#ARB/USDT#ARB

The price is moving within a descending channel on the 1-hour frame and is expected to break and continue upward.

We have a trend to stabilize above the 100 moving average once again.

We have a downtrend on the RSI indicator, which supports the upward move by breaking it upward.

We have a support area at the lower limit of the channel at 0.4033, acting as strong support from which the price can rebound.

Entry price: 0.4120

First target: 0.4229

Second target: 0.4373

Third target: 0.4540

ARBUSDT

TradeCityPro | Deep Search: In-Depth Of Arbitrum👋 Welcome to TradeCity Pro!

Today we have a deep research analysis on the Arbitrum project, and in this review, I’ll fully break down the project for you. First, let’s take a look at the project’s information, and then we’ll analyze the ARB coin from a technical perspective.

🌉 What is Arbitrum?

Arbitrum is a Layer 2 scaling solution for Ethereum that leverages Optimistic Rollups to enhance the network’s speed, scalability, and cost-efficiency. By offloading the majority of computation and data storage to off-chain processes, Arbitrum significantly reduces transaction fees while increasing throughput — all without compromising Ethereum’s security and full compatibility.

The network’s native token, ARB, plays a central role in governance. With the launch of the decentralized organization Arbitrum DAO, holders of ARB can participate in critical decision-making related to protocol upgrades, treasury allocations, and electing members of the Security Council.

🛠 Development and Roadmap

Arbitrum is developed by the U.S.-based company Offchain Labs. The 2023 roadmap introduced several key developments:

The launch of Orbit, a Layer 3 framework

Stylus integration, allowing smart contracts to be written in Rust, C++, and other popular languages

Increased inclusion of institutional validators

Enhanced decentralization of Arbitrum One

On March 16, 2023, Arbitrum announced that 12.75% of its total ARB token supply would be distributed via airdrop to early users and DAOs in its ecosystem. The token generation event (TGE) was executed on March 23, 2023.

👥 Founders of Arbitrum

Arbitrum was founded by three computer scientists from Princeton University:

Ed Felten, Professor at Princeton and former U.S. Deputy CTO under President Obama — Co-founder and Chief Scientist

Steven Goldfeder, Ph.D. in Computer Science — CEO

Harry Kalodner, Ph.D. candidate — CTO

In 2021, Offchain Labs raised $120 million in a Series B funding round led by Lightspeed Venture Partners, resulting in a $1.2 billion valuation. Other participants included Polychain Capital, Pantera Capital, and Mark Cuban.

🧬 What Makes Arbitrum Unique?

Arbitrum sets itself apart through its implementation of Optimistic Rollups, delivering several distinct advantages:

Full EVM Compatibility: Ethereum apps can run on Arbitrum without code changes

High Throughput: Capable of processing thousands of transactions per second with low fees

Developer Flexibility: Stylus allows for smart contract development in Rust, C++, and more

True Decentralization: Transactions are validated by a distributed set of validators, without relying on centralized sequencers

Arbitrum supports a dynamic ecosystem that includes projects like GMX, Treasure (MAGIC), Camelot (GRAIL), Radiant Capital (RDNT), Vela Exchange, ZyberSwap, Dopex, PlutusDAO, and Jones DAO.

As of the latest data from DeFiLlama, Arbitrum reached a peak TVL of $3.2 billion in November 2021 and currently maintains around $1.85 billion, making it the largest Layer 2 network by total value locked.

💸 Token Supply and Allocation

The ARB token has a total fixed supply of 10 billion. It is not used for gas payments — transactions are settled in ETH or other supported ERC-20 tokens — but serves solely as a governance asset.

The distribution breakdown is as follows:

DAO Treasury: 42.78%

Offchain Labs team and advisors: 26.94%

Investors: 17.53%

Airdrop to users: 11.62%

Airdrop to DAOs: 1.13%

ARB holders participate in governance over both Arbitrum One and Nova, voting on upgrades, resource allocation, feature integration, and treasury decisions.

🛡 Network Security

Arbitrum’s security is anchored in Ethereum. Transactions are executed off-chain and posted in batches to Ethereum’s mainnet via Optimistic Rollups. These batches are assumed valid unless contested during a designated fraud-proof window, during which challengers can submit cryptographic evidence of invalidity.

💱 Where to Buy ARB

ARB is available across a wide range of trading platforms, including:

Centralized exchanges: Binance, Coinbase, KuCoin, Bybit, Kraken, and Bitfinex

Decentralized exchanges: Uniswap V3 (Ethereum & Arbitrum) and SushiSwap (Arbitrum)

Fundraising and Token Vesting

Since its inception in 2019, Offchain Labs has completed three major fundraising rounds totaling over $143 million.

The Seed round raised $3.7 million from Pantera Capital and Compound VC. In April 2021, the company secured $20 million in a Series A round led by Lightspeed and supported by Mark Cuban. The most significant round, Series B, came in August 2021, with $100 million raised and a valuation of $1.2 billion.

Approximately 17.5% of ARB’s total supply was allocated to these investors, subject to a one-year cliff followed by monthly vesting. These funds provided the financial foundation for ecosystem growth, DAO development, and further decentralization.

🔓 Token Unlocks and Vesting Status

As of May 2025, the ARB token distribution is as follows:

Unlocked: 4.278 billion ARB (42.74%)

Locked: 2.378 billion ARB (23.72%)

Untracked: 3.356 billion ARB (33.54%)

Market Cap of Unlocked Tokens: ~$1.708 billion

The majority of remaining tokens will unlock monthly until March 2027. Most of these allocations pertain to the team, advisors, and early investors.

Current token distribution by role:

Team, future members, and advisors: 40.53%

Investors: 26.38%

DAO Treasury: 13.91%

Arbitrum ecosystem DAOs: 1.70%

Individual wallets: 17.48%

On-Chain Activity – May 2025 Snapshot

According to DeFiLlama’s latest figures, Arbitrum remains one of the most active and liquid Layer 2 environments. Key indicators include:

TVL: $2.63 billion

Stablecoin market cap: $2.76 billion

Bridge-in value: $14.02 billion

Treasury balance: $21.26 million

24h active addresses: 286,467

24h network fees: $33,415

24h protocol revenue: $33,032

24h dApp revenue: $92,966

24h DEX volume: $513 million

24h derivatives volume: $299 million

24h capital inflow: $163.4 million

ARB price: ~$0.40

Circulating market cap: ~$1.92 billion

Fully diluted valuation (FDV): ~$3.96 billion

Revenue Performance

Arbitrum has maintained a steady and upward revenue trend throughout the past year. On average, the network generates around $2.7 million per month in protocol revenue — primarily from transaction fees. dApps on the network contribute substantially as well, especially through DEXs, derivatives, and lending platforms.

With daily protocol revenue averaging $30,000–$35,000, the data reflects ongoing, high-frequency use by both end-users and developers. This recurring income stream enhances the network’s long-term sustainability.

🎁 The ARB Airdrop

On March 16, 2023, Offchain Labs announced the ARB airdrop as a core component of decentralizing network governance through the creation of the Arbitrum DAO.

A total of 12.75% of ARB supply was distributed:

11.62% to early users

1.13% to DAOs contributing to the Arbitrum ecosystem

Eligibility was determined via a point-based system that rewarded meaningful engagement — such as using Arbitrum bridges, interacting with dApps, and providing liquidity. The eligibility cutoff date was March 1, 2023.

The token generation event took place on March 23, 2023, with ARB going live on major exchanges the same day. Unlike ETH, ARB does not serve as gas; instead, it is used solely for governance.

✅ Conclusion

Over the past two years, Arbitrum has become one of the most essential infrastructure layers in Ethereum’s Layer 2 ecosystem. Leveraging Optimistic Rollup technology, it has successfully delivered scalability, speed, and cost-efficiency to both users and developers. From a tokenomics perspective, the total supply of ARB is capped at 10 billion, of which over 4.2 billion have already been unlocked. Approximately 2.3 billion tokens remain locked under a structured vesting program set to continue through 2027. A significant portion of these tokens is allocated to the core team, advisors, and early investors.

On-chain data further supports Arbitrum’s leading position: with over $2.6 billion in total value locked (TVL), more than $2.7 billion in stablecoin market cap, and over $14 billion bridged into the network, it has firmly established itself among the most robust Layer 2 platforms. This is backed by more than 280,000 active daily addresses and substantial volumes in both decentralized exchanges and derivatives markets.

Economically, Arbitrum generates an average daily protocol revenue of $30,000 to $35,000, while dApps on the network collectively bring in over $90,000 daily. On a monthly basis, network revenue exceeds $2.7 million — ranking Arbitrum second only to Base among Layer 2 networks in revenue generation.

In summary, Arbitrum stands strong not only in its technical foundation but also in its economic sustainability. With a stable revenue cycle, progressive token unlocks, and consistent user engagement, the network is well-positioned to expand its ecosystem, strengthen DAO governance, and reinforce its competitive edge in the evolving Layer 2 landscape.

Now that we’ve reviewed the project, let’s go to the chart and analyze it technically.

📅 Weekly Timeframe

As you can see in the weekly timeframe, after the token was listed in mid-2023, and following a correction, the price made a bullish move up to a high of 2.0997. After that, ARB entered a downtrend.

There was a very important support level at 0.8038, which was the most critical support for ARB, but during the sell-off, this level was broken. The price formed a new low at 0.4844, then made a pullback to 1.2115 before continuing its decline and reaching a new low at 0.2618.

The RSI oscillator during this downtrend remained below the 50 zone, except for when price pulled back to 1.2115 — indicating that the overall momentum has been bearish. For a trend reversal and bullish confirmation, if the RSI makes a higher high and higher low above the 50 level, we can take that as a momentum confirmation.

As for price confirmation, the 0.4844 zone is a good reference — the price is currently interacting with this level and ranging just below it. If this level is broken and price consolidates above it while forming a higher high and higher low, we will get confirmation of a trend reversal.

This can also be used as a trigger for spot buying. However, it’s better to wait for Bitcoin dominance to turn bearish and then look for a trigger on this chart.

📅 Daily Timeframe

In the daily timeframe, we can better observe the price movements. As shown, after rebounding from the 0.2618 bottom, price formed a higher low and higher high, and is currently building a base at the 0.3747 level after reaching the 0.4844 resistance.

For long positions or spot buying, given that the trend has turned bullish in the daily timeframe, we can enter if price reacts positively to the 0.3747 support. The main trigger remains the breakout of 0.4844.

RSI has been able to stabilize above the 50 level during this cycle. If this continues and RSI stays above 50, the likelihood of a sustained bullish trend significantly increases.

The main confirmation of ARB’s bullish reversal will come from breaking 0.4844. But if the price fails to break this level and instead prints a lower high, we could consider a short position with a break of 0.3747.

The key support level for ARB is 0.2618. For the broader trend to return to bearish, this level must be broken. If that happens, we’ll likely see some very sharp downward moves.

❌ Disclaimer ❌

Trading futures is highly risky and dangerous. If you're not an expert, these triggers may not be suitable for you. You should first learn risk and capital management. You can also use the educational content from this channel.

Finally, these triggers reflect my personal opinions on price action, and the market may move completely against this analysis. So, do your own research before opening any position.

ARB - Beautiful Falling Wedge Pattern---------------------------------------------------------------

Description

---------------------------------------------------------------

+ Perfect falling wedge pattern has formed for ARB, a clear breakout from this falling wedge pattern is imminent.

+ breakout from this falling wedge pattern could push the price to previous All time high.

---------------------------------------------------------------

VectorAlgo Trade Details

------------------------------

Entry Price: 0.39

Stop Loss: 0.16

------------------------------

Target 1: 0.6229

Target 2: 0.9196

Target 3: 1.1430

Target 4: 1.6343

Target 5: 2.1129

------------------------------

Timeframe: 1W

Capital: 1-2% of trading capital

Leverage: 5-10x

---------------------------------------------------------------

Enhance, Trade, Grow

---------------------------------------------------------------

Agree or Disagree with the ideas ? lets discuss in the comments.

Like and follow us for more ideas.

Best Regards,

VectorAlgo

$ARB time to fly $1 this bull run 2025 and it's Last Wave...AMEX:ARB Time to Fly and Touching $1 this Quarter. I guess it will be happened and gain bonuses $1+ and $2+ if big investor entry on this token.

My Magic Indicator Say ARB Price have touch Yellow line. Previous Day, Bounce back to above Yellow Line and It's Bull Run 2025 for ARB .

From News: ARB Eyes Trend Reversal With Breakout Signal Above $0.45 This Week

Arbitrum is trading at $0.41 inside a falling wedge and a breakout above $0.45 might confirm a wide shift from its yearlong downward trend.

Arbitrum has formed a falling wedge with lower highs and higher lows now compressing price at $0.41.

If the price moves above $0.45 with strong volume this could confirm a new bullish pattern for $ARB.

The wedge has been forming since 2024 and a breakout may signal the start of a strong trend reversal.

The descending wedge pattern forming on the Arbitrum chart spans nearly one year, beginning from its 2024 highs near $2.50. Several failed rallies marked by red arrows define the top boundary, while green arrows at the base represent support retests. This structure has now tightened into a narrow apex where breakout probability increases significantly.

#Write2Earn #BinanceSquareFamily #Binance #BTC☀ #SUBROOFFICIAL

Disclaimer: This article is for informational purposes only and does not constitute financial advice. Always conduct your own research before making any investment decisions. Digital asset prices are subject to high market risk and price volatility. The value of your investment may go down or up, and you may not get back the amount invested. You are solely responsible for your investment decisions and Binance is not available for any losses you may incur. Past performance is not a reliable predictor of future performance. You should only invest in products you are familiar with and where you understand the risks. You should carefully consider your investment experience, financial situation, investment objectives and risk tolerance and consult an independent financial adviser prior to making any investment.

ARB/USDT 1-Day Chart – Downtrend Channel with a Bullish Twist!Arbitrum is playing out a textbook downtrend channel on the 1-day chart, and the structure is crystal clear!

We’ve been cycling through Accumulation → Rise → Distribution → Selloff, and right now, we’re in the Rise phase at $0.43. The price is climbing steadily after bouncing from the $0.35 support after breakout from Fallind Wedge within Selloff phase, and I’m eyeing a potential target of $0.66 — 0.618 Fib near the upper boundary of the channel!

This channel has been guiding ARB’s price action since late 2023, with each phase clearly marked. The current $0.35 level is a key support to watch — if it holds, this rise could have legs. But if we break below, the next accumulation zone might kick in. Let’s see if ARB can keep the momentum going and hit that $0.66 target!

Key Levels to Watch:

Support: $0.35 (current base of the rise)

Current Price: $0.43 (rise phase)

Target: $0.66 (0.618 fib near channel resistance)

What do you think, traders? Are we heading for $0.66, or will the downtrend channel strike back? Drop your thoughts below!

#ARB/USDT#ARB

The price is moving within a descending channel on the 1-hour frame, adhering well to it, and is heading for a strong breakout and retest.

We are experiencing a rebound from the lower boundary of the descending channel, which is support at 4050.

We are experiencing a downtrend on the RSI indicator, which is about to be broken and retested, supporting the upward trend.

We are looking for stability above the 100 Moving Average.

Entry price: 0.4436

First target: 0.4700

Second target: 0.4994

Third target: 0.5367

ARB (the strongest weekly candle what next ?)ARB / USDT

The Price printed the strongest weekly candle at horizon trendline after Series of downtrends such price action support the idea of being the bottom !

What next ?

Possible playout in coming weeks we see the price hit the recent high of December and after that if bulls continue showing their strength may hit the next target in my chart

Best wishes

ARBUSDT - This was just the beginning.The upcoming wave will be directed toward all Ethereum-based tokens, with ARB being one of the most significant.

On the 3-day timeframe, you’ll notice it has broken the downward trendline with a giant bullish candle, signaling a trend reversal from bearish to bullish.

It has also formed an inverse Head & Shoulders pattern, a strong bullish signal.

While the long-term targets for this token are insane, I’ll settle for a $2 target—for now.

Best regards Ceciliones 🎯

#ARB/USDT#ARB

The price is moving in a descending channel on the 1-hour frame and is adhering to it well and is heading to break it strongly upwards and retest it

We have a rebound from the lower limit of the descending channel, this support is at a price of 0.3640

We have a downtrend on the RSI indicator that is about to be broken and retested, which supports the rise

We have a trend to stabilize above the moving average 100

Entry price 0.3730

First target 0.3890

Second target 0.4047

Third target 0.4266

#ARB/USDT#ARB

The price is moving within a descending channel on the 1-hour frame, adhering well to it, and is heading for a strong breakout and retest.

We are seeing a bounce from the lower boundary of the descending channel, which is support at 0.2460.

We have a downtrend on the RSI indicator that is about to be broken and retested, supporting the upward trend.

We are looking for stability above the 100 Moving Average.

Entry price: 0.2720

First target: 0.2850

Second target: 0.2954

Third target: 0.3095

ARB Secondary trend. 24 04 2025Logarithm. Time frame 3 days (less is not necessary).

⚠️ Currently a decline from the maximum of -90% . For assets of such liquidity, these are not the lowest values, but perhaps the previous hype played a role in this. Work from the average price, or on a breakout , and you will not care when the reversal occurs. The main thing is to distribute the entry and exit points after the purchase in advance, that is, distribute the risk and profit. And, after that, no longer be interested in the asset, or opinions, or fictitious positive / negative news to stimulate demand / supply of “stupid money”. Do not get stuck in market noise and unnecessary, fear-driven or greed-driven opinions.

Main trend (the entire history of cryptocurrency trading), for clarity of pricing and the zone for work now, which is discussed.

ARB Main Trend 24 04 2025

🟣 Local trend. At the moment, a wedge-shaped formation has formed in it, there is an attempt to break through it and the price is clamped.

1️⃣ If this zone of minimums is held — for a start, the potential for a downward trend of the secondary trend (shown with a red line).

2️⃣ Then, when it is broken through , — to the channel median (green dotted line).

ARB Main Trend 24 04 2025Logarithm. Time frame 1 week.

Previously a very hyped coin, "killer" of something there...

Now - the dominant opinion is that this is a scam, a scam, "whales are selling now", and so on. It's funny to look at all this and how the opinion changes with the price. Crypto is a mess, there are no other words... That is, now is the time to take a closer look at the asset, and the start of the set.

If the price drops to lower values (shown on the chart), from the position of the trend, and potential percentages of the pump, the price is now acceptable, and the profit will be significant, but not "hamster". Set adequate goals, fix in parts as the trend develops, protect your profit. When there is an aggressive pump "with a stick", by a large %, - completely exit the asset, or protect the profit with a stop.

There is a small probability that an asset of such capitalization, and the unrealization of "buy a candy wrapper", will be knocked down in advance before the full 3rd alt season of this cycle, without distributing "prospects" on the "revival of faith".

⚠️ Now the decline from the maximum is -90% . For assets of such liquidity, these are not the lowest values, but perhaps the previous hype played a role in this. Work from the average price, or on a breakthrough and you will not care when the reversal occurs. The main thing is to distribute the entry and exit points after the purchase in advance, that is, distribute the risk and profit. And, after that, no longer be interested in the asset, or opinions, or fictitious positive / negative news to stimulate demand / supply of "stupid money". Do not get stuck in market noise and unnecessary opinions driven by fear or greed.

1️⃣ If this zone of minimums is held — for starters, the potential for a downward trend of the secondary trend (shown with a red line).

2️⃣ Then, when it is broken , — to the channel median (green dotted line).

🟣Local trend At the moment, a wedge-shaped formation has formed in it, there is an attempt to break through it and the price is clamped.

What Has Warren Buffet, Elizabeth Warren & Arbitrum In Common?The good news is that the market is now turning green. All is well that ends well.

There was lots of excitement in late 2024 because of the bullish period, but this bullish period was followed by an even stronger bearish period. Just as there was excitement, now all that there is is depression. People are worn out, they can't take it anymore.

That's the signal. When the market participants are tired and ready to give up, that's when the market turns.

When nobody is around and people no longer care, that's the best time to buy and that's exactly when the market looks great.

When people are on vacation away from home, that's when the signals will start to show that the bearish wave is over, but people won't know.

When the market becomes strongly bullish again, it will be too late. There will be additional growth but when the majority decide to buy because of a challenge of the previous high, a new correction will form.

The participants seeing a correction and having samskaras of the previous bearish wave, they start thinking that this one will be the same and will last a long-term, so instead of holding they decide to fold. The moment they fold, the market resumes growing but too fast for them to decide to buy again and there goes the last run.

It is a psychological game. One has to buy when there is strong aversion to the market, one has to sell when the feeling is to stay in for as long as possible; forever growth.

When people start talking about Bitcoin going to $1,000,000 when it already trades at $160,000 or $180,000, that's the time to take profits.

When people start calling for Bitcoin to $5,000,000 and Michael Saylor starts making videos, that's the time to consider how much money you can withdraw.

When even Elizabeth Warren starts to admit that we were right and she was wrong, that's the moment to sell everything because the moment the bank puppet turns, that's the sure sign of a doom scenario.

The moment that Warren Buffet decides, "I am buying Bitcoin," that's it, all 21 million Bitcoins will be already gone. By the time Mr. Buffet figures out that Bitcoin is the new Internet, it will already be the year 2,140, it will be impossible to mine a new Bitcoin.

Actually, I don't know anything about these people, all I know is that Crypto is going up.

Arbitrum is ready to start a new wave of growth.

Namaste.

ARBUSDT: What Happens Next Could Shock ManyYello, Paradisers! Are you watching this key level hold by a thread? The market is giving us signals, but most traders are too distracted to see them. If you're not careful here, you’ll be on the wrong side of the next big move.

💎ARBUSDT is currently trading below both the 50 EMA and the 200 EMA, confirming a strong bearish bias in the market. The trend remains in a clear markdown phase, with price action continuing to respect the descending channel, and no clear signs of bullish reversal just yet.

💎We’re approaching a moderate resistance level around $0.32 has already shown signs of weakness if price fails again at this area, it will likely confirm that sellers are still dominating, increasing the probability of a renewed leg down.

💎If the market rejects at current levels, the first key support to watch is around $0.2847, which could be hit quickly. However, the real danger lies below. A breakdown beneath the $0.2847 zone would expose the market to significant downside pressure, opening the path for a much deeper correction.

💎With ARB trading below the 200 EMA, we must remain cautious. The trend remains bearish, and any short term rally into resistance is more likely to present a shorting opportunity than a bullish breakout.

💎Still, if the market manages to close decisively above the $0.35 mark, it could shift the structure and momentum, targeting $0.37 and higher in the short term. Until then, the bias remains with the bears.

Stay focused, Paradisers. Be the hunter, not the hunted.

MyCryptoParadise

iFeel the success🌴

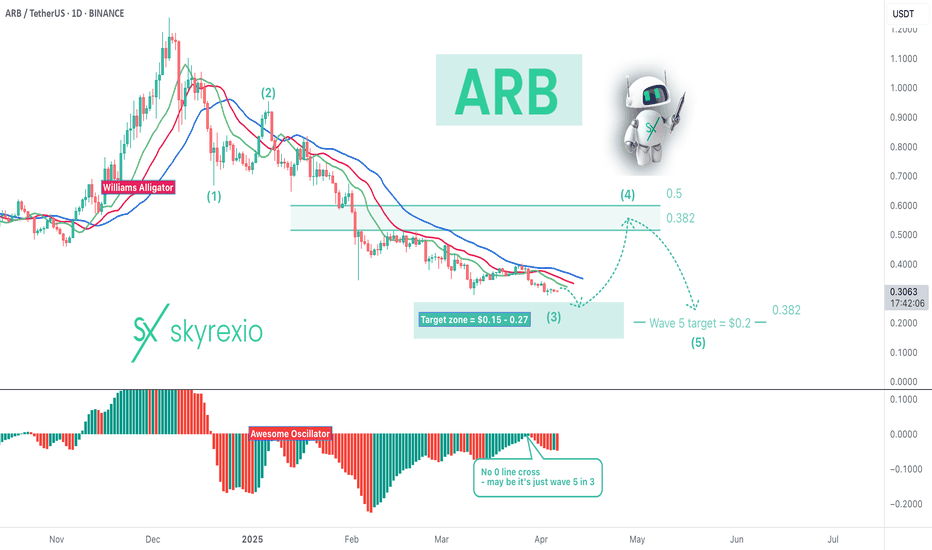

Bear Market Will Continue For Arbitrum ARBHello, Skyrexians!

Despite we expect the alt coin's dominance bottom at approximately 25th of April some altcoins like BINANCE:ARBUSDT can continue the bear market even further. Looking at the price chart we found the most likely and realistic scenario.

Let's take a look at the daily chart. Here we can see that on the Awesome Oscillator price has not crossed zero line and this is extremely bad. There is a high probability that currently asset is not in wave 5, but in wave 5 inside 3. This subway has the target $0.15-0.27. We suppose that $0.27 is our case. We will see the bounce in wave 4 soon to 0.38 Fibonacci and then the new deep dive to $0.2 in the wave 5. We pointed out the most conservative targets. Price can go even lower, but in our experience it's not likely because the max targets leads to price below zero.

Best regards,

Skyrexio Team

___________________________________________________________

Please, boost this article and subscribe our page if you like analysis!

ARB/USDT: Bearish Pressure Builds Below Key ResistanceThe ARB/USDT market recently tested support before rebounding toward the psychological 0.400 level, forming what appears to be an ABC pullback, often a signal for an upcoming retracement. Price has moved above last week’s high, which may indicate a liquidity grab before a potential drop.

When comparing the current bullish pullback to previous stronger bearish moves, the broader momentum appears to favor the bears. If the market fails to break through the channel boundary, trendline, and the 0.420 resistance, a move lower is likely. The next target is the support zone around 0.3500

ARB/USDT – The zone is interesting for starting accumulation.Arbitrum - is an Ethereum layer-two (L2) scaling solution. It uses optimistic rollups to achieve its goal of improving speed, scalability and cost-efficiency on Ethereum. Arbitrum benefits from the security and compatibility of Ethereum. Another benefit is the higher throughput and lower fees compared to Ethereum. That is made possible thanks to moving most of the computation and storage load off-chain.

Arbitrum’s native token is called ARB and is used for governance. Offchain Labs, the developers behind Arbitrum, announced the shift to a decentralized autonomous organization (DAO) structure — the Arbitrum DAO. ARB holders can vote on proposals that affect the features, protocol upgrades, funds allocation and election of a Security Council.

CoinMarketCap : #51

The hyped-up Arbitrum! 😂

📉 January - February - March 2024: Bloggers trapped a huge number of people, and now we’re seeing a massive -87% decline!

Looking at the main trend, a large descending channel is forming. The price is currently at the support of the inner channel, and if the market makes a final liquidity grab with a downward wick, the price could head toward the support of the outer channel, targeting a -30% drop.

In my previous trading idea, I marked the 1.1552 zone, which is exactly where the price reversed. Everything is marked on the chart—the potential profit is very solid, especially for spot trading. The price will react strongly to the resistance zones of both the inner and outer channels.

🚀 These are the moments to watch for position accumulation—when no one is interested and belief in growth is dead, not when everyone is screaming "BUY NOW!" at local tops!

*I will update the trading idea as the trend develops.

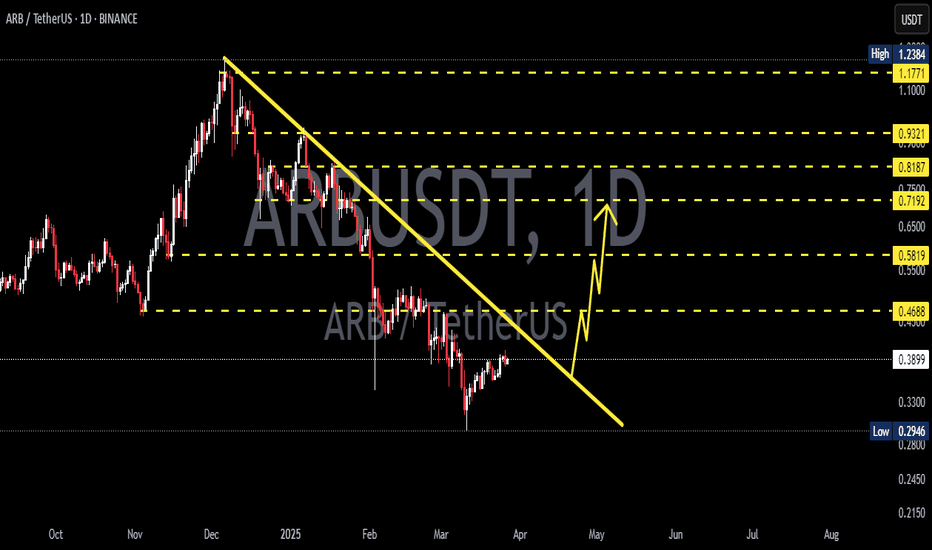

Arbitrum ARB Is About To Flash Insane Long Signal!Hello, Skyrexians!

We decided to find the crypto assets with the largest potential and the proper Elliott waves structure and found BINANCE:ARBUSDT which is still at the bottom but has a great chance to print the super strong long signal.

Let's take a look at the weekly chart. We can count all the price action on the Binance exchange as the large irregular correction ABC. Wave C lasts already exactly one year. This wave always consists of 5 waves and here we can have a clear counting. Look how perfect was the wave 4 touch of 0.38-0.5 Fibonacci zone. Now price has reached the maximum target of wave 5. In conjunction with the divergence with the Awesome Oscillator, angulation with Alligator and potential green dot on or Bullish/Bearish Reversal Bar Indicator we can conclude that probability of reversal now is more than 80%. The only one thing we need to wait for the next week to see the green dot confirmation.

Best regards,

Skyrexio Team

___________________________________________________________

Please, boost this article and subscribe our page if you like analysis!

Breaking: Arbitrum Surged 12% Today- Enroute Bullish BreakoutArbitrum spike 12% today amidst the general crypto dip. The Ethereum layer-two (L2) scaling solution that uses optimistic rollups to achieve its goal of improving speed, scalability and cost-efficiency on Ethereum was in a prolong dip that saw its token dipped to $0.37 level with growing momentum a breakout above the $0.622 resistant point could pave way for major breakout for AMEX:ARB coin as that is the current barrier holding AMEX:ARB from breaking Out.

With the Relative Strength Index (RSI) at 43, AMEX:ARB could capitalize on this growing momentum. Further validating the bullish thesis is the fact that AMEX:ARB is trading below key moving averages.

Data from DefiLlama shows about $2.576 Billion is locked in the Arbitrum ecosystem. This numbers shows a level of trust placed on the layer 2 ecosystem. Similarly, about $1.276 Billion volume has been circulated in the Arbitrum ecosystem for the past 3 days.

Arbitrum Price Live Data

The live Arbitrum price today is $0.424093 USD with a 24-hour trading volume of $393,289,251 USD. We update our ARB to USD price in real-time. Arbitrum is up 11.42% in the last 24 hours, with a live market cap of $1,874,197,514 USD. It has a circulating supply of 4,419,312,625 ARB coins and the max. supply is not available.