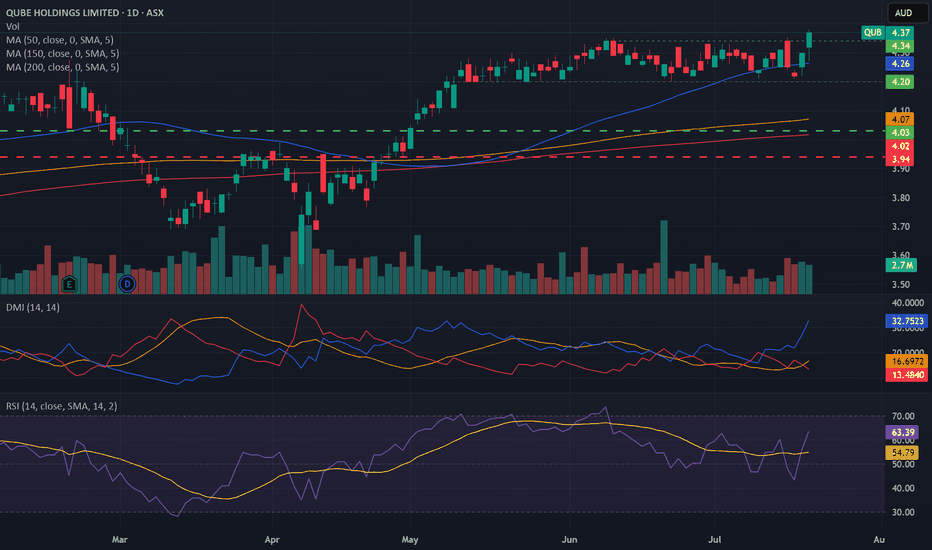

Bullish potential detected for QUBEntry conditions:

(i) higher share price for ASX:QUB along with swing up of indicators such as DMI/RSI.

Depending on risk tolerance, the stop loss for the trade would be:

(i) a close below the bottom of the formed channel (i.e.: below $4.20), or

(ii) below previous support of $4.11 from the open of 9th May, or

(iii) below the rising 150 day moving average (currently $4.07).

Asx200long

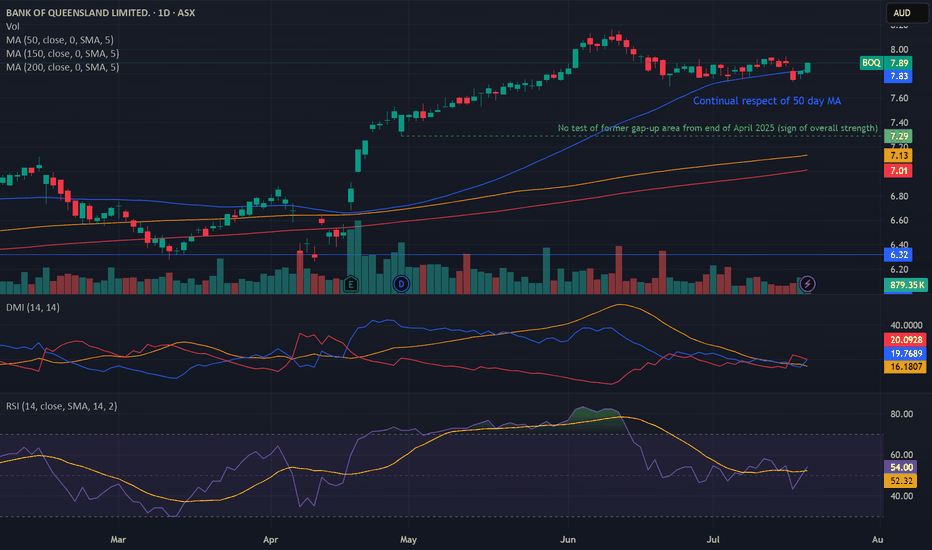

Bullish potential detected for BOQEntry conditions:

(i) higher share price for ASX:BOQ along with swing up of indicators such as DMI/RSI.

Depending on risk tolerance, the stop loss for the trade would be:

(i) a close below the 50 day moving average (currently $7.83), or

(ii) below previous swing low of $7.69 from the low of 23rd June, or

(iii) below previous support of $7.60 from the open of 12th May.

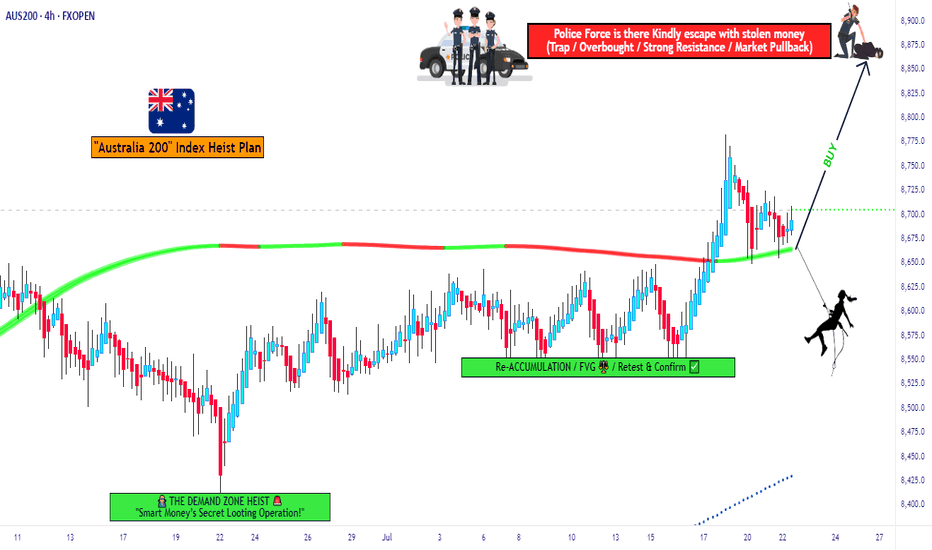

ASX200 Heist Blueprint – Entry, Exit, Escape Mapped Out!💼💣 The ASX200 Heist Blueprint: Bullish Loot Incoming! 🔥💰

🌍 Hi! Hola! Ola! Bonjour! Hallo! Marhaba! 👋

Welcome back, Money Makers & Market Robbers! 🤑💸✈️

It's time for another high-stakes heist, this time targeting the ASX200 / AUS200 “Australia 200” Index. Get your trading toolkit ready – we're planning a strategic, stealthy bullish operation based on Thief Trader’s signature blend of technical setups + macro fundamental analysis.

💹 ENTRY STRATEGY – "The Vault Is Open!"

The bullish loot is ripe for the taking. Watch for pullbacks on the 15M to 30M charts – layer in limit buy orders near recent swing lows or key levels.

🧠 Use DCA-style (Dollar Cost Averaging) layering to maximize your position like a smart thief scaling walls.

Every entry counts – but precision matters. Time your move, rob the dip, and don’t get caught by the bears. 🐂💥

🛡 STOP LOSS – "Don’t Trip the Alarm!"

Protect your capital like it’s the last stack of bills in the vault.

📉 Suggested SL: Near 4H swing low/high (e.g., 8620.0)

Always adjust based on:

Your risk tolerance

Position size

Number of open entries

Risk smart. The getaway must be clean. 🚁💨

🎯 TARGET – "8880.0 & Beyond!"

That’s the main exit point for our current job.

Expect tough resistance ahead – the police barricade zone where supply, exhaustion, and reversal pressure builds.

Book profits and treat yourself like a boss – your hustle deserves celebration! 💪🎉🍾

📊 Market Condition Overview

The ASX200 is currently in a bullish trend, supported by:

Risk-on sentiment globally 🌐

Aussie economic data strength 📈

Global indices correlation 🧩

Technical confirmations from Thief Trader tools 🔧

📌 Important Note – Stay Informed!

📢 Fundamentals Matter!

Tap into macro analysis, COT reports, geopolitical news, sentiment indicators, and intermarket flows. These are the real gears behind the charts.

📡 Always stay sharp and analyze what’s behind the candles.

⚠️ NEWS TRAP WARNING

🚨 Big news = big volatility. Don’t get caught during releases.

✔️ Avoid opening new positions around high-impact events

✔️ Use trailing SLs to protect open profits

✔️ Manage leverage like a pro thief manages their escape route

💖 Support the Thief Gang!

If this heist plan helped you, hit that Boost 💥 & Follow – it fuels our mission to help more traders rob the market cleanly and smartly.

Together we earn. Together we learn.

🧠💼 Stay tuned for more heist blueprints and tactical break-ins into global markets with the Thief Trading Style™.

🔥 Until next time, rob responsibly. 🕶💸🎯

AUS200 Breakout or Fakeout? I Say Breakout – Here's Why🔍 Technical Overview:

After monitoring the recent movement in AUS200, I believe we are in the early phase of a bullish breakout continuation rather than a fakeout.

Uptrend Structure: Price has been consistently respecting higher lows and trending above the green trendline.

Break of Descending Resistance: The downtrend line has now been pierced with momentum candles — a bullish sign.

Buy Condition Set:

Next 1-hour/s candle should close above the intersection (highlighted zone).

Candle should be green, and preferably no wick on the top (indicating strength).

Volume analysis to be considered on confirmation.

✅ Trade Plan:

Buy Zone marked.

Stop Loss Zone clearly defined – I plan to exit the trade if price closes back below the shaded red/gray zone.

Upside Potential: Initial target around 8,820–8,840, with extension toward 8,900+ if momentum sustains.

Risk/Reward ratio looks favorable based on current structure.

📰 Fundamentals:

I have not yet identified any bearish macro or news catalyst that contradicts the current technical picture. If you know of any relevant developments (e.g., RBA policy, earnings, CPI releases), feel free to comment.

🔄 Validation Request:

Would love the community’s take:

Do you see this as a valid breakout?

Any hidden divergence or bearish signals I might have missed?

Let me know if you're tracking the same structure or see something different.

Bullish potential detected for ORGEntry conditions:

(i) breach of the upper confines of the Darvas box formation for ASX:ORG

- i.e.: above high of $11.69 of 16th June (most conservative entry), and

(ii) swing up of indicators such as DMI/RSI.

Stop loss for the trade (based upon the Darvas box formation) would be:

(i) below the support level from the low of 26th June (i.e.: below $10.62).

Bullish potential detected for RIOEntry conditions:

(i) higher share price for ASX:RIO along with swing up of indicators such as DMI/RSI.

Depending on risk tolerance, the stop loss for the trade would be:

(i) below the recent swing low of 14th May (i.e. $118.63), or

(ii) a close below the 200 day moving average (currently $116.88), or

(iii) a close below the 50 day moving average (currently $115.66).

ASX short term bias remains positive.ASX200 - 24h expiry

Our short term bias remains positive.

Intraday dips continue to attract buyers and there is no clear indication that this sequence for trading is coming to an end.

Buying continued from the 78.6% pullback level of 8321.

We look to buy dips.

50 4hour EMA is at 8331.

We look to Buy at 8330 (stop at 8275)

Our profit targets will be 8495 and 8545

Resistance: 8386 / 8426 / 8500

Support: 8343 / 8300 / 8249

Risk Disclaimer

The trade ideas beyond this page are for informational purposes only and do not constitute investment advice or a solicitation to trade. This information is provided by Signal Centre, a third-party unaffiliated with OANDA, and is intended for general circulation only. OANDA does not guarantee the accuracy of this information and assumes no responsibilities for the information provided by the third party. The information does not take into account the specific investment objectives, financial situation, or particular needs of any particular person. You should take into account your specific investment objectives, financial situation, and particular needs before making a commitment to trade, including seeking advice from an independent financial adviser regarding the suitability of the investment, under a separate engagement, as you deem fit.

You accept that you assume all risks in independently viewing the contents and selecting a chosen strategy.

Where the research is distributed in Singapore to a person who is not an Accredited Investor, Expert Investor or an Institutional Investor, Oanda Asia Pacific Pte Ltd (“OAP“) accepts legal responsibility for the contents of the report to such persons only to the extent required by law. Singapore customers should contact OAP at 6579 8289 for matters arising from, or in connection with, the information/research distributed.

Bullish potential detected for WOWEntry conditions:

(i) higher share price for ASX:WOW along with swing up of indicators such as DMI/RSI, and

(ii) observation of market reaction at the resistance level / volume profile area at $32.32 after closing above 200 day MA.

Stop loss for the trade would be, dependent on risk tolerance:

(i) a close below the 200 day moving average (currently $31.63), or

(ii) a close below the 50 day moving average (currently $30.17).

Potential key reversal bottom detected for JHXAwait signals for entry such as DMI/ADX and/or RSI swing to the bullish direction.

Stop loss for the trade involving ASX:JHX (and indication that this trade is an absolute 'no-go') is any trade below the low of the signal day of 21st March (i.e.: any trade below $45.52).

Potential key reversal bottom detected for NHCAwait signals for entry such as DMI/ADX and/or RSI swing to the bullish direction.

Stop loss for the trade involving ASX:NHC (and indication that this trade is an absolute 'no-go') is any trade below the low of the signal day of 14th March (i.e.: any trade below $3.64).

Potential outside week and bullish potential for RMSEntry conditions:

(i) higher share price for ASX:RMS above the level of the potential outside week noted on 31st January (i.e.: above the level of $2.48).

Stop loss for the trade would be:

(i) below the low of the outside week on 28th January (i.e.: below $2.26), should the trade activate.

ASX to find buyers at market price?AU200AUD - 24H expiry

Price action has continued to trend strongly lower and has stalled at the previous support near 8150.

Price action looks to be forming a bottom.

Risk/Reward would be poor to call a buy from current levels.

A move through 8250 will confirm the bullish momentum.

The measured move target is 8300.

We look to Buy at 8175 (stop at 8125)

Our profit targets will be 8275 and 8300

Resistance: 8250 / 8275 / 8300

Support: 8200 / 8175 / 8150

Risk Disclaimer

The trade ideas beyond this page are for informational purposes only and do not constitute investment advice or a solicitation to trade. This information is provided by Signal Centre, a third-party unaffiliated with OANDA, and is intended for general circulation only. OANDA does not guarantee the accuracy of this information and assumes no responsibilities for the information provided by the third party. The information does not take into account the specific investment objectives, financial situation, or particular needs of any particular person. You should take into account your specific investment objectives, financial situation, and particular needs before making a commitment to trade, including seeking advice from an independent financial adviser regarding the suitability of the investment, under a separate engagement, as you deem fit.

You accept that you assume all risks in independently viewing the contents and selecting a chosen strategy.

Where the research is distributed in Singapore to a person who is not an Accredited Investor, Expert Investor or an Institutional Investor, Oanda Asia Pacific Pte Ltd (“OAP“) accepts legal responsibility for the contents of the report to such persons only to the extent required by law. Singapore customers should contact OAP at 6579 8289 for matters arising from, or in connection with, the information/research distributed.

Bullish potential detected for QUBEntry conditions:

(i) breach of the upper confines of the Darvas box formation for ASX:QUB

- i.e.: above high of $4.04 of 28th November (most conservative entry), or

(ii) swing up of indicators such as DMI/RSI along with a test of prior level of $4.00 from 25th November.

Stop loss for the trade (based upon the Darvas box formation) would be:

(i) below the support level from the low of 13th December (i.e.: below $3.80).

Potential outside week and bullish potential for HLIEntry conditions:

(i) higher share price for ASX:HLI above the level of the potential outside week noted on 17th January (i.e.: above the level of $4.65).

Stop loss for the trade would be:

(i) below the low of the outside week on 13th January (i.e.: below $4.44), should the trade activate.

ASX intraday dips continues to attract buyers.AU200AUD - 24h expiry

Trend line support is located at 8500.

Further upside is expected although we prefer to buy into dips close to the 8500 level.

A move through 8550 will confirm the bullish momentum.

The measured move target is 8675.

Short term RSI has turned positive.

We look to Buy at 8500 (stop at 8440)

Our profit targets will be 8660 and 8675

Resistance: 8550 / 8600 / 8675

Support: 8525 / 8500 / 8450

Risk Disclaimer

The trade ideas beyond this page are for informational purposes only and do not constitute investment advice or a solicitation to trade. This information is provided by Signal Centre, a third-party unaffiliated with OANDA, and is intended for general circulation only. OANDA does not guarantee the accuracy of this information and assumes no responsibilities for the information provided by the third party. The information does not take into account the specific investment objectives, financial situation, or particular needs of any particular person. You should take into account your specific investment objectives, financial situation, and particular needs before making a commitment to trade, including seeking advice from an independent financial adviser regarding the suitability of the investment, under a separate engagement, as you deem fit.

You accept that you assume all risks in independently viewing the contents and selecting a chosen strategy.

Where the research is distributed in Singapore to a person who is not an Accredited Investor, Expert Investor or an Institutional Investor, Oanda Asia Pacific Pte Ltd (“OAP“) accepts legal responsibility for the contents of the report to such persons only to the extent required by law. Singapore customers should contact OAP at 6579 8289 for matters arising from, or in connection with, the information/research distributed.

Potential key reversal bottom detected for WORLevel of interest: Prior support/resistance levels in the past of $13.32 (17-Oct-2022) and $12.92 (10-Oct-2022) (key support/resistance areas to observe).

Await signals for entry such as DMI/ADX and/or RSI swing to the bullish direction.

Stop loss for the trade involving ASX:WOR (and indication that this trade is an absolute 'no-go') is any trade below the low of the signal day of 4th December (i.e.: any trade below $13.16).

Bullish potential detected for FMGEntry conditions:

(i) higher share price for ASX:FMG along with swing up of indicators such as DMI/RSI.

Stop loss for the trade (once activated) would be:

(i) below the support level from the open of 14th November (i.e.: below $18.20), or

(ii) below the support level from the open of 21st November (i.e.: below $17.87), depending on risk tolerance.

Bullish potential detected for WOWEntry conditions:

(i) higher share price for ASX:WOW along with swing up of indicators such as DMI/RSI.

Stop loss for the trade (once activated) would be:

(i) below the support level from the open of 11th November (i.e.: below $29.85), or

(ii) below the support level from the low of 14th November (i.e.: below $29.20), depending on risk tolerance.

ASX to continue in the upward move?ASX200 - 24h expiry

Price action has continued to trend strongly lower and has stalled at the previous support near 8350.

The correction lower is assessed as being complete.

RSI (relative strength indicator) is flat and reading close to 50 (mid-point) highlighting the fact that we are non- trending.

A move through 8400 will confirm the bullish momentum.

The measured move target is 8475.

We look to Buy at 8350 (stop at 8310)

Our profit targets will be 8450 and 8475

Resistance: 8425 / 8450 / 8475

Support: 8375 / 8350 / 8325

Risk Disclaimer

The trade ideas beyond this page are for informational purposes only and do not constitute investment advice or a solicitation to trade. This information is provided by Signal Centre, a third-party unaffiliated with OANDA, and is intended for general circulation only. OANDA does not guarantee the accuracy of this information and assumes no responsibilities for the information provided by the third party. The information does not take into account the specific investment objectives, financial situation, or particular needs of any particular person. You should take into account your specific investment objectives, financial situation, and particular needs before making a commitment to trade, including seeking advice from an independent financial adviser regarding the suitability of the investment, under a separate engagement, as you deem fit.

You accept that you assume all risks in independently viewing the contents and selecting a chosen strategy.

Where the research is distributed in Singapore to a person who is not an Accredited Investor, Expert Investor or an Institutional Investor, Oanda Asia Pacific Pte Ltd (“OAP“) accepts legal responsibility for the contents of the report to such persons only to the extent required by law. Singapore customers should contact OAP at 6579 8289 for matters arising from, or in connection with, the information/research distributed.

Potential outside week and bullish potential for RMSEntry conditions:

(i) higher share price for ASX:RMS above the level of the potential outside week noted on 30th August (adjusted with the incidence of the inside week the following week, allowing activation of the trade above the level of the range for that week, i.e.: above the level of $2.20, as depicted by the blue dotted line and accompanying text on the chart).

Stop loss for the trade would be:

(i) below the swing low of 27th August (i.e.: below $2.02), should the trade activate.

ASX: AGL Fibonacci retracements

ASX:AGL AGL Energy is have been underperforming for long time , now for one year return is just 3.16%

Look the chart and notice

- double bottom formation on weekly chart

- higher high higher low formation

- no supply

- stock also above the key level of fib levels

disc: invested and tracking