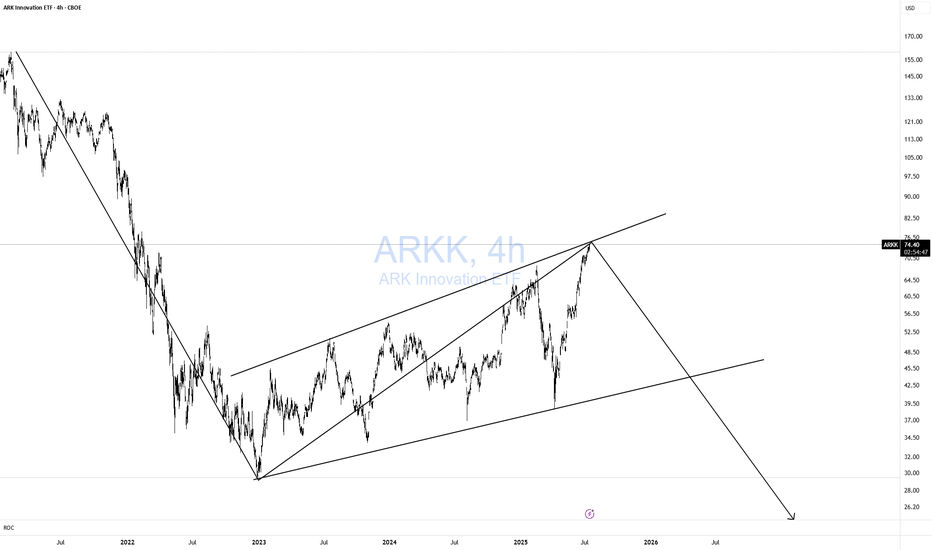

ARKK DOOMED!Classic 123 wave move down! As I like to say Short when no one else is looking! Not when everyone is looking. TOO LATE!

Simple but very effective pattern with excellent risk-reward. Remember, I am a macro trader, so don't expect to see a return on this investment tomorrow.

I won't get into the macro stuff.

ARKK

ARKK: when a breakout isn’t just a breakout-it’s a runway to $91On the weekly chart, ARKK has broken out of a long-standing ascending channel, ending a year-long consolidation phase. The breakout above $71.40, with a confident close and rising volume, signals a transition from accumulation to expansion. The move came right after a golden cross (MA50 crossing MA200), further confirming institutional interest. Price has already cleared the 0.5 and 0.618 Fibonacci retracements — and the 1.618 extension points to $91.40 as the next technical target.

Momentum indicators like MACD and stochastic remain bullish with room to run. Volume profile shows low supply above $75, which could fuel an acceleration toward the target zone.

Fundamentally, ARKK remains a high-beta, high-risk vehicle — but one with focus. The ETF is positioned around next-gen tech: AI, robotics, biotech, and automation. Assets under management now exceed $9.3B with +$1.1B net inflow in 2025. YTD return stands at 37%, and its top holdings (TSLA, NVDA, COIN) are back in favor. This isn’t just a bet on innovation — it’s diversified exposure to a full-blown tech rally.

Tactical setup:

— Entry: market $69.50 or on retest

— Target: $80.21 (1.272), $91.40 (1.618 Fibo)

Sometimes a breakout is just technical. But when there’s volume, a golden cross, and billions backing it — it’s a signal to buckle up.

ARKUSDT: A Green Beacon in a Red Sea? ARKUSDT: A Green Beacon in a Red Sea? 💹

While everything else seems to be sinking, ARKUSDT stands a chance to stay green. However, let’s not get overly optimistic just yet. The green box below is a potentially safer entry zone , depending on market conditions.

Here’s the game plan:

Green Box: A solid area for entries if the market aligns.

Confirmation Required: Always wait for low time frame (LTF) structure breaks before making a move.

Stay sharp, manage your risk, and let the charts guide you. Boost, comment, and follow for more trading insights! 🚀

Let me tell you, this is something special. These insights, these setups—they’re not just good; they’re game-changers. I've spent years refining my approach, and the results speak for themselves. People are always asking, "How do you spot these opportunities?" It’s simple: experience, clarity, and a focus on high-probability moves.

Want to know how I use heatmaps, cumulative volume delta, and volume footprint techniques to find demand zones with precision? I’m happy to share—just send me a message. No cost, no catch. I believe in helping people make smarter decisions.

Here are some of my recent analyses. Each one highlights key opportunities:

🚀 GMTUSDT: %35 FAST REJECTION FROM THE RED BOX

🎯 ZENUSDT.P: Patience & Profitability | %230 Reaction from the Sniper Entry

🐶 DOGEUSDT.P: Next Move

🎨 RENDERUSDT.P: Opportunity of the Month

💎 ETHUSDT.P: Where to Retrace

🟢 BNBUSDT.P: Potential Surge

📊 BTC Dominance: Reaction Zone

🌊 WAVESUSDT.P: Demand Zone Potential

🟣 UNIUSDT.P: Long-Term Trade

🔵 XRPUSDT.P: Entry Zones

🔗 LINKUSDT.P: Follow The River

📈 BTCUSDT.P: Two Key Demand Zones

🟩 POLUSDT: Bullish Momentum

🌟 PENDLEUSDT.P: Where Opportunity Meets Precision

🔥 BTCUSDT.P: Liquidation of Highly Leveraged Longs

🌊 SOLUSDT.P: SOL's Dip - Your Opportunity

🐸 1000PEPEUSDT.P: Prime Bounce Zone Unlocked

🚀 ETHUSDT.P: Set to Explode - Don't Miss This Game Changer

🤖 IQUSDT: Smart Plan

⚡️ PONDUSDT: A Trade Not Taken Is Better Than a Losing One

💼 STMXUSDT: 2 Buying Areas

🐢 TURBOUSDT: Buy Zones and Buyer Presence

🌍 ICPUSDT.P: Massive Upside Potential | Check the Trade Update For Seeing Results

🟠 IDEXUSDT: Spot Buy Area | %26 Profit if You Trade with MSB

📌 USUALUSDT: Buyers Are Active + %70 Profit in Total

🌟 FORTHUSDT: Sniper Entry +%26 Reaction

🐳 QKCUSDT: Sniper Entry +%57 Reaction

📊 BTC.D: Retest of Key Area Highly Likely

This list? It’s just a small piece of what I’ve been working on. There’s so much more. Go check my profile, see the results for yourself. My goal is simple: provide value and help you win. If you’ve got questions, I’ve got answers. Let’s get to work!

ARK Innovation. Granny Wood is Back — What She's Brewing..?!Hooray! Granny Wood 👵 is roaring back!

Well, here we are, The @PandorraResearch Team, to discuss what Ma'am Wood is brewing, since the epic things are almost there!

In a nutshell, Cathie Wood is an American investor and founder, chief executive officer (CEO), and chief investment officer (CIO) of Ark Invest, an investment management firm.

Her flagship ARK Innovation exchange-traded fund - AMEX:ARKK ETF has received accolades for its performance in 2017, 2020 and 2023, but is also considered by Morningstar to be the third highest "wealth destroyer" investment fund from 2014–2023, losing US$7.1 billion of shareholder value in ten years.

Overview of the ARK Innovation ETF AMEX:ARKK

The ARK Innovation ETF (ARKK), managed by ARK Investment Management and led by Cathie Wood, focuses on investing in companies that are at the forefront of "disruptive innovation." This term encompasses technologies that have the potential to significantly alter industries and consumer behaviors. The fund primarily targets sectors such as genomics, automation, AI, and energy, aiming for long-term capital appreciation.

Current Performance Metrics

As of January 31, 2025, ARKK is priced at approximately $64.50, reflecting a 1.53% increase on that day.

Over January 2025 ARKK has demonstrated a bold return of about 13.60%, following a volatile period marked by significant fluctuations in value. Notably, that ARKK's performance over January 2025 shows a stark contrast with U.S. stock market benchmarks (just compare - S&P500 Index SP:SPX demonstrates nearly +4% return so far in 2025 while Nasdaq Composite Index NASDAQ:IXIC has added just around 3% in first month of 2025).

ARKK Fundamental Analysis

Investment Strategy. ARKK employs an actively managed approach, focusing on companies that are leaders or enablers of innovation. The fund's strategy combines both top-down and bottom-up research to identify high-potential stocks across various sectors.

Sector Exposure. The ETF is heavily weighted towards technology and healthcare sectors, with significant investments in companies involved in AI and biotechnology. For instance, Tesla is often highlighted as a major holding due to its advancements in autonomous driving technology.

Technical Outlook

The technical outlook for ARKK shows signs of recovery and epic 200-week SMA Bullish breakthrough after a challenging period from late 2021 through much of 2023. The ETF has rebounded from lows around $36.85 in August 2024 to recent highs near $64.50 in January 2025, indicating a potential bullish trend if momentum continues.

Support and Resistance Levels

Support Level. Approximately $60.00 (recent low that corresponds to current 200-week SMA value)

Resistance Level. Approximately $71.50 (3-years high)

These levels will be critical for traders watching for potential supports or reversals.

Market Sentiment

Investor sentiment surrounding ARKK remains mixed due to its historical volatility and speculative nature. While some investors view it as an opportunity to capitalize on innovation-driven growth, others express caution due to its past performance dips and high-risk profile associated with its concentrated holdings.

Conclusion

The ARK Innovation ETF presents a compelling case for investors interested in disruptive technologies and long-term growth potential. However, its inherent volatility and the concentrated nature of its holdings necessitate careful consideration before investing. As the market continues to evolve with advancements in AI and other technologies, ARKK may offer significant upside momentum now, but also comes with considerable potential risk.

Full ARKK Reverse Gamma Scalping PositionThe basic essence of reverse gamma scalping is to do additive and subtractive delta adjustments over time to keep delta fairly neutral so that theta can do its dirty work.

Shown here is my full ARKK position that started as a delta neutral iron condor to which (a) I layered in an additional iron condor as a delta adjustment trade; (b) mixed and matched profitable put side with profitable call side to reduce units and/or risk; and (c) did an additive long delta short put vertical as a delta adjustment. Rather than continue showing each of these additive/subtractive delta adjustments as separate trades, I'm setting out the full banana here.

I've collected a net 3.22 in credits on a buying power effect of 11.78, and the position has a delta/theta ratio of -2.09/6.00. With 36 days to go, I'll primarily look at doing profitable subtractive adjustments first; then additive ones.

Opening (IRA): ARKK Feb 21st 45/50/61/66 Iron Condor... for a 1.43 credit.

Comments: An additive delta adjustment trade. With the short call of the setup I put on Friday (See Post Below) at -20 delta and the short put at 29, layering in an iron condor with the short call at the -28 delta and the short put at the 20 delta to flatten out net delta of the entire position. This is skewed slightly short to offset the slightly long delta skew of the setup I put on Friday, so am indicating that it's "short."

Metrics:

Max Profit: 1.43

Buying Power Effect: 3.57

ROC at Max: 40.06%

50% Max: .72

ROC at 50% Max: 20.03%

Since you can't close out an eight-legged setup, will either look to take off each iron condor individually at 50% max or mix and match profitable call side with profitable put side to reduce units/risk running into expiry.

Opening (IRA): ARKK February 21st 47/52/63/68 Iron Condor... for a 1.50 credit.

Comments: High IVR/IV. Doing a little delta neutral premium-selling stuff while I hand sit and wait for stuff to come in/be managed.

Metrics:

Max Profit: 1.50

Buying Power Effect: 3.50

ROC at Max: 42.9%

50% Max: .75

ROC at 50% Max: 21.4%

Will generally look to take profit at 50% max, roll in untested side on side test.

ARKK potential Breakout to 66 - 70s before new year !After an impressive climb, ARKK’s price has paused near $56.21, forming a classic bull flag pattern. This is a textbook signal: a strong initial rally followed by sideways consolidation, often hinting at continuation in the direction of the previous trend. The trendlines reveal the ETF is compressing, building energy like a coiled spring.

The moving averages are lined up perfectly for bulls. The short-term yellow moving average is trending well above the long-term blue one, confirming the strength of the upward momentum. This tells us the battle-tested bulls are still in control, with the bears retreating to lower ground.

The RSI is sitting at 70.14, signaling strength. While some might see it as "overbought," seasoned traders know this is where momentum players thrive. The ETF’s ability to hold this level without significant pullbacks shows strong buying interest from institutions and retail traders alike. It’s like a crowd gathering behind the archer, ready to release the bowstring.

The MACD histogram is glowing green, reinforcing the narrative that buyers are still active. As the histogram bars hold steady, there’s no sign yet of the bears staging a comeback. At this point, ARKK is testing the $58.38 resistance level, a successful breakout could launch ARKK toward its next resistance levels at $61.85 and $67.20, offering a significant upside for traders who act decisively.

Target Levels:

First target: $61.85

Second target: $67.20

Stop-Loss: Place a stop-loss just below $52.32 , the key support zone, to protect against sudden reversals.

As an options trader, I’ve entered the following positions:

ARKK December 20, 2024, $70 call at a premium of $0.12 (open).

ARKK December 20, 2024, $66 call at a premium of $0.24 (open).

#AR/USDT#AR

The price is moving in a descending channel on the 4-hour frame and is holding it tightly and is about to break out to the upside

We have a bounce from the lower limit of the channel at 17.70

We have a bearish trend for the RSI that is about to break out, which supports the upside

We have a trend to stabilize above the 100 moving average

Entry price 18.40

First target 20.50

Second target 22.22

Third target 24.95

Opening (IRA): ARKK October 18th 36/43/43/50 Iron Fly... for a 3.68 credit.

Comments: >35% IV. Doing a smidge of nondirectional here in ARKK, which is toward the top of my ETF board for 30-day IV behind BITO, TQQQ, and SMH (which I already have positions in). Structuring this as a risk one to make one, which is what I like to see out of these.

Metrics:

Buying Power Effect: 3.32

Max Profit: 3.68

ROC at Max: 110.84%

25% Max: .92

ROC at 25% Max: 27.71%

Will look to take profit at 25% max. These generally aren't managed intraexpiry; they work or they don't ... .

🔀 Bang Bang. Zoom Hit The Ground. Bang Bang. Bears Shot It DownZoom company's video-conferencing service became so ubiquitous during the Covid-19 pandemic that its corporate name became a verb describing the act of firing up a video chat to connect with coworkers online.

Zoom shares VIE:ZOOM rose seven-fold in 2020 as sales surged after millions of workers were stuck at home because of COVID-19 restrictions. By 2021, though, revenue growth slowed, and the stock plunged. The company has shed at least $100 billion in market value since then.

Meanwhile over the past two years, the stock has stagnated because Zoom's video-conferencing service is needed less as businesses continue pushing staff back to the office.

Zoom, one of the main enablers and beneficiaries of remote work, in August 2023 has asked its employees to head back to the office. The company announced that employees living within 50 miles of a Zoom office must work there at least two days a week.

"We believe that a structured hybrid approach – meaning employees that live near an office need to be onsite two days a week to interact with their teams – is most effective for Zoom," a spokesperson said in a statement. "As a company, we are in a better position to use our own technologies, continue to innovate, and support our global customers."

As pandemic Covid-19 is over, many other companies have announced return-to-office mandates, but Zoom's change of heart is surprising given the role its technology plays in remote work. The company's video-conferencing service became so ubiquitous during the pandemic that its corporate name became a verb describing the act of firing up a video chat to connect with coworkers online.

People are back to Travelling. The annual graph for NYSE:RPM , Revenue Passenger Miles for U.S. Air Carrier Domestic and International, Scheduled Passenger Flights.

Meanwhile, there're some important things to say.

Warren Buffett's 99-year-old business partner, Charlie Munger, was surprisingly embraced Zoom during the pandemic. Eric Yuan, the founder and CEO of the video-conferencing platform, celebrated the veteran investor's endorsement of his product on an earnings in 2021.

"I have fallen in love with Zoom," Munger, the vice-chairman of Berkshire Hathaway, said in a CNBC interview filmed at Berkshire's annual shareholder meeting in May, 2021.

"Zoom is here to stay. It just adds so much convenience."

• Munger added that he struck a deal in Australia using the communications tool. He trumpeted its prospects at Daily Journal's annual meeting in February, 2021 as well.

• When the pandemic is over, I don't think we're going back to just the way things were," the newspaper publisher's chairman said.

• We're going to do a lot less travel and a lot more Zooming.

Charlie loves Zoom and uses it frequently for business and to keep in touch with his family, as it's difficult for him to travel.

His business advice was to build a better product or offer a better solution, that it's all about competition, and that successful people are those with the acumen to understand life better than everyone else. He said it's up to you to work harder and better than the next person.

Charlie also said investments are better than money in the bank, and it's important to go to the office to work in person.

The main graph says, Zoom equities just hit the major all history ground support near $59 per share.

Market 101:From the Drama King VIX to the Steady Eddie UtilitiesVolatility Index (VIX) - The Drama King

Let’s kick things off with the Volatility Index, aka the market’s drama king. It’s like that one friend who always makes a big deal out of nothing—spiking dramatically whenever the market so much as sneezes. Recently, it shot up faster than a caffeine-fueled trader on Monday morning, but now it’s calming down a bit, hovering around 20.73. Keep an eye on this guy—he’s always a sign of market anxiety like I said, the the fear gauge. If he starts climbing again, it might be time to batten down the hatches.

Utilities Sector (XLU) - The Steady Eddie

Moving on to the Utilities sector, which is the market’s equivalent of your reliable, always-on-time friend. XLU has been climbing steadily, but just like every other reliable person, it needs a break sometimes. It’s currently chilling around 76.20, looking like it’s taking a well-deserved breather. Nothing too exciting here, but that’s exactly what you want from Utilities—slow and steady wins the race.

ARK Innovation ETF (ARKK) - The Wild Child

Now, let’s talk about ARKK—Cathie Wood’s wild child. This chart is like a rollercoaster at an amusement park: up, down, up, down, and sometimes you’re not sure if you should scream or cheer. After some wild moves, ARKK is sitting around 42.98, but don’t be surprised if it decides to take another loop-de-loop soon. Just remember to strap in and hold on tight.

Technology Sector (XLK) - The Overachiever

Next up, the Technology sector, which has been the market’s overachiever for quite some time. XLK had been climbing like it’s trying to win the market’s gold star, but recently it’s hit a bit of a speed bump, pulling back to 210.28. No worries though—this sector is like that student who’s always doing extra credit. It’ll likely bounce back in no time, probably while giving the rest of the market a lesson in resilience.

Consumer Discretionary Sector (XLY) - The Big Spender

Finally, we’ve got the Consumer Discretionary sector, which is the market’s big spender. XLY has been on a shopping spree, but it looks like it might be hitting the credit limit soon. The chart shows some clear support around 184.61, but if it breaks below this, we might see some belt-tightening ahead. Keep an eye on it—everyone loves a spender until the bill comes due.

Summary: From the dramatic spikes of the VIX to the steady climb of Utilities, each of these charts has its own personality. Whether you’re dealing with the rollercoaster that is ARKK or the disciplined overachiever in Technology, there’s always something to learn from the market’s diverse cast of characters. Stay sharp, keep your sense of humour and energy, and remember: in the markets, as in life, it’s all about balance.

Opening (IRA): ARKK Sept 20th 38 Covered Call... for a 36.93 debit.

Comments: High IVR/IV (77.6/43.3). Selling the -75 call against long stock to emulate the delta metrics of a 25 delta short put, but with the built-in defense of the short call.

Metrics:

Break Even/Buying Power Effect: 36.93

Max Profit: 1.07 ($107)

ROC at Max: 2.90%

50% Max: .54

ROC at 50% Max: 1.45%

Innovation, Robots, Tech, Applied Tech Will SkyrocketI thought I would share some of my research for everyone to review.

Most of my work involves deep analysis of the markets related to shifting capital function, core fundamental dynamics, and future opportunities.

If you are following my SPY Cycle Patterns videos (the Plan Your Trade videos) - you already know how powerful my predictive models are.

Now, I'm sharing with you my belief that ignored, undervalued, and overlooked stocks/sectors are about to explode - and there are hundreds of symbols available for you to consider related to this move.

One of the most significant moves in 2025 and beyond will be the resurgence of innovation, robotics, technology, and applied functions related to the current/past technology boom. This is the 1990s (again) - leading to the second growth phase in new applications related to improved AI/tech capabilities.

You can profit from it if you take steps to prepare for the next 24+ months right now. All you have to do is watch this video, learn why I believe these will be some of the biggest movers over the next 24+ months, and then make your own decisions about what to trade.

Follow my research. My goal is to make you a better trader.

Right now, and for the next 7+ years, the markets will be the greatest opportunity of your life.

#AR/USDT#AR

The price is moving in a bearish channel on a 4-hour frame and is holding it strongly and is about to break it upward

We have a bounce from the green support area at 23.00

We have a tendency to stabilize above the Moving Average 100

We have a downtrend on the RSI indicator that is about to break higher and supports the rise

Entry price is 24.00

The first goal is 31.11

The second goal is 35.77

The third goal is 41.30

Opening (IRA): ARKK July 19th 41 Monied Covered Call... for a 39.64 debit.

Comments: After taking off my 44 monied for a small profit, re-upping with a setup in the same expiry, but with a better break even. Selling the -75 call against a one lot of stock to emulate the delta metrics of a 25 delta short put, but with built-in short call defense.

Metrics:

Buying Power Effect/Break Even: 39.64

Max Profit: 1.36

ROC at Max: 3.43%

ROC at 50% Max: 1.72%

Will generally look to take profit at 50% max.