AUDHKD

AUD is not a buy now. Period.I think we need aud to drop a bit more before we can enter in a buy position with it as the RSI is getting a bit overvalued and also it broke down of its wedge pattern. What do you think? Leave your comments and likes below. WARNING! I am not a financial adviser and take this advice with a grain of salt. Tell me what I should analyze next!

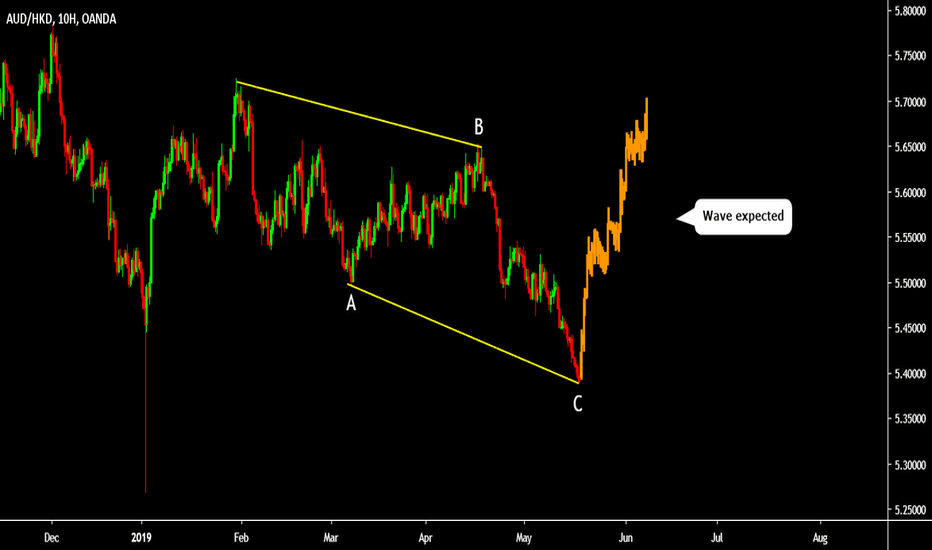

AUD HKD Trade opportunityHello everyone, we are back with another blog post, this one, being at a completely reasonable time for once. It is a beautiful Saturday and I look forward to charting quite a bit as a way to prepare for this coming week. I have a feeling that these next couple of weeks are going to be quite exciting, but only time will tell!

Elliott wave analysis: It appears to me, that we have just finished a wave a, and wave B, and are looking to start the wave c of a move upwards. On the larger time frame, we have just retraced from a major peak and are probably looking to visit the 0.8 retracement of this drop. As a result, the target for wave c is the 2.0 extension of wave one, which is 5.71842, and the stop loss is right under the most recent low.

Macd analysis: The macd isn't telling me too much right now, besides the fact that on the larger time frames, we have entered the positive zone. On the 3 hour we appear to be just hovering above the zero line, which means many things can occur. We can completely jump up, or we could cross back downwards. On the price action will confirm either of these ideas, but I do have a stronger sensation we are headed to the upside.

RSI analysis: The RSI on the 3 hours is telling me that a breakout above the rsi resistance is possible. This is because we have bounced off of the resistance 3 times, but most recently we have bounced off of the RSI support. This tells me that the support is even stronger than all the bearish momentum that has built up from the resistance. In purple you can find what I expect to happen with the RSI.

All in all I think that we are headed quite a ways up. The risk to reward for this trade is also quite beautiful. We have a 2.6, which means this is definitely a trade I will take.

Anyway, enjoy the rest of your day and goodluck trading this week.

AUDHKDCould be a great opportunity to short the AUD against the Honk Kong Dollar

Waiting a signal at the horizontal resistance but if price pushes above then i will be waiting for a signal at the diagonal resistance - incase the big boys are trying to catch people on the wrong side of the market.

Will see how this materialises over the coming days

AUDHKD: Taking full advantage of the Channel Down on 4H.The pair is on a standard 4H Channel Down (RSI = 33.623, MACD = -0.012, Highs/Lows = -0.0225, B/BP = -0.0448), which since it crossed the 5.5788 4H support is expected to continue lower. The expected Lower Low is estimated at 5.5380 where a pull back to 5.5788 is expected.

** If you like our free content follow our profile (www.tradingview.com) to get more daily ideas. **

Comments and likes are greatly appreciated.

AUDHKD Possible trend Change, Inverse H&STrying to play a long term trend change here. Had a dropping trend channel from the start of 2018 and this month we have had the first breakout of this channel. We had a nice double bottom in Oct which already reached it's target. At the moment it has dropped but it could potentially make a right shoulder for an inverse H&S. I am going to scale in several orders. Doing two 25% of a normal position at those yellow circles and i will increase on the way.

So risking a small amount here with the potential of a very big win when playing it right.

Target hit. Channel Down intact. Short on new Lower High.TP = 5.66170 hit as the 1W Channel Down (MACD = -0.073, Highs/Lows = -0.0245, B/BP = -0.1173) made a new Low just below the target. The price jumped to a new Lower High and is now set to price a new technical Lower Low. The 1D Lower Low line supports earlier however, so our new short's TP is 5.58718.