Trade the Angle, Not the Chop: Angle of MA ExplainedNot all moving averages are created equal. While most traders rely on the slope of a moving average to gauge trend direction, the Angle of Moving Average script by Mango2Juice takes it a step further—literally measuring the angle of the MA to help filter out sideways markets and highlight trending conditions.

Let’s explore how this tool works, how we use it at Xuantify, and how it can sharpen your trend-following strategy.

🔍 What Is the Angle of Moving Average?

This indicator calculates the angle of a moving average (default: EMA 20) to determine whether the market is trending or ranging. It introduces a No Trade Zone , visually marked in gray, to signal when the angle is too flat—suggesting the market is consolidating.

Key Features:

Measures the slope of the moving average

Highlights ranging zones with a gray color

Helps filter out low-momentum conditions

Customizable MA type and length

🧠 How We Use It at Xuantify

We use the Angle of Moving Average as a trend filter —not a signal generator.

1. Trend Confirmation

We only take trades in the direction of a steep enough angle. If the MA is flat or in the gray zone, we stay out.

2. Entry Timing

We combine this with structure tools (like BOS/CHOCH) to time entries after the angle confirms a trend is underway.

🎨 Visual Cues That Matter

The script uses color to show when the market is:

Trending : Clear slope, colored line

Ranging : Flat slope, gray line (No Trade Zone)

This makes it easy to:

Avoid choppy markets

Focus on momentum-driven setups

Stay aligned with the dominant trend

⚙️ Settings That Matter

You can customize:

MA Type : EMA, SMA, etc.

MA Length : Default is 20

Angle Sensitivity : Adjust to define what counts as “flat”

⚙️ Higher timeframe alignment

You can look at HTFs for better and stronger entry and exit points.

Below a 1H and 4H chart where the 4H clearly adds strong buying power for a good long entry point.

🔗 Best Combinations with This Indicator

We pair the Angle of MA with:

Structure Tools – BOS/CHOCH for trend context

MACD 4C – For momentum confirmation

Volume Profile – To validate breakout strength

Fair Value Gaps (FVGs) – For sniper entries

⚠️ What to Watch Out For

This is a filter , not a signal. It won’t tell you when to enter or exit—it tells you when not to trade . Use it with price action and structure for best results.

🚀 Final Thoughts

If you’re tired of getting chopped up in sideways markets, the Angle of Moving Average is a simple but powerful filter. It helps you stay out of low-probability trades and focus on trending opportunities.

Try it, tweak it, and see how it fits into your system.

Angle

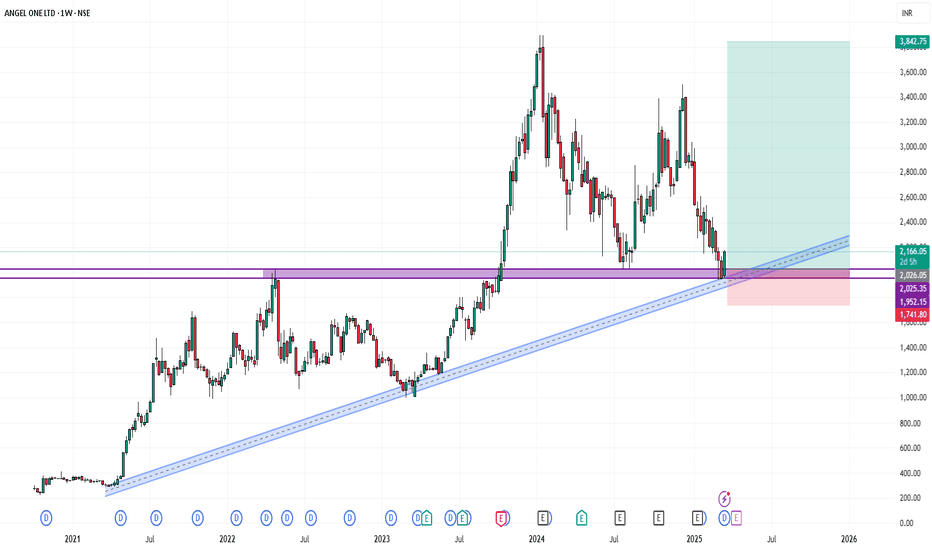

SWING IDEA - ANGELONE

ANGELONE

's stock price has been retesting around the 2000 resistance level for approximately two and half years. Following multiple retest, the stock finally broke out above this level in October 2023 and has since established it as a key support.

The stock subsequently surged to a peak of 3895, representing a 87% increase. However, it then experienced a sharp correction, plummeting 45% to revisit the 2000 support level again. This pivotal point, formerly a resistance, has now become a robust support.

Currently, ANGELONE is exhibiting an upward momentum, poised to retest its swing high at 3895. The weekly MACD crossover, occurring after the establishment of support at 2000, indicates a bullish trend reversal.

KEY OBSERVATIONS:

- Two-year resistance level of 2000 broken in October 2023

- Stock surged 87% to 3895 before correcting 45%

- 2000 level now serves as robust support

- Weekly MACD crossover indicates bullish momentum

- Upward momentum poised to retest swing high at 3895

RECOMMENDATION:

Based on this technical analysis, I would recommend holding ANGELONE for a Long Term horizon. This could potentially yield:

- 35% returns from the current price (as of writing)

- 87% returns from the support point (2000)

This analysis highlights a compelling buying opportunity in ANGELONE, driven by its breakout and momentum reversal.

IMPORTANT NOTE: Investors should be aware that there is a possibility that the stock may revisit this Support level at 2000 in the near future before resuming its upward momentum towards the swing high at 3895. This potential pullback should be monitored closely, and investors may consider adjusting their strategies accordingly.

DISCLAIMER: This IDEA is for informational/educational purposes only and should not be considered as investment advice. The analysis presented is based on technical indicators and historical data but does not guarantee future performance. Please conduct thorough research based on financial goals and risk tolerance, and consult with a financial advisor before making any investment decisions.

USDCAD H1 - Stress-Free Clear Charts.Stress-Free Clear Charts. (Required 10 years in R&D.)

In this layout, we see these indicators:

(From top to bottom of the screen)

-Angle: Shows the Angle of the Trend.

-Bear&Bull Powers: Displays who are in Power, the Bulls or the Bears.

-Strength: Shows the Strength of the Trend.

-Template: Always clearly shows the direction and precisely where to open and close (where to flip position). We open at the beginning of the Trend and stay in all the way till the end, stress-free. Turns perfectly.

-Performance: We see where to enter and close, the pullbacks and the performance.

-Odds: Shows the Odds everywhere.

-Probability: Shows the Probability all the way.

-Compare Forex: We see the performance of each currency of the Pair on chart. Each line is one currency. USD in Red. CAD in White. When the USD is above the CAD, the USDCAD pair goes up. And vice versa, when the USD is below the CAD, the USDCAD pair goes down. The background color displays the intensity of the trend.

How we have been trading EURUSD D1How we have been trading EURUSD D1 (Daily chart) with our indicators + hand-drawn trend lines.

After 10 years of R&D (we have been testing different indicators every day for a decade), we have developed our own Suite of 26 indicators. Here are just a few of them.

Indicators names (from top to bottom):

- Strength

Shows the strength of the market, the direction, pullbacks, equilibrium, and flats.

- Bear&Bull Powers

Shows the battle between the bears and the bulls.

- Angle

Indicates the direction and angle of the trend and the pullbacks.

- Template

Our main central indicator simplifying charts and bringing clarity.

- Steepness

Displays how steep the trend is and comments:

Going Up/Down | Trending | Strong/Weak | Pulling Back | Retracement | Flat | 75% Blue Background | ...

- Odds

11 indicators calculating the odds.

- Probability

75 indicators calculating the probabilities.

How we have been trading Bitcoin D1How we have been trading Bitcoin (Daily chart) with our indicators + hand-drawn trend lines.

After 10 years of R&D (we have been testing different indicators every day for a decade), we have developed our own Suite of 26 indicators. Here are just a few of them.

Indicators names (from top to bottom):

- Strength

Shows the strength of the market, the direction, pullbacks, equilibrium, and flats.

- Bear&Bull Powers

Shows the battle between the bears and the bulls.

- Angle

Indicates the direction and angle of the trend and the pullbacks.

- Template

Our main central indicator simplifying charts and bringing clarity.

- Steepness

Displays how steep the trend is and comments:

Going Up/Down | Trending | Strong/Weak | Pulling Back | Retracement | Flat | 75% Blue Background | ...

- Odds

11 indicators calculating the odds.

- Probability

75 indicators calculating the probabilities.

On the down-low Money Supply factsThe chart shows two recent and unprecedented occurrences that may lead to an outcome of equally unprecedented proportions. In the past year the money supply

peaked and is still negative over a year since

reached peak liquidity

Causes include the effects of the pandemic, asset conversions spurred by tax reforms and corporate buybacks, rising unemployment and housing prices amid interest hikes , and government security buybacks initiated due to bond market stress.

This general and massive sell-off at peak valuation with no likely intent or ability to spend in the near term at a time of impending stagnation forebodes a bearish outlook for markets worldwide.

Bitcoin above $70k resistance levelThe neat thing about Cosmic Flow is that is lets you use one MA period for the resistance and another one for the support. Here we used the HMA with 50 bar resistance and 100 bar support to recognize a repeating pattern on the 1W chart, in combination with the Cosmic BB SR indicator. While these two indicators show that the price is now more bullish than it was during the last $70k top in November 2021, the Cosmic Angle indicator is still showing a significant negative trajectory and is changing its angle at a very slow pace. This information suggests two likely effects: 1) a large and sudden bullish movement 2) a gradual reversion to the Cosmic Flow basis line.

Market Tutorials: Creating ArcsHope you are well!

For this tutorial, the topic is how to create arcs using an angulation method.

First, take an axis. This axis is down to up. Observe and determine whether it fits better as a 8x1 or 4x1 - or 1x8 and 1x4.

Once that is determined, place the geometric angles onto the axis, and use the 1x1 angle as the axis for the arc.

Grab your favorite arc tool such as the fibonacci circles, speed resistance arcs, or the gann box. Place the arc over the image and be sure the arc aligns with the box created from the angulation method.

Tip:

Be sure that the arc is circling the square, so the arc will only tip the edge of the square rather than end inside of it.

The height of the original square to use comes from the height of the initial axis used to create the angulation.

The intersection of the height of the square and the 1x1 is where the arc should tip the square.

The final height and width of the true square comes from the height and width of the arc measured from the horizontal and vertical portions of said arc.

Enjoy! Be well!

Suggested Reading:

Law of Vibration - Tony Plummer

Michael Jenkins - Geometry of Stock Market Profits, Chart Reading for Professional Traders, Complete Stock Market Forecasting Course

Scott M. Carney - The Harmonic Trader, Harmonic Trading Volume I, Harmonic Trading Volume II, Harmonic Trading Volume III

H.M. Gartley - Profits in the Stock Market

Bill Williams - Trading Chaos, New Trading Dimensions, Trading Chaos 2nd Edition

J.M. Hurst - The Profit Magic of Stock Transaction Timing, Cyclic Analysis: A Dynamic Approach

Fabio Oreste - Quantum Trading

Michael Jardine - New Frontiers in Fibonacci Trading

The Wave Principle, Nature's Law

Ralph Nelson Elliot

Technical Analysis of the Financial Markets

John J. Murphy

A Complete Guide to Volume Price Analysis

Anna Coulling

Mastering The Elliot Wave

Glenn Neely

The Best Trendline Methods of Alan Andrews and Five New Trendline Techniques

Patrick Mikula

Market Structure: Speed and Slope on Multiple TimeframesHey! Hope you are well!

In this selection, there is a showing of the use of angles to measure the passage of time and price.

In the first chart, the 30 minute chart, there is 40 units of time, and 40 units of price. The angle that is correspondent with this ratio spans to the end of the enclosed trend.

In the next chart, the four minute chart, there is 40 units of time and 40 units of price. The angle that corresponds to this ratio spans only to the end of the first trend.

However, the 8x1 angle stretches to the end of the full segment.

By these examples, the concept of speed is meant to be shown. In each corresponding timeframe, there is a speed. For the daily chart, the speed is one day. On the five minute chart, the speed is five minutes, so in making forecasts, predictions, trendlines, and others, consider the speed.

Suggested Reading:

Law of Vibration - Tony Plummer

Michael Jenkins - Geometry of Stock Market Profits, Chart Reading for Professional Traders, Complete Stock Market Forecasting Course

Scott M. Carney - The Harmonic Trader, Harmonic Trading Volume I, Harmonic Trading Volume II, Harmonic Trading Volume III

H.M. Gartley - Profits in the Stock Market

Bill Williams - Trading Chaos, New Trading Dimensions, Trading Chaos 2nd Edition

J.M. Hurst - The Profit Magic of Stock Transaction Timing, Cyclic Analysis: A Dynamic Approach

Fabio Oreste - Quantum Trading

Michael Jardine - New Frontiers in Fibonacci Trading

The Wave Principle, Nature's Law

Ralph Nelson Elliot

Technical Analysis of the Financial Markets

John J. Murphy

A Complete Guide to Volume Price Analysis

Anna Coulling

Mastering The Elliot Wave

Glenn Neely

BTC SLOW UPTREND, RETEST 51K BETWEEN 1700-1900 EST TODAY (04MAR)Measuring the average uptrend angle since correction on 23 February is around 57 degrees. Adjusting for the 72 hour timeframe and current uptrend angle we arrive at 47 degrees uptrend. Factoring in the range of growth on each swing, we arrive at 3 possible price targets on this current movement.

If BTC continues up along this current channel, we will retest resistance around 51k between 1700-1900 Eastern Time (NA) today. If it fails to break out, possible drop to retracement support zones around 49k or 46k and prolonged correction period.

As noted in other TA, the previous corrections in this current bull cycle averaged around 10 days longer than what the late February correction reported, though at a notably slower downtrend. Long term sentiments remain bullish but short term may see additional correction over the next week due to how quickly we appeared to recover.

If we break through resistance at 51k, continuing this current channel would put us on a path to retest 60k by the second week of March.

This is assuming that over the coming week we do not see any significant new news regarding the US stimulus, bond yields, or miners selling off significantly more than they have been. It is worth noting that overall minors outflow to exchanges is continuing to increase, but this is also the byproduct of industry money flowing into crypto willing to buy up more BITCOIN at these prices, which builds stronger support for BITCOIN long term, even if short term it leads to bearish turns.

ETH 1530 February Month Close Based on Historical TrendApplying historical angle trends to current market.

Historical: 2017 ATH closed that month on the same angle trend the FIB retracement posted to the ATH , when overlayed against the start of the trend versus lowest low.

Current/2021: applying that logic to the current trend we arrive at 1530 for the monthly close.

Note: I am still relatively new at TA so feedback is welcome. I know this is a simple analysis but I the correlation between trend angles and temporal data is an interesting way to analyze the market.

Note 2: I don't think this is the end of the uptrend but an indicator of where the current trend will fall on the monthly candle.

Trend angle ascending channel analysisNote: This is a fun/practice analysis using the trend angle tool within ascending/descending channel patterns. Do not take this trade literal.

Presented is a 1 hour chart. We can scope out an ascending channel patter as presented. Using the trend angle I calculated a 50 degree angle ascend to retest top channel off the bottom channel retest in play.

My take profit marks correlate to pivots within the channel. With a MACD/SIGNAL cross and up through the zero line we may see a push to retest the top. If this occurs our RSI will match a 50 degree trend angle according to chart trend.

Please comment with thought s and ideas. Thank you.