#APT/USDT#APT

The price is moving within a descending channel on the 1-hour frame and is expected to break and continue upward.

We have a trend to stabilize above the 100 moving average once again.

We have a downtrend on the RSI indicator that supports the upward move with a breakout.

We have a support area at the lower limit of the channel at 5.50, acting as strong support from which the price can rebound.

Entry price: 5.70

First target: 5.82

Second target: 6.00

Third target: 6.17

Aptos

#APT/USDT#APT

The price is moving within a descending channel on the 1-hour frame, adhering well to it, and is heading for a strong breakout and retest.

We are experiencing a rebound from the lower boundary of the descending channel, which is support at 4.95.

We are experiencing a downtrend on the RSI indicator that is about to be broken and retested, supporting the upward trend.

We are looking for stability above the 100 Moving Average.

Entry price: 5.22

First target: 5.34

Second target: 5.47

Third target: 5.65

Aptos scalp n swing trade setupAptos is facing daily Order Block resistance , While on Weekly clearly showing to take out the previous high 15-16$, It's a weekly TF so it will take time. On a day trade you can take long position from the mentioned zone, while in upcoming days it's gonna hit 7.42$ at least to fill the imbalance even if it's a bear market. If any 1hr candle closes below the mentioned zone then it will take correction for short term of period then it will take flight to towards the 15-16$. If you are investor then accumulate between 4.5-5$ and set tp and forget it. If you wanna take the long position then take it from the mentioned zone if candle closes below the zone then wait for the retest and close on breakeven.

TradeCityPro | APT: Testing Momentum After Key Breakout👋 Welcome to TradeCity Pro!

In this analysis, I want to review the APT coin for you. This coin belongs to the Aptos project, which is one of Ethereum’s Layer 2 solutions.

⚡️ APT, with a market cap of $3.6 billion, is currently ranked 32 on CoinMarketCap.

⏳ 4-Hour Timeframe

As you can see in the 4-hour timeframe, after finding support at the 4.687 zone, the price made a very sharp bullish move and reached 5.708. After an initial rejection, it has now managed to stabilize above this level.

🔍 If this bullish move continues, we could see another upward leg, with the next resistance at 6.047. If this level breaks, the price could move up to 6.752.

✔️ There’s a very important RSI ceiling at 80.76, which has consistently caused rejections after sharp upward moves. If the price aims for another bullish wave, this level will be critical and could mark the top of the move.

⭐ A breakout above this level seems unlikely for now, since 80.76 is a very high reading for the RSI oscillator, and the chance of it breaking is quite low. But if it does happen, we could see an extremely sharp and unusual move.

🔽 As for a bearish scenario and short positions, we currently need to wait for a trend reversal. If the breakout above 5.708 turns out to be fake and the price starts moving downward, we can look for a trigger in a lower timeframe to enter.

🔑 But keep in mind that short positions in these market conditions are very, very risky. And if you do open such a position, make sure to secure profits frequently with small risk-to-reward setups.

📝 Final Thoughts

This analysis reflects our opinions and is not financial advice.

Share your thoughts in the comments, and don’t forget to share this analysis with your friends! ❤️

#APT/USDT#APT

The price is moving within a descending channel on the 1-hour frame, adhering well to it, and is heading for a strong breakout and retest.

We are seeing a bounce from the lower boundary of the descending channel, which is support at 4.60.

We have a downtrend on the RSI indicator that is about to break and retest, supporting the upward trend.

We are looking for stability above the 100 Moving Average.

Entry price: 4.76

First target: 4.88

Second target: 5.03

Third target: 5.23

Scamtos and it's futureWe've all seen how the indian founder ( a.k.a scammer) sold his stack of APT when it was at 14-15$ and left the company. A few weeks later the market crashes and APT is now ~ 5$.

- Aptos during 3 years didn't succeed nor in good gains or adoption.

- The asian founder that is in charge now ( a.k.a new scammer) just proposed the community to cut staking rewards from 7% to 3%. This will make whales re-think their holdings

Meanwhile SUI did a few times already 4-7x'es and it attracts more users and community so it's clear SUI will be the winner of the cycle ( but it's market cap is already 12 bln circulating so ...)

For me, it's clear that APT, from the very beginning, was meant for 1 thing only: Dump on retail long-term, while "building" to show that they are working, in other words : an old form of scam but with new design :)

This was my biggest dissapointment as investment all these years and I'm not sure it has any future but : you never know ) If bullrun continues, it might pump 10x one day

Aptos, Bottom Pattern: Growth Now Imminent —Alert!It does not matter the pattern shape or what name we give it; after it forms, we know the next thing that happens is growth. When a bottom pattern forms, it is followed by a period of growth. Some growth periods are bigger than others but it is always growth.

The last bottom pattern happened between mid- to late 2024 and it preceded a small sized bullish wave. The bottom pattern, accumulation zone or consolidation period, lasted some 90 days (3 months).

This time around is exactly the same. I am seeing drawings on the charts made by the candles that are exactly the same as 7 years ago. It is amazing. The exact same dynamics, always... It is so easy to spot a true bottom when the market is trading low.

Ok. Current bottom formation is some 85 days old. The same thing as before. The shape doesn't matter nor the name. There was a bullish wave that ended in the current situation, an accumulation zone or consolidation period, and this will be followed by a bull market. So this case is different to the previous one. 2024 was still part of the transition, 2025 is the bull market year.

The only reason we can know these things is because of experience and the charts.

Without experience, it is really hard to make sense of what is going and to understand the market.

Sometimes I detach for several months and I when I comeback I start from zero and wow, I understand why people become anxious when I am not publishing these charts. It is just hard to read, how to understand. If someone like me is doing this work daily, a bigger picture of the market develops, a broader perspective develops and you can grasp easily, understand what is happening and you can also hold easy long-term.

Just watch. I will show you by disappearing for a few days or weeks when the market shakes. Even though I've been sharing the bigger picture you'll see how your mind becomes clouded... It is just hard when we don't know what to look for. That will be a lesson for another day.

Today, I am revealing everything the market will do before it does it.

Thanks a lot for your continued support.

» Aptos is about to enter a strong bullish wave. 100% certainty level.

Thank you for reading.

Namaste.

Aptos (APT)Aptos is a new project in crypto market with a lot of attention as well as features to offer. There is not much price candles to tell the big picture pattern; but as can be seen after APT made a harmonic pattern, it went into a corrective phase which seems unfolded in a complex two a-b-c pattern. Please note that this corrective wave might take longer to finish and get more complex. Anyway, we need to see the minor downtrend line break as the first signal for upward continuation. Let's see what happens.

#APT/USDT

#APT

The price is moving within a descending channel on the 1-hour frame, adhering well to it, and is heading for a strong breakout and retest.

We are experiencing a rebound from the lower boundary of the descending channel, which is support at 4.75.

We are experiencing a downtrend on the RSI indicator that is about to be broken and retested, supporting the upward trend.

We are looking for stability above the 100 Moving Average.

Entry price: 4.95

First target: 5.06

Second target: 5.17

Third target: 5.28

Aptos Preparing For A New All-Time High —$22.22, $33.33 & $44.44Good morning my fellow Cryptocurrency trader, I hope you are having a wonderful day.

Here we have a pretty nice dynamic on the Aptos (APTUSDT) chart. There is a sequence of long-term lower highs and lower lows, yet the chart looks solid and strong.

These lower lows and lower highs are not a bearish trend but rather a long-term, wide consolidation channel. April 2025 produced the lowest prices since Aptos initial low in December 2022.

From a TA perspective, seeing a reversal happening after this event is good news. The August 2024 stop-loss orders placed below this low have been activated, the same for October 2023. This means that liquidity is no longer on the downside. Once support has been challenged, the action moves toward resistance.

While these major support levels were pierced, this only happened for a few days. Now, APTUSDT is trading back above both those low points and this makes the market extremely bullish.

The Altcoins are growing but Bitcoin is not yet trading above 100K. The Altcoins tend to follow Bitcoin, if Bitcoin grows, the entire Cryptocurrency market grows.

The fact that many Altcoins are moving ahead and producing 2-3 digits green means that this is the real deal, we are ready for the 2025 bull market. This is to say, that the next rise for Aptos will not end in another long-term lower high, we are set to experience a new All-Time High. This is seen on the chart as $22.222, $33.333 and $.44.444. These are the levels for this bull market cycle.

When Bitcoin moves above 100K, expect the Altcoins market to explode!

Thank you for reading and for your continued support.

Namaste.

APT/USDT:BUYHello friends

Given the good price growth, we see that the price is in an ascending channel and has fallen, we can buy in a stepwise manner in the price decline within the specified ranges and move with it to the specified targets.

Observe capital and risk management.

*Trade safely with us*

#APT/USDT#APT

The price is moving within a descending channel on the 1-hour frame, adhering well to it, and is heading toward a strong breakout and retest.

We are experiencing a rebound from the lower boundary of the descending channel, which is support at 4.50.

We are experiencing a downtrend on the RSI indicator, which is about to break and retest, supporting the upward trend.

We are heading toward stability above the 100 Moving Average.

Entry price: 4.55

First target: 4.65

Second target: 4.74

Third target: 4.86

Aptos Low Prices (Bottom) Means Bullish —6000X PotentialIt has been 126 days since Aptos produced its last peak, 2-December 2024. The last major low happened on the 5-August 2024 session. The action this week pierced below the Aug. low and moved back above it. The action this week activated the same low levels as in early January 2023, more than two years ago.

So Aptos grew and did so nicely but this is all part of a wide sideways phase. After the last bullish wave, a full correction followed deleting more than 100% of all gains. A full market flush. This means the doors are now open for maximum growth. Bottom prices. The best possible.

Timing is right. Timing is great. Regardless of the outcome; please, keep this in mind, regardless of the outcome this is a great buy zone. That is because we buy when prices are trading low, relative to past action, or at a strong support level. This is a very strong support level that was just activated.

The market can always produce additional moves after support is hit, swings and shakeouts, but these should be ignored and recognized as market noise. If prices move lower, we buy more and wait patiently, we hold. All you need to do is to buy and wait, when the market starts moving, you will be glad you took action, you can't get it wrong with a simple spot trade. Buy and hold. You will be happy with the results.

Thank you for reading.

Your support is appreciated.

Namaste.

(APT) aptos "ahead of the game, or not"It is not use in being ahead of the price trend if the price is not going to recovery before Bitcoin, Ethereum, Dogecoin. Dogecoin used to be the one to measure between the big three cryptocurrency prices. Nowadays, Dogecoin is so popular with such a strong price hold and the fact that the unlimited coins means to measure Dogecoin is quite a bit more strange when compared to all the other limited circulating supply companies. Aptos appears to be closer to a neutral position, or will the price keep falling if Etherum and Bitcoin do not go flat? That is what I mean by this.

#APT/USDT#APT

The price is moving within a descending channel on the 1-hour frame and is expected to continue upward.

We have a trend to stabilize above the 100 moving average once again.

We have a downtrend on the RSI indicator, supporting the upward move with a breakout.

We have a support area at the lower boundary of the channel at 5.20.

Entry price: 5.41

First target: 5.46

Second target: 5.58

Third target: 5.70

#APT/USDT#APT

The price is moving within a descending channel on the 1-hour frame and is expected to continue lower.

We have a trend to stabilize below the 100 moving average once again.

We have a downtrend on the RSI indicator, supporting the upward move with a break above it.

We have a resistance area at the upper limit of the channel at 5.43.

Entry price: 5.32

First target: 5.28

Second target: 5.21

Third target: 5.10

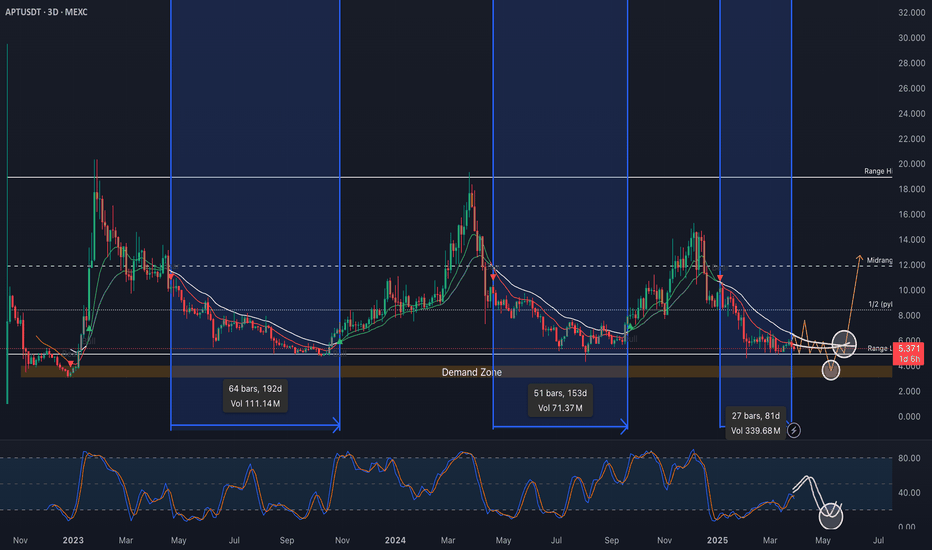

APT 3D Trade Journal - pt I3D Timeframe Update: APTUSDT – Structural and Trend Analysis

March 27, 2025

This update focuses on the structural and trending environments of APTUSDT on the 3D timeframe, laying the foundation for deeper correlations (volatility, volume, momentum) as the bottoming process evolves.

The goal is to provide a clear, actionable framework while maintaining a disciplined approach to key inflection points.

Structural Analysis: Range Dynamics

From a range perspective, APTUSDT is framed by key levels derived from previous yearly lows, highs, and EQ (adjusted to Range Low, Range High, and Midrange for broader context):

Range High (PYH): $19 – Key resistance, repeatedly capping upward moves.

Midrange (PYEQ): $11.9 – Neutral zone, acting as a pivot.

Range Low (PYL): $4.9 – Critical support, currently retested.

Demand Zone: $3–$4 – A high-probability reversal area below the Range Low.

Notably, the majority of trading activity has occurred between the Range Low and Midrange, with only brief, unsustainable periods above the Midrange.

This suggests a strong gravitational pull toward the lower half of the range, reflecting a market dominated by selling pressure and limited bullish conviction. To enhance granularity, an intermediary level market 1/2 (PYL → PYEQ) at $8.4 has been added, providing a secondary pivot within the lower range.

A critical observation, deviations below the Range Low have historically triggered significant expansions. The Demand Zone, therefore, represents a high-probability area for accumulation, likely to attract strong buying interest and catalyze the next major leg up if tested.

Trend Analysis: 12 & 25 EMA Dynamics

The 12-period and 25-period Exponential Moving Averages (EMAs) provide a clean lens for identifying bull and bear phases on the 3D timeframe.

Historical bear periods (e.g., April–October 2023 and April–September 2024) reveal a consistent pattern: price repeatedly attempted to reclaim the EMA bands but was rejected each time, with no daily close above the bands during downtrends.

This underscores the EMAs’ reliability as a dynamic resistance during bearish phases.

Currently, the price is at $5.8, testing the lower EMA band after a sustained downtrend. The 12 EMA remains well below the 25 EMA, with a wide separation between the bands, confirming the ongoing bearish trend.

While the price appears to be forming a base near the Range Low (a potential recovery signal) caution is warranted.

Previous bear periods lasted approximately 150 days, whereas the current bear phase is only 81 days.

Although time-based correlations are not definitive, this suggests the bottoming process may not be complete, especially given the persistent downward trend and lack of bullish confirmation.

Key Levels and Scenarios to Watch

To shift to a bullish bias, the following conditions must be met:

Price Action: Price must test the $6.7–$7.6 area (aligned with the weekly 12 & 25 EMAs) multiple times, demonstrating sustained buying interest.

EMA Compression: The 12 & 25 EMAs should compress (narrowing the gap) before a bullish crossover, signaling a potential trend shift.

Breakout Confirmation: A violent break above the EMA bands, followed by a 12/25 EMA crossover and price expansion to the upside, would mark a structural trend reversal.

Conversely, a rejection from the $6.7–$7.6 area could drive the price below the Range Low, targeting the Demand Zone. Such a move (mirroring the July 20–August 4, 2024 move) would present the optimal buying opportunity.

A strong reaction from the Demand Zone, coupled with a break above the EMA bands, would likely initiate the next bullish leg.

Next Steps and Recommendations

While the current base formation near the Range Low is a first step, it lacks the subtlety required for aggressive positioning, so patience is critical.

Over the coming updates, we will integrate momentum via oscillators, volatility and volume analysis to cross-check trend shifts as the price approaches key levels.

For now, I will:

Monitor: Price reaction at the Range Low and the $6.7–$7.6 area over the next 1–2 3D candles.

Avoid: Random trades based solely on the base structure, as the trend remains bearish.

Prepare: For a potential test of the Demand Zone, which could trigger significant volatility and liquidity adjustments.

This disciplined approach ensures we capture the structural shift at the right moment, maximizing opportunities for strategic positioning.

From now on, every trade I take will be broken down here. Thought process, strategy, and lessons learned. A permanent record of my evolution as a trader, set in stone. Or glued to my profile :)