Audcadanalysis

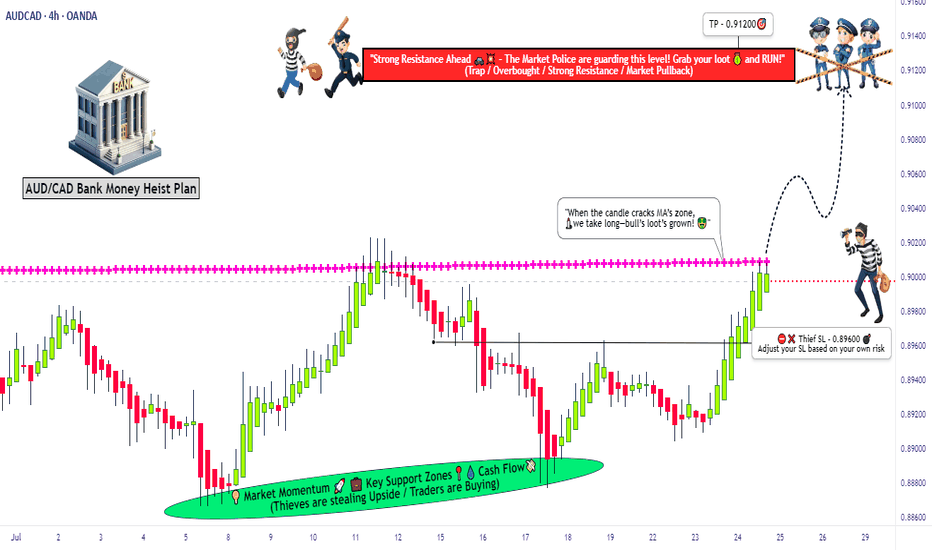

AUDCAD Forex Heist Plan: Entry, SL & TP by Thief Trader Style🏴☠️🔥 AUD/CAD Bank Heist Plan – Thief Trader's Long Con in Motion! 🔥🏴☠️

Breakout Bulls vs Bearish Guards – Who Wins the Forex Vault This Time?

🌍 Hello Money Makers, Market Bandits, and Strategic Robbers! 💰🚀💣

It’s Thief Trader back again, dropping heat with another high-stakes Forex bank job – this time we're targeting the AUD/CAD vault. This is not your grandma’s trading plan. We’re executing a well-calculated heist based on a fusion of technical breakouts + fundamental drivers with a dose of pure trading psychology warfare. 🎯

💼 The Heist Blueprint: Long Entry Game Plan

🧠 Our job is to move in silence until the breakout alarms go off.

We target 0.90200 as the clean breakout trigger over the Moving Average. This zone marks the guard shift — bulls take over if we break through.

📌 Entry Types (Choose your weapon):

🔹 Buy Stop: Above 0.90200 (Post-MA breakout confirmation).

🔹 Buy Limit (DCA Style): Set limit buys at recent lows (M15/M30 swing low) for pullback entries. Layer your entries like a true strategist.

🔔 Set Alerts: Don't sleep on this. Place alerts at breakout zones – let the chart notify you when the bank door opens. 📡

🛑 Risk Management – The Escape Plan

We don't jump in blind. Place your Stop Loss ONLY AFTER the breakout confirms.

📍Suggested SL: 0.89600, near recent 4H wick low.

🔥 Reminder: Your stop depends on your lot size, risk tolerance, and how many entries you're stacking. Don't set it too tight – we don't want early alarms killing the mission.

🎯 Profit Target – Rob & Exit

📍 Primary TP: 0.91200

🎭 Or simply: Escape before the alarm rings (i.e., close early if you see price weakness near resistance or news surprises).

🧲 Scalpers, stick to long bias only. If you're running capital deep, go in hard. If not, ride with the swing team. Use trailing SLs to protect and ride the move like a ghost.

🧠 Behind the Heist – What Fuels Our Mission?

The AUD/CAD pair is showing bullish signs backed by:

✴️ Macroeconomic indicators

✴️ Central Bank divergences

✴️ COT data (Commitment of Traders)

✴️ Intermarket correlations

✴️ Sentiment shifts & positioning strategies

Before executing any trade, read your fundamentals. Study the landscape. Then strike. 🕵️♂️

⚠️ Trading Safety Alert – Timing Is Everything

🚫 Avoid placing trades during high-impact news.

✅ Use trailing SL to lock in profits and prevent whipsaw hits.

📊 Protect your capital like it’s stolen loot – because it is!

💥Support the Crew 💥

🚀 Smash that 💗 Boost Button if you’re vibing with the plan.

Every like strengthens the Thief Trading Crew – and gets us closer to daily market domination. 🎉💪

📲 Stay locked in. Another heist is coming soon.

Till then – rob smart, trade sharp, and vanish like a legend. 🐱👤💸

🔑 #AUDCAD #ThiefTrader #ForexBreakout #LongSetup #ScalpToSwing #TradeWithPlan #DCAEntry #ForexHeist #MarketStrategy #RiskReward

AUDCAD - Possible Buy Setup AheadThe market is approaching a significant zone.

We’re standing by — no rush, no guessing.

If a clean bullish signal appears, we go long.

If it breaks through, we wait for a pullback and adapt.

Our job isn’t prediction — it’s reaction.

Follow the plan. Let the profits take care of themselves

AUDCAD | Weekly Outlook | July 14, 2025🟦 AUDCAD | Weekly Outlook | ICT-Based Analysis

📅 Week Starting: July 14, 2025

🧠 "Don't chase — let the trade come to you."

🧭 Market Context (1H + HTF Alignment)

This chart outlines a clear Smart Money framework for AUDCAD using ICT principles. The market recently completed a manipulation phase below a major accumulation zone, forming a clear SMT divergence and respecting a CISD (Clean Internal Sell-side Displacement).

After manipulation and SMT confirmation, price respected the CISD and showed willingness to displace bullishly, suggesting a potential re-accumulation phase on the lower timeframes.

🔍 Key Observations

Accumulation + SMT:

We had a prolonged accumulation phase that led to a smart money manipulation (fakeout), marked by SMT divergence. This was followed by a bullish shift in structure, confirming intent.

CISD + CE Reaction:

Price respected the CISD zone and formed a bullish W reversal + OB/BI setup. This is a common ICT pattern before major expansions.

Re-Accumulation Area:

The current consolidation near ERL levels shows signs of controlled accumulation, with price respecting previous liquidity levels.

This area may act as a springboard for expansion towards HTF objectives.

📈 HTF Targeting: Reversal Area + EQH

The chart marks a High Time Frame Reversal Area (HTF) above the current price, potentially acting as a premium inefficiency or sell-side liquidity target.

EOH (Expansion Objective High) is drawn in that same region, providing a long-term magnet for price.

This aligns with the broader Monthly Cycle expectation.

🔄 Monthly Cycle Analysis

“Monthly Cycle is Created — Open, Low... Now We Wait for the High and Close.”

This suggests:

Monthly Open and Low are already formed.

A bullish monthly cycle is anticipated — meaning we're waiting for the High to form next.

Once the high is set, a retracement towards the Close level is expected by the end of the month.

This macro view gives us context for aiming long positions on pullbacks — buying dips within the re-accumulation range.

⚠️ Trader's Insight

Don’t Chase — Let the Trade Come to You.

The setup is not about chasing price. Instead, the idea is to:

Wait for price to return to favorable zones (e.g., CE of OB inside CISD)

Confirm intent with LTF SMT, FVGs, or M15 structural shifts

Target HTF inefficiencies and liquidity zones (EOH & Reversal Area)

🎯 Bias for the Week

Bullish, based on:

Monthly cycle direction (expecting HIGH)

Price behavior post-CISD respect

Clear smart money accumulation and displacement

Re-accumulation on LTFs suggesting continuation

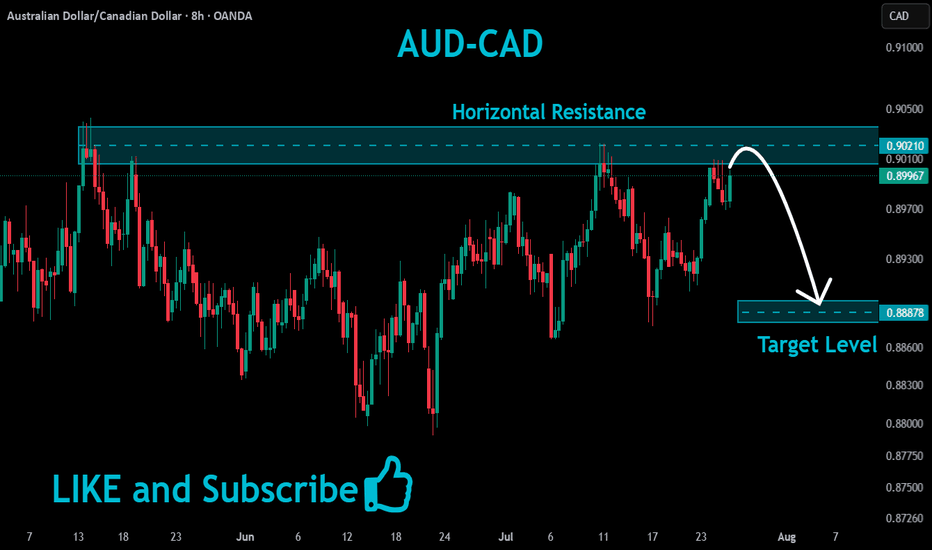

AUDCAD – Bearish Rejection at Key Resistance ZoneAUDCAD is showing signs of weakness near the 0.8980 supply zone after an extended rally. The pair is now reacting to a historically respected resistance area, with bearish momentum building as exhaustion sets in.

🔍 Technical Outlook:

✅ Price rejected at multi-touch resistance around 0.8980

📐 Clean bearish structure forming after wedge-like exhaustion

📉 Expecting a move down toward:

TP1: 0.89365 – recent minor structure

TP2: 0.89080 – key demand zone from early July

TP3: 0.88654 – full measured target from range

📛 Invalidation above: 0.8985

🌍 Fundamental Breakdown:

🇦🇺 Australia:

📉 Softening inflation and retail sales

🏦 RBA cautious with limited appetite for further hikes

🇨🇳 Weak Chinese demand adds pressure on AUD

🇨🇦 Canada:

💪 Supported by rising oil prices and solid employment data

🏦 BoC remains vigilant on inflation, though on hold

🛢️ Strong WTI prices continue to support CAD

⚠️ Risks to the Bearish View:

⚡ Unexpectedly strong China data could boost AUD

📉 Sudden drop in oil prices would hurt CAD

🗣️ Surprise hawkish shift from RBA

🔗 Correlation & Flow:

AUDCAD is a lagging asset, heavily influenced by WTI crude (boosting CAD) and China-linked risk flows (affecting AUD).

Keep an eye on AUDUSD and USDCAD for early signals.

📆 Upcoming Key Events:

🇦🇺 RBA Minutes, Jobs Data, Wages Index

🇨🇦 BoC Business Outlook, CPI Print

🛢️ US Oil Inventories (affects CAD)

🧭 Summary:

🔻 Bias: Bearish

📊 Drivers: Oil strength, RBA caution, CAD resilience

⚠️ Risk: China rebound or oil correction

🕵️ Watch: Canadian CPI + Australian jobs data

📉 Likely to Follow: Oil and AUDUSD/USDCAD macro trends

AUDCAD SHORT DAILY FORECAST Q3 D10 W28 Y25AUDCAD SHORT DAILY FORECAST Q3 D10 W28 Y25

Professional Risk Managers👋

Welcome back to another FRGNT chart update📈

Diving into some Forex setups using predominantly higher time frame order blocks alongside confirmation breaks of structure.

Let’s see what price action is telling us today! 👀

💡Here are some trade confluences📝

✅Daily Order block identified

✅4H Order Block identified

✅1H Order Block identified

🔑 Remember, to participate in trading comes always with a degree of risk, therefore as professional risk managers it remains vital that we stick to our risk management plan as well as our trading strategies.

📈The rest, we leave to the balance of probabilities.

💡Fail to plan. Plan to fail.

🏆It has always been that simple.

❤️Good luck with your trading journey, I shall see you at the very top.

🎯Trade consistent, FRGNT X

AUDCAD – Bearish Setup Following Retracement to Key ResistanceWelcome to Velatrix Capital.

Below is a live market opportunity identified by our internal trading desk.

This is not financial advice. It’s a data-backed, logic-driven trading edge. Use it with discipline — or don’t use it at all.

🧠 Technical Outlook

AUDCAD is currently showing bullish momentum on the lower timeframes, approaching a key resistance zone between 0.89057 – 0.89272.

Our trading desk expects price to reach this supply zone and then present a short-selling opportunity with favorable risk/reward potential.

We advise waiting patiently for the price to enter this key range before initiating any short trades.

Trade Parameters:

• Timeframe: 1H

• Direction: Sell

• Entry Zone: 0.89272 – 0.89057

• Stop Loss (SL): 0.89386

• Take Profit 1 (TP1): 0.88458

• Take Profit 2 (TP2): 0.87954

• Risk/Reward (R/R): 1:2 / 1:4.80

Note: Setup is invalidated if price breaks and closes above 0.89386.

🔔 Follow Us

This is just the surface.

For more setups, clean breakdowns, and performance-driven content:

📌 Follow, engage, and stay sharp. Our edge is real — and it’s public.

We don’t chase hype. We build edge.

Why AUDCAD is On My Watchlist for a Short Trade🔎 AUDCAD Trade Idea Overview 🔎

Currently watching AUDCAD closely 👀 — and here’s what I’m seeing across the key timeframes:

📉 On the weekly timeframe, the pair remains in a clear bearish trend, with lower highs and lower lows forming consistently.

🕰️ Dropping down to the daily, we’re seeing continued bearish momentum in alignment with the higher timeframe bias.

⏳ On the 4-hour chart, there’s been a clean break of market structure, confirming short-term weakness.

🎯 I’m eyeing a pullback into equilibrium within the current price range for a potential short entry.

🔹 Entry: On retracement into a key value zone

🔹 Stop loss: Positioned above recent swing highs

🔹 Take profit: Targeting previous lows and liquidity pockets 💧

Patience is key here — waiting for the right setup to align across multiple timeframes. 📊

⚠️ Disclaimer: This is not financial advice. This analysis is for educational and informational purposes only. Always do your own research and manage risk responsibly. 💼

AUDCAD SHORT FORECAST Q2 W24 D12 Y25AUDCAD SHORT FORECAST Q2 W24 D12 Y25

Professional Risk Managers👋

Welcome back to another FRGNT chart update📈

Diving into some Forex setups using predominantly higher time frame order blocks alongside intraday confirmation breaks of structure.

💡Here are some trade confluences📝

✅Weekly 50 EMA

✅Weekly order block rejection

✅Daily order block rejection

✅15’ order block identification

🔑 Remember, to participate in trading comes always with a degree of risk, therefore as professional risk managers it remains vital that we stick to our risk management plan as well as our trading strategies.

📈The rest, we leave to the balance of probabilities.

💡Fail to plan. Plan to fail.

🏆It has always been that simple.

❤️Good luck with your trading journey, I shall see you at the very top.

🎯Trade consistent, FRGNT X

AUDCAD SHORT FORECAST Q2 W24 D10 Y25AUDCAD SHORT FORECAST Q2 W24 D10 Y25

Professional Risk Managers👋

Welcome back to another FRGNT chart update📈

Diving into some Forex setups using predominantly higher time frame order blocks alongside intraday confirmation breaks of structure.

💡Here are some trade confluences📝

✅Weekly 50 EMA

✅Weekly order block rejection

✅Daily order block rejection

✅15’ order block identification

🔑 Remember, to participate in trading comes always with a degree of risk, therefore as professional risk managers it remains vital that we stick to our risk management plan as well as our trading strategies.

📈The rest, we leave to the balance of probabilities.

💡Fail to plan. Plan to fail.

🏆It has always been that simple.

❤️Good luck with your trading journey, I shall see you at the very top.

🎯Trade consistent, FRGNT X

DAILY HOT PICK ! AUDCAD SHORT FORECAST Q2 W23 D3 Y25AUDCAD SHORT FORECAST Q2 W23 D3 Y25

🔥🔥DAILY HOT PICK !!!!!! 🎯🎯

Professional Risk Managers👋

Welcome back to another FRGNT chart update📈

Diving into some Forex setups using predominantly higher time frame order blocks alongside intraday confirmation breaks of structure.

💡Here are some trade confluences📝

✅Daily 50 EMA

✅Weekly order block rejection

✅Daily order block rejection

✅15’ order block identification

🔑 Remember, to participate in trading comes always with a degree of risk, therefore as professional risk managers it remains vital that we stick to our risk management plan as well as our trading strategies.

📈The rest, we leave to the balance of probabilities.

💡Fail to plan. Plan to fail.

🏆It has always been that simple.

❤️Good luck with your trading journey, I shall see you at the very top.

🎯Trade consistent, FRGNT X

AUDCAD SHORT FORECAST Q2 W23 D2 Y25AUDCAD SHORT FORECAST Q2 W23 D2 Y25

Professional Risk Managers👋

Welcome back to another FRGNT chart update📈

Diving into some Forex setups using predominantly higher time frame order blocks alongside intraday confirmation breaks of structure.

💡Here are some trade confluences📝

✅Daily 50 EMA

✅Weekly order block rejection

✅Daily order block rejection

✅15’ order block identification

🔑 Remember, to participate in trading comes always with a degree of risk, therefore as professional risk managers it remains vital that we stick to our risk management plan as well as our trading strategies.

📈The rest, we leave to the balance of probabilities.

💡Fail to plan. Plan to fail.

🏆It has always been that simple.

❤️Good luck with your trading journey, I shall see you at the very top.

🎯Trade consistent, FRGNT X

POI = LIQUIDITY AUDCAD SHORT FORECAST Q2 W22 D29 Y25

AUDCAD SHORT FORECAST Q2 W22 D29 Y25

POI = LIQUIDITY = Let's print money!

Professional Risk Managers👋

Welcome back to another FRGNT chart update📈

Diving into some Forex setups using predominantly higher time frame order blocks alongside intraday confirmation breaks of structure.

💡Here are some trade confluences📝

✅Weekly 50 EMA

✅Weekly order block rejection

✅Daily order block rejection

✅15’ order block identification

🔑 Remember, to participate in trading comes always with a degree of risk, therefore as professional risk managers it remains vital that we stick to our risk management plan as well as our trading strategies.

📈The rest, we leave to the balance of probabilities.

💡Fail to plan. Plan to fail.

🏆It has always been that simple.

❤️Good luck with your trading journey, I shall see you at the very top.

🎯Trade consistent, FRGNT X

D & 4H 50 EMA HOLD? AUDCAD SHORT FORECAST Q2 W22 D28 Y25🔥DAILY & 4H 50 EMA POI HOLD SOUTH...

AUDCAD SHORT FORECAST Q2 W22 D28 Y25

Professional Risk Managers👋

Welcome back to another FRGNT chart update📈

Diving into some Forex setups using predominantly higher time frame order blocks alongside intraday confirmation breaks of structure.

💡Here are some trade confluences📝

✅Weekly 50 EMA

✅Weekly order block rejection

✅Daily order block rejection

✅15’ order block identification

🔑 Remember, to participate in trading comes always with a degree of risk, therefore as professional risk managers it remains vital that we stick to our risk management plan as well as our trading strategies.

📈The rest, we leave to the balance of probabilities.

💡Fail to plan. Plan to fail.

🏆It has always been that simple.

❤️Good luck with your trading journey, I shall see you at the very top.

🎯Trade consistent, FRGNT X

VALID POI'S AUDCAD SHORT FORECAST Q2 W22 D27 Y25🔥VALID POI'S AUDCAD SHORT FORECAST Q2 W22 D27 Y25

Professional Risk Managers👋

Welcome back to another FRGNT chart update📈

Diving into some Forex setups using predominantly higher time frame order blocks alongside intraday confirmation breaks of structure.

💡Here are some trade confluences📝

✅Weekly 50 EMA

✅Weekly order block rejection

✅Daily order block rejection

✅15’ order block identification

🔑 Remember, to participate in trading comes always with a degree of risk, therefore as professional risk managers it remains vital that we stick to our risk management plan as well as our trading strategies.

📈The rest, we leave to the balance of probabilities.

💡Fail to plan. Plan to fail.

🏆It has always been that simple.

❤️Good luck with your trading journey, I shall see you at the very top.

🎯Trade consistent, FRGNT X

IN DEPTH HOT PICK ALERT AUDCAD SHORT FORECAST Q2 W22 D26 Y25🔥IN DEPTH HOT PICK ALERT AUDCAD SHORT FORECAST Q2 W22 D26 Y25

Professional Risk Managers👋

Welcome back to another FRGNT chart update📈

Diving into some Forex setups using predominantly higher time frame order blocks alongside intraday confirmation breaks of structure.

💡Here are some trade confluences📝

✅Weekly 50 EMA

✅Weekly order block rejection

✅Daily order block rejection

✅15’ order block identification

🔑 Remember, to participate in trading comes always with a degree of risk, therefore as professional risk managers it remains vital that we stick to our risk management plan as well as our trading strategies.

📈The rest, we leave to the balance of probabilities.

💡Fail to plan. Plan to fail.

🏆It has always been that simple.

❤️Good luck with your trading journey, I shall see you at the very top.

🎯Trade consistent, FRGNT X

HOT PICK ALERT AUDCAD SHORT FORECAST Q2 W22 Y25HOT PICK ALERT AUDCAD SHORT FORECAST Q2 W22 Y25

SELL SELL SELL

Professional Risk Managers👋

Welcome back to another FRGNT chart update📈

Diving into some Forex setups using predominantly higher time frame order blocks alongside confirmation breaks of structure.

💡In depth trade confluences provided during the week 📝

🔑 Remember, to participate in trading comes always with a degree of risk, therefore as professional risk managers it remains vital that we stick to our risk management plan as well as our trading strategies.

📈The rest, we leave to the balance of probabilities.

💡Fail to plan. Plan to fail.

🏆It has always been that simple.

❤️Good luck with your trading journey, I shall see you at the very top.

🎯Trade consistent, FRGNT X

AUDCAD – breakout and short likely .. the week of 26 MayThe support zone between 0.8890 and 0.8870 has been holding firm, while this pair has been making lower highs for the past couple of weeks. Price is now below the 50ema too. The most recent bounce from the zone looks rather weak and IMO a breakout to the downside may happen in the next few days.

I see an initial target around 0.8730 with the potential to go much lower. Anything can happen in the markets, so best to monitor price action on lower time frames to look for bearish evidence before committing to a trade.

This is not a trade recommendation; it’s merely my own analysis. Trading carries a high level of risk so carefully managing your capital and risk is important. If you like my idea, please give a “boost” and follow me to get even more.

It’s not whether you are right or wrong, but how much money you make when you are right and how much you lose when you are wrong – George Soros

ALL WE NEED IS A PULL BACK.AUDCAD SHORT FORECAST Q2 W21 D22 Y25ALL WE NEED IS A PULL BACK

AUDCAD SHORT FORECAST Q2 W21 D22 Y25

Professional Risk Managers👋

Welcome back to another FRGNT chart update📈

Diving into some Forex setups using predominantly higher time frame order blocks alongside confirmation breaks of structure.

Let’s see what price action is telling us today!

💡Here are some trade confluences📝

✅ Weekly order block

✅ Intraday 15 order block

✅Tokyo ranges to be filled

✅ Weekly 50 EMA

🔑 Remember, to participate in trading comes always with a degree of risk, therefore as professional risk managers it remains vital that we stick to our risk management plan as well as our trading strategies.

📈The rest, we leave to the balance of probabilities.

💡Fail to plan. Plan to fail.

🏆It has always been that simple.

❤️Good luck with your trading journey, I shall see you at the very top.

🎯Trade consistent, FRGNT X