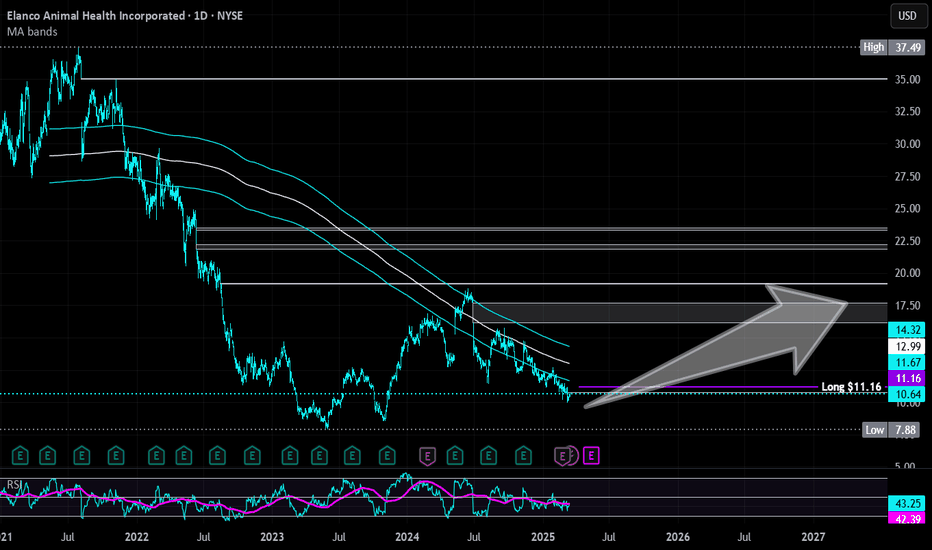

Elanco Animal Health Inc | ELAN | Long at $11.16Elanco Animal Health NYSE:ELAN is riding my historical simple moving average and likely to make a move up soon. Insiders have recently been awarded options and bought $483,000+ worth of shares. Became profitable this year, low debt, P/E = 15x.

Long at $11.16

Targets:

$12.50

$14.50

$16.00

$17.50

Animals

Zoetis | ZTS | Long at $156.94Zoetis NYSE:ZTS , the largest global animal health company, generated more than $9 billion in revenue in 2024 and earnings have grown 9.3% per year over the past 5 years. Free cash flow for FY2024 was over $2.2 billion. Dividend consistently raised every year for the past for years (currently 1.28%). The growth of the company isn't expected to slow any time soon, and I believe the animal health care market will grow right alongside the human health care market - if not potentially faster (people love their pets).

Thus, at $156.94, NYSE:ZTS is in a personal buy zone. There may be some near-term risk with the potential for a daily price-gap close near $136.00, but I personally view that as an even better buy opportunity (unless fundamentals change).

Targets

$170.00

$180.00

$200.00

Is Chewy Getting Ready for a Run?Pet supplier Chewy has been cooped up like a border collie in a kennel, but some technical patterns suggest it may run again soon.

CHWY doubled in value since mid-September, rallying out of a bullish ascending triangle. Its animal spirits took a nap around the “nice round number” of $100 in mid-December, and the stock has consolidated there since.

Bollinger Band Width has narrowed to the tightest level in 2-1/2 months, highlighting how rangebound it’s been.

Second, notice how CHWY recently wagged some tails under $100 but closed above it. Also notice that today it started to climb despite remaining $0.30 above $100. Is price saying good-bye to double digits?

Third is the large outside day on January 27. That’s when then bull(dog)s tried for a breakout, but were yanked back like a terrier on a leash. CHWY has tied up inside that candle since.

Finally, the 21-day exponential moving average (EMA) has provided support throughout this consolidation phase. That line is now over $100, which could squeeze prices higher.

TradeStation is a pioneer in the trading industry, providing access to stocks, options, futures and cryptocurrencies. See our Overview for more.

Bart Simpson stealing your Bitcoins Ever since i started with forex and crypto almost 2 years ago i was wondering what even

is goin on ? In my early days i read every book i could get my hands on, always

thinking the magical answer to trading must be somewhere hidden in those books. Edward

Magee , Murphy, Voigt were definitely the good ones.

Anyway.

95 % of all traders loose their money.

And yet, here we are.

Retail traders use all these lagging indicators, combining them, changing settings and

interpreting things diffrently on all sort of timeframes.

We use literally over 100 year old technical analyses to predict the future based on

past price action?

Doesnt that sound stupid to anyone?

Tell that to your neighbour and watch the irritated look on his face.

The best way to predict the price would be to manipulate it yourself. Of course this is

already being done simply through the media.

The Bitcoin price is choreographed through news. Good news always come in bulk as will

bad news. Coincidence?

No.

We might aswell lower the opacity of our candlesticks to zero and trade on google trend

searches for "bitcoin". More than 50 searches day for one week means we are in an

uptrend. Wait till cointelegrah trashes bitcoin and buy the dip.

While my tinfoil hat is already warming up, who is owning and funding cointelegraph?

Sadly we are not all billionaires and can control the bigger picture ourself.

But what about the small picture, how is the price manipulated on the 1minute to 4

hour timeframe?

Nowadays you cant look on any chart without seeing Bart Simpson like modern art

everywhere.

But what is even going on?

From my understanding whales go stop hunting. If the bigger trend is up, and we are

trading around support a whale would love to squeeze the longs, triggering the stops to

push the price a ittle lower, to then buy his crypto at a discount and start the pump.

High frequency trading bots then create the illusion of a weak pullback, so noobs fomo

in and pump the price even higher. With every stop hunt, pump, barting, the momentum gets

weaker and weaker. At key resistence the whale decides that the price should go down

and starts the short squeeze setup. If anyone has a better understanding i would like

to hear a different theory.