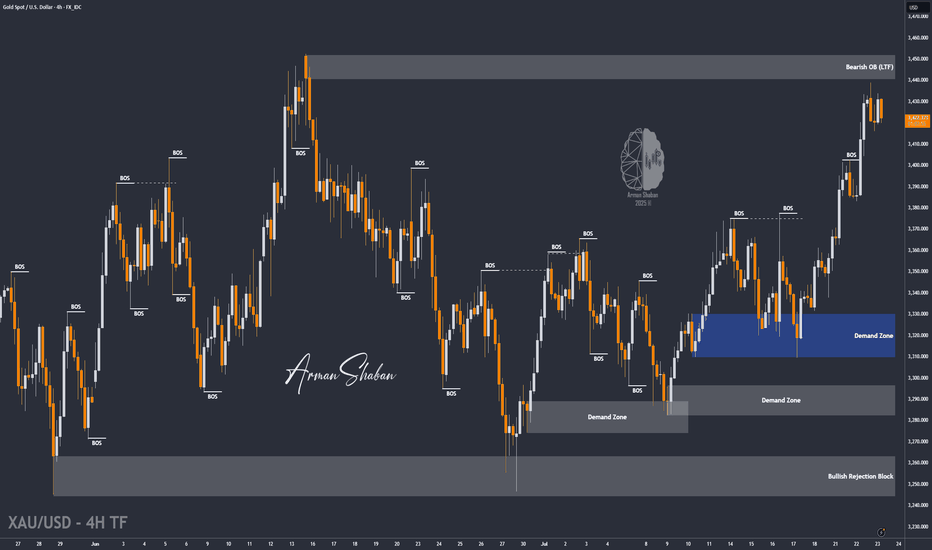

XAU/USD | Watching for Potential Drop Toward $3391! (READ)By analyzing the gold chart on the 4-hour timeframe, we can see that gold continued its bullish move after holding above $3409, successfully hitting the $3440 target and delivering over 200 pips in returns! After reaching this key supply zone, gold corrected down to $3415 and is now trading around $3421. If the price stabilizes below $3431, we can expect further downside movement, with the next bearish targets at $3415, $3404, and $3391. If this scenario fails, an alternative setup will be shared.

Please support me with your likes and comments to motivate me to share more analysis with you and share your opinion about the possible trend of this chart with me !

Best Regards , Arman Shaban

Arman_shaban

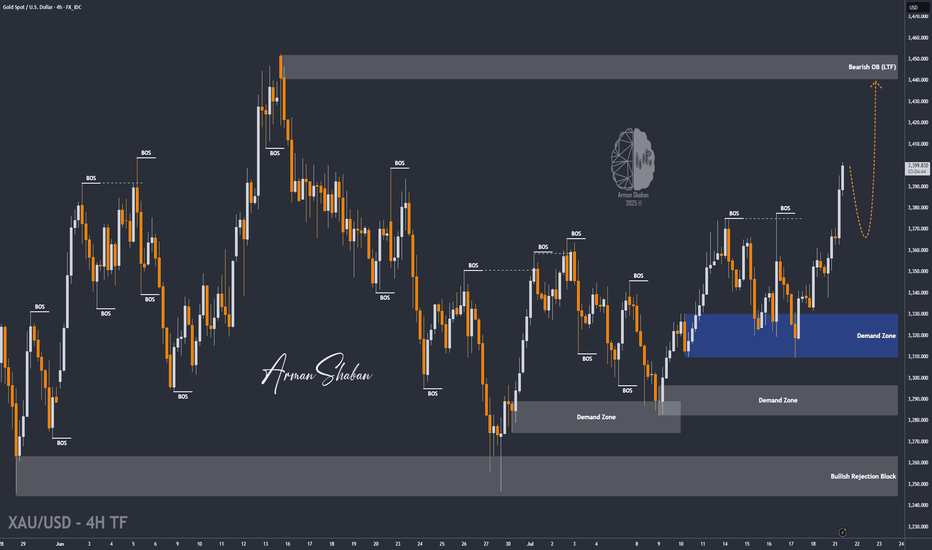

XAU/USD | Get Ready for Another Bullrun, $3500 is Coming!By analyzing the gold chart on the 4-hour timeframe, we can see that on Friday, the price finally closed at $3350. After the market opened today, we saw an initial correction down to $3339 (exactly as expected), followed by another strong bullish wave, pushing gold above $3400 just moments ago. If the price stabilizes below $3398 within the next 4 hours, I expect a potential rejection toward $3388 and $3377. However, if gold holds above $3400, the next target will be $3409. Key demand zones are $3365–$3375, and levels $3355, $3344, and $3336.

Please support me with your likes and comments to motivate me to share more analysis with you and share your opinion about the possible trend of this chart with me !

Best Regards , Arman Shaban

GOLD Set for Big Move? | Key Zones + CPI Impact Explained !Gold Analysis – Key Levels + CPI Outlook!

In this video, I broke down the recent rejection from the $3366–$3369 resistance zone, the drop to $3346, and current price action around $3357.

We’ll also look ahead at what to expect with the upcoming CPI report — and how it could shape gold’s next big move.

📌 I’ve covered both bullish and bearish scenarios, shared key demand/supply zones, and outlined possible targets.

👉 For full context and trading strategy, make sure to watch the video till the end — and don’t forget to drop your opinion in the comments:

Do you think gold will break $3380 next, or are we headed for another pullback?

THE MAIN ANALYSIS :

BTC/USD: More Bullish MOVE Ahead? (READ THE CAPTION)By analyzing the #Bitcoin chart on the weekly timeframe, we can see that the price has finally reached our expected level of $111,880, setting a new all-time high.

Currently, Bitcoin is trading around $110,800, and if it manages to hold above this key level, we could expect further bullish movement.

The next potential targets are $130,000 and $163,000, respectively.

Please support me with your likes and comments to motivate me to share more analysis with you and share your opinion about the possible trend of this chart with me !

Best Regards , Arman Shaban

GBP/USD : Ready for Fall (READ THE CAPTION)By examining the GBP/USD chart on the 4-hour timeframe, we can see that the price is currently trading within the 1.35 supply zone. If a strong rejection occurs from this level, we can expect further downside movement. The potential bearish targets are 1.34915 and 1.34500. Other key supply zones are located at 1.35520, 1.35730, and 1.35930.

Please support me with your likes and comments to motivate me to share more analysis with you and share your opinion about the possible trend of this chart with me !

Best Regards , Arman Shaban

Gold at Key Rejection Zone: Will the Drop Resume from $3310?By examining the gold chart on the 4-hour timeframe, we can see that after some consolidation between $3294 and $3302, the price finally began a sharp drop, correcting down to $3245. This area was a key demand zone on lower timeframes, which triggered a rebound, and gold is now trading around $3310. If the price gets rejected from the $3310–$3313 zone, we can expect another potential decline.

Please support me with your likes and comments to motivate me to share more analysis with you and share your opinion about the possible trend of this chart with me !

Best Regards , Arman Shaban

XAU/USD: Gold Eyes $3400+ After Explosive Surge! (READ CAPTION)By analyzing the gold chart on the 1-hour timeframe, we can see that price once again hit our targets! As expected, gold had a strong bullish rally yesterday and today, reaching both $3328 and $3345, and even extending to $3387.

This surge was fueled by escalating tensions in the Middle East, particularly between Israel and Yemen. Since the conflict shows no signs of easing and further threats remain on the table, I believe gold is not done yet — we may soon see it push above $3400.

These are sensitive days, so please be extra cautious with your trades. Don’t let fear or greed take over — consistency and emotional stability are key to long-term success in this market.

I’ll continue posting more frequent updates to help you stay informed — but that depends on your strong support! Let’s keep growing together!

Please support me with your likes and comments to motivate me to share more analysis with you and share your opinion about the possible trend of this chart with me !

Best Regards , Arman Shaban

USD/JPY : Bull or Bear? Let's See! (READ THE CAPTION)Upon reviewing the USD/JPY chart on the daily timeframe, we observe that due to the sharp drop in the Dollar Index, the price has reached the 140.850 level. This decline was very strong and impulsive; however, as seen on the chart, the price has now approached a significant demand zone between 139.6 and 141. If the price manages to close and stabilize above this area, we can expect a further bullish move from this pair.

Please support me with your likes and comments to motivate me to share more analysis with you and share your opinion about the possible trend of this chart with me !

Best Regards , Arman Shaban

XAU/USD: Ready for another Fall? (READ THE CAPTION)By examining the gold chart on the 30-minute timeframe, we can see that yesterday the price once again moved exactly as expected, hitting all four targets: $3022, $3016, $3010, and $3000, and even dropped further to $2956, resulting in a total return of over 700 pips!

Currently, gold is trading around $3003, and if the price stabilizes below $3014, we can expect further downside.

All key demand and supply zones are marked on the chart and are fully tradable.

If the drop continues, the next bearish targets will be $2997, $2991, $2984, and $2976, respectively.

Please support me with your likes and comments to motivate me to share more analysis with you and share your opinion about the possible trend of this chart with me !

Best Regards , Arman Shaban

XAU/USD: First Long,Then SHORT! (READ THE CAPTION)By examining the gold chart on the 15-minute timeframe, we can see that the price is currently trading around $3122, and I expect the price to soon reach higher levels such as $3128, $3133, $3135, and $3143, and after reaching each of these important levels, we will probably see an initial negative reaction!

Ultimately, I expect a strong rejection from the price once gold reaches $3144!

The level of this analysis is very high, so make sure to study it carefully!

Don’t forget to support this analysis!

Please support me with your likes and comments to motivate me to share more analysis with you and share your opinion about the possible trend of this chart with me !

Best Regards , Arman Shaban

EUR/USD: Ready for another Fall? (READ THE CAPTION)By examining the EUR/USD chart on the 3-day timeframe, we can see that the price has moved exactly as expected since our last analysis. After reaching the supply zone between 1.083 and 1.093, the pair began a correction and is currently trading around 1.079. Keep in mind, only if the price stabilizes below the 1.080 level can we expect further downside from this pair.

Please support me with your likes and comments to motivate me to share more analysis with you and share your opinion about the possible trend of this chart with me !

Best Regards , Arman Shaban

XAU/USD: Possible Fall Ahead? (READ THE CAPTION)By examining the gold chart on the 4-hour timeframe, we can see that, as expected, the price continued its bullish movement and climbed close to its all-time high of $3057, reaching $3056 today. Since this level acted as a Bearish Rejection Block, we’re now seeing a price correction from that area, with gold currently trading around $3049. If the price stabilizes below the $3050 mark, we may see further downside. Potential bearish targets are $3045, $3040, and $3035, respectively.

Please support me with your likes and comments to motivate me to share more analysis with you and share your opinion about the possible trend of this chart with me !

Best Regards , Arman Shaban

XAU/USD: Another ATH (All Time High) Ahead? (READ THE CAPTION)By analyzing the gold chart in the 2-hour timeframe, we can see that the price has finally made its big move, just as we predicted! After a correction to $2905, demand increased, pushing the price up by over 400 pips to $2949.

Currently, gold is trading around $2940, and there are two key scenarios:

1️⃣ Holding support at $2940, leading to a rise above $2950 as the first target.

2️⃣ Breaking below $2940 and stabilizing under it, which could trigger a further correction to $2923.

This analysis will be more complete with your support, and more details will be added soon!

Please support me with your likes and comments to motivate me to share more analysis with you and share your opinion about the possible trend of this chart with me !

Best Regards , Arman Shaban

XAU/USD: Gold at a Critical Crossroad: Will $2930 Hold or Break?By analyzing the gold chart on the two-hour timeframe, we can see that the price followed the expected bearish movement yesterday, correcting from its recent high of $2928 down to $2900 before finding temporary support. Currently, gold is trading around $2916, showing signs of indecision as it consolidates within a key range.

🔍 Key Levels & Liquidity Considerations

A significant liquidity pool exists between $2928 and $2930, which could act as a magnet for price. If gold moves toward this range, we might witness liquidity collection before a potential strong rejection and deeper decline.

As long as gold remains below $2930, the bearish outlook remains intact, and further corrections toward $2900 and potentially lower levels could unfold. However, if buyers manage to push the price above $2930 and sustain a breakout with clear confirmation and bullish momentum, we could see gold targeting levels above $2950 in the coming sessions.

📌 Primary & Alternative Scenarios:

🔹 Primary Bearish Scenario: A move into the $2928-$2930 liquidity zone, followed by rejection and continuation of the correction.

🔹 Alternative Bullish Scenario: A clean breakout above $2930 with a strong close and confirmation, leading to further bullish expansion toward $2950+.

🎯 Final Outlook

At this stage, the bearish bias remains dominant, but traders should carefully monitor price action near key liquidity zones before executing positions. Watching how gold reacts around these critical levels will be crucial in determining the next major move.

Stay updated as we track the market closely! 🔥

Please support me with your likes and comments to motivate me to share more analysis with you and share your opinion about the possible trend of this chart with me !

Best Regards , Arman Shaban

EUR/USD : Get Ready for a Huge Sell Position! (READ CAPTION)By analyzing the EUR/USD chart on the three-day timeframe, we can see that the price has started to rise following the sharp decline in the U.S. Dollar Index (DXY). Currently, it is attempting to fill the identified Fair Value Gap (FVG).

The key supply zone is located between 1.08300 and 1.09380. Traders can look for a suitable sell trigger within this range for potential short positions.

Please support me with your likes and comments to motivate me to share more analysis with you and share your opinion about the possible trend of this chart with me !

Best Regards , Arman Shaban

XAU/USD : Get ready for a new ATH, Towards $3000?! (READ)Gold's one-hour chart analysis confirms that the price has followed our previous forecast precisely, reaching the $2951 level as expected. Comparing the last five analyses highlights the accuracy of these projections.

Currently, after hitting $2951, gold is facing selling pressure and is trading around $2947. I anticipate a slight correction before another upward move.

Short-term targets: $2954 and $2956

Medium-term targets: $2966 and $2969

Please support me with your likes and comments to motivate me to share more analysis with you and share your opinion about the possible trend of this chart with me !

Best Regards , Arman Shaban

BTC/USD: From $95K Surge to Critical $89K Support – What’s Next?Bitcoin's 6-hour chart shows that after our last analysis, the price successfully rallied from $95,000, reaching all three targets: $96,200, $97,600, and $101,700, yielding over 8% return.

Today, Bitcoin finally broke the $90,000 support after holding for several days, dropping to $86,000 before recovering to the $89,000 range. If the price stabilizes above $89,000 in the next two days, we could expect an upward move towards the next targets at $90,800, $93,800, and $98,000.

Please support me with your likes and comments to motivate me to share more analysis with you and share your opinion about the possible trend of this chart with me !

Best Regards , Arman Shaban

USD/JPY : Another Bearish Move Ahead ? Let's see! (READ CAPTION)By analyzing the daily USD/JPY chart, we can see that, as expected from the previous analysis, the price continued its downtrend, correcting down to 151.

Currently, USD/JPY is trading around 153.620, and I expect it to resume its decline soon from the current zone (153.68 - 155.3).

This analysis will be updated as price action develops. The next potential bearish targets are 152.70, 151.70, and 151.

Please support me with your likes and comments to motivate me to share more analysis with you and share your opinion about the possible trend of this chart with me !

Best Regards , Arman Shaban

EUR/USD : First SELL, then BUY! (READ THE CAPTION)By analyzing the 3-day EUR/USD chart, we can see that, as expected, the price has resumed its correction and is currently trading around 1.03. I still anticipate further downside movement in this range.

The key demand zones are 1.02, 1.005, and 0.99. So, the strategy remains: first, look for SELL opportunities, and then wait for a solid BUY trigger at these levels! 🚀

Please support me with your likes and comments to motivate me to share more analysis with you and share your opinion about the possible trend of this chart with me !

Best Regards , Arman Shaban

EUR/USD : More Fall Ahead? Let's See! (READ THE CAPTION)By analyzing the EUR/USD chart on the three-day timeframe, we can see that the price was rejected from the 1.053 level, as per our main analysis, leading to a decline of over 300 pips down to 1.021.

Currently, EUR/USD is trading around 1.036, and if the price stabilizes below 1.042, we can expect further downside movement. Keep an eye on the price reaction to the key levels marked on the chart!

Please support me with your likes and comments to motivate me to share more analysis with you and share your opinion about the possible trend of this chart with me !

Best Regards , Arman Shaban

XAU/USD : Bull or Bear (READ THE CAPTION)By analyzing the 4-hour gold chart, we see that, as expected, the price continued its upward movement following yesterday's analysis, hitting the $2752 and $2764 targets, delivering a 200-pip return. After reaching $2764, gold corrected from $2766 down to $2757, and it is currently trading around $2759. If the price stabilizes below this level, we could see further corrections.

⚠ Important Note: Today, we have the FOMC meeting and the U.S. interest rate decision, which could lead to high market volatility. I strongly recommend avoiding trading during these critical hours!

THE MAIN ANALYSIS :

Please support me with your likes and comments to motivate me to share more analysis with you and share your opinion about the possible trend of this chart with me !

Best Regards , Arman Shaban

XAU/USD : Key Levels $2717 and $2727 to Define Next Move! (READ)Analyzing the 4-hour gold chart, we observe that after rising to approximately $2725, gold underwent a correction down to $2703. Currently, gold is trading around $2708, and the key level to watch over the next two hours is $2717.

If gold fails to breach and stabilize above $2717, we may expect further corrections. Alternatively, gold might move above $2727 to collect liquidity, followed by a potential reaction to this liquidity pool, leading to a correction.

Stay tuned for updates once the confirmations are in place!

Please support me with your likes and comments to motivate me to share more analysis with you and share your opinion about the possible trend of this chart with me !

Best Regards , Arman Shaban

XAU/USD : Ready for LONG? (READ THE CAPTION)Based on the 4-hour gold chart analysis, we observe that the price followed the second scenario from the previous analysis. Failing to break and hold above $2662, it experienced a deeper pullback, correcting down to $2625. Currently, gold is trading around $2633, and if it manages to hold above $2626, we can expect further upside potential. The possible targets for this upward movement are $2638, $2647, and $2656.

Please support me with your likes and comments to motivate me to share more analysis with you and share your opinion about the possible trend of this chart with me !

Best Regards , Arman Shaban