Megalodon Pro Automated Trader - Strat - Short Term Bull Megalodon Pro Automated Trader is giving short term buy signals(orange) on hourly time frame.

----------------------------------------------------------------------------

We believe that enlightening others is an incredible way to make this world a better place. That's why we created the tools you need to stop worrying about your investments and focus on what really matters in your life.

What is Megalodon ?

Megalodon uses Artificial Intelligence that combines 574 back-tested indicators and 2674 back-tested setups, simultaneously.

Megalodon works with any kind of asset , market state and time frame .

What is the win rate?

Megalodon is extremely accurate and offers insane profits as long as the fundamental analysis is done right .

Backtesting results can be found on our social media or down below .

How to use Megalodon Pro Automated Trader?

Simply, orange rectangles are buy signals and purple rectangles are sell signals .

Green clouds show buy signals and red clouds show sell signals.

Yellow line shows the difference between buy and sell counts.

How to set alarms on Megalodon Pro Automated Trader?

Click on Alert, select Megalodon Pro Automated Trader and click on Buy-Signal or Sell-Signal. More details can be found on our social media.

You may also watch our Megalodon Investing Tutorials on Youtube for more information.

How to purchase?

Megalodon is totally FREE .

You may upgrade to Megalodon Pro for the most important features , including automizing your trading on any asset profitably, setting up alarms to get notified , joining to our VIP telegram channel to learn and our VIP telegram group to interact with the community. Simply go to our website on our TradingView page for learning more and joining us for free.

Some of the backtesting results are:

BTC/USD for longer time frame trading in the bear market for the last year.

APPLE for longer time frame trading in the bull market for the last 10 years.

EURO/USD for day trading in the neutral market for the last month.

BTC/USD for day trading in the bull market for the last 15 days.

APPLE for day trading in the neutral market for the last 2 days and 6 hours.

ARTIFICIAL_INTELIGENCE

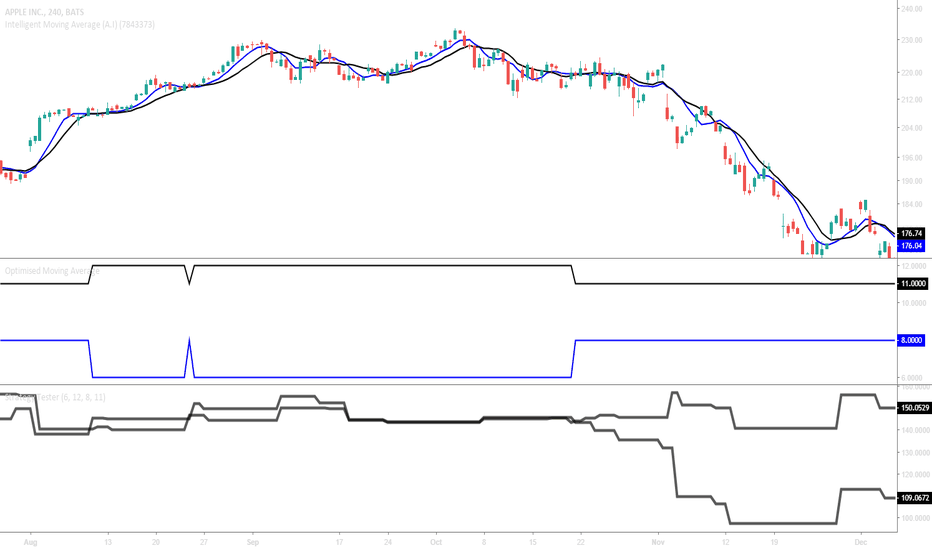

Sneak Peek: Intelligent Moving Average (AI)Here is the first sneak peak of the beta-version Intelligent Moving Average (AI).

Remember, this is currently the ONLY intelligent indicator on TradingView and any other indicator labelled as an "Intelligent" indicator may not be artificially intelligent.

I have been working hard to publish this in a reasonable amount of time and I should be done with it within the next couple of days (or less.)

Thanks for all of the kind messages and support.

BLACK FRIDAY SALE - NVDA 50% off recent 290 highNVDA AMD AXTI MU INTC STM

STM is up off low yesterday and NVDI as leading graphics processor for AI with AMD is 50% off recent high. GPU's are a key component for AI, or artificial intelligence and visual learning.

Big data is the other that goes with it, along with blockchain and cybersecurity and code software.

CYBR MIME RPD

PANW MDB

NVDA bargain entry at $120 in a week?NVDA showing sellers not happy with earnings growth announcement for GPU, however relates to trade war and slump in electronics.

This could be great bargain watch as GPU need for AI, self-driving cars, and many other high growth tech area's. Watch or short.

Sell or Hold, what's your thoughts? $138 sell for lower entry on DPO day chart. await LONG opportunity, market giving many lessons.

If I Could Buy One Stock for the Next 5 Years,It Would Be NVIDIATake a look at its 720% surge since 2016.

Now I know you might be thinking: Stephen, this stock has already had a heck of a run… why buy it now?

I understand the concern.

But when investing in truly disruptive companies , this way of thinking is often a mistake.

From 2009–2013, Amazon (AMZN) stock gained 680%. Most so-called “experts” said the easy money had already been made. In 2013, CNN “reported” that “Amazon is one of the most overvalued stocks.”

Amazon has soared another 700% since 2013.

Nvidia Makes High-Performance Graphic Processing Units

Nvidia developed the first mass-market graphic processing unit (GPU) in 1999. GPUs use what’s called “parallel processing,” which allows the chips to perform millions of calculations at the same time.

That’s different from the way other computer chips work. Most computer chips, like the one powering the laptop or phone you’re reading this on, calculate one by one.

At first, GPUs were mostly used to create realistic graphics in video games. Remember the blocky Nintendo graphics from the early ‘90s?

The ability of GPUs to process huge amounts of data all at once helped create the movie-like video game graphics you see today.

GPUs Are Ideal for “Training” Artificial Intelligence

I’m sure you’ve seen the Hollywood movies about AI going rogue and attacking humans.

In reality, AI isn’t that glamorous. It all comes down to processing massive amounts of data.

Show a computer millions of pictures of a stop sign, for example, and it will learn to recognize stop signs on its own in the real world.

AI is the driving force behind Google’s self-driving car subsidiary Waymo. As I recently discussed in the RiskHedge Report , Waymo’s robot cars are cruising around America’s roads right now.

At the core of Waymo’s self-driving car fleet is a centralized “brain.” It has learned to recognize stop signs, pedestrian crossings, red lights, and all the other obstacles that human drivers navigate.

The Likes of Amazon, Google, and Microsoft Use Nvidia Chips to Train Their AI

The faster a computer can process data, the faster it can “learn” by recognizing patterns in the data.

Nvidia latest chips process 125x faster than traditional computer chips. They can process 125 trillion data points per second… which slashes AI “learn” times from eight days to eight hours.

This is why more than 2,000 companies including Amazon, Google, and Microsoft use Nvidia’s hardware to “train” their AI programs.

Last quarter, the revenue Nvidia earned from selling AI chips and hardware jumped 82%. In the last two years, AI-related sales have accounted for over 70% of the surge in Nvidia’s revenue. AI sales now make up 24% of its total revenue.

Most Self-Driving Car Companies Use Nvidia’s Products

As I mentioned, Nvidia supplies self-driving car companies with chips that “train” cars’ brains. It also sells hardware that processes data from the cars’ many cameras and sensors.

For example, Nvidia’s self-driving supercomputer, named Pegasus, can tackle 320 trillion operations per second. And it does so using one-third the electricity at just one-fifth the cost of its closest competitor.

Over 370 companies working on self-driving cars now use Nvidia’s products. Auto sales make up just 5% of NVDA’s total revenue today, and I see this exploding higher over the next few years as true self-driving cars roll out.

I mentioned earlier that $100 billion has been spent on developing self-driving cars so far. With the likes of Google and Apple pouring billions into driverless projects, I see that jumping to $1 trillion over the next two to three years.

Thanks to its superior technology, I expect Nvidia to capture a large chunk of this.

It’s a “High-Flying” Tech Company, but Extremely Profitable

Nvidia is nothing like many of the barely profitable tech darlings (like Netflix) out there.

While many high-flying tech stocks get by on stories and hype, Nvidia is extremely profitable.

It has a net profit margin of 33%. That is, for every $1 in sales, $0.33 becomes pure profit.

That’s better than Google’s 21% margin… and even Microsoft’s 29%.

Nvidia’s high margins allow it to continually pour cash into Research & Development (R&D). It reinvests close to 20% of its revenue into R&D every year, which is a key reason why it has blown away its rivals.

Nvidia is financially sound, too. It’s sitting on a record $7.95 billion in cash. Which is enough to pay off its total debt four times over.

Why I’m Not Concerned About Nvidia’s Price-to-Earnings (P/E) Ratio of 39.

Can buying a stock at such a high valuation be risky? Sure. But Nvidia deserves its rich valuation.

Nvidia’s earnings are growing at almost six times the rate of the S&P 500. Yet its P/E ratio is not even double the S&P’s.

I think investing in a company like Ford (F), with a P/E of 5, is far riskier than buying NVDA. I can hear the groans coming from the value investors out there.

But the fact is, Nvidia is leading the self-driving revolution… while Ford is going to get crushed by it.

Because it is powering today’s most disruptive trends, I see Nvidia doubling over the next two years.

Appen Prediction (ASX:APX)Good morning all,

Here is my personal opinion on the future of the heavily publicised, machine learning company, Appen.

By looking at the trend line across a history of lows it shows that the position we are currently in is quite a major moment.

In my opinion 1 of the 2 options below will occur:

Option 1: Price bounces back, bottoming at around $11.15 before rising back up on another wave

Option 2: Price continues downfall, breaks trend line and retests supports at the $10 mark

Disclaimer: Please take all of my ideas with a grain of salt as these are mostly for me to look back and reflect so I can learn and grow as a trader :)

Wishing a good day to you all,

Kyle

This Shit is Next Level: Years from now, Because IBM has been building it's arsenal,

oh yea, Amazon, Google, ect... Blah,

IBM still has that aura about it,

+IBM just announced a debate ai, \

LOL Just what I need right, Turn it on during a dinner conversation and Peace!

Not exactly at the moment,

Their plan is to- Help with Search, !?!!%$#$#

yes, that consistent google search for item x, research opinions, think about alternatives Garbage

AI Google Buttler, AI assist me with goals, Hmmm should I go to soccer practice or should I get some much needed rest....maybe a stretch

Hmm were starting a nicknack buisness should we go with a office or outsource,

Oh great idea, and you priced up items for our team, WOW,

The early stages seem to be a web of connections driven to aid in decision making, but the future is Golden, As their Watson ; is Begining to lay dem golden eggs.

IBM has streamlined, and gone back to good old garage-nerd

And Shit will be quick in the year(s) ahead.

Wild A.I. Forecast & TA Say_________?Bitcoin/USD Daily Bars, LOG Scale, 06/12/18, 11:10 PM EST, by Mike Mansfield

(REDONE SO CYCLES FIT)

Hi trader friends, this is one of our most detailed and important Bitcoin updates. Our first post with screenshots of our deep learning A.I. project’s 12 month forecast. I will post those screenshots after this clears the 15 minute publishing hold. So let’s get to it.

SUMMARY:

BTCUSD is likely to drop another 30-60% over the next 4-12 months, possibly 18 months.

Short-term cycle lows are expected in July and October 2018.

The mid-July 2018 cycle low should be followed by a 3-8 week trading bounce. Then, another big down wave into early to mid October 2018.

October could be “the low,” but we are thinking next year, based on our data.

The final cycle low, or momentum lows are expected to be in February 2019 (A.I. low date), or June 9th, 2019 (pink cycle low), or possibly January 2020 (blue cycle low).

Initial price targets lower are $4935, then $2967-2380 (or lower).

A.I. project forecasts 12 month low @ $2774, due in February 2019.

The deep learning A.I. project’s forecast is confirmed by Elliott Waves, Andrews Lines, Wolfe Waves, and a few other techniques shown here, most suggesting much lower prices ahead.

Bitcoin has broken its “low to low” support trend-line.

Will likely close below the Andrews Median Line (orange pitchfork's mid line), which, would put Bitcoin below the black dotted trend-line drawn off the lowest closing prices of 2018. Once broken, the first three price targets to the downside become quite likely.

Time Cycle Caveat:

We are working on pattern matching comparison called an analog. This suggests an October 2018 low. That fits the secondary A.I model's forecast, but not the top performing algorithm's forecast (February 2019 low). Remember, two of the longer-term cycles are pointing to either a June 2019 low (pink cycle), or January 2020 low (blue cycle). Therefore, the October low this year seems less likely thus far, but not out of the question.

Truth Seekers & The Crypto Land Bear:

Are you a “truth seeker?" Really a truth seeker? If you want to be a more objective trader, be a truth seeker. Try to be a truth seeker in all things. Accept that there are many possibilities in life, as in trading. Seek to find the ultimate “truth," but while doing it, at least for trading, go with the highest probabilities. Else, you'll live in La La Land of wannabe moonshots for every crypto market. Of course, some tokens moonshot, even in a bear market. But, as the top 10-25 go, so goes most of the market.

PRICE TARGETS:

Target 1: $4935, likely minimum target. It's the prior Wave (3) high on Sept 1st, 2017.

The “forever trend-line” (black upward sloping) is currently around $3700. Yet, by the time the market could logically get there, that trend-line would likely be around $4450-$4950.

Target 2: $2972, the June 2017 high of the prior Wave V of Wave (3). This is close to our

A.I. derived target. Outcome, likely.

Target 3: $2774, A.I. deep learning 12 month projected low, due February 2019.

Since target 2 and 3 are so close, just a blip in Crypto Land, I would be targeting a low between those two figures, unless more data changes the A.I. forecasts. Target, likely.

Target 4: $2380, September 15th, 2017, Wave ii low.

Target 5: $1138, where the Wolfe Wave support (purple line) and the prior Wave ( III) high of large degree meet. This is a potential attractor point (less likely now). There is a far lower target, but I'll let you find it on the chart.

----------

The good news for bulls is that the Alternative Wave Count (lighter blue) could very well be correct. That would mean one more all-time high to complete Bitcoin’s Wave (V) advance.

BOTTOM LINE:

Down 30-60%, Feb. or June low, around $2774.

DISCLOSURE:

This analysis is meant for educational purposes only. You trade at your own risk!

Cheers and best wishes,

Michael Mans

BTC/USD (Bitcoin) Wild A.I. Forecast & TA Say_________?Bitcoin/USD Daily Bars, LOG Scale, 06/12/18, 9:00 PM EST, by Mike Mansfield

Hi trader friends, this is one of our most detailed and important Bitcoin updates. Our first post with screenshots of our deep learning A.I. project’s 12 month forecast. I will post those screenshots immediately after this clears the 15 minute publishing hold. So let’s get to it.

BOTTOM LINE:

BTCUSD is likely to drop another 30-60% over the next 4-12 months, possibly 18 months.

Short-term cycle lows are expected in July and October 2018.

The mid-July 2018 cycle low should be followed by a 3-8 week trading bounce. Then, another big down wave into early to mid October 2018.

October could be “the low,” but we are thinking next year, based on our data.

The final cycle low, or momentum lows are expected to be in February 2019 (A.I. low date), or June 9th, 2019 (pink cycle low), or possibly January 2020 (blue cycle low).

Initial price targets lower are $4935, then $2967-2380 (or lower).

A.I. project’s 12 month low price forecast's is $2774, due in February 2019.

The deep learning A.I. project’s forecast is also confirmed by Elliott Waves, Andrews Lines, Wolfe Waves, and a few other techniques shown here, most suggesting much lower prices ahead.

Bitcoin has broken its “low to low” support trend-line. It also appears to on its way to closing below the Andrews Median Line (orange pitchfork's mid line), which, would put Bitcoin below the black dotted trend-line drawn off the lowest closing prices of 2018. Once broken, the first three price targets to the downside become quite likely.

Time Cycle Caveat:

We are working on pattern matching comparison called an analog. This also suggests an October 2018 low. That fits the secondary A.I model's forecast, but not the top performing algorithm forecast that calls for a February 2019 low. And remember, two of the longer-term cycles are pointing to either a June 2019 low (pink cycle), or January 2020 low (blue cycle). Thus, the October low this year seems less likely thus far, but not out of the question.

Truth Seekers & The Crypto Land Bear:

Are you a “truth seeker?" Really a truth seeker? If you want to be a more objective trader, be a truth seeker. Try to be a truth seeker in all things. Accept that there are many possibilities in life and in trading. Seek to find the ultimate “truth," but while doing it, at least for trading, go with the highest probabilities. Else, you'll live in La La Land of wannabe moonshots for every crypto market. Of course, some tokens will moonshot, even in a bear market, but as the top 10-25 go, so goes most of the market.

PRICE TARGETS:

Target 1: $4935, likely minimum target. It's the prior Wave (3) high on Sept 1st, 2017.

The “forever trend-line” (black upward sloping) is currently around $3700, but by the time the market could logically get there, that trend-line would likely be around $4450-$4950.

Target 2: $2972, the June 2017 high of the prior Wave V of Wave (3). This is close to our A.I. derived target. Likely.

Target 3: $2774, A.I. deep learning 12 month projected low for February 2019. Since target 2 and 3 are so close, just a blip in Crypto Land, I would be targeting a low between those two figures, unless more data changes the A.I. forecasts. Target, likely.

Target 4: $2380, September 15th, 2017, Wave ii low.

Target 5: $1138, where the Wolfe Wave support (purple line) and the prior Wave (III) high of large degree meet. This is a potential attractor point (less likely now). There is a far lower target, but I'll let you find it on the chart.

----------

The good news for bulls is that the Alternative Wave Count could very well be correct. That would mean one more all-time high to complete Bitcoin’s Wave (V) advance.

Summary:

Down 30-60%, Feb. or June low around $2774.

DISCLOSURE:

This analysis is meant for educational purposes only. You trade at your own risk!

Cheers and best wishes,

Michael Mansfield CIO

AAL 5 Day Ahead Prediction - 04/16 - 04/20 PeriodArtificial Intelligence/Deep Learning Enabled 5 Day Ahead Predicted values for American Airlines Group ( AAL ) have been plotted on the chart.

The method used in this prediction is Deep Learning/Artificial Neural Network based, and using complex mathematical models/methodologies to analyze and extract hidden time series features in vast amounts of AAL related data. The "trained" and optimized neural network then generates the multi-day ahead predictions which are plotted on the chart and given in the explanation below.

The expected 5 Day Change is 2.572 %

Predictability Indicator is calculated as : 0.812

Predicted 5-Day Ahead Prices are as follows:

Mon Apr 16 Tue Apr 17 Wed Apr 18 Thu Apr 19 Fri Apr 20

46.552 46.690 46.698 46.856 47.049

Please note that outliers/non-linearities might occur, however FinBrain's Artificial Intelligence/Deep Learning Enabled predictions indicate the softened/smoothed moving direction of the stocks/commodities/World Indices/ETFs/Foreign Currencies/Cryptocurrencies.

NASDAQ (IXIC) 10-Day Ahead Prediction 04/12 - 04/25 PeriodArtificial Intelligence/Deep Learning Enabled 5 Day Ahead Predicted values for NASDAQ Index ( IXIC ) have been plotted on the chart.

The method used in this prediction is Deep Learning based, and using complex mathematical models/methodologies to extract hidden time series features in vast amounts of IXIC related data.

The expected 5 Day Change is 0.766 %

The expected 10 Day Change is 0.905 %

Predictability Indicator is calculated as : 0.943

Predicted 10-Day Ahead Prices are as follows:

2018-04-12, 2018-04-13, 2018-04-16, 2018-04-17, 2018-04-18

7121.792, 7123.413, 7111.571, 7112.247, 7123.214

2018-04-19, 2018-04-20, 2018-04-23, 2018-04-24, 2018-04-25

7130.753, 7131.628, 7130.451, 7130.865, 7133.020

Please note that outliers/non-linearities might occur, however our Artificial Intelligence/Deep Learning Enabled predictions indicate the softened/smoothed moving direction of the stocks/commodities/World Indices/ETFs/Foreign Currencies/Cryptocurrencies.

Dow Jones (DJI) 10-Day Ahead Prediction 04/12 - 04/25 PeriodArtificial Intelligence/Deep Learning Enabled 5 Day Ahead Predicted values for Dow Jones Index ( DJI ) have been plotted on the chart.

The method used in this prediction is Deep Learning based, and using complex mathematical models/methodologies to extract hidden time series features in vast amounts of DJI related data.

The expected 5 Day Change is 0.370 %

The expected 10 Day Change is 0.470 %

Predictability Indicator is calculated as : 0.774

Predicted 10-Day Ahead Prices are as follows:

2018-04-12, 2018-04-13, 2018-04-16, 2018-04-17, 2018-04-18

24263.273, 24280.051, 24274.102, 24272.583, 24278.988

2018-04-19, 2018-04-20, 2018-04-23, 2018-04-24, 2018-04-25

24286.935, 24292.546, 24296.235, 24299.600, 24303.338

Please note that outliers/non-linearities might occur, however our Artificial Intelligence/Deep Learning Enabled predictions indicate the softened/smoothed moving direction of the stocks/commodities/World Indices/ETFs/Foreign Currencies/Cryptocurrencies.

V 10-Day-Ahead Prediction - 04/11-04/24 PeriodArtificial Intelligence/Deep Learning Enabled 5 Day Ahead Predicted values for Visa Inc. ( V ) have been plotted on the chart.

The method used in this prediction is Deep Learning based, and using complex mathematical models/methodologies to extract hidden time series features in vast amounts of V related data.

The expected 5 Day Change is 0.817 %

The expected 10 Day Change is 1.310 %

Predictability Indicator is calculated as : 0.806

Predicted 10-Day Ahead Prices are as follows:

Wed Apr 11 Thu Apr 12 Fri Apr 13 Mon Apr 16 Tue Apr 17

122.15 122.37 122.06 121.78 121.70

Wed Apr 18 Thu Apr 19 Fri Apr 20 Mon Apr 23 Tue Apr 24

121.80 121.94 122.08 122.20 122.30

Please note that outliers/non-linearities might occur, however our Artificial Intelligence/Deep Learning Enabled predictions indicate the softened/smoothed moving direction of the stocks/commodities/World indices/ETFs/Foreign Currencies/Cryptocurrencies.

Feel free to contact us for your questions.

BAC 5-Day-Ahead Prediction - 04/11-04/17 PeriodArtificial Intelligence/Deep Learning Enabled 5 Day Ahead Predicted values for Bank of America Corp ( BAC ) have been plotted on the chart.

The method used in this prediction is Deep Learning based, and using complex mathematical models/methodologies to extract hidden time series features in vast amounts of BAC related data.

The expected 5 Day Change is 1.177 %

Predictability Indicator is calculated as : 0.838

Predicted 5-Day Ahead Prices are as follows:

Wed Apr 11 Thu Apr 12 Fri Apr 13 Mon Apr 16 Tue Apr 17

30.751 30.727 30.702 30.773 30.838

Please note that outliers/non-linearities might occur, however our Artificial Intelligence/Deep Learning Enabled predictions indicate the softened/smoothed moving direction of the stocks/commodities/World indices/ETFs/Foreign Currencies/Cryptocurrencies.

Feel free to contact us for your questions.

FB 10-Day-Ahead Prediction - 04/10-04/19 PeriodArtificial Intelligence/Deep Learning Enabled 10 Day Ahead Predicted values for Facebook Inc. ( FB ) have been plotted on the chart.

The method used in this prediction is Deep Learning based, and using complex mathematical models/methodologies to extract hidden time series features in vast amounts of FB related data.

The expected 5 Day Change is 0.588 %

The expected 10 Day Change is 0.733 %

Predictability Indicator is calculated as : 0.768

Predicted 10-Day Ahead Prices are as follows:

Mon Apr 09 Tue Apr 10 Wed Apr 11 Thu Apr 12 Fri Apr 13

158.06 158.31 158.21 158.11 158.12

Mon Apr 16 Tue Apr 17 Wed Apr 18 Thu Apr 19 Fri Apr 20

158.19 158.25 158.29 158.32 158.35

You can see our previously posted prediction for FB on the same chart, highlighted in green, as well.

Please note that outliers/non-linearities might occur, however our Artificial Intelligence/Deep Learning Enabled predictions indicate the softened/smoothed moving direction of the stocks/commodities/World indices/ETFs/Foreign Currencies/Cryptocurrencies.

Feel free to contact us for your questions.

CVX 10-Day-Ahead Prediction - 04/10-04/19 PeriodArtificial Intelligence/Deep Learning Enabled 10 Day Ahead Predicted values for Chevron Corporation ( CVX ) have been plotted on the chart.

The method used in this prediction is Deep Learning based, and using complex mathematical models/methodologies to extract hidden time series features in vast amounts of CVX related data.

The expected 5 Day Change is 0.822 %

The expected 10 Day Change is 1.409 %

Predictability Indicator is calculated as : 0.675

Predicted 10-Day Ahead Prices are as follows:

Mon Apr 09 Tue Apr 10 Wed Apr 11 Thu Apr 12 Fri Apr 13

115.01 115.20 115.38 115.54 115.70

Mon Apr 16 Tue Apr 17 Wed Apr 18 Thu Apr 19 Fri Apr 20

115.85 115.99 116.12 116.25 116.37

Please note that outliers/non-linearities might occur, however our Artificial Intelligence/Deep Learning Enabled predictions indicate the softened/smoothed moving direction of the stocks/commodities/World indices/ETFs/Foreign Currencies/Cryptocurrencies.

Feel free to contact us for your questions.

XRP-USD 10-Day-Ahead Prediction - 04/10-04/19 PeriodArtificial Intelligence/Deep Learning Enabled 10 Day Ahead Predicted values for Ripple (XRP) have been plotted on the chart.

The method used in this prediction is Deep Learning based, and using complex mathematical models/methodologies to extract hidden time series features in vast amounts of XRP related data.

The expected 5 Day Change is 2.396 %

The expected 10 Day Change is 2.7961 %

Predictability Indicator is calculated as : 0.676

Predicted 10-Day Ahead Prices are as follows:

Tue Apr 10 Wed Apr 11 Thu Apr 12 Fri Apr 13 Sat Apr 14

0.5085 0.5099 0.5125 0.5152 0.5169

Sun Apr 15 Mon Apr 16 Tue Apr 17 Wed Apr 18 Thu Apr 19

0.5175 0.5180 0.5185 0.5189 0.5190

You can see our previous predictions for XRP on the same chart highlighted in green as well.

Please note that outliers/non-linearities might occur, however our Artificial Intelligence/Deep Learning Enabled predictions indicate the softened/smoothed moving direction of the stocks/commodities/World indices/ETFs/Foreign Currencies/Cryptocurrencies.

Feel free to contact me for your questions.

CRM 10-Day-Ahead Prediction - 04/02-04/13 PeriodArtificial Intelligence/Deep Learning Enabled 10 Day Ahead Predicted values for Salesforce.com - CRM have been plotted on the chart.

The method used in this prediction is Deep Learning based, and using complex mathematical models to extract hidden time series features in vast amounts of CRM related data.

We have chosen the stocks with the highest expected percentage change in 10 Days, and CRM is one of them.

The expected 5 Day Change is 4.9324 %

The expected 10 Day Change is 5.942 %

Predictability Indicator is calculated as : 0.847

Predicted 10-Day Ahead Prices are as follows:

Mon Apr 02 Tue Apr 03 Wed Apr 04 Thu Apr 05 Fri Apr 06

119.89 121.29 121.46 121.68 122.03

Mon Apr 09 Tue Apr 10 Wed Apr 11 Thu Apr 12 Fri Apr 13

122.58 123.04 123.19 123.16 123.21

Please note that outliers/non-linearities might occur, however our Artificial Intelligence/Deep Learning Enabled predictions indicate the softened/smoothed moving direction of the stocks/commodities/World indices/ETFs/Foreign Currencies/Cryptocurrencies.

Feel free to contact me for your questions.

ADBE 10-Day-Ahead Prediction - 04/02-04/13 PeriodAI/Deep Learning Enabled 10 Day Ahead Predicted values for Adobe Systems Inc - ADBE have been plotted on the chart.

The method used in this prediction is Deep Learning based, and using complex mathematical models to extract hidden time series features in vast amounts of ADBE related data.

The expected 5 Day Change is 1.8900 %

The expected 10 Day Change is 2.9667 %

Predictability Indicator is calculated as : 0.823

Predicted 10-Day Ahead Prices are as follows:

Mon Apr 02 Tue Apr 03 Wed Apr 04 Thu Apr 05 Fri Apr 06

218.33 218.97 219.16 219.56 220.16

Mon Apr 09 Tue Apr 10 Wed Apr 11 Thu Apr 12 Fri Apr 13

220.81 221.36 221.78 222.14 222.49

Please note that outliers/non-linearities might occur, however our AI Enabled predictions indicate the softened/smoothed moving direction of the stocks/commodities/World indices/ETFs/Foreign Currencies/Cryptocurrencies.