Aptusdtanalysis

APT/USDT – Final Defense at Weekly Demand Zone! Prepare for MoveAPT is currently standing at a make-or-break level. Price has retraced back to the critical weekly demand zone between $4.00 and $4.40 — a region that previously served as the launchpad for a major rally in early 2023.

This isn't just any support — it’s a historical accumulation zone, where strong buying interest was previously observed. The big question is: Will history repeat itself, or is a major breakdown looming?

🔍 Pattern Structure and Technical Outlook:

APT has been consolidating inside a large horizontal range (accumulation box) between $4.00 and $18.27 for nearly two years.

Price is now retesting the lower boundary of this range, right at the $4.00–$4.40 zone.

Current price action shows heavy selling pressure, but buyers may step in at this demand level.

A potential double bottom or false breakdown could form if this week closes with a long lower wick and bullish body.

🟢 Bullish Scenario: Reversal from the Legendary Support

If the $4.00–$4.40 zone holds once again, we could witness a technical rebound with meaningful upside targets:

Key Bullish Targets:

1. $5.14 – Immediate minor resistance, easy to break if short-covering begins.

2. $5.86 – A key level previously rejected, acting as the first confirmation of trend reversal.

3. $7.63 – $9.00 – Former consolidation zone, potential mid-term target.

4. $10.18 to $14.51 – If momentum builds, this becomes the next major expansion zone.

> 📈 Positive catalysts such as improving crypto sentiment, strong volume inflow, or bullish fundamentals could accelerate this scenario.

🔴 Bearish Scenario: Critical Breakdown from Demand Structure

If sellers remain dominant and price closes below $4.00, this would:

Confirm a breakdown from the long-standing accumulation range

Open the door for a deeper retracement toward:

$3.50

$2.80

Possibly as low as the psychological level of $2.00

> ⚠️ Such a breakdown could indicate a major distribution phase and a loss of confidence from larger market players.

🧠 Suggested Trading Strategies:

Buy on Confirmation: Look for strong bullish reversal candles (hammer, pin bar, bullish engulfing) at the demand zone.

Breakout Strategy: Wait for a breakout and retest above $5.86–$7.63 for a safer entry.

Bearish Bias: Consider short entries on a confirmed breakdown and failed retest above $4.00.

📌 Conclusion:

APT is testing its final line of defense. The $4.00 zone remains the last stand for bulls before opening the door to deeper downside levels. Will buyers show strength once again, or are we headed for a major sell-off?

> This week’s close is crucial and could define APT’s trajectory for the upcoming quarter. Watch volume, candle structure, and buyer reaction very closely.

#APTUSDT #APTAnalysis #CryptoReversal #DemandZone #SupportAndResistance #PriceActionTrading #AltcoinSetup #TechnicalAnalysis #CryptoBreakout

APTUSDT LONG 4H [2 Targets Done]This position received new variables from the roar on this fall , generating EQL values of $5.04

Accordingly, the POI range test as a basis for personal expectations is confirmed :

-volume

-retention rate

-confirmation of the structure.

At the moment, 2 targets are fixed and the stop is moving to breakeven . A more detailed review can be seen in this replay:

APT : an Ethereum Layer 2 project | Univers Of SignalsLet's take a quick look at APT, an Ethereum Layer 2 project with a market cap of $3.3 billion, currently ranked 31st in coin market cap.

🔍 In the 4-hour timeframe, we're witnessing a bearish trend where the price has reached a support level at $5.16, forming a range between $5.16 and $6.49. This coin has managed to maintain its crucial support at $5.16 during Bitcoin's recent price drops, staying above this level.

☄️ Following the Bybit exchange hack news, the price, which had broken above $6.49, sharply reversed, faking out that breakout and reintroducing bearish momentum into the market. However, the support at $5.16 has held strong, preventing further price declines and proving itself as a significant support level.

📉 Given the importance of this support, breaking below $5.16 could initiate the next bearish leg, and I would personally consider opening a short position if this level is breached.

📈 On the flip side, given the resilience shown by the $5.16 area, there's a possibility that the price could rebound from here. In such a scenario, if $6.49 is breached, it could be a good opportunity to enter a long position, banking on a recovery and potential uptrend continuation.

APT target $8.64h time frame

-

Entry: $5.95

TP: $8.6

SL: $5.77

RR: 14.3

-

(1) APT has broken out the wedge structure on 19th Feb.

(2) Currently retesting this wedge and fibonacci 0.382 at $5.95

(3) One more time to retest $5.95 with effective support is our entry opportunity

(4) Targets analyzed from structure and fibonaaci are $7.27 and $8.76

(4) Stop loss once going below $5.77

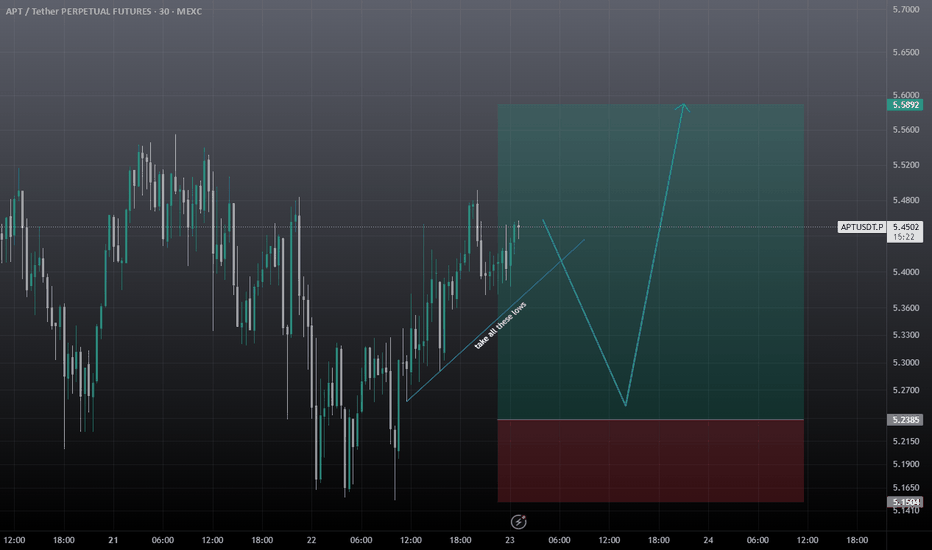

#APTUSDT expecting further decline📉 SHORT BYBIT:APTUSDT.P from $5.5950

🛡 Stop Loss: $5.7250

⏱ 1H Timeframe

✅ Overview:

➡️ BYBIT:APTUSDT.P remains in a downtrend, forming lower lows. The price broke key support at $5.6600 and continues downward.

➡️ POC (Point of Control) at $5.94 indicates the highest liquidity zone, confirming a bearish market sentiment.

➡️ A breakdown of $5.5950 strengthens the downtrend, opening the way toward $5.2950, where buyers previously showed interest.

➡️ Holding below $5.5950 will likely accelerate selling pressure.

⚡ Plan:

➡️ Enter SHORT after confirming a breakdown below $5.5950, signaling further downside.

➡️ Risk management through Stop-Loss at $5.7250, placed above resistance.

➡️ Primary downside target – $5.2950, where buyers may step in.

🎯 TP Targets:

💎 TP1: $5.2950 – key support level.

📢 BYBIT:APTUSDT.P remains in a strong downtrend with no clear signs of reversal. If the $5.5950 level breaks with increasing volume, the decline may accelerate.

📢 It is crucial to watch the reaction at $5.2950—if significant buying interest appears, a short-term bounce is possible. However, if selling pressure persists, the price may continue to fall toward $4.3450.

🚀 BYBIT:APTUSDT.P remains weak - expecting further decline!

APTUSDT Technical Analysis: Risk-Reward Setup with Dynamic Sp.LvRisk: %17 | Reward: %45 and beyond

APTUSDT is exhibiting signs of potential price movement with significant technical indicators supporting the analysis. A noticeable bullish divergence on RSI and a temporary retracement towards a key support level may provide an ideal opportunity for long positions. Traders are advised to watch price action closely around the identified trendline and support zones for entry confirmations.

Trading suggestion:

A possible retracement to the $8.37 support line might occur.

Traders can consider setting buy orders based on price action confirmation near the suggested support and aim for mid to long-term targets.

Technical analysis:

The RSI is oversold, indicating potential upside momentum if the trendline is respected.

The DMF Index shows declining bearish pressure, hinting at a reversal possibility.

SL = Break below $6.91 support zone.

This setup offers a favorable risk-to-reward ratio with dynamic levels to monitor. Always trade with proper risk management strategies.

APT/USDT Trading ScenarioIn a persistently optimistic market environment, APT has shown a strong increase of over 250% from its local low, reaching $15.3.

Despite a sharp correction, the asset’s growth potential remains significant. Volume profile analysis indicates steady interest from market participants within the current price range. The asset is currently trading near the Point of Control (POC), a strong support zone, making it an attractive buying opportunity for anticipating a continuation of the upward trend.

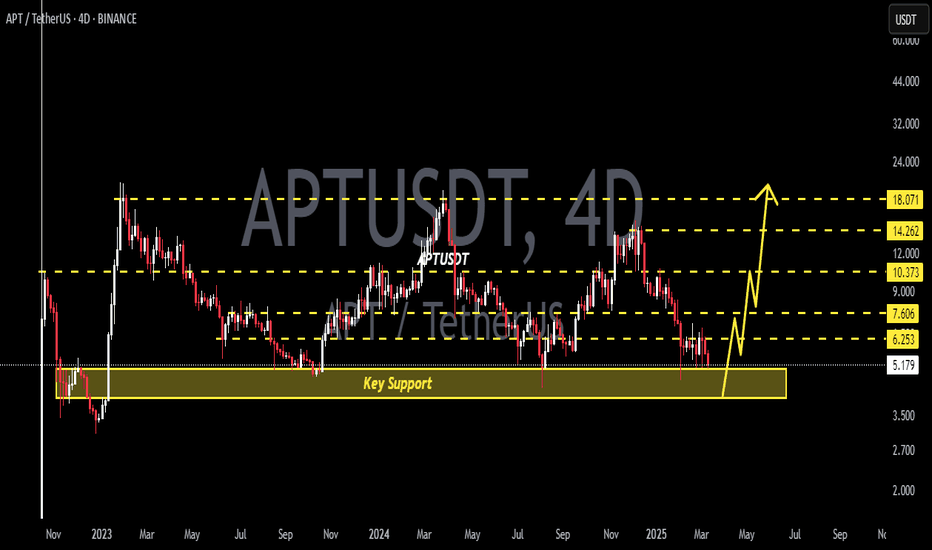

Aptos APT is ready to take off!Hello, Skyrexians!

Yesterday we considered ADA analysis and today the price of this asset started moving up and surged +14% in less than one day. Hope you were able to make a right decision. Today we will take a look at BINANCE:APTUSDT - another one interesting cryptocurrency with the great potential in the bull market.

On the chart you can see the weekly time frame for Aptos. Technically it is printing the global 2 year sideways. As you know, the sideways movement can be the accumulation or distribution. We suppose that it's accumulation before the mark up phase. Elliott waves analysis gives us the clear answer. We consider the early growth as the impulsive wave 1, after that APT is in flat correction, the wave 2, which consists of zigzag ABC. Look how perfectly wave C collected liquidity below the wave's A bottom and started going up.

Let's also notice the green dot which has been flashed by Bullish/Bearish Bars Indicator . It's is showing us the potential reversal points. Take a look how great it worker previous 2 times, indicated wave's A bottom and wave's B top. Now there is a high probability that it was the global bottom before the expansion to the upside.

The while line of the indicator showing the local support, if price is able to maintain above it, usually it leads to impulse. If our analysis is correct the wave 3 is incoming. We can calculate the targets using Fibonacci extension levels. The minimal one is $42, max target is $64.

Best regards,

Skyrexio Team

___________________________________________________________

Please, boost this article and subscribe our page if you like analysis!

APTUSDT Surges Above 100 and 200 EMAAPTUSDT technical analysis update

APT's price has crossed above the 100 and 200 EMA on the daily chart. It has now retested the 200 EMA and is bouncing back, having also broken through a major resistance zone. We can expect a strong bullish move in the coming days.

Regards

Hexa

APTOS Sell Position / Setup SettingBINANCE:APTUSDT

COINBASE:APTUSD

Hello Traders

SL1 ---> Low-risk status: 3x-4x Leverage

SL2 ---> Mid-risk status: 5x-8x Leverage

👾The setup is active but expect the uncertain phase as well.

➡️Entry Area:

Yellow zone

⚡️TP:

On the chart

🔴SL:

On the chart

🧐The Alternate scenario:

If the price stabilizes below the trigger zone, the setup will be cancelled.

Long Position on APTUSDT 1H / (Volume Projection)BINANCE:APTUSDT

COINBASE:APTUSD

Mid-risk status: 5x-8x Leverage

Low-risk status: 3x-4x Leverage

👾The setup is active but expect the uncertain phase as well.

⚡️TP:

5.96

6.05

6.15

6.25

6.32

6.45

6.52

6.60(In Optimistic Scenario)

➡️SL:

5.6

🧐The Alternate scenario:

🔴If the price stabilizes below the trigger zone, the setup will be cancelled.