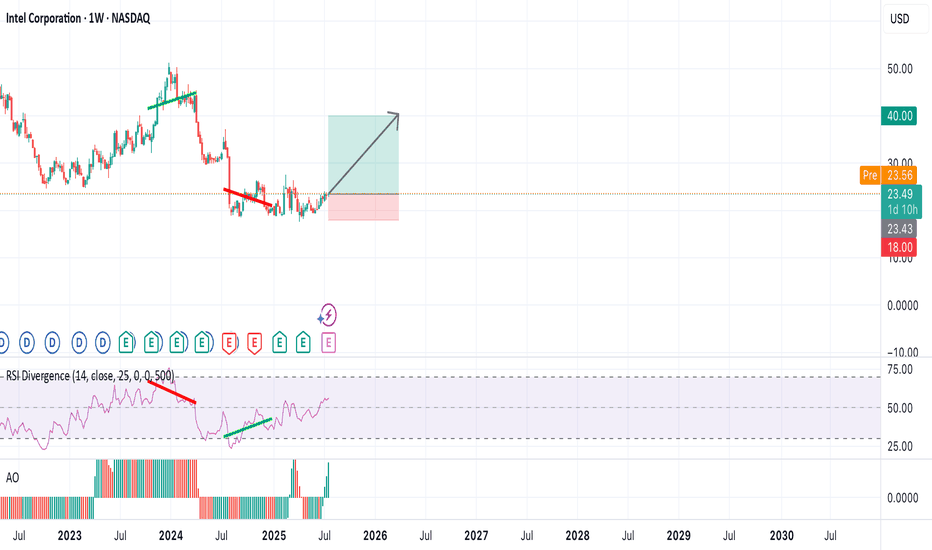

Intel to 40. A bet on America's chip when the chips are downIntel is an interesting stock. I made a bet on it this week. It’s very cheap trading at book value. Lots of bad news has destroyed this stock while other chip stocks are at all time highs. With a new CEO running the show and investing in next gen chip production, I think he turns it around.

I think it's at 40 within a year, and makes new all time highs after that.

Artificialintelligence

FET – HTF Setup Primed for ExpansionFET is looking strong here from a high time frame perspective — currently sitting around $0.739, well into the discount zone of the macro trend channel.

We’ve got:

✅ Price holding monthly demand

✅ A clear swing higher low forming on the weekly and 3W

✅ Already seen the first expansion leg out of demand

✅ Now potentially loading the next move higher

Zooming out, price is still trading below the midline of the long-term uptrend channel — and a move back to the upper boundary puts targets in the $6 region, aligned with a new higher high.

📈 HTF Structure

Midline rejection flipped support

Demand tested and respected

HL printed after clean retest

370% upside just to retest the prior HH at $3.50

HTF trend structure still fully intact

This setup is also supported by the broader HTF bullish bias across BTC, ETH, and majors, which adds confluence to a potential larger expansion phase for alts — especially strong narratives like AI.

🎯 Targets

🎯 $3.50 = prior high

🎯 $6.00+ = upper channel target / next HTF extension zone

From current levels, risk/reward looks very clean.

1W:

3W:

3M:

NVIDIA to $228If Nvidia were truly done for, why is it impossible to find their latest 5000 series GPUs?

Even if someone wanted to buy one, they simply can't.

The reason lies in Nvidia's commitment to fulfilling the soaring demand from AI data centers, which has left them unable to produce enough H100 and H200 models.

This situation also allows Nvidia to increase their profit margins significantly, capitalizing on the disparity between demand and the media frenzy surrounding them.

DeepSeek serves as a prime example of how out of touch mainstream media can be.

All DeepSeek did was replicate Chat GPT.

Training models requires substantial computing power. The panic surrounding Nvidia and other semiconductor companies is quite amusing; the demand for computing power is skyrocketing!

The gap between the reality of the AI mega-trend and the narrow focus of mainstream media is staggering! It's astonishingly out of touch! Just as out of touch as Cramer was when he declared META was done at $100, or when he thought Chat GPT would obliterate Google at $88.

Stock prices fluctuate between being overvalued and undervalued. While we have metrics like EGF and PE ratios to assess valuation, indicating that Nvidia is currently inexpensive, this doesn't guarantee it won't drop further. However, it is generally wiser to buy stocks when they are cheap rather than when they are costly.

The greater the deviation from the high then the greater the BUYING OPPORTUNITY being presented for the very best leading companies.

The key takeaway is that the deeper Nvidia falls during its corrections, the more advantageous it could be.

Those who are experiencing anxiety during these declines may find themselves selling at a loss, or for a marginal profit possibly around previous highs, while the stock has the potential to rise to $228 and beyond.

The potential for growth is significant; the $228 Fibonacci extension may not represent the peak. Attempting to predict a top for Nvidia could be misguided. Once it reaches $228, Nvidia might maintain a valuation similar to its current $130 level.

Is BigBear.ai the Next Titan of Defense AI?BigBear.ai (NYSE: BBAI) is emerging as a significant player in the artificial intelligence landscape, particularly within the critical national security and defense sectors. While often compared to industry giant Palantir, BigBear.ai carves its niche by intensely focusing on modern warfare applications, including guiding unmanned vehicles and optimizing missions. The company has recently garnered considerable investor attention, evidenced by its impressive 287% rally over the past year and a notable surge in public interest. This enthusiasm stems from several key factors, including a substantial 2.5x increase in backlog orders to $385 million by March 2025 and a significant ramp-up in research and development spending, signaling robust foundational growth.

BigBear.ai's technological prowess underpins its rising profile. The company develops sophisticated AI and machine learning models for diverse applications, from facial recognition systems deployed at major international airports like JFK and LAX to AI-augmented shipbuilding software for the U.S. Navy. Its Pangiam® Threat Detection and Decision Support Platform enhances airport security by integrating with advanced CT scanner technology, while its ConductorOS platform facilitates secure communication and coordination for drone swarm operations under the U.S. Army's Project Linchpin. These cutting-edge solutions position BigBear.ai at the forefront of AI-driven advancements crucial for evolving geopolitical landscapes and increasing defense AI investments.

Strategic collaborations and a favorable market environment further fuel BigBear.ai's ascent. The company recently formed a significant partnership in the UAE with Easy Lease and Vigilix Technology Investment to accelerate AI adoption across key industries like mobility and logistics, marking a major step in its international expansion. Additionally, multiple contracts with the U.S. Department of Defense, including those for J-35 fleet management and geopolitical risk assessment, underscore its vital role in government initiatives. While BigBear.ai faces challenges, including revenue stagnation, escalating losses, and stock volatility, its strategic market position, growing backlog, and continuous innovation in mission-critical AI solutions present a compelling high-risk, high-reward investment opportunity in the burgeoning defense AI sector.

AMD - Inverted Head & Shoulders (Bullish Reversal)Let´s see if we can break the neckline (White trendline) and stay above with a close and possibly a retest on the neckline to confirm this pattern. If so, Im looking for the previous top on daily which is the all time high (So far).

This is not a financial advise. Always do your own research and decision before investing.

Lundin Mining Outlook - Copper trade - Coming monthsIm getting really bullish on this stock. With a few copper mines left in the world with tiny lifespans, Lundin mining comes in with copper mines that will deliver for the next 15-20 years. Taking advantage of these high copper prices in the coming raging bull market.

If the price close above the upper resistance line then it will most likely take off. Eventually we will most likely get a pullback to make the resistance line to a support level. Im using DCA method for entry on this one.

Always make your own analysis and your own decision. Don´t see this as a financial advice. I only show you what I do. Nothing else.

OMXSTO:LUMI

CMCMARKETS:COPPERN2025

COMEX:HG1!

OANDA:XCUUSD

CAPITALCOM:COPPER

AMZNThis is a company I believe can become one of the most valuable companies by market cap I think they have a toe in every sector at this point. AI is a massive one and robots also them just possibly replacing all employees with AI and robots. That could make them extremely efficient and profitable short term target of 250 with longer term targets of 300. Not a professional and this is not financial advice just what I am speculating.

FET Correction Bottom Confirmed —Buy OpportunityThe next All-Time High for FETUSDT in late 2025 or early 2026 can reach between $5.42 or $8.56, giving us more than 1,600% profits potential from the current price. This is taking $8.56 as the next All-Time High. Let's get that part out of the way because I want to show you the end of the current correction. I am using the linear scale so it won't let me show you higher targets on the chart.

There was a resistance level in April 2022 as the bear market developed. This resistance was confirmed again in February 2023. It took 270 days, or 9 months, before this resistance level was conquered (broken). As soon as it broke, it was tested as support (Feb. 2024) and then a major rise. This major rise completed a long-term bullish cycle and after a bullish cycle a correction always develops.

How far down can the correction reach?

How low can prices go?

The correction started in March 2024 and is active until this present day. Obviously, the strongest resistance price range in the history of FETUSDT will need to be tested again but as support.

Now, FETUSDT bottomed last week and this bottom happened at the same level where the April 2022 and February 2023 resistance was found. As the action approached this level, volume started to go up. The next week, this week, we have a bullish candle and this is very likely the end of the correction; the bottom is in.

I just wanted to let you know that this level will hold because it was a strong resistance in the past. A resistance level once conquered turns into support.

As prices are now, it is the best possible time to enter; buy, go LONG.

This is a friendly reminder. I am wishing you tons of success and huge profits in this bull market that is just about to develop. It will be a bull market that will change the world. The world is already changing, but this bull market will close the deal. By the time it is over, Cryptocurrency will have taken over the world.

New money. The rich nouveau.

Namaste.

Decentralized AI Infrastructure in a trade war between US/ChinaThe AI revolution is real, but it has a critical weakness: GPU scarcity.

NVIDIA's H100s are sold out to specific countries around the world, serving as crucial hardware for AI development. Cloud costs are skyrocketing. Access to compute is being gatekept by Big Tech. Meanwhile, China is no longer allowed to purchase these GPUs from the US due to the ongoing trade war and the escalating AI arms race between the two countries.

Enter $CRYPTO: IONEUSD — a decentralized GPU network on Solana aiming to become the infrastructure layer for AI, machine learning, and high-performance computing.

Just like Helium tokenized wireless infrastructure, IO is tokenizing global compute power.

-AI is the fastest-growing sector globally, but compute remains the biggest bottleneck.

-Cloud GPU costs are 4–10x higher than decentralized alternatives.

-IO.Net positions itself at the intersection of AI, Web3, and tokenized infrastructure.

-IO is early in its growth curve, currently holding a market cap of $131 million.

I believe that IO.Net could represent a way for China to compete with the US in the AI race, offering a high-demand substitute for expensive and sanctioned chips — helping China stay competitive in AI development.

Because IO.Net is decentralized, it cannot be easily shut down. I believe IO.Net is here to stay and has strong potential to grow significantly from its current market cap of $131 million.

COINBASE:IOUSD

NASDAQ:NVDA

NASDAQ:AMD

NYSE:TSM

BITSTAMP:BTCUSD

BINANCE:SOLUSD

AMEX:SPY

POLESTAR (PSNY) - LONGTERM BUYING OPPORTUNITY, RISK:REWARD 1:10Polestar (PSNY) has been in a long term downtrend since its launch on the NASDAQ, the EV sector has seen some excitement however adoption to EV vehicles has been a slow trend worldwide compared to the hype when first introduced. At current, EV sector participants are in the beginning phases of mass adoption and battery and charger technology is seeing some much needed advancement before mass adoption can take place, many barriers exist in real world infrastructure and this technology will take many years to advance. The promise of autonomous self driving will ultimately catapult these EV companies to new heights financially, however the timing is not right just yet. Once AI advances enough to power ASD, rob taxis and self driving will be a common sight around the world starting in smaller cities and eventually becoming advanced enough to power more of the vehicles worldwide. Polestar's all time low trading price is at $.60 cents and currently sits right above $1.00 per share. Any price between $.60 cents and its current price would be a good 1:10 risk reward investment with downside very limited to potential upside gains to $10 and potentially higher in the long term future. If the EV and AI fulfill its promise, the investment should pay off in the long term.

Disclaimer: With any investment advice especially those where you plan to invest your hard earned money, do your own research before taking any financial advice to understand your exposure and risk tolerance, analyze the utilization of any broker(s) or investment vehicle(s) to understand how your funds are stored or utilized within the platform and always have a plan and strategy prior to entering any market.

$AIXBT macro analysis [ ai coin having huge potential ] Hi it's me ur Raj_crypt0

Here is my view on BINANCE:AIXBTUSDT an #ai sector coin .DYOR / NFA

This is low cap high risky coin u may lose 100% before investment check ur self

Entry - $0.25 below

targets ....

¹$0.55

²$1.5

³$3.5

Note - $0.1 below stop buying ( I will update where to avg or wt to do )

If , u are risky taker $1.5 ( get ur liquid there + 1x profit )

Why Echelon Prime will hit $200 and potentially $400 in 2025Echelon Prime (PRIME) is at the forefront of a transformative movement in Web3 gaming and AI-driven virtual economies. With its innovative ecosystem and upcoming flagship game, Parallel Colony, Echelon Prime is poised for significant growth.

The Echelon Ecosystem: Merging AI and Gaming

Echelon Prime is a blockchain-focused organization supporting a decentralized gaming ecosystem. It provides the PRIME token and Web3 tools for game developers, facilitating resource allocation and governance within a community-led environment.

The ecosystem's cornerstone is the PRIME token, which serves as the native currency across its platforms. PRIME enables players to access exclusive content, participate in governance, and engage in various in-game activities.

Parallel Colony: A Revolutionary AI-Driven Game

Parallel Colony is an upcoming simulation game where players partner with AI avatars to navigate a mining colony. Each avatar controls a wallet, allowing them to own digital possessions and interact with other semi-autonomous agents.

This "1.5 player" game design introduces a new paradigm in gaming, where AI agents operate alongside human players, creating a dynamic and immersive experience. The game's integration of AI and blockchain technology exemplifies the innovative direction of the Echelon ecosystem.

Market Potential and Price Outlook

As of now, Echelon Prime (PRIME) is trading at approximately $4.24, with a market capitalization of around $151 million. Given the ecosystem's innovative approach and the anticipated release of Parallel Colony, there is substantial growth potential.

A projected market cap of $15 billion would correspond to a PRIME token price of approximately $204, representing a 50x increase from current levels. This projection is based on the expected adoption of the Echelon ecosystem and the success of its flagship game. This could very well be a $30 billion market cap by end of 2025 as well, depending on other game title releases and new updates to other ambitious projects.

Conclusion: A Promising Investment in Web3 Gaming

Echelon Prime stands at the intersection of gaming and AI, offering a unique and forward-thinking ecosystem. With the upcoming release of Parallel Colony and the continued development of its platforms, Echelon Prime presents a compelling opportunity for investors interested in the future of Web3 gaming.

ETH 2025 Bull Run Price Targets: PT1 $5,800 PT2 $8,725Pectra: Ethereum’s Most Ambitious Upgrade Yet

On May 7, 2025, Ethereum activated the Pectra upgrade, marking its most comprehensive enhancement since the 2022 Merge. This dual-layer upgrade, combining the Prague execution layer and Electra consensus layer, introduced 11 Ethereum Improvement Proposals (EIPs) aimed at boosting scalability, usability, and staking efficiency .

Key features include:

EIP-7702: Introduces account abstraction, enabling wallets to function like smart contracts. This allows for batch transactions, gasless operations, and improved user experiences.

EIP-7251: Raises the staking cap per validator from 32 ETH to 2,048 ETH, streamlining staking operations and catering to institutional participants.

Enhanced Layer-2 Integration: Improves data handling and reduces costs for Layer-2 solutions, fostering greater scalability and efficiency across the Ethereum ecosystem.

These advancements position Ethereum to handle increased demand and support a broader range of decentralized applications, setting the stage for substantial growth.

Institutional and Governmental Embrace of Ethereum

Ethereum's adoption is accelerating among institutional investors and government entities:

Spot Ether ETFs: In May 2024, the U.S. Securities and Exchange Commission approved the first spot Ethereum exchange-traded funds (ETFs), launched by major firms like BlackRock and Fidelity. This milestone has facilitated greater institutional investment and integration of Ethereum into traditional financial markets.

Tokenization of Assets: Financial institutions are leveraging Ethereum's blockchain to tokenize assets, including U.S. Treasury bonds, enhancing transparency and efficiency in asset management.

Federal Initiatives: The U.S. government is exploring the creation of a national digital asset reserve, potentially incorporating Ethereum, signaling a significant shift toward embracing blockchain technologies at the federal level.

These developments underscore Ethereum's growing role as foundational infrastructure in the evolving digital financial landscape.

Price Targets for 2025

Considering the technological advancements and increasing institutional adoption, Ethereum's price is projected to reach:

Price Target 1: $5,800 (1.618 Fib Line)

Price Target 2: $8,725 (Bull Flag PT and near the 2.618 confluence)

These targets reflect a bullish outlook based on Ethereum's enhanced capabilities and its expanding role in global finance.

Reploy (RAI) – Web3 x AI Revenue-Earning Project with 61x UpsideReploy (RAI) is a rapidly emerging project at the intersection of Web3 and artificial intelligence, designed to streamline how developers build, deploy, and monetize AI agents across blockchains. Unlike many speculative tokens, Reploy stands out for one critical reason: it already earns real revenue.

According to Reploy.ai, the platform offers a no-code/low-code experience that allows anyone to launch custom AI agents and integrate them into DeFi protocols, gaming environments, and decentralized applications. Their architecture combines an on-chain identity layer with decentralized agent hosting, positioning RAI as core infrastructure for the next evolution of intelligent Web3 tools.

The project is still under the radar, trading well below $2, but the fundamentals support a much larger valuation. My 12–18 month price target is $105, which represents a 61x increase from today’s levels. This forecast is based on:

Early revenue traction from agent deployment and API integrations

Strong market tailwinds for decentralized AI applications

Platform stickiness due to unique agent monetization tools and developer incentives

Token utility driving recurring demand (staking, gas, and access control)

RAI isn’t just another AI narrative coin, it's building real infrastructure, already being used, and gaining traction. As adoption grows and more AI agents are hosted through the protocol, the value capture for RAI token holders could be exponential.

Price Target: $105

Current Price: ~$1.72 (as of May 2025)

Upside Potential: +6,000%

$NVDA In, $AAPL Out – AI Supercycle May Be Just Starting🚨 JUST IN: NASDAQ:NVDA surpasses NASDAQ:AAPL to become the second-largest company in the world, right behind $MSFT.

And if that wasn’t enough:

Trump calls Nvidia’s Huang "my friend"

Hints that Nvidia replaces Apple as his go-to tech ally

Meanwhile, Bloomberg reports Nvidia could ship 500,000 AI chips yearly to the UAE until 2027 under revised export rules.

Jensen Huang also confirmed Saudi Arabia is building massive GPU factories, describing them as “energy in, intelligence out” systems.

⚠️ The market may be waking up to the reality that AI is not as cyclical as many feared.

🔍 On the chart:

NASDAQ:NVDA broke to a higher high (HH)

NASDAQ:AMD testing lower high (LH) breakdown resistance

Could AMD follow Nvidia’s breakout? The setup is there.

TradeCityPro | RENDER: AI Token at Breakout or Breakdown Point👋 Welcome to TradeCity Pro!

In this analysis, I want to review the RENDER coin for you. This project is one of the crypto AI projects that gained a lot of hype after AI projects started trending.

🔍 The coin of this project currently has a market cap of $2.36 billion and ranks 45th on CoinMarketCap. Let’s move on to the analysis to see the technical condition of this coin.

📅 Daily Timeframe

As you can see in the daily timeframe, after the drop shown in the chart, with the price falling to the 2.774 area, a ranging structure has formed, and the top of this box is at the 4.52 level.

⭐ Currently, the price has reached the top of the box and is interacting with this level. If the box top is broken, the main bullish trend can begin, and the price may move toward the 6.682 area.

🎲 If this happens, pay attention to the volume, because the volume should increase alongside the price movement and be in convergence. If a large buying volume enters the market, the probability of this scenario increases.

📈 So for spot buying or opening a long position, you can enter on the breakout of 4.520.

🔽 To confirm the market turning bearish, we need to confirm the end of the current bullish leg. If the price gets rejected from the box top or if a fake breakout happens, a break of 4.119 confirms the rejection, and in that case, the price can move back down to the box bottom.

💥 The support levels ahead for the price are 3.513 and 2.774, which can be used as targets for short positions.

📊 The main trigger for the beginning of the next bearish leg is the 2.774 area. If this level is broken, the price will likely make a sharp downward move.

📝 Final Thoughts

This analysis reflects our opinions and is not financial advice.

Share your thoughts in the comments, and don’t forget to share this analysis with your friends! ❤️

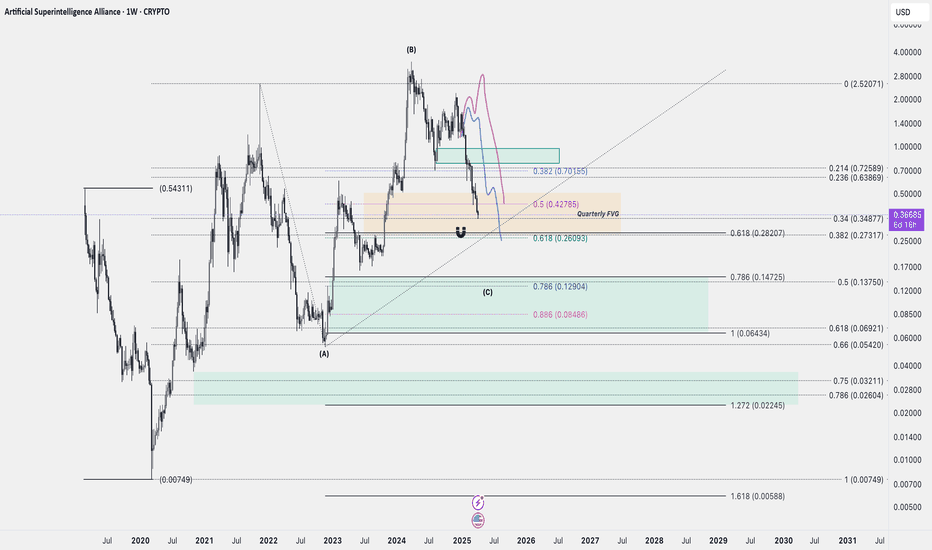

FETUSDI sold every single FET I had at around 2.50s in May 24 and I've not been really interested in it since then, apart from a few short term traders. It's always been a terrible asset to trade frequently, a pain to wait for it to do its thing and then everything happens in a matter of few weeks. As if it's not enough, the merger made it even less attactive.

Anyway, this chart is from December and finally it's in my buy zone. If the qFVG doesn't hold, then i think it'll go down to htf golden pocket for a 98% retrace from ATH. The team behind is relentlessly building and making partnerships, so i think its time can come again.

QUBICUSDT 4-hr Demand at Entry Time-Frame Price-Based LiquiditySymbol: QUBIC/USDT

Higher Time Frame (HTF): 4-hour

Entry Time Frame (ETF): 4-hour

Strategy: 4-hour demand at ETF PBL

Status: Open

R: 0

Before

I have been waiting for this moment to buy into QUBIC, as the technological offering is profound. I waited for price to form a base - and before I started buying, I wanted demnd to form, and I wanted to see supply begin to get consumed. This was key. This started to happen a few weeks ago, and this is when I wanted to begin to accumulate a long position.

Narrative

I started buying at market, as price began to accumulate. I also put a limit order in, which was recently filled. I am going to hold this position for some time, as I feel that this project has masive potential and utility. All orders are now filled and working, now it's just a waiting game.

Emotions: None.

Management: None.

Notes: None.

After an 80% Drop, Is FET Finally Ready to Reverse?Exactly one year ago, FET reached its all-time high of $3.5, but since then, it has experienced a steep decline of over 80%.

However, the coin has recently found strong technical support around the $0.45 zone, which, in my view, signals a potential rebound on the horizon.

Currently, FET is trading near $0.52, and from a psychological standpoint, being around a key round number and its Binance listing price, we could see a bounce from these levels.

With this in mind, I anticipate a trend reversal, with an initial target of $1 in the near future. Additionally, $0.80 stands as a significant resistance level and could serve as an interim target before further upside movement.

From a risk-reward perspective, this setup offers an attractive 1:5 ratio