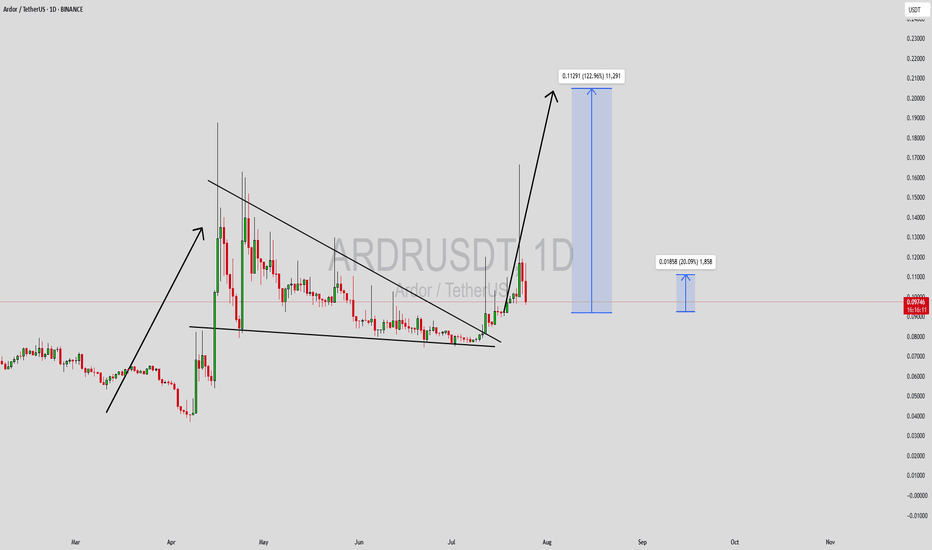

ARDRUSDT Forming Falling WedgeARDRUSDT is displaying a strong bullish technical structure following the successful breakout from a falling wedge pattern—a formation typically associated with trend reversals and substantial upside moves. This breakout is accompanied by solid volume, which further validates the move and hints at strong buying interest. Historically, falling wedge breakouts have produced impressive gains, and in this case, the chart is suggesting a potential rally in the range of 90% to 100%+.

Ardor (ARDR) is gaining traction among traders and long-term investors due to its scalable blockchain infrastructure and real-world applications, especially in enterprise use cases. As the project continues to evolve, market participants are starting to take note of its utility and strong development backing. The recent price consolidation within the wedge and the explosive breakout is a textbook signal for bullish continuation, especially when it occurs after prolonged accumulation.

The price target zones projected on the chart—up to the 0.1129 USDT level—highlight the bullish momentum that may follow. Technical indicators such as MACD crossover and RSI divergence also support this outlook. If the current trend persists and market sentiment remains supportive, ARDRUSDT could easily hit and even surpass these levels, delivering triple-digit percentage returns.

This setup represents a classic high-reward scenario for both breakout traders and position holders aiming to capitalize on mid-term trends. Keep an eye on volume spikes, as they often precede or confirm large moves. With overall market sentiment leaning bullish and increasing social engagement, ARDR is shaping up to be a potential breakout performer in the coming weeks.

✅ Show your support by hitting the like button and

✅ Leaving a comment below! (What is You opinion about this Coin)

Your feedback and engagement keep me inspired to share more insightful market analysis with you!

Ardrusdt

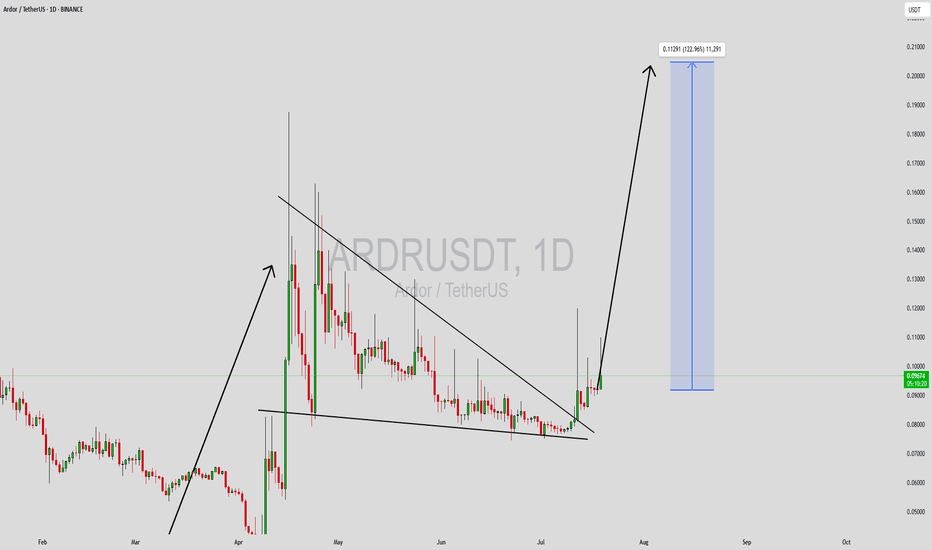

ARDRUSDT Forming Bullish WaveARDRUSDT is currently demonstrating a strong bullish wave pattern, indicating a powerful shift in market momentum. After a period of accumulation, the price has begun to trend upward with higher highs and higher lows forming on the chart. This bullish structure, supported by healthy trading volume, points to increasing confidence among traders and investors. If the pattern continues to hold, we can expect a significant breakout, with potential gains estimated between 90% to 100% in the near term.

The Ardor platform is gaining renewed attention in the blockchain space due to its unique multi-chain architecture and real-world applications, especially in enterprise solutions. As interest in scalable and interoperable blockchain ecosystems grows, ARDR is beginning to surface on more investors’ radars. The technical breakout is aligning well with this growing fundamental support, providing added conviction for bullish traders.

From a trading perspective, the current breakout offers a solid entry opportunity, especially if the price consolidates above recent resistance levels. Traders should watch for volume surges and continuation candles as confirmation of the bullish trend. With strong technical indicators aligning with positive sentiment, ARDRUSDT could become one of the leading performers in the upcoming altcoin rally.

✅ Show your support by hitting the like button and

✅ Leaving a comment below! (What is You opinion about this Coin)

Your feedback and engagement keep me inspired to share more insightful market analysis with you!

ARDRUSDT Forming Bullish BreakoutARDRUSDT is showing a highly promising setup that is catching the eyes of crypto traders looking for the next big breakout. The chart displays a clear structure that suggests a significant move could be imminent. With volume picking up steadily, the pair is indicating strong buyer interest, which supports the potential for a sharp upward surge. The current market sentiment combined with this technical formation points towards a likely bullish continuation that could deliver impressive gains for patient holders.

What makes ARDRUSDT stand out right now is the clear consolidation phase it has been undergoing, which often precedes explosive price action. As traders search for undervalued altcoins, ARDR is increasingly appearing on their radar due to its history of strong price swings and its current attractive technical setup. The market is closely watching the resistance levels, and a confirmed breakout could attract even more momentum-driven buying pressure, potentially driving the price towards the projected gain of 90% to 100%+.

Investors are showing renewed interest in ARDRUSDT because of its strong community support and its role within the blockchain ecosystem. With the broader crypto market stabilizing and altcoins regaining traction, ARDR could benefit from increased capital flow into smaller-cap projects that have room for growth. If the breakout holds with solid volume, this pair could easily outperform many peers in the coming weeks.

✅ Show your support by hitting the like button and

✅ Leaving a comment below! (What is You opinion about this Coin)

Your feedback and engagement keep me inspired to share more insightful market analysis with you!

ARDRUSDT Forming Descending TriangleARDRUSDT is showing a powerful breakout from a descending triangle pattern, indicating a strong bullish reversal in progress. The breakout candle is backed by solid volume, reinforcing the strength of the move and hinting at a potential trend shift. Historically, this pattern signals the end of consolidation and the start of a significant upward rally, especially when confirmed by a volume surge as seen here.

With the price currently above key resistance levels, ARDR is now poised for a sharp move to the upside. The projected gain stands around 90% to 100%+, based on the height of the triangle formation and historical breakout behavior. This makes ARDRUSDT a high-reward setup for swing traders and mid-term holders who are looking for undervalued assets with upside potential in the altcoin space.

The Ardor blockchain project has continued to evolve in the background, with real-world use cases and innovative multi-chain architecture. As the market begins to price in utility-driven growth, coins like ARDR tend to outperform during bullish cycles. Moreover, increased investor interest in lower-cap, fundamentally strong altcoins is starting to reflect in the current price momentum.

Given the technical breakout and rising community engagement, ARDR could attract more attention in the coming days. Keep an eye on this pair as it potentially leads the next wave of altcoin rallies, especially if Bitcoin maintains stability or trends upward.

✅ Show your support by hitting the like button and

✅ Leaving a comment below! (What is You opinion about this Coin)

Your feedback and engagement keep me inspired to share more insightful market analysis with you!

ARDRUSDT: Blue Box Looks Promising!ARDRUSDT: Blue Box Looks Promising! 🚀

Here’s the quick breakdown:

Volume Surge: A 100% daily volume spike—buyers are waking up!

Key Zone: The blue box is shaping up to be a strong potential demand zone.

Next Steps: Waiting for confirmation—bullish market structure breaks on lower time frames or a strong reaction with CDV support.

This setup looks like a great opportunity if conditions align. Patience is key here—don’t chase the move, let the trade come to you.

Boost, comment, and follow for more insights like this! Let’s make it happen! 💪

Let me tell you, this is something special. These insights, these setups—they’re not just good; they’re game-changers. I've spent years refining my approach, and the results speak for themselves. People are always asking, "How do you spot these opportunities?" It’s simple: experience, clarity, and a focus on high-probability moves.

Want to know how I use heatmaps, cumulative volume delta, and volume footprint techniques to find demand zones with precision? I’m happy to share—just send me a message. No cost, no catch. I believe in helping people make smarter decisions.

Here are some of my recent analyses. Each one highlights key opportunities:

🚀 RENDERUSDT: Strategic Support Zones at the Blue Boxes +%45 Reaction

🎯 PUNDIXUSDT: Huge Opportunity | 250% Volume Spike - %60 Reaction Sniper Entry

🌐 CryptoMarkets TOTAL2: Support Zone

🚀 GMTUSDT: %35 FAST REJECTION FROM THE RED BOX

🎯 ZENUSDT.P: Patience & Profitability | %230 Reaction from the Sniper Entry

🐶 DOGEUSDT.P: Next Move

🎨 RENDERUSDT.P: Opportunity of the Month

💎 ETHUSDT.P: Where to Retrace

🟢 BNBUSDT.P: Potential Surge

📊 BTC Dominance: Reaction Zone

🌊 WAVESUSDT.P: Demand Zone Potential

🟣 UNIUSDT.P: Long-Term Trade

🔵 XRPUSDT.P: Entry Zones

🔗 LINKUSDT.P: Follow The River

📈 BTCUSDT.P: Two Key Demand Zones

🟩 POLUSDT: Bullish Momentum

🌟 PENDLEUSDT.P: Where Opportunity Meets Precision

🔥 BTCUSDT.P: Liquidation of Highly Leveraged Longs

🌊 SOLUSDT.P: SOL's Dip - Your Opportunity

🐸 1000PEPEUSDT.P: Prime Bounce Zone Unlocked

🚀 ETHUSDT.P: Set to Explode - Don't Miss This Game Changer

🤖 IQUSDT: Smart Plan

⚡️ PONDUSDT: A Trade Not Taken Is Better Than a Losing One

💼 STMXUSDT: 2 Buying Areas

🐢 TURBOUSDT: Buy Zones and Buyer Presence

🌍 ICPUSDT.P: Massive Upside Potential | Check the Trade Update For Seeing Results

🟠 IDEXUSDT: Spot Buy Area | %26 Profit if You Trade with MSB

📌 USUALUSDT: Buyers Are Active + %70 Profit in Total

🌟 FORTHUSDT: Sniper Entry +%26 Reaction

🐳 QKCUSDT: Sniper Entry +%57 Reaction

📊 BTC.D: Retest of Key Area Highly Likely

This list? It’s just a small piece of what I’ve been working on. There’s so much more. Go check my profile, see the results for yourself. My goal is simple: provide value and help you win. If you’ve got questions, I’ve got answers. Let’s get to work!

#ARDR (SPOT) entry range(0.06350- 0.0685) T.(,10390) SL(,06256)BINANCE:ARDRUSDT

entry range ( 0.06350- 0.06850)

Target1 (0.07590)- Target2 (0.09149) - Target3 (0.10390)

SL .1D close below (0.06256)

**** #Manta ,#OMNI, #DYM, #AI, #IO, #XAI , #ACE #NFP #RAD #WLD #ORDI #BLUR #SUI #Voxel #AEVO #VITE #APE #RDNT #FLUX #NMR #VANRY #TRB #HBAR #DGB #XEC #ERN #ALT #IO #ACA #HIVE #ASTR #ARDR ****

#ARDR/USDT #ARDR

The price succeeded in breaking the bear flag.

At the price of 0.9000. The price trended upward.

after penetrating the Moving Average 100.

The first goal is 0.2000.

The second target is 0.2666

This rise is supported by seven sells on the MACD

But attention must be paid to the correction before completing the ascent.

ardr looking good for 2 3x recovery seems like ardr has already bottomed out and finally preparing for solid gains in midterm

formed text book descending channel and testing its crucial resistance trendline with multi years long horizontal accumulation zone once both got cleared massive recovery can start

incase of successful breakout expecting 200 to 300% bullish wave

#ARDR/USDT#ARDR

The price has chosen the bearish channel to the top and the channel is now being retested again at the 0.0900 level.

We have a higher stability moving average of 100

We have an uptrend on RSI

We also have a bullish incentive from the rise of Bitcoin

Entry price is 0.0900

The first target is 0.1000

The second goal is 0.1086

The third goal is 0.1181

ARDR buy setupGiven the bullish iCH and iBOS, we have a bullish view on ARDR.

We have a liquidity pool above, which is expected to move from the demand range towards this pool.

Closing a 4-hour candle below the invalidation level will invalidate this analysis.

Note that the financial market is risky, so:

Do not enter any position without confirmation and trigger.

Do not enter a position without setting a stop.

Do not enter a position without capital management.

When we reach the first TP, save some profit and try to move the stop continuously in the direction of your profit.

If you have any comments please post them, comments will help us improve our performance

Thanks

ARDR ANALYSIS🔮 #ARDR Analysis 💰💰

🌟🚀 As we can see that there is a formation of Falling Wedge Pattern in #ARDR in 1W time frame. Broken out could lead to a relief rally towards $0.1500 📈📈

🔖Current Price --- $0.0963

🎯Target Price ----- $0.1500

⁉️ What to do?

- We have marked some crucial levels in the chart. We can trade according to the chart and make some profits in #ARDR. 🚀💸

🏷Remember, the crypto market is dynamic in nature and changes rapidly, so always use stop loss and take proper knowledge before investments.

#ARDR #Cryptocurrency #DYOR

ARDR/USDT - Ardor: Trend Reversal◳◱ On the $ARDR/ CRYPTOCAP:USDT chart, the Trend Reversal pattern suggests momentum building up for a significant move. Traders might observe resistance around 0.0966 | 0.1027 | 0.1165 and support near 0.0828 | 0.0751 | 0.0613. Entering trades at 0.092 could be strategic, aiming for the next resistance level.

◰◲ General info :

▣ Name: Ardor

▣ Rank: 303

▣ Exchanges: Binance, Hitbtc

▣ Category/Sector: Infrastructure - Smart Contract Platforms

▣ Overview: Ardor offers a live multi-chain “blockchain as a service” platform based on a revolutionary parent/child chain architecture. This architecture, in combination with 250+ APIs and lightweight smart contracts coded in Java, allows businesses to launch custom blockchains (“child chains”). Each child chain on the Ardor platform can interface with off-chain databases while leveraging the Ardor parent chain’s decentralized network of nodes for energy-efficient proof of stake security.

◰◲ Technical Metrics :

▣ Mrkt Price: 0.092 ₮

▣ 24HVol: 731,043.724 ₮

▣ 24H Chng: 4.903%

▣ 7-Days Chng: 3.49%

▣ 1-Month Chng: 36.47%

▣ 3-Months Chng: 14.53%

◲◰ Pivot Points - Levels :

◥ Resistance: 0.0966 | 0.1027 | 0.1165

◢ Support: 0.0828 | 0.0751 | 0.0613

◱◳ Indicators recommendation :

▣ Oscillators: NEUTRAL

▣ Moving Averages: STRONG_BUY

◰◲ Technical Indicators Summary : BUY

◲◰ Sharpe Ratios :

▣ Last 30D: 2.40

▣ Last 90D: 1.70

▣ Last 1-Y: 0.38

▣ Last 3-Y: 0.44

◲◰ Volatility :

▣ Last 30D: 1.50

▣ Last 90D: 0.98

▣ Last 1-Y: 0.86

▣ Last 3-Y: 1.19

◳◰ Market Sentiment Index :

▣ News sentiment score is N/A

▣ Twitter sentiment score is 0.52 - Bullish

▣ Reddit sentiment score is 0.55 - Bullish

▣ In-depth ARDRUSDT technical analysis on Tradingview TA page

▣ What do you think of this analysis? Share your insights and let's discuss in the comments below. Your like, follow and support would be greatly appreciated!

◲ Disclaimer

Please note that the information and publications provided are for informational purposes only and should not be construed as financial, investment, trading, or any other type of advice or recommendation. We encourage you to conduct your own research and consult with a qualified professional before making any financial decisions. The use of the information provided is solely at your own risk.

▣ Welcome to the home of charting big: TradingView

Benefit from a ton of financial analysis features, instruments and data. Have a look around, and if you do choose to go with an upgraded plan, you'll get up to $30.

Discover it here - affiliate link -

Ardor ARDR Bearish SentimentSeptember has major catalysts for the crypto market as well as for the stock market.

The Ethereum merge on September 6th, that will end on Sept 20, the inflation report on September 13 and the next FOMC meeting afterwards with the new interest rates hike.

That is reflected in the crypto space in general as a bearish outlook.

Ardor ARDR has a negative overall sentiment recently.

I have the following price targets:

ARDR/USDT short

Entry Range: $0.095 - 0.110

Take Profit 1: $0.090

Take Profit 2: $0.0805

Take Profit 3: $0.072

Stop Loss: $0.119

Ardor (ARDR) formed bullish Cypher for upto 19% pumpHi dear friends, hope you are well and welcome to the new trade setup of Ardor (ARDR) coin with US Dollar pair.

Previously we had a nice trade of ARDR:

Now on a 4-hr time frame, ARDR has formed a bullish Cypher pattern.

Note: Above idea is for educational purpose only. It is advised to diversify and strictly follow the stop loss, and don't get stuck with trade.