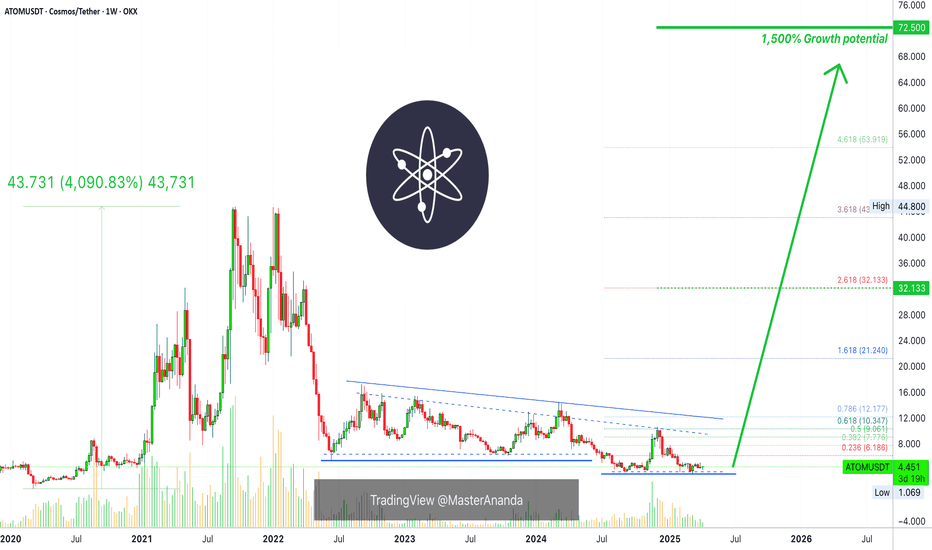

Cosmos: Your Altcoin ChoiceATOM is performing perfect market bottom behavior. It bottomed first in late 2024, around September. A higher low in November. Now, in 2025, we have a lower low in March but the session close happened above the 2024 bottom, much higher.

So you can count all the action between late 2024 and present day as the formation of the bottom. This is where and when smart money buy Crypto. This is the whales buy-zone. Retail traders and investors can also buy if they are smart.

The best prices are available only now and won't continue to be available for long.

The orthodox end of the bear market for Cosmos (ATOMUSDT) happened in June 2022, almost three years ago.

The bear market was down, clearly. The end of the bear market heralds the start of a neutral period. This neutral period can be seen as sideways action on the chart. This sideways action can also be called consolidation before the next major bullish phase. We are in front of this new phase. There will be a major rise, look at the arrow on the chart. Believe it or not, this is exactly what will take place.

This is nothing new. After the March 2020 low, ATOMUSDT went through a similar consolidation period but with an upward bent. After a few months, the market developed a strong bullish phase. Total growth amounted to more than 4,000%. Are you ready for the 2025 bull market?

Cosmos is ready to grow more than 1,000%.

Targets can be seen on the chart.

Expect surprises. Prepare for something great.

Everything will grow more than anything you can imagine, calculate or expect.

The only reason I will be wrong is because the All-Time High will end up being much higher than my projected targets, and this is ok.

Just let the market the grow.

The more it grows, the better it will get.

We are ready for 1 billion users trading Crypto.

Thank you for reading.

Namaste.

ATOM

Cosmos ATOM price analysisThere are signs that they are trying to keep the NASDAQ:ATOM price in the global buying zone of $3.80-5.50

🟡 If this is true, then the risky buying zone is $3.80-4.30 and the OKX:ATOMUSDT price should not be allowed to fall below that.

🟢 Well, a safe medium-term purchase of #Cosmos is possible only after the price is confidently fixed above $5.50 with a growth potential of at least $7.60-8.20. And if you're lucky, up to $10.

_____________________

Did you like our analysis? Leave a comment, like, and follow to get more

ATOM: Double Bottom Confirmed – Gap Fill to $10 in Sight#ATOM nailed the perfect bounce from the $3.611 support, confirming a clean double bottom pattern. The structure looks strong, and the next major target is the $10 level for a potential gap fill.

Follow me to catch more plays like this in real time. 🚀

Entry: 4.2

TP: 10

SL: 3.3

BRIEFING Week #14 : What a Mess !Here's your weekly update ! Brought to you each weekend with years of track-record history..

Don't forget to hit the like/follow button if you feel like this post deserves it ;)

That's the best way to support me and help pushing this content to other users.

Kindly,

Phil

ATOM (SPOT - INVESTMENT )BINANCE:ATOMUSDT

ATOM / USDT

(4H + 1D) time frames

analysis tools

____________

SMC

FVG

Trend lines

Fibonacci

Support & resistance

MACD Cross

EMA Cross

______________________________________________________________

Golden Advices.

********************

* Please calculate your losses before any entry.

* Do not enter any trade you find it not suitable for you.

* No FOMO - No Rush , it is a long journey.

Useful Tags.

****************

My total posts

www.tradingview.com

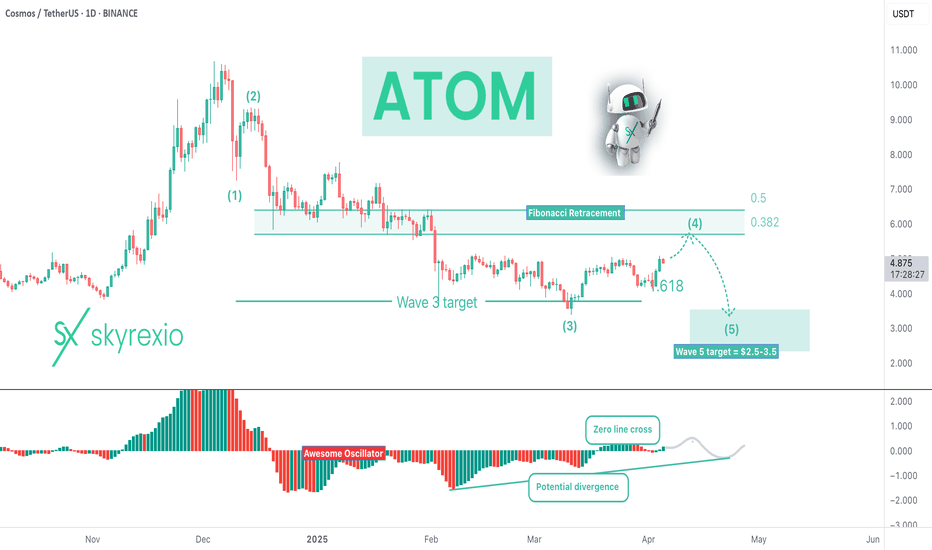

ATOM Will Reach $3 In This Bear MarketHello, Skyrexians!

As we shared with you earlier we suppose that the last bearish wave will happen for all altcoins in April and BINANCE:ATOMUSDT is not the exception. Despite the growth against the market the waves order shall be remained and we will finally see this dump.

Let's take a look at the daily chart. You can tell us that wave 5 has been already finished recently and now this is bull run but pay attention that Awesome oscillator has not crossed the zero line. It means that it was wave 5 inside wave 3. Now price is in wave 4 and entering the target area. The most optimistic scenario if price will reach $5.7 at 0.38 Fibonacci retracement, but it can reverse even now as well. Finally it will reach $2.5-3.5 in the wave 5 in April.

Best regards,

Skyrexio Team

___________________________________________________________

Please, boost this article and subscribe our page if you like analysis!

ATOM is bullish (12H)It appears that the ATOM symbol has initiated a bullish wave at the swing degree. The structure and bullish signals such as the trigger line break, bullish CH (Change of Character), and momentum in the candles are evident on the chart.

There is a resistance flip zone ahead of the price. If this zone is broken, two targets on the chart will be in play for ATOM.

A daily candle closing below the invalidation level would invalidate this analysis.

Do not enter the position without capital management and stop setting

Comment if you have any questions

thank you

ATOMUSD: Channel Down bottomed. Strong buy signal.Cosmos turned bullish on its 1D technical outlook (RSI = 60.498, MACD = 0.008, ADX = 27.015), which raised 1W to a neutral state. This is perfectly aligned with the market structure at the moment, which is a technical rebound at the bottom of the 3 year Channel Down. The 1W RSI is on a HL trendline, which is a bullish divergence as far as the Channel's LL are concerned. This means that there is potential to break this Channel to the upside, but until this happens, we will be targeting the 0.786 Fibonacci retracement level (TP = 9.500), like the previous bullish wave did.

## If you like our free content follow our profile to get more daily ideas. ##

## Comments and likes are greatly appreciated. ##

atom buy midterm"🌟 Welcome to Golden Candle! 🌟

We're a team of 📈 passionate traders 📉 who love sharing our 🔍 technical analysis insights 🔎 with the TradingView community. 🌎

Our goal is to provide 💡 valuable perspectives 💡 on market trends and patterns, but 🚫 please note that our analyses are not intended as buy or sell recommendations. 🚫

Instead, they reflect our own 💭 personal attitudes and thoughts. 💭

Follow along and 📚 learn 📚 from our analyses! 📊💡"

BRIEFING Week #13 : ETH offers perfect opportunityHere's your weekly update ! Brought to you each weekend with years of track-record history..

Don't forget to hit the like/follow button if you feel like this post deserves it ;)

That's the best way to support me and help pushing this content to other users.

Kindly,

Phil

TradeCityPro | ATOMUSDT Restarting Daily Analyses!👋 Welcome to TradeCityPro Channel!

Let's get back to our daily analysis routine starting today! From now on, I’ll be sharing daily altcoin analyses again. Today, we’re focusing on one of my favorite coins for futures trading: ATOM.

🌐 Overview Bitcoin

Before starting the analysis, I want to remind you again that we moved the Bitcoin analysis section from the analysis section to a separate analysis at your request, so that we can discuss the status of Bitcoin in more detail every day and analyze its charts and dominances together.

This is the general analysis of Bitcoin dominance, which we promised you in the analysis to analyze separately and analyze it for you in longer time frames.

📊 Weekly Time Frame

ATOM is currently neither in a great position nor in a terrible one. Unlike some altcoins like BNB, SOL, and SUI that have moved towards their highs, ATOM hasn’t made a significant move towards $44 yet. However, it also hasn’t lost its major lows.

The strong green candle from the past two weeks bounced off the $3.728 support level, confirming that this level remains significant and won’t be easily lost. But this alone is not a reason to buy. After the candle closed, the price did not make a significant move.

If you are holding ATOM (like me, as I have staked ATOM in my wallet), I would exit below $3.728 because there is a high probability of a sharp drop toward $1.824.

For buying opportunities, setting a stop-buy order above $5.088 could be an option. We’ll discuss this more in the daily time frame section.

📉 Daily Time Frame

After bouncing off the $3.58 support, we started a bullish move but couldn’t reach $14.184. Instead, after getting rejected at $10.434, we formed a lower high and continued the price correction.

Following this rejection, we continued forming lower highs and lower lows based on Dow Theory. After breaking $5.665, which was an important support, we experienced a sharp drop, reaching the $3.585 support level. After bouncing, a V Pattern was formed.

$4.948 is an important level to watch as it triggers both the V Pattern activation and the trendline breakout.

I will only open short positions below $4.337, but I will not sell my coins unless $3.585 is broken, in which case I will exit my holdings.

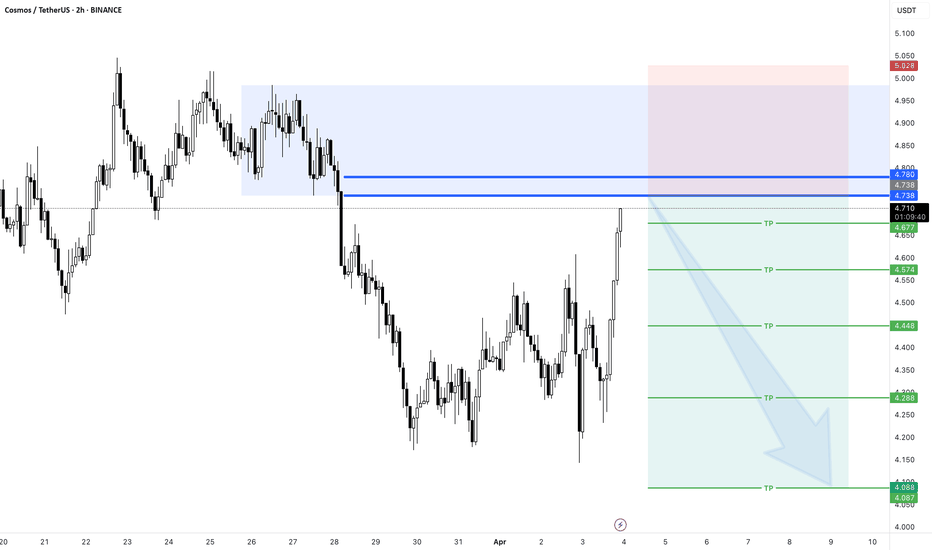

⏳ 4H Time Frame

After getting rejected at $4.948, the price dropped to the $4.424 support level. Since it’s Saturday and the market is relatively slow, we might see range-bound movement around this level.

🔴 Short Position:

If $4.424 breaks and RSI enters the oversold zone with increased volume, we could see a short opportunity targeting $4.020.

🟢 Long Position:

I am currently waiting and prefer to open a long position on MKR instead. I don't want to waste the $4.948 trigger, so I will wait for a confirmed breakout before entering a position.

✍️ Final Thoughts

Stay level headed, trade with precision, and let’s capitalize on the market’s top opportunities!

This is our analysis, not financial advice always do your own research.

What do you think? Share your ideas below and pass this along to friends! ❤️

BRIEFING Week #12 : Alt-Season might be coming soonHere's your weekly update ! Brought to you each weekend with years of track-record history..

Don't forget to hit the like/follow button if you feel like this post deserves it ;)

That's the best way to support me and help pushing this content to other users.

Kindly,

Phil

atom buy midterm"🌟 Welcome to Golden Candle! 🌟

We're a team of 📈 passionate traders 📉 who love sharing our 🔍 technical analysis insights 🔎 with the TradingView community. 🌎

Our goal is to provide 💡 valuable perspectives 💡 on market trends and patterns, but 🚫 please note that our analyses are not intended as buy or sell recommendations. 🚫

Instead, they reflect our own 💭 personal attitudes and thoughts. 💭

Follow along and 📚 learn 📚 from our analyses! 📊💡"

atom buy midterm"🌟 Welcome to Golden Candle! 🌟

We're a team of 📈 passionate traders 📉 who love sharing our 🔍 technical analysis insights 🔎 with the TradingView community. 🌎

Our goal is to provide 💡 valuable perspectives 💡 on market trends and patterns, but 🚫 please note that our analyses are not intended as buy or sell recommendations. 🚫

Instead, they reflect our own 💭 personal attitudes and thoughts. 💭

Follow along and 📚 learn 📚 from our analyses! 📊💡"

BRIEFING Week #11 : Are we done ? (nope)Here's your weekly update ! Brought to you each weekend with years of track-record history..

Don't forget to hit the like/follow button if you feel like this post deserves it ;)

That's the best way to support me and help pushing this content to other users.

Kindly,

Phil

TradeCityPro | ATOM: Cosmos Trends and Key Resistance Insights👋 Welcome to TradeCityPro!

Today, I'm going to analyze the coin ATOM, part of the Osmosis projects and the Cosmos ecosystem, which is currently ranked 49th with a market cap of $1.8 billion.

📅 Daily Timeframe

In the daily timeframe, as you can observe, after reaching a peak at $10.363, a downward trend started, which continued down to the area of $3.562.

✨ Currently, the price is in a corrective phase, having risen from the low of $3.562, and is moving upward. The last major peak is located at $5.082, and the corrective leg could continue up to this area.

💥 The RSI oscillator has moved above the 50 zone, potentially injecting upward momentum into the market, which could help the price reach $5.082.

🔍 However, there is a strong resistance range between $5.082 and $5.683. As long as the price is under this range, the buying power is weaker than the selling pressure. But if the price breaks through $5.683, it could move higher.

✔️ The next resistance levels are at $7.469 and $10.363, with $10.363 being particularly robust and visible in higher timeframes as well. The main trigger for a spot purchase would be the breakout of $10.363.

⭐ Conversely, if the price rejects from $5.082, the main short trigger would be $3.562. A break below this level could initiate the next downward leg.

📝 Final Thoughts

This analysis reflects our opinions and is not financial advice.

Share your thoughts in the comments, and don’t forget to share this analysis with your friends! ❤️

#ATOM/USDT#ATOM

The price is moving within a descending channel on the 1-hour frame, adhering well to it, and is heading for a strong breakout and retest.

We are seeing a bounce from the lower boundary of the descending channel, which is support at 3.48.

We have a downtrend on the RSI indicator that is about to be broken and retested, supporting the upward trend.

We are looking for stability above the 100 Moving Average.

Entry price: 3.86

First target: 4.09

Second target: 4.28

Third target: 4.53

How Cosmos ATOM Will Outperform Market In 2025?Hello, Skyrexians!

We have already forgot about BINANCE:ATOMUSDT , asset which can only drill the bottom and be weaker than other crypto, but last 2 days it shows strength against all market. While most of coins are below the February 3 low, Cosmos is about escape this dead zone. The Elliott waves order is the king and price cannot be in correction forever, so it's ATOM's time and we will explain why.

Let's take a look at the weekly time frame. We can see two green dots on the Bullish/Bearish Reversal Bar Indicator , both of them have been conformed. They have the great angle with Alligator and have been formed at 0.61 Fibonacci level. Moreover we can see the divergence between first and second reversal bar with Awesome Oscillator. We have a lot of strong signals that bear market is over and now price can reach the new ATH in the global wave 3. We need just wait!

Best regards,

Skyrexio Team

___________________________________________________________

Please, boost this article and subscribe our page if you like analysis!