USDCHF Equilibrium| Structural Resistance| Declining Volume Today’s Technical Analysis – USDCHF- trading in equilibrium where a break is imminent

Points to consider,

- Structural resistance (bearish retest)

- Declining volume

- Apex

- RSI at 50

A break in USDCHF will be imminent as price continues to reach its apex. The support and resistance lines will converge leading into a break in structure.

The structural resistance is a key level, a bearish retest will allow for a valid short. It is important to monitor how price action forms at the level as weakness will indicate a possible liquidity grab.

Volume is clearly declining, which is an indication of a true equilibrium. A breakout needs to be backed with increasing volume; this will decrease the probability of a false breakout.

Overall, in my opinion, if USDCHF breaks bullish, its immediate target will be structural resistance. If price action shows weakness and confirms a bearish retest, lower level will then be likely.

What are your thoughts?

Please leave a like and comment,

And remember,

“Do not anticipate and move without market confirmation—being a little late in your trade is your insurance that you are right or wrong.” -Jesse Livermore

Apex

Oil To APEX After breaking out of price consolidation (yellow rectangle) it’s crucial that the bulls keep oil above this price point and move to the apex depicted in the chart. A break of the inner upward Trend line will see oil back into the consolidation point so its imperative that the Bulls keep at these levels or above. A Rise to 32 (R1) will see some bears to contend with. This P action will show strength and solidify the second point to maybe see a parallel channel upward form/ing.

📈Support & Resistance📉*

Support Levels

1st Support Zone: 23.41

2nd Support Zone: 17.80

3rd Support Zone: 12.94

Resistance Levels:

1st Resistance Zone: 28.71

2nd Resistance Zone: 37.62

3rd Resistance Zone: 42.11

Price Level Consideration

ATH: 147.27

All Time High Half Way Point: 73.64

Prominent High: 65.53

Prominent Low: ZERO

🐃 Bulls Verse Bears 🐻

🐃 Bullish above: 77.04

🐻 Bearish below: BEARISH at the moment

Monthly & Weekly Opens

Monthly Open:18.86

Weekly Open: 29.78

APEX FROZEN - OBSERVE PRICE ACTION NEAR 175-170 levelsAPEX FROZEN - OBSERVE PRICE ACTION NEAR 175-170 levels

The structure of stock still looks weak, so currently its better to avoid any trading in it, though it has created a good support zone near 170 levels, hence any pullback towards this level has to observe carefully to find any trading opportunity in the stock

USDCHF Symmetrical Triangle|Low Volume|Apex|Breakout Imminent Evening Traders,

Today’s Technical Analysis – USDCHF- a clear symmetrical triangle at pay, price is approaching its apex before an imminent break.

Points to consider,

- Trend Bullish (Consecutive higher lows)

- Support and Resistances converging

- RSI neutral (Above 50)

- Stochastics in upper regions

- Volume declining

The immediate trend is bullish with consecutive lower highs from local bottom. Price is finding its equilibrium in this larger symmetrical triangle as support and resistance converge.

The RSI is neutral above 50 whilst the stochastics is in the upper regions, an indication of buy momentum still being present.

Volume is clearly declining as price is reaching its apex of the symmetrical triangle; this is an indication of an influx in volume.

Overall, in my opinion, a breakout is imminent, very tradeable, price is coming close to its apex as support and resistance converge.

What are your thoughts?

Telegram Link in Bio – Please Join :)

And remember,

“You become fearful the moment you identify with fear. But once you begin seeing it as an impersonal changing phenomenon, you become free.” ― Yvan Byeajee

S&P 500 futures pending supply, intraday trading is the planS&P 500 futures ( CME_MINI:ES1! ) slide more than 1% in the Asia session after OPEC plus reached a deal in record oil production cut of 9.7 million barrels per day.

On the hourly timeframe, S&P 500 futures dropped sharply at the opening candle to below the support level at 2750. Subsequently it is forming an apex formation during London session, suggests indecisiveness among the participants.

Just 2 hours before the opening of the US markets, ES broke out from the apex formation and currently testing the resistance zone around 2770 and the opening candle today.

If the price action fails to commit above 2770 and broke below 2750, it is likely to swing down to test the next support level at 2700.

Should the supply emerge, this could be a start of a larger down move to test the support at low levels or even the selling climax low at 2174.

Bias - neutral to slightly bearish.

Key levels - Resistance: 2800 Support: 2750, 2700, 2630

Potential setup for S&P 500 futures -pay attention to how the price interacts with the apex formation. Either direction be traded. Always judge the market by its own action.

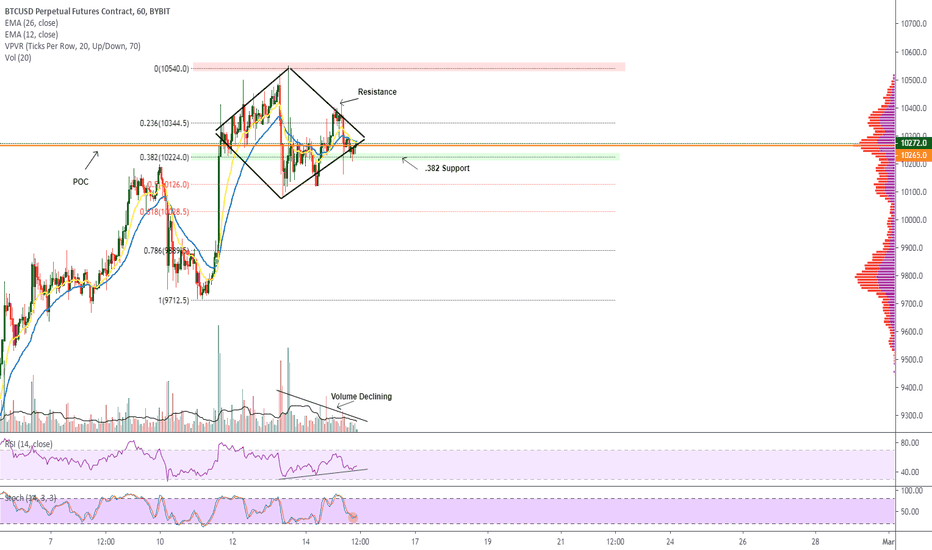

Diamond Continuation Pattern| Low volume| Bullish Continuation?Hello Traders,

Today’s chart update will on BTC’s immediate projection- we have a probable diamond formation which serves as a bullish continuation pattern.

Points to consider

- Trend travelling into apex

- .382 Fibonacci as local support

- RSI respecting trend

- Stochastics in lower regions

- Volume declining

- VPVR area being tested

BTC is closing in on its apex signalling a break from this formation is imminent as local support and resistances converge. Local support is the .382 Fibonacci; BTC has been respecting this level as buy pressure is evident.

The RSI is respecting its trend line, must hold for a bullish bias as this is in confluence with the stochastics being in lower regions. It can stay trading there for an extended period of time, however lots of stored momentum to the upside.

Volume is clearly declining; increase is highly probable upon breaking out of the Diamond formation. The VPVR confirms the .382 being a strong trade location for buy pressure.

Overall, in my opinion, a break bullish is probable as the Diamond Pattern serves as a bullish continuation pattern. BTC may have one more leg up before a proper correction as this trend is getting more extended.

What are your thoughts?

Please leave a like and comment,

And remember,

“The big ones take the psychology out of the game. Have a game plan, and stick to it.” Tim Erber

BTCUSD OVER 10K! Parabola | Blow of top?| .618 Fibonacci!Hello Traders!

Today’s chart update will be on BTCUSD where we have a parabola forming, closing on a key Fibonacci retracement level indicating a probable blow of top.

Points to consider,

- Trend broke key resistance - .382 Fibonacci

- Structural resistance in confluence with .618 Fibonacci

- Strong support from 20 week MA

- RSI entering overbought

- Stochastics in upper regions

BTC managed to break key resistance with a valid retest confirming the S/R flip on the .382 Fibonacci level before taking of further. The structural resistance can be the potential target for the parabola as this level is in confluence with the .618 Fibonacci.

The RSI has broken key resistance and now has entered overbought conditions on the daily timeframe. The Stochastics is currently in the upper regions, it can stay trading here for an extended period of time, however lots of stored momentum to the downside.

The 20 week Moving Average as a very good visual guide as it has held significance as support since bitcoins initial bull move, a break will essentially indicate a probable reversal.

Overall, in my opinion, BTCUSD is in the latter part of the parabola, its apex ends exactly at the .618 Fibonacci where the potential reversal may occur. The 20 week MA is a strong indication of the current direction of this trend, a break of this will greatly increase the probability of a correction, which is imminent at some point.

What are your thoughts?

Please leave a like and comment,

And remember,

“Trading mastery is a state of complete acceptance of probability, not a state of fight it.”

― Yvan Byeajee

Nearing Apex, high insider buying & a HEMP playArcadia Biosciences, Inc.

Highlights:

Insider Trans 324.51%

Market Cap 49.80M

Shs Float 7.01M

Consensus Price Target: $17.00 / 195.65% upside

Plenty of catalyst for this kid,

Hemp, soybean, wheat & Nitrogen fertilizer is the name. Easing trade tensions could play a factor in better prices for soybeans and wheat. Already seeing a high demand for Hemp, an end to the cannabis slump could help fuelling RKDA's ascend even further.

Increasing awareness of Sustainibility and interest from investors could be another factor.

* GoodHemp varieties improve plant quality, productivity & reduces waste.

* Their Nitrogen fertilizer is created to significantly reducing fertilizer use which will decrease greenhouse gas emission and chemicals in the ground water.

* HB4 Drought Tolerant Soybeans. These proprietary varieties hold great promise for bringing better yield stability to agriculture in areas that experience chronic water stress problems

Recently launched GOODHEMP, a commercial pipeline of superior non-GMO hemp seed varieties.

USDA guidelines requiring the destruction of “hot crops” with more than 0.3% THC, unstable seeds can lead to huge losses for hemp farmers.

GoodHemp meets compliance requirements because of their ultra-low THC profiles. On top of that, some GoodHemp varieties are also tolerant to a variety of diseases. Resulting in more stable, cost-effective crop and higher profit margin.

Short term view : Consolidation Hello fellas, let's make it a very quick and detail analysis about current bitcoin's condition which is crucial once again. This analysis will cover the bitcoin's potential movement for short term time frame. So, let's enjoy this technical analysis.

Looking at lower time frame which is the 4 hours chart, I see that currently the price is trending closer to the strong area of support which is the golden pocket zone. And this area however is becoming point of interest for most of the long position for bitcoin. This is because at the past performance, we see this area coincides with the previous unbroken support that always produced the huge wick to the downside (Although we saw a drop below it for about 1 day to form inverse head pattern). On the other hand, since the height on November 29th, 2019 , we can see that the price always formed a lower high which means a lot of pressure is coming from the bear.

So, the conclusion is that although the price trends just slightly above the strong support in short term, I don't think that there will be a huge rally in near future, simply because the lower high structure is still holding strong and the price must respect the resistance trend line as potential upper line that could be the candidate of triangle. I do believe, we will see a losing in volatility of bitcoin's movement at least in the next 1 or 2 days until the price can breaks the APEX of the triangle.

So, for now just enjoy your profit from shorting bitcoin!

Low Levels to BTFD Ultimately, I see no logical reason for "new lows" or even 3ks again. But anything can happen.

I believe these levels will be some of the best bets for long term additions/holdings.

Ik The daily is filled with memes but cool to see how things play out. HA candles again preformed much better overall.

Could be heading for a big move soon based on that apex in orange, could be something to watch.

#BTCUSD - 3D, APEX zone nearbyHello guys, it´s time to look at the bigger picture again. As usual I am using the 3D interval to try and figure out what are our odds here. Fact is, we could be on the well known gigantic symmetrical triangle, which increases the odds, we will follow up the downtrend until a possible support will be hit not before middle of 2020. Does this have to happen? No, this strongly depends on two factors: The yearly Pivot and the next couple of days (lots of small bearish flags following each other on small intervals) and the APEX zone.

The stage, that I mentioned in last post, that we will experience a couple of hundred $ swing-time will likely very soon be over.

The odds we will bounce here are a little worse than the odds, that we will go down further to the triangle support. Overall and long-term this is not bearish. For Hodlers this is a very uncomfortable scenario, it will take a long long time until alts start recovery, bags will go on bleeding if this becomes truth and remember, the way up is MUCH harder than the way down.

Keep your mind open for both scenarios and don´t get too stuck with one of them, it will paralyze you towards active trading.

-------------------------------

Warm regards, Nerubica

My open group:

t.me/nerugroup

Alerts:

NeruSuite Alerts XBT: t.me/nerusuite_alerts

Divergence Alerts BTC: t.me/nerudivs

Cryptopedia & Cheatsheet Bot: (under construction)

@NerubicaBot in Telegram

Web:

www.nerusuite.com

FTMBTC BullishFTMBTC is in the apex of big triangle so in few days I´m expecting massive break out from this triangle. Take profits, Stop loss, rezistence, trend lines are set in chart :) I wish you at least 20% profit ;))

BTC Bullish PennantBtc appears to be forming a bullish pennant on the daily. Pennants are usually continuation patterns & very rarely produce a trend reversal. The move before the pennant formation is in an uptrend, so btc is likely to continue its move upwards if it breaks up above when we reach the apex of the triangle (we're nearly there/possibly already there).

Another key point is the volume. Volume should dry up during the formation of a pennant, which is what has been happening thus far. This adds further confirmation that this is very likely a bullish pennant. However a close below $9,300 at this point would invalidate this idea.

Bitcoin Calm Before The Storm! Bulls vs Bears !Hello Traders,

Welcome back to another update, this time on BTC, The Calm Before The Storm!

Bitcoin has been trading within a very tight range coming into its apex within the macro descending triangle formation.

Usually this is a bearish formation, however coming from a very strong impulse move up, we can literally break either direction…

Points to consider at current given time

- Price approaching apex within descending triangle

- Volume decreasing noticeably

- Major support at $9300 - $9200 area (green zone)

- Major resistance at $11,400 to $11,600 area, also in confluence with .50 Fibonacci

- EMA’s currently neutral

- RSI itself also approaching apex

- Stochs neutral and testing its own resistance

It is quite obvious that the volatility will be coming back into Bitcoin after trading in this range for some time now. This structure has been putting in lower highs over the past couple months after a crazy impulse move up from the bear market earlier this year. Bitcoin has also established a strong base of support, which has been tested multiple times, we must remember, the more times a level is tested the more it’s prone to break…

Bitcoin right now is testing a smaller uptrend within the descending triangle where it is bound to break. We have a local resistance that needs to break, if not then this can be a potential triple top. To test this level, Bitcoin would have broken the major downwards trending line, changing the macro trend and putting a higher low, this need to be confirmed with increasing bull volume.

The .50 Fibonacci is a strong resistance area as Bitcoin has had multiple rejections, break this area (Red Zone), will put in a higher high in the macro trend, which is quite bullish. If Bitcoin fails to break bullish from current apex, then the probability of testing support will be much greater, this time it’s more likely to give way as support has been tested multiple times. A break from this area will be quite bearish as this will confirm yet another macro lower high and also hold the descending formation true.

EMA’s are quite neutral at current given time as price is trading within in, we can’t really establish if its given price any support or resistance…

The RSI is looking interesting, we can see that its respecting its downwards trend, coming closer to its apex and with a break in either direction can determine which way Bitcoin will break. Similarly, the Stochastics are neutral, however a break from or a rejection from its local resistance will also help determine which way bitcoin breaks...

Overall, it’s just a matter of time for an impulsive move to come to fruition, Bitcoin has been trading range bounce for a while now coming into its major apex, and we can expect a break within the next couple days!

What are your thoughts on Bitcoin price action? Will it break bullish or bearish?

Please leave a like and comment

And remember,

“If you can learn to create a state of mind that is not affected by the market’s behaviour, the struggle will cease to exist.” – Mark Douglas

Detailed BTC Analysis. The day of resolution is near!!! What is up my people? Have not published a trade idea for a while because the market has been mostly moving sideways since my last post and my last trade idea about a possible resolution to the downside still holds as much water as it did a week ago. However, recent developments give me a hint that we might have an explosive resolution of this insufferable macro triangle/ pendant formation.

Additionally, I want to bring you a bit more meat on the bone compared to other trade ideas that I have seen recently. You are in for a treat, If you like a deep dive into a price action & technical analysis.

Caveat: The sentiment is long but, this does not mean that we will not see some blood in the streets prior to the decisive move to the upside.

Contents:

- Moving Averages

- Price action

- Price channels and possible continuation

- MACD Cross on weekly

Here we go:

On 4 Hours we are under all major moving averages including And price action to the upside is governed by 21 EMA and 50 EMA which will most likely serve as resistance.

We are still under the death cross on 4H, which means that this territory comes with great buying opportunities for long term investors and with possible unpredictable moves in all directions for traders and scalpers. Keep your shorts tight and don’t buy into this BS DCA nonsense unless you are a swing trader or a long term investor. I also would like to note that the distance between blue 50 and green 200 SMA has been increasing, there is 50 and 377 SMA bearish cross fast approaching and all of the major (21+) moving averages are sloping downwards which means that there is still some more nastiness in store for us.

However! The direction of the price movement is not as unpredictable as it looks, and here is why:

- We are approaching the end of the price movement channel that has been governing the price action since August 4 and you can identify this channel with green dotted borders and red pointers.

- Given that we do not break out from the triangle formation we would need to find a pivot to a new price action channel start of which is marked with a green pointer.

- Red circles mark the areas of confluence and they have a gravitational effect on the price action however the price usually chooses to take the path of the least resistance. Least resistance = Channel governed with STRONG support and resistance borders.

- Possible support and resistance channels are charted, bolder lines indicate major S&R and lighter indicate neutral S&R.

- Unlikely, but still possible - we might pivot immediately to a new price channel marked with bold red dotted border and orange cross arrows.

On daily we have purple 100 and brown 377 EMAs fresh bullish cross, which resulted in explosive 500$ move to the upside, however this cross is not that significant from purely TA perspective, yet it could serve as an indication that bulls want to take control of the price action. Sadly, on 4 Hour we have the same SMAs trying to cross bearish which could result in the price action that can push us over the edge.

On daily the price action is supported by 100 EMA sitting at 9800, which means that as long as we don’t open or close a daily dildo under this level, the most probable breakout from the current formation will be resolved to the upside, on the contrary, opening and closing daily price action under 100 EMA will result in early resolution of the formation to the downside and will have a waterfall effect to 9.4K, 9.1K, 8.8K and 8.5K levels.

In order to get this situation (macro consolidation) resolved to the upside, bulls need to reclaim 50 EMA (@10450 $) on daily and open and close the price action above it. Which in my opinion will create a massively bullish sentiment.

Oh one more thing: MACD on weekly just has crossed bearish. This indicator has not been great or massively helpful on high timeframes, however, in the previous situations the resolution of the MACD cross has been following:

- In bearish markets, like January 2018 it has signalled possible capitulation as was followed by 50% selloff

- In bullish trending markets, it usually signalled that the resolution of ongoing consolidation was near. This is usually followed by 5-15% drop from the current price action and a price level achieved as a result is this drop will be a new low that we will not revisit anytime soon.

Hope this is helpful to you are enjoying this detailed analysis provided by me and if you wish to have more of it, please subscribe and give an idea a like so I will now that you fancy when I deep dive into this market.

Cheers

Archie

MATICBTC Bull BreaK?Hello Traders,

Today's Chart will be on MATICBTC

Points to consider here are,

- Bullish trend on the 4hr time frame

- Next Major resistance is at around the RED zone

- RSI on upwards momentum, putting in Higher High's

- Stochs looking into upwards momentum

- EMA's currently giving price resistance but looks weak

- Below average volume coming into Apex

Matic is approaching decision time after breaking major structure, putting in Higher Highs on the 4hr Timeframe. Volume is below average indicating that a move is approaching, if break bullish then price will be looking to retest next resistance. However this whole set up can be invalidated if BTC decides to dump at given time, so its important to have stop losses in place!

Please leave a comment on what you think is most probable

and remember,

“In this business if you’re good, you’re right six times out of ten. You’re never going to be right nine times out of ten.” - Peter Lynch