Ashokleyland

Ashok leyland below Value area.See how value creates support and resistance zones for price. supply and demand and how the sellers position themselves at the value high and buyers at value low. Once these levels get broken, there is a change in supply and demand dynamics. As you can see in the chart it was broken with pinbar ( shown rejection).

Long Ashok Leyland Target toward 50-53

Thanks

Perfect Elliot Wave In Ashok Leyland (Probability 2)We're in the correction waves of Elliot with a perfect head and shoulders at the end of impulse. Another head and shoulders is seen in making which also completes the corrective waves. (Fundamentally company is cool, this is just the mood of investors captured by the Great Elliot

Perfect Elliot Wave In Ashok Leyland (Probability 1)We're in the correction stage of the long term elliot wave in Ashok leyland. Perfect head and shoulders seen at the end of Elliot's impulse wave.

Hence there can be two possibilities according to elliot wave (there can be more, is pointed two most probable) and this is Probability 1

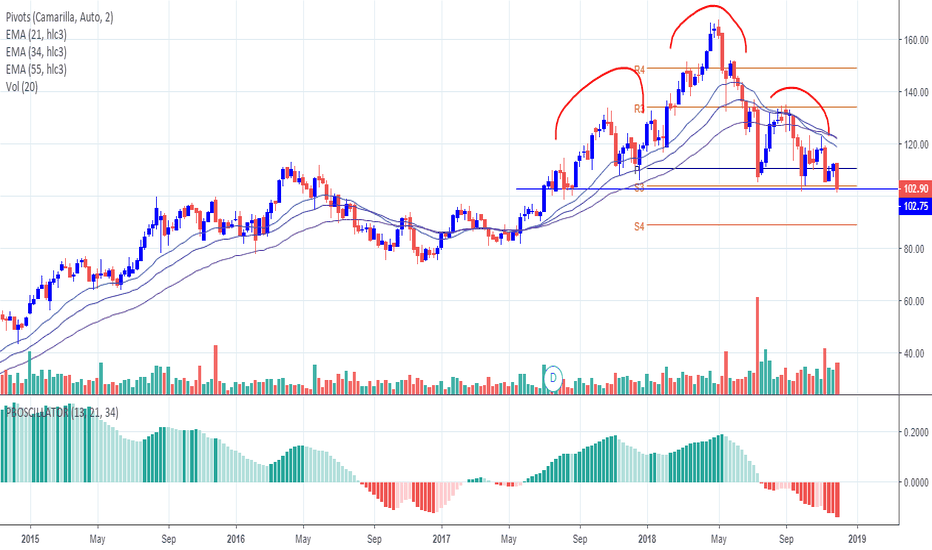

ASHOK LEYLAND - WEAK STRUCTURE#ASHOKLEYLAND

CMP 102.9

Bias - Bearish SUBJECT TO BREAKDOWN OF 100 LEVELS.

Weekly chart shows a perfect H & S pattern.

Price at the neckline region with higher probability of breakdown.

Breakdown of 100 possibly could be disaster for the stock.

Pivot based ema oscillator is at a new 2 year low.

Next major support seen in the region of 80-82. Camarilla S4 at 88.

View negated if price crosses above 112.