Asx200

ASX 200 Rallies into Resistance ClusterIt can be useful to monitor several renditions of the same market, in order to identify higher probability support and resistance levels. And I would personally argue this becomes the more important if one trades CFDs exclusively.

Today I am comparing the ASX 200 cash market (XJO) and ASX 200 futures market (SPI 200, or AP1!) alongside the forem.com AUS200 CFD.

All three markets are approaching a key resistance cluster around 8,000. Neither the cash market nor futures market has broken above 8,000 yet and have several resistance levels (including a 61.8% Fibonacci ratio while the March low and December high) remain unbreached. Also note that futures volumes have been declining while prices rise, which shows a lack of bullish initiation (and also points to a short-covering rally).

Therefore, my bias is to fade into moves on the AUS200 should it breach its own 8,000, with the short bias becoming invalidated with a break above the 61.8% Fib level.

Matt Simpson, Market Analyst at City Index and Forex.com

ASX to find sellers at market price?ASX200 - 24h expiry

Daily signals are bearish.

Daily signals for sentiment are at oversold extremes.

The lack of interest is a concern for bulls.

Offers ample risk/reward to sell at the market.

20 1day EMA is at 7766.

We look to Sell at 7785 (stop at 7905)

Our profit targets will be 7435 and 7365

Resistance: 7817 / 7865 / 7987

Support: 7716 / 7600 / 7500

Risk Disclaimer

The trade ideas beyond this page are for informational purposes only and do not constitute investment advice or a solicitation to trade. This information is provided by Signal Centre, a third-party unaffiliated with OANDA, and is intended for general circulation only. OANDA does not guarantee the accuracy of this information and assumes no responsibilities for the information provided by the third party. The information does not take into account the specific investment objectives, financial situation, or particular needs of any particular person. You should take into account your specific investment objectives, financial situation, and particular needs before making a commitment to trade, including seeking advice from an independent financial adviser regarding the suitability of the investment, under a separate engagement, as you deem fit.

You accept that you assume all risks in independently viewing the contents and selecting a chosen strategy.

Where the research is distributed in Singapore to a person who is not an Accredited Investor, Expert Investor or an Institutional Investor, Oanda Asia Pacific Pte Ltd (“OAP“) accepts legal responsibility for the contents of the report to such persons only to the extent required by law. Singapore customers should contact OAP at 6579 8289 for matters arising from, or in connection with, the information/research distributed.

ASX Weekly Market Wrap: XJO, LYC, IMD, NST, APA & CHC in FocusASX Weekly Market Wrap: XJO, LYC, IMD, NST, APA & CHC in Focus

In this week’s market analysis, we break down key price movements and trends across the #ASX, with a close look at the XJO and standout stocks like Lynas Rare Earths (#LYC), Imdex (#IMD), Northern Star (#NST), APA Group (#APA), and Charter Hall (#CHC). We explore current momentum, trend direction, and price action indicators to help you spot opportunities and make more confident trading decisions. Whether you're paper trading or actively investing, this is your must-watch guide for the week ahead.

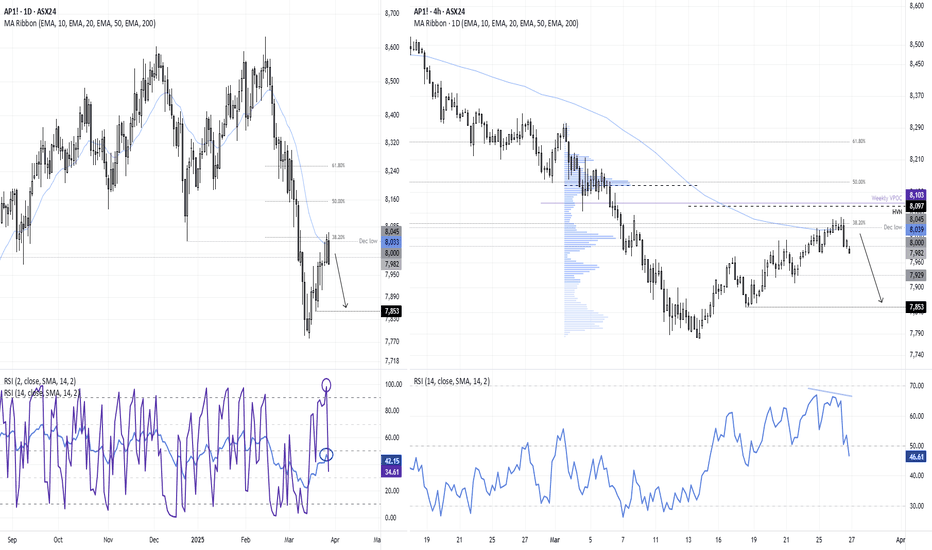

Momentum Turns Against the ASXThe rally of the past two week on the ASX took a turn for the worse on Wednesday, on the warning (and official announcement) of Trump's 25% tariff on non-US cars.

This has seen the ASX get caught in the negative sentiment on Wall Street.

The daily chart shows that momentum has turned lower around a resistance cluster, including the December low, 38.2% Fibonacci ration and 20-day EMA. The daily RSI (2) reached a highly overbought level on Wednesday and now sits below 50, and the RSIK (14) has remained beneath 50 to show negative momentum overall.

A bearish divergence also formed on the 4-hour RSI ahead of the selloff.

The bias is for a move down to at least the 7930 area, a break beneath which brings the lows around 7850 into focus.

Matt Simpson, Market Analyst at City Index and Forex.com

Potential key reversal bottom detected for JHXAwait signals for entry such as DMI/ADX and/or RSI swing to the bullish direction.

Stop loss for the trade involving ASX:JHX (and indication that this trade is an absolute 'no-go') is any trade below the low of the signal day of 21st March (i.e.: any trade below $45.52).

ASX200 H4 | Potential bullish bounceASX200 (AUS200) is falling towards an overlap support and could potentially bounce off this level to climb higher.

Buy entry is at 7,994.30 which is an overlap support that aligns with the 23.6% Fibonacci retracement.

Stop loss is at 7,859.00 which is a level that lies underneath an overlap support and the 50.0% Fibonacci retracement.

Take profit is at 8,092.48 which is an overlap resistance that aligns close to the 38.2% Fibonacci retracement.

High Risk Investment Warning

Trading Forex/CFDs on margin carries a high level of risk and may not be suitable for all investors. Leverage can work against you.

Stratos Markets Limited (www.fxcm.com):

CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 63% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Stratos Europe Ltd (www.fxcm.com):

CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 63% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Stratos Trading Pty. Limited (www.fxcm.com):

Trading FX/CFDs carries significant risks. FXCM AU (AFSL 309763), please read the Financial Services Guide, Product Disclosure Statement, Target Market Determination and Terms of Business at www.fxcm.com

Stratos Global LLC (www.fxcm.com):

Losses can exceed deposits.

Please be advised that the information presented on TradingView is provided to FXCM (‘Company’, ‘we’) by a third-party provider (‘TFA Global Pte Ltd’). Please be reminded that you are solely responsible for the trading decisions on your account. There is a very high degree of risk involved in trading. Any information and/or content is intended entirely for research, educational and informational purposes only and does not constitute investment or consultation advice or investment strategy. The information is not tailored to the investment needs of any specific person and therefore does not involve a consideration of any of the investment objectives, financial situation or needs of any viewer that may receive it. Kindly also note that past performance is not a reliable indicator of future results. Actual results may differ materially from those anticipated in forward-looking or past performance statements. We assume no liability as to the accuracy or completeness of any of the information and/or content provided herein and the Company cannot be held responsible for any omission, mistake nor for any loss or damage including without limitation to any loss of profit which may arise from reliance on any information supplied by TFA Global Pte Ltd.

The speaker(s) is neither an employee, agent nor representative of FXCM and is therefore acting independently. The opinions given are their own, constitute general market commentary, and do not constitute the opinion or advice of FXCM or any form of personal or investment advice. FXCM neither endorses nor guarantees offerings of third-party speakers, nor is FXCM responsible for the content, veracity or opinions of third-party speakers, presenters or participants.

Bearish potential detected for WHCEntry conditions:

(i) lower share price for ASX:WHC along with swing up of the DMI indicators and swing down of the RSI indicator, and

(ii) observation of market reaction at the support level at $5.55.

Stop loss for the trade would be, dependent of risk tolerance:

(i) above the resistance level from the open of 21st February (i.e.: above $5.80),

(ii) above the resistance level from the open of 13th January (i.e.: above $5.91), or

(iii) above the resistance level from the open of 30th December (i.e.: above $6.00).

ASX to turnaround?AU200AUD - 24H EXPIRY

Price action has continued to trend strongly lower and has stalled at the previous support near 7750.

Price action looks to be forming a bottom.

Further upside is expected.

Risk/Reward would be poor to call a buy from current levels.

A move through 7900 will confirm the bullish momentum.

The measured move target is 8100.

We look to Buy at 7850 (stop at 7750)

Our profit targets will be 8050 and 8100

Resistance: 7900 / 8000 / 8100

Support: 7850 / 7800 / 7750

Risk Disclaimer

The trade ideas beyond this page are for informational purposes only and do not constitute investment advice or a solicitation to trade. This information is provided by Signal Centre, a third-party unaffiliated with OANDA, and is intended for general circulation only. OANDA does not guarantee the accuracy of this information and assumes no responsibilities for the information provided by the third party. The information does not take into account the specific investment objectives, financial situation, or particular needs of any particular person. You should take into account your specific investment objectives, financial situation, and particular needs before making a commitment to trade, including seeking advice from an independent financial adviser regarding the suitability of the investment, under a separate engagement, as you deem fit.

You accept that you assume all risks in independently viewing the contents and selecting a chosen strategy.

Where the research is distributed in Singapore to a person who is not an Accredited Investor, Expert Investor or an Institutional Investor, Oanda Asia Pacific Pte Ltd (“OAP“) accepts legal responsibility for the contents of the report to such persons only to the extent required by law. Singapore customers should contact OAP at 6579 8289 for matters arising from, or in connection with, the information/research distributed.

Potential key reversal bottom detected for NHCAwait signals for entry such as DMI/ADX and/or RSI swing to the bullish direction.

Stop loss for the trade involving ASX:NHC (and indication that this trade is an absolute 'no-go') is any trade below the low of the signal day of 14th March (i.e.: any trade below $3.64).

ASX200/AUS200 "Australia 200" Indices Market Bearish Heist Plan🌟Hi! Hola! Ola! Bonjour! Hallo! Marhaba!🌟

Dear Money Makers & Thieves, 🤑 💰🐱👤🐱🏍

Based on 🔥Thief Trading style technical and fundamental analysis🔥, here is our master plan to heist the ASX200/AUS200 "Australia 200" Indices Market. Please adhere to the strategy I've outlined in the chart, which emphasizes short entry. Our aim is the high-risk Green Zone. Risky level, oversold market, consolidation, trend reversal, trap at the level where traders and bullish thieves are getting stronger. 🏆💸Book Profits Be wealthy and safe trade.💪🏆🎉

Entry 📈 : "The vault is wide open! Swipe the Bearish loot at any price - the heist is on!

however I advise placing Sell limit orders within a 15 or 30 minute timeframe. Entry from the most recent or closest low or high level should be in retest.

Stop Loss 🛑: Thief SL placed at (8360) swing Trade Basis Using the 3H period, the recent / swing high or low level.

SL is based on your risk of the trade, lot size and how many multiple orders you have to take.

Target 🎯: 8000 (or) Escape Before the Target

🧲Scalpers, take note 👀 : only scalp on the Short side. If you have a lot of money, you can go straight away; if not, you can join swing traders and carry out the robbery plan. Use trailing SL to safeguard your money 💰.

📰🗞️Fundamental, Macro, COT Report, Sentimental Outlook:

ASX200/AUS200 "Australia 200" Indices Market is currently experiencing a Bearish trend in short term, driven by several key factors.

⭐Fundamental Analysis

Earnings: Q4 2024 EPS growth strong for ASX 200 firms (e.g., banks, miners); Q1 2025 prelims suggest resilience—bullish.

Rates: RBA at 4.35% (stable, Feb 2025)—high yields vs. ECB (2.5%) pressure equities—bearish.

Inflation: Australia at 2.8% (Jan 2025)—above RBA’s 2-3% target, mixed impact.

Growth: GDP ~1.5% (Q4 2024 est.)—steady, mildly bullish.

Geopolitics: U.S.-China tariffs shift trade to Australia—bullish for miners.

⭐Macroeconomic Factors

U.S.: Fed at 3-3.5%, PCE 2.6%—USD softness aids AUD—bullish (Eurostat/U.S. data).

Eurozone: PMI 46.2—stagnation pressures global equities—bearish

Global: China 4.5%, Japan 1%—slow growth, commodity demand soft—bearish (ECB forecasts).

Commodities: Iron ore ~$100/ton, oil $70.44—stable, neutral for ASX miners/energy (global data).

Trump Policies: Tariffs (25% Mexico/Canada, 10% China)—benefits Australian exports—bullish.

⭐Global Market Analysis

Equity Markets: S&P 500 at 5,990, DAX ~19,000—range-bound, neutral correlation with ASX.

Commodities Influence: Stable mining/energy sectors (BHP, Rio Tinto) support ASX—bullish.

Liquidity: High trading volume reflects global interest—bullish stability.

⭐Commitments of Traders (COT) Data

Speculators: Net long ~60,000 contracts (down from 70,000)—cautious bullishness (global futures).

Hedgers: Net short ~65,000—stable, locking in highs.

Open Interest: ~130,000 contracts—steady global interest, neutral.

⭐Market Sentiment Analysis

Retail: 55% short contrarian upside—bullish potential.

Institutional: Mixed—optimism for miners, caution on rates—neutral.

Corporate: Firms hedge at 8,600-8,650—neutral.

Social media Trends: Bearish bias to 8,200-8,160—bearish short-term (

⭐Positioning Analysis

Speculative: Longs target 8,675-8,700, shorts aim for 8,080-8,000.

Retail: Shorts at 8,568-8,600—squeeze risk if price rises.

Institutional: Balanced, commodity-focused optimism.

⭐Next Trend Move

Technical:

Support: 8080-8000

Resistance: 8,675-8,700

Below 8,080 targets 8,000; above 8,675 aims for 8,750.

Short-Term (1-2 Weeks): Dip to 8,000 if risk-off persists; rebound to 8,700 if support holds.

Medium-Term (1-3 Months): Range 8,080-8,800, tariff-driven.

⭐Overall Summary Outlook

ASX 200 at 8,080.00 balances bullish fundamentals (earnings, tariffs, commodity stability) with bearish pressures (global slowdown, RBA rates, sentiment). COT shows cautious longs, positioning suggests short-term caution, and global trends support a dip before recovery. Short-term downside to 8,000 likely, with medium-term upside to 8,800 if macro stabilizes.

📌Keep in mind that these factors can change rapidly, and it's essential to stay up-to-date with market developments and adjust your analysis accordingly.

⚠️Trading Alert : News Releases and Position Management 📰 🗞️ 🚫🚏

As a reminder, news releases can have a significant impact on market prices and volatility. To minimize potential losses and protect your running positions,

we recommend the following:

Avoid taking new trades during news releases

Use trailing stop-loss orders to protect your running positions and lock in profits

💖Supporting our robbery plan 💥Hit the Boost Button💥 will enable us to effortlessly make and steal money 💰💵. Boost the strength of our robbery team. Every day in this market make money with ease by using the Thief Trading Style.🏆💪🤝❤️🎉🚀

I'll see you soon with another heist plan, so stay tuned 🤑🐱👤🤗🤩

Potential outside week and bullish potential for RMSEntry conditions:

(i) higher share price for ASX:RMS above the level of the potential outside week noted on 31st January (i.e.: above the level of $2.48).

Stop loss for the trade would be:

(i) below the low of the outside week on 28th January (i.e.: below $2.26), should the trade activate.

ASX to find buyers at market price?AU200AUD - 24H expiry

Price action has continued to trend strongly lower and has stalled at the previous support near 8150.

Price action looks to be forming a bottom.

Risk/Reward would be poor to call a buy from current levels.

A move through 8250 will confirm the bullish momentum.

The measured move target is 8300.

We look to Buy at 8175 (stop at 8125)

Our profit targets will be 8275 and 8300

Resistance: 8250 / 8275 / 8300

Support: 8200 / 8175 / 8150

Risk Disclaimer

The trade ideas beyond this page are for informational purposes only and do not constitute investment advice or a solicitation to trade. This information is provided by Signal Centre, a third-party unaffiliated with OANDA, and is intended for general circulation only. OANDA does not guarantee the accuracy of this information and assumes no responsibilities for the information provided by the third party. The information does not take into account the specific investment objectives, financial situation, or particular needs of any particular person. You should take into account your specific investment objectives, financial situation, and particular needs before making a commitment to trade, including seeking advice from an independent financial adviser regarding the suitability of the investment, under a separate engagement, as you deem fit.

You accept that you assume all risks in independently viewing the contents and selecting a chosen strategy.

Where the research is distributed in Singapore to a person who is not an Accredited Investor, Expert Investor or an Institutional Investor, Oanda Asia Pacific Pte Ltd (“OAP“) accepts legal responsibility for the contents of the report to such persons only to the extent required by law. Singapore customers should contact OAP at 6579 8289 for matters arising from, or in connection with, the information/research distributed.

Bullish potential detected for QUBEntry conditions:

(i) breach of the upper confines of the Darvas box formation for ASX:QUB

- i.e.: above high of $4.04 of 28th November (most conservative entry), or

(ii) swing up of indicators such as DMI/RSI along with a test of prior level of $4.00 from 25th November.

Stop loss for the trade (based upon the Darvas box formation) would be:

(i) below the support level from the low of 13th December (i.e.: below $3.80).

ASX 200 futures (SPI 200) stablising around 8200The ASX 200 futures market has fallen close to 5% from its all-time high, with 5 of the 7 candles since the top being bearish. However, the daily RSI (2) reached oversold on Friday, a bullish pinbar formed on Monday and a small bullish divergence is now forming on the daily and 1-hour chart. The pinbar low also found support at a weekly VPOC (volume point of control) and weekly S1 pivot.

Given the selloff came in a relatively straight line, I cannot help but suspect at least a minor bounce is due.

The near-term bias remains bullish while prices hold above last week’s low, and bulls could seek dips towards 8200 / 8191 VPOC area. 8300 and the weekly pivot point at 8345 could make viable upside targets for bulls.

Potential outside week and bullish potential for HLIEntry conditions:

(i) higher share price for ASX:HLI above the level of the potential outside week noted on 17th January (i.e.: above the level of $4.65).

Stop loss for the trade would be:

(i) below the low of the outside week on 13th January (i.e.: below $4.44), should the trade activate.

ASX intraday dips continues to attract buyers.AU200AUD - 24h expiry

Trend line support is located at 8500.

Further upside is expected although we prefer to buy into dips close to the 8500 level.

A move through 8550 will confirm the bullish momentum.

The measured move target is 8675.

Short term RSI has turned positive.

We look to Buy at 8500 (stop at 8440)

Our profit targets will be 8660 and 8675

Resistance: 8550 / 8600 / 8675

Support: 8525 / 8500 / 8450

Risk Disclaimer

The trade ideas beyond this page are for informational purposes only and do not constitute investment advice or a solicitation to trade. This information is provided by Signal Centre, a third-party unaffiliated with OANDA, and is intended for general circulation only. OANDA does not guarantee the accuracy of this information and assumes no responsibilities for the information provided by the third party. The information does not take into account the specific investment objectives, financial situation, or particular needs of any particular person. You should take into account your specific investment objectives, financial situation, and particular needs before making a commitment to trade, including seeking advice from an independent financial adviser regarding the suitability of the investment, under a separate engagement, as you deem fit.

You accept that you assume all risks in independently viewing the contents and selecting a chosen strategy.

Where the research is distributed in Singapore to a person who is not an Accredited Investor, Expert Investor or an Institutional Investor, Oanda Asia Pacific Pte Ltd (“OAP“) accepts legal responsibility for the contents of the report to such persons only to the extent required by law. Singapore customers should contact OAP at 6579 8289 for matters arising from, or in connection with, the information/research distributed.

ASX200 outlook ahead of RBA Rate Decision The ASX200 (AUS200) price action sentiment appears bullish, supported by the longer-term prevailing uptrend. The recent intraday price action appears to be a corrective pullback. towards the previous consolidation price range and also the rising support trendline zone.

The key trading level is at the 8490 level, the previous consolidation price range, and also rising support trendline zone. A corrective pullback from the current levels and a bullish bounce back from the 8490 level could target the upside resistance at 8570 followed by the 8620 and 8650 levels over the longer timeframe.

Alternatively, a confirmed loss of the 8490support and a daily close below that level would negate the bullish outlook opening the way for a further retracement and a retest of 8450 support level followed by 8420.

This communication is for informational purposes only and should not be viewed as any form of recommendation as to a particular course of action or as investment advice. It is not intended as an offer or solicitation for the purchase or sale of any financial instrument or as an official confirmation of any transaction. Opinions, estimates and assumptions expressed herein are made as of the date of this communication and are subject to change without notice. This communication has been prepared based upon information, including market prices, data and other information, believed to be reliable; however, Trade Nation does not warrant its completeness or accuracy. All market prices and market data contained in or attached to this communication are indicative and subject to change without notice.

ASX200 (AUS200) uptrend continuation retest 8460 level?The ASX200 (AUS200) price action sentiment appears bullish, supported by the longer-term prevailing uptrend. The recent intraday price action appears to be a corrective pullback. towards the previous consolidation price range and also the rising support trendline zone.

The key trading level is at the 8460 level, the previous consolidation price range, and also rising support trendline zone. A corrective pullback from the current levels and a bullish bounce back from the 8460 level could target the upside resistance at 8570 followed by the 8620 and 8650 levels over the longer timeframe.

Alternatively, a confirmed loss of the 8460support and a daily close below that level would negate the bullish outlook opening the way for a further retracement and a retest of 8400 support level followed by 8376.

This communication is for informational purposes only and should not be viewed as any form of recommendation as to a particular course of action or as investment advice. It is not intended as an offer or solicitation for the purchase or sale of any financial instrument or as an official confirmation of any transaction. Opinions, estimates and assumptions expressed herein are made as of the date of this communication and are subject to change without notice. This communication has been prepared based upon information, including market prices, data and other information, believed to be reliable; however, Trade Nation does not warrant its completeness or accuracy. All market prices and market data contained in or attached to this communication are indicative and subject to change without notice.

ASX 200: Why I don't trust today's 'record high'The ASX 200 reached a record high in today's session, but it's not a convincing record high in my books. If anything, it could signal yet another false break. Using the ASX cash and futures market alongside Wall Street indices, I delve into why we need to be on guard for another bull trap before the real move potentially begins.

Matt Simpson, Market Analyst at City Index and Forex.com

ASX200 H4 | Bullish uptrend to continue?ASX200 (AUS200) is falling towards a swing-low support that intersects with an ascending trendline and could potentially bounce off this level to climb higher.

Buy entry is at 8,465.34 which is a swing-low support that intersects with an ascending trendline and aligns with the 50.0% Fibonacci retracement level.

Stop loss is at 8,410.00 which is a level that lies underneath a swing-low support.

Take profit is at 8,569.74 which is a swing-high resistance.

High Risk Investment Warning

Trading Forex/CFDs on margin carries a high level of risk and may not be suitable for all investors. Leverage can work against you.

Stratos Markets Limited (www.fxcm.com):

CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 63% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Stratos Europe Ltd (www.fxcm.com):

CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 63% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Stratos Trading Pty. Limited (www.fxcm.com):

Trading FX/CFDs carries significant risks. FXCM AU (AFSL 309763), please read the Financial Services Guide, Product Disclosure Statement, Target Market Determination and Terms of Business at www.fxcm.com

Stratos Global LLC (www.fxcm.com):

Losses can exceed deposits.

Please be advised that the information presented on TradingView is provided to FXCM (‘Company’, ‘we’) by a third-party provider (‘TFA Global Pte Ltd’). Please be reminded that you are solely responsible for the trading decisions on your account. There is a very high degree of risk involved in trading. Any information and/or content is intended entirely for research, educational and informational purposes only and does not constitute investment or consultation advice or investment strategy. The information is not tailored to the investment needs of any specific person and therefore does not involve a consideration of any of the investment objectives, financial situation or needs of any viewer that may receive it. Kindly also note that past performance is not a reliable indicator of future results. Actual results may differ materially from those anticipated in forward-looking or past performance statements. We assume no liability as to the accuracy or completeness of any of the information and/or content provided herein and the Company cannot be held responsible for any omission, mistake nor for any loss or damage including without limitation to any loss of profit which may arise from reliance on any information supplied by TFA Global Pte Ltd.

The speaker(s) is neither an employee, agent nor representative of FXCM and is therefore acting independently. The opinions given are their own, constitute general market commentary, and do not constitute the opinion or advice of FXCM or any form of personal or investment advice. FXCM neither endorses nor guarantees offerings of third-party speakers, nor is FXCM responsible for the content, veracity or opinions of third-party speakers, presenters or participants.

ASX 200 Futures: Finding a Signal Amid the NoiseWe're sandwiched between an incoming NFP report and the turbulence from Trump's tariffs. That could provide a double dose of 'fickle' price action, which we tend to see leading up to big events such as nonfarm payrolls or Fed meetings. With that in mind, I update my bearish bias on ASX 200 futures, using the intraday timeframe and a glance at Wall Street indices.

Matt Simpson, Market Analyst at City Index and Forex.com

ASX 200: Why I'm not banking on [an immediate] record highThe ASX 200 cash market is tantalisingly close to retesting its record high set in December. Traders are betting on an RBA cut in February (and 100bp of cuts this year) which is helping to support the market. Yet I doubt the ASX will simply break to a new high without a fresh catalyst. Comparing the ASX 200 cash and futures market and their key levels, I explain why.

Matt Simpson, Market Analyst at City Index and Forex.com