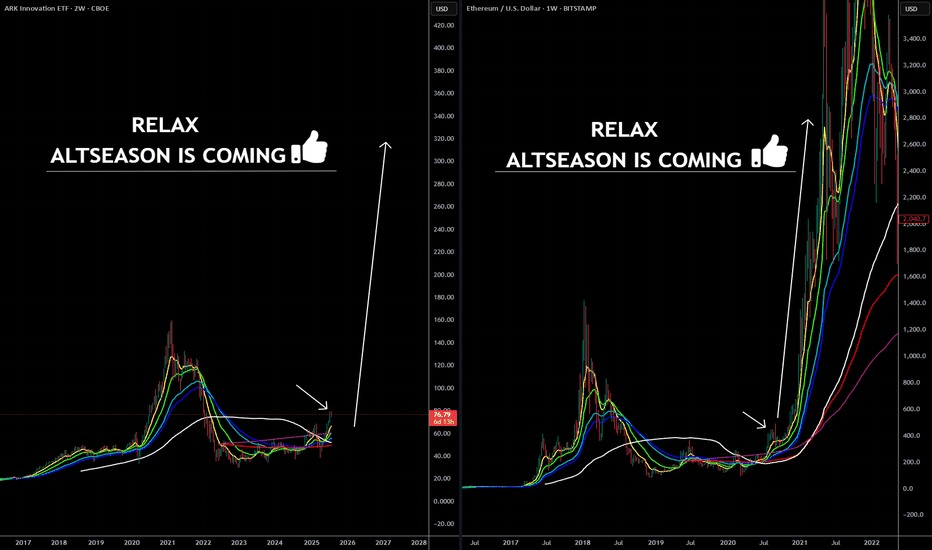

ARKK: The Calm Before the Innovation Storm -ALTSEASON Is COMING🚀 ARKK: The Calm Before the Innovation Storm 🌪️

The markets are shifting, and disruption is about to go vertical. ARK Innovation ETF (ARKK) is quietly positioning itself for what could be the most explosive move of this decade. With high-conviction bets in AI, Bitcoin, genomics, and next-gen tech, this isn’t just a fund—it’s a launchpad for exponential growth.

This post breaks down exactly why ARKK could go parabolic—and why the smart money is already moving in. 👇

Explosive upside in 2026

ARKK is already up over 24% YTD , showing strong momentum compared to broader markets and signaling early stages of a potential parabolic move .

High-conviction concentration in game-changers

Top 10 holdings include Tesla, Roku, Zoom, Coinbase, UiPath, Block, Crispr Therapeutics, DraftKings, Shopify, and Exact Sciences. These are leaders in innovation sectors with massive upside potential .

Deep exposure to Bitcoin and digital assets

Heavy allocation to Coinbase and Block gives indirect exposure to Bitcoin . If BTC breaks into a new cycle high , ARKK stands to benefit significantly.

Positioned in exponential growth sectors

Focus on AI, genomics, EVs, fintech, robotics, and blockchain , all of which are entering accelerating adoption phases globally.

Aggressive smart-money accumulation

Cathie Wood’s team continues buying aggressively during dips, reinforcing institutional confidence in the fund’s long-term trajectory.

Technical breakout structures forming

Ascending triangle and multi-month consolidation breakouts suggest a technical setup primed for explosive upside .

Innovation supercycle aligning

ARKK's themes are aligned with major global shifts like de-dollarization, decentralized finance, and AI convergence .

High beta = massive upside leverage

With a beta above 2 , ARKK tends to outperform in bull runs , offering leveraged exposure to innovation without the need for margin.

Resurgence of top holdings

Names like Coinbase, Tesla, Shopify, and Roku are up 50%–100% YTD , driving ARKK’s NAV growth and fueling bullish sentiment .

Long-term vision with short-term catalysts

The fund projects 5x returns over the next five years , while Bitcoin halving cycles, tech innovation, and regulatory clarity serve as short-term ignition points .

Marty Boots | 17-Year Trader — smash that 👍👍, hit LIKE & SUBSCRIBE, and share your views in the comments below so we can make better trades & grow together!

Arkinnovation

ARK Innovation. Granny Wood is Back — What She's Brewing..?!Hooray! Granny Wood 👵 is roaring back!

Well, here we are, The @PandorraResearch Team, to discuss what Ma'am Wood is brewing, since the epic things are almost there!

In a nutshell, Cathie Wood is an American investor and founder, chief executive officer (CEO), and chief investment officer (CIO) of Ark Invest, an investment management firm.

Her flagship ARK Innovation exchange-traded fund - AMEX:ARKK ETF has received accolades for its performance in 2017, 2020 and 2023, but is also considered by Morningstar to be the third highest "wealth destroyer" investment fund from 2014–2023, losing US$7.1 billion of shareholder value in ten years.

Overview of the ARK Innovation ETF AMEX:ARKK

The ARK Innovation ETF (ARKK), managed by ARK Investment Management and led by Cathie Wood, focuses on investing in companies that are at the forefront of "disruptive innovation." This term encompasses technologies that have the potential to significantly alter industries and consumer behaviors. The fund primarily targets sectors such as genomics, automation, AI, and energy, aiming for long-term capital appreciation.

Current Performance Metrics

As of January 31, 2025, ARKK is priced at approximately $64.50, reflecting a 1.53% increase on that day.

Over January 2025 ARKK has demonstrated a bold return of about 13.60%, following a volatile period marked by significant fluctuations in value. Notably, that ARKK's performance over January 2025 shows a stark contrast with U.S. stock market benchmarks (just compare - S&P500 Index SP:SPX demonstrates nearly +4% return so far in 2025 while Nasdaq Composite Index NASDAQ:IXIC has added just around 3% in first month of 2025).

ARKK Fundamental Analysis

Investment Strategy. ARKK employs an actively managed approach, focusing on companies that are leaders or enablers of innovation. The fund's strategy combines both top-down and bottom-up research to identify high-potential stocks across various sectors.

Sector Exposure. The ETF is heavily weighted towards technology and healthcare sectors, with significant investments in companies involved in AI and biotechnology. For instance, Tesla is often highlighted as a major holding due to its advancements in autonomous driving technology.

Technical Outlook

The technical outlook for ARKK shows signs of recovery and epic 200-week SMA Bullish breakthrough after a challenging period from late 2021 through much of 2023. The ETF has rebounded from lows around $36.85 in August 2024 to recent highs near $64.50 in January 2025, indicating a potential bullish trend if momentum continues.

Support and Resistance Levels

Support Level. Approximately $60.00 (recent low that corresponds to current 200-week SMA value)

Resistance Level. Approximately $71.50 (3-years high)

These levels will be critical for traders watching for potential supports or reversals.

Market Sentiment

Investor sentiment surrounding ARKK remains mixed due to its historical volatility and speculative nature. While some investors view it as an opportunity to capitalize on innovation-driven growth, others express caution due to its past performance dips and high-risk profile associated with its concentrated holdings.

Conclusion

The ARK Innovation ETF presents a compelling case for investors interested in disruptive technologies and long-term growth potential. However, its inherent volatility and the concentrated nature of its holdings necessitate careful consideration before investing. As the market continues to evolve with advancements in AI and other technologies, ARKK may offer significant upside momentum now, but also comes with considerable potential risk.

$ARKK Inverse Head & Shoulders PatternThe ARK Innovation ETF ( AMEX:ARKK ) is currently displaying an inverse head and shoulders pattern on its chart, a formation typically indicative of a potential bullish reversal. However, for this pattern to remain valid, it's crucial that AMEX:ARKK does not close below the key level of $34.72 on a weekly basis. A weekly close below this price point would invalidate the pattern, suggesting a potential shift or continuation of the bearish trend.

ARKK - Still looks concerningHello friends, today you can review the technical analysis idea on a 1D linear scale chart for ARK Innovation ETF (ARKK).

The chart is self-explanatory. I have been providing warnings since December 2021 so I hope you followed along.

If you enjoy my ideas, feel free to like it and drop in a comment. I love reading your comments below.

Disclosure: This is just my opinion and not any type of financial advice. I enjoy charting and discussing technical analysis . Don't trade based on my advice. Do your own research! #millionaireeconomics

ARK Worth investing into this long-term Bullish DivergenceThe ARK Innovation ETF (ARKK) has been holding the 33.30 Support since the October 10 1W candle. As shown on this 1W time-frame, this is the Support that was formed on the March 16 2020 low during the COVID crash.

Perhaps the most important development here is that, while the price has been on Lower Lows since June 13, the 1W RSI has been on Higher Lows, flashing a huge Bullish Divergence. Holding the 30.30 Support is a strong signal that the market may have bottomed and a strong rebound is about to begin.

The first Resistance is the 1W MA50 (blue trend-line) and the Q1 target for us is the 1D MA200 (orange trend-line), which had the last major rejection on ARK (March 28). It is interesting to observe how strong Resistance (and Support) levels the Fibonacci lines have formed during this 2 year correction, especially in the upper bands. They can be used as targets later on after the 1W MA50 and MA200 break.

-------------------------------------------------------------------------------

** Please LIKE 👍, SUBSCRIBE ✅, SHARE 🙌 and COMMENT ✍ if you enjoy this idea! Also share your ideas and charts in the comments section below! This is best way to keep it relevant, support me, keep the content here free and allow the idea to reach as many people as possible. **

-------------------------------------------------------------------------------

You may also TELL ME 🙋♀️🙋♂️ in the comments section which symbol you want me to analyze next and on which time-frame. The one with the most posts will be published tomorrow! 👏🎁

-------------------------------------------------------------------------------

💸💸💸💸💸💸

👇 👇 👇 👇 👇 👇

ARKK fund price targetsWith investors moving from growth stocks to the safest dividend paying sector companies, the ARKK fund finds itself in a difficult position.

Once the interest rates go higher and money will be harder to borrow, my price targets from this ETF are $60, respectively $49 by the end of Q2.

Looking forward to read your opinion about it.

ARKK ARK Innovation: 1D Chart ReviewHello friends, today you can review the technical analysis idea on a 1D linear scale chart for ARK Innovation ETF (ARKK).

The chart is self-explanatory. The price is currently in a Descending Parallel Channel with the RSI oversold so there may be a short term upward price movement, however the overall trend is still down. I put in multiple support lines to keep an eye on. If price moves back up, expect the areas I noted as major resistance areas.

Included in the chart: Trend line, Support and Resistance Lines, Volume, RSI, MFI ( Money Flow Index), Descending Parallel Channel.

If you enjoy my ideas, feel free to like it and drop in a comment. I love reading your comments below.

Disclosure: This is just my opinion and not any type of financial advice. I enjoy charting and discussing technical analysis . Don't trade based on my advice. Do your own research! #cryptopickk

SARK The Most Profitable ETF !!If you haven`t bought SARK at the beginning of this year:

Then you should know that SARK or The Tuttle Capital Short Innovation ETF offers investors access to a short vehicle that may otherwise be difficult to execute on their own.

The fund attempts to achieve the inverse (-1x) of the return of the ARK Innovation ETF for a single day, not for any other period.

Looking forward to read your opinion about it.

Ark Innovation ETF Analysis 10.12.2021Hello Traders,

welcome to this free and educational analysis.

I am going to explain where I think this asset is going to go over the next few days and weeks and where I would look for trading opportunities.

If you have any questions or suggestions which asset I should analyse tomorrow, please leave a comment below.

If you enjoyed this analysis, I would definitely appreciate it, if you smash that like button and maybe consider following my channel.

Thank you for watching and I will see you tomorrow!

ARKK Ark Innovation ETF: Short TermHello friends, today I am completing a technical analysis on the 1D linear scale chart for Ark Innovation ETF ( ARKK ) led by Cathie Wood.

#CryptoPickk notes the following:

1) Ark Innovation has had a great run from 2020 into early 2021 when the ETF made an all time high. Since that point, it has been correcting.

2) Since the all the high, the price has been ranging within a multi-month triangle pattern, which it recently broke down from.

3) Since this was a Symmetrical Triangle, measurement from the top to the bottom of the triangle shown in the yellow line was taken to estimate a measured move.

4) The pattern breakdown, shows a target price around the $75-85 range before the next possible pattern may begin.

5) This also falls in line with the Fibonacci Retracement level of 0.382 which is around $81.

6) Since the RSI (relative strength index) is heavily oversold at this point, the price may have a relief rally or a dead cat bounce before moving lower to the target price. Usually the dead cat bounce occurs around the 0.786 Fib level shown in the cyan color Fibonacci Retracement.

7) The Volume is strong so expect volatility.

8) Short term for ARKK is not looking great, but neither is the entire stock market so let's see where this one is headed.

What are your opinions on this?

If you enjoy my ideas, feel free to like it and drop in a comment. I love reading your comments below.

Disclosure: This is just my opinion and not any type of financial advice. I enjoy charting and discussing technical analysis . Don't trade based on my advice. Do your own research! #cryptopickk

ARKK 1D - Golden Cross Coming UpARK Innovation ETF (ARKK) led by Cathie Wood is shown a possible near break of the triangle with a possible golden cross on the MA coming up very soon. I plotted fib levels to see how I we can possibly go. There has been consolidation since March 2021. It seems that a breakout is coming very soon.

What are your opinions on this? Comment below, hit the like and follow me. Thank you!

Check out more below for recent Altcoin, Bitcoin and Stock Ideas.

Disclosure: This is just my opinion and not any type of financial advice. I enjoy charting and discussing technical analysis . Don't trade based on my advice. Do your own research! #cryptopickk #bitcoin #altcoins

ARK Innovation ETF Fund Can Breakout To The UpsideTraders, There is a lot of media ta the moment talking about Cathie Wood's ARKK ETF reportedly seeing record short interest as investors turn against the fund. However if you look at the charts, they tell you a little different story. In fact of the short positions story is correct, we might see a short squeeze.

The price is right at the breakout point and from this level, it can move to much levels in the fcp zone. So watch the current levels and look for indications on the chart.

Rules:

1. Never trade too much

2. Never trade without a confirmation

3. Never rely on signals, do your own analysis and research too

✅ If you found this idea useful, hit the like button, subscribe and share it in other trading forums.

✅ Follow me for future ideas, trade set ups and the updates of this analysis

✅ Don't hesitate to share your ideas, comments, opinions and questions.

Take care and trade well

-Vik

____________________________________________________

📌 DISCLAIMER

The content on this analysis is subject to change at any time without notice, and is provided for the sole purpose of education only.

Not a financial advice or signal. Please make your own independent investment decisions.

____________________________________________________

ARK - Bring Investors along with Investment "Themes" - Eat ThemDeep Learning, Data Center Paradigm Shift, Digital Wallets, Virtual Worlds,

Bitcoin Transition, EV's, Autonomy, AeroSpace, SLA (aka 3D Printing) and

Genome Science.

To ARK's credit - Transparency is not an issue, providing relevant and

timely information to Investors is a large "Chit" in CW's corner.

To ARK's debit - Youth, relatively new to Investing has adopted the

TESLA Witch without prior knowledge of Events of the Fourth Kind.

Ignorance of previous TTIDs is no excuse for remorse.

Kathy speaks well to the DOTCOM Era rehash, she is, after all, well spoken.

And yet so were a great many during the DOTCON Era, the similarities are

astounding frankly.

She reminds me of a younger, more aggressive Jim Crammer.

Very few remember Jimmy blowing up his own Hedge Fund, instead their

timeline appears to begin an end with "Mad Money" - the Money Honey, Joey K,

etal into the Becky Q / Warren Buffet love affair.

The frenzy can be illustrated by ARKs Capital Under Management - ARK grew

50% in just shy of Six Months.

Passive/Aggressive Investors tossed loads of Capital into ARKs pond.

I've watched Kuh Kuh Cathy invest in some extremely risky Small Caps from Israel

for the purpose of simply creating a chase.

ARK is exceptional at this strategy - and why they are only too pleased to provide

timely updates to their Portfolio adjustments... They create a chase outside the fund.

"I'll just follow Kuh Kuh and buy what she buys - but on my own account, no need to pay

fees when she is guide."

Kuh Kuh's strategy of concentration worked until it did not as there is only so much Junk

one can buy, she became a primary Seller as chasers became late entries or "Disrupters"

to her Strategy.

Smaller, less liquid stocks are outsized positions in ARK's Innovation Fund as well as her

stable of Funds.

Simply put - Kuh Kuh has become the Egg Man.

ARK trapped itself, a post-DotCom Ponzi which has experienced its own disruption

as the Innovation's Fund Share price took a very large clipping.

The first rules of investing - Kuh Kuh thought she was smarter than basic math.

Investing in high-growth, over-valued, hyper sensitive Small Cap Tech has never been

a diverse strategy, it is one of concentration and immense Risk.

Market rotations only serve to compound the Price destruction.

Stable swapped for Speculative... is not management, it is Degenerate Gambling.

Kuh Kuh's Management fees are 25X competitors.

Look before you leap passive/aggressive, Kuh Kuh eats her own.

Will Tesla hold?...A weekly chart of TSLA will show us the longer term trend, which fate could be tested at the $550 level, which is coincidental with the 61.8% Fibonacci Retracement, a break below this level suggests the next target on the downside is $330 approximately.

There is a slight divergence with the RSI, when you take a look at the last bottom. (Bearish)

I will be keeping this on a close watch.

BFLY HITTING SUPPORT - $20 PRICE TARGETBFLY - Current Price $ 10.23 Price Target (short-term) $12.50 Long Term $20

This company created an Ultra sound that is hand held and can give you the same images and accuracy as the ones in use in the USA. The best part about the innovation is the cost reduction. These cost under 3k while most ultra sounds cost a million +. This innovative tech will be used to bring this technology to poorer developing countries. Just reported $0.57 EPS last quarter on an annual basis that would be a PE of 4.5x which is cheap given the growth prospects for this company. Looks great on the chart as we are seeing a double bottom off that $9.80 level. Long shares and calls here.