APT 3D Trade Journal - pt I3D Timeframe Update: APTUSDT – Structural and Trend Analysis

March 27, 2025

This update focuses on the structural and trending environments of APTUSDT on the 3D timeframe, laying the foundation for deeper correlations (volatility, volume, momentum) as the bottoming process evolves.

The goal is to provide a clear, actionable framework while maintaining a disciplined approach to key inflection points.

Structural Analysis: Range Dynamics

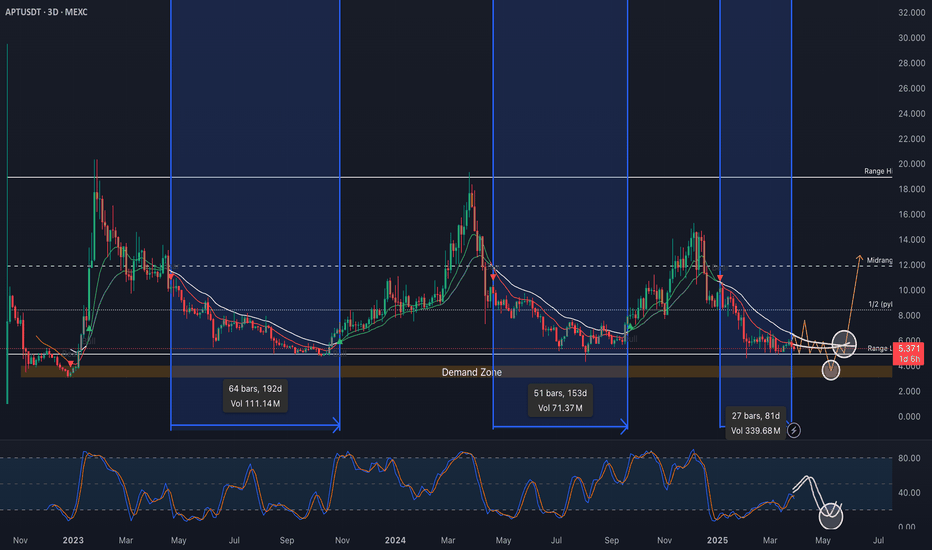

From a range perspective, APTUSDT is framed by key levels derived from previous yearly lows, highs, and EQ (adjusted to Range Low, Range High, and Midrange for broader context):

Range High (PYH): $19 – Key resistance, repeatedly capping upward moves.

Midrange (PYEQ): $11.9 – Neutral zone, acting as a pivot.

Range Low (PYL): $4.9 – Critical support, currently retested.

Demand Zone: $3–$4 – A high-probability reversal area below the Range Low.

Notably, the majority of trading activity has occurred between the Range Low and Midrange, with only brief, unsustainable periods above the Midrange.

This suggests a strong gravitational pull toward the lower half of the range, reflecting a market dominated by selling pressure and limited bullish conviction. To enhance granularity, an intermediary level market 1/2 (PYL → PYEQ) at $8.4 has been added, providing a secondary pivot within the lower range.

A critical observation, deviations below the Range Low have historically triggered significant expansions. The Demand Zone, therefore, represents a high-probability area for accumulation, likely to attract strong buying interest and catalyze the next major leg up if tested.

Trend Analysis: 12 & 25 EMA Dynamics

The 12-period and 25-period Exponential Moving Averages (EMAs) provide a clean lens for identifying bull and bear phases on the 3D timeframe.

Historical bear periods (e.g., April–October 2023 and April–September 2024) reveal a consistent pattern: price repeatedly attempted to reclaim the EMA bands but was rejected each time, with no daily close above the bands during downtrends.

This underscores the EMAs’ reliability as a dynamic resistance during bearish phases.

Currently, the price is at $5.8, testing the lower EMA band after a sustained downtrend. The 12 EMA remains well below the 25 EMA, with a wide separation between the bands, confirming the ongoing bearish trend.

While the price appears to be forming a base near the Range Low (a potential recovery signal) caution is warranted.

Previous bear periods lasted approximately 150 days, whereas the current bear phase is only 81 days.

Although time-based correlations are not definitive, this suggests the bottoming process may not be complete, especially given the persistent downward trend and lack of bullish confirmation.

Key Levels and Scenarios to Watch

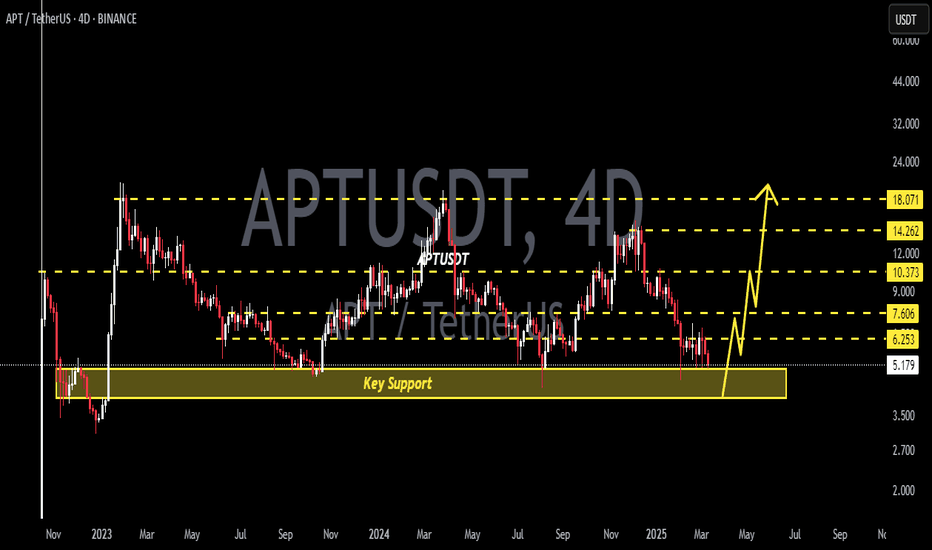

To shift to a bullish bias, the following conditions must be met:

Price Action: Price must test the $6.7–$7.6 area (aligned with the weekly 12 & 25 EMAs) multiple times, demonstrating sustained buying interest.

EMA Compression: The 12 & 25 EMAs should compress (narrowing the gap) before a bullish crossover, signaling a potential trend shift.

Breakout Confirmation: A violent break above the EMA bands, followed by a 12/25 EMA crossover and price expansion to the upside, would mark a structural trend reversal.

Conversely, a rejection from the $6.7–$7.6 area could drive the price below the Range Low, targeting the Demand Zone. Such a move (mirroring the July 20–August 4, 2024 move) would present the optimal buying opportunity.

A strong reaction from the Demand Zone, coupled with a break above the EMA bands, would likely initiate the next bullish leg.

Next Steps and Recommendations

While the current base formation near the Range Low is a first step, it lacks the subtlety required for aggressive positioning, so patience is critical.

Over the coming updates, we will integrate momentum via oscillators, volatility and volume analysis to cross-check trend shifts as the price approaches key levels.

For now, I will:

Monitor: Price reaction at the Range Low and the $6.7–$7.6 area over the next 1–2 3D candles.

Avoid: Random trades based solely on the base structure, as the trend remains bearish.

Prepare: For a potential test of the Demand Zone, which could trigger significant volatility and liquidity adjustments.

This disciplined approach ensures we capture the structural shift at the right moment, maximizing opportunities for strategic positioning.

From now on, every trade I take will be broken down here. Thought process, strategy, and lessons learned. A permanent record of my evolution as a trader, set in stone. Or glued to my profile :)

APT

#APT/USDT

#APT

The price is moving within a descending channel on the 1-hour frame, adhering well to it, and is heading for a strong breakout and retest.

We are experiencing a rebound from the lower boundary of the descending channel, which is support at 5.45.

We are experiencing a downtrend on the RSI indicator that is about to break and retest, supporting the upward trend.

We are looking for stability above the 100 Moving Average.

Entry price: 5.45

First target: 5.55

Second target: 5.66

Third target: 5.80

Aptos ($APT) Bullish Signal and ETF PotentialAptos (APT) is currently exhibiting a descending wedge pattern on the daily chart, characterized by converging trendlines that slope downward, typically signaling a potential bullish reversal upon breakout. Concurrently, Bitwise Asset Management has submitted an S-1 registration statement to the U.S. Securities and Exchange Commission (SEC) to launch an exchange-traded fund (ETF) tracking APT. This regulatory filing underscores growing institutional interest in the asset and could enhance liquidity, market exposure, and investor confidence if approved.

From a technical perspective, the Relative Strength Index (RSI) on the daily timeframe has formed a bullish divergence, with the price establishing lower lows while the RSI (14-period) prints higher lows. This discrepancy suggests weakening bearish momentum and strengthens the likelihood of a price reversal. Collectively, these factors position APT for a potential resurgence towards recent resistance levels, aligning with the projected breakout from the wedge pattern.

The combination of favorable technical indicators and the prospect of ETF-driven capital inflows presents a constructive outlook for APT in the near term.

Alex Kostenich,

Horban Brothers.

#APT/USDT#APT

The price is moving in a descending channel on the 1-hour frame and is adhering to it well and is heading to break it strongly upwards and retest it

We have a bounce from the lower limit of the descending channel, this support is at a price of 5.74

We have a downtrend on the RSI indicator that is about to break and retest, which supports the rise

We have a trend to stabilize above the Moving Average 100

Entry price 5.94

First target 6.076

Second target 6.27

Third target 6.48

#APT/USDT#APT

The price is moving in a descending channel on the 1-hour frame and is adhering to it well and is heading to break it upwards strongly and retest it

We have a bounce from the lower limit of the descending channel, this support is at a price of 2.36

We have a downtrend on the RSI indicator that is about to break and retest, which supports the rise

We have a trend to stabilize above the Moving Average 100

Entry price 5.44

First target 5.72

Second target 5.96

Third target 6.20

APT on the move!APT has been trading within a range between $5 support and $7.7 resistance.

Currently, APT is hovering around the lower bound of the range, so we will be looking for longs as long as it holds.

For the bulls to take over in the long term, a break above the $7.7 resistance is required.

Disclaimer:

This content is for informational purposes only and should not be considered financial or investment advice. Always do your own research and consult with a professional before making any investment decisions.

Aptos 6X Trade-Numbers (3,558% Potential)Aptos was one of the pairs that helped us identify the bottom early. The low was clearly established 3-February and the rest of the action has been shaky but clearly sideways with higher lows. This one left no room for doubt.

Once we hit bottom, look at the action in August 2024. After the low was in, no new lows. The same for Bitcoin, I was one of those that got caught. Will not make the same mistake.

The time is now. We are bullish now. We are ready for growth and we are going LONG.

After a down-wave comes an up-wave. This is clear. Many pairs are moving ahead. Bitcoin is now trading back above 90K.

Consider this, last week Bitcoin closed at 94K. The week before last, Bitcoin closed at $96K, this week who knows, but green. This means that Bitcoin is ready to continue growing. When Bitcoin grows, the Altcoins explode.

The market needs a relief after strong bearish action. Strong bearish action is present on this chart. The market started to move straight down, market as in APTUSDT, since 5-December 2024, three months ago. Three months is the standard time for a correction to be over.

This is a friendly reminder.

Full trade-numbers below:

____

LONG APTUSDT

Leverage: 6X

Entry levels:

1) $6.45

2) $6.20

3) $5.65

Targets:

1) $6.90

2) $7.80

3) $8.95

4) $10.0

5) $11.8

6) $13.6

7) $16.1

8) $19.3

9) $22.9

10) $25.1

11) $28.6

12) $34.4

13) $38.5

14) $43.7

Stop-loss:

Close weekly below $5.40

Potential profits: 3558%

Capital allocation: 4%

_____

Note: When you are in the green, secure a portion of your profits or secure the trade. When it is still early, pyramiding is possible but don't get carried away. This can be done only at the start of the bullish wave and after conquering a major resistance level.

There are many ways to trade and approach the market. Another option is not to touch anything until you reach your goals, your goal can be 100% just as it can be 1,000%. The choice is yours.

Many ways to approach the market. The most important part is the planning followed by the price and timing. Right now we have the second part covered, timing and pricing. What's your plan?

Thanks a lot for your continued support.

Namaste.

APTUSDT LONG 4H [2 Targets Done]This position received new variables from the roar on this fall , generating EQL values of $5.04

Accordingly, the POI range test as a basis for personal expectations is confirmed :

-volume

-retention rate

-confirmation of the structure.

At the moment, 2 targets are fixed and the stop is moving to breakeven . A more detailed review can be seen in this replay:

#APT/USDT#APT

The price is moving in a descending channel on the 1-hour frame and is adhering to it well and is heading to break it strongly upwards and retest it

We have a bounce from the lower limit of the descending channel, this support is at a price of 5.67

We have a downtrend on the RSI indicator that is about to break and retest, which supports the rise

We have a trend to stabilize above the Moving Average 100

Entry price 5.74

First target 5.87

Second target 6.03

Third target 6.26

APT/USDT : Next Stop $20?BINANCE:APTUSDT

"In the weekly timeframe, the price is at a bottom and has shown a positive reaction. Considering the current conditions of Bitcoin and Ethereum—especially Ethereum, which has had a significant drop and is now at strong support—I believe this Symbol has strong potential for a substantial upward move. My price target, based on liquidity above key highs, is over $20."

Aptos APT Will Reach $100 This CycleHello, Skyrexians!

Recently talked enough about the Bitcoin and Dominance, it's time to come back to altcoins with great potential. This is time for BINANCE:APTUSDT because it looks like to flash the insane long signal.

Let's take a look at the weekly time frame. We cannot define the Elliott waves, but we have the great performance in the past by the Bullish/Bearish Reversal Bar Indicator on this asset. Recently it flashed the green dot. You can see how it performed in the past. Moreover t is happening next to 0.61 Fibonacci zone. We can consider this move a a huge accumulation before the bull run. The target for the long term is $100.

Best regards,

Skyrexio Team

___________________________________________________________

Please, boost this article and subscribe our page if you like analysis!

Bullish Aptos, Bullish Crypto: Buy & HoldThis is the daily chart, two signals:

1) Three green days and a break above EMA13.

2) A higher low: 25-Feb vs 3-Feb.

The weekly timeframe also shows a higher low but based on the long-term. February 2025 vs August 2024. There is also a triple-bottom when we consider the low set in October 2023 and count these last two lows as reaching the same level.

This week, in early February and in August 2024, in all instances, APTUSDT produced a long lower wick on the session. This means that buyers were ready and buyers bought. Prices dropped but the close happened close to the session open. After these candles, there was never a retest of the lower levels. Something very similar can be happening today.

The theme is now looking for proof that supports the end of the correction, the start of a new bullish wave. So far I shared the same signal repeated throughout many charts.

Aptos has great potential for long-term growth. In this chart setup, it is hard not to go LONG.

The correction is over. The next major move will be up. All sellers are being bought.

Do not sell now. Right now is the best time to buy and hold.

Either buy or if you already bought, just hold.

Namaste.

APT : an Ethereum Layer 2 project | Univers Of SignalsLet's take a quick look at APT, an Ethereum Layer 2 project with a market cap of $3.3 billion, currently ranked 31st in coin market cap.

🔍 In the 4-hour timeframe, we're witnessing a bearish trend where the price has reached a support level at $5.16, forming a range between $5.16 and $6.49. This coin has managed to maintain its crucial support at $5.16 during Bitcoin's recent price drops, staying above this level.

☄️ Following the Bybit exchange hack news, the price, which had broken above $6.49, sharply reversed, faking out that breakout and reintroducing bearish momentum into the market. However, the support at $5.16 has held strong, preventing further price declines and proving itself as a significant support level.

📉 Given the importance of this support, breaking below $5.16 could initiate the next bearish leg, and I would personally consider opening a short position if this level is breached.

📈 On the flip side, given the resilience shown by the $5.16 area, there's a possibility that the price could rebound from here. In such a scenario, if $6.49 is breached, it could be a good opportunity to enter a long position, banking on a recovery and potential uptrend continuation.

APT target $8.64h time frame

-

Entry: $5.95

TP: $8.6

SL: $5.77

RR: 14.3

-

(1) APT has broken out the wedge structure on 19th Feb.

(2) Currently retesting this wedge and fibonacci 0.382 at $5.95

(3) One more time to retest $5.95 with effective support is our entry opportunity

(4) Targets analyzed from structure and fibonaaci are $7.27 and $8.76

(4) Stop loss once going below $5.77

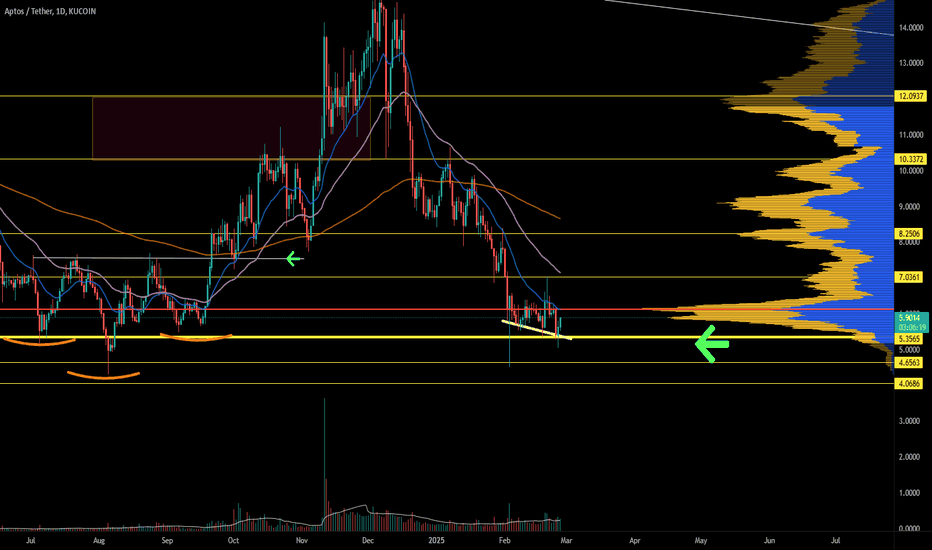

[LONG] APTOS' time to shineAPTOS started the year in free fall, the so called "SOLANA killer" is testing the $5 support for the 3rd time since 2023. APTOS needs buyers ASAP and this week so far is finding them.

On the daily chart some signs of strength and a more consistent volume are giving hope for the bull case

On the 4H chart price broke bellow $5.50 but quickly found buyers and went to try and break the top of the descending channel. It failed, but was expected, now buyers need to commit on this pullback for a definitive breakout and continuation

Entry: $6.00

current price

1st target: $7.10

at this price bulls are in control, move SL to break even point

1st take profit: $8.80

big volume node and 200d EMA, this can be a hard nut to crack

2nd take profit: $12.45

sellers took control here last December and most likely will be there again

Stop loss (conservative): $5.25

bellow the last swing low

Stop loss: $4.85

is $5 is lost I'm giving up my hopes on APTOS for the time being

APTUSDT Analysis: Waiting for Lower LevelsI see no reason not to wait for lower levels in APTUSDT. The market conditions suggest that there might be a better opportunity for entries at these levels.

Key Points:

Lower Levels: Waiting for lower levels might provide better risk/reward setups.

Market Conditions: Keep in mind that market conditions can change quickly, so stay cautious.

Confirmation Indicators: Use CDV, liquidity heatmaps, volume profiles, volume footprints , and upward market structure breaks in lower time frames for validation.

Learn With Me: If you're interested in learning how to use these tools for accurate demand zone identification, feel free to DM me.

If this analysis helps you, please don’t forget to boost and comment. Your support motivates me to share more insights!

If you think this analysis helps you, please don't forget to boost and comment on this. These motivate me to share more insights with you!

I keep my charts clean and simple because I believe clarity leads to better decisions.

My approach is built on years of experience and a solid track record. I don’t claim to know it all, but I’m confident in my ability to spot high-probability setups.

If you would like to learn how to use the heatmap, cumulative volume delta and volume footprint techniques that I use below to determine very accurate demand regions, you can send me a private message. I help anyone who wants it completely free of charge.

My Previous Analysis

🎯 ZENUSDT.P: Patience & Profitability | %230 Reaction from the Sniper Entry

🐶 DOGEUSDT.P: Next Move

🎨 RENDERUSDT.P: Opportunity of the Month

💎 ETHUSDT.P: Where to Retrace

🟢 BNBUSDT.P: Potential Surge

📊 BTC Dominance: Reaction Zone

🌊 WAVESUSDT.P: Demand Zone Potential

🟣 UNIUSDT.P: Long-Term Trade

🔵 XRPUSDT.P: Entry Zones

🔗 LINKUSDT.P: Follow The River

📈 BTCUSDT.P: Two Key Demand Zones

🟩 POLUSDT: Bullish Momentum

🌟 PENDLEUSDT.P: Where Opportunity Meets Precision

🔥 BTCUSDT.P: Liquidation of Highly Leveraged Longs

🌊 SOLUSDT.P: SOL's Dip - Your Opportunity

🐸 1000PEPEUSDT.P: Prime Bounce Zone Unlocked

🚀 ETHUSDT.P: Set to Explode - Don't Miss This Game Changer

🤖 IQUSDT: Smart Plan

⚡️ PONDUSDT: A Trade Not Taken Is Better Than a Losing One

💼 STMXUSDT: 2 Buying Areas

🐢 TURBOUSDT: Buy Zones and Buyer Presence

🌍 ICPUSDT.P: Massive Upside Potential | Check the Trade Update For Seeing Results

🟠 IDEXUSDT: Spot Buy Area | %26 Profit if You Trade with MSB

📌 USUALUSDT: Buyers Are Active + %70 Profit in Total

🌟 FORTHUSDT: Sniper Entry +%26 Reaction

🐳 QKCUSDT: Sniper Entry +%57 Reaction

📊 BTC.D: Retest of Key Area Highly Likely

I stopped adding to the list because it's kinda tiring to add 5-10 charts in every move but you can check my profile and see that it goes on..

Aptos (APT) Surge 16% as Token Unlocks Spark Market AnticipationAptos (APT), one of the emerging Layer 1 blockchain networks, saw a remarkable 16% price surge today despite the upcoming release of 11.31 million APT tokens—representing 1.97% of its total supply—on February 10, 2025. This release, valued at approximately $71.25 million, had initially created uncertainty, causing APT to dip 6.08% last week to $5.80, with a 20.62% drop in trading volume to $219.93 million. However, today’s bullish movement suggests traders have already priced in the token unlock event and are positioning for potential gains.

Token Unlock and Market Sentiment

Token unlocks can often introduce downward pressure due to an increase in circulating supply. However, in the case of Aptos, previous major unlock events have historically led to significant trading activity and, in some cases, price recoveries. The anticipation surrounding this unlock indicates that investors are still confident in Aptos’ long-term fundamentals and its position in the Layer 1 blockchain space.

Moreover, Aptos’ past all-time high (ATH) of $44 demonstrates its potential upside, and with market sentiment stabilizing, analysts suggest a potential rally towards $20 in the coming weeks. The broader crypto market’s resurgence and increasing demand for high-performance Layer 1 networks further support this bullish outlook.

Technical Analysis

Currently, APT is trading within a bullish zone, up 13.82% at the time of writing, with the Relative Strength Index (RSI) at 61.44—indicating strong momentum but still within a range that allows further upside movement.

- Support Level: The one-month low is serving as a key support point. If APT were to break below this level, it could test the $3 mark.

- Resistance Level: The 38.2% Fibonacci retracement level is acting as a significant resistance point. A breakout above this level could propel APT towards $10 and potentially $15.

Conclusion

Technical indicators suggest APT could target $10–$15 in the near term. As the market adjusts to the increased supply, Aptos remains one to watch in the coming weeks, with a possible move toward $20 if bullish momentum persists.

Aptos APT price analysisAMEX:APT price was bought back quite nicely overnight, although buyers still have a lot of work to do before a confident return to the ap trend.

‼️Do you believe in a bright future for #Aptos? Then there are two types of purchases for you:

1️⃣ risky - as close to $5.50 as possible

2️⃣ conservative purchase only after the price of OKX:APTUSDT is confidently fixed above $8

_____________________

Did you like our analysis? Leave a comment, like, and follow to get more