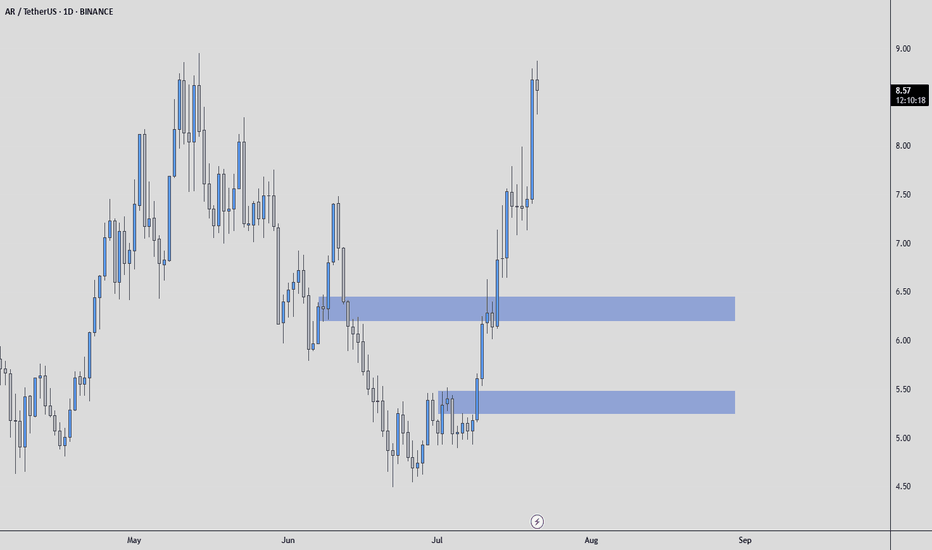

ARUSDT Mid-Term AnalysisIt made a nice rise, but I’m waiting for price in the blue boxes I’ve marked.

I won’t chase it at high prices.

If price comes to my levels, I’ll watch for:

✅ Footprint absorption

✅ CDV support

✅ Structure reclaim

If these align, I’ll consider a trade with clear risk. If not, I’m fine staying out.

Patience over chasing. The right price, or no trade.

Arusd

AR Looks Bullish (1D)The AR symbol appears to be completing a double corrective pattern | the first part being a plapyonic diametric and the second part a flat. The green zone represents a demand area that could potentially push the price upward. Note that this type of setup is generally safer for spot trading, while futures trading would require more precise entry levels.

Targets are marked on the chart.

A daily candle closing below the invalidation level will invalidate this analysis.

For risk management, please don't forget stop loss and capital management

Comment if you have any questions

Thank You

Rebuy Setup for AR (3D)From the point where we placed the red arrow on the chart, the AR correction seems to have begun.

It now appears to be in wave C of the corrective pattern. The green zone is where the bearish wave C could potentially end.

A daily candle close below the invalidation level will invalidate this analysis.

For risk management, please don't forget stop loss and capital management

Comment if you have any questions

Thank You

ARUSD Bullish IdeaBullish Idea

Entry Zone:

$23.50 - $24.00: This is a strong support area where buying interest is expected. Look for consolidation or bullish reversal signals before entering.

Targets:

Short-term Target: $28.00 (previous resistance level)

Medium-term Target: $30.00 (psychological resistance)

Long-term Target: $35.00 (major swing high from previous trends)

Stop Loss:

Place a stop-loss below $22.50, as a breakdown below this level could invalidate the bullish setup and signal a deeper retracement toward $19-$20.

Risk-Reward:

Risk: Approximately $1.50 (entry at $23.50, stop at $22.00).

Reward: Potential upside of $4.50 to $11.50, giving a risk-reward ratio of 3:1 or higher depending on your target.

Key Technical Reasons for Bullish Bias:

Market Structure:

The market is forming higher lows and maintaining a bullish structure above key support levels.

Healthy RSI Reset:

RSI has cooled off to neutral (47.72), allowing room for further upside without being overbought.

Breakout Momentum:

The breakout above $20 remains intact, with consolidation forming above this key level, signaling bullish accumulation.

Volume Confirmation Likely:

Consolidation phases often precede strong volume-driven moves, and a breakout above $25-$26 could bring new buyers into the market.

Strategy:

Watch $23-$24 Support Zone: Enter long positions if price holds or shows bullish reversal patterns.

Set Conservative Stops: Below $22.50 to protect against unexpected breakdowns.

Add on Confirmation: Consider adding positions if price breaks above $25-$26 with strong volume.

AR is getting ready to leave the canal!We can see that this is a key level for AR right now and we are actually at the starting point before the upside. I expect that we will hold 50 EMA now, then we will have a sharp impulse and exit from the parallel channel. Fixation points on the chart according to Fibonacci levels!

Best regards, Horban Brothers.

Is #ARUSDT Ready to Skyrocket or Dive? Key Levels to WatchYello, Paradisers! Have you been watching #ARUSDT? Let's look at the latest analysis of #Arweave and see what's happening:

💎Currently, #AR is trading within a falling wedge, a pattern often associated with bullish reversals. The price is retesting the descending resistance, with increasing volume and the 50EMA reinforcing a bullish momentum. These are promising signals, but the next steps are critical to confirm the breakout.

💎#Arweave is approaching the $15.40 support level, a vital zone that could spark a new leg up if held. A rally from this point, combined with a break above the descending resistance, would mark a significant shift in the market structure. Such a move could pave the way for higher resistance targets and signal a sustained upward trend.

💎However, if #ARUSDT fails to hold this demand zone, the price could slip further to test the $12.38 support. This range, aligning with a previous low, serves as a crucial price floor. A failure to reclaim $15.40 with strength would jeopardize the bullish case.

💎A daily close below $12.38 would invalidate the bullish outlook entirely. In such a scenario, Arweave risks setting a new lower low, potentially leading to further declines and increased bearish pressure.

Always aim for precision and keep a close eye on the critical zones to maximize your trading edge.

MyCryptoParadise

iFeel the success🌴

ARUSDT Ready for a Strong UpsideARUSDT Technical analsysi update

ARUSDT has been trading inside a falling wedge pattern for the last 250 days. The price is now moving toward the wedge resistance line for a potential breakout. Once the breakout is confirmed on the daily chart, we can expect a strong bullish move in AR.

The 2022 resistance level is acting as strong support at the bottom of the falling wedge, and the price is currently bouncing from this level.

Regards

Hexa

AR RoadMap (1D)From where we put the arrow on the chart, it looks like AR has entered a correction.

We can call the bullish pattern A/W wave and consider the wave we are in now as B/X.

It is expected to form the green range of the C/Y wave.

AR support range cannot be optimized and the range is large so control the risk.

The targets are clear on the chart.

For risk management, please don't forget stop loss and capital management

When we reach the first target, save some profit and then change the stop to entry

Comment if you have any questions

Thank You

ARUSDT Shows Potential for Rally!ARUSDT technical analysis update

AR's price is breaking the falling wedge resistance on the daily chart after 200 days of formation and is about to cross above the 100 EMA. Once the breakout is confirmed on the daily chart, we can expect a strong bullish rally in AR

Regards

Hexa

ARUSDT Strong Support!ARUSDT technical analysis update

AR's price has dropped 67% from its peak and is now trading at its major support zone, where we can expect a bounce.

Before the drop, AR's price had increased by 300% after a broadening wedge pattern breakout. The current price is trading at the broadening wedge's previous peak resistance level, which is now acting as strong support for AR.

target: 200%-300%

Regards

Hexa

AR: Support Level Reached, Potential for Bounce Back#AR/USDT #Analysis

Description

---------------------------------------------------------------

+ The price has hit the support line for the third time, underscoring the significance of this level. Each previous test has resulted in a reversal, suggesting that this support remains robust.

+ The current price action is showing signs of a reversal from this support zone, which could signal the beginning of an upward move.

---------------------------------------------------------------

VectorAlgo Trade Details

------------------------------

Entry Price: 20.82

Stop Loss: 15.78

------------------------------

Target 1: 24.38

Target 2: 28.28

Target 3: 31.39

Target 4: 41.01

Target 5: 48.50

------------------------------

Timeframe:

Capital Risk: 1-2% of trading amount

Leverage: 5-10x

---------------------------------------------------------------

Enhance, Trade, Grow

---------------------------------------------------------------

Feel free to share your thoughts and insights.

Don't forget to like and follow us for more trading ideas and discussions.

Best Regards,

VectorAlgo

AR: Resistance BreakoutTrade setup : Price remains in a long-term Uptrend. Price got oversold (RSI < 30) and bounced off of $23 support and 200-day moving average. It's now broken above $28 resistance and could swing up to $37 next. Momentum is inflecting bullish again (MACD Histogram rising).

Pattern : Resistance Breakout . Once a price breaks above a resistance zone, it signals that buyers have absorbed all the supply from sellers at this level and price can resume it's advance. Following a resistance breakout, the next closest resistance zone becomes a price target. Learn to trade key level breakouts in Lesson 7.

Trend : Short-term trend is Down, Medium-term trend is Down and Long-term trend is Up.

Momentum : Price is neither overbought nor oversold currently, based on RSI-14 levels (RSI > 30 and RSI < 70).

Support and Resistance : Nearest Support Zone is $23.00, then $17.00. Nearest Resistance Zone is $28.00, then $37.00.

AR buy setupThe internal structure of the AR is a bear. AR has a good support range ahead of it.

A trigger line has also been broken

On this range, we will look for buy/long positions in the form of scalpy

Closing a daily candle above the invalidation level will violate the analysis.

Note that the financial market is risky, so:

Do not enter any position without confirmation and trigger.

Do not enter a position without setting a stop.

Do not enter a position without capital management.

When we reach the first TP, save some profit and try to move the stop continuously in the direction of your profit.

If you have any comments please post them, comments will help us improve our performance

Thanks

AR is close to a dropFrom the place where we entered "START" on the chart, our correction has started.

AR seems to be forming a triangle.

We are now in wave D of this triangle. Wave D is a large diametric.

We are now in the last wave of this diametric

In the red box, we wait for wave D to end and enter wave E.

Wave E here is a bearish wave.

The targets are marked on the picture.

Closing a daily candle above the invalidation level will violate the analysis.

invalidation level : 53.9936

For risk management, please don't forget stop loss and capital management

When we reach the first target, save some profit and then change the stop to entry

Comment if you have any questions

Thank You