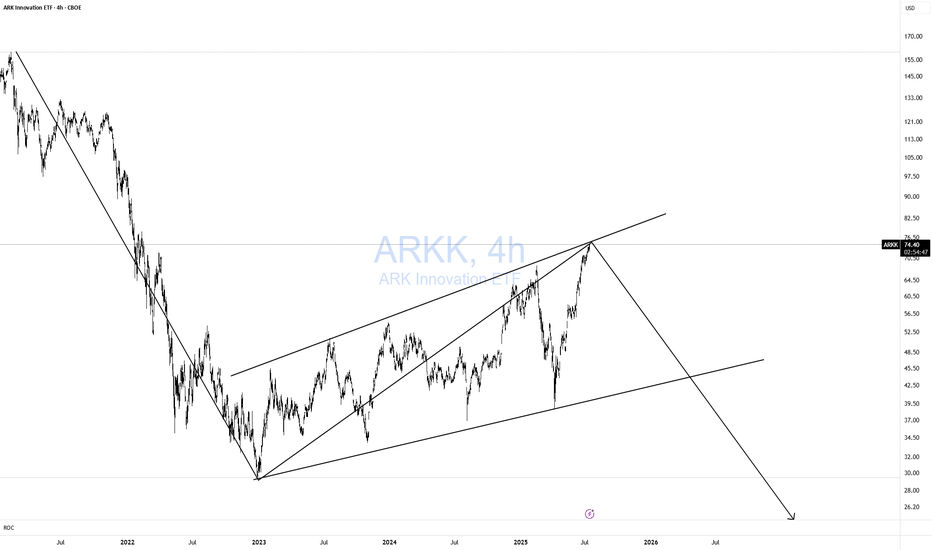

ARKK DOOMED!Classic 123 wave move down! As I like to say Short when no one else is looking! Not when everyone is looking. TOO LATE!

Simple but very effective pattern with excellent risk-reward. Remember, I am a macro trader, so don't expect to see a return on this investment tomorrow.

I won't get into the macro stuff.

Arkkshort

I wasn't bearish enough on $ARKK, going to $22 before bouncingARKK is complete garbage with many of the stocks in the ETF now breaking to fresh lows. I originally thought we'd bottom in the $45 range (you can see how that panned out in the previous analysis below), but it turns out I wasn't bearish enough. Now, I think we're likely to see a capitulation move down to $22 before it starts to recover.

If we look at the chart, ARKK broke through it's final support and now the only thing that can hold it up is the minor support at $35 that's already been tested multiple times. Because of that, the support is weak, and if it breaks that support, there's nothing keeping it from freefalling down to $22. ~50% drop from here? I think so.

If you're already long in this, set a stop under $35 to prevent yourself from losing a lot of money quickly.

$ARKK bottom somewhere between $45.92-60.02?Many people seem to be interested in going long $Arkk because it's already fallen substantially. However, the chart tells me there could be continued downside to come over the next 2-3 months.

I lean towards the bottom not being until we hit $60.02-45.92, and my bias leans towards the middle to lower support being hit before seeing a trend reversal.

Stay safe out there.

Short $ARKK $84.42Short $ARKK $84.42. Appears to heavy sell off. Downtrend will continue in my opinion. $ARKK walking on very fine line of support. Any further sell off below $85 area is not good for the $ARKK. Trading below all major moving averages. MACD turned negative recently. Current support level $85 area. If broken below then expect short target 1 is $73 area in coming weeks followed by short target 2 $62 area.

Nasdaq Index - Bull or bear market more likely?I got a bit of criticism over not being clear enough in my previous chart. So i have created specifically a Nasdaq index chart which will show my thinking more clearly.

The Nasdaq index back at the start of 2000 was the bull market to end bull markets. The innovation of using the internet was a technological revolution and no one saw an end to the bull market...until it ended.

The end coincided with a break of medium term trendline as the internet startups folded one by one. From that point onwards the Nasdaq entered a brear market and didn't recover the old highs for another 15 years.

We're in a similiar position today, with the fed about to raise rates to control inflation, no one appears to think the impossible is possible.

It is.

If we break this medium term trendline, which appears to be very close to breaking (2 weekly closes below the line would confirm a break), we would expect a bear market to follow. This could take decades to recover from.

What goes up, must also come down (at least a bit).

The fact that the nasdaq market cap is more than half comprised of only 6 companies, suggests that it is just as sensitive to a large correction today. Albeit the reasons for a bear market will be very different.

Easy money has distorted the markets and funds like Arkk that think 40% annualised returns are possible with these stocks may be signs that we are at frenzy level of bullishness (just like in 2000).

I do not expect the bear market to be as bad as the beginning of the millenium, however i do think it will be signficiant and it could be coming sooner than expected, with fed tightening expected to quicken.