Why Apple Could Be Entering a Structural Correction🍎📉 Why Apple Could Be Entering a Structural Correction ⚠️🔍

After scanning major tech names today, one stock stood out— for all the wrong reasons : NASDAQ:AAPL .

Technically, Apple has broken below long-standing trendline support , and my chart now assigns a 70% probability(roughly guys...roughly and rounded) of further downside vs only 30% upside . But it's not just about the chart...

Here’s the macro storm Apple is walking into:

🧭 1. Trade War Revival

New tariffs on Chinese electronics could cost Apple up to $1.1B/quarter , even as it tries to diversify production. India and Vietnam are promising, but not mature enough to offset risk.

🤖 2. Lagging in the AI Arms Race

While Nvidia, Google, and Microsoft pour $30B+ into AI, Apple is spending less than half that. Analysts weren’t impressed with “Apple Intelligence.” Siri still isn’t leading.

🇨🇳 3. China: Flatlining Growth, Rising Risk

~18% of Apple’s revenue still comes from China. With Huawei resurging and tightening regulations, Apple’s dominance is being chipped away.

🛑 4. Innovation Pipeline: Empty?

There’s no iPhone super-cycle ahead. Vision Pro remains niche. Apple now looks like a mature tech stock without a breakout catalyst —risky when valuation is still premium.

⚖️ 5. Legal Pressure on Both Sides of the Atlantic

The DOJ and EU are targeting Apple’s App Store dominance. If changes are enforced, the service revenue moat weakens.

🔽 Summary: This Isn’t Panic. It’s Repricing.

The market is re-rating Apple based on real structural risks.

Downside levels I’m watching:

📉 177.65 (first support)

📉 154.53 (next key level)

❗️134–113 zone if macro pressure escalates

Chart = structure. Narrative = pressure. Both are aligned.

Let me know your thoughts—still long NASDAQ:AAPL , or hedging this weakness?

One Love,

The FXPROFESSOR 💙

Disclosure: I am happy to be part of the Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis. Awesome broker, where the trader really comes first! 🌟🤝📈

Appleinc

Apple Stock Falls Despite Strong EarningsApple stock is down more than 4% in the final session of the week, following the company’s earnings release yesterday. Apple reported earnings per share of $1.57, beating expectations of $1.43, while total revenue reached $94.04 billion, surpassing the $89.53 billion forecasted by the market.

However, despite the strong results, the stock is once again facing a notable short-term bearish bias as investor concerns grow. The primary issue is the perception that Apple is falling behind in the race for artificial intelligence, especially compared to its main competitors. In addition, shortly after the earnings announcement, it was noted that the company may face challenges in sustaining growth throughout the remainder of 2025, which has fueled additional downward pressure on the stock.

Sideways Range Emerges

In recent weeks, Apple’s price action has consolidated within a clear lateral range, with resistance around $211 and support near $194. So far, price fluctuations have not been strong enough to break this structure, and the latest bearish candlestick has reinforced the validity of the channel. For now, this sideways range remains the most relevant technical formation to watch in the upcoming sessions.

Technical Indicators

RSI:

The RSI line is falling rapidly and is now approaching the oversold zone at the 30 level. If the indicator reaches that threshold, it could suggest a technical imbalance, opening the door to a short-term bullish correction.

MACD:

The MACD histogram has moved into negative territory in recent sessions, suggesting a clear dominance of bearish momentum in the moving average structure. If this persists, selling pressure may continue to build in the near term.

Key Levels to Watch:

$211 – Main Resistance: Upper boundary of the current range. A breakout above this level could trigger a stronger bullish trend.

$200 – Psychological Support: Round number zone, a breakdown here could activate an immediate bearish bias for the next sessions.

$194 – Key Support: Corresponds to recent weekly lows. A move below this level would likely confirm a more extended bearish trend.

Written by Julian Pineda, CFA – Market Analyst

Apple - The next major push higher!🍎Apple ( NASDAQ:AAPL ) will head for new highs:

🔎Analysis summary :

Apple has been underperforming markets for a couple of months lately. However technicals still remain very bullish, indicating an inherent and substantial move higher soon. All we need now is bullish confirmation and proper risk management and this setup looks very decent.

📝Levels to watch:

$200, $300

🙏🏻#LONGTERMVISION

Philip - Swing Trader

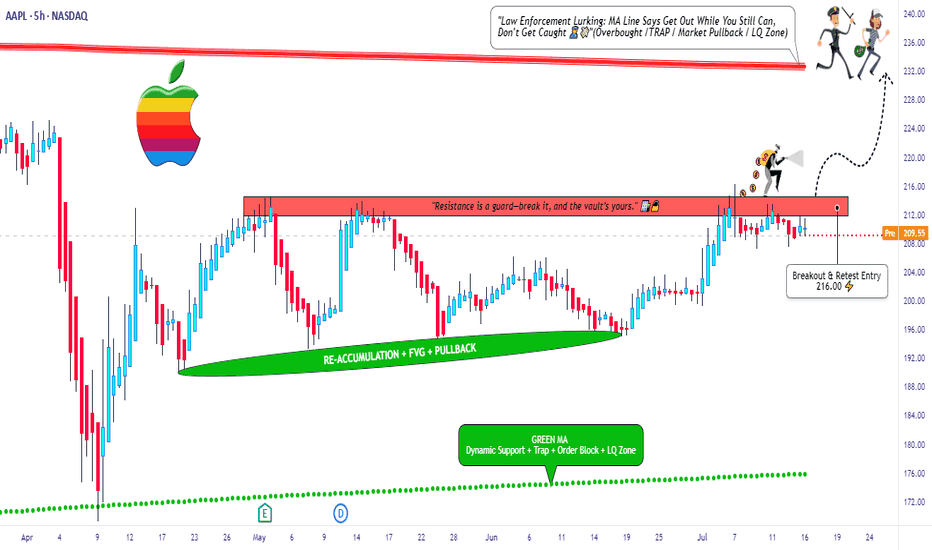

Apple Inc Long Setup – Break, Ride, Exit Like a Pro🕵️♂️💼 “The Apple Heist: Thief Trader's Masterplan for a Clean Escape” 💸🚀

🌟 Hi! Hola! Ola! Bonjour! Hallo! Marhaba! 🌟

Welcome, Money Makers & Market Thieves! 🤑💰💸✈️

This ain’t your average stock analysis — this is a high-level blueprint for the Apple Inc. (AAPL) market heist, built using the Thief Trading Style 🔥📊.

We've scouted the field using a mix of technical patterns, market sentiment, and fundamental fuel, and we’re ready to make our move. The plan is set: go long once the resistance wall cracks, and aim for a clean getaway just before the danger zone hits.

🎯 THE PLAN: INFILTRATE, ESCAPE, PROFIT

Entry Point:

💥 “The vault’s cracking – the breakout begins at 216.00!”

Place Buy Stop orders just above the resistance wall or wait for a pullback to recent swing zones (15M–30M charts work best).

📌 Set your alerts early – you don’t want to miss the opening.

🛑 STOP LOSS - YOUR BACKUP PLAN

🔊 “Listen up, crew: No stop loss until the breakout confirms! Once you’re in, place SL wisely – use the 4H swing low (200.00). Your risk, your rules. Don't get caught slippin’.”

📍 Adjust SL based on lot size, entry volume, and trade size. Protect your stash.

🏁 TARGET ZONE:

🎯 Heist Target = 232.00

(Or bail early if the heat's on – you know the drill.)

⚠️ SCALPERS & SWINGERS

💸 Long side only – don’t fight the wave.

🧲 Scalpers: Get in, grab the cash, trail the stop.

📈 Swing Traders: Hold firm. This setup has legs.

🔎 WHY WE’RE ROBBING THIS CHART:

Apple’s bullish momentum is fueled by:

📌 Strong institutional sentiment

📌 Earnings strength

📌 Index rotation and positioning

📌 COT data & macro tailwinds

Get the full scope: fundamentals, macro outlook, positioning data, sentiment, and intermarket dynamics 🔗📊.

Stay sharp – stay informed.

📰 NEWS ALERTS & POSITION MANAGEMENT

🚨 Avoid new entries during high-impact news releases.

🏃 Use trailing SLs to lock profits and exit clean.

💖 BOOST THE CREW — STRENGTH IN NUMBERS

🚀 Hit that BOOST button if this helped you steal a profitable trade. Your support powers our heist team.

Let’s keep making money the Thief Way – with style, planning, and confidence. 🎉💪🏆

📌 NOTE FROM HQ:

This analysis is for educational purposes. It’s not personalized financial advice. Manage your trades responsibly. Conditions can shift quickly — stay updated and flexible. Stay in the shadows and move smart. 🐱👤

💬 Drop a comment, hit like, share with your gang – the market's a vault, and we’re the codebreakers.

See you on the next heist, Thief Fam. 🤑🔥🕶️💼

Apple Stock Drops: Is Slow AI Development to Blame?The tech world was abuzz on Monday as Apple, a titan of industry and a beacon of innovation, experienced a sudden and significant dip in its stock value, shedding approximately $75 billion in market capitalization. This abrupt decline sent ripples through the investment community, prompting a closer examination of the underlying factors contributing to what many perceive as a rare moment of vulnerability for the Cupertino giant. While market fluctuations are a normal part of the financial landscape, this particular downturn has been widely attributed to growing investor apprehension regarding Apple's perceived slow progress in the burgeoning field of generative artificial intelligence (AI). In an era where competitors are aggressively pushing the boundaries of AI capabilities, Apple's more measured approach appears to be raising questions about its future competitive edge and its ability to maintain its unparalleled ecosystem.

The $75 Billion Question: Unpacking Apple's Stock Drop

Apple's stock drop on Monday was not an isolated incident but rather a culmination of mounting concerns among investors. While the immediate trigger for such a sharp decline can often be a specific news event or analyst downgrade, the broader context points to a deeper anxiety: the pace and direction of Apple's generative AI development. For a company that has historically set the pace in consumer technology, a perception of lagging in a critical emerging technology like generative AI is a significant red flag for the market.

The $75 billion loss in market value represents a substantial sum, even for a company of Apple's immense size. It signifies that a considerable portion of investor confidence, particularly concerning future growth prospects, has been eroded. This erosion stems from the understanding that generative AI is not just another feature; it is poised to revolutionize how users interact with technology, from personal assistants to content creation and productivity tools. Companies that fail to innovate rapidly and effectively in this space risk being left behind, potentially losing market share and, more importantly, mindshare among consumers.

Investors are keenly aware that the tech landscape is unforgiving. Past leaders, even those with seemingly unassailable positions, have faltered when they failed to adapt to paradigm shifts. The market's reaction to Apple's AI progress, or lack thereof, is a testament to the perceived urgency and transformative potential of generative AI. It suggests that the market is valuing future AI capabilities heavily, and any perceived deficit in this area translates directly into a discounted valuation. The stock drop, therefore, serves as a stark reminder that even for Apple, continued dominance is not guaranteed without aggressive innovation in key technological frontiers.

Apple's Generative AI Journey: A Work in Progress

Apple's approach to AI has historically been characterized by a focus on integration, privacy, and user experience. Features like Siri, Face ID, and computational photography are all powered by sophisticated AI algorithms, seamlessly woven into the Apple ecosystem. However, these applications typically fall under the umbrella of discriminative AI, which is designed to make predictions or classifications based on input data. Generative AI, on the other hand, is about creating new content—text, images, audio, video—that is often indistinguishable from human-created output. This is where Apple's "work in progress" status becomes a point of contention.

For years, Apple has been quietly investing in AI research, acquiring smaller AI companies, and hiring top talent. Its chips, particularly the A-series and M-series, are designed with powerful Neural Engines specifically optimized for on-device AI processing. This emphasis on on-device AI aligns with Apple's core philosophy of privacy, allowing many AI computations to occur directly on the device without sending user data to the cloud. While this approach offers significant privacy benefits and can lead to faster, more responsive experiences, it may also present challenges in scaling the massive computational power required for large language models (LLMs) and other complex generative AI applications that often rely on vast cloud infrastructures.

The challenge for Apple lies in translating its existing AI prowess and privacy-centric philosophy into compelling generative AI experiences that can compete with the rapid advancements seen elsewhere. While there have been reports and rumors of Apple developing its own LLMs and generative AI tools, concrete product announcements or widespread public demonstrations have been notably absent. This silence, coupled with the aggressive public releases from competitors, has fueled the narrative that Apple is behind the curve. The market is looking for tangible evidence of Apple's generative AI capabilities, not just promises of future integration. The "work in progress" status, while a natural part of any complex technological development, is being scrutinized under a microscope, especially given the high stakes of the generative AI race.

The AI Race: Contrasting Apple with OpenAI, Google, and Microsoft

The generative AI landscape is currently dominated by a few key players who have made significant strides, setting a high bar for innovation and public perception. The contrast between these leaders and Apple's perceived pace is stark and forms the crux of investor concerns.

OpenAI, with its groundbreaking ChatGPT, DALL-E, and Sora models, has arguably ignited the current generative AI boom. Its strategy has been one of rapid iteration, public release, and collaborative development, often prioritizing innovation and accessibility over immediate commercialization. This approach has allowed OpenAI to capture significant public attention and demonstrate the immense potential of generative AI, effectively becoming the face of the movement.

Google, a long-standing leader in AI research, has been quick to integrate generative AI into its vast ecosystem. Its Gemini models are designed to be multimodal and highly capable, powering features across Google Search, Workspace, and Android. Google's advantage lies in its immense data reserves, vast computational infrastructure, and decades of AI expertise. While it initially faced criticism for being slow to respond to ChatGPT, Google has since demonstrated its commitment to integrating generative AI deeply into its core products and services, showcasing a comprehensive and aggressive strategy.

Microsoft, through its strategic partnership and substantial investment in OpenAI, has positioned itself as a formidable force in the generative AI space. By integrating OpenAI's models into its Azure cloud services, Microsoft 365 suite (Copilot), and Bing search engine, Microsoft has rapidly brought generative AI capabilities to millions of enterprise and consumer users. This partnership has allowed Microsoft to leverage cutting-edge AI research without having to build every component from scratch, accelerating its time to market and providing a significant competitive advantage.

In contrast, Apple has historically preferred to develop its core technologies in-house, maintaining tight control over its hardware and software integration. While this approach has resulted in highly optimized and secure products, it may be a slower path when it comes to rapidly evolving, data-intensive fields like generative AI. The lack of a public-facing, widely accessible generative AI product from Apple, akin to ChatGPT or Gemini, creates a perception that it is not participating in the same league as its rivals. This perception, whether entirely accurate or not, is what is currently impacting investor confidence and contributing to the stock's recent performance. The market is looking for Apple to demonstrate its unique value proposition in generative AI, beyond its traditional strengths.

Challenges and Implications for Apple

Apple's perceived lag in generative AI development presents several significant challenges and implications for its future.

Firstly, there's the risk of falling behind in core product experiences. As generative AI becomes increasingly integrated into operating systems, productivity suites, and creative tools, devices and platforms that lack these capabilities may appear less competitive. Imagine a future where intelligent agents seamlessly manage tasks, generate content, and provide hyper-personalized experiences. If Apple's ecosystem doesn't offer comparable features, it could erode its premium appeal and lead users to platforms that do.

Secondly, developer mindshare is crucial. The most innovative applications and services often gravitate towards platforms that offer the best tools and capabilities. If generative AI developers perceive Apple's platform as less capable or slower to adopt cutting-edge AI models, they might prioritize other ecosystems, potentially leading to a stagnation in the breadth and quality of third-party applications within the Apple App Store.

Thirdly, ecosystem lock-in, a traditional Apple strength, could be challenged. While Apple's integrated hardware and software create a powerful ecosystem, the allure of superior AI capabilities on other platforms could tempt users to switch. For instance, if Google's AI-powered features on Android become significantly more advanced and useful than what Apple offers on iOS, even loyal Apple users might consider alternatives.

Finally, there's the impact on brand perception and innovation narrative. Apple has built its brand on innovation and pushing technological boundaries. A perception of being a follower rather than a leader in a transformative technology like generative AI could tarnish this image, potentially affecting consumer loyalty and its ability to attract top talent in the long run. The $75 billion stock drop is a clear signal that the market is taking these implications seriously.

The Path Forward: Apple's Strategy to Reclaim AI Leadership

Despite the current concerns, it would be premature to count Apple out of the generative AI race. The company possesses immense resources, a vast user base, unparalleled brand loyalty, and a proven track record of entering established markets and redefining them. Apple's path forward in generative AI will likely involve several strategic moves.

One approach could be to leverage its existing hardware advantage. Apple's custom silicon, particularly the Neural Engine in its A-series and M-series chips, provides a powerful foundation for on-device AI. The company could double down on developing highly efficient, privacy-preserving generative AI models that run directly on its devices, offering unique capabilities that cloud-based solutions cannot match. This would align with its privacy-first philosophy and differentiate its offerings.

Secondly, strategic acquisitions and partnerships could accelerate its progress. While Apple prefers in-house development, the rapid pace of generative AI might necessitate acquiring specialized AI startups or forming partnerships with leading AI research labs to quickly integrate cutting-edge models and talent. This would allow Apple to bridge any perceived gaps more rapidly.

Thirdly, Apple might focus on integrating generative AI subtly and seamlessly into its existing products and services, rather than launching standalone, attention-grabbing AI models. This "Apple way" of introducing technology often involves refining and perfecting features before a public rollout, ensuring they are intuitive and enhance the user experience without being overtly complex. This could involve AI-powered enhancements to Siri, improved content creation tools in its creative suite, or more intelligent automation within iOS and macOS.

Finally, developer engagement will be crucial. Apple needs to provide robust tools and frameworks that empower developers to integrate generative AI capabilities into their apps, leveraging Apple's on-device AI power. This would foster a vibrant ecosystem of AI-powered applications that further enhance the value proposition of Apple devices.

In conclusion, Apple's recent stock drop serves as a potent reminder of the market's high expectations and the transformative power of generative AI. While the company's deliberate and privacy-focused approach to AI has its merits, the rapid advancements by competitors like OpenAI, Google, and Microsoft have created a perception of lag. The challenge for Apple is to demonstrate how its unique strengths—integrated hardware and software, a focus on user experience, and a commitment to privacy—can translate into a compelling and competitive generative AI strategy. The coming months will be critical as Apple navigates this pivotal technological shift, aiming to reassure investors and consumers that it remains at the forefront of innovation, ready to define the next era of personal computing with its own distinct AI vision.

Apple Stock Heist Blueprint – Precision Buy Setup Unlocked!🏴☠️ Apple Stock Heist: The Stealthy Long Setup

🎯 Entry Zone – Loot the Dip!

Current Price: $200.21

Action: Initiate long positions now or target pullbacks near the $193–$190 support zone.

Pro Tip: Place buy limits near swing lows/highs. Utilize chart alerts as your secret weapon.

🛡️ Stop Loss – Guard the Treasure!

Swing Traders: Position stop loss below the $190 support level.

Day Traders: Adjust stop loss according to your risk tolerance and order count.

TECHi

💰 Profit Target – Escape with the Loot!

Primary Target: $210 resistance zone.

Secondary Target: $227–$230 range.

⚔️ Scalpers vs. Swing Traders – Choose Your Weapon!

Scalpers: Focus on quick strikes. Enter long positions and exit swiftly.

Swing Traders: Trail stops and lock in gains as the price moves in your favor.

🌪️ Market Pulse – Bullish Winds Blowing!

Technical Indicators: Price is supported near $201, with potential to bounce back toward local resistance at $213.

RSI: Approximately 35 on the 1-hour timeframe, indicating oversold conditions and potential for a rebound.

TradingView

⚠️ News Trap Warning!

Upcoming Events: Monitor for any high-impact news that may affect Apple's stock price.

Strategy: Freeze trades or tighten stops ahead of major announcements.

🚨 Join the Trading Crew!

Engage: Like 👍 or Boost 🚀 this idea to fuel our next raid.

Support: Your engagement keeps the strategies alive!

🤑 Stay Locked In – The Next Big Score is Coming…

Timing: Watch the charts closely.

Action: Strike hard. Exit smarter.

APPLE I Stock Forecast and Price Target Welcome back! Let me know your thoughts in the comments!

** APPLE Analysis - Listen to video!

We recommend that you keep this pair on your watchlist and enter when the entry criteria of your strategy is met.

Please support this idea with a LIKE and COMMENT if you find it useful and Click "Follow" on our profile if you'd like these trade ideas delivered straight to your email in the future.

Thanks for your continued support!Welcome back! Let me know your thoughts in the comments!

Apple: Wave [1] IntactDespite a significant setback, Apple managed to gather new momentum on the upside and continue its work on the green wave . The impulse structure remains intact, and we expect a new high imminently before the next countermovement with wave follows. The stock should not breach the support at $168 to enable wave to initiate the next upward phase. If the price does fall below the $168 mark, our 34% likely alternative scenario will allow for a new low of wave alt.(IV) in blue, though the rise would also continue after this lower low.

$GOOGL Breakdown – AI Risk Is No Longer "Future Tense"🚨 BREAKING: NASDAQ:AAPL confirms they are exploring AI-powered search within Safari after a decline in browser searches for the first time ever.

💥 NASDAQ:GOOGL is down over 8% intraday, cracking long-term trendline support and decisively below the 200DMA ($173).

📉 The setup is ugly:

Insiders sold post-earnings (again).

Trendline + moving average both lost.

Volume spike and vertical price action = capitulation risk ahead.

🔻 Downside momentum could accelerate if price fails to reclaim $155 quickly.

Apple Shares (AAPL) Drop Below $200Apple Shares (AAPL) Drop Below $200

Late last week, Apple released a quarterly report that beat analysts’ expectations:

→ Earnings per share: actual = $1.65, forecast = $1.63

→ Revenue: actual = $95.36bn, forecast = $94.5bn

However, today AAPL stock price is below the psychological $200 mark, over 7% lower than last week’s high (point E).

Why did AAPL shares fall?

According to media reports, investors were concerned about weaker-than-expected services revenue and disappointing sales in China. These factors have renewed fears that the ongoing US–China trade tensions could have a deeper impact on Apple going forward.

Bearish sentiment may also have been amplified by Warren Buffett’s decision to step down as head of Berkshire Hathaway — as we noted yesterday — since his company is one of Apple’s major shareholders.

Technical Analysis of Apple Shares (AAPL)

Key AAPL price action patterns (marked) show a sequence of lower highs and lows, forming the basis for a downward channel. Fibonacci ratios reinforce bearish characteristics in price movements:

→ The rise from B to C is approximately 50% of the decline from A to B

→ The rise from D to E is around 50% of the decline from A to D

This technical picture suggests a potential bear market, where rallies may be corrective rebounds following impulsive drops. This strengthens the scenario in which AAPL shares could continue falling within the established descending channel.

This article represents the opinion of the Companies operating under the FXOpen brand only. It is not to be construed as an offer, solicitation, or recommendation with respect to products and services provided by the Companies operating under the FXOpen brand, nor is it to be considered financial advice.

Apple Inc. Stock Price Target Lowered Amid Tariff ConcernsApple Inc. (NASDAQ: AAPL) is trading at $208.37 after climbing 4.32% in the latest session. Despite the recent bounce, analysts have made downward adjustments to its price outlook ahead of the company’s March 2025 quarterly earnings report. UBS analyst David Vogt has revised Apple’s price target from $236 to $210 while maintaining a ‘Neutral’ rating. This adjustment comes in response to anticipated U.S. tariffs and potential pressure on production costs.

UBS reported that Apple expedited about one million iPhone shipments during the quarter. This strategy contributed to a modest increase in iPhone revenue, despite flat demand. With the U.S. dollar weakening against major currencies, UBS also raised its March quarter revenue estimate to $95.5 billion, up from $93.5 billion. EPS forecasts were adjusted accordingly.

On the other hand, MoffettNathanson Research downgraded its price target from $184 to $141 and reiterated a “Sell” rating. The firm highlighted risks related to trade tensions, increasing manufacturing costs due to tariffs, and slowing innovation. According to their analysis, Apple faces difficult choices—either absorb high tariff costs or reconfigure supply chains at a premium. Both options are expected to affect profitability.

Technical Analysis

The stock has rebounded from a key support level near $170, which aligns with a long-term demand zone visible on the 3-day chart. It has broken above the 200-day moving average of $192.82 and now trades slightly below the 100-day moving average of $213.53 and 50-day MA at $229.03.

Momentum indicators suggest a possible continuation. The RSI stands at 45.67, showing recovering strength. If AAPL holds above $200, it may retest the $197 support level before targeting $260.10. A rejection could lead to a retest of the $170 support area.

AAPL Weekly Options Trade Plan 2025-04-16AAPL Weekly Analysis Summary (2025-04-16)

Below is a synthesized analysis of the AAPL data and the five model reports:

──────────────────────────────

SUMMARY OF EACH MODEL’S KEY POINTS

• Grok/xAI Report – Observes a slightly recovered 5‐minute bounce but a generally volatile, declining daily trend. – Notes bearish technicals (price below EMAs, RSI recovering from oversold levels but MACD still below signal) and mixed sentiment (max pain at $202.50 with heavy put volume). – Recommends a trade on the $190 PUT given its attractive liquidity and proximity (–2.60% from current price).

• Claude/Anthropic Report – Highlights AAPL trading below key EMAs with persistent bearish momentum on both short and daily timeframes and a downtrend of –17% over 30 days. – Points out oversold conditions on the 5‑minute chart with continuing bearish pressure on the daily charts, alongside caution from negative news. – Chooses the $190 PUT as the best blend of risk and reward given its liquidity and technical setup.

• Gemini/Google Report – Emphasizes AAPL’s price below intraday and daily EMAs, with the short-term bounce near the lower Bollinger Band offering a minor contradiction. – Underlines strong bearish sentiment supported by high VIX and negative news, while noting resistance at the call side. – Recommends a bearish pick – the $187.50 PUT – though with a similar rationale as the others (i.e. trading just out‐of‐the‐money to capture a move).

• Llama/Meta Report – Notes bearish indicators including price under moving averages, low RSI, and MACD below the signal line. – Recognizes key support and resistance levels (supports near $194 and resistance near $197) and the opposing pressure suggested by max pain. – Ends up favoring a moderately bearish setup with the $190 PUT given its attractive liquidity and risk profile.

• DeepSeek Report – Reviews the technical and sentiment picture and concludes a moderately bearish position, underscored by negative news and broad put interest. – Emphasizes that a break from near-term support (around $194) could steer the price toward the $190 area. – Also recommends the $190 PUT, noting that its setup offers a reasonable risk/reward profile.

────────────────────────────── 2. AREAS OF AGREEMENT AND DISAGREEMENT

• Agreement: – All reports agree that AAPL is trading in a bearish environment overall, with price below key moving averages and a downtrend on daily charts. – There is a common focus on the options chain, where puts at or below $190 are highly liquid and carry significant open interest. – Every model, despite minor nuances, leans toward buying a naked PUT as the trade idea for this weekly options expiry. – All analysts recommend an entry at market open.

• Disagreement: – One model (Gemini/Google) slightly deviates by suggesting a $187.50 PUT as an alternative to $190, while the majority favor the $190 strike. – The exact profit target and stop‐loss levels differ somewhat between models, but all align on the general risk controls and short-term nature due to weekly expiration.

────────────────────────────── 3. CONCLUSION AND RECOMMENDED TRADE

Overall Market Direction: • Consensus is moderately bearish. Despite a brief short-term bounce noted on the intraday charts, the dominant trend and negative news sentiment favor further downside.

Recommended Trade: • Trade: Buy a single-leg, naked PUT option on AAPL • Expiration: Weekly (April 17, 2025) • Strike and Price: The $190 PUT (with an Ask around $0.83; it is about 2.60% below the current price) • Strategy Rationale: – This strike is liquid (high volume and open interest) and is supported by the bearish bias from momentum indicators and negative sentiment. – Although the premium of ~$0.83 is a bit above the preferred $0.30–$0.60 band, it is justified by the sharper risk/reward setup in this environment. • Entry Timing: At market open • Proposed Risk/Reward: – Profit Target: Approximately a 50% gain on the premium (target near $1.25) – Stop-Loss: Approximately a 50% loss on the premium (stop-loss near $0.42) • Confidence Level: 70% • Key Risks and Considerations: – A brief intraday bounce (short-term oversold recovery) could push prices above support, triggering the stop-loss. – Any unexpected news or a reversal in overall market sentiment may rapidly alter the risk profile given the short-dated expiration. – Monitor price action closely at open, as weekly options are particularly sensitive to early volatility.

────────────────────────────── 4. TRADE_DETAILS (JSON Format) { "instrument": "AAPL", "direction": "put", "strike": 190.0, "expiry": "2025-04-17", "confidence": 0.70, "profit_target": 1.25, "stop_loss": 0.42, "size": 1, "entry_price": 0.83, "entry_timing": "open" }

Disclaimer: This newsletter is not trading or investment advice but for general informational purposes only. This newsletter represents my personal opinions based on proprietary research which I am sharing publicly as my personal blog. Futures, stocks, and options trading of any kind involves a lot of risk. No guarantee of any profit whatsoever is made. In fact, you may lose everything you have. So be very careful. I guarantee no profit whatsoever, You assume the entire cost and risk of any trading or investing activities you choose to undertake. You are solely responsible for making your own investment decisions. Owners/authors of this newsletter, its representatives, its principals, its moderators, and its members, are NOT registered as securities broker-dealers or investment advisors either with the U.S. Securities and Exchange Commission, CFTC, or with any other securities/regulatory authority. Consult with a registered investment advisor, broker-dealer, and/or financial advisor. By reading and using this newsletter or any of my publications, you are agreeing to these terms. Any screenshots used here are courtesy of TradingView. I am just an end user with no affiliations with them. Information and quotes shared in this blog can be 100% wrong. Markets are risky and can go to 0 at any time. Furthermore, you will not share or copy any content in this blog as it is the authors' IP. By reading this blog, you accept these terms of conditions and acknowledge I am sharing this blog as my personal trading journal, nothing more.

Apple ($AAPL): Shares Jump After Tariff Exemption on ElectronicsApple Inc. (AAPL) experienced a significant rally on Monday, climbing as high as $212.94 before settling around $206.05 as of writing, reflecting a 4.5% intraday gain. The spike followed the U.S. government's decision over the weekend to exclude smartphones and other electronics from the latest round of tariffs on Chinese imports. This move provided relief for tech companies like Apple that rely on global supply chains.

As of 3:38 PM EDT, Apple shares Volume reached 258.63 million shares, indicating heightened investor interest. The favorable news also triggered substantial profits for derivatives traders. One bullish options trade worth $5 million, opened on Friday, was reportedly valued at around $14 million by Monday morning—a 180% gain as per Reuters.

According to Capital Market Laboratories CEO Ophir Gottlieb, the trade may have been a calculated bet anticipating favorable policy moves affecting Apple or broader China-related tariffs.

Technical Analysis

The 2-day chart shows a strong bullish reaction from a major support zone near $172, where the price rebounded sharply following the news. The current price at $206 is trading slightly below key moving averages, including the 50-day at $231.81, 100-day MA at $228.36, and 200-day MA at $205.91

Price action also broke above a previous resistance area of $196, turning that level into new support. If momentum holds, Apple could aim for a move toward the $260.10 recent high. However, technical structure suggests a possible pullback before further upside continuation. Overall, the rebound and volume surge indicate strong buyer interest in the wake of the tariff announcement.

APPLE Best buy opportunity of the last 6 years.Back in August 02 2024 (see chart below), we introduced this model on Apple Inc. (AAPL) that had high probabilities of success at predicting Cycle peaks:

We may have not hit $280 but $260 is close enough especially if you are a long-term investor that values buying low and selling high.

Now that the price has corrected by -35% and just hit the 1M MA50 (blue trend-line) for the first time in almost 10 years (since July 2016), it is time to revisit this macro-model once again.

As you can see, -35% corrections have been present on every Cycle since the January 2009 bottom of the Housing Crisis. The pattern that the stock follows is very specific and it starts with a prolonged correction, the Bear Cycle essentially, which is a lengthy correction phase, such as the 2008 Housing Crisis, the 2015/16 China slowdown and the 2022 Inflation Crisis.

Then a very structured uptrend phase starts in the form of a Channel Up that leads the market to its first peak, followed by a shorter, quicker correction phase that tests the 1M MA50 and rebounds. The rebound is the final bull phase of the Cycle, usually strong and sharp and leads to the eventual Cycle Top and then starts then new Bear Cycle (prolonged correction).

Right now the current 4-month correction is technically, based on this model, the new shorter correction. Being more than -35% in size, the last one larger than this was the previous short correction of the last Trade War in October 2018 - January 2019 (-38%).

The similarities don't stop here but extend to the 1M RSI as well, which just entered its 25-year mega Buy Zone that has been holding since December 2000 and the Dotcom Crash! In fact the last time Apple's 1M RSI was this low was in June 2013, which was the bottom of the 1st short correction on our chart.

This remarkable symmetry just shows how similar the current phase is with its previous ones and if the symmetry continues to hold, we should be expecting a strong recovery to start. Even if the price makes a slightly deeper low as -38% (like the January 2019 bottom), we may still expect the minimum rise that it had all those years shown on the chart, +145%, which translates to a potential $390 Target long-term.

It is in times like this, that patient long-term investors filter out the news noise, make their unbiased moves and maximize their profit.

-------------------------------------------------------------------------------

** Please LIKE 👍, FOLLOW ✅, SHARE 🙌 and COMMENT ✍ if you enjoy this idea! Also share your ideas and charts in the comments section below! This is best way to keep it relevant, support us, keep the content here free and allow the idea to reach as many people as possible. **

-------------------------------------------------------------------------------

💸💸💸💸💸💸

👇 👇 👇 👇 👇 👇

AAPL (Apple): Has a Large Correction Begun? More Downside Ahead?On this chart, we are currently tracking the potential beginning of a larger downtrend, which could be a larger-degree Wave 4 correction. It is possible that a larger-degree third wave topped in December 2024 at $260, and for now, I am assuming this is the case. While further confirmation is needed, the price has already broken below our first signal line, which supports the idea that a larger decline has begun—unless the next rally develops into a clear impulse structure.

At the moment, the price appears to be in the late stages of Wave C of Circle Wave A to the downside. Immediate resistance sits between $220 and $224, and only a break above $224 would indicate that Circle Wave B to the upside may have already started.

One important note: Circle Wave B could technically overshoot to the upside, meaning that if Circle Wave A completed as a three-wave pullback, we could even see a new high in the next bounce before the larger downtrend continues. This is something to keep an open mind about, as it is still early to confirm a substantial top on the long-term chart.

For now, as long as resistance at $224 holds, the assumption remains that Circle Wave A needs one more low before a stronger bounce occurs.

Apple Inc. (AAPL) Forming a Potential W-Pattern – A Bullish SignApple Inc. (AAPL) Forming a Potential W-Pattern – A Bullish Signal

Apple Inc. (AAPL) appears to be shaping a significant W-pattern, a well-known technical formation often associated with bullish momentum. From a psychological standpoint, this pattern suggests a potential buying opportunity.

Should fundamental factors align with this technical setup, I anticipate a strong upward move, targeting my 3 TP levels at $245, $250, and $260.

To maximize profitability and maintain a disciplined approach, traders should consider managing risk effectively.

Holding positions for optimal gains becomes easier when avoiding excessive leverage—or better yet, trading with no leverage at all.

Trade with caution.

Always align technical insights with fundamental analysis before making investment decisions.

Apple Inc. (AAPL) Technical Analysis –Potential Bullish Reversalhello guys!

let's analysis Apple!

Support Area (~$219 - $221): This zone has previously acted as a strong demand level, preventing further decline.

Target Area (~$252 - $254): A key resistance level where the price might face selling pressure.

Candlestick Signal – Bullish Engulfing:

The engulfing pattern indicates a potential reversal, signaling bullish momentum after a decline.

If confirmed with increased volume, it strengthens the possibility of an upward move.

Trade Setup:

Entry: Around the current price level (~$227).

Stop-Loss: To minimize downside risk, below the support area (~$219).

Take-Profit Target: Around $252 - $254, aligning with the resistance zone.

Confirmation Factors:

A strong breakout above $230 would validate bullish momentum.

A retest of support with a bounce would reinforce the setup.

The bullish setup would be invalidated if the price falls below $219.

Conclusion:

Bullish Bias: The pattern suggests a recovery towards the target zone.

Key Level to Watch: $230 as confirmation for an upward move.

Risk Management: Stop-loss below support is crucial to limit losses.

Apple Surges 3% in Premarket Amid AI Optimism & Strong ForecastApple Inc. (NASDAQ: NASDAQ:AAPL ) has seen a notable 3.46% surge in premarket trading, defying concerns over declining China sales. The upward momentum follows an optimistic sales forecast, hinting at a resurgence in iPhone demand fueled by Apple's strategic adoption of artificial intelligence (AI) features.

Earnings Outlook

Apple’s latest earnings report revealed a nuanced performance, with robust overall revenue counterbalanced by a slight dip in iPhone sales. Despite a shortfall in China, where revenue declined 11% to $18.5 billion—falling short of the projected $21.57 billion—Apple’s services unit exhibited strong growth, climbing 14% year-over-year to $26.34 billion. This exceeded Wall Street expectations of $26.09 billion, reinforcing Apple’s ability to diversify revenue streams beyond hardware sales.

CEO Tim Cook emphasized that Apple Intelligence, the company’s AI-powered suite of features, is playing a crucial role in boosting iPhone sales where available. However, Apple’s cautious approach to AI investments, unlike its peers such as Microsoft (MSFT) and Meta (META), has insulated its stock from recent market turbulence. The restrained AI strategy aligns with Apple's focus on integrating AI within its hardware ecosystem, enhancing device functionality without excessive capital expenditure on data centers.

The company posted earnings of $2.42 per share on revenue of $124.3 billion, surpassing analyst expectations of $2.36 EPS on $124.12 billion revenue. While iPhone sales, accounting for nearly half of Apple's revenue, declined to $69.14 billion from $69.70 billion year-over-year, the broader growth trajectory suggests a potential iPhone rebound in FY26.

Technical Outlook

From a technical standpoint, NASDAQ:AAPL is demonstrating strong bullish patterns. The stock is currently up 3.41%, benefiting from the renewed confidence in its growth trajectory. Prior to this recent rally, Apple shares had experienced a 15% decline since late December 2024. However, the current price action suggests a recovery, with NASDAQ:AAPL reclaiming 10% of its lost value, forming a falling wedge pattern—a historically bullish signal.

The premarket surge sets up the possibility of a gap-up pattern at market open, a strong bullish indicator that could further accelerate buying pressure. In the event of a pullback, immediate support lies at the 61.8% Fibonacci retracement level, a key level that often dictates price reversals in technical analysis.

The China Factor and AI’s Role in Future Growth

While Apple’s sales slump in China remains a wildcard, analysts expect a recovery once Apple Intelligence is introduced in the region. The lack of AI features has been cited as a major reason for weaker-than-expected sales in the Chinese market. TD Cowen analysts predict that demand could rebound once Apple secures a local partner to facilitate AI integration, boosting sales in a highly competitive market.

Moreover, Apple's performance relative to its tech peers remains strong. In 2024, Apple stock surged 30.07%, outperforming Microsoft’s 12.09% increase but trailing Meta’s impressive 65.42% rise. Apple’s 12-month forward price-to-earnings (P/E) ratio stands at 31.12, compared to Microsoft’s 29.2 and Meta’s 26, indicating sustained investor confidence in Apple’s long-term growth potential.

AAPL Positioned for Further Gains

Apple’s ability to weather market challenges, coupled with its strategic AI rollout, positions it favorably for continued growth. The bullish technical setup, strong fundamentals, and AI-driven sales optimism indicate that AAPL could maintain its upward trajectory. Investors should monitor key support and resistance levels, as well as further developments regarding Apple Intelligence’s expansion into new markets.

With analysts raising price targets and market sentiment improving, Apple’s stock could be on track for a sustained rally in 2024 and beyond.

Apple Breaks Downtrend and Key Resistance Ahead of Earnings...!APPLE has broken the downtrend as well as the important resistance level of 237-238 dollars and currently trying to sustain above it just before the earning report. As investors/traders, we should wait till the earning report which will be available on 30 JAN before taking the trade.

Apple: Bearish Movements Face the Most Important Barrier Apple's stock has experienced a decline of over 9% from its peak price of $260 , recorded during the last days of December. The stock has seen a reduction in market confidence, with selling positions now dominating.

Crucial Barrier: The current $234 zone serves as a critical support level, where the upward trendline, the 100-period moving average, and the 61.8% Fibonacci level converge. This is now the most solid barrier to consider for the long-term upward trend. Persistent bearish oscillations that manage to break below this level could dismantle the current bullish formation and pave the way for a potential sustained bearish movement.

MACD: Both MACD lines maintain a negative slope, and the histogram oscillates below the indicator's neutral 0 level. This indicates that, on average, bearish oscillations in recent periods have been significantly stronger, and selling pressure may increase as the histogram continues to diverge further from the 0 line.

By Julian Pineda, CFA - Market Analyst

AAPL/USD: Potential Bullish Opportunity!AAPL/USD: Potential Bullish Opportunity! 📈

Here’s what I’m seeing:

Buyer/Seller Activity: Buyers seem to be gaining the upper hand.

Blue Box: A promising correction zone where I believe the dip may end.

My approach:

I’ll monitor the lower time frames (1H) for market structure breaks bullish for confirmation, bearish as a caution signal.

Keep your eyes peeled for action in this zone. Boost, comment, and follow for sharper insights! 🚀

Let me tell you, this is something special. These insights, these setups—they’re not just good; they’re game-changers. I've spent years refining my approach, and the results speak for themselves. People are always asking, "How do you spot these opportunities?" It’s simple: experience, clarity, and a focus on high-probability moves.

Want to know how I use heatmaps, cumulative volume delta, and volume footprint techniques to find demand zones with precision? I’m happy to share—just send me a message. No cost, no catch. I believe in helping people make smarter decisions.

Here are some of my recent analyses. Each one highlights key opportunities:

🌐 CryptoMarkets TOTAL2: Support Zone

🚀 GMTUSDT: %35 FAST REJECTION FROM THE RED BOX

🎯 ZENUSDT.P: Patience & Profitability | %230 Reaction from the Sniper Entry

🐶 DOGEUSDT.P: Next Move

🎨 RENDERUSDT.P: Opportunity of the Month

💎 ETHUSDT.P: Where to Retrace

🟢 BNBUSDT.P: Potential Surge

📊 BTC Dominance: Reaction Zone

🌊 WAVESUSDT.P: Demand Zone Potential

🟣 UNIUSDT.P: Long-Term Trade

🔵 XRPUSDT.P: Entry Zones

🔗 LINKUSDT.P: Follow The River

📈 BTCUSDT.P: Two Key Demand Zones

🟩 POLUSDT: Bullish Momentum

🌟 PENDLEUSDT.P: Where Opportunity Meets Precision

🔥 BTCUSDT.P: Liquidation of Highly Leveraged Longs

🌊 SOLUSDT.P: SOL's Dip - Your Opportunity

🐸 1000PEPEUSDT.P: Prime Bounce Zone Unlocked

🚀 ETHUSDT.P: Set to Explode - Don't Miss This Game Changer

🤖 IQUSDT: Smart Plan

⚡️ PONDUSDT: A Trade Not Taken Is Better Than a Losing One

💼 STMXUSDT: 2 Buying Areas

🐢 TURBOUSDT: Buy Zones and Buyer Presence

🌍 ICPUSDT.P: Massive Upside Potential | Check the Trade Update For Seeing Results

🟠 IDEXUSDT: Spot Buy Area | %26 Profit if You Trade with MSB

📌 USUALUSDT: Buyers Are Active + %70 Profit in Total

🌟 FORTHUSDT: Sniper Entry +%26 Reaction

🐳 QKCUSDT: Sniper Entry +%57 Reaction

📊 BTC.D: Retest of Key Area Highly Likely

This list? It’s just a small piece of what I’ve been working on. There’s so much more. Go check my profile, see the results for yourself. My goal is simple: provide value and help you win. If you’ve got questions, I’ve got answers. Let’s get to work!

Apple Stock W-Pattern: Another Bullish Entry on the HorizonOver the past few weeks, we’ve repeatedly seen the same W pattern forming in Apple’s stock. I believe the stock is still in an uptrend, and the next good entry point could be during the downswing of the second leg. I’m planning to open a long position.

Whether I’ll close this position at around $260 as a day trade or decide to hold it longer is something I’ll let you know soon. What’s your take on this? Let me know!

Stay tuned, and I’ll catch you in the next one — peace!