time high at 2022 will add more confidence to this view.

Will update the chart as it develops further.

Thanks for reading!