ASX 200 Looks Set to BounceThe ASX 200 has drifted lower since its latest record high was set six days ago. 8500 held as support before doji formed on Tuesday to mark a false break of this key level. ASX 200 futures also tried but failed to break beneath it overnight.

Given the bullish divergence on the 1-hour RSI (14) and RSI (2), the bias is to seek dips towards 8500 for a cheeky long towards the December high.

Matt Simpson, Market Analyst at City Index and Forexc.com

AP1!

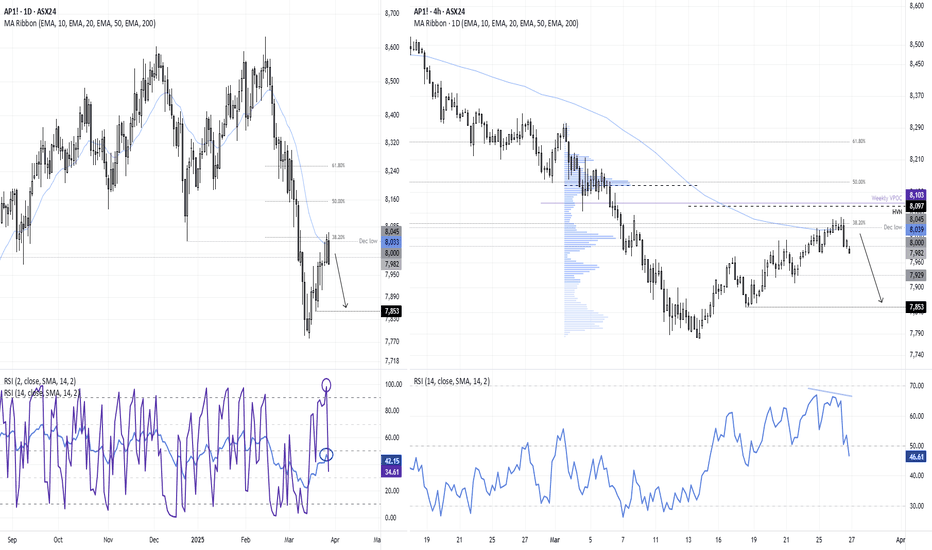

Momentum Turns Against the ASXThe rally of the past two week on the ASX took a turn for the worse on Wednesday, on the warning (and official announcement) of Trump's 25% tariff on non-US cars.

This has seen the ASX get caught in the negative sentiment on Wall Street.

The daily chart shows that momentum has turned lower around a resistance cluster, including the December low, 38.2% Fibonacci ration and 20-day EMA. The daily RSI (2) reached a highly overbought level on Wednesday and now sits below 50, and the RSIK (14) has remained beneath 50 to show negative momentum overall.

A bearish divergence also formed on the 4-hour RSI ahead of the selloff.

The bias is for a move down to at least the 7930 area, a break beneath which brings the lows around 7850 into focus.

Matt Simpson, Market Analyst at City Index and Forex.com

ASX 200 futures (SPI 200) stablising around 8200The ASX 200 futures market has fallen close to 5% from its all-time high, with 5 of the 7 candles since the top being bearish. However, the daily RSI (2) reached oversold on Friday, a bullish pinbar formed on Monday and a small bullish divergence is now forming on the daily and 1-hour chart. The pinbar low also found support at a weekly VPOC (volume point of control) and weekly S1 pivot.

Given the selloff came in a relatively straight line, I cannot help but suspect at least a minor bounce is due.

The near-term bias remains bullish while prices hold above last week’s low, and bulls could seek dips towards 8200 / 8191 VPOC area. 8300 and the weekly pivot point at 8345 could make viable upside targets for bulls.

ASX 200: Why I don't trust today's 'record high'The ASX 200 reached a record high in today's session, but it's not a convincing record high in my books. If anything, it could signal yet another false break. Using the ASX cash and futures market alongside Wall Street indices, I delve into why we need to be on guard for another bull trap before the real move potentially begins.

Matt Simpson, Market Analyst at City Index and Forex.com

ASX 200 Futures: Finding a Signal Amid the NoiseWe're sandwiched between an incoming NFP report and the turbulence from Trump's tariffs. That could provide a double dose of 'fickle' price action, which we tend to see leading up to big events such as nonfarm payrolls or Fed meetings. With that in mind, I update my bearish bias on ASX 200 futures, using the intraday timeframe and a glance at Wall Street indices.

Matt Simpson, Market Analyst at City Index and Forex.com

ASX 200: Why I'm not banking on [an immediate] record highThe ASX 200 cash market is tantalisingly close to retesting its record high set in December. Traders are betting on an RBA cut in February (and 100bp of cuts this year) which is helping to support the market. Yet I doubt the ASX will simply break to a new high without a fresh catalyst. Comparing the ASX 200 cash and futures market and their key levels, I explain why.

Matt Simpson, Market Analyst at City Index and Forex.com

ASX dragged lower by the DowThe Dow Jones futures market fell for an 8th consecutive day on Monday, a bearish sequence not seen in over 12 years. And that's not good news for ASX 200 bulls, as the index tends to track the Dow very closely.

The daily chart looks like it wants to head to 8200, and it just 1 - 2 bearish trading days away from it looking at a typical day's range. The 1-hour trend has favoured bearish swing traders, who could seek to fade into moves towards the 20-50 hour EMAs.

ASX 200 futures look set to bounceThe Nasdaq reached a record high and the S&P 500 is close to reaching its own record high. So while the Dow was lower for a fourth day, 2 out of 3 indices rising could help support the ASX today.

It's been over a week since the ASX began retracing from its record high, and with prices now trying to form a base above the monthly pivot point and historical weekly VPOC (volume point of control), I'm now looking for longs.

The ASX has opened lower but remains within the overnight range. Assuming prices hold above the spike low, the bias is for a move higher to last week's VAL (value area low) or VPOC.

ASX 200 futures could tease bears at these highsThe ASX 200 futures market has struggled to retest 8500, after a brief and uninspiring spell above it. Overnight gains on Tuesday were seen on low volumes, and Wall Street indices have provided a weak lead today. A bearish divergence has also formed on the daily and 1-hour chart.

While prices have rebounded from the weekly pivot point, price action looks corrective. Hence the bias for it being a corrective channel that could break to the downside.

If we see prices rise at the open, I am on guard for it being a 'last hurrah", which could make it a suitable market to fade into with a stop above the record high. The weekly pivot (8390), weekly VPOC (8348) and weekly S1 around 8300 make viable downside targets for bears.

MS

ASX 200 flirts with bearish reversal breakoutElection jitters are in the air, and it is weighing on Wall Street sentiment - and dragging the ASX 200 with it, which also faces pressure from a spate of weak China figures in recent weeks.

A potential head and shoulders top has formed on the daily chart, and prices are close to testing a support zone which could double up as a neckline.

For now, the ASX appears hesitant to break the 8130/50 support zone which brings could prompt a minor bounce over the near term.

A break beneath 8130 confirms the bearish reversal, which projects an approximate downside target near 7900 and the 200-day EMA. Also note the 8100 and 8000 levels which could provide support along the way

MS

ASX to new highs, or fakeout in the making?The ASX 200 futures chart reached a record high on Wednesday, and momentarily traded above 8400. Yet repeatedly we see the market hold above this level (also note the weekly R3 pivot is within the area).

A bearish divergence is forming on the 1-hour chart, so the bias is for a false break of the highs and retracement lower ahead of its next sustained record high.

Bears could seek a move towards the 20-hour or 50-hour EMA, or bulls could wait for such a level to be respected as support before rejoining the bullish trend.

*Take note that AU employment data is released in just over 1hr*

MS

ASX 200 futures look ominous heading into NFPIts failure to retest 8,000 after a feeble 2-day recovery this week looks like it may not take much to topple ASX 200 futures for another leg lower. And with an all-important NFP report lined up and traders heavily focused on minor signs of weakness, the path of least resistance could well be lower. Matt Simpson take a quick look.

ASX futures snap 9-day streak, further downside loomsYesterday I outlined why I was suspicious of the ASX 200 rally, and today I see it has now retraced. The ASX 200 futures market snapped an 11-day streak after forming a bearish pinbar perfectly at a 78.6% Fibonacci level, below the 8,000 handle. Volumes have been declining during the entire ‘rally’ which shows a lack of bullish enthusiasm, and potentially points to a deeper pullback.

A bearish trend has developed on the 1-hour chart, and the support zone ~7917/25 has now been respected as resistance. The bias is to fade into rallies towards that resistance zone in anticipation of a move down to 7860.

ASX looks set to retrace from resistanceThe ASX 200 cash market enjoyed its most bullish day in seven on Thursday. But like the SPI 200 futures contract, it met resistance before pausing.

The daily chart shows that a double top formed around the June 26 high and trend resistance. And as it's not unusual to see a market retrace against a strong move, and we have an NFP report looming which could suppress volatility, we're looking for prices to retrace lower against yesterday's rally.

Bears could target the 20-day EMA between the weekly and monthly pivot point, with a stop above yesterday's high.

SPI 200 looks set for lift-off ahead of US PCE dataWe have a huge risk event in the coming hours; US PCE inflation. Should it come in softer than expected, risk is likely to pick up as this is how it has behaved pretty much every time inflation has come in soft. Conversely, a hot inflation report could dent risk - but we suspect not to such a large degree.

Fed members have been very vocal about maintaining higher rates, and markets seem more likely to jump on any chance of re-pricing in multiple cuts which could send indices higher.

SPI 200 futures (of the ASX 200 cash market) just tapped a record high ahead of the European Open. Given the US dollar is also retracing, it suggests traders are placing last minute bets of a softer inflation report.

But the bullish trend structure of the SPI 200 futures chart is hard to ignore. Prices have remained above the bullish trendline despite two intraday spikes below it. And an inverted head and shoulders pattern (bullish continuation during an uptrend) appears to have formed at the record high, which projects an upside target around 7900. The 100% projection of the prior rally lands around 7800.