This is a beautiful chat, We hava two chart, Broardening wedge and Ascending wedge.

Diamond Formation

www.forexstrategieswork.com

The diamond pattern is a rare pattern but when it occurs you can expect price reversal on the horizon. This is usually formed at the top end of the rally and as the name suggests the consolidation leads to a diamond shape pattern.

Broadening Formation or Broadening wedge

The broadening wedge is where prices consolidate and in the process form higher highs and lower lows, thus expanding the range. At the end of the consolidation, the broadening wedge pattern breaks by forming a lower high before price fall sharply. The broadening wedge pattern occurs in a bullish trend. Similar to a rising or falling wedge pattern, the broadening wedge pattern is formed by five reference points.

Ascendingwedg

forexTrdr AUDUSD - CHANNEL VISION Afternoon traders

With the ECB press conference now complete the market is now cleaner to enter other trades. In this case we are looking to get long Aussie Dollar versus US dollar after the pair have settled in oversold levels at support price of 0.6970 area. As per our chart work on trading view we have an ascending channel which is allowing us to set up for a great risk reward trade with stop loss just below the rising support and an upside potential towards 0.712 area as per our predicted bar chart work.

Follow us on tradingview under forexTrdr to get our sample ideas free and immediately - its free to setup a profile and the charting tools and software is easier to use than Meta trader and most broker platforms. Or if you want a free one month signals trial with us please get in touch.

Good luck trading

from the Team at forexTrdr

XRP BTC Fibconacci level analysis and ascending wedgeXRP BTC is currently testing the support zone of an ascending wedge, if XRP breaks the 9000 satoshi support level with good trading volume then the pattern would indicate a target that near 6000 satoshi level, although the target may not be met if it finds support on one of the lower fibonacci levels indicated on the chart. The moving average oscillator and RSI indicators also suggest that correction is likely at this time as we see the 50 level of the RSI being broken and the MACD crossover on the oscillator.

Not intended to be financial advice.

Biffy.

SWISS FRANC CURRENCY INDEX (SXY) DAILY TIMEFRAME SHORTThe Swiss Franc currency index is currently moving in a series of lower highs and lower lows, characteristic of a downtrend. The price is clearly moving downwards with brief correctional pauses as shown by the ascending wedges and bear flag chart patterns. I am targeting a short trade toward the 97.8 area, which will be my profit taking zone. This area represents a potential buy zone as it is the bottom of the correctional structure. I certainly hope history repeats itself with this trade and the 90% rule sticks out!!!.

A break above 100 might change my bias a bit, but currently i am targeting the 07.8 price level for profit-taking.

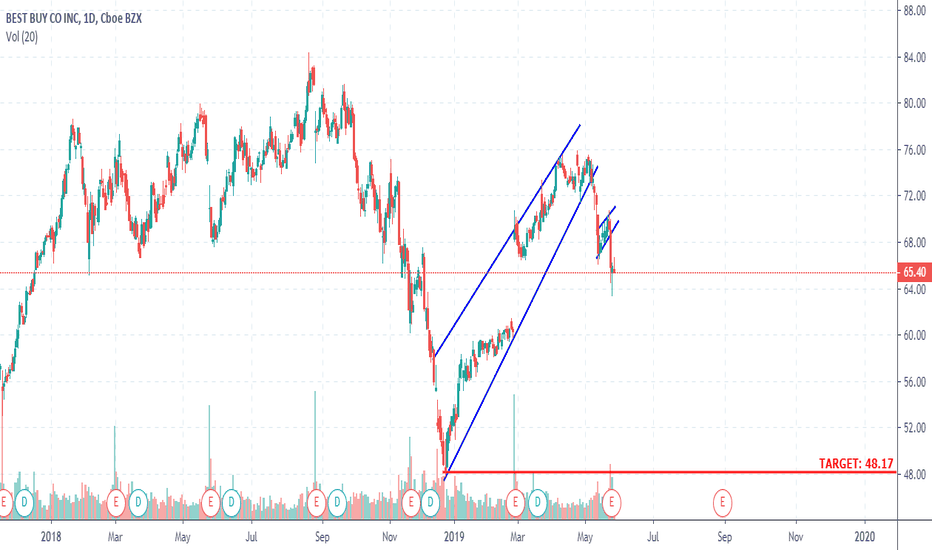

BEST BUY DAILY TIMEFRAME SHORTPrices dropped sharply before forming an ascending wedge, which topped out at the 76 price level. Now, price has already broken out of this corrective structure to the downside and is making a continuation move, with two opportunities to scale in already gone. But you can still jump in with proper risk management and target the bottom of the corrective structure, at the 48.17 price level. May the bears pounce on unsuspecting buyers lol!!

AUDJPY - Potential SELL from KEY resistance - ASCENDING WEDGE AUDJPY has been trading between a nice range since early January.

Potential SELL from 79.50 with stop loss set above 80.00

First Take Profit set at 78.50.

The pair are also trading between an Ascending Wedge Pattern, this indicates a potential reversal

Dow Likely Entering Bear Market: Broadening Top; Bear Flag Ominous portents. Broadening top in September led to the microcrash in October and US Equities have been struggling since.

November usually one of the best months for stocks, has only been a down month in 3 years of past 20; those were in Bear Markets...

Some very fine textbook chart formations appearing over past few months. The Zig-Zag Correction has led to what appears to be the end of the Great Bull.

Fed will hike again next month and if they hike twice more we will get a recession starting in 2019. Earnings have already passed their halcyon days, look at Apple and NVidia, IBM and many other issues already entering bear markets. The power to drive this market to new heights has leaked out of the balloon, I'm afraid.

Spent a weekend reading Murphy's Technical Analysis of Financial Markets, Chapter 6: Continuation Patterns is a lovely read, quoted for your reading pleasure:

"The Broadening Formation is an unusual variation of the triangle and is relatively rare.... looks like an expanding triangle... also called a 'Megaphone Top.' In other triangular patterns, the volume tends to diminish as the swings grow narrower; in the broadening formation, volume tends to expand along with wider price swings. This situation represents a market that is out of control and unusually emotional. Because this pattern also represents an unusual amount of public participation, it most often occurs at major market tops. The expanding pattern, therefore, is usually a bearish formation. It generally appears near the end of a major bull market."

-Murphy, 1999 Revised Ed., pages 140-141.

"The flag and pennant represent brief pauses in a dynamic market move. One requirement... is they be preceded by a sharp, almost straight-line move. They represent pauses in which that market 'catches its breath' before running off in the same direction. Flags and pennants are among the most reliable continuation patterns and only rarely produce a trend reversal. ...Flags and pennants are said to 'fly at half-mast' from a 'flagpole,' as they appear at the midpoint of a major move. Pennants and flags on downtrends are completed very quickly, often in only 1-2 weeks, after which the breaking of the lower trendline in the pennant signals the resumption of the downtrend. The break down will take place on heavy volume, and the magnitude of the move is estimated by measuring the vertical distance of the preceding move from the breakout point of the pennant . Flags are small parallelograms that slope against the prevailing trend. Pennants resemble small horizontal symmetrical triangles."

-Murphy, 1999 Revised Ed., pages 141-145.

Well, this flag started flying on 14 Nov, I reckon it might snap off after the holiday week, maybe sooner, who knows? Expect it to fly a bit higher, to form a right shoulder which might be expected to occur around 25600 on Dow. We saw 25500 very briefly Friday on Trumptweet, another such tweet could top off the flag. Good luck!

As always this is an educational post for your amusement and does not constitute investment advice; trade at your own risk!

Ethereum possibilities for further movement#ETH

We hold the long-term Long Ethereum, but in the more short term the situation looks like this: we are approaching the upper edge of the descending channel; there can be an impulsive breakdown, after which there will be a logical rollback to support, in the role of which this upper bound will already act. If this is not a false breakdown, then after the test of new support, the price should move higher. But at the moment there is an upward wedge inside the channel, which can indicate the current weakness of the market for breaking through the current resistance, we can now go lower for the next test of support of 200 and a set of volume for the next attempt to break through the resistance of the upper edge of the channel.

BTC likely scenarios#BTC

The nearest scenario for Bitcoin might look like this: we are within the rising wedge, which is a pattern predicting a further decline, but the current state of the market indicates the possibility of continuing to move within this wedge. Therefore, we can approach a tight resistance range, around 6900, from where the price should begin to form a decline. If at the moment the local support of the 6580 does not keep the market pressure, then there will be a scenario of premature exit from the wedge with a subsequent test of stronger support for 6400.

#EOS moving in triangle#EOS

We form a triangle, we can continue to move inside its faces. At the moment, there is an upward wedge with a strong resistance from above, to break through that little chance, but if this happens, then we will test the upper side of the triangle, the breakdown of which will enable a more bullish scenario. Most likely we will go below and continue the movement inside the triangular pattern.

Bitcoin under strong resistance#BTC

The market continues to follow the scenario, which we voiced earlier. We all have the same dense resistance and we have more and more chances to go down. The price continues to be inside the triangle, its upper edge can be broken, but probably it will be a false breakdown with a further decline (bull trap). The formed local resistance at this stage looks very dense and is difficult to overcome and fix above it.

BTC danger of going lower#BTC

Despite the formation of a possible upward wedge, in small timeframes the price looks rather bullish. You can see a tight resistance near the level of 6625, which the market is trying to overcome more than once. At the moment, the Stoch RSI bounces off the oversold area and can move higher, which will give a chance to tighten the price again to test the level of 6625. Overcoming this resistance will push the market to the next target area near the zone near the level of 6835. But small scales can be misleading and show unnecessary " noise ", so we are looking at the scale of 1 day: Stoch RSI is still very bullish, and MACD may intersect and move higher, which will give the chance to push the price some more time up.

From the negative point of view, on the 4-hour scale, the formation of the figure is visible, the breakdown of the lower edge of which will direct the market and further follow the downtrend, and the growth of the last days is only a correction of the fall, but not the prerequisites for a global turn and then the range of trade at lower levels.

INTC bearish ascending wedge nearing end. Risk/Reward 1:5The chart says it all. If I wanted to guess at fundamental catalysts that would cause this, is Intel's continued delay of 10nm. Also, Intel's only competitor, AMD's chart is just breaking resistance of over a year of consolidation. I'm guessing AMD will be taking market share in a big way.

This is a simple short setup, nothing too overly complicated to explain here. Typically, wedges breakout to 100% of their height in the opposite direction.