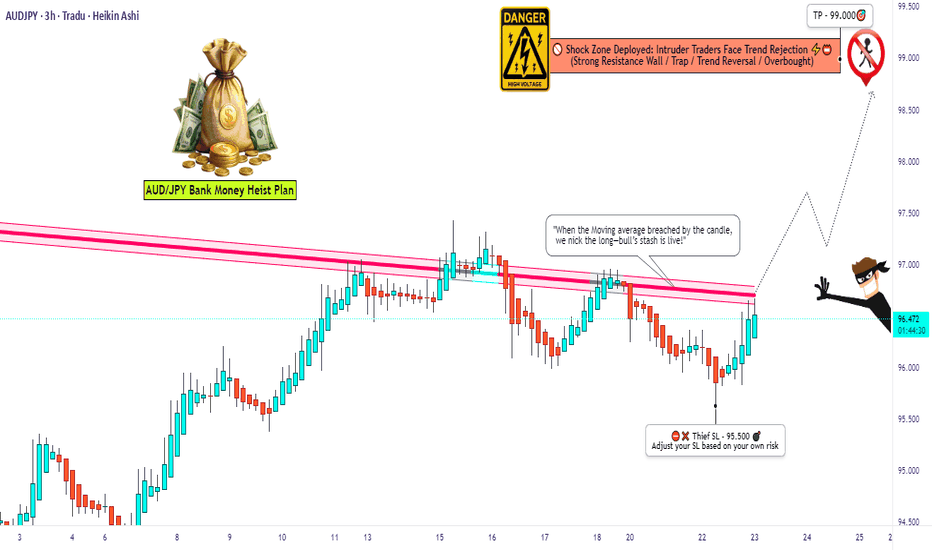

Aussie vs Yen: Setup for a Clean Long Robbery💣AUD/JPY Forex Heist: Aussie vs Yen 🔥Master Robbery Plan Unfolded!

🌟Hi! Hola! Ola! Bonjour! Hallo! Marhaba!🌟

Dear Money Makers, Bandits & Chart Pirates 🤑💰💸✈️

It's time to reload your gear and lock in the blueprint. Based on our 🔥Thief Trader Technical + Fundamental Intelligence🔥, we’re all set to ambush the AUD/JPY "Aussie vs Yen" battlefield. This ain’t no casual walk—it’s a full-scale market operation targeting the High Voltage Reversal Trap Zone⚡. The pressure is real: Overbought, Tricky Consolidation, and Bears camping at resistance. Your job? Steal profits before they smell the breakout! 🏆💪💵

🎯 Entry Point — "Let the Heist Begin"

🗝 Entry Level: Wait for the Breakout @ 94.500. When price shatters the Moving Average ceiling—that's your greenlight!

🚀 Execution Choices:

Place Buy Stop above the breakout point

Or, use Buy Limit Orders near recent swing highs/lows on the 15/30-min chart using Layering/DCA tactics (that’s how the real thieves sneak in 🕶️).

🔔 Set an alert to stay sharp—don’t miss the vault crackin’ open!

🛑 Stop Loss — “Cover Your Escape”

🎯 SL Level: Just under the recent swing low on the 3H timeframe (around 95.500)

🚫 Never place the SL before the breakout confirms! Let the move prove itself first.

🧠 SL sizing depends on your capital, lot size, and number of entries stacked. You control the risk, not the other way around!

🎯 Target — "Cash Out or Vanish"

💎 First Take-Profit: 99.000

🚪Optional Escape: Secure the bag early if momentum fades. Better leave rich than be late!

👀 For Scalpers & Swing Robbers Alike

🔍 Scalpers: Only ride the Long wave.

💼 Big pockets? Hit straight entry.

👟 Small capital? Tag in with swing trades and trail that SL like a pro.

🎣 Use a Trailing SL to lock profits as price sprints toward resistance.

📰 The Bigger Picture: Why AUD/JPY?

The pair is pumped by:

📈 Macro Economics

📊 Quant Analysis

📰 COT Reports

📉 Intermarket Correlations

🧠 Sentiment Heatmaps

🔥 Future Price Dynamics

Don’t pull the trigger blind. Read the battlefield before charging in.

⚠️ Thief’s Caution Zone: News Traps Ahead

🛎 News = chaos.

📌 Avoid entering fresh trades during major data drops.

🔐 Use Trailing SLs to protect ongoing plays.

📉 Let the market dance, but you control the music.

💥Hit the Boost Button!💥

If this heist plan pumps your portfolio, smash that boost. That’s how we fund more blueprints, fuel the Thief Gang’s vault, and keep the robbery cycle alive.

🤑💵 Together, let’s rob this market clean—Thief Style.

New plan drops soon. Stay locked. Stay sharp. Stay profitable.

🧠💰🏴☠️

— Thief Trader Out 🐱👤🔓🚀

Audjpyanalysis

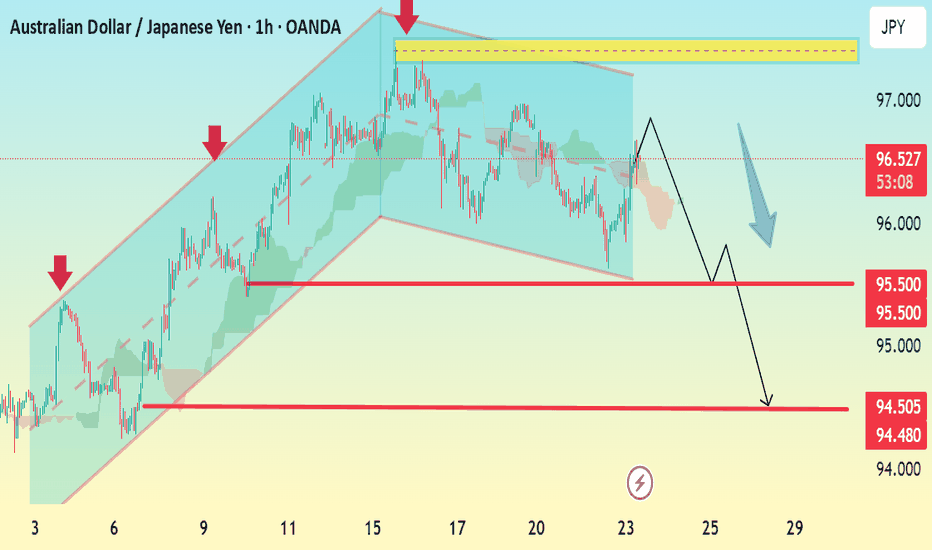

AUD/JPY 1H Bearish Reversal Setup Analysis:The chart shows a clear ascending channel that has now been broken to the downside, signaling a bearish breakout.

Price recently tested the upper boundary near 97.00 and faced rejection.

The break below the channel support and the projection with a blue arrow suggest a trend reversal.

Multiple support levels are marked, indicating potential take-profit zones.

Key Levels:

Resistance: 97.00

Immediate Support: 95.50

Target 1 (TP1): 95.00

Target 2 (TP2): 94.50 – 94.48

Bias: Bearish

Confirmation: Watch for a clean break below 95.50 to confirm further downside momentum.

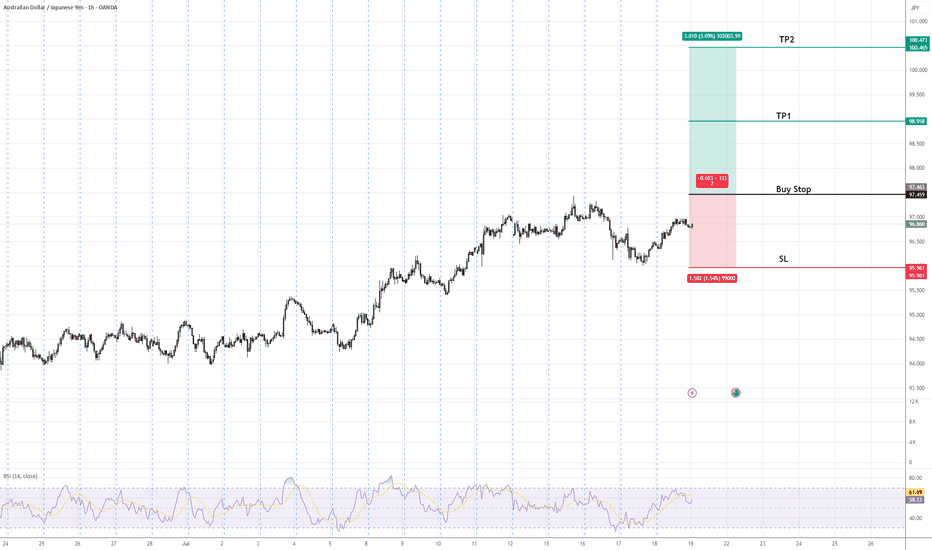

AUDJPY Buy Stop Setup | Trend Continuation in FocusAUDJPY is in an established uptrend, forming higher highs and higher lows. A buy stop is positioned above the recent swing high to confirm bullish continuation. The setup includes a defined stop-loss below the previous higher low to manage risk and two target profit levels (TP1 & TP2) aligned with key resistance zones. This approach favors trend-following traders seeking confirmation of upward momentum before entry.

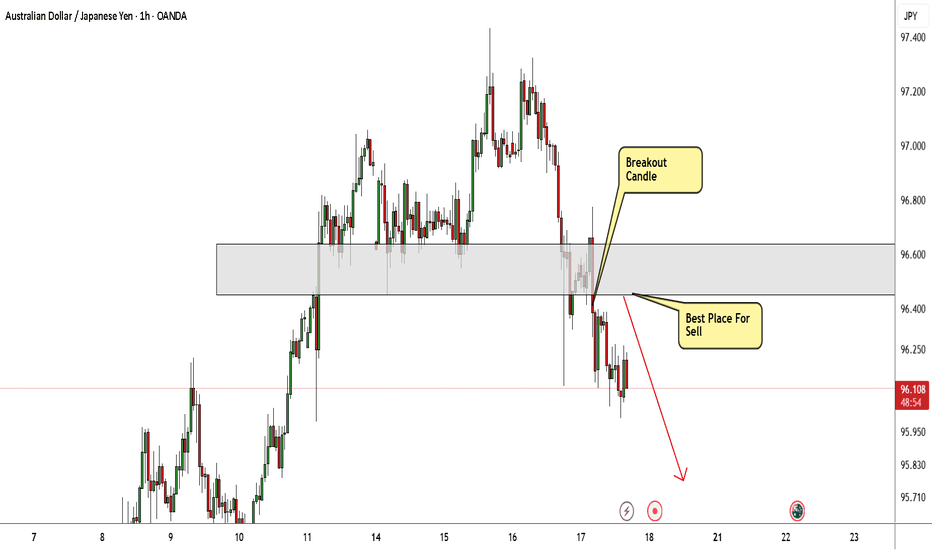

AUD/JPY Finally Decided To Go Down , Don`t Miss This 150 Pips !Here is my 1H Chart on AUD/JPY , And my opinion is we have a very clear breakout and the price will go down a little to make a retracement after this huge movement to upside without any correction , so i`, waiting the price to retest my broken supp and new Res and then we can enter a sell trade and targeting 100 : 150 pips . if the price go up again and closed above my res area with daily candle then this idea will not be valid anymore.

Unique Bearish Setup Emerges for AUD/JPY This QuarterFenzoFx—AUD/JPY is bullish, currently testing the critical resistance and order block at 97.3. This level coincides with the VWAP and volume profile point of interest. Bears are interested in adding short positions at the 97.3 price level.

Since this level is highly important and has the potential to change the trend, it is necessary to form a double top at this price, which has not happened before.

From a technical perspective, if a double top pattern forms at 97.3 and this level holds, a new bearish trend will likely emerge. In this scenario, the 93.9 level is likely to be targeted.

AUDJPY – Waiting for the Long SetupThe price is currently in a corrective move,

and as always, we’ve already marked our key level.

📍 We’re patiently waiting for price to reach our support zone.

If a valid buy signal appears, we’ll take the long position

according to our trading plan.

❌ What if the level breaks?

No worries.

We don’t predict — we follow the market.

We’ll wait for a clean pullback and enter short if confirmed.

🎯 Our job isn’t to predict where price will go,

our job is to manage risk and stay aligned with the market.

Price can do anything —

we’re ready for every scenario.

"AUD/JPY: Bulls About to Raid Tokyo? (Long Plan)"🎯 AUD/JPY BULLISH BANK HEIST! (Long Setup Inside) - Thief Trading Strategy

🚨 Yen Carry Trade Alert: Aussie Loot Up For Grabs! 💰

🦹♂️ ATTENTION ALL MARKET PIRATES!

To the Profit Raiders & Risk-Takers! 🌏💣

Using our 🔥Thief Trading Tactics🔥 (a deadly combo of carry trade flows + risk sentiment + institutional traps), we're executing a bullish raid on AUD/JPY—this is not advice, just a strategic heist plan for traders who play by their own rules.

📈 THE LOOTING BLUEPRINT (LONG ENTRY PLAN)

🎯 Treasure Zone: 92.700 (or escape earlier if bears attack)

💎 High-Reward Play: Neutral turning bullish - trap for yen bulls

👮♂️ Cop Trap: Where bears get squeezed at support

🔑 ENTRY RULES:

"Vault Unlocked!" – Grab bullish loot on pullbacks (15-30min TF)

Buy Limit Orders near swing lows OR Market Orders with tight stops

Aggressive? Enter at market but watch JPY news

🚨 STOP LOSS (Escape Plan):

Thief SL at nearest swing low (4H chart)

⚠️ Warning: "Skip this SL? Enjoy donating to yen bulls."

🎯 TARGETS:

Main Take-Profit: 92.700

Scalpers: Ride the Asian session momentum

🔍 FUNDAMENTAL BACKUP (Why This Heist Works)

Before raiding, check:

✅ BOJ Policy (Yen weakness continuing?)

✅ Commodity Prices (Iron ore/coal supporting AUD?)

✅ Risk Sentiment (Stocks rally = carry trade fuel)

✅ Interest Spreads (AUD-JPY yield advantage)

🚨 RISK WARNING

Avoid BOJ/RBA speeches (unless you like volatility torture)

Trailing stops = your golden parachute

💎 BOOST THIS HEIST!

👍 Smash Like to fund our next raid!

🔁 Share to recruit more trading pirates!

🤑 See you at the target, rebels!

⚖️ DISCLAIMER: Hypothetical scenario. Trade at your own risk.

#AUDJPY #CarryTrade #TradingView #RiskOn #ThiefTrading

💬 COMMENT: "Long already—or waiting for better entry?" 👇🔥

P.S. Next heist target already being scouted... stay tuned! 🏴☠️

AUDJPY Bullish Channel Still Intact, Eyeing Breakout Above 95.00AUDJPY continues to respect its ascending channel, with the current bounce occurring right at the 61.8% Fibonacci retracement and lower trendline support. The structure supports further upside as long as price holds above the 94.00–93.80 zone, with targets set toward 94.77 and 95.36, potentially extending to 95.63 highs.

🧠 Fundamentals:

AUD Strength Drivers:

RBA remains relatively hawkish vs other G10 banks.

Australia's data this week (retail sales, NAB confidence) were mixed, but no rate cut pricing in the near term supports AUD.

Iron ore demand showing resilience despite Chinese slowdown concerns.

JPY Weakness Drivers:

BoJ remains ultra-dovish. No action expected in July.

Japan’s inflation remains tame; the yield gap with other majors keeps widening.

Risk-on sentiment reduces demand for safe-havens like JPY.

🔍 Technical Structure:

Strong upward channel since early June remains valid.

Current pullback held the 61.8% Fib retracement of the June-July leg.

Bullish engulfing near support confirms entry.

Immediate resistance at 94.77 → 95.36 → potential breakout to 95.63.

Invalid if price closes below 93.80 (channel break).

⚠️ Risk Factors:

Risk-off shift (e.g., geopolitical escalation or U.S. CPI surprise) may boost JPY.

China growth fears can weigh on AUD.

A sudden dovish shift from the RBA would invalidate bullish fundamentals.

🔁 Leader/Lagger Dynamics:

AUDJPY typically leads other yen crosses (e.g., NZDJPY, CADJPY) during risk-on moves. It’s also a barometer for broader risk sentiment, often following moves in equity indices like US500 or commodity-linked assets.

✅ Trade Bias: Bullish

TP1: 94.77

TP2: 95.36

TP3 (aggressive): 95.63

SL: Below 93.80

Event to Watch: China data this week + U.S. CPI (Jul 11)

📌 Watch for a strong bullish daily candle above 94.77 for continuation confirmation. Stay nimble around key global risk events.

AUDJPY OUTLOOKOn the monthly charts, the AUDJPY has shifted in market structure indicating the long term outlook is bearish. In the interim (weekly), price action is pushing higher to mitigate price inefficiency and fair value gaps. After mitigation, we will look for sell opportunities targeting liquidity below the relative equal lows.

AUDJPY SHORT FORECAST Q2 W26 D27 Y25AUDJPY SHORT FORECAST Q2 W26 D27 Y25

Professional Risk Managers👋

Welcome back to another FRGNT chart update📈

Diving into some Forex setups using predominantly higher time frame order blocks alongside confirmation breaks of structure.

Let’s see what price action is telling us today! 👀

💡Here are some trade confluences📝

✅Weekly Order Block Identified

✅Daily Order block identified

✅4H Order Block identified

✅15' Order block identified

🔑 Remember, to participate in trading comes always with a degree of risk, therefore as professional risk managers it remains vital that we stick to our risk management plan as well as our trading strategies.

📈The rest, we leave to the balance of probabilities.

💡Fail to plan. Plan to fail.

🏆It has always been that simple.

❤️Good luck with your trading journey, I shall see you at the very top.

🎯Trade consistent, FRGNT X

AUDJPY SHORT FORECAST Q2 W25 D20 Y25AUDJPY SHORT FORECAST Q2 W25 D20 Y25

Professional Risk Managers👋

Welcome back to another FRGNT chart update📈

Diving into some Forex setups using predominantly higher time frame order blocks alongside confirmation breaks of structure.

Let’s see what price action is telling us today! 👀

💡Here are some trade confluences📝

✅Weekly Order block rejection

✅15' Order block to be confirmed

✅4H Order block

✅1H Order block

🔑 Remember, to participate in trading comes always with a degree of risk, therefore as professional risk managers it remains vital that we stick to our risk management plan as well as our trading strategies.

📈The rest, we leave to the balance of probabilities.

💡Fail to plan. Plan to fail.

🏆It has always been that simple.

❤️Good luck with your trading journey, I shall see you at the very top.

🎯Trade consistent, FRGNT X

AUDJPY SHORT FORECAST Q2 W24 D12 Y25AUDJPY SHORT FORECAST Q2 W24 D12 Y25

Professional Risk Managers👋

Welcome back to another FRGNT chart update📈

Diving into some Forex setups using predominantly higher time frame order blocks alongside confirmation breaks of structure.

Let’s see what price action is telling us today! 👀

💡Here are some trade confluences📝

✅Weekly Order block rejection

✅15' Order block

✅1H 50EMA

✅Daily 50 EMA

🔑 Remember, to participate in trading comes always with a degree of risk, therefore as professional risk managers it remains vital that we stick to our risk management plan as well as our trading strategies.

📈The rest, we leave to the balance of probabilities.

💡Fail to plan. Plan to fail.

🏆It has always been that simple.

❤️Good luck with your trading journey, I shall see you at the very top.

🎯Trade consistent, FRGNT X

AUDJPY SHORT FORECAST Q2 W23 D10 Y25AUDJPY SHORT FORECAST Q2 W23 D10 Y25

Professional Risk Managers👋

Welcome back to another FRGNT chart update📈

Diving into some Forex setups using predominantly higher time frame order blocks alongside confirmation breaks of structure.

Let’s see what price action is telling us today! 👀

💡Here are some trade confluences📝

✅Weekly Order block rejection

✅15' Order block to be confirmed

✅4H 50EMA

✅Daily 50 EMA

🔑 Remember, to participate in trading comes always with a degree of risk, therefore as professional risk managers it remains vital that we stick to our risk management plan as well as our trading strategies.

📈The rest, we leave to the balance of probabilities.

💡Fail to plan. Plan to fail.

🏆It has always been that simple.

❤️Good luck with your trading journey, I shall see you at the very top.

🎯Trade consistent, FRGNT X

AUD/JPY Short📍 AUD/JPY Short Setup – Sell Limit Order

Entry: 94.00

(clean retest of daily + weekly resistance zone, aligned with previous structure)

Stop Loss: 95.10

Take Profit 1: 91.00

(recent support shelf with high reaction probability)

Take Profit 2: 88.50

(strong weekly support zone; ideal mid-term target if momentum continues)

AUDJPY SHORT FORECAST Q2 W23 D2 Y25AUDJPY SHORT FORECAST Q2 W23 D2 Y25

Professional Risk Managers👋

Welcome back to another FRGNT chart update📈

Diving into some Forex setups using predominantly higher time frame order blocks alongside confirmation breaks of structure.

Let’s see what price action is telling us today! 👀

💡Here are some trade confluences📝

✅Weekly Order block rejection

✅15' Order block identification

✅4H 50EMA

✅Daily 50 EMA

🔑 Remember, to participate in trading comes always with a degree of risk, therefore as professional risk managers it remains vital that we stick to our risk management plan as well as our trading strategies.

📈The rest, we leave to the balance of probabilities.

💡Fail to plan. Plan to fail.

🏆It has always been that simple.

❤️Good luck with your trading journey, I shall see you at the very top.

🎯Trade consistent, FRGNT X

AUDJPY SHORT FORECAST Q2 W22 D29 Y25AUDJPY SHORT FORECAST Q2 W22 D29 Y25

😎CONFLUENCE IS KEY HERE!

Professional Risk Managers👋

Welcome back to another FRGNT chart update📈

Diving into some Forex setups using predominantly higher time frame order blocks alongside confirmation breaks of structure.

Let’s see what price action is telling us today! 👀

💡Here are some trade confluences📝

✅Weekly Order block rejection

✅15' Order block identification

✅4H 50EMA

✅Daily 50 EMA

🔑 Remember, to participate in trading comes always with a degree of risk, therefore as professional risk managers it remains vital that we stick to our risk management plan as well as our trading strategies.

📈The rest, we leave to the balance of probabilities.

💡Fail to plan. Plan to fail.

🏆It has always been that simple.

❤️Good luck with your trading journey, I shall see you at the very top.

🎯Trade consistent, FRGNT X

From Breakdown to Breakout: AUD/JPY Flips Structure Above 92🟡 What happened recently?

At the beginning of April, AUD/JPY dropped to a low of 86, but by early May, the pair had surged over 600 pips, reclaiming the key 92 support level.

Most importantly, price reached a high of 95.50 — breaking well above the descending trendline that started back in July 2024.

📉 The recent pullback confirms the breakout

The drop from 95.50 wasn’t bearish — it was confirmation:

✅ Clear rejection from the 92 zone

✅ Former resistance now acting as strong support

✅ Market structure has shifted to bullish

📈 What’s next?

At the time of writing, AUD/JPY is trading around 92.76, and the structure suggests more upside ahead.

🧭 My strategy:

➡️ Buy dips toward 92.00

➡️ Target: 95.50 — the recent high

🚀 The breakout is confirmed, the trend has shifted, and the opportunity is clear.

Let the market do the work — we just need to stay aligned.

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analyses and educational articles.

WICK INTO HTF 50 EMA AUDJPY SHORT FORECAST Q2 W22 D28 Y25

SHORT FORECAST Q2 W22 D28 Y25

😎🫡TAP INTO HTF 50 EMA BEFORE ROLLOVER SOUTH

Professional Risk Managers👋

Welcome back to another FRGNT chart update📈

Diving into some Forex setups using predominantly higher time frame order blocks alongside confirmation breaks of structure.

Let’s see what price action is telling us today! 👀

💡Here are some trade confluences📝

✅Weekly Order block rejection

✅15' Order block identification

✅4H 50EMA

✅Daily 50 EMA

🔑 Remember, to participate in trading comes always with a degree of risk, therefore as professional risk managers it remains vital that we stick to our risk management plan as well as our trading strategies.

📈The rest, we leave to the balance of probabilities.

💡Fail to plan. Plan to fail.

🏆It has always been that simple.

❤️Good luck with your trading journey, I shall see you at the very top.

🎯Trade consistent, FRGNT X

Bearish Outlook on AUD/JPY – Watching for Entry After Retrace!I'm currently focused on the AUD/JPY currency pair 📉.

We’re seeing a clear, sustained downtrend on the daily timeframe, marked by a recent break of market structure — a key sign that sellers are firmly in control 🐻.

At the moment, price appears overextended and is trading directly into a major liquidity pool — specifically, a cluster of sell-side liquidity sitting below previous lows 🧲.

I’m watching for a retracement or pullback into a zone of interest. If that happens, I’ll be on the lookout for a bearish break of structure on the lower timeframes to confirm a high-probability short setup 🎯.

As always, this is not financial advice, just a look at how I’m approaching the current price action ⚠️.

AUDJPY SHORT FORECAST Q2 W22 D26 Y25AUDJPY SHORT FORECAST Q2 W22 D26 Y25

Professional Risk Managers👋

Welcome back to another FRGNT chart update📈

Diving into some Forex setups using predominantly higher time frame order blocks alongside confirmation breaks of structure.

Let’s see what price action is telling us today! 👀

💡Here are some trade confluences📝

✅Weekly Order block rejection

✅4H Order block identification

✅15' Order block identification

✅4H 50EMA target

✅Daily 50 EMA target

🔑 Remember, to participate in trading comes always with a degree of risk, therefore as professional risk managers it remains vital that we stick to our risk management plan as well as our trading strategies.

📈The rest, we leave to the balance of probabilities.

💡Fail to plan. Plan to fail.

🏆It has always been that simple.

❤️Good luck with your trading journey, I shall see you at the very top.

🎯Trade consistent, FRGNT X

AUD/JPY “Aussie vs. Yen” Skyrocketing Safari!🌈 G’day, Forex Adventurers & PIP Hunters! 🌏✨

Join our epic AUD/JPY Forex expedition! 🦘🚀 Our Stellar Navigator Strategy fuses pinpoint technicals with powerful fundamentals to chase profits in the Aussie-Yen jungle. Ready to soar to new heights and grab those pips? Let’s embark on this bullish quest! 🌍💰

🌟 The Stellar Navigator Plan

Entry Points 🛫:

🦅 Bullish Launch: Jump in after a breakout above the Sky High at 94.800—your cue for bullish gains!

🐾 Pullback Path: Place buy limit orders near the 15M/30M support (94.200) for a savvy entry.

Pro Tip: Set alerts to spot the breakout spark! 🔔

Stop Loss (SL) 🛡️:

Bullish Trade: Secure SL at the 2H support (93.600) for day trades.

Tailor SL to your risk, lot size, and order count. This is your safety net—keep it snug! ⚠️

Take Profit (TP) 🎯:

Bullish Explorers: Aim for the Star Peak at 96.500 or exit if the momentum dips.

Scalpers: Grab quick pips on the long side, but lock in gains with trailing stops! 🚨

🌏 Why AUD/JPY?

The Aussie’s soaring 📈 as of May 12, 2025, powered by:

Fundamentals: RBA’s 4.35% rate dwarfs BoJ’s 0.1%, boosting AUD.

Macroeconomics: Australia’s commodity boom (gold, iron ore) outpaces Japan’s slow recovery.

COT Data (May 9, 2025): Rising AUD net longs signal bullish sentiment (source: CFTC).

Intermarket: AUD/JPY tracks Nikkei 225’s risk-on rally.

Quantitative: RSI (14) at 59 and a break above the 50-day SMA (93.57) confirm upward momentum.

📊 Sentiment Snapshot (May 12, 2025, UTC+1)

Retail Traders:

🟢 Bullish: 53% 😊 (RBA strength, China trade optimism)

🔴 Bearish: 37% 😣 (Yen safe-haven demand on tariff risks)

⚪ Neutral: 10% 🤔

Institutional Traders:

🟢 Bullish: 46% 💼 (Commodity demand, risk-on flows)

🔴 Bearish: 39% ⚠️ (BoJ intervention fears, US yields)

⚪ Neutral: 15% 🧐

📰 Market Buzz (May 12, 2025)

- US-China trade progress lifts risk appetite, pushing AUD/JPY to 94.50.

- Easing tariff concerns weaken JPY safe-haven appeal.

- Japan’s soft consumer spending data pressures JPY.

📡 Risk Navigation ⚡

Markets can be wild—tread carefully:

- Avoid new trades during major news (RBA, BoJ, US CPI).

- Use trailing stops to protect profits and cap losses.

- Watch for BoJ moves if JPY weakens sharply! 🌪️

💸 Real-Time Market Data (May 12, 2025, UTC+1)

- Forex: AUD/JPY at 94.50, up 0.5% daily (source: Financial Juice).

- Commodities CFD: Gold (XAU/USD) at 2,650, up 0.2%; Iron Ore at 105.50, flat.

- Metals: Silver (XAG/USD) at 31.820, down 1.3%.

- Energies: WTI Crude Oil at 78.40, up 0.6%.

- Crypto: BTC/USD at 62,300, down 0.5%.

- Indices: Nikkei 225 at 39,200, up 0.7%; ASX 200 at 7,850, up 0.4%.

🚀 Join the Stellar Navigator Squad!

Smash the Boost Button to supercharge our Stellar Navigator Strategy and make this safari epic! 🌟 Every boost empowers our crew to dominate the markets. Let’s conquer AUD/JPY together! 🤝

Stay glued to your charts, keep alerts active, and vibe high. See you in the profits, adventurers! 🤑🎉

#StellarNavigator #AUDJPY #AussieYen #TradingView #ChaseThePips