Apple - The next major push higher!🍎Apple ( NASDAQ:AAPL ) will head for new highs:

🔎Analysis summary :

Apple has been underperforming markets for a couple of months lately. However technicals still remain very bullish, indicating an inherent and substantial move higher soon. All we need now is bullish confirmation and proper risk management and this setup looks very decent.

📝Levels to watch:

$200, $300

🙏🏻#LONGTERMVISION

Philip - Swing Trader

Applebuy

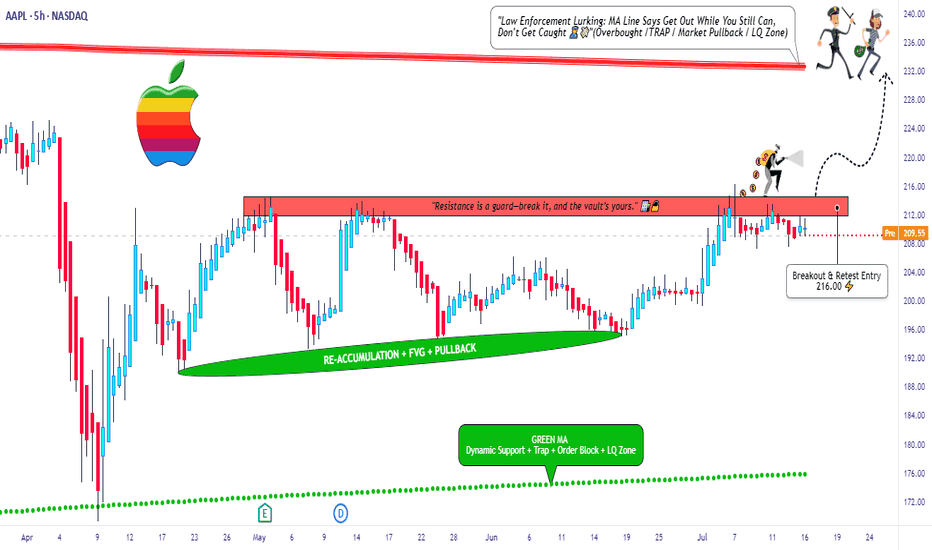

Apple Inc Long Setup – Break, Ride, Exit Like a Pro🕵️♂️💼 “The Apple Heist: Thief Trader's Masterplan for a Clean Escape” 💸🚀

🌟 Hi! Hola! Ola! Bonjour! Hallo! Marhaba! 🌟

Welcome, Money Makers & Market Thieves! 🤑💰💸✈️

This ain’t your average stock analysis — this is a high-level blueprint for the Apple Inc. (AAPL) market heist, built using the Thief Trading Style 🔥📊.

We've scouted the field using a mix of technical patterns, market sentiment, and fundamental fuel, and we’re ready to make our move. The plan is set: go long once the resistance wall cracks, and aim for a clean getaway just before the danger zone hits.

🎯 THE PLAN: INFILTRATE, ESCAPE, PROFIT

Entry Point:

💥 “The vault’s cracking – the breakout begins at 216.00!”

Place Buy Stop orders just above the resistance wall or wait for a pullback to recent swing zones (15M–30M charts work best).

📌 Set your alerts early – you don’t want to miss the opening.

🛑 STOP LOSS - YOUR BACKUP PLAN

🔊 “Listen up, crew: No stop loss until the breakout confirms! Once you’re in, place SL wisely – use the 4H swing low (200.00). Your risk, your rules. Don't get caught slippin’.”

📍 Adjust SL based on lot size, entry volume, and trade size. Protect your stash.

🏁 TARGET ZONE:

🎯 Heist Target = 232.00

(Or bail early if the heat's on – you know the drill.)

⚠️ SCALPERS & SWINGERS

💸 Long side only – don’t fight the wave.

🧲 Scalpers: Get in, grab the cash, trail the stop.

📈 Swing Traders: Hold firm. This setup has legs.

🔎 WHY WE’RE ROBBING THIS CHART:

Apple’s bullish momentum is fueled by:

📌 Strong institutional sentiment

📌 Earnings strength

📌 Index rotation and positioning

📌 COT data & macro tailwinds

Get the full scope: fundamentals, macro outlook, positioning data, sentiment, and intermarket dynamics 🔗📊.

Stay sharp – stay informed.

📰 NEWS ALERTS & POSITION MANAGEMENT

🚨 Avoid new entries during high-impact news releases.

🏃 Use trailing SLs to lock profits and exit clean.

💖 BOOST THE CREW — STRENGTH IN NUMBERS

🚀 Hit that BOOST button if this helped you steal a profitable trade. Your support powers our heist team.

Let’s keep making money the Thief Way – with style, planning, and confidence. 🎉💪🏆

📌 NOTE FROM HQ:

This analysis is for educational purposes. It’s not personalized financial advice. Manage your trades responsibly. Conditions can shift quickly — stay updated and flexible. Stay in the shadows and move smart. 🐱👤

💬 Drop a comment, hit like, share with your gang – the market's a vault, and we’re the codebreakers.

See you on the next heist, Thief Fam. 🤑🔥🕶️💼

Apple Stock Is Surging! Here’s What Most People MissWhen it comes to trading, we don’t care about the latest news headlines or whether some analyst has upgraded or downgraded Apple stock. We focus on one thing and one thing only: the undeniable forces of supply and demand imbalances on higher timeframes.

Right now, Apple’s monthly chart is a textbook example of how waiting for a strong demand imbalance pays off. That $178 monthly level is no random number. It’s the exact origin of a massive bullish impulse that happened in June 2024 — the kind of move that only happens when smart money and big institutions step in, creating an imbalance that pushes the price away rapidly.

📈 It’s Not About Fundamentals. It’s About Imbalances.

Most retail traders waste time chasing news, earnings, or rumours about iPhone sales. But if you think about it, all those factors are already priced in once a strong imbalance is formed. Institutions don’t wait for tomorrow’s news — they plan their positions weeks or months ahead, and those footprints are visible right on your chart.

The $178 level indicates a significant drop in supply and a surge in demand large enough to propel Apple higher, marked by consecutive large bullish candlesticks. That’s our signal — nothing more, nothing less.

APPLE I Stock Forecast and Price Target Welcome back! Let me know your thoughts in the comments!

** APPLE Analysis - Listen to video!

We recommend that you keep this pair on your watchlist and enter when the entry criteria of your strategy is met.

Please support this idea with a LIKE and COMMENT if you find it useful and Click "Follow" on our profile if you'd like these trade ideas delivered straight to your email in the future.

Thanks for your continued support!Welcome back! Let me know your thoughts in the comments!

Apple Inc. Stock Price Target Lowered Amid Tariff ConcernsApple Inc. (NASDAQ: AAPL) is trading at $208.37 after climbing 4.32% in the latest session. Despite the recent bounce, analysts have made downward adjustments to its price outlook ahead of the company’s March 2025 quarterly earnings report. UBS analyst David Vogt has revised Apple’s price target from $236 to $210 while maintaining a ‘Neutral’ rating. This adjustment comes in response to anticipated U.S. tariffs and potential pressure on production costs.

UBS reported that Apple expedited about one million iPhone shipments during the quarter. This strategy contributed to a modest increase in iPhone revenue, despite flat demand. With the U.S. dollar weakening against major currencies, UBS also raised its March quarter revenue estimate to $95.5 billion, up from $93.5 billion. EPS forecasts were adjusted accordingly.

On the other hand, MoffettNathanson Research downgraded its price target from $184 to $141 and reiterated a “Sell” rating. The firm highlighted risks related to trade tensions, increasing manufacturing costs due to tariffs, and slowing innovation. According to their analysis, Apple faces difficult choices—either absorb high tariff costs or reconfigure supply chains at a premium. Both options are expected to affect profitability.

Technical Analysis

The stock has rebounded from a key support level near $170, which aligns with a long-term demand zone visible on the 3-day chart. It has broken above the 200-day moving average of $192.82 and now trades slightly below the 100-day moving average of $213.53 and 50-day MA at $229.03.

Momentum indicators suggest a possible continuation. The RSI stands at 45.67, showing recovering strength. If AAPL holds above $200, it may retest the $197 support level before targeting $260.10. A rejection could lead to a retest of the $170 support area.

Apple ($AAPL): Shares Jump After Tariff Exemption on ElectronicsApple Inc. (AAPL) experienced a significant rally on Monday, climbing as high as $212.94 before settling around $206.05 as of writing, reflecting a 4.5% intraday gain. The spike followed the U.S. government's decision over the weekend to exclude smartphones and other electronics from the latest round of tariffs on Chinese imports. This move provided relief for tech companies like Apple that rely on global supply chains.

As of 3:38 PM EDT, Apple shares Volume reached 258.63 million shares, indicating heightened investor interest. The favorable news also triggered substantial profits for derivatives traders. One bullish options trade worth $5 million, opened on Friday, was reportedly valued at around $14 million by Monday morning—a 180% gain as per Reuters.

According to Capital Market Laboratories CEO Ophir Gottlieb, the trade may have been a calculated bet anticipating favorable policy moves affecting Apple or broader China-related tariffs.

Technical Analysis

The 2-day chart shows a strong bullish reaction from a major support zone near $172, where the price rebounded sharply following the news. The current price at $206 is trading slightly below key moving averages, including the 50-day at $231.81, 100-day MA at $228.36, and 200-day MA at $205.91

Price action also broke above a previous resistance area of $196, turning that level into new support. If momentum holds, Apple could aim for a move toward the $260.10 recent high. However, technical structure suggests a possible pullback before further upside continuation. Overall, the rebound and volume surge indicate strong buyer interest in the wake of the tariff announcement.

Is Apple Stock Really Worth Investing in January 2025?Strong weekly demand level took control. Expecting a decent reaction.

As we enter 2025, the financial landscape is buzzing with excitement and uncertainty. Investors are searching for promising opportunities, and one name that consistently tops the charts is Apple Inc. (NASDAQ: AAPL). Love it or hate it, this tech giant has become synonymous with innovation and growth—drawing both seasoned investors and newcomers alike to its stock like moths to a flame.

AAPL/USD: Potential Bullish Opportunity!AAPL/USD: Potential Bullish Opportunity! 📈

Here’s what I’m seeing:

Buyer/Seller Activity: Buyers seem to be gaining the upper hand.

Blue Box: A promising correction zone where I believe the dip may end.

My approach:

I’ll monitor the lower time frames (1H) for market structure breaks bullish for confirmation, bearish as a caution signal.

Keep your eyes peeled for action in this zone. Boost, comment, and follow for sharper insights! 🚀

Let me tell you, this is something special. These insights, these setups—they’re not just good; they’re game-changers. I've spent years refining my approach, and the results speak for themselves. People are always asking, "How do you spot these opportunities?" It’s simple: experience, clarity, and a focus on high-probability moves.

Want to know how I use heatmaps, cumulative volume delta, and volume footprint techniques to find demand zones with precision? I’m happy to share—just send me a message. No cost, no catch. I believe in helping people make smarter decisions.

Here are some of my recent analyses. Each one highlights key opportunities:

🌐 CryptoMarkets TOTAL2: Support Zone

🚀 GMTUSDT: %35 FAST REJECTION FROM THE RED BOX

🎯 ZENUSDT.P: Patience & Profitability | %230 Reaction from the Sniper Entry

🐶 DOGEUSDT.P: Next Move

🎨 RENDERUSDT.P: Opportunity of the Month

💎 ETHUSDT.P: Where to Retrace

🟢 BNBUSDT.P: Potential Surge

📊 BTC Dominance: Reaction Zone

🌊 WAVESUSDT.P: Demand Zone Potential

🟣 UNIUSDT.P: Long-Term Trade

🔵 XRPUSDT.P: Entry Zones

🔗 LINKUSDT.P: Follow The River

📈 BTCUSDT.P: Two Key Demand Zones

🟩 POLUSDT: Bullish Momentum

🌟 PENDLEUSDT.P: Where Opportunity Meets Precision

🔥 BTCUSDT.P: Liquidation of Highly Leveraged Longs

🌊 SOLUSDT.P: SOL's Dip - Your Opportunity

🐸 1000PEPEUSDT.P: Prime Bounce Zone Unlocked

🚀 ETHUSDT.P: Set to Explode - Don't Miss This Game Changer

🤖 IQUSDT: Smart Plan

⚡️ PONDUSDT: A Trade Not Taken Is Better Than a Losing One

💼 STMXUSDT: 2 Buying Areas

🐢 TURBOUSDT: Buy Zones and Buyer Presence

🌍 ICPUSDT.P: Massive Upside Potential | Check the Trade Update For Seeing Results

🟠 IDEXUSDT: Spot Buy Area | %26 Profit if You Trade with MSB

📌 USUALUSDT: Buyers Are Active + %70 Profit in Total

🌟 FORTHUSDT: Sniper Entry +%26 Reaction

🐳 QKCUSDT: Sniper Entry +%57 Reaction

📊 BTC.D: Retest of Key Area Highly Likely

This list? It’s just a small piece of what I’ve been working on. There’s so much more. Go check my profile, see the results for yourself. My goal is simple: provide value and help you win. If you’ve got questions, I’ve got answers. Let’s get to work!

Exploring Apple's Latest AI: What Does the Future Hold? Apple's recent announcement of Apple Intelligence, coupled with the launch of a new iMac, has sent ripples through the tech industry and the financial markets. While the long-term impact of these innovations on Apple's stock price remains to be seen, initial market reactions suggest a positive outlook.

Apple Intelligence: A Game-Changer?

Apple's foray into artificial intelligence (AI) with Apple Intelligence marks a significant milestone for the company. This new AI framework is designed to enhance various Apple products and services, from the iPhone to the Mac. By integrating AI capabilities into its ecosystem, Apple aims to provide a more personalized, efficient, and intuitive user experience.

Key features of Apple Intelligence include:

• Enhanced Siri: A more intelligent and capable virtual assistant.

• Advanced Image Processing: Improved photo and video editing capabilities.

• Natural Language Processing: More sophisticated text analysis and generation.

While the full potential of Apple Intelligence is yet to be realized, the initial response from analysts and investors has been cautiously optimistic. Many believe that AI could be a significant growth driver for Apple, particularly in areas such as augmented reality, virtual reality, and autonomous vehicles.

The New iMac: A Refreshing Update

The new iMac, powered by the M4 chip, represents a significant upgrade over its predecessor. With improved performance, stunning visuals, and a sleek design, the new iMac is poised to attract both consumers and professionals. However, the impact of this product launch on Apple's stock price is likely to be more modest compared to the introduction of Apple Intelligence.

Market Reaction and Future Outlook

In the immediate aftermath of the announcement, Apple's stock price experienced a modest increase. While this initial positive reaction is encouraging, it is important to note that the long-term impact of these innovations will depend on various factors, including:

• Consumer Adoption: The success of Apple Intelligence and the new iMac will ultimately depend on consumer adoption.

• Competitive Landscape: The intense competition from other tech giants, such as Google, Microsoft, and Samsung, could impact Apple's market share and profitability.

• Global Economic Conditions: Economic factors, such as interest rates, inflation, and geopolitical tensions, can influence investor sentiment and stock prices.

While Apple has a strong track record of innovation and financial performance, it is crucial to approach the company's future with a balanced perspective. While Apple Intelligence and the new iMac represent exciting developments, it is too early to predict their full impact on the company's bottom line.

In conclusion, Apple's recent announcements have generated significant buzz and positive sentiment among investors. However, the long-term trajectory of Apple's stock price will depend on a variety of factors, including the successful execution of its AI strategy and the overall health of the global economy. As Apple continues to push the boundaries of technology, investors will be closely watching to see how these innovations translate into sustainable growth and shareholder value.

AAPL POTENTIAL UPSIDE RUNNASDAQ:AAPL - Sellers halted at a Daily Buy Liquidity Level (Major Level) with the 4h showing Potential change in 4h trend narrative due to the Broken structure to the upside. If price can break above and hold 232.20 I will look for buy opportunities througout the week as long as the 4h can continue to show healthy bullish price action fueled by market anticipation leading up to Earnings on Thursday.

APPLE Soars! Long Trade Achieves Key Targets – Bulls in ControlApple has displayed a strong uptrend since the long entry at 184.92 on 7th May, 2024, reaching multiple profit targets as the bullish momentum continued.

Key Levels

Entry: 184.92 – The long position was initiated as the price broke above this level, indicating bullish strength.

Stop-Loss (SL): 174.50 – Positioned below recent support to manage risk and protect against a downside move.

Take Profit 1 (TP1): 197.80 – The first target was achieved, confirming the continuation of the uptrend.

Take Profit 2 (TP2): 218.65 – Bullish momentum carried the price to this level.

Take Profit 3 (TP3): 239.50 – A further extension of the rally will bring the price to this target which looks very likely.

Take Profit 4 (TP4): 252.38 – The final profit target, indicating a significant uptrend since the entry.

Trend Analysis

Apple's price is well above the Risological Dotted trendline, affirming the strength of the uptrend. The sustained upward movement suggests strong market sentiment, with the potential for further gains beyond the final target.

The long trade on Apple has performed exceptionally well, with multiple targets reached. The final target at 252.38 reflects a robust rally, supported by the Risological Dotted trendline and consistent buying interest.

APPLE Stock 22% Gain - Profit Target 2 Reached!The APPLE stock price crosses over the Risological swing trader dotted line on on May 3, 2024 giving us a clear bullish trade setup.

LONG Trade Setup

Entry 185.5

Current trailing stop loss at : 203.6

Overall gain from the entry: 22%

Last profit target is at 254.5

Congratulations, who made profit!

Betting on the Apple Ecosystem: A Long-Term Look at AAPL StockApple (AAPL) has captivated investors for decades. Their sleek design, user-friendly interface, and commitment to innovation have fueled a loyal customer base and consistent stock growth. But with a recent focus on rebranding artificial intelligence (AI) as "Apple Intelligence," some wonder if the company can maintain its momentum. While this AI rebranding sparks debate, a long-term bullish outlook on AAPL remains strong, driven by the company's core strengths and a vibrant ecosystem.

Beyond the Buzzword: Why Apple?

Despite the recent "Apple Intelligence" announcement, the company's true value lies beyond a single rebranding effort. Here are some key factors driving a long-term bullish outlook on AAPL stock:

• Brand Loyalty: Apple boasts an unrivaled level of customer loyalty. Their products are not simply seen as tools, but as integral parts of users' lives. This loyalty translates to consistent product sales and recurring revenue streams.

• Innovation Engine: Apple is a constant innovator. From the revolutionary iPhone to the powerful M1 chip, they consistently push boundaries and create products that redefine user experiences. This drive to innovate keeps them ahead of the curve and ensures a steady stream of new revenue opportunities.

• A Walled Garden that Works: While some criticize Apple's closed ecosystem, it fosters a tightly integrated user experience. Seamless connectivity between hardware, software, and services like iCloud creates a smooth and efficient experience that users appreciate.

• Services Boom: Apple's services segment, encompassing offerings like Apple Music, iCloud, and Apple Arcade, is experiencing explosive growth. This recurring revenue stream provides stability and reduces dependence on hardware sales alone.

The "Apple Intelligence" Gamble: A Double-Edged Sword?

Apple's recent rebranding of AI to "Apple Intelligence" is a bold move. While it reflects a user-centric approach, some potential drawbacks exist:

• Managing Expectations: "Apple Intelligence" sets high expectations. Delivering features that consistently live up to the name is crucial to avoid user disappointment. Bugs and limitations can erode trust and damage the brand.

• Transparency Challenges: Apple hasn't always been at the forefront of AI transparency. Building trust requires openness about how their algorithms work and how user data is used.

• Integration Hurdles: Successfully integrating powerful AI features across their ecosystem requires meticulous engineering. Any hiccups in this process can hinder user adoption and adoption of the "Apple Intelligence" moniker.

The Long View: Betting on the Ecosystem

Despite potential roadblocks with "Apple Intelligence," the core strengths of the Apple ecosystem remain compelling. Their focus on user experience, consistent innovation, and a loyal customer base position them well for continued success. The "Apple Intelligence" rebranding might be a gamble, but it shouldn't overshadow the company's commitment to building a seamless and intelligent user experience.

For long-term investors, AAPL remains a strong contender. The company's dedication to innovation, a loyal user base, and a robust ecosystem suggest continued growth potential. However, keeping a watchful eye on the execution of "Apple Intelligence" and its impact on user experience is prudent. After all, in the world of technology, even the most brilliant ideas can falter without flawless execution.

APPLE (AAPL) STOCK ANALYSIS Hello, traders here is an analysis of APPLE as you can see the price has been in a bullish form and it created an ascending triangle pattern that signals a bullish move so now I will wait for the price to break the upper structure of the pattern and retest it (as shown in the chart) then I will look for the long opportunities.

AAPL Long Term: A Bite Out of Innovation Still Worth Chewing OnThe tech giants of yesterday aren't always the titans of tomorrow. Ask any BlackBerry or Myspace user. But Apple (AAPL) seems different. It's a brand synonymous with sleek design, intuitive interfaces, and a rabidly loyal fanbase. Yet, whispers abound that Apple's best days are behind it. Is this a reason to abandon AAPL? Not necessarily. Here's why a long position on Apple might still be a juicy investment.

Peak Influence, Peak Products Not Synonymous

There's a valid argument to be made that Apple's cultural influence has peaked. The days of revolutionary product launches that sent shockwaves through the tech world might be over. The iPhone, for instance, forever changed the mobile landscape, but incremental updates might not hold the same groundbreaking appeal.

However, strong influence doesn't guarantee a stagnant product line. Apple's design language and user experience (UX) philosophy remain best-in-class. While competitors scramble to mimic features like multi-touch interfaces, Apple continues to refine and innovate within its established ecosystem. The upcoming AR/VR headset, rumored for release in the coming years, is a prime example. It has the potential to be a game-changer, much like the iPhone was in its time.

The Loyal Legion: A Moat Wider Than Ever

One of Apple's greatest strengths is its fervent user base. Apple users are notoriously loyal, often deeply entrenched within the company's ecosystem of devices and services. Switching from iPhone to Android, for instance, can be a significant hurdle due to factors like iMessage integration and a user interface many have grown accustomed to. This loyalty translates to recurring revenue streams through things like App Store purchases and iCloud subscriptions.

Furthermore, Apple isn't resting on its laurels when it comes to user loyalty. Services like Apple Music and Apple TV+ are constantly improving, offering compelling reasons for users to stay within the Apple fold.

The Maturing Tech Landscape: A Friend, Not a Foe

It's true, America's tech dominance isn't what it once was. But that doesn't spell doom for Apple. The rise of other tech powerhouses like China shouldn't be seen as an existential threat, but rather as a sign of a maturing tech landscape. This fosters healthy competition, pushing companies to constantly innovate and improve their offerings.

Apple, with its immense resources and proven track record, is well-positioned to thrive in this environment. The company has a global presence, a strong brand image, and a loyal user base – all of which are assets that can't be easily replicated.

A Bite-Sized Conclusion

Apple might not be the revolutionary force it once was, but that doesn't mean its best days are over. The company continues to produce high-quality products with a focus on design and user experience. Its loyal user base and focus on services provide strong foundations for continued growth. While the broader tech landscape is evolving, Apple's position within it remains secure. So, for investors seeking a long-term play in the tech sector, AAPL might still be a bite worth taking.

Disclaimer: This article is for informational purposes only and should not be considered financial advice. Please consult with a financial professional before making any investment decisions.

iPads Expected at Apple Event, But Hold On For the AI ChipsApple enthusiasts can finally breathe a sigh of relief. The wait for new iPads is nearly over, with a splashy Apple event titled "Let Loose" scheduled for today. This comes after an unusually long gap between iPad releases.

New iPads Take Center Stage

According to reliable sources, the spotlight will be on the latest iPad lineup. Rumors suggest the unveiling of a new iPad Pro boasting a cutting-edge OLED display, potentially accompanied by a larger 13-inch version. An upgraded iPad Air with a similar display technology might also be part of the show.

M4 Chip: A Surprise Guest?

While the focus is firmly on the iPads, whispers suggest a surprise appearance by the next-generation M4 chip. This unveiling would be a mere six months after the launch of the M3 series, prompting speculation about Apple's strategic direction.

A.I. Chip Development: A Side Story

An article from Wall Street Journal also touches upon Apple's development of a custom-designed chip for artificial intelligence applications within data centers. However, the Wall Street Journal report casts doubt on whether this chip will ever see real-world deployment.

wsj.com/tech/ai/apple-is-developing-ai-chips-for-data-centers-seeking-edge-in-arms-race-0bedd2b2

Investor Takeaway

The "Let Loose" event holds significant promise for Apple investors. The launch of new iPads, particularly the potentially premium iPad Pro models, could generate a surge in sales. The M4 chip, if confirmed, could further solidify Apple's position as a leader in chip technology. While the A.I. chip development is intriguing, investors should likely focus on the more immediate impact of the upcoming iPad releases.

Apple's Q2 Earnings: Mixed Bag with Share Buyback Boost

Apple's fiscal second-quarter earnings report presented a mixed picture for investors. While earnings per share (EPS) surpassed Wall Street expectations, overall revenue and iPhone sales experienced a decline. However, the company's massive share buyback announcement signaled confidence in its future.

Earnings Beat Expectations, Revenue and iPhone Sales Fall

Apple reported earnings per share of $1.52, exceeding analyst estimates of $1.48. This indicates that the company remained profitable, with each share of Apple stock generating slightly more income than anticipated.

However, the news wasn't entirely positive. Total revenue for the quarter dropped 4% year-over-year to $89.5 billion. This decline highlights a slowdown in overall business compared to the same period last year.

Further dampening investor sentiment was a 10% year-over-year decline in iPhone sales. This, Apple's flagship product, is a crucial source of revenue for the company. The decrease suggests a potential softening of demand or increased competition in the smartphone market.

Tim Cook Cites Difficult Comparisons

Apple CEO Tim Cook offered some context for the declining revenue and iPhone sales. He attributed the figures to a "difficult comparison" to the stellar performance of the same quarter in 2023. Last year's Q2 saw a surge in demand for Apple products due to factors like pandemic-driven remote work and learning.

Share Repurchase Announcement: A Confidence Signal

Despite the decline in revenue and iPhone sales, Apple made a bold move by announcing a staggering $110 billion share repurchase program. This is the largest such program in the company's history.

Share repurchases, also known as stock buybacks, involve a company buying back its own shares from the market. This can have several implications:

• Boosting Stock Price: By reducing the number of shares outstanding, buybacks can increase the earnings per share (EPS) ratio, potentially making the stock more attractive to investors.

• Signaling Confidence: A large buyback program can be interpreted as a sign of management's confidence in the company's future prospects. They are essentially using excess cash to invest back into the company itself.

• Returning Value to Shareholders: Buybacks are a way for companies to return excess cash to shareholders. This can be particularly appealing to investors seeking to generate income from their holdings.

Looking Ahead: A Balancing Act

Apple's Q2 earnings report presents a company navigating a dynamic market landscape. While EPS exceeded expectations, declines in revenue and iPhone sales raise questions about future growth. The massive share repurchase program indicates a commitment to shareholder value, but the effectiveness of this strategy hinges on Apple's ability to reignite revenue growth.

Investors will be closely monitoring upcoming reports and developments to assess Apple's ability to overcome these challenges and maintain its position as a tech industry leader.

Testing Vix Cheat Sheet on Apple, 5 days + 4.11%The Viz cheat sheet indicator reveals that if the Vix closes above the upper Bollinger band ($19.01) during the next 5 days that means the Apple stock price will increase by 4.11% to $174. Currently the Vix is around $18.

I've tested this indicator the Vix cheat sheet before with quite impressive results.

Apple's Share Price and AI Potential Attract Hedge Funds

Hedge funds are circling Apple like sharks in feeding frenzy, according to a recent report by Bloomberg. This newfound interest stems from a confluence of factors: a recent slump in Apple's share price and the company's anticipated foray into artificial intelligence (AI) for its flagship iPhones.

A Discount Apple: Value in Slumping Shares

Apple's stock price has dipped by roughly 13% so far in 2024, lagging behind the broader market. This decline has made the company's valuation more attractive to hedge funds, who are constantly seeking strategic buying opportunities.

JPMorgan Chase analysts point out that Apple's current valuation, hovering around 24 times its forward earnings, is lower compared to its tech megacap peers like Microsoft. It's even slightly below the tech-heavy Nasdaq 100 benchmark. This relative discount has piqued the interest of value-oriented hedge funds searching for undervalued stocks with strong growth potential.

AI: The Next Frontier for iPhones?

Hedge funds are not just enticed by the discounted share price; they're also excited about the potential for AI integration within Apple's iPhones. The anticipation of significant AI upgrades to future iPhones is seen as a major growth driver.

While details remain under wraps, analysts speculate that Apple might be planning to incorporate advanced AI features into its iPhones, potentially revolutionizing user experience and functionality. This strategic shift aligns with the broader trend of tech giants embracing AI to enhance their products and services.

Navigating Headwinds: Challenges Remain

Despite the recent surge in hedge fund interest, Apple isn't without its challenges. The ongoing global chip shortage continues to disrupt supply chains, potentially impacting production and shipment timelines for new iPhones. Additionally, the economic slowdown in China, a crucial market for Apple, could dampen overall demand for its products.

A Strategic Entry Point: Betting on Apple's Future

JPMorgan analysts see the current headwinds as a strategic entry point for hedge funds. They believe these challenges are temporary and that Apple is well-positioned for long-term growth, especially with its anticipated AI advancements.

Hedge funds are likely betting on Apple's ability to innovate and maintain its market dominance within the premium smartphone segment. The success of AI integration within iPhones could be a game-changer, propelling Apple's share price significantly higher.

The Bottom Line: A Calculated Gamble

The influx of hedge fund interest underscores Apple's enduring appeal as a potentially undervalued tech giant. While the short-term outlook might be clouded by economic uncertainties and supply chain disruptions, the long-term prospects appear promising, fueled by the company's commitment to AI development. However, investors, including hedge funds, should carefully consider the inherent risks before dipping their toes into the Apple stock pool. The success of Apple's AI endeavors will ultimately determine whether this surge in hedge fund interest translates into a sustained rise in the company's share price.

The Power of Supply and Demand: Apple Stock Smart InvestmentAre you looking to make a smart investment with the potential for high returns? Look no further than Apple stock (NASDAQ: AAPL). In this supply and demand stock analysis, I will explore the power of supply and demand in driving the value of Apple stock and why investing in this tech giant could be a game-changing move for your portfolio. Read on to discover why now is the perfect time to jump on board with one of the most iconic companies in the world.

One of the key factors driving the success of Apple’s stock is its strong weekly demand level, which recently took control a couple of weeks ago at $174 per share. This demand level refers to the amount of interest and investor purchases in a given week. In simpler terms, it reflects how many people buy and hold onto Apple shares.