APRN Gained on Big Earnings Miss SHORTAPRN on the 2H chart demonstrates continued burning of cash and the burn rate

is more than the estimates of the analysts. With the double Bollinger Band overlaid,

Price since those dismal earnings has increased up more than 50% and is now at the dynamic

resistance of the volatility bands. Confluent with its rise to the upper bands is the rise of price

to three standard deviations above the mean VWAP. I see this as a short trade setup

with the price falling to the 0.5 Fib level confluent with the POC line of the volume profile

as well as the mean VWAP which I will target in the trade. If you want my idea as to the

put option equivalent parameters, please leave a comment. ( like and follow if you are

inclined !) I am looking to get 20% out of the short sell. The put option is screaming for

at least 100% and potentially double that.

APRN

$APRN Commons Long Swing IdeaSome attention to this name recently up 164% last 3 months and one of Citadel's longs they constantly pump

I like the way it's bouncing off the 21 daily moving average and right here at the .618 FIB retracement.

Starter position at 500 shares, first PT $7 and will add more at $6.5

Loss of 21 DMA invalidates trade

$APRN Forecastusing the 15m chart, looking at a wedge pointing at $8.50 or so level. I have been in since $3.03, pretty nice and steady rise the last few weeks, nothing too squeezy. I prefer it that way.

GL

Another Short on the Apron. APRNBlue Apron Holdings.

Goals 4, 3, 1.8. Invalidation at 8.58 .

We are not in the business of getting every prediction right, no one ever does and that is not the aim of the game. The Fibonacci targets are highlighted in purple with invalidation in red. Fibonacci goals, it is prudent to suggest, are nothing more than mere fractally evident and therefore statistically likely levels that the market will go to. Having said that, the market will always do what it wants and always has a mind of its own. Therefore, none of this is financial advice, so do your own research and rely only on your own analysis. Trading is a true one man sport. Good luck out there and stay safe

APRNThey call this a graveyard but what they forget is that graveyards look their best when there is a full moon shining above.

Blue Apron Holdings descending. APRNYou can just see the dropping momentum on the candlesticks here. Then what comes up must come down. How low? Only time can tell. It is much easier to say which way we are going in the market than how high or how low.

We are not in the business of getting every prediction right, no one ever does and that is not the aim of the game. The Fibonacci targets are highlighted in purple with invalidation in red. Fibonacci goals, it is prudent to suggest, are nothing more than mere fractally evident and therefore statistically likely levels that the market will go to. Having said that, the market will always do what it wants and always has a mind of its own. Therefore, none of this is financial advice, so do your own research and rely only on your own analysis. Trading is a true one man sport. Good luck out there and stay safe!

mid term +900%Blue Apron Holdings, Inc. operates direct-to-consumer platform that delivers original recipes, and fresh and seasonal ingredients.

Blue Apron A Sleeping Giant [PENNYSTOCK]Here we have a trade in APRN that I was contemplating keeping for myself as this setup appears almost too good to be true. This is a popular stock as of recent, however, it should pointed out right away that the marketcap on this is tiny and therefor this kind of trade does require some experience as penny stocks are very volatile.

As a crypto trader at heart, I see much similarities between low cap stocks and cryptocurrencies, which for me personally makes penny stocks some of my favorite assets to trade.. especially when we have something such as exhibit A here in Blue Apron that has done 3 major bullish things that I love to see as a trader:

#1 ) APRN has broken bullish out of a downward sloping trendline (in green) that has been significant in keeping the price down almost year to date.

#2 ) We have some conviction that this could be real in the fact that we have broken not only major resistance, but have also just broken the .236 Fibonacci level as well, a great level to long when price is having a breakout.

#3 ) Classic bullish divergence on the RSI on a significant timeframe which only means that the price of this asset has a TON of pent up bullish energy waiting to be unleashed potentially.

If the $4.46 (.236 fib) is held as support on this daily chart, a move to $5.98 could be our first target before any real resistance is found.. 30% to the upside from where we currently stand.

Lastly, and it almost goes without saying, anything below out .236 fib level is bearish and we want nothing to do with it should a daily candle close below it OR if we gap down underneath the .236 level at the daily open.

APRN Cooking is my loveI may be crazy but I'm crazier in the kitchen. I love the food industry and some hidden gems aka whole in the wall spots get over looked.

I'm BULLISH on APRN..I have a theory and in my mind it stands true and charts never lie.

This Stock must be kept below $5.00 for some reason or an other. ( If anyone feels the same way please let me know ) once it's goes above $5.00 builds support...... I believe it's going to turn into a HOT POT

$APRNHot sector on watch. Trending upwards first PT 9.31 then so on. 20% of float short, setting up a squeeze.

AprnI always let myself get distracted by big cap, but there are a lot plays to be made out there. This chart is screaming. Keep an eye on SPY and VIX. Manage your risk

Blue apron aprnMakes shitty food. But ceo bought 5$ mill Shares last Friday. Technically looking long and strong

APRN's Crashing Slighly After Rally, but Likely a $10 ShortFirst off, please don't take anything I say seriously or as financial advice. As always, this is on opinion based basis. That being said, let me get into some important key points. Blue Apron had one of its biggest rallies given the surge in demand for obvious reasons, especially after poor earnings and operational performances. However, some operational problems are rumored to be returning, but it looks like even w/ mismanagement and the current resistance target, the price of Blue Apron's stock should reach around $10 soon, even given many of the professional analyst's negative sell-off orders.

$APRN Shares Seek Out Upside Resistance as Stay-at-Home ExpandsAPRN shares found pullback support in the $10 area, and has started back higher in response to that support, and in response to more states turning to stay-at-home protocols.

The target for longs should be $16-plus.

APRN buy signalAPRN

The buyer is stepping in, and seller is getting weak.

Target price is around $10

APRN, the little stock that couldThis is starting to breakout, I see it trying to push up, up and away. If it can hold, and push up then it's got legs! keeping this guy on the watch list may be going

+.12 is a +12% gain. choices choices choices. uc.

Possible buying opportunity for two IPO blundersAn initial public offering (IPO) is often described as a company's "coming out party." It's the moment when a successful, privately held business says, "Hey, world! Who wants a piece of the action?

But what if nobody shows up?

Blue Apron APRN has seen 90 percent of its market value disappear since its initial public offering in June 2017 and SNAP shares' 70 percent plunge in 2018 make these two stocks among the most unsuccessful IPOs of all time.

2019 might finally present a buying opportunity for these two stocks. Further details explained on the graph.

APRN - Why I went Long on CallsThe most disappointing IPO in 2017

NYSE:APRN

This turd has been such a disaster from the get go but it does present a pretty solid technical setup right here with low risk IMO.

* Broke out of its descending trend line in May of this year to realize about 115% return in about 2 months only to return back to the ATL's

* The weekly and D3 price action has remained above the ATL's consistently in March and again in August of this year - this is an established strong support for now ...

* Obviously this trash has lots of hurdles to overcome with overhead resistance in basically every price point from beyond here -- the imminent ones would be the 10EMA and 50EMA which are about 2.22 and 2.72 respectively

I bought a few $2 leap calls for 1/2019 -- 60 cents each -- I went small size and will average down to a half size position if price can get in the mid 1.9's and be supported.

* Risk is a D3 close below 1.88

* Profit target is 3.50

NYSE:APRN

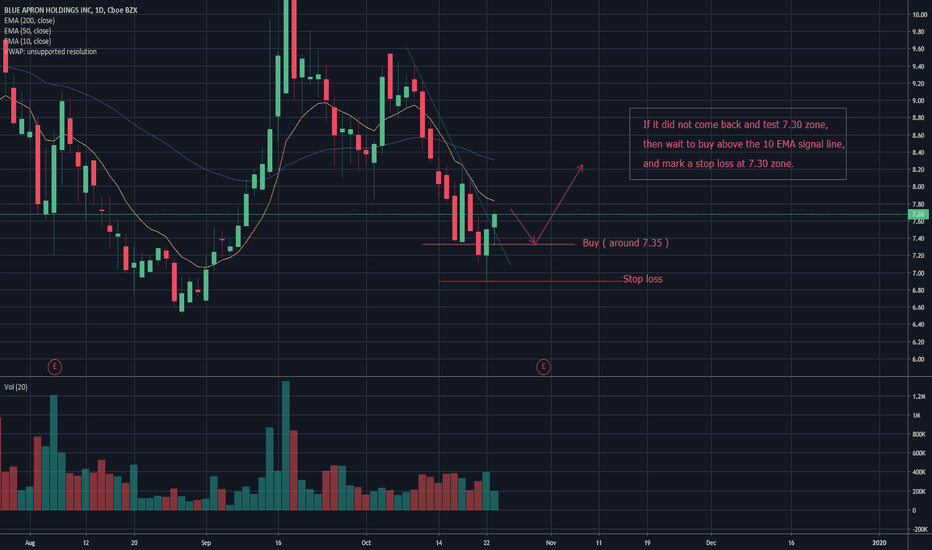

Main resistance 50EMA weeklyAPRN is topped by her 50EMA as resistance, wait for to break above... then MY thoughts are to look at buying.