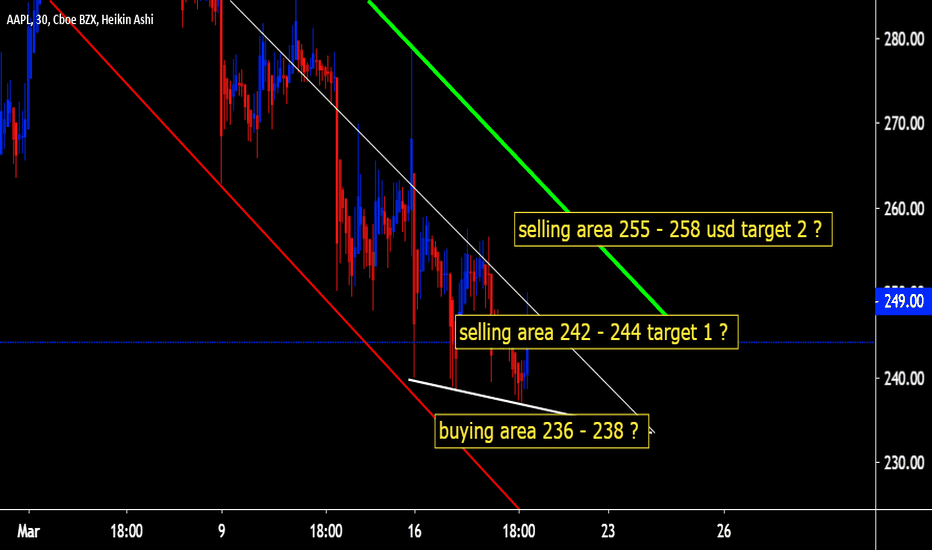

Appleshort

Apple inc shortthe stock almost near to strong resistance zone area and the is continiously moving in a rising wedge pattern so keep eyes on this stock if it break the lower channel thgen the stiocks can show major fall in upcoming trading days.hit the like iy you gree with my setup. and folow me fore more effective setup.

#AAPL ANALYSIS.. NEVER SAY NEVER.. In my previous analysis, I mentioned that a strong sales wave could come to the markets again, in this context, I expect a structure as I mentioned in the chart.. Never say never.. Markets will be very interesting after 6 months, we will wait and see.. I firmly believe that big crash will come eventually and oil prices were the leading indicator of this..

Disclaimer: Please do your own due diligence when it comes to investing.. Never put in money that you cannot afford to lose.. Invest at your own risk..

I wish you all the best..

Apple: Technical Gap Analysis 1D (Apr. 26)X FORCE GLOBAL ANALYSIS:

Apple has shown great strength in its recovery from the damage caused by the corona virus (Covid-19). In this analysis, we explore a purely technical approach to Apple (AAPL), using the gap theory.

Analysis

- Gaps are areas on a chart where the price of a stock moves sharply up or down, with little or no trading in between.

- As a result, the asset's chart shows a gap in the normal price pattern

- Gaps have a tendency of getting filled.

- Thus, when we see gaps below the price during an uptrend, it indicates that there is a probability of a correction

- Apple's chart on the daily is rather choppy, and presents room for multiple gaps

- Gaps that have been filled are marked by green

- We currently see two major unfilled gaps both above and below the current price level

- While the Relative Strength Index (RSI) moves in an uptrend, creating higher lows, we have not yet broken the descending trend line

- The Moving Average Convergence Divergence (MACD) shows a potential death cross, as the bullish histogram show signs of weakened momentum

What We Believe

Based on the gap theory, given that all gaps fill, this would be the most probable scenario; we see a rejection at the descending trend line support, and as prices fill the gaps below, a double bottom is formed on the daily. Then, we see a breakout from the descending trend line resistance, and a continued bullish rally to fill the gaps above. However, it's imperative to note that gaps don't get filled all the time.

Trade Safe.

Apple Support - lower than you thinkHi, thanks for viewing.

I think there is less demand for over-priced (subjective call) personal electronics at the moment. People are rightly thinking about more essential items, paying down debt, and increasing savings.

Probably worth pointing out how strong the 200 week moving average is as support - somewhere around 185, which is lower than people think. Anyone out there thinking that they are safe because "Warren Buffett bough Apple" need to look into the recent cut-losses by Berkshire Hathaway. Warren said many many times in the past things along the lines of "I don't understand electronics firms, so I don't invest in them," "I don't understand Apple so I don't invest," "if I ever invest in airlines - then call the Psychologist because I have lost my mind." Not direct quotes, but anyone who has followed Warren Buffett for a long time will know what I am talking about.

So, what happened recently? Berkshire cut losses on Delta Airlines - shares bough expecting the bail-out would somehow replace lost customer demand and bleak fundamentals. To hear that Warren even bought Airline shares just doesn't sound right to me. The same here, they invested in Stocks they didn't understand as well as their traditional 'bread and butter', departed dramatically from a value investing philosophy, and they will have to take their losses - just like everyone else. Apple is over-valued. Anything that is 'consumer discretionary' that may be affected by the steep drop-off in consumer demand will be sold - at least until the future comes into sharper focus. I bought a cheaper smartphone recently after getting annoyed at having to charge my iPhone before the day was over. My new phone has an 11,000Mah battery and I don't even need to charge it every day - every second day is more than enough. I don't need to pay crazy prices for cordless earphones, or $1000 for a computer stand etc etc. Apples has a good product, not necessarily the best in class, but they are compensating for lower sales by raising their prices - that makes them more vulnerable to lower consumer discretionary spending in the event of an economic downturn.

I am not sure if I will be a buyer at $185, because we are in the biggest economic shock of a lifetime. But there will likely be a bounce at that level.

Now we can watch how this market unfolds. The forces at play are massive US, ECB, BOJ stimulus versus a massive supply chain, and demand shock. Unfortunately, the Fed cannot make people able to afford their credit card bills, their rent, medical costs, cannot re-create a supply chain, or convince anyone that savings aren't essential right now. Long-term, they will have to convince the public that massive and un-serviceable Fed and Public debt isn't something to worry about. That owning public debt that yields below inflation and cannot be paid from income is a good idea. I am very concerned that all the monetised debt this year and next will be met with lower and lower demand as people realise they are not being adequately compensated to hold it, and that at maturity it will be paid in newly printed devalued USD. US Treasuries are a promise to deliver USD in the future, that promise to pay is very unlikely to be funded by additional income, so T-bonds are effectively a promise to print money. Anyone who knows about gold, knows that all the brakes have been taken off the gold price recently. ZIRP (that can never be raised), global uncertainty, negative real yields of 10 year T-bonds, and a struggling equity market, all lend strength (and reduce the opportunity cost to hold it) of gold.

Ok, I ended up going a little off-road there. But we are over-all in a "risk off" environment. Safe havens will out-perform vs equities or treasuries (treasuries have stopped being a safe haven). Corporate debt is definitely not a safe haven.