ARKMUSDT Make or Break? Testing the Ultimate Historical Support!🧱 Critical Support Zone in Play

ARKM is currently trading around $0.470, sitting right on top of a major historical support zone ($0.400–$0.470) highlighted in yellow on the chart. This area previously served as a launchpad in late 2023, propelling price to an all-time high of $3.996.

Now, after a prolonged downtrend, the price is once again testing this same key level. The market's reaction here will likely define the next macro direction—will ARKM bounce and reverse, or break down into new lows?

---

📐 Technical Structure & Key Levels

Major Support (Demand Zone): $0.400 – $0.470

Layered Resistance:

Minor: $0.616, $0.730, $0.894

Mid-Level: $1.575

Major: $2.493 & $3.188

All-Time High: $3.996

Volume Insight: Still relatively low, suggesting possible accumulation.

---

🔄 Pattern Development:

✅ Potential Double Bottom or Accumulation Base – Multiple bounces off the $0.400 zone hint at the formation of a medium-term reversal structure.

If buyers step in and push the price above $0.616–$0.730, we could see confirmation of a trend reversal beginning.

---

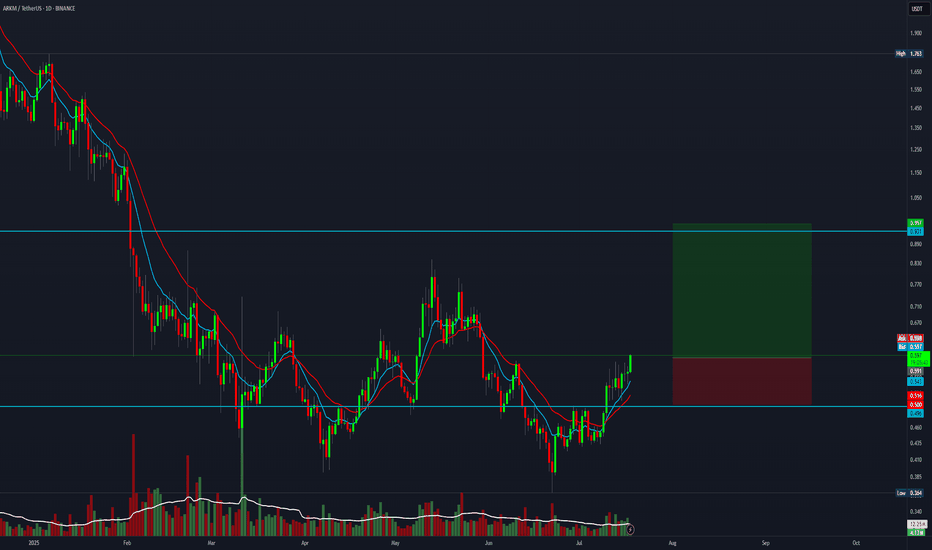

📈 Bullish Scenario:

If price:

Holds and rebounds strongly from $0.400–$0.470

Breaks and closes above $0.616 and $0.730 with increasing volume

Then next bullish targets are:

➡️ $0.894 (key resistance)

➡️ $1.575 (mid-range supply zone)

➡️ $2.493 – $3.188 (macro targets for medium-long term rally)

📌 Volume breakout and bullish candle structures will strengthen this scenario.

---

📉 Bearish Scenario:

If price:

Breaks and closes decisively below $0.400, invalidating the support zone

This could trigger a mass stop-loss cascade, with sellers taking over.

Next possible supports: ⚠️ $0.250 (minor support)

⚠️ $0.170 (last structural support in breakdown mode)

This scenario might unfold if overall crypto market sentiment worsens.

---

🧠 Strategy & Trade Ideas:

Buy on Reversal: Strong bounce at $0.400 zone with tight stop-loss below support

Buy on Breakout: Clear break and retest of $0.730 with volume confirmation

Sell/Short: Breakdown below $0.400 with failed retest

🛡️ Always apply proper risk management with a minimum 1:2 risk-reward ratio. Avoid FOMO—wait for confirmation.

---

🔍 Final Thoughts:

ARKM is in a high-stakes zone that has historically generated explosive moves. This is either a huge opportunity for accumulation or a potential breakdown into uncharted lows. The next few candles could define the rest of the year for this asset.

#ARKM #ARKMUSDT #CryptoTA #AltcoinAnalysis #SupportAndResistance #CryptoBreakout #DoubleBottomPattern #ReversalZone #BuyOrBreak #CryptoSetup

Arkm

ARKM/USDT – Major Breakout Signal from Multi-Month Accumulation Detailed Analysis:

ARKM/USDT is currently showing a strong technical signal for a potential bullish reversal after a prolonged downtrend from its peak near $3.996. Here are the key insights from the chart:

1. Long-Term Accumulation Zone:

Price has formed a strong horizontal support zone between $0.35 and $0.45 (highlighted in yellow).

Multiple rejections from this zone indicate accumulation by smart money.

2. Descending Triangle Breakout Pattern:

A clear downward trendline has been tested multiple times and is now close to being broken.

A successful breakout could trigger a powerful upward rally.

3. Potential Upside Targets (Resistance Levels):

Target 1: $0.73

Target 2: $0.894

Target 3: $1.575

Target 4: $2.493

Target 5: $3.188

Final Target (ATH): $3.996

4. Potential Trading Strategy:

Aggressive entry: On breakout above the descending trendline with strong volume.

Conservative entry: On retest of the broken trendline, now acting as support.

Stop-loss: Just below the accumulation zone (~$0.30).

5. Market Sentiment:

The market structure suggests a potential bullish reversal is building.

If momentum confirms, this setup has significant upside potential.

🎯 Summary:

ARKM is showing signs of strength as it approaches a breakout from a key descending triangle pattern. A move above the resistance could mark the beginning of a strong bullish trend. Keep an eye on volume and breakout confirmation.

#ARKM #ARKMUSDT #CryptoBreakout #AltcoinAnalysis #TechnicalAnalysis #CryptoReversal #BullishSetup #CryptoTrading #TradingView #DescendingTriangle

Arkham (ARKM) Structure Analysis (1D)Interesting chart for BINANCE:ARKMUSDT

Apologies for the trendlines mess, but they're all potentially relevant.

Watch for

• Bounce at ~$0.49 (0.786 Fib)

• Break above the yellow and orange resistance trendlines (~$0.57)

These conditions could form a Cup & Handle pattern and lead to a retest of the $0.80-$0.85 supply zone.

If that it broken, it could set the next target to ~$1.25.

#ARKM/USDT#ARKM

The price is moving within a descending channel on the 1-hour frame, adhering well to it, and is heading for a strong breakout and retest.

We are seeing a bounce from the lower boundary of the descending channel, which is support at 0.690.

We have a downtrend on the RSI indicator that is about to be broken and retested, supporting the upward trend.

We are looking for stability above the 100 moving average.

Entry price: 0.695

First target: 0.742

Second target: 0.798

Third target: 0.862

#ARKM/USDT#ARKM

The price is moving within a descending channel on the 1-hour frame, adhering well to it, and is heading for a strong breakout and retest.

We are seeing a bounce from the lower boundary of the descending channel, which is support at 0.612.

We have a downtrend on the RSI indicator that is about to break and retest, supporting the upward trend.

We are looking for stability above the 100 moving average.

Entry price: 0.635

First target: 0.684

Second target: 0.663

Third target: 0.684

My eyes are on Arkm.The downtrend in Arkm may be over. I was actually predicting a further downtrend, but the fact that the trade war issue is getting off the agenda and Bitcoin remains strong in my opinion may start the rise.

A possible bull market in Arkm wouldn't surprise me, as the possibility of a strong upside on the Bitcoin side begins to emerge. The falling wedge target may be the first target

* The purpose of my graphic drawings is purely educational.

* What i write here is not an investment advice. Please do your own research before investing in any asset.

* Never take my personal opinions as investment advice, you may lose your money.

ARKM/USDTHello friends

Given the price growth of this token, now that we are in a price correction, it is a good opportunity to buy.

We have identified the buying steps for you, which are three ranges, one is the market, the other two are green ranges, and price targets have also been identified.

*Trade safely with us*

Over 70% profit with ARKM (1D)ARKM is approaching a strong support zone with a 3D structure, presenting a BUY opportunity for us.

We are looking for buy/long opportunities within the POI (Point of Interest) zone. The target can be the Supply box.

A daily candle closing below the invalidation level could invalidate this analysis.

Do not enter the position without capital management and stop setting

Comment if you have any questions

thank you

ARKM | CHART PATTERNS | BUY the BOTTOMARKM is a fairly new altcoin that's been on my TOP alt list for some time.

The bearish M chart pattern is a pattern that signifies a large correction, especially in the macro timeframe such as the weekly. By looking at the chart, e can see the correction is nearly over since it has almost retraced ack to opening levels - almost .

Opening levels have in fact not yet been retested, and this may be a great place to stack up / re-accumulate if you're a believer.

Another ALT that's seems to be approaching a bottom is AVAX:

______________

BINANCE:ARKMUSDT

ARKUSDT: A Green Beacon in a Red Sea? ARKUSDT: A Green Beacon in a Red Sea? 💹

While everything else seems to be sinking, ARKUSDT stands a chance to stay green. However, let’s not get overly optimistic just yet. The green box below is a potentially safer entry zone , depending on market conditions.

Here’s the game plan:

Green Box: A solid area for entries if the market aligns.

Confirmation Required: Always wait for low time frame (LTF) structure breaks before making a move.

Stay sharp, manage your risk, and let the charts guide you. Boost, comment, and follow for more trading insights! 🚀

Let me tell you, this is something special. These insights, these setups—they’re not just good; they’re game-changers. I've spent years refining my approach, and the results speak for themselves. People are always asking, "How do you spot these opportunities?" It’s simple: experience, clarity, and a focus on high-probability moves.

Want to know how I use heatmaps, cumulative volume delta, and volume footprint techniques to find demand zones with precision? I’m happy to share—just send me a message. No cost, no catch. I believe in helping people make smarter decisions.

Here are some of my recent analyses. Each one highlights key opportunities:

🚀 GMTUSDT: %35 FAST REJECTION FROM THE RED BOX

🎯 ZENUSDT.P: Patience & Profitability | %230 Reaction from the Sniper Entry

🐶 DOGEUSDT.P: Next Move

🎨 RENDERUSDT.P: Opportunity of the Month

💎 ETHUSDT.P: Where to Retrace

🟢 BNBUSDT.P: Potential Surge

📊 BTC Dominance: Reaction Zone

🌊 WAVESUSDT.P: Demand Zone Potential

🟣 UNIUSDT.P: Long-Term Trade

🔵 XRPUSDT.P: Entry Zones

🔗 LINKUSDT.P: Follow The River

📈 BTCUSDT.P: Two Key Demand Zones

🟩 POLUSDT: Bullish Momentum

🌟 PENDLEUSDT.P: Where Opportunity Meets Precision

🔥 BTCUSDT.P: Liquidation of Highly Leveraged Longs

🌊 SOLUSDT.P: SOL's Dip - Your Opportunity

🐸 1000PEPEUSDT.P: Prime Bounce Zone Unlocked

🚀 ETHUSDT.P: Set to Explode - Don't Miss This Game Changer

🤖 IQUSDT: Smart Plan

⚡️ PONDUSDT: A Trade Not Taken Is Better Than a Losing One

💼 STMXUSDT: 2 Buying Areas

🐢 TURBOUSDT: Buy Zones and Buyer Presence

🌍 ICPUSDT.P: Massive Upside Potential | Check the Trade Update For Seeing Results

🟠 IDEXUSDT: Spot Buy Area | %26 Profit if You Trade with MSB

📌 USUALUSDT: Buyers Are Active + %70 Profit in Total

🌟 FORTHUSDT: Sniper Entry +%26 Reaction

🐳 QKCUSDT: Sniper Entry +%57 Reaction

📊 BTC.D: Retest of Key Area Highly Likely

This list? It’s just a small piece of what I’ve been working on. There’s so much more. Go check my profile, see the results for yourself. My goal is simple: provide value and help you win. If you’ve got questions, I’ve got answers. Let’s get to work!

ARKMArkham is a blockchain analysis platform that uses artificial intelligence (AI) to deanonymize the blockchain and on-chain data.

The platform’s two main components are the Analytics Platform and Intel Exchange. The Analytics Platform covers analytics on various entities, exchanges, funds, whales and tokens. For instance, you can check the portfolio holdings, transaction history, exchange flows, network relationships and other on-chain analytics. The Intel Exchange allows anyone to buy and sell address labels and other intelligence, either through bounties, auctions or the DATA Program.

Arkham uses an in-house AI engine with various sources of data, such as public records, social media, web scraping and user submissions. The data is used to label addresses and provide entity analytics for ULTRA, the company’s AI algorithm.

Arkham’s platform can be used for various purposes, such as tracking stolen funds, identifying fraudsters, verifying counterparties, auditing transactions, investigating hacks, and more. Arkham claims that its platform can help combat the proliferation of crypto crimes and scams by incentivizing on-chain research.

However, Arkham’s platform has also raised privacy concerns among some crypto users and advocates, who argue that deanonymizing the blockchain violates the principles of anonymity and censorship-resistance that underpin the crypto movement. Arkham has defended its platform by saying that it does not collect or store any personal data from users, and that it only provides publicly available information that can be verified on the blockchain.

FET | ALTCOINS | Fetch.AI - GREAT Re-Accumulation ZoneFET was one of my top altcoins for 2024, and it did not disappoint after a 500%+ increase early last year.

FET has since been trading in a major corrective cycle, with near-term bounces (also called mid-cycles or mini-cycles).

A great re-accumulation zone is approaching, and it's possible that FET may trade range before making another push for the upside.

Make sure you don't miss yesterday's update on another great alt, ARKM:

______________

BINANCE:FETUSDT

ARKM | ALTCOINS | Is another 400% Increase Possible??ARKM is an altcoin that has great upside potential, and it's approaching a key support zone - the opening levels.

The good news, is that the corrective pattern (in the macro timeframe) is nearly over. However, there are large bounces possible between these zones that look "small" in the weekly timeframe:

_____________________

BINANCE:ARKMUSDT

ARKM to $4 (Arkham Intelligence)Based on the chart of ARKM/USDT, here are the key support and resistance levels:

Support Levels:

Support 1: 1.85–1.90 USD

Aligned with the 0.618 Fibonacci retracement and recent price consolidation zone. This could act as immediate support.

Support 2: 1.60–1.65 USD

Located near the Area of Interest on the chart and represents the 0.786 Fibonacci level, a strong demand zone.

Support 3: 1.20–1.30 USD

A major historical support level, where buyers have previously stepped in. A break down to this level would likely indicate a deeper correction.

Resistance Levels:

Resistance 1: 2.50–2.70 USD

This is the nearest resistance, aligning with the volume profile and Fibonacci extensions. Breaking above this level would confirm bullish momentum.

Resistance 2: 3.50–3.80 USD

A medium-term target, marked by previous highs and projected by the yellow trend path.

Resistance 3: 4.50–4.60 USD

The long-term resistance target, representing significant upside potential in the next bullish wave.

Scenario Analysis:

Bullish Case: Holding above 1.85 USD and breaking through 2.50 USD could trigger a rally toward 3.50 USD. Sustained buying pressure could extend this move to 4.50 USD.

Bearish Case: A break below 1.85 USD may push the price towards 1.60 USD or lower to 1.20 USD, offering potential re-entry opportunities.

Volume confirmation and MACD momentum will be critical in validating these levels.

BINANCE:ARKMUSDT BINANCE:ARKMBTC BINANCE:BTCUSDT

Arkham | ARKM’s Bat Signal was Lit!The Dark Knight of Blockchain Sleuthing

Arkm is 400% up since our first signal and 100% up since got listed on OKX so lets double check it

Arkham isn’t just a blockchain analysis platform it’s like Sherlock Holmes with a PhD in AI, out here doxxing wallets and decoding on chain secrets. Its main weapons of choice? The Analytics Platform, which spies on exchanges, funds, whales, and your favorite meme coins, and the Intel Exchange, where blockchain gossip is bought and sold like trading Pokémon cards

From Whale Watching to Wallet Doxxing

Instead of sticking to one blockchain, Arkham’s AI system, ULTRA, plays detective across the entire crypto universe, connecting dots that most wouldn’t even know existed. You get the tea on everything from shady transactions to whale movements, all while sitting in your pajamas.

Oh, and the Intel Exchange? It’s like Craigslist for blockchain nerds. People bid, bounty, and barter for address labels and insider scoops, all using ARKM tokens. It’s a hustler’s paradise for anyone with the intel to monetize kind of like being a blockchain bounty hunter.

The mastermind behind all this is Miguel Morel, a crypto veteran who knows his way around both markets and investors. Speaking of investors, Arkham has a lineup that could make a startup founder weep with envy, including an OpenAI cofounder (ooo, mysterious), Palantir’s Joe Lonsdale, and crypto big shots like Tim Draper. Together, they’ve poured over $10 million into Arkham, valuing it at a cool $150 million.

Where do you snag some ARKM tokens? Binance is the hotspot, with ARKM/USDT volumes hitting millions daily. Just don’t expect all-time highs anytime soon—ARKM is currently chilling at 39.82% below its peak. Still, it’s sitting pretty at 731.40% above its all-time low.

With a market cap nearing $752M and a fully diluted valuation of $2.38B, Arkham might just be the blockchain snoop the world didn’t know it needed. but Wen lambo(I mean Batmobile)?

ARKM gets ready for 2.5, 2.7 and 2.9$ and if BTC do correction we will back to 1.9$ support