APPLE Trading Opportunity! SELL!

My dear subscribers,

This is my opinion on the APPLE next move:

The instrument tests an important psychological level 244.56

Bias - Bearish

Technical Indicators: Supper Trend gives a precise Bearish signal, while Pivot Point HL predicts price changes and potential reversals in the market.

Target - 234.19

My Stop Loss - 250.52

About Used Indicators:

On the subsequent day, trading above the pivot point is thought to indicate ongoing bullish sentiment, while trading below the pivot point indicates bearish sentiment.

———————————

WISH YOU ALL LUCK

Apple

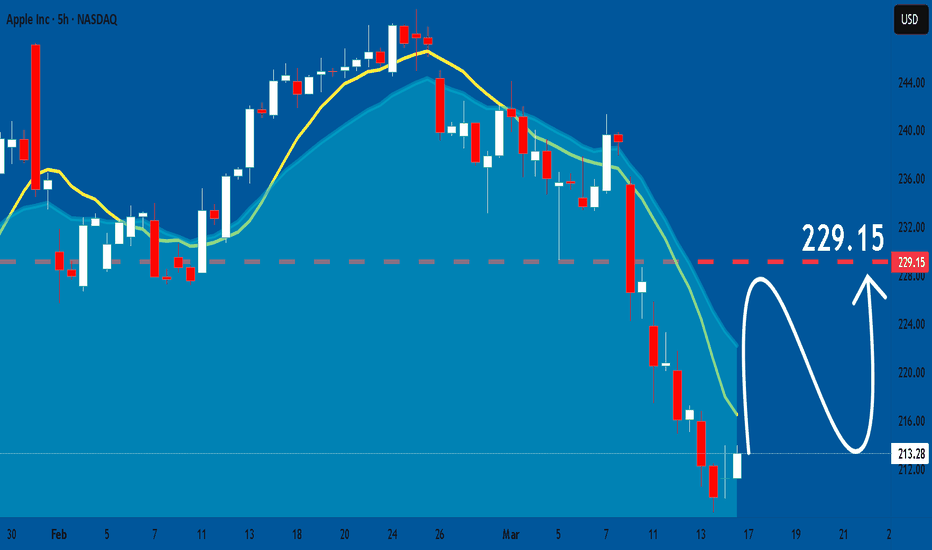

APPLE The Target Is UP! BUY!

My dear friends,

Please, find my technical outlook for APPLE below:

The instrument tests an important psychological level 213.28

Bias - Bullish

Technical Indicators: Supper Trend gives a precise Bullish signal, while Pivot Point HL predicts price changes and potential reversals in the market.

Target - 227.02

Recommended Stop Loss - 205.96

About Used Indicators:

Super-trend indicator is more useful in trending markets where there are clear uptrends and downtrends in price.

———————————

WISH YOU ALL LUCK

AAPL (Apple): Has a Large Correction Begun? More Downside Ahead?On this chart, we are currently tracking the potential beginning of a larger downtrend, which could be a larger-degree Wave 4 correction. It is possible that a larger-degree third wave topped in December 2024 at $260, and for now, I am assuming this is the case. While further confirmation is needed, the price has already broken below our first signal line, which supports the idea that a larger decline has begun—unless the next rally develops into a clear impulse structure.

At the moment, the price appears to be in the late stages of Wave C of Circle Wave A to the downside. Immediate resistance sits between $220 and $224, and only a break above $224 would indicate that Circle Wave B to the upside may have already started.

One important note: Circle Wave B could technically overshoot to the upside, meaning that if Circle Wave A completed as a three-wave pullback, we could even see a new high in the next bounce before the larger downtrend continues. This is something to keep an open mind about, as it is still early to confirm a substantial top on the long-term chart.

For now, as long as resistance at $224 holds, the assumption remains that Circle Wave A needs one more low before a stronger bounce occurs.

APPLE: Expecting Bullish Continuation! Here is Why:

Looking at the chart of APPLE right now we are seeing some interesting price action on the lower timeframes. Thus a local move up seems to be quite likely.

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

❤️ Please, support our work with like & comment! ❤️

APPLE, will we see 200$ again ?Hello traders, Hope you're doing great. What are your thoughts about NASDAQ:AAPL ?

for upcoming weeks, I expect an upward correction at first and after that I expect a SELL OFF situation in the market that causes a huge drop in stock market, my first Target is 200$.

This post will be Updated.

Trade Safe and have a great week.

APPLE Buy opportunity on the 1W MA50.Apple Inc. (AAPL) has been trading within a 2-year Channel Up since the January 03 2023 bottom and in the past 3 months (December 26 2024) has been forming the latest Bearish Leg. On Tuesday this Leg broke below its 1W MA50 (red trend-line) for the first time in 10 months (since May 08 2024), which is the strongest buy signal since the April 19 2024 Higher Low bottom of the Channel Up.

As you can see, even the 1D RSI pattern is similar with the one that made the October 26 2023 1W MA50 test. That was also on the 0.618 Fibonacci retracement level from the respective previous Low.

As a result, it is now highly likely to see a rebound, especially if the 1W candle closes above the 1W MA50, to test the previous High and 1.0 Fib at $260, like the December 14 2023 High did.

-------------------------------------------------------------------------------

** Please LIKE 👍, FOLLOW ✅, SHARE 🙌 and COMMENT ✍ if you enjoy this idea! Also share your ideas and charts in the comments section below! This is best way to keep it relevant, support us, keep the content here free and allow the idea to reach as many people as possible. **

-------------------------------------------------------------------------------

💸💸💸💸💸💸

👇 👇 👇 👇 👇 👇

AAPL - Bearish IdeaAAPL has been moving consistently up the green solid line, finding support over and over again

Will this continue? (white circle)

If not will we see a break down to a lower trend line (dotted line) This dotted trend line extends further back on the Monthly timeframe which I can't really show on this Weekly timeframe

I am bearish

Your Stock, My Analysis – Key Levels Straight to Comments!Hey-hey

I want to give back to this amazing community! If you need a technical analysis (TA) on almost any asset, here’s all you have to do:

📌 Like this post & Follow me

📌 Comment your ticker

📌 Tell me what you want – Buying zones? Selling zones?

I’ll personally send you my TA straight to comments as soon as possible! 📩

Let’s spot the best setups together – Drop your request below! 👇

💡 Does Technical Analysis Work?

🔗 I picked 75 stocks from the S&P 500 purely based on technicals – and they outperformed the index.

Cheers,

Vaido

Is Apple's Empire Built on Sand?Apple Inc., a tech titan valued at over $2 trillion, has built its empire on innovation and ruthless efficiency. Yet, beneath this dominance lies a startling vulnerability: an overreliance on Taiwan Semiconductor Manufacturing Company (TSMC) for its cutting-edge chips. This dependence on a single supplier in a geopolitically sensitive region exposes Apple to profound risks. While Apple’s strategy has fueled its meteoric rise, it has also concentrated its fate in one precarious basket—Taiwan. As the world watches, the question looms: what happens if that basket breaks?

Taiwan’s uncertain future under China’s shadow amplifies these risks. If China moves to annex Taiwan, TSMC’s operations could halt overnight, crippling Apple’s ability to produce its devices. Apple’s failure to diversify its supplier base left its trillion-dollar empire on a fragile foundation. Meanwhile, TSMC’s attempts to hedge by opening U.S. factories introduce new complications. If Taiwan falls, the U.S. could seize these assets, potentially handing them to competitors like Intel. This raises unsettling questions: Who truly controls the future of these factories? And what becomes of TSMC’s investments if they fuel a rival’s ascent?

Apple’s predicament is a microcosm of a global tech industry tethered to concentrated semiconductor production. Efforts to shift manufacturing to India or Vietnam pale against China’s scale, while U.S. regulatory scrutiny—like the Department of Justice’s probe into Apple’s market dominance—adds further pressure. The U.S. CHIPS Act seeks to revive domestic manufacturing, but Apple’s grip on TSMC muddies the path forward. The stakes are clear: resilience must now trump efficiency, or the entire ecosystem risks collapse.

As Apple stands at this crossroads, the question echoes: Can it forge a more adaptable future, or will its empire crumble under the weight of its design? The answer may not only redefine Apple but also reshape the global balance of tech and power. What would it mean for us all if the chips—both literal and figurative—stopped falling into place?

APPLE Buyers In Panic! SELL!

My dear followers,

This is my opinion on the APPLE next move:

The asset is approaching an important pivot point 245.60

Bias - Bearish

Safe Stop Loss - 251.37

Technical Indicators: Supper Trend generates a clear short signal while Pivot Point HL is currently determining the overall Bearish trend of the market.

Goal - 235.33

About Used Indicators:

For more efficient signals, super-trend is used in combination with other indicators like Pivot Points.

———————————

WISH YOU ALL LUCK

Apple: Top and DropAs part of Apple's ongoing wave (2) correction, we assume that the subordinate turquoise wave X still needs to conclude in the short term before the price can drop into our magenta Target Zone between $209.57 and $196.05. There, we anticipate a bullish reversal, which should offer trading opportunities for the long side and mark the starting point for the next major upward move. Alternatively, there is a 37% chance that the low of wave alt.(2) has already been reached, which will be confirmed if the price surpasses $260.10.

XRP on Sale?As posted before we are in a bullish liquidation zone on xrp between $2.30-2.69. XRP completed a bearish butterfly pattern in the recent market liquidation this past weekend. I now expect it to settle around the support of $2.30 and trend upward towards $2.69, $3, $4, $5.

This is NFA. Good luck! 🤠

- R2C

S&P500 Index Goes 'Floundering', ahead of Bearish HarvestWhile the S&P 500 is generally expected to perform well in 2025, with forecasts suggesting gains ranging from 9% to 14.7% depending on the source, there are several factors that could lead to a less favorable performance or even a decline:

High Valuations: The S&P 500 is currently trading at high valuations, with a P/E multiple of 22 times projected earnings, which is above historical averages. This elevated valuation increases the risk of market downturns if there are negative economic shocks.

Economic Uncertainties: The economic landscape is filled with uncertainties, including potential inflation increases and geopolitical tensions. These factors can impact investor confidence and lead to market volatility.

Interest Rates and Bond Yields: Higher bond yields can reduce the attractiveness of stocks compared to bonds, potentially leading to a decline in stock prices.

Earnings Growth Expectations: While earnings are expected to grow, there is a risk that actual growth may not meet these expectations, which could negatively impact the market.

Policy Risks: Changes in trade policies, such as tariffs, and shifts in fiscal policy could also affect the market's performance.

Historical Patterns: Achieving three consecutive years of high returns (above 20%) is rare for the S&P 500, suggesting that 2025 might not see such strong gains.

Overall, while there are positive forecasts for the S&P 500 in 2025, these potential risks could lead to a less robust performance or even a decline if they materialize.

// While salmon make up the bulk of their diet, Coastal Brown Bears also enjoy a fresh flounder now, and again.

Best wishes,

PandorraResearch Team 😎

AAPL Price Analysis: Targeting $270 by December 2024Hello Traders,

I'm sharing my latest analysis on AAPL, currently trading at $226.5. Previously, on August 23, 2023, I predicted that AAPL would hit its first target of $220 and its second target of $250. As you can see in the attached chart, AAPL has been making significant progress.

On the weekly chart, a flag pattern has emerged in the middle of the chart. I’ve drawn a parallel channel surrounding this flag pattern and aligned the channel’s upper and lower lines with the Fibonacci levels of 38% and 61.8%. By projecting these lines to the 100% level, I’ve identified a target price of $270, a key level based on important angular calculations.

Target 🎯: $270

When? Based on the time it took for AAPL to move from the 0% level at $55 to the 50% level at $165, which was 86 weeks or 602 days, I anticipate a similar timeframe for the move from the 50% level to the 100% level (yellow circles on chart). This places the expected date to reach $270 around December 23, 2024.

NASDAQ:AAPL

APPLE: Bearish Continuation & Short Signal

APPLE

- Classic bearish formation

- Our team expects fall

SUGGESTED TRADE:

Swing Trade

Sell APPLE

Entry Level - 245.60

Sl - 251.83

Tp - 233.21

Our Risk - 1%

Start protection of your profits from lower levels

❤️ Please, support our work with like & comment! ❤️

The global market is rebootingOn February 18, negotiations between the United States and Russia are scheduled to take place in Saudi Arabia. These talks could pave the way for restoring economic relations and addressing global challenges.

“American companies lost over $300 billion by exiting the Russian market,” said Kirill Dmitriev, head of RFPI, on the eve of talks with the U.S. delegation in Saudi Arabia. He emphasized the importance of economic dialogue, noting that the Russian market remains attractive to investors.

It is now known that several major American companies intend to return to Russia. Amid a potential thaw in U.S.-Russia relations, Visa (#Visa), Mastercard (#MasterCard), Apple (#Apple), PepsiCo (#PepsiCo) and McDonald's (#McDonald) have all announced their intentions in recent days.

The U.S. stock market remains resilient thanks to domestic growth drivers. Additionally, several key factors are expected to drive growth in the near future:

Federal reserve monetary policy: A possible rate cut or maintaining low interest rates is spurring investments. This, in turn, boosts company valuations and pushes up indices such as the Dow Jones (#DJI30) and S&P 500 (#SP500).

Technology sector: Ongoing advancements in AI, cloud services, and biotechnology are attracting capital. Moreover, integrating artificial intelligence into large businesses helps reduce costs by automating routine processes, while AI algorithms enhance strategic planning and risk management.

Corporate earnings growth: Increasing corporate profits are one of the key factors supporting the positive momentum in the stock market, including the S&P 500 (#SP500), which reflects the performance of the 500 largest U.S. companies. Strong quarterly reports from these companies play a crucial role in reinforcing investor confidence and ensuring market stability.

Geopolitical expectations: Tensions among major global players like the U.S., EU, and Russia could lead to sanctions, trade wars, and economic restrictions, which negatively impact the global economy and stock markets. A thaw in relations could reduce the likelihood of such conflicts and, consequently, lower the risks associated with sanctions and instability.

FreshForex analysts are confident that as geopolitical tensions ease, companies will start to return, which will undoubtedly drive up their stock prices. Don’t miss this chance – invest in stocks with us!

Our terminal offers 270 trading instruments, including CFDs on corporate stocks and indices. Trade with a favorable leverage of 1:1000 and enjoy attractive bonuses!

Apple: Ready to see new highs!!The technical aspect of Apple is clearly bullish and everything points to it being on its way to new highs.

On Monday, December 30, the DAILY timeframe chart indicated that the MOMENTUM was turning bearish (Bear), and as expected, the price began to fall until it reached the 219 zone, just when the oscillator showed an oversold signal (January 22). Since then, the price began to recover until last Friday, when TREND, STRENGTH and MOMENTUM aligned bullish (Bull), clearly warning us that the price will most likely attack the highs.

In addition to the technical aspect, Apple has an accumulated fall of -2.32%, which makes it easier for us to see new highs in the coming days.

--------------------------------------

Strategy to follow:

ENTRY: We will open 2 long positions if the price exceeds the 247.5 zone

POSITION 1 (TP1): We close the first position in the maximum zone of 259 (+5%)

--> Stop Loss at 234 (-5%).

--> Ratio (1:1)

POSITION 2 (TP2): We open a Trailing Stop type position.

--> Initial dynamic Stop Loss at (-5%) (coinciding with the 234 of position 1).

--> We modify the dynamic Stop Loss to (-1%) when the price reaches TP1 (259).

-------------------------------------------

SET UP EXPLANATIONS

*** How do you know which 2 long positions to open? Let's take an example: If we want to invest 2,000 euros in the stock, what we do is divide that amount by 2, and instead of opening 1 position of 2,000, we will open 2 positions of 1,000 each.

*** What is a Trailing Stop? A Trailing Stop allows a trade to continue gaining value when the market price moves in a favorable direction, but automatically closes the trade if the market price suddenly moves in an unfavorable direction by a certain distance. That certain distance is the dynamic Stop Loss.

-->Example: If the dynamic Stop Loss is at -1%, it means that if the price drops by -1%, the position will be closed. If the price rises, the Stop Loss also rises to maintain that -1% in the rises, therefore, the risk is increasingly lower until the position becomes profitable. In this way, very solid and stable trends in the price can be taken advantage of, maximizing profits.

APPLE ($AAPL) – Q1 FY25 EARNINGS & WHAT’S NEXT APPLE ( NASDAQ:AAPL ) – Q1 FY25 EARNINGS & WHAT’S NEXT

(1/8)

Revenue: $124.3B (+4% YoY) – A new all-time record! Services soared +14% to $26.3B, offsetting a slight dip in iPhone sales. Let’s see how Apple’s holding up. 🍎📈

(2/8) – EARNINGS BEAT

• EPS: $2.40 (beat by $0.06)

• Gross margin: 46.9%, topping estimates 🔥

• Despite China sales dropping 11% to $18.51B, Apple still racked up big gains elsewhere 🌏

(3/8) – SECTOR SNAPSHOT

• Market cap $3.5T+, P/E ~30

• Some call it pricey vs. tech peers, but brand strength + services + potential AI expansions = possible undervaluation 🤔

• Compares favorably to Microsoft, Samsung, etc., given stable product + services synergy 🌐

(4/8) – RISKS TO WATCH

• Geopolitical: China manufacturing & sales reliance → Trade tensions? Tariffs? 🏭

• Innovation Pace: Competitors could leapfrog Apple in AI or other emerging tech 💡

• Regulatory: Antitrust cases (App Store) could pinch profitability ⚖️

• Economy: Premium pricing in downturn—brand loyalty helps, but can’t ignore recession effects 💸

(5/8) – SWOT HIGHLIGHTS

Strengths:

Legendary brand loyalty & huge install base

Growing services revenue (+14%!)

Massive cash reserves for R&D & buybacks

Weaknesses:

Heavy dependence on iPhone sales

China manufacturing concentration

Opportunities:

AI, AR/VR expansions (Vision Pro, maybe more)

Emerging markets → untapped smartphone penetration 🌍

Services sector continuing to expand ⚡

Threats:

Fierce competition (especially in China) 🦖

Trade tensions & supply chain hiccups 🌐

Shifts in consumer tech tastes or new disruptors

(6/8) – CHINA SALES DENT

• China down 11%—that’s a chunk given its importance

• Local giants (Xiaomi, Huawei) are snapping at Apple’s heels 🦾

• Will Vision Pro + AI upgrades woo Chinese consumers back? 🤔

(7/8) – Is Apple undervalued at a $3.5T market cap & P/E of 30?

1️⃣ Bullish—Brand power + AI = unstoppable 🍀

2️⃣ Neutral—Solid, but watch those China risks 🔍

3️⃣ Bearish—Too expensive, competition’s rising 🐻

Vote below! 🗳️👇

GSAT - Split and Move to NASDAQ Monday at CloseI closed all my options except some short dated cheap OTM calls and puts in lots of 15 to hold as standard options post split, more as a lotto and protection for shares. I exercised all the 0.5c calls, the profit wasn't that high and it brought my average price down quite a bit.

I have no idea how its going to move post split. Sized for sideways or down. If it does drop farther I'll add after it stabilizes. Long play for me.

Apple Inc. (AAPL) Technical Analysis –Potential Bullish Reversalhello guys!

let's analysis Apple!

Support Area (~$219 - $221): This zone has previously acted as a strong demand level, preventing further decline.

Target Area (~$252 - $254): A key resistance level where the price might face selling pressure.

Candlestick Signal – Bullish Engulfing:

The engulfing pattern indicates a potential reversal, signaling bullish momentum after a decline.

If confirmed with increased volume, it strengthens the possibility of an upward move.

Trade Setup:

Entry: Around the current price level (~$227).

Stop-Loss: To minimize downside risk, below the support area (~$219).

Take-Profit Target: Around $252 - $254, aligning with the resistance zone.

Confirmation Factors:

A strong breakout above $230 would validate bullish momentum.

A retest of support with a bounce would reinforce the setup.

The bullish setup would be invalidated if the price falls below $219.

Conclusion:

Bullish Bias: The pattern suggests a recovery towards the target zone.

Key Level to Watch: $230 as confirmation for an upward move.

Risk Management: Stop-loss below support is crucial to limit losses.