Applelong

Apple Inc FORECAST: Meeting resistance soonWELCOME TO MY PAGE, PLEASE DO LIKE AND SUPPORT MY ANALYSIS, I hope what I shared can help everyone out in their trades! = )

AAPL Apple Inc appears to be in a long sustained BULL RUN on the D1 Time Frame, with short impulse pullbacks and long sustained daily green candles.

Stochastics and MACD points towards a strong buying pressure, both showing green in the buy zone. (Possible overbought scenario)

I'm looking for AAPL to touch the resistance line @ 314-315, for now would be a quick LONG opportunity to that line. Thereafter, watch for a rejection for a SELL to the nearest support line @ 303.25.

OVERALL, I'm bullish on Apple Inc but playing safe on the fact that:

1) 8 days of consecutive green bullish candles seen on D1 Time Frame

2) Approaching 3 lines of strong resistance levels @ 315, 323, and 327 last touched in mid - January 2020

3) Buying volume seems to be slowly dropping --> Indicating weakening buying pressure

For these reasons, I see a quick correction downwards next week or so nearing the resistance lines stated above, before continuing its bullish long term trend.

As always, REMEMBER TO LIKE AND SUBSCRIBE IF YOU LIKED WHAT I SHARED, THANK YOU ALL

Regards,

Gol D Roger

BULLSEYE - A 10% profits trade.Some trades are easy, some are not. This one here was definitely among the easy ones . If you missed my previous analysis on AAPL, just check it bellow and remember to follow me to keep updated of our trades and analysis. Here’s the link to my previous analysis, on April 22:

When that candle closed, it formed a pattern that those who follow me know I like to trade – a Harami. But there’s more! The pattern was close to 3 main supports: 1 – The 21 ema; 2 – The purple trendline; 3 – The previous top (now bottom). And even better: The green candle closed above all the 3 of them. As I said in my previous analysis, that would be a very good sign. I love when a trade is absolutely obvious, like this one!

But how to trade a Harami? Simple, I usually put a buy order 1 cent (sometimes more) above the previous candle’s high. If I’m afraid that a gap will not let me buy just one cent above, then I buy half of my position near the end of the Harami’s day and wait for the confirmation next day. The confirmation is always the most important thing , because we need to know if the Harami was triggered or not.

Now, AAPL reached our main target after 2 weeks, and now we can sell it and book our profits. Congratulations to those who did catch this trade, that was an easy one! If you missed this trade, now it isn’t time to buy, neither to short. It’s too close to the trendline, and there’s a chance that it will hold the price again, then the risk/reward of a short is not attractive. There’re more interesting trades to do.

Remember to follow me, I’m a trader who uses the classic technical analysis (barely any indicator, just the candles and the volume). Like this idea if it helped.

Thank you very much.

* LIKE this idea and FOLLOW me, because:

- Here, you will see clean charts;

- Trades with clear risk management;

- The best of Dow Theory, Price Action and Candlestick psychology;

- Chart patterns with statistics. *

* My name is Nathan, I'm a trader and portfolio manager and I'm here to LEARN. Leave your COMMENT and FOLLOW me to keep in touch. *

Apple: Technical Gap Analysis 1D (Apr. 26)X FORCE GLOBAL ANALYSIS:

Apple has shown great strength in its recovery from the damage caused by the corona virus (Covid-19). In this analysis, we explore a purely technical approach to Apple (AAPL), using the gap theory.

Analysis

- Gaps are areas on a chart where the price of a stock moves sharply up or down, with little or no trading in between.

- As a result, the asset's chart shows a gap in the normal price pattern

- Gaps have a tendency of getting filled.

- Thus, when we see gaps below the price during an uptrend, it indicates that there is a probability of a correction

- Apple's chart on the daily is rather choppy, and presents room for multiple gaps

- Gaps that have been filled are marked by green

- We currently see two major unfilled gaps both above and below the current price level

- While the Relative Strength Index (RSI) moves in an uptrend, creating higher lows, we have not yet broken the descending trend line

- The Moving Average Convergence Divergence (MACD) shows a potential death cross, as the bullish histogram show signs of weakened momentum

What We Believe

Based on the gap theory, given that all gaps fill, this would be the most probable scenario; we see a rejection at the descending trend line support, and as prices fill the gaps below, a double bottom is formed on the daily. Then, we see a breakout from the descending trend line resistance, and a continued bullish rally to fill the gaps above. However, it's imperative to note that gaps don't get filled all the time.

Trade Safe.

Apple Stock update Elliott wave analysis hello, this is my update on apple, many people are bearish last week on apple and the stock is holding the levels very well!

as wave count we finish wave 4 and heading to wave 5 which will end be near $311 i hope it's will go even more with the earning call apple will use their own processors 2021.

we have also head and shoulders pattern and we can buy when price action break the neckline.

good luck

AAPL - Apple S/R zonesHello traders,

Description of the analysis:

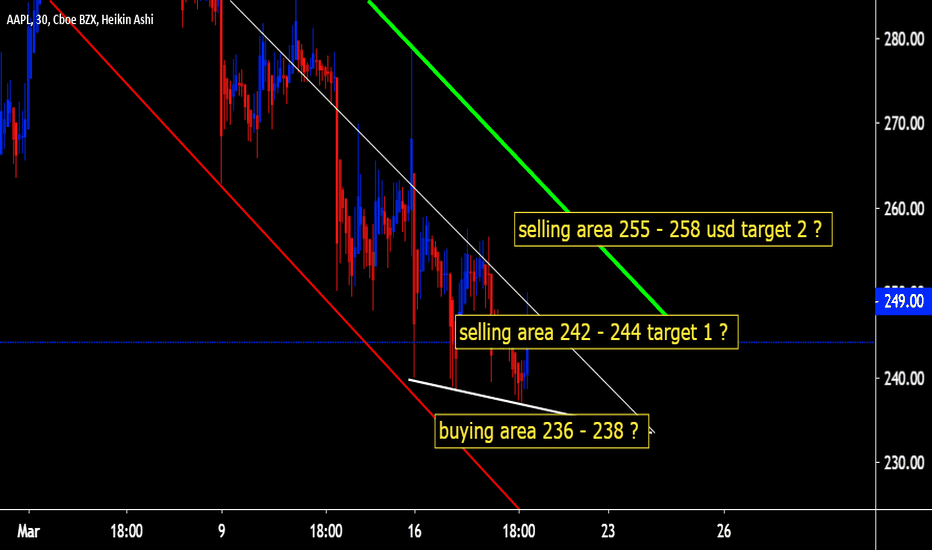

Apple is returning to a fairly wide band of the previous period in which the fair price was 275.5 however the current profile creates a range in this band with a higher fair price of approximately 284. Currently testing support for the first standard deviation. This support could be interesting for more aggressive investors, but for more conservative investors I would target a more appropriate price tag around 252. Most patient can try zone around 242. It will all depend on whether strong support will be reactionary or break through. Who would consider buying 100pcs shares can try the entry with a bonus and sell the put option at the given price of entry. If the market does not reach there until the expiration date of the option, you will at least receive a premium for the sold put option. Invest and trade sparingly and carefully, we still have VIX in extreme.

About me:

Hi, my name is Jacob Kovarik and I´m trading on stock exchange since 2008. I started with a capital of 3000 USD. My first strategy was based on OTM options. (American stock index and their ETF ). I´ve learnt on my path that professional trading is based on two main fundaments which have to complement each other, to make a bussiness attitude profitable. I´ve tried a lot of techniques and many manners how to analyze the market. From basic technical analysis to fundamental analysis of single title. My analytics gradually changed into professional attitude. I work with logical advantages of stock exchange (return of value back to average, volume , expected volatility , advantage of high stop-loss, the breakdown of time in options, statistics and cosistent thorough control of risk). At the moment, my main target is ITM on SPM index. Biggest part of my current bussiness activity comes from e mini futures (NQ, ES). I´m trader of positions. I´m from Czech republic and I take care of a private fund (4 000 000 USD). During my career I´ve earned a lot of valuable experience, such as functionality of strategies and what is more important, control of emotions. Professional trading is, in my opinion, certain kind of mental training and if we are able to control our emotions, accomplishment will show up. I will share with you my analysis and trades on my profile. I wish to all of you successul trades.

Jacob

Apple Full Trend Reversal W/ MA?NASDAQ:AAPL

Apple might be in the middle of a full on reversal from this massive drop it's been on for awhile now. Follow the 20/50/150/200 MA from 1 minute all the way up to 1 hour chart and notice how they are all reversing trend. The key now is to follow the 2H-4H today maybe more to see if they complete the reversal on the 50 passing over the 150 etc. Could be an amazing sign for Apple. If it gets stuck though the downside would be a big sell off. I think Apple is bullish and people want it to be bullish in the market so my hopes are directed that way. Also is was massively oversold since Feb.

Thoughts?

Do you due diligence as always and make sure to keep up to date with all the market news and pre market buzz concerning the overall market and virus.