AUDUSD 4Hour TF - July 27th, 2025AUDUSD 7/27/2025

AUDUSD 4hour Bullish idea

Monthly - Bearish

Weekly - Bearish

Dailly - Bullish

4hour - Bullish

AUDUSD is holding steady in this weekly channel but has been showing signs of high volume ranging over the last month. Going into this week we’re looking mostly bullish but we have some minor zones that could slow price action down.

Here are two scenarios we are looking out for, for the week ahead:

Bullish Continuation - This is our ideal scenario as we want the trend to continue so we can have the best quality trade. For us to get comfortable going long AU we need to see structure above our 0.65800 zone. We want to see price action use this zone as support and establish structure (the next higher low).

If this happens we can look to target higher toward major resistance levels and key fib levels.

Bearish Reversal into range - If we fail to see bullish conviction at the current zone it’s possible price action will fall back into the range. This is a likely scenario as we have seen price action bounce between 0.65800 and 0.65000 multiple times over the last month.

I wouldn’t recommend trading this scenario as I don’t like trading ranges but we could see price action head lower to 0.65000.

AU

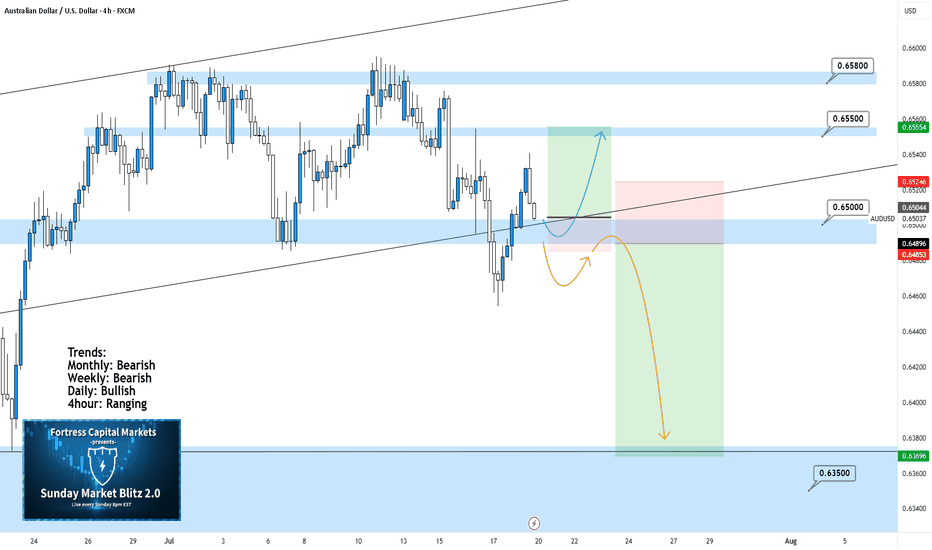

AUDUSD 4Hour TF - July 20th, 2025AUDUSD 7/20/2025

AUDUSD 4hour Neutral idea

Monthly - Bearish

Weekly - Bearish

Dailly - Bullish

4hour - Ranging

We’re looking at a fairly large range here on AU and although the higher timeframe suggests a potential bearish move, I am unsure until we have some clarity around 0.65000. Here are two scenarios that break down what could happen this week and how 0.65000 plays into it:

Range Continuation - Since late June we have seen price action establish this large range and stick to it (0.65800 Resistance & 0.65000 Support).

Currently, we can see price action attempting to break 0.65000 support but it has not done so yet. If we don’t break below 0.65000 early this week it is very likely we will see a rally into the top of the range.

Bearish Breakout - This is the setup we want to see play out this week as it presents a beauty of a trade.

For us to see AU as bearish on the 4hour we need to see a clear break below 0.65000 with a confirmed lower high below. If this happens look to target toward major support levels like 0.63500 area.

AUDUSD SHORT & LONG – WEEKLY FORECAST Q3 | W 29 | Y25💼 AUDUSD SHORT & LONG – WEEKLY FORECAST

Q3 | W 29 | Y25

📊 MARKET STRUCTURE OVERVIEW

AUDUSD is currently trading around a previously mitigated Daily and 4H Order Block zone.

Price has shown signs of short-term bearish momentum on lower timeframes (1H & 15m), but the broader structure still allows for bullish re-entries from deeper discounted levels.

We’re entering a key decision zone with potential for both short and long opportunities, depending on intraday confirmation.

🔍 Confluences to Watch 📝

✅ Daily OB – Previously Mitigated

Larger structure still holds room for bullish continuation if key internal supports hold.

✅ 4H OB – Mitigated with Initial Rejection

✅ 1H & 15m OBs – Valid for Intraday Shorts

Clean bearish structure on intraday timeframes.

Potential shorts available

📈 Risk Management Protocols

🔑 Core Principles

Risk per trade: Max 1%

Only act at planned levels — never chase

RR minimum: 1:2

Use scaling techniques on intraday shorts, and hold conviction for swings when structure confirms

🧠 Your risk plan is your protection. Without it, your strategy is meaningless.

🧠 Weekly FRGNT Insight

“Bias is flexible. Discipline is not.”

Adapt to what price gives — but never abandon your risk framework.

🏁 Final Thoughts from FRGNT

📌 Both short and long opportunities are valid this week.

📌 Choose your bias based on structure + confirmation.

📌 Let the order flow lead and risk management guide.

❤️ Stay sharp, stay structured. I’ll see you at the very top.

🎯 Trade consistent. FRGNT X

AUDUSD SHORT FORECAST Q3 D10 W28 Y25AUDUSD SHORT FORECAST Q3 D10 W28 Y25

Professional Risk Managers👋

Welcome back to another FRGNT chart update📈

Diving into some Forex setups using predominantly higher time frame order blocks alongside confirmation breaks of structure.

Let’s see what price action is telling us today! 👀

💡Here are some trade confluences📝

✅Daily Order block identified

✅4H Order Block identified

✅1H Order Block identified

🔑 Remember, to participate in trading comes always with a degree of risk, therefore as professional risk managers it remains vital that we stick to our risk management plan as well as our trading strategies.

📈The rest, we leave to the balance of probabilities.

💡Fail to plan. Plan to fail.

🏆It has always been that simple.

❤️Good luck with your trading journey, I shall see you at the very top.

🎯Trade consistent, FRGNT X

AUDUSD SHORT & LONG FORECAST Q3 W28 Y25AUDUSD SHORT & LONG FORECAST Q3 W28 Y25

Professional Risk Managers👋

Welcome back to another FRGNT chart update📈

Diving into some Forex setups using predominantly higher time frame order blocks alongside confirmation breaks of structure.

Let’s see what price action is telling us today! 👀

💡Here are some trade confluences📝

✅Daily Order block identified

✅4H Order Block identified

✅1H Order Block identified

🔑 Remember, to participate in trading comes always with a degree of risk, therefore as professional risk managers it remains vital that we stick to our risk management plan as well as our trading strategies.

📈The rest, we leave to the balance of probabilities.

💡Fail to plan. Plan to fail.

🏆It has always been that simple.

❤️Good luck with your trading journey, I shall see you at the very top.

🎯Trade consistent, FRGNT X

AUDUSD SHORT FORECAST Q2 W26 D27 Y25AUDUSD SHORT FORECAST Q2 W26 D27 Y25

Professional Risk Managers👋

Welcome back to another FRGNT chart update📈

Diving into some Forex setups using predominantly higher time frame order blocks alongside confirmation breaks of structure.

Let’s see what price action is telling us today!

💡Here are some trade confluences📝

✅Daily order block

✅1H Order block

✅Intraday breaks of structure

✅4H Order block

🔑 Remember, to participate in trading comes always with a degree of risk, therefore as professional risk managers it remains vital that we stick to our risk management plan as well as our trading strategies.

📈The rest, we leave to the balance of probabilities.

💡Fail to plan. Plan to fail.

🏆It has always been that simple.

❤️Good luck with your trading journey, I shall see you at the very top.

🎯Trade consistent, FRGNT X

AUDUSD LONG & SHORT FORECAST Q2 W25 D19 Y25AUDUSD LONG & SHORT FORECAST Q2 W25 D19 Y25

Professional Risk Managers👋

Welcome back to another FRGNT chart update📈

Diving into some Forex setups using predominantly higher time frame order blocks alongside intraday confirmation & breaks of structure.

Let’s see what price action is telling us today! 🔥

💡Here are some trade confluences📝

✅4H Order block identified

✅1H Order block identified

✅15’ order block

✅Intraday bullish breaks of structure

🔑 Remember, to participate in trading comes always with a degree of risk, therefore as professional risk managers it remains vital that we stick to our risk management plan as well as our trading strategies.

📈The rest, we leave to the balance of probabilities.

💡Fail to plan. Plan to fail.

🏆It has always been that simple.

❤️Good luck with your trading journey, I shall see you at the very top.

🎯Trade consistent, FRGNT X

AUDUSD LONG FORECAST Q2 W25 D16 Y25AUDUSD LONG FORECAST Q2 W25 D16 Y25

Professional Risk Managers👋

Welcome back to another FRGNT chart update📈

Diving into some Forex setups using predominantly higher time frame order blocks alongside intraday confirmation & breaks of structure.

Let’s see what price action is telling us today! 🔥

💡Here are some trade confluences📝

✅4H Order block identified

✅1H Order block identified

✅15’ order block

✅Intraday bullish breaks of structure

🔑 Remember, to participate in trading comes always with a degree of risk, therefore as professional risk managers it remains vital that we stick to our risk management plan as well as our trading strategies.

📈The rest, we leave to the balance of probabilities.

💡Fail to plan. Plan to fail.

🏆It has always been that simple.

❤️Good luck with your trading journey, I shall see you at the very top.

🎯Trade consistent, FRGNT X

AUDUSD LONG FORECAST Q2 W23 D3 Y25👀 AUDUSD LONG FORECAST Q2 W23 D3 Y25

Professional Risk Managers👋

Welcome back to another FRGNT chart update📈

Diving into some Forex setups using predominantly higher time frame order blocks alongside intraday confirmation & breaks of structure.

Let’s see what price action is telling us today! 🔥

💡Here are some trade confluences📝

✅Weekly 50 EMA

✅Daily 50 EMA

✅15’ order block

✅Intraday bullish breaks of structure

🔑 Remember, to participate in trading comes always with a degree of risk, therefore as professional risk managers it remains vital that we stick to our risk management plan as well as our trading strategies.

📈The rest, we leave to the balance of probabilities.

💡Fail to plan. Plan to fail.

🏆It has always been that simple.

❤️Good luck with your trading journey, I shall see you at the very top.

🎯Trade consistent, FRGNT X

AUDUSD LONG FORECAST Q2 W22 D29 Y25👀 AUDUSD LONG FORECAST Q2 W22 D29 Y25

Professional Risk Managers👋

Welcome back to another FRGNT chart update📈

Diving into some Forex setups using predominantly higher time frame order blocks alongside intraday confirmation & breaks of structure.

Let’s see what price action is telling us today! 🔥

💡Here are some trade confluences📝

✅Weekly 50 EMA

✅Daily 50 EMA

✅15’ order block

✅Intraday bullish breaks of structure

🔑 Remember, to participate in trading comes always with a degree of risk, therefore as professional risk managers it remains vital that we stick to our risk management plan as well as our trading strategies.

📈The rest, we leave to the balance of probabilities.

💡Fail to plan. Plan to fail.

🏆It has always been that simple.

❤️Good luck with your trading journey, I shall see you at the very top.

🎯Trade consistent, FRGNT X

CAUTION 50'EMA NOT ON SIDE AUDUSD SHORT FORECAST Q2 W21 D22 Y25CAUTION 50'EMA NOT ON SIDE AUDUSD SHORT FORECAST Q2 W21 D22 Y25

Professional Risk Managers👋

Welcome back to another FRGNT chart update📈

Diving into some Forex setups using predominantly higher time frame order blocks alongside confirmation breaks of structure.

Let’s see what price action is telling us today!

💡Here are some trade confluences📝

✅4H Order Block

✅Tokyo ranges to be filled

✅15' order block identified

✅Weekly 50 EMA forecasting rejection

✅Daily 50 EMA target

🔑 Remember, to participate in trading comes always with a degree of risk, therefore as professional risk managers it remains vital that we stick to our risk management plan as well as our trading strategies.

📈The rest, we leave to the balance of probabilities.

💡Fail to plan. Plan to fail.

🏆It has always been that simple.

❤️Good luck with your trading journey, I shall see you at the very top.

🎯Trade consistent, FRGNT X

AngloGold Ashanti $AU: A Hidden Goldmine or High-Risk Play? AngloGold Ashanti ( NYSE:AU ): A Hidden Goldmine or High-Risk Play? 🏅🔍

1/10

AngloGold Ashanti NYSE:AU shows 6% annual revenue growth but faces a tough challenge—earnings have been declining at -35.8% per year! Industry earnings are up 10.9%, leaving AngloGold behind. 📉 Can they turn things around?

2/10

Major shakeup: NYSE:AU is acquiring Egypt’s largest gold miner, Centamin, in a $2.5 billion deal. This could reshape their future production and reserves. 🚨 Bold move or financial strain?

3/10

Asset sales are also in play! AngloGold is fielding bids for the Tropicana gold mine in Australia. A strategic move to streamline operations—or desperation for cash flow? 🏗️

4/10

Analysts have set a target price of $31.75, hinting at upside potential from the current price. Yet NYSE:AU ’s ROE of 3.4% and net margins of 2.3% lag behind peers. 📊 Is the stock undervalued or stuck in a profit rut?

5/10

Operational risks loom large. AngloGold operates across Africa and South America, exposing it to geopolitical instability, regulatory shifts, and potential disruptions. 🌍 How stable are these gold mines?

6/10

Strengths: AngloGold has diversified operations across multiple continents and a strong asset base. That reduces over-dependence on any one region. 🗺️ Diversity is their defensive edge.

7/10

Weaknesses: Declining earnings are a red flag for investors. High operational costs further squeeze profitability. 💸 Can NYSE:AU control expenses while scaling up production?

8/10

Opportunities: The Centamin acquisition could supercharge their gold production. Meanwhile, asset sales might optimize their portfolio by shedding low-margin operations. 🏆 Growth through smarter assets?

9/10

Threats: Volatile gold prices remain a double-edged sword. Plus, political risks in key regions like Africa can disrupt mining operations. ⚠️ Can AngloGold weather these external shocks?

10/10

Your turn! Is AngloGold Ashanti NYSE:AU a buy, hold, or avoid? Vote now! 🗳️

Golden buy opportunity 🏆

Hold for now 🔄

Too risky, avoid ⚠️

AU Index Rallies from Demand Area as Bullish Sentiment GrowsThe AU Index experienced a significant development yesterday as it reached a key demand area, showing a strong rejection today that indicates potential bullish momentum. This demand zone, identified through technical analysis, has historically served as a pivotal point for price action, suggesting an opportunity for a price turnaround. With the opening candle reflecting a robust rejection of lower levels, traders are increasingly optimistic about the possibility of a bullish trend emerging in the coming months.

From a technical standpoint, this demand area presents a solid foundation for potential upward movement. The absence of follow-through selling and the strength of the rejection signal that buyers are stepping in to support the price. When coupled with historical seasonality patterns, which indicate a likelihood of gains during this period, there is a compelling case for a bullish outlook on the AU Index. Historical trends suggest that this time frame has often led to price rallies, providing further confirmation for those considering long positions.

On the fundamental side, the insights from the Commitment of Traders (COT) report paint an interesting picture. While retail traders are predominantly bearish, indicating a cautious sentiment among the broader market participants, the smart money narrative tells a different story. Institutional investors appear to be either bullish or in the early stages of building long positions, which can be a telling signal for future price action. This divergence between retail bearishness and institutional buying often creates an environment ripe for a market reversal, particularly as the smart money tends to lead rather than follow market trends.

Given these dynamics, traders are now on the lookout for a long setup on the AU Index. Emphasizing risk management and entry strategies will be essential in this endeavor. With the price showing resilience at the demand area and fundamental signals suggesting a shift towards bullishness, there is a growing confidence that the AU Index may be poised for a sustained rally.

In conclusion, the confluence of technical indicators, seasonal patterns, and the contrasting sentiments present in the COT report presents an enticing opportunity in the AU Index. As traders position themselves for potential gains, the next few sessions will be crucial in determining whether this demand area will indeed act as a launchpad for a bullish trend in the months ahead. Investors will be closely monitoring price movements, looking for confirmation to validate their long strategies in what could be an exciting period for this index.

✅ Please share your thoughts about AU in the comments section below and HIT LIKE if you appreciate my analysis. Don't forget to FOLLOW ME; you will help us a lot with this small contribution.

AUD/USD Reaches Key Supply Area, possible ReversalThe AUD/USD pair has reached our identified supply area, coinciding with the start of the London session. A rejection candle has formed, signaling a potential reversal, with the spike briefly hitting 0.6872 before pulling back. This price action suggests that sellers are stepping in at this level, creating a possible reversal opportunity.

Traders are now watching closely for further confirmation of a bearish move. Today, the US CB Consumer Confidence report is set to be released, and this key economic indicator could provide additional momentum for the US Dollar. A stronger-than-expected reading may further bolster the USD, potentially driving the AUD/USD lower and continuing its downward trajectory.

With the market's focus on the upcoming US data, we remain poised for a potential short setup in anticipation of a reversal in the AUD/USD pair. Traders should keep a close eye on both the technical patterns and the economic news to confirm entry points.

✅ Please share your thoughts about AUD/USD in the comments section below and 👍 HIT LIKE if you appreciate my analysis. Don't forget to FOLLOW ME; you will help us a lot with this small contribution.

AUDUSD 0.67582 -0.09% SHORT MULTI TIME-FRAME ANALYSIS + DXYHELLO TRADERS

Hope everyone is doing great

📌 A look at The AUDUSD At the close of ASIA GOING INTO THE LONDON, TO NY PM SESSION

* With a bullish run into Monday CLOSE ( PO3) today will be looking for some retracement.

* looking at the daily last week Friday failed to take high which is a sign of weakness on AU alike with EU & GU.

* Looking at the +FVG below as targets as well.

* on the 4H looking for a bullish open to take ASIA high LQ.

* PO3

* Push higher before going for lower structures.

* AU sweeping the ASIA HIGH.

* Looking for an AGGRESIVE MOVE back into the range.

* this where I would look for entries short.

* Looking for the take of that ERL.

* with two possible OTE ( ASIA HIGHS, AND LONG TERM HIGH) , EXECUTION IS BASED ON RR & RISK MANAGEMENT.

* DXY 4H

- Will wait for the DXY to take ASIA lows and trade back in the range as a confirmation as well...

* BASED on the price action served next session...

* We will see what does the market dish.

🤷♂️😉🐻📉🐮📈

HOPE YOU ENJOYED THIS OUT LOOK, SHARE YOUR PLAN BELOW,🚀 & LETS TAKE SOME WINS THIS WEEK.

SEE YOU ON THE CHARTS.

IF THIS IDEA ASSISTS IN ANY WAY OR IF YOU ENJOYED THIS ONE

SMASH THAT 🚀 & LEAVE A COMMENT.

ALWAYS APPRECIATED

____________________________________________________________________________________________________________________

Kindly follow your entry rules on entries & stops. |* Some of The idea's may be predictive yet are not financial advice or signals. | *Trading plans can change at anytime reactive to the market. | * Many stars must align with the plan before executing the trade, kindly follow your rules & RISK MANAGEMENT.

_____________________________________________________________________________________________________________________

|

* ENTRY & SL -KINDLY FOLLOW YOUR RULES | * RISK-MANAGEMENT | *PERIOD - I TAKE MY TRADES ON A INTRA DAY SESSIONS BASIS THIS IS NOT FINACIAL ADVICE TO EXCECUTE ❤

LOVELY TRADING WEEK TO YOU!

AU D Buy Idea 5/8/24Daily bearish trendline has broken and is now being retesting, so I am now looking at buys.

There's been a bullish impulse with a bearish correction (pullback) happening now. If price follows suit there should be a bullish continuation happening soon pushing price bullish.

This will have EMCers looking for entries Thursday or Friday to take price up to around .66722 for a -.27 TP.

**This is for educational purposes only and this is not financial advice because I am not a financial advisor.**

AU D Sell Idea 3/10/24The Daily (D) time frame has made an inverted hammer off the top of the Weekly (W) consolidation zone.

On top of that price is wicking off the .786 FIB levels from a minor W FIB from 1/14/24.

Looking for price to push back down to a minimum the mid point of the W consolidation zone that started 1/29/24.

Gold analysis before NFP(4/5/2024)In our last analysis, we had anticipated the gold price to reach the 2300-2350 zone. right now the price has touched 2305$ and ranging.

We believe that the price has the potential to move upward and reach the 2325-2350 zone.

Our technical view has been shown in the chart.

If you like it then Support us by Like, Following, and Sharing.

Thanks For Reading

Team Fortuna

-RC

(Disclaimer: Published ideas and other Contents on this page are for educational purposes and do not include a financial recommendation. Trading is Risky, so before any action do your research.)

AU - a gold mining stock rises with spot gold LONGAU AngloGold Ashanti has operations in a variety of locations including North America and Africa.

With spot gold rising and mostly fixed operational costs, AU stands to improve its overall

margins. Here on a weekly chart, price has crossed over the POC line of the volume

profile and the mean anchored VWAP line. The Price Momentum Oscillator and Relative

Trend Index indicators are showing reversals from bearish to bullish. Price action is in

a symmetrical triangle. Price has 20% upside before reaching the descending resistance

trendline which may take a month or so. I will open a long trade here looking for a best

entry on a 120-240 minute chart.

NGD - a gold mining penny stock is bullish LONGNGD on the highly reliable monthly chart has signs of bullish momentum including a cross over

the POC line of the volume profile,a monthly volume bar over the running mean for the first

time in two years price crossing over the mean anchored VWAP and both the trend and

the momentum indicators making reversals. I will open a long trade of both shares as well

as a lot of call options for mid- November striking OTM at $ 1.50. This junior miner

stands to gain earnings when gold prices rise proportionately more than established global

mining operations. My target is 3.5 just under two standard deviations above VWAP. I will

take off 1/3 of the position at 2.7 at the first standard deviation above VWAP in best practices

for risk management.