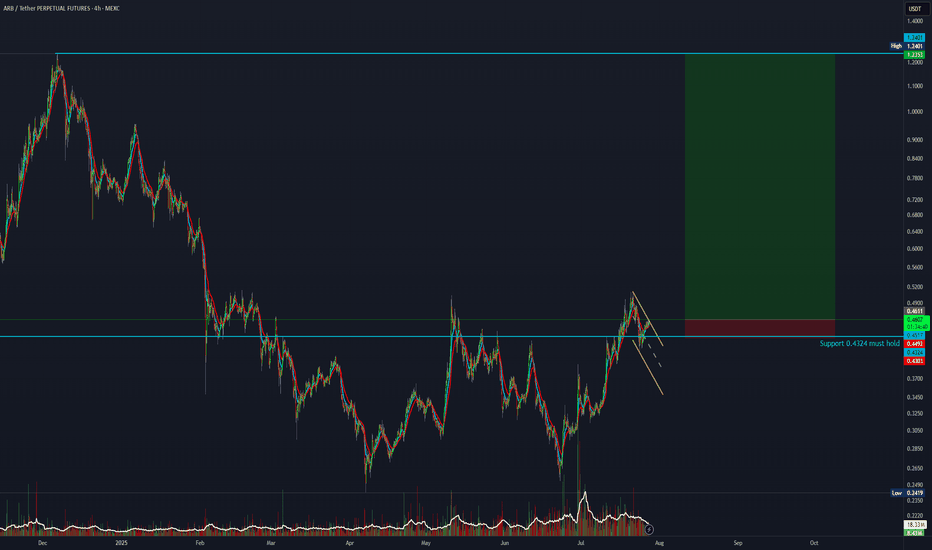

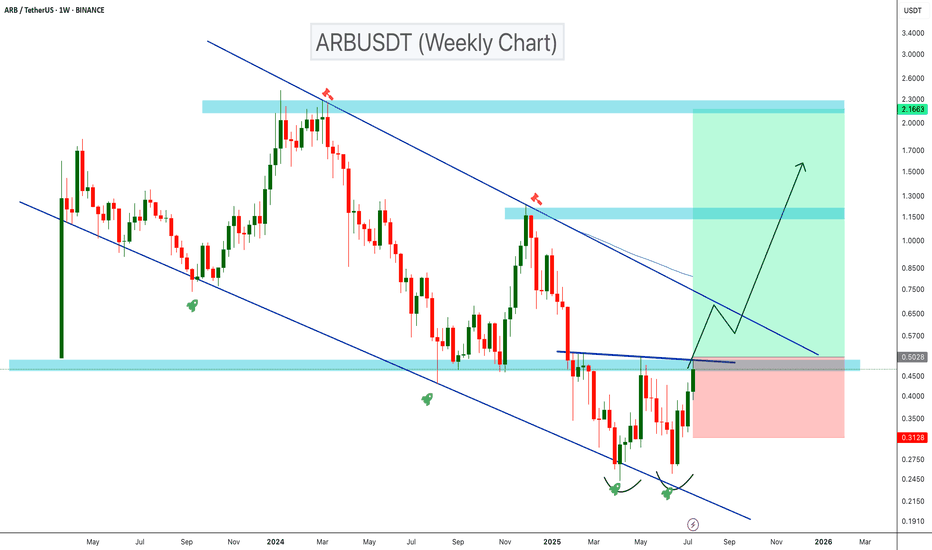

Arbitrum ARB price analysis — Can It Reclaim $1 ?Airdrop history 🪂 left a trail of regret — #ARB was widely distributed near $1, but most holders are still underwater 2 years later 💀

🔹 For recovery to start: break $0.50

🔻 Avoid the death zone: $0.30 must hold

🔄 If momentum returns and GameFi/DeFi reawakens — #ARB could lead.

🎯 If OKX:ARBUSDT price touches $1 again — don’t let greed win this time 😉

________________

📚 Follow us ❤️ for daily crypto insights & updates!

🚀 Don’t miss out on important market moves

Arbitrum

#ARB/USDT#ARB

The price is moving within an ascending channel on the 1-hour frame, adhering well to it, and is on track to break it strongly upwards and retest it.

We have support from the lower boundary of the ascending channel, at 0.3735.

We have a downtrend on the RSI indicator that is about to break and retest, supporting the upside.

There is a major support area (in green) at 0.3688, which represents a strong basis for the upside.

Don't forget a simple thing: ease and capital.

When you reach the first target, save some money and then change your stop-loss order to an entry order.

For inquiries, please leave a comment.

We have a trend to hold above the 100 Moving Average.

Entry price: 0.3832.

First target: 0.3913.

Second target: 0.4025.

Third target: 0.4145.

Don't forget a simple thing: ease and capital.

When you reach your first target, save some money and then change your stop-loss order to an entry order.

For inquiries, please leave a comment.

Thank you.

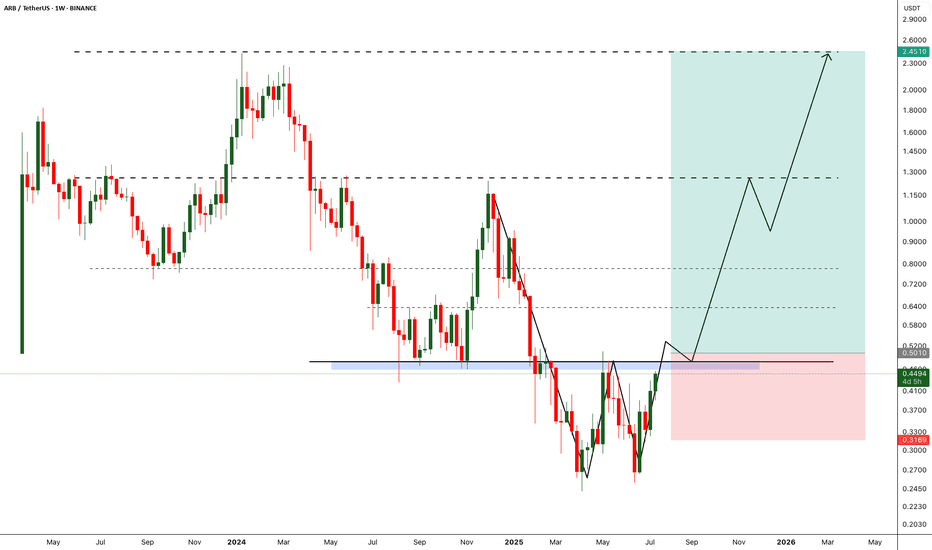

Altseason is Loading... Which One’s Your 10x Pick – $POL or $ARB🚨 BULL MARKET ACCUMULATION ALERT 🚨

Both PSX:POL and AMEX:ARB are currently trading below $0.40, and both charts are showing strong long-term bullish structure.

PSX:POL Analysis:

• Current Price: Under $0.40

• Strong Entry Zone: $0.20 – $0.17

• Bull Run Targets: $2 – $5

• Backed by powerful fundamentals, strong tech, and serious investors.

AMEX:ARB Analysis:

• Current Price: ~$0.40

• Key Accumulation Zone: $0.40 – $0.30

• Bull Run Targets: $2 – $5

• One of the strongest L2 ecosystems with deep liquidity and solid fundamentals.

Both are technically oversold, fundamentally strong, and positioned for major upside in the coming altseason.

Question for the community:

Which one hits $2 first — PSX:POL or AMEX:ARB ?

Drop your pick below 👇

NFA & DYOR

Arbitrum Structural Bull Unfolding Amid Ethereum ETF Surge 🚀📊 Arbitrum Structural Bull Unfolding Amid Ethereum ETF Surge 🌐🔥

🏦 Institutional Tidal Wave – Ethereum ETF Inflows Surge

Spot Ethereum ETFs have minted over $7.7 billion in net inflows, with more than $533 million coming in on a single day—a new record level of institutional capital deployment

Analysts estimate $50–100B more capital is set to flow into ETH over the next 12–18 months, fueling long-duration structural demand beyond speculators

ETF inflows are now collectively absorbing more ETH than new issuance, tightening supply dynamics and driving pricing power

🌉 Why ARB Is Positioned to Capitalize

Arbitrum TVL exceeds $2.5B, with network activity up more than 90% since spring. ⚙️ ARB’s price surged ~91% from April lows, though $0.50 remains critical resistance

Stablecoin supply on Arbitrum hit an all-time high in July , highlighting real use-case growth and on-chain USD demand

Robinhood launched tokenized U.S. stock trading on Arbitrum— a major milestone showing enterprise-level trust and integration

📈 Network Fundamentals & Technical Drivers

The In-kind ETF ruling link s real ETH custody to TradFi flows —Arbitrum sits directly in that fast lane as a scaling infrastructure ﹘ this isn’t theory, it's architectural necessity.

Recent academic research shows that optimistic MEV (arbitrage probing) constitutes over 50% of L2 gas consumption on Base/OP, though only ~7% on Arbitrum —suggesting steadier, lower-waste gas dynamics and room for growth in blockspace usage

🔧 Chart Structure – ARBUSDT (8H & 30m)

Horizontal support around $0.3950 held, while resistance at $0.5196 defines the upper micro‑range. Holding above support suggests buyers are stepping in.

Macro channel structure points toward $1.33 (mid-channel) and $2.66 (upper channel) as multi-month targets—now in play if resistance breaks

30-minute consolidation turned into a textbook breakout— volume picked up above $0.3950, reinforcing the resumption of bullish momentum.

🧠 Risk & Narrative Considerations

Vote-buying incidents in the Arbitrum DAO raised questions about governance integrity—though these were isolated and transparently addressed

A $140K exploit via signature bypass in March highlights the need for continued security evolution—though the protocol responded promptly

On-chain data shows user churn remains an obstacle—some studies find 80% of users quit blockchains within 90 days. Retention is the next frontier for L2 credibility

✅ Trade Setup Recap

📌 Entry zone: Hold above $0.3950, target initial breakout to $0.5196; next extensions toward $1.33 / $2.66.

📌 Catalysts: ETF capital flow, TradFi infrastructure demand, tokenized stock settlement, stablecoin adoption, and developer activity.

📌 Metrics watching: Futures open interest, DAO participation, new dApp deployment, stablecoin inflows.

🧵 Narrative Summary:

Arbitrum is sitting at the intersection of scaling demand, institutional capital landing in Ethereum, and real-world utility use cases. The current structure—which includes firm technical support, active protocol adoption, and ETF-induced capital flows—sets it apart from altcoin speculation cycles.

If ARB can close convincingly above $0.52, expect the macro expansion phase to begin.

Stay sharp. Structure > Noise.

One 💙 Love,

The FX PROFESSOR

Disclosure: I am happy to be part of the Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis. Awesome broker, where the trader really comes first! 🌟🤝📈

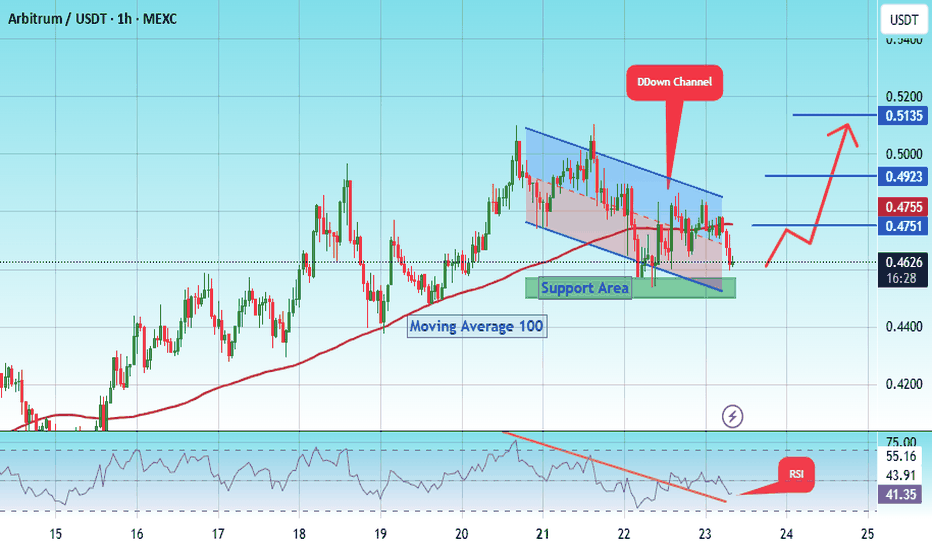

#ARB/USDT#ARB

The price is moving within a descending channel on the 1-hour frame, adhering well to it, and is on its way to breaking strongly upwards and retesting it.

We have support from the lower boundary of the descending channel, at 0.4550.

We have a downtrend on the RSI indicator that is about to be broken and retested, supporting the upside.

There is a major support area in green at 0.4520, which represents a strong basis for the upside.

Don't forget a simple thing: ease and capital.

When you reach the first target, save some money and then change your stop-loss order to an entry order.

For inquiries, please leave a comment.

We have a trend to hold above the 100 Moving Average.

Entry price: 0.4616

First target: 0.4751

Second target: 0.4923

Third target: 0.5135

Don't forget a simple thing: ease and capital.

When you reach the first target, save some money and then change your stop-loss order to an entry order.

For inquiries, please leave a comment.

Thank you.

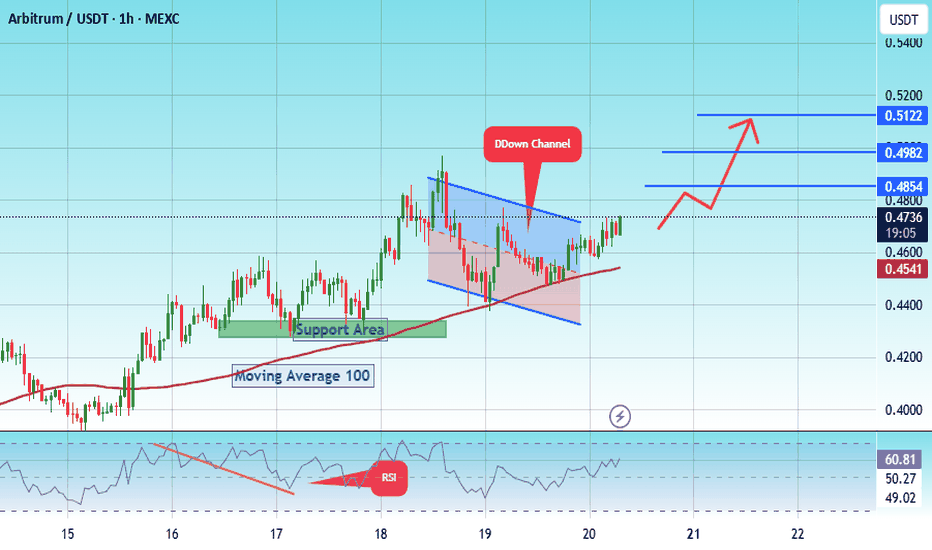

#ARB/USDT Arbitrum scalp long to $ 0.5122#ARB

The price is moving within a descending channel on the 1-hour frame, adhering well to it, and is on its way to breaking strongly upwards and retesting it.

We have support from the lower boundary of the descending channel at 0.4270.

We have a downtrend on the RSI indicator that is about to be broken and retested, supporting the upside.

There is a major support area in green at 0.4300, which represents a strong basis for the upside.

Don't forget a simple thing: ease and capital.

When you reach the first target, save some money and then change your stop-loss order to an entry order.

For inquiries, please leave a comment.

We have a trend to hold above the 100 Moving Average.

Entry price: 0.4720

First target: 0.5554

Second target: 0.4982

Third target: 0.5122

Don't forget a simple thing: ease and capital.

When you reach your first target, save some money and then change your stop-loss order to an entry order.

For inquiries, please leave a comment.

Thank you.

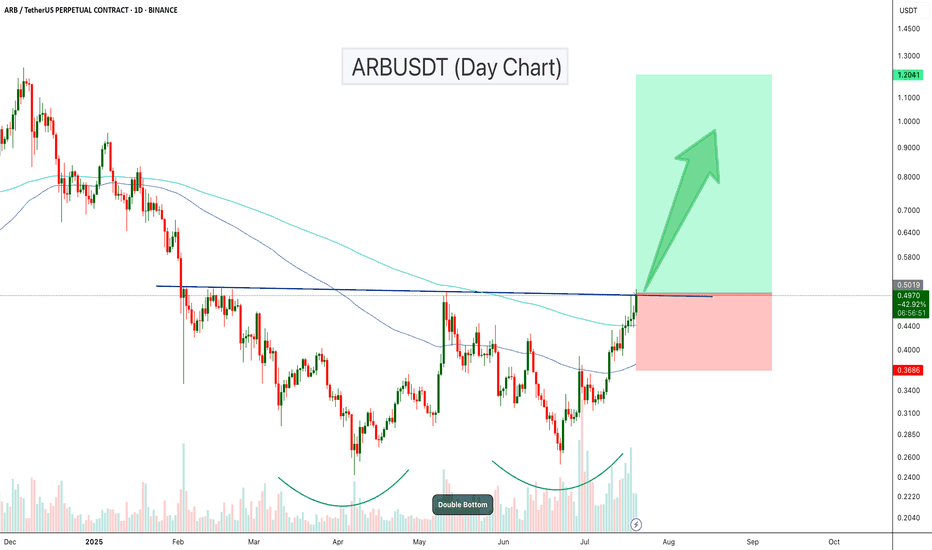

ARBUSDT Breaks Out of Double Bottom!ARB has formed a clear double bottom pattern on the daily chart, signaling a strong reversal structure. After multiple rejections, the price has now broken above the neckline resistance, confirming bullish momentum.

The breakout is also supported by increasing volume and a bullish crossover of the 100 and 200 EMA zones. If the current momentum holds, ARB could reach the target of $0.75- $1.20 level.

#ARB/USDT Arbitrum scalp long to $ 0.4783#ARB

The price is moving within a descending channel on the 1-hour frame, adhering well to it, and is poised to break it strongly upwards and retest it.

We have 0.4254 from the lower boundary of the descending channel. This support is at 0.0001500.

We have a downtrend on the RSI indicator that is about to be broken and retested, supporting the upward move.

There is a key support area in green at 0.4170, which represents a strong basis for the upward move.

Don't forget one simple thing: ease and capital.

When you reach the first target, save some money and then change your stop-loss order to an entry order.

For inquiries, please leave a comment.

We have a trend of stability above the Moving Average 100.

Entry price: 0.4484

First target: 0.4566

Second target: 0.4675

Third target: 0.4783

Don't forget one simple thing: ease and capital.

When you reach the first target, save some money and then change your stop-loss order to an entry order.

For inquiries, please leave a comment.

Thank you.

ARBUSDT Double Bottom Signals Bullish Reversal!ARBUSDT is showing a bullish reversal setup on the weekly timeframe after trading within a descending channel for over a year. A clear double bottom has formed near the channel’s lower support, and the price is now breaking above key resistance around $0.50. If this breakout holds, a move toward the upper resistance of the channel and potentially reach the ATH end of this bull run.

Cheers

Hexa

#ARB/USDT Arbitrum scalp long to $ 0.4451#ARB

The price is moving within a descending channel on the 15-minute frame and is expected to break and continue upward.

We have a trend to stabilize above the 100 Moving Average once again.

We have a bearish trend on the RSI indicator, supporting the upward break.

We have a support area at the lower boundary of the channel at 0.4070, acting as strong support from which the price can rebound.

We have a major support area in green that pushed the price upward at 0.3970.

Entry price: 0.4160.

First target: 0.4300.

Second target: 0.4407.

Third target: 0.4451.

To manage risk, don't forget stop loss and capital management.

When you reach the first target, save some profits and then change the stop order to an entry order.

For inquiries, please comment.

Thank you.

ARB - Breakout will break the market- Arbitrum is one of the fundamentally strong token on ETH L2.

- After back to back crashes finally we are seeing some reversal from the bottom

- A breakout from the local resistance would push the arb price further, we need to wait till the breakout to enter the trade.

Entry Price: 0.5010 (after breakout)

StopLoss: 0.3169

TP1: 0.6300

TP2: 0.7698

TP3: 1.2297

TP4: 1.7566

TP5: 2.3943

Max Leverage: 5x

Don't forget to keep stoploss

Cheers

GreenCrypto

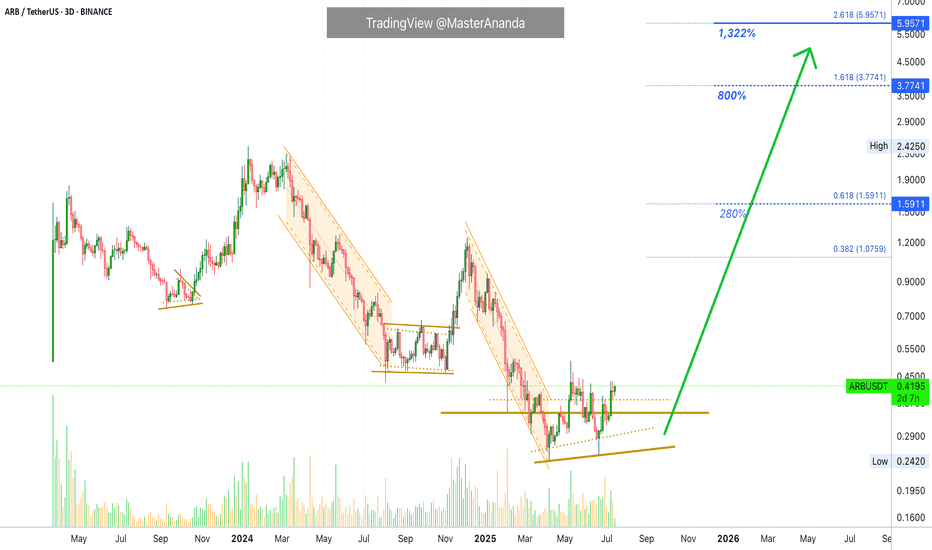

Arbitrum 1,322% Profits Potential · Easy · Crypto is Going Up!This will be intense, truly intense. Arbitrum will perform one of the strongest bullish waves in the entire market. Just one red session and we are back up, back green and ready to move. It will be huge.

This is a big project and yet, we have a standard, easy target, around 1,322%. Such huge potential for growth and there is no doubt now, 100% certainty; you can bet your house on it. We are going up.

When the market goes down, it is unforgiving, it gives no break. It goes down and down and down long-term.

When the market goes up, it is unforgiving, it gives no break. It goes up and up and up, many times higher and much more stronger than any previous bearish wave.

So the market is biased in favor of going up. Just as new all-time lows can be hit on a crash, new all-time highs will be hit during a major bullish impulse. Mark my words.

We are not talking about just "another bullish wave." Not just an "advance." We are talking about the strongest, biggest, longest, exciting and highly profitable bullish phase the Cryptocurrency market has yet to offer. We are talking about exceptional exponential growth. We are talking about a bull market like nothing you've seen before.

Get ready because Crypto is going up.

Namaste.

ARB New Analysis (3D)Before anything else, pay attention to the timeframe | it's a higher timeframe and will take time.

The higher timeframe structure of ARB is honestly not that bullish. In this scenario, we’ve considered the entire correction | starting from where the red arrow is placed on the chart | as a diametric/symmetrical pattern.

From a time perspective, wave E has not yet completed, and it is expected to finish somewhere between the two vertical lines. Wave E here is a bearish wave.

If the price pulls back and reaches the green box, we can look for a buy setup in that area.

A 3-day candle closing below the invalidation level will invalidate this analysis.

For risk management, please don't forget stop loss and capital management

When we reach the first target, save some profit and then change the stop to entry

Comment if you have any questions

Thank You

Perfect Short Setup? ARB Enters Bear TerritoryARB/USDT on the 4-hour chart is trading right into a proven resistance zone between 0.4266 and 0.4448 USDT, where the price has reversed multiple times before, as shown by the red “S” markers. This level acted as a ceiling during prior rallies, triggering sharp declines each time it was tested.

The current move up is steep and impulsive, climbing almost vertically from the strong support around 0.3581 without meaningful consolidation. Such rallies often attract profit-taking as traders who bought lower look to exit into overhead supply. The fact that price is already stalling just below resistance suggests momentum is weakening and sellers may soon step back in.

Another reason for a bearish bias is the absence of any strong base or sideways build-up under this resistance area. Typically, a sustained breakout requires accumulation or compression just below resistance; here, price simply surged straight up into it. If this zone holds again, it will likely trigger a pullback back toward the last breakout levels.

A short scenario is attractive because the trade offers a clear invalidation level and clean downside targets. Entering near 0.4266–0.4448 with a stop above 0.4450 protects against a breakout trap while aiming for a retracement first to the 0.3901 zone, which acted as former resistance-turned-support, and potentially deeper to the strong support around 0.3581.

In summary, the chart structure favors a short-term bearish reversal at this resistance. The combination of historical rejection, overextension without consolidation, and evident prior sell reactions makes this level a high-probability area to look for shorts, unless price convincingly breaks and closes above 0.4450 with strong bullish candles.

#ARB Can Long Soon#ARB

The price is moving within a descending channel on the 1-hour frame and is expected to break and continue upward.

We have a trend to stabilize above the 100 moving average once again.

We have a downtrend on the RSI indicator that supports the upward move with a breakout.

We have a support area at the lower boundary of the channel at 0.3190, acting as strong support from which the price can rebound.

We have a major support area in green that pushed the price upward at 0.3180.

Entry price: 0.3200

First target: 0.3297

Second target: 0.3393

Third target: 0.3513

To manage risk, don't forget stop loss and capital management.

When you reach the first target, save some profits and then change your stop order to an entry order.

For inquiries, please comment.

Thank you.

#ARB/USDT Ready for a Major Breakout!#ARB

The price is moving within a descending channel on the 1-hour frame, adhering well to it, and is heading for a strong breakout and retest.

We are seeing a bounce from the lower boundary of the descending channel. This support is at 0.3500.

We have a downtrend on the RSI indicator that is about to be broken and retested, supporting the upside.

There is a major support area in green at 0.3050, which represents a strong basis for the upside.

Don't forget a simple thing: ease and capital.

When you reach the first target, save some money and then change your stop-loss order to an entry order.

For inquiries, please leave a comment.

We are looking to hold above the 100 Moving Average.

Entry price: 0.3640

First target: 0.3828

Second target: 0.4009

Third target: 0.4229

Don't forget a simple thing: ease and capital.

When you reach your first target, save some money and then change your stop-loss order to an entry order.

For inquiries, please leave a comment.

Thank you.

ARB/USDT Ready for a Major Breakout! Accumulation1. Downtrend Line:

ARB has been in a sustained downtrend since late 2024, marked by a descending trendline from previous highs. The current price is testing this resistance line, hinting at a possible breakout.

2. Strong Support Zone (Demand Area):

A clear accumulation zone is observed between $0.28–$0.30, where the price has consistently bounced back. This indicates solid buying pressure and strong investor interest at this level.

3. Potential Breakout Signal:

The price is now compressing near the end of the descending triangle and is forming higher lows, suggesting a breakout setup is forming.

4. Projected Price Targets (If Breakout Confirmed):

Upon successful breakout and retest confirmation, ARB may rally toward the following resistance levels:

$0.3586

$0.3930

$0.4131

$0.4887

$0.6400

Ultimate targets could reach as high as $0.7148–$0.9197, depending on market momentum.

5. Risk & Invalidations:

A failure to hold the $0.28–$0.30 support zone and a breakdown below may invalidate the bullish structure, potentially retesting the low near $0.2420.

Conclusion:

This chart presents a high-potential breakout opportunity for ARB/USDT. Strong accumulation at key support, along with building pressure against the descending trendline, suggests a significant reversal could be underway. A great setup for swing traders and medium-term investors to monitor closely.

Bullish Setup on ARBUSDT: Risking 5.5% to Gain 13% Toward $0.339The price action of ARBUSDT has shown a significant reversal from a strong support region around 0.2612–0.2838 USDT, marked by bullish engulfing candles and a clear break above the descending trendline. This breakout is reinforced by the Supertrend indicator flipping green, signaling a potential shift in momentum toward the upside.

After bottoming out near 0.26, ARBUSDT has established a short-term higher low structure, and the current price action shows consolidation above the trendline, hinting at a possible continuation toward the next resistance.

A resistance level is marked at 0.3399, which coincides with previous supply and rejection zones. Volume and structure suggest buyers are regaining control, especially after holding support above 0.29 despite market-wide volatility.

📈 Trade Setup

• Entry Zone: 0.3000–0.3015

(Preferably on a bullish 4H candle close above 0.3000 for confirmation)

• Stop-Loss: 0.2838

(Just below the short-term demand zone and minor structure)

• Take-Profit: 0.3399

(Aligns with recent resistance and upper rejection zones)

• Risk–Reward Ratio: ~2.36

(Potential gain: ~13.11%, Potential loss: ~5.56%)

💬 Conclusion

ARBUSDT looks poised for a recovery after bottoming out near a strong multi-week support region. The break of the falling trendline and transition above the Supertrend resistance enhances the bullish outlook. A breakout above 0.3015 could lead to a push toward the 0.3399 resistance.

Note: If momentum builds above 0.3399, we may even see extension targets around 0.36–0.38 in the coming sessions. However, for now, staying disciplined within the trade plan ensures better risk control.

ETH / USDC Pool StakeSharp sell-off following the U.S. strike on Iran—ETH whale has entered. Set your liquidity pool range wide to capture a potential rebound. If the price continues to drop, no problem—full ETH position is anchored at the bottom of the range. Avoid swapping ETH to realize losses. Hold your original ETH and continue adjusting the range downward if needed. Your only real costs are minting and gas fees, so operate on a low-cost network like Arbitrum or Base to keep expenses minimal.

#ARB/USDT#ARB

The price is moving within a descending channel on the 1-hour frame, adhering well to it, and is heading for a strong breakout and retest.

We are seeing a bounce from the lower boundary of the descending channel, which is support at 0.2625.

We have a downtrend on the RSI indicator that is about to be broken and retested, supporting the upward trend.

We are looking for stability above the 100 moving average.

Entry price: 0.2677

First target: 0.2772

Second target: 0.2884

Third target: 0.3033

Is #ARB Ready For a Recovery or will it continue to Fall? Yello Paradisers! Are you watching #ARBUSDT closely or not? Let's look at the latest #Arbitrum trading setup and what could be next for it:

💎#ARB just completed a breakdown from an Ascending Broadening Wedge. This breakdown has made the previous support into the resistance after the price rejection. Currently, there is a high probability that #ARBUSD might do a retest before continuing downward.

💎After the wedge breakdown, price got rejected hard from the $0.39–$0.42 resistance zone, where both the 50 EMA and 200 EMA are now stacked against the bulls, acting as strong dynamic resistances. This confluence of resistance increases the probability that this level won't be reclaimed easily. The setup is clearly bearish unless invalidated above $0.42.

💎We’re seeing a lack of follow-through on the bounces, which signals hesitation and likely a trap for late buyers. As long as we remain below the resistance block, the next logical move is a retest of mid-term support at $0.2391.

💎But it doesn't stop there. If this mid-level gives in — and the structure suggests it might — the next area to watch is the $0.1450 zone, a strong historical support and the first place we expect real buyers to step in. This could be the level where a high-probability reversal finally sets up.

Trade smart, Paradisers. This setup will reward only the disciplined.

MyCryptoParadise

iFeel the success🌴