AUDCHF Will Go Down! Short!

Here is our detailed technical review for AUDCHF.

Time Frame: 9h

Current Trend: Bearish

Sentiment: Overbought (based on 7-period RSI)

Forecast: Bearish

The market is on a crucial zone of supply 0.524.

The above-mentioned technicals clearly indicate the dominance of sellers on the market. I recommend shorting the instrument, aiming at 0.522 level.

P.S

Please, note that an oversold/overbought condition can last for a long time, and therefore being oversold/overbought doesn't mean a price rally will come soon, or at all.

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

Like and subscribe and comment my ideas if you enjoy them!

AUDCHF

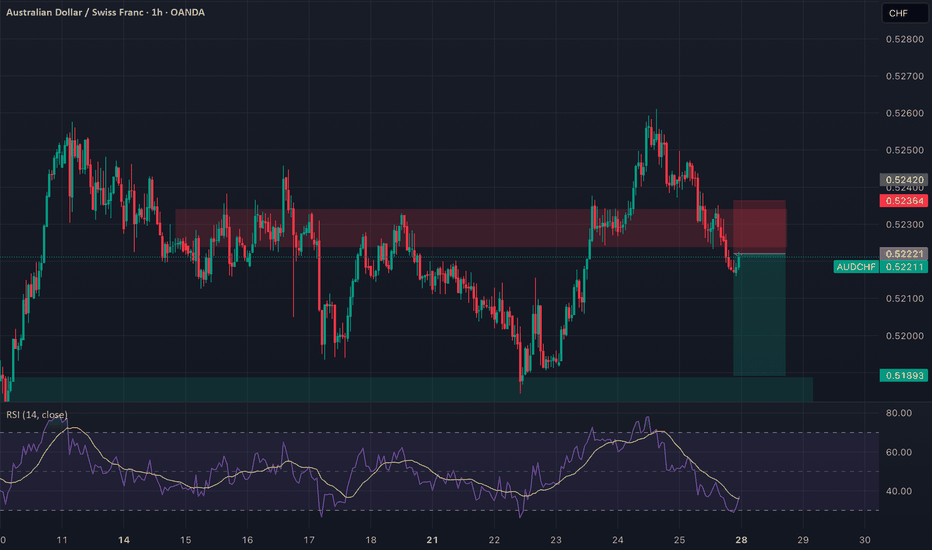

AUDCHF: Broken Support, Bearish Flow In Play Timeframe: 1H

Bias: Bearish

Type: Support Turncoat → Breakdown Play

📊 Technical Setup

AUDCHF previously broke the 4H resistance (0.5236) which flipped to support. However, price has now broken below this support, confirming it as a failed demand zone.

• Entry: Market execution or retest of 0.5236

• SL: Above 0.5245

• TP: 0.5189

• RR: ~1:2

• RSI: Below 50 and heading lower = momentum supports downside

📉 Macro & Fundamental Confluence

• AUD Weakness: RBA dovish, conditional score declining, bearish seasonality

• CHF Slightly Less Weak: Despite SNB dovish stance, CHF is outperforming AUD

• COT + Sentiment: AUD CFTC weakening, CHF holding steady

• Risk Sentiment: RISK ON environment reduces CHF demand but AUD still underperforms

🧭 Gameplan

“Support failed to hold. Bearish pressure intensifies. Target previous swing low zone.”

🔔 Watch for retest of 0.5236 for better RR setup before continuing short.

AUDCHF: Bullish Continuation & Long Signal

AUDCHF

- Classic bullish formation

- Our team expects pullback

SUGGESTED TRADE:

Swing Trade

Long AUDCHF

Entry - 0.5221

Sl - 0.5215

Tp - 0.5235

Our Risk - 1%

Start protection of your profits from lower levels

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

❤️ Please, support our work with like & comment! ❤️

Bullish bounce off pullback support?AUD/CHF is falling towards the pivot, which is a pullback support and could bounce to the 1st resistance.

Pivot: 0.52113

1st Support: 0.51691

1st Resistance: 0.53019

Risk Warning:

Trading Forex and CFDs carries a high level of risk to your capital and you should only trade with money you can afford to lose. Trading Forex and CFDs may not be suitable for all investors, so please ensure that you fully understand the risks involved and seek independent advice if necessary.

Disclaimer:

The above opinions given constitute general market commentary, and do not constitute the opinion or advice of IC Markets or any form of personal or investment advice.

Any opinions, news, research, analyses, prices, other information, or links to third-party sites contained on this website are provided on an "as-is" basis, are intended only to be informative, is not an advice nor a recommendation, nor research, or a record of our trading prices, or an offer of, or solicitation for a transaction in any financial instrument and thus should not be treated as such. The information provided does not involve any specific investment objectives, financial situation and needs of any specific person who may receive it. Please be aware, that past performance is not a reliable indicator of future performance and/or results. Past Performance or Forward-looking scenarios based upon the reasonable beliefs of the third-party provider are not a guarantee of future performance. Actual results may differ materially from those anticipated in forward-looking or past performance statements. IC Markets makes no representation or warranty and assumes no liability as to the accuracy or completeness of the information provided, nor any loss arising from any investment based on a recommendation, forecast or any information supplied by any third-party.

AUD/CHF BEARS ARE STRONG HERE|SHORT

AUD/CHF SIGNAL

Trade Direction: short

Entry Level: 0.524

Target Level: 0.521

Stop Loss: 0.526

RISK PROFILE

Risk level: medium

Suggested risk: 1%

Timeframe: 9h

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

✅LIKE AND COMMENT MY IDEAS✅

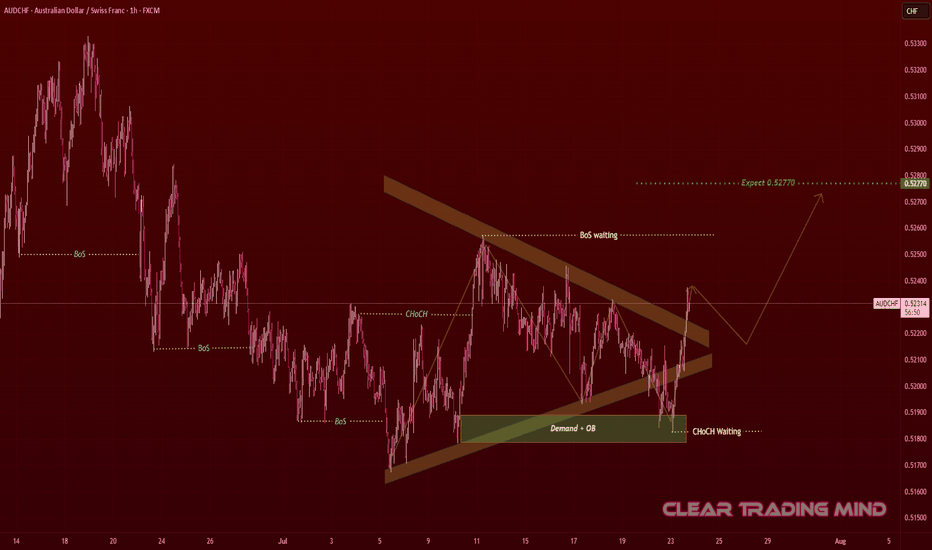

AUDCHF Contracting Triangle – Waiting for Breakout Confirmation

AUDCHF on the 1-hour chart is forming a contracting triangle 🔺, showing consolidation after a downtrend.

From an SMC perspective:

🟩 Demand + OB (Order Block) zone holding strong near 0.51900

🔄 Previous CHoCH shows buyer interest

⏳ Waiting for BoS (Break of Structure) confirmation above the triangle

Plan:

* Breakout Entry: Above 0.52400 after retest 🔓

🎯 First Target: 0.52770 – 0.52800 (≈ 37 pips from breakout)

🛡 Invalidation: Below 0.51900 (demand failure)

Reasoning:

+ Contracting triangles often lead to strong impulsive moves ⚡

+ Buyers are already active at demand 🔥

+ Confirmation of CHoCH + BoS could push price to targets 🚀

// (Not financial advice – personal chart observation)

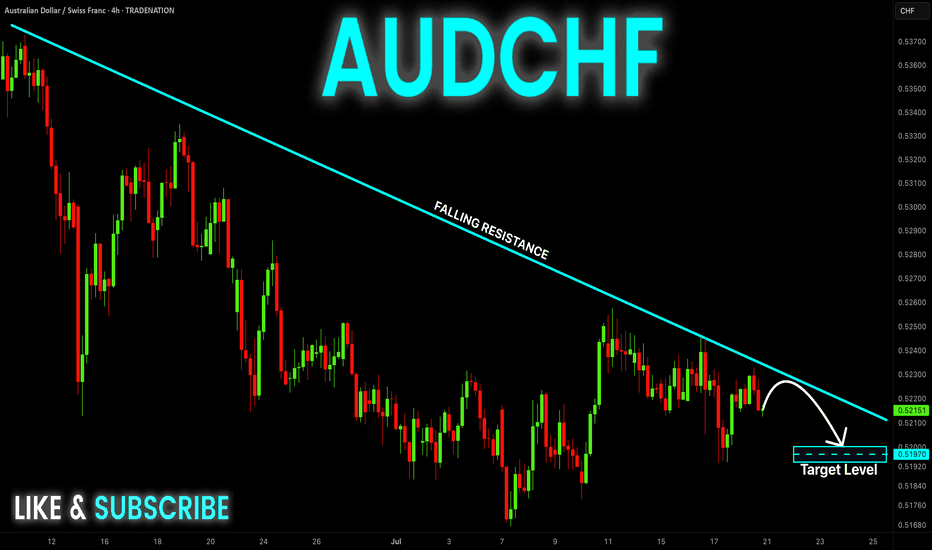

AUD-CHF Risky Short From Falling Resistance! Sell!

Hello,Traders!

AUD-CHF is trading in a

Downtrend along the falling

Resistance line so we are

Bearish biased and after

The potential retest of the

Falling resistance we will

Be expecting a further

Bearish move down

Sell!

Comment and subscribe to help us grow!

Check out other forecasts below too!

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

AUD/CHF BEST PLACE TO SELL FROM|SHORT

AUD/CHF SIGNAL

Trade Direction: short

Entry Level: 0.524

Target Level: 0.520

Stop Loss: 0.526

RISK PROFILE

Risk level: medium

Suggested risk: 1%

Timeframe: 3h

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

✅LIKE AND COMMENT MY IDEAS✅

AUDCHF Will Grow! Buy!

Take a look at our analysis for AUDCHF.

Time Frame: 1D

Current Trend: Bullish

Sentiment: Oversold (based on 7-period RSI)

Forecast: Bullish

The market is on a crucial zone of demand 0.519.

The oversold market condition in a combination with key structure gives us a relatively strong bullish signal with goal 0.534 level.

P.S

The term oversold refers to a condition where an asset has traded lower in price and has the potential for a price bounce.

Overbought refers to market scenarios where the instrument is traded considerably higher than its fair value. Overvaluation is caused by market sentiments when there is positive news.

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

Like and subscribe and comment my ideas if you enjoy them!

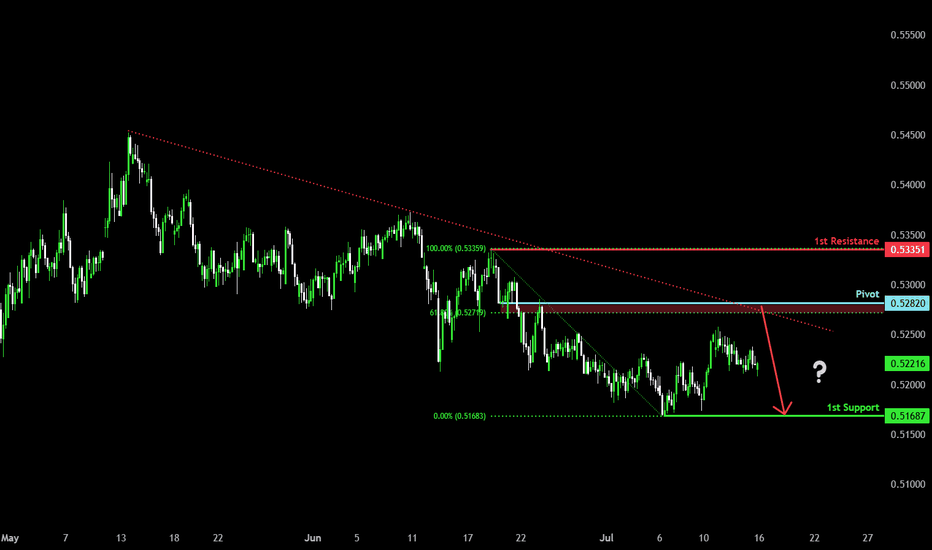

Bearish reversal?AUD/CHF is rising towards the pivot, which is a pullback resistance and could reverse to the 1st support.

Pivot: 0.52820

1st Support: 0.51687

1st Resistance: 0.53351

Risk Warning:

Trading Forex and CFDs carries a high level of risk to your capital and you should only trade with money you can afford to lose. Trading Forex and CFDs may not be suitable for all investors, so please ensure that you fully understand the risks involved and seek independent advice if necessary.

Disclaimer:

The above opinions given constitute general market commentary, and do not constitute the opinion or advice of IC Markets or any form of personal or investment advice.

Any opinions, news, research, analyses, prices, other information, or links to third-party sites contained on this website are provided on an "as-is" basis, are intended only to be informative, is not an advice nor a recommendation, nor research, or a record of our trading prices, or an offer of, or solicitation for a transaction in any financial instrument and thus should not be treated as such. The information provided does not involve any specific investment objectives, financial situation and needs of any specific person who may receive it. Please be aware, that past performance is not a reliable indicator of future performance and/or results. Past Performance or Forward-looking scenarios based upon the reasonable beliefs of the third-party provider are not a guarantee of future performance. Actual results may differ materially from those anticipated in forward-looking or past performance statements. IC Markets makes no representation or warranty and assumes no liability as to the accuracy or completeness of the information provided, nor any loss arising from any investment based on a recommendation, forecast or any information supplied by any third-party.

AUDCHF Will Go Higher From Support! Long!

Take a look at our analysis for AUDCHF.

Time Frame: 1D

Current Trend: Bullish

Sentiment: Oversold (based on 7-period RSI)

Forecast: Bullish

The market is testing a major horizontal structure 0.522.

Taking into consideration the structure & trend analysis, I believe that the market will reach 0.533 level soon.

P.S

We determine oversold/overbought condition with RSI indicator.

When it drops below 30 - the market is considered to be oversold.

When it bounces above 70 - the market is considered to be overbought.

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

Like and subscribe and comment my ideas if you enjoy them!

AUDCHF Expected Growth! BUY!

My dear friends,

AUDCHF looks like it will make a good move, and here are the details:

The market is trading on 0.5224 pivot level.

Bias - Bullish

Technical Indicators: Supper Trend generates a clear long signal while Pivot Point HL is currently determining the overall Bullish trend of the market.

Goal - 0.5232

About Used Indicators:

Pivot points are a great way to identify areas of support and resistance, but they work best when combined with other kinds of technical analysis

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

———————————

WISH YOU ALL LUCK

AUD-CHF Local Long! Buy!

Hello,Traders!

AUD-CHF made a bullish

Breakout of the key horizontal

Level of 0.5221 which is now a

Support and the pair is going down

To retest the level from where

We will be expecting a

Further bullish move up

Buy!

Comment and subscribe to help us grow!

Check out other forecasts below too!

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

AUDCHF Technical Analysis! SELL!

My dear subscribers,

My technical analysis for AUDCHF is below:

The price is coiling around a solid key level - 0.5226

Bias - Bearish

Technical Indicators: Pivot Points Low anticipates a potential price reversal.

Super trend shows a clear sell, giving a perfect indicators' convergence.

Goal - 0.5205

About Used Indicators:

By the very nature of the supertrend indicator, it offers firm support and resistance levels for traders to enter and exit trades. Additionally, it also provides signals for setting stop losses

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

———————————

WISH YOU ALL LUCK

AUDCHF; Heikin Ashi Trade IdeaOANDA:AUDCHF

In this video, I’ll be sharing my analysis of AUDCHF, using FXAN's proprietary algo indicators with my unique Heikin Ashi strategy. I’ll walk you through the reasoning behind my trade setup and highlight key areas where I’m anticipating potential opportunities.

I’m always happy to receive any feedback.

Like, share and comment! ❤️

Thank you for watching my videos! 🙏

AUD-CHF Rebound Ahead! Buy!

Hello,Traders!

AUD-CHF keeps falling but

A horizontal support level

Is ahead around 0.5160

And as the pair is locally

Oversold we will be expecting

A local bullish rebound

Buy!

Comment and subscribe to help us grow!

Check out other forecasts below too!

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

AUD_CHF BEARISH BREAKOUT|SHORT|

✅AUD_CHF is going down currently

As the pair broke the key structure level of 0.5240

Which is now a resistance, and after the pullback

And retest, I think the price will go further down

SHORT🔥

✅Like and subscribe to never miss a new idea!✅

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

AUDCHF: Bullish Flag from PRZ — Rally to 0.54444?AUDCHF ( OANDA:AUDCHF ) bounced from the Potential Reversal Zone (PRZ) , which aligns with the Yearly Support(1) and the 50% Fibonacci level of the previous bullish impulse.

From a Classic Technical Analysis perspective , AUDCHF appears to be breaking out of a Bullish Flag Pattern , which may suggest the continuation of the previous uptrend .

This bullish reaction also confirms the importance of the Support zone(0.51166 CHF-0.49773 CHF) , where buyers stepped in aggressively.

In terms of Elliott Wave theory , it seems that AUDCHF has completed the bearish waves and we should wait for the bullish waves .

I expect AUDCHF to continue rising after a successful breakout from the flag’s upper boundary . If momentum sustains, the target could be around 0.54444 CHF .

Note: Stop Loss (SL) = 0.51972 CHF

Australian Dollar/ Swiss Franc Analyze (4-hour time frame).

Be sure to follow the updated ideas.

Do not forget to put a Stop loss for your positions (For every position you want to open).

Please follow your strategy; this is just my idea, and I will gladly see your ideas in this post.

Please do not forget the ✅ ' like ' ✅ button 🙏😊 & Share it with your friends; thanks, and Trade safe.

AUDCHF - ShortI have been short on AUDCHF for a few days. Here's my breakdown:

Technical:

- Descending channel

- Strong resistance on the upper channel line

- Potential descending triangle forming, suggesting continuation of this downtrend

- Following the overall trend of this pair, which is bearish

Fundamental:

- Risk off mood globally, CHF is a safe haven currency

- Dovish RBA

- Commodity pressure on AUD

- SNB stability

AUD_CHF LONG SIGNAL|

✅AUD_CHF was trading in a

Strong downtrend but then

Has reached a strong horizontal

Demand area around 0.5215

And failed to break the level

Which means that the bearish

Impulse might be absorbed

And we will finally see a

Bullish move up so we can

Enter a long trade with the

TP of 0.5276 and the SL of 0.5212

LONG🚀

✅Like and subscribe to never miss a new idea!✅

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

AUDCHF at Make-or-Break Zone: Smart Money Reversal or Breakdown?1. Price Action

Price is currently trading within a descending channel, with 0.5244 hovering near a key demand zone (0.5150–0.5200), where a first bullish reaction has already occurred.

The structure suggests a potential fake breakdown, with room for a rebound toward static resistances at 0.5330, and possibly 0.5450.

RSI is rising from oversold, showing signs of a potential bullish divergence.

📌 Technical bias: Waiting for confirmation of a reversal at key support.

Upside targets: 0.5330 > 0.5450.

Ideal stop-loss below 0.5160.

2. Retail Sentiment

72% of retail traders are long, with an average entry at 0.5551, now facing a 300+ pip drawdown.

This increases short-term contrarian bearish pressure, but also signals liquidity above the highs, which could be targeted before a true bullish reversal.

3. Commitment of Traders (as of June 17, 2025)

AUD – Bearish

Massive drop in both commercial longs (-60k) and shorts (-60k) suggests broad disengagement.

Non-commercials remain net short (-69k), with overall open interest declining.

CHF – Neutral to Bullish

CHF also sees declines in positioning, but commercial traders remain firmly net long (+51.7k).

Non-commercials are net short (-25.5k).

📌 COT Conclusion: AUD remains structurally weaker than CHF, but both currencies are showing signs of positioning uncertainty. This compression phase may precede a technical rebound on AUDCHF.

4. Seasonality

AUD

June historically shows modest strength on 10Y and 5Y averages.

However, 2Y data points to weakness → any rally may be short-lived or fragile.

CHF

CHF tends to be strong in June, especially on 20Y and 10Y views.

Yet, short-term (2Y) data shows end-of-month weakness, suggesting possible profit-taking ahead.

✅ Operational Outlook

Short-term bias: Long AUDCHF (corrective rebound)

Medium/long-term bias: Bearish (still in a downtrend)