#ARB/USDT#ARB

The price is moving within a descending channel on the 1-hour frame, adhering well to it, and is on its way to breaking strongly upwards and retesting it.

We have support from the lower boundary of the descending channel, at 0.4550.

We have a downtrend on the RSI indicator that is about to be broken and retested, supporting the upside.

There is a major support area in green at 0.4520, which represents a strong basis for the upside.

Don't forget a simple thing: ease and capital.

When you reach the first target, save some money and then change your stop-loss order to an entry order.

For inquiries, please leave a comment.

We have a trend to hold above the 100 Moving Average.

Entry price: 0.4616

First target: 0.4751

Second target: 0.4923

Third target: 0.5135

Don't forget a simple thing: ease and capital.

When you reach the first target, save some money and then change your stop-loss order to an entry order.

For inquiries, please leave a comment.

Thank you.

Arbusdtperp

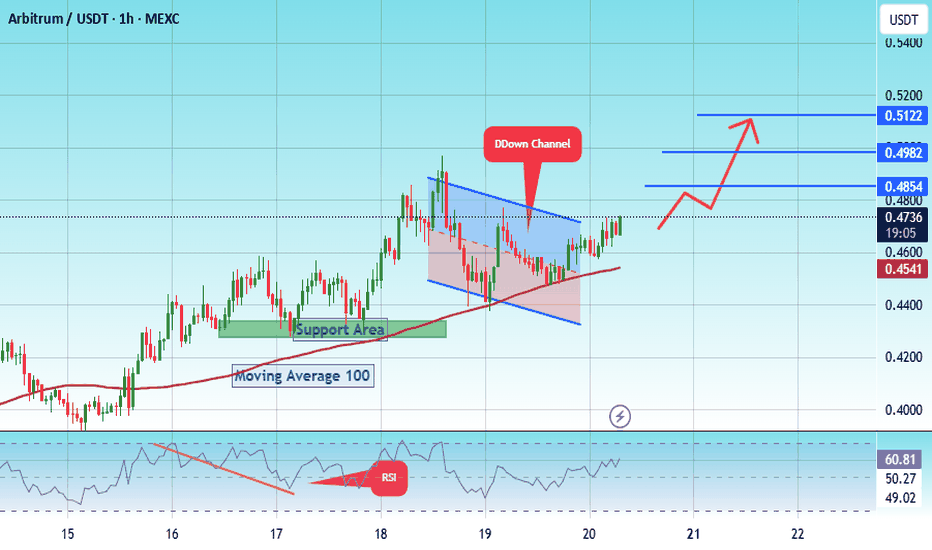

#ARB/USDT Arbitrum scalp long to $ 0.5122#ARB

The price is moving within a descending channel on the 1-hour frame, adhering well to it, and is on its way to breaking strongly upwards and retesting it.

We have support from the lower boundary of the descending channel at 0.4270.

We have a downtrend on the RSI indicator that is about to be broken and retested, supporting the upside.

There is a major support area in green at 0.4300, which represents a strong basis for the upside.

Don't forget a simple thing: ease and capital.

When you reach the first target, save some money and then change your stop-loss order to an entry order.

For inquiries, please leave a comment.

We have a trend to hold above the 100 Moving Average.

Entry price: 0.4720

First target: 0.5554

Second target: 0.4982

Third target: 0.5122

Don't forget a simple thing: ease and capital.

When you reach your first target, save some money and then change your stop-loss order to an entry order.

For inquiries, please leave a comment.

Thank you.

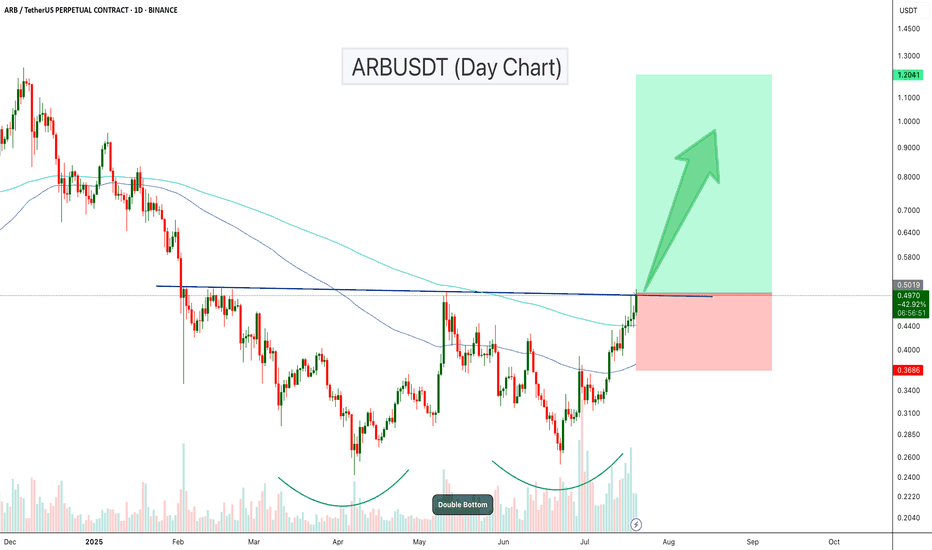

ARBUSDT Breaks Out of Double Bottom!ARB has formed a clear double bottom pattern on the daily chart, signaling a strong reversal structure. After multiple rejections, the price has now broken above the neckline resistance, confirming bullish momentum.

The breakout is also supported by increasing volume and a bullish crossover of the 100 and 200 EMA zones. If the current momentum holds, ARB could reach the target of $0.75- $1.20 level.

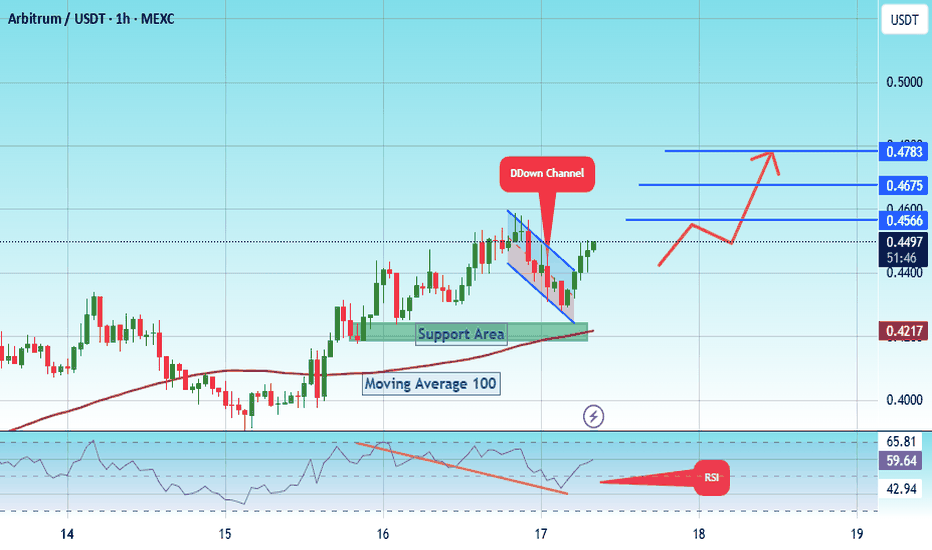

#ARB/USDT Arbitrum scalp long to $ 0.4783#ARB

The price is moving within a descending channel on the 1-hour frame, adhering well to it, and is poised to break it strongly upwards and retest it.

We have 0.4254 from the lower boundary of the descending channel. This support is at 0.0001500.

We have a downtrend on the RSI indicator that is about to be broken and retested, supporting the upward move.

There is a key support area in green at 0.4170, which represents a strong basis for the upward move.

Don't forget one simple thing: ease and capital.

When you reach the first target, save some money and then change your stop-loss order to an entry order.

For inquiries, please leave a comment.

We have a trend of stability above the Moving Average 100.

Entry price: 0.4484

First target: 0.4566

Second target: 0.4675

Third target: 0.4783

Don't forget one simple thing: ease and capital.

When you reach the first target, save some money and then change your stop-loss order to an entry order.

For inquiries, please leave a comment.

Thank you.

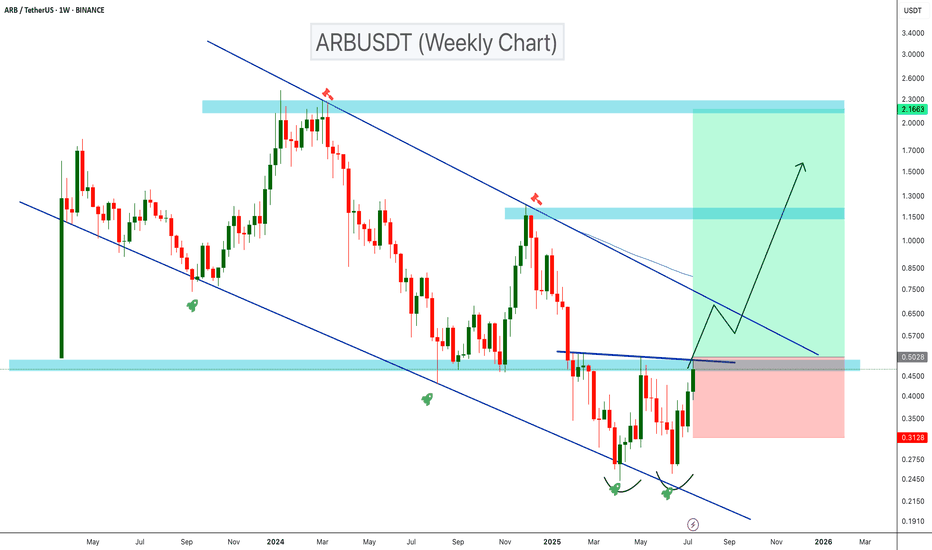

ARBUSDT Double Bottom Signals Bullish Reversal!ARBUSDT is showing a bullish reversal setup on the weekly timeframe after trading within a descending channel for over a year. A clear double bottom has formed near the channel’s lower support, and the price is now breaking above key resistance around $0.50. If this breakout holds, a move toward the upper resistance of the channel and potentially reach the ATH end of this bull run.

Cheers

Hexa

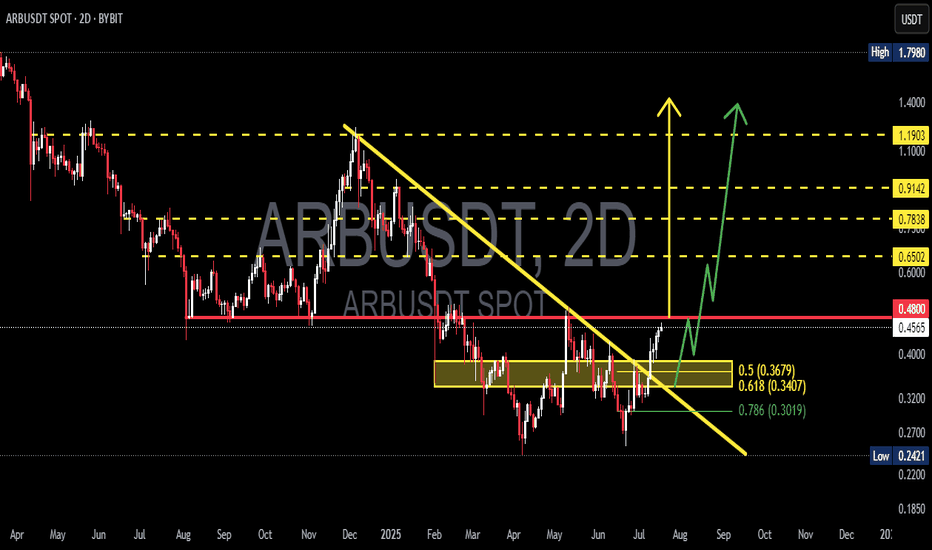

ARBUSDT Ready to Fly? Strong BreakoutARBUSDT has just completed one of its most critical technical phases in recent months — a clean breakout from a medium-term descending trendline that has been suppressing price since December 2024.

📌 Pattern and Price Structure Analysis:

🔹 Descending Trendline Breakout:

After months of downward pressure, ARBUSDT has finally broken above a long-standing trendline. This isn't just another breakout — it's a strong structural signal indicating a potential trend reversal.

🔹 Well-Defined Accumulation Zone:

A solid consolidation base formed between $0.30 - $0.37, highlighted in yellow, serving as a key demand zone. This area aligns perfectly with the Fibonacci retracement levels:

0.5 = $0.3679

0.618 = $0.3407

0.786 = $0.3019

This confluence of support suggests smart money accumulation before the breakout.

📈 Bullish Scenario (High Probability):

If price holds above the recent breakout zone ($0.45–$0.48), the bullish structure remains intact and a multi-level rally may unfold.

🎯 Bullish Targets:

1. First Target: $0.6502 — immediate horizontal resistance.

2. Key Target: $0.7838 — major resistance and previous rejection level.

3. Psychological Level: $0.9142 — pre-breakdown price zone.

4. Maximum Extension: $1.1903 — a potential target if a macro bullish wave develops.

📌 Look for higher lows (HL) and higher highs (HH) structure to confirm sustained bullish momentum.

📉 Bearish Scenario (If Breakout Fails):

A drop back below $0.45 would weaken the bullish outlook.

If the price slips below $0.3679 and loses the 0.618 Fib level at $0.3407, expect a deeper retracement toward:

$0.3019 (0.786 Fib level)

$0.2421 (previous macro low and key support)

🚨 Failure to hold the breakout level could trigger a bull trap, especially if accompanied by declining volume.

🧠 Additional Technical Notes:

Volume increased during the breakout, adding reliability to the move.

Potential formation of an inverse head and shoulders pattern within the base (still early but worth watching).

Momentum indicators like RSI and MACD (not shown) are likely to support the bullish breakout — watch for divergence confirmation.

🧭 Conclusion:

ARBUSDT stands at a critical juncture. The breakout from a long-standing downtrend coupled with a strong accumulation structure gives bulls a tactical edge. However, it must hold above key levels to sustain the momentum.

Smart traders may consider strategic entries on minor retracements while keeping risk in check below the golden pocket zone.

#ARBUSDT #CryptoBreakout #AltcoinReversal #TechnicalAnalysis

#BullishSetup #TrendlineBreakout #FibonacciLevels #CryptoTrading

#Altseason #CryptoSignals

#ARB/USDT Arbitrum scalp long to $ 0.4451#ARB

The price is moving within a descending channel on the 15-minute frame and is expected to break and continue upward.

We have a trend to stabilize above the 100 Moving Average once again.

We have a bearish trend on the RSI indicator, supporting the upward break.

We have a support area at the lower boundary of the channel at 0.4070, acting as strong support from which the price can rebound.

We have a major support area in green that pushed the price upward at 0.3970.

Entry price: 0.4160.

First target: 0.4300.

Second target: 0.4407.

Third target: 0.4451.

To manage risk, don't forget stop loss and capital management.

When you reach the first target, save some profits and then change the stop order to an entry order.

For inquiries, please comment.

Thank you.

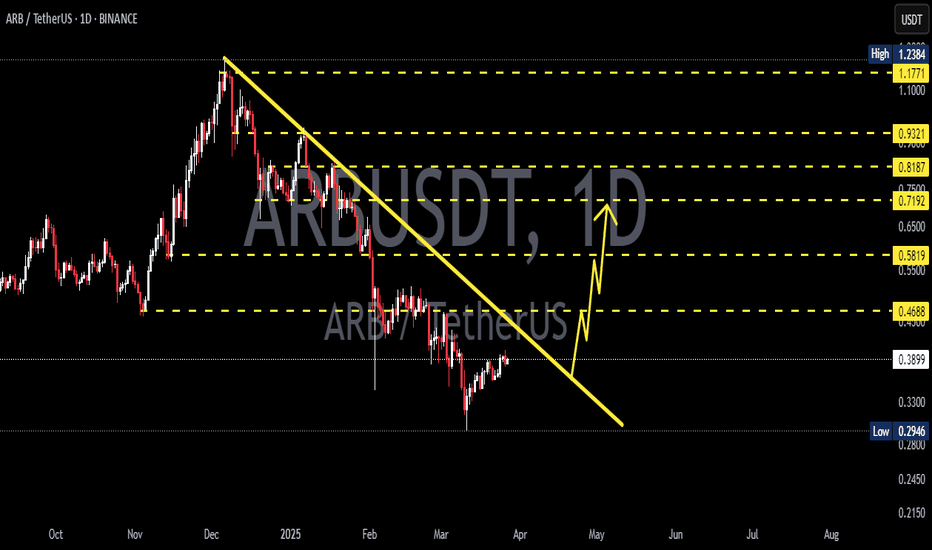

ARB/USDT Breaks Downtrend – Major Bullish Reversal in Play!📊 Technical Analysis (Daily Timeframe)

ARB has officially broken out of a long-standing descending trendline that has defined its downtrend since late 2024. This breakout, supported by strong demand at key Fibonacci levels, could be the start of a major bullish reversal.

🧠 Key Chart Patterns & Structure:

🔸 Descending Triangle Breakout

Originally viewed as bearish, this triangle has instead resolved to the upside — a rare but powerful bullish reversal signal when paired with growing volume and price compression near the breakout.

🔸 Fib Retracement Bounce

Price rebounded precisely from the 0.618 (0.3210) and 0.786 (0.2910) levels, confirming these zones as strong accumulation and liquidity areas.

🔸 Break & Retest Zone at 0.3422 – 0.3210

This golden zone will be key for confirming the breakout. A successful retest here sets the stage for the next leg up.

🔸 Bullish Price Structure Formation

A potential higher low and higher high formation is beginning, which would fully confirm the shift from bearish to bullish market structure.

🟢 Bullish Scenario (High Probability)

If the breakout is validated with a successful retest of the zone:

✅ Short-term Targets:

0.4873 — First major resistance

0.6701 — Mid-range zone with historical confluence

🚀 Mid to Long-Term Targets:

0.8224

0.9216

1.1730

1.2384 — Full recovery back to former highs

🔼 These zones align with Fibonacci extensions and historical resistance areas. Bull momentum can accelerate quickly due to short covering and new buyers entering.

🔴 Bearish Scenario (Invalidation Level)

If price fails to hold above 0.3210, the bullish setup is invalidated short-term:

Breakdown could revisit 0.2910 (Fib 0.786 support)

Below that: full retrace to the December–March demand base at 0.2420

🛑 Key Invalidation Level: Break below 0.3210 with strong selling pressure.

📌 Strategic Summary

ARB has broken its macro downtrend, signaling the start of a new phase.

Holding above the golden pocket zone (0.3210–0.3422) is critical for continuation.

Targets above 0.9–1.2 are realistic if the market sustains its momentum.

Monitor volume and RSI for further confirmation of bullish strength.

🔍 Traders Note:

This setup reflects an ideal blend of trend reversal, Fibonacci support, and breakout confirmation — a textbook setup for swing and positional traders aiming for medium-term upside.

#ARB #ARBUSDT #BreakoutAlert #CryptoTA #TrendReversal #BullishSetup #TechnicalAnalysis #CryptoTrading #FibonacciLevels #DescendingTriangle #AltcoinBreakoutl

#ARB Can Long Soon#ARB

The price is moving within a descending channel on the 1-hour frame and is expected to break and continue upward.

We have a trend to stabilize above the 100 moving average once again.

We have a downtrend on the RSI indicator that supports the upward move with a breakout.

We have a support area at the lower boundary of the channel at 0.3190, acting as strong support from which the price can rebound.

We have a major support area in green that pushed the price upward at 0.3180.

Entry price: 0.3200

First target: 0.3297

Second target: 0.3393

Third target: 0.3513

To manage risk, don't forget stop loss and capital management.

When you reach the first target, save some profits and then change your stop order to an entry order.

For inquiries, please comment.

Thank you.

#ARB/USDT Ready for a Major Breakout!#ARB

The price is moving within a descending channel on the 1-hour frame, adhering well to it, and is heading for a strong breakout and retest.

We are seeing a bounce from the lower boundary of the descending channel. This support is at 0.3500.

We have a downtrend on the RSI indicator that is about to be broken and retested, supporting the upside.

There is a major support area in green at 0.3050, which represents a strong basis for the upside.

Don't forget a simple thing: ease and capital.

When you reach the first target, save some money and then change your stop-loss order to an entry order.

For inquiries, please leave a comment.

We are looking to hold above the 100 Moving Average.

Entry price: 0.3640

First target: 0.3828

Second target: 0.4009

Third target: 0.4229

Don't forget a simple thing: ease and capital.

When you reach your first target, save some money and then change your stop-loss order to an entry order.

For inquiries, please leave a comment.

Thank you.

ARB/USDT Ready for a Major Breakout! Accumulation1. Downtrend Line:

ARB has been in a sustained downtrend since late 2024, marked by a descending trendline from previous highs. The current price is testing this resistance line, hinting at a possible breakout.

2. Strong Support Zone (Demand Area):

A clear accumulation zone is observed between $0.28–$0.30, where the price has consistently bounced back. This indicates solid buying pressure and strong investor interest at this level.

3. Potential Breakout Signal:

The price is now compressing near the end of the descending triangle and is forming higher lows, suggesting a breakout setup is forming.

4. Projected Price Targets (If Breakout Confirmed):

Upon successful breakout and retest confirmation, ARB may rally toward the following resistance levels:

$0.3586

$0.3930

$0.4131

$0.4887

$0.6400

Ultimate targets could reach as high as $0.7148–$0.9197, depending on market momentum.

5. Risk & Invalidations:

A failure to hold the $0.28–$0.30 support zone and a breakdown below may invalidate the bullish structure, potentially retesting the low near $0.2420.

Conclusion:

This chart presents a high-potential breakout opportunity for ARB/USDT. Strong accumulation at key support, along with building pressure against the descending trendline, suggests a significant reversal could be underway. A great setup for swing traders and medium-term investors to monitor closely.

#ARB/USDT#ARB

The price is moving within a descending channel on the 1-hour frame, adhering well to it, and is heading for a strong breakout and retest.

We are seeing a bounce from the lower boundary of the descending channel, which is support at 0.2625.

We have a downtrend on the RSI indicator that is about to be broken and retested, supporting the upward trend.

We are looking for stability above the 100 moving average.

Entry price: 0.2677

First target: 0.2772

Second target: 0.2884

Third target: 0.3033

#ARB/USDT#ARB

The price is moving within a descending channel on the 1-hour frame and is expected to break and continue upward.

We have a trend to stabilize above the 100 moving average once again.

We have a downtrend on the RSI indicator, which supports the upward move by breaking it upward.

We have a support area at the lower limit of the channel at 0.3382, acting as strong support from which the price can rebound.

Entry price: 0.3408

First target: 0.3466

Second target: 0.3523

Third target: 0.3596

#ARB/USDT#ARB

The price is moving within a descending channel on the 1-hour frame, adhering well to it, and is heading towards a strong breakout and retest.

We are experiencing a rebound from the lower boundary of the descending channel. This support is at 0.3620.

We are experiencing a downtrend on the RSI indicator, which is about to break and retest, supporting the upward trend.

We are heading towards stability above the 100 moving average.

Entry price: 0.3667

First target: 0.3700

Second target: 0.3750

Third target: 0.3820

#ARB/USDT#ARB

The price is moving within a descending channel on the 1-hour frame and is expected to break and continue upward.

We have a trend to stabilize above the 100 moving average once again.

We have a downtrend on the RSI indicator, which supports the upward move by breaking it upward.

We have a support area at the lower limit of the channel at 0.3210, acting as strong support from which the price can rebound.

Entry price: 0.3250

First target: 0.3406

Second target: 0.3510

Third target: 0.3667

#ARB/USDT#ARB

The price is moving within a descending channel on the 1-hour frame and is expected to break and continue upward.

We have a trend to stabilize above the 100 moving average once again.

We have a downtrend on the RSI indicator, which supports the upward move by breaking it upward.

We have a support area at the lower limit of the channel at 0.4033, acting as strong support from which the price can rebound.

Entry price: 0.4120

First target: 0.4229

Second target: 0.4373

Third target: 0.4540

#ARB/USDT#ARB

The price is moving within a descending channel on the 1-hour frame, adhering well to it, and is heading for a strong breakout and retest.

We are experiencing a rebound from the lower boundary of the descending channel, which is support at 4050.

We are experiencing a downtrend on the RSI indicator, which is about to be broken and retested, supporting the upward trend.

We are looking for stability above the 100 Moving Average.

Entry price: 0.4436

First target: 0.4700

Second target: 0.4994

Third target: 0.5367

#ARB/USDT#ARB

The price is moving in a descending channel on the 1-hour frame and is adhering to it well and is heading to break it strongly upwards and retest it

We have a rebound from the lower limit of the descending channel, this support is at a price of 0.3640

We have a downtrend on the RSI indicator that is about to be broken and retested, which supports the rise

We have a trend to stabilize above the moving average 100

Entry price 0.3730

First target 0.3890

Second target 0.4047

Third target 0.4266

#ARB/USDT#ARB

The price is moving within a descending channel on the 1-hour frame, adhering well to it, and is heading for a strong breakout and retest.

We are seeing a bounce from the lower boundary of the descending channel, which is support at 0.2460.

We have a downtrend on the RSI indicator that is about to be broken and retested, supporting the upward trend.

We are looking for stability above the 100 Moving Average.

Entry price: 0.2720

First target: 0.2850

Second target: 0.2954

Third target: 0.3095

#ARB/USDT Ready to launch upwards#ARB

The price is moving in a descending channel on the 1-hour frame and is adhering to it well and is heading to break it strongly upwards

We have a bounce from the lower limit of the descending channel, this support is at a price of 0.5960

We have a downtrend on the RSI indicator that is about to be broken, which supports the rise

We have a trend to stabilize above the moving average 100

Entry price 0.6220

First target 0.6567

Second target 0.6890

Third target 0.7262

ARBUSDT Potentially BullishBINANCE:ARBUSDT hits its lowest support area at the 0.4605 area creating a double bottom around the lowest support and a neckline at the 0.6537 level. We have seen the neckline broken and retested almost immediately however, price has come back to same area for a major structural retest. If this holds as a new found support, we just might see price going higher and a 10x is highly possible.

Potential buying areas:

0.6537

0.7393

0.8228

I will not just buy at these areas without seeing price action setup indicating the buy opportunity, hence do your due diligence before taking any trade idea

Past results does not guarantee future results

#ARBUSDT