Aussie vs Yen: Setup for a Clean Long Robbery💣AUD/JPY Forex Heist: Aussie vs Yen 🔥Master Robbery Plan Unfolded!

🌟Hi! Hola! Ola! Bonjour! Hallo! Marhaba!🌟

Dear Money Makers, Bandits & Chart Pirates 🤑💰💸✈️

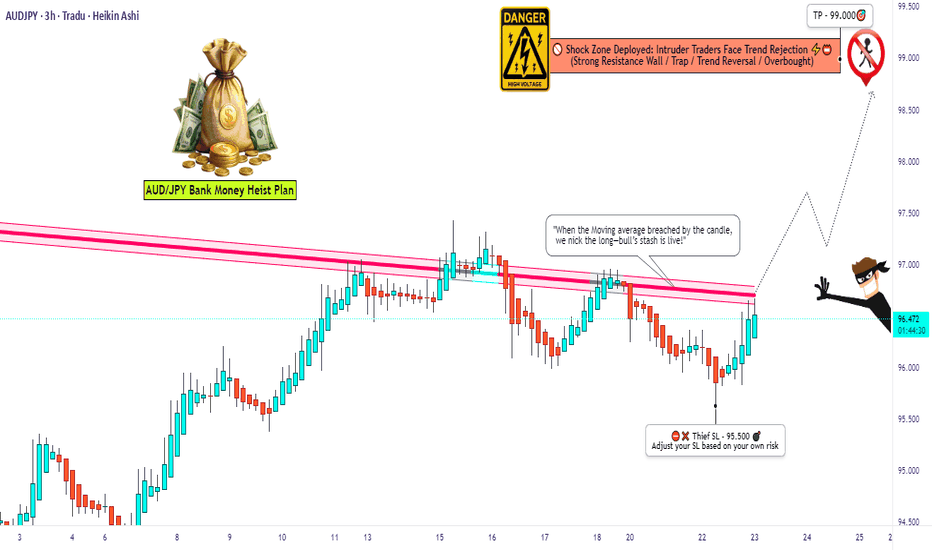

It's time to reload your gear and lock in the blueprint. Based on our 🔥Thief Trader Technical + Fundamental Intelligence🔥, we’re all set to ambush the AUD/JPY "Aussie vs Yen" battlefield. This ain’t no casual walk—it’s a full-scale market operation targeting the High Voltage Reversal Trap Zone⚡. The pressure is real: Overbought, Tricky Consolidation, and Bears camping at resistance. Your job? Steal profits before they smell the breakout! 🏆💪💵

🎯 Entry Point — "Let the Heist Begin"

🗝 Entry Level: Wait for the Breakout @ 94.500. When price shatters the Moving Average ceiling—that's your greenlight!

🚀 Execution Choices:

Place Buy Stop above the breakout point

Or, use Buy Limit Orders near recent swing highs/lows on the 15/30-min chart using Layering/DCA tactics (that’s how the real thieves sneak in 🕶️).

🔔 Set an alert to stay sharp—don’t miss the vault crackin’ open!

🛑 Stop Loss — “Cover Your Escape”

🎯 SL Level: Just under the recent swing low on the 3H timeframe (around 95.500)

🚫 Never place the SL before the breakout confirms! Let the move prove itself first.

🧠 SL sizing depends on your capital, lot size, and number of entries stacked. You control the risk, not the other way around!

🎯 Target — "Cash Out or Vanish"

💎 First Take-Profit: 99.000

🚪Optional Escape: Secure the bag early if momentum fades. Better leave rich than be late!

👀 For Scalpers & Swing Robbers Alike

🔍 Scalpers: Only ride the Long wave.

💼 Big pockets? Hit straight entry.

👟 Small capital? Tag in with swing trades and trail that SL like a pro.

🎣 Use a Trailing SL to lock profits as price sprints toward resistance.

📰 The Bigger Picture: Why AUD/JPY?

The pair is pumped by:

📈 Macro Economics

📊 Quant Analysis

📰 COT Reports

📉 Intermarket Correlations

🧠 Sentiment Heatmaps

🔥 Future Price Dynamics

Don’t pull the trigger blind. Read the battlefield before charging in.

⚠️ Thief’s Caution Zone: News Traps Ahead

🛎 News = chaos.

📌 Avoid entering fresh trades during major data drops.

🔐 Use Trailing SLs to protect ongoing plays.

📉 Let the market dance, but you control the music.

💥Hit the Boost Button!💥

If this heist plan pumps your portfolio, smash that boost. That’s how we fund more blueprints, fuel the Thief Gang’s vault, and keep the robbery cycle alive.

🤑💵 Together, let’s rob this market clean—Thief Style.

New plan drops soon. Stay locked. Stay sharp. Stay profitable.

🧠💰🏴☠️

— Thief Trader Out 🐱👤🔓🚀

Audjpybreakout

"AUD/JPY: Bulls About to Raid Tokyo? (Long Plan)"🎯 AUD/JPY BULLISH BANK HEIST! (Long Setup Inside) - Thief Trading Strategy

🚨 Yen Carry Trade Alert: Aussie Loot Up For Grabs! 💰

🦹♂️ ATTENTION ALL MARKET PIRATES!

To the Profit Raiders & Risk-Takers! 🌏💣

Using our 🔥Thief Trading Tactics🔥 (a deadly combo of carry trade flows + risk sentiment + institutional traps), we're executing a bullish raid on AUD/JPY—this is not advice, just a strategic heist plan for traders who play by their own rules.

📈 THE LOOTING BLUEPRINT (LONG ENTRY PLAN)

🎯 Treasure Zone: 92.700 (or escape earlier if bears attack)

💎 High-Reward Play: Neutral turning bullish - trap for yen bulls

👮♂️ Cop Trap: Where bears get squeezed at support

🔑 ENTRY RULES:

"Vault Unlocked!" – Grab bullish loot on pullbacks (15-30min TF)

Buy Limit Orders near swing lows OR Market Orders with tight stops

Aggressive? Enter at market but watch JPY news

🚨 STOP LOSS (Escape Plan):

Thief SL at nearest swing low (4H chart)

⚠️ Warning: "Skip this SL? Enjoy donating to yen bulls."

🎯 TARGETS:

Main Take-Profit: 92.700

Scalpers: Ride the Asian session momentum

🔍 FUNDAMENTAL BACKUP (Why This Heist Works)

Before raiding, check:

✅ BOJ Policy (Yen weakness continuing?)

✅ Commodity Prices (Iron ore/coal supporting AUD?)

✅ Risk Sentiment (Stocks rally = carry trade fuel)

✅ Interest Spreads (AUD-JPY yield advantage)

🚨 RISK WARNING

Avoid BOJ/RBA speeches (unless you like volatility torture)

Trailing stops = your golden parachute

💎 BOOST THIS HEIST!

👍 Smash Like to fund our next raid!

🔁 Share to recruit more trading pirates!

🤑 See you at the target, rebels!

⚖️ DISCLAIMER: Hypothetical scenario. Trade at your own risk.

#AUDJPY #CarryTrade #TradingView #RiskOn #ThiefTrading

💬 COMMENT: "Long already—or waiting for better entry?" 👇🔥

P.S. Next heist target already being scouted... stay tuned! 🏴☠️

AUD/JPY "Aussie vs Yen" Forex Market Heist Plan🌟Hi! Hola! Ola! Bonjour! Hallo! Marhaba!🌟

Dear Money Makers & Thieves, 🤑💰💸✈️

Based on 🔥Thief Trading style technical and fundamental analysis🔥, here is our master plan to heist the AUD/JPY "Aussie vs Yen" Forex market. Please adhere to the strategy I've outlined in the chart, which emphasizes long entry. Our aim is the high-risk Red Zone. Risky level, overbought market, consolidation, trend reversal, trap at the level where traders and bearish robbers are stronger. 🏆💸Book Profits wealthy and safe trade.💪🏆🎉

Entry 📈 : "The heist is on! Wait for the MA breakout (94.500) then make your move - Bullish profits await!"

however I advise to Place Buy stop orders above the Moving average (or) Place buy limit orders within a 15 or 30 minute timeframe most recent or swing, low or high level.

📌I strongly advise you to set an alert on your chart so you can see when the breakout entry occurs.

Stop Loss 🛑:

Thief SL placed at the recent/swing low or high level Using the 4H timeframe (92.500) swing trade basis.

SL is based on your risk of the trade, lot size and how many multiple orders you have to take.

Target 🎯: 87.000 (or) Escape Before the Target

🧲Scalpers, take note 👀 : only scalp on the Long side. If you have a lot of money, you can go straight away; if not, you can join swing traders and carry out the robbery plan. Use trailing SL to safeguard your money 💰.

AUD/JPY "Aussie vs Yen" Forex Market is currently experiencing a Bullish trend., driven by several key factors. 📰🗞️Get & Read the Fundamental, Macro Economics, COT Report, Quantitative Analysis, Intermarket Analysis, Sentimental Outlook, Future Trend Move:

Before start the heist plan read it.👉👉👉

📌Keep in mind that these factors can change rapidly, and it's essential to stay up-to-date with market developments and adjust your analysis accordingly.

⚠️Trading Alert : News Releases and Position Management 📰 🗞️ 🚫🚏

As a reminder, news releases can have a significant impact on market prices and volatility. To minimize potential losses and protect your running positions,

we recommend the following:

Avoid taking new trades during news releases

Use trailing stop-loss orders to protect your running positions and lock in profits

💖Supporting our robbery plan 💥Hit the Boost Button💥 will enable us to effortlessly make and steal money 💰💵. Boost the strength of our robbery team. Every day in this market make money with ease by using the Thief Trading Style.🏆💪🤝❤️🎉🚀

I'll see you soon with another heist plan, so stay tuned 🤑🐱👤🤗🤩

AUD/JPY "Aussie vs Yen" Forex Bank Heist Plan(Swing/Day)🌟Hi! Hola! Ola! Bonjour! Hallo! Marhaba!🌟

Dear Money Makers & Robbers, 🤑 💰💸✈️

Based on 🔥Thief Trading style technical and fundamental analysis🔥, here is our master plan to heist the AUD/JPY "Aussie vs Yen" Forex Bank. Please adhere to the strategy I've outlined in the chart, which emphasizes long entry. Our aim is to escape near the high-risk ATR Zone. Risky level, overbought market, consolidation, trend reversal, trap at the level where traders and bearish robbers are stronger. 🏆💸"Take profit and treat yourself, traders. You deserve it!💪🏆🎉

Entry 📈 : "The vault is wide open! Swipe the Bullish loot at any price - the heist is on!

however I advise to Place buy limit orders within a 15 or 30 minute timeframe nearest or swing low or high level for pullback entries.

Stop Loss 🛑:

📍 Thief SL placed at the recent/swing low level Using the 1H timeframe (89.000) Day/Swing trade basis.

📍 SL is based on your risk of the trade, lot size and how many multiple orders you have to take.

Target 🎯: 94.200

🧲Scalpers, take note 👀 : only scalp on the Long side. If you have a lot of money, you can go straight away; if not, you can join swing traders and carry out the robbery plan. Use trailing SL to safeguard your money 💰.

💰💵💴💸AUD/JPY "Aussie vs Yen" Forex Bank Heist Plan (Day / Swing Trade) is currently experiencing a bullishness🐂.., driven by several key factors.☝☝☝

📰🗞️Get & Read the Fundamental, Macro Economics, COT Report, Quantitative Analysis, Sentimental Outlook, Intermarket Analysis, Future trend targets... go ahead to check 👉👉👉🔗🔗

Detailed Explanation Point-by-Point 🧠

1. **Fundamental Analysis** 📊: AUD strength hinges on RBA policy and China’s demand, while JPY reacts to BoJ dovishness and safe-haven flows. A tug-of-war dynamic. ⚔️

2. **Macro Economics** 🌎: Australia’s trade-driven growth contrasts Japan’s structural challenges, supporting a balanced but AUD-leaning pair. 🦘🏯

3. **Global Market Analysis** 🌍: Risk sentiment drives the pair, with commodities and equities as key influencers. 🎢

4. **COT Data** 📑: Bullish speculator positioning aligns with price stability but warns of reversal risks. ⚠️

5. **Seasonality** 📅: Mixed April trends emphasize real-time catalysts over historical patterns. 🤔

6. **Intermarket Analysis** 🔗: Yield spreads and equity correlations reinforce risk sensitivity. 📈

7. **Quantitative Analysis** 📉: Consolidation at 90.900 signals a looming breakout with defined levels. 🚀

8. **Market Sentiment** 😊: Retail bullishness vs. institutional caution suggests potential surprises. 🗣️

9. **Trend Prediction** 🔮: Multi-timeframe targets offer actionable levels for bullish and bearish scenarios. 🎯

10. **Outlook** 📝: A 6/10 score reflects optimism tempered by risks, guiding a long bias with vigilance. 😊

⚠️Trading Alert : News Releases and Position Management 📰 🗞️ 🚫🚏

As a reminder, news releases can have a significant impact on market prices and volatility. To minimize potential losses and protect your running positions,

we recommend the following:

Avoid taking new trades during news releases

Use trailing stop-loss orders to protect your running positions and lock in profits

💖Supporting our robbery plan 💥Hit the Boost Button💥 will enable us to effortlessly make and steal money 💰💵. Boost the strength of our robbery team. Every day in this market make money with ease by using the Thief Trading Style.🏆💪🤝❤️🎉🚀

I'll see you soon with another heist plan, so stay tuned 🤑🐱👤🤗🤩

AUD/JPY "Aussie vs Yen" Forex Market Heist Plan (Scalping/Day)🌟Hi! Hola! Ola! Bonjour! Hallo! Marhaba!🌟

Dear Money Makers & Robbers, 🤑 💰💸✈️

Based on 🔥Thief Trading style technical and fundamental analysis🔥, here is our master plan to heist the AUD/JPY "Aussie vs Yen" Forex Market. Please adhere to the strategy I've outlined in the chart, which emphasizes long entry. Our aim is to escape near the high-risk MA Zone. Risky level, overbought market, consolidation, trend reversal, trap at the level where traders and bearish robbers are stronger. 🏆💸"Take profit and treat yourself, traders. You deserve it!💪🏆🎉

Entry 📈 : "The vault is wide open! Swipe the Bullish loot at any price - the heist is on!

however I advise to Place buy limit orders within a 15 or 30 minute timeframe nearest or swing low or high level for pullback entries.

Stop Loss 🛑:

📍 Thief SL placed at the recent/swing low level Using the 30mins timeframe (88.500) Day trade basis.

📍 SL is based on your risk of the trade, lot size and how many multiple orders you have to take.

🏴☠️Target 🎯: 92.700 (or) Escape Before the Target

🧲Scalpers, take note 👀 : only scalp on the Long side. If you have a lot of money, you can go straight away; if not, you can join Day traders and carry out the robbery plan. Use trailing SL to safeguard your money 💰.

💰💵💸AUD/JPY "Aussie vs Yen" Forex Market Heist Plan (Scalping/Day) is currently experiencing a bullishness,., driven by several key factors. 👇👇👇

📰🗞️Get & Read the Fundamental, Macro, COT Report, Quantitative Analysis, Sentimental Outlook, Intermarket Analysis, Future trend targets and Overall outlook score..., go ahead to check 👉👉👉🔗

⚠️Trading Alert : News Releases and Position Management 📰 🗞️ 🚫🚏

As a reminder, news releases can have a significant impact on market prices and volatility. To minimize potential losses and protect your running positions,

we recommend the following:

Avoid taking new trades during news releases

Use trailing stop-loss orders to protect your running positions and lock in profits

💖Supporting our robbery plan 💥Hit the Boost Button💥 will enable us to effortlessly make and steal money 💰💵. Boost the strength of our robbery team. Every day in this market make money with ease by using the Thief Trading Style.🏆💪🤝❤️🎉🚀

I'll see you soon with another heist plan, so stay tuned 🤑🐱👤🤗🤩

AUD/JPY "Aussie vs Japanese" Forex Market Bearish Heist Plan🌟Hi! Hola! Ola! Bonjour! Hallo!🌟

Dear Money Makers & Robbers, 🤑💰🐱👤

Based on 🔥Thief Trading style technical and fundamental analysis🔥, here is our master plan to heist the AUD/JPY "Aussie vs Japanese" Forex Market. Please adhere to the strategy I've outlined in the chart, which emphasizes short entry. Our aim is the high-risk Green Zone. Risky level, oversold market, consolidation, trend reversal, trap at the level where traders and bullish robbers are stronger. 🏆💸Be wealthy and safe trade.💪🏆🎉

Entry 📈 : "The vault is wide open! Swipe the Bearish loot at any price - the heist is on!

however I advise placing Sell limit orders within a 15 or 30 minute timeframe. Entry from the most recent or closest high or low level should be in retest.

Stop Loss 🛑: Thief SL placed at 96.800 (swing Trade) Using the 4H period, the recent / nearest low or high level.

SL is based on your risk of the trade, lot size and how many multiple orders you have to take.

Target 🎯: 93.500 (or) Escape Before the Target

Scalpers, take note 👀 : only scalp on the Short side. If you have a lot of money, you can go straight away; if not, you can join swing traders and carry out the robbery plan. Use trailing SL to safeguard your money 💰.

📰🗞️Fundamental, Macro, COT, Sentimental & Positioning:

AUD/JPY "Aussie vs Japanese" Forex Market is currently experiencing a Bearish trend., driven by several key factors.

🔴Fundamental Analysis

- The Australian economy is experiencing a slowdown, with a decline in GDP growth rate and a rise in unemployment rate.

- The Japanese economy is also experiencing a slowdown, with a decline in GDP growth rate and a rise in inflation rate.

- The interest rate differential between Australia and Japan is narrowing, with the Reserve Bank of Australia (RBA) expected to cut interest rates and the Bank of Japan (BOJ) expected to keep interest rates low.

🔵Macro Economics

- The global economic slowdown is expected to continue, with a forecast of 3.0% global GDP growth rate for 2023.

- The US-China trade tensions are expected to continue, with a potential impact on global trade and economic growth.

- The commodity prices are expected to remain low, with a potential impact on the Australian economy.

🟤COT Report

- Non-commercials (speculators) are net short 40,000 contracts, indicating a bearish sentiment.

- Commercials (hedgers) are net long 20,000 contracts, indicating a bullish sentiment.

- The net positioning of non-commercials has decreased by 10,000 contracts in the past week, indicating a decrease in bearish sentiment.

🟢Sentimental Market

- Retail traders have a bearish sentiment towards AUD/JPY, with 60% being bearish.

- Institutional investors have a bearish sentiment towards AUD/JPY, with 55% being bearish.

- Hedge funds have a bearish sentiment towards AUD/JPY, with 58% being bearish.

⚪Positioning

- Institutional traders are holding short positions in AUD/JPY, indicating a bearish sentiment.

- Retail traders are holding short positions in AUD/JPY, indicating a bearish sentiment.

- Hedge funds are holding short positions in AUD/JPY, indicating a bearish sentiment.

🟡Overall Outlook

- AUD/JPY is expected to trend bearish in the short term, driven by the global economic slowdown, US-China trade tensions, and the narrowing interest rate differential between Australia and Japan.

- The bearish sentiment among retail traders, institutional investors, and hedge funds is expected to continue, putting downward pressure on AUD/JPY.

- The COT report indicates a decrease in bearish sentiment among non-commercials, which could potentially lead to a short-term rebound in AUD/JPY.

⚠️Trading Alert : News Releases and Position Management 📰 🗞️ 🚫🚏

As a reminder, news releases can have a significant impact on market prices and volatility. To minimize potential losses and protect your running positions,

we recommend the following:

Avoid taking new trades during news releases

Use trailing stop-loss orders to protect your running positions and lock in profits

📌Please note that this is a general analysis and not personalized investment advice. It's essential to consider your own risk tolerance and market analysis before making any investment decisions.

📌Keep in mind that these factors can change rapidly, and it's essential to stay up-to-date with market developments and adjust your analysis accordingly.

💖Supporting our robbery plan will enable us to effortlessly make and steal money 💰💵 Tell your friends, Colleagues and family to follow, like, and share. Boost the strength of our robbery team. Every day in this market make money with ease by using the Thief Trading Style.🏆💪🤝❤️🎉🚀

I'll see you soon with another heist plan, so stay tuned 🤑🐱👤🤗🤩

AUD/JPY "Aussie vs Japanese" Forex Market Heist Plan on Bullish🌟Hi! Hola! Ola! Bonjour! Hallo!🌟

Dear Money Makers & Robbers, 🤑 💰

Based on 🔥Thief Trading style technical and fundamental analysis🔥, here is our master plan to heist the AUD/JPY "Aussie vs Japanese" Forex market. Please adhere to the strategy I've outlined in the chart, which emphasizes long entry. Our aim is the high-risk Red Zone. Risky level, overbought market, consolidation, trend reversal, trap at the level where traders and bearish robbers are stronger. Be wealthy and safe trade.💪🏆🎉

Entry 📈 : Traders & Thieves with New Entry A bull trade can be initiated on the MA level breakout of 98.400

However I advise placing Buy limit orders within a 15 or 30 minute timeframe. Entry from the most recent or closest low or high level should be in retest.

Stop Loss 🛑: Using the 4H period, the recent / nearest low or high level.

Goal 🎯: 101.300 (or) Escape Before the Target

Scalpers, take note 👀 : only scalp on the Long side. If you have a lot of money, you can go straight away; if not, you can join swing traders and carry out the robbery plan. Use trailing SL to safeguard your money 💰.

Fundamental Outlook 📰🗞️

AUD/JPY is a popular currency pair that can be influenced by various fundamental and macroeconomic factors. Here's a brief analysis to help you make an informed decision:

Fundamental Analysis---

Interest Rate Differential: The Reserve Bank of Australia (RBA) has been keeping interest rates relatively high compared to the Bank of Japan (BOJ). This difference can make the AUD more attractive to investors, potentially driving up the value of AUD/JPY.

Commodity Prices: Australia is a major exporter of commodities like iron ore, coal, and gold. An increase in commodity prices can boost the Australian economy and support the AUD.

Economic Growth: Australia's economy has been showing signs of resilience, with a growing services sector and a rebound in consumer spending. Japan's economy, on the other hand, has been facing challenges, including a declining population and low inflation.

Macroeconomic Analysis---

Global Risk Sentiment: AUD/JPY is often considered a risk-on/risk-off pair. When investors are risk-averse, they tend to sell AUD and buy JPY, causing the pair to decline. Conversely, when risk appetite increases, AUD/JPY tends to rise.

Yield Curve: The yield curve in Australia has been relatively steep compared to Japan, which can attract investors seeking higher returns.

Central Bank Policies: The RBA has been maintaining a hawkish stance, while the BOJ has been keeping its ultra-loose monetary policy. This contrast can influence the AUD/JPY exchange rate.

Technical Analysis---

The AUD/JPY chart is showing a bullish trend, with the pair trading above its 200-day moving average. The Relative Strength Index (RSI) is around 60, indicating a moderate bullish momentum.

Conclusion---

Based on the fundamental and macroeconomic analysis, it seems that AUD/JPY might continue its bullish trend. However, it's essential to keep an eye on global risk sentiment, commodity prices, and central bank policies, as these factors can influence the pair's direction.

Trading Alert⚠️ : News Releases and Position Management 📰 🗞️ 🚫🚏

As a reminder, news releases can have a significant impact on market prices and volatility. To minimize potential losses and protect your running positions,

we recommend the following:

Avoid taking new trades during news releases

Use trailing stop-loss orders to protect your running positions and lock in profits

Please note that this is a general analysis and not personalized investment advice. It's essential to consider your own risk tolerance and market analysis before making any investment decisions.

Keep in mind that these factors can change rapidly, and it's essential to stay up-to-date with market developments and adjust your analysis accordingly.

💖Supporting our robbery plan will enable us to effortlessly make and steal money 💰💵 Tell your friends, Colleagues and family to follow, like, and share. Boost the strength of our robbery team. Every day in this market make money with ease by using the Thief Trading Style.🏆💪🤝❤️🎉🚀

I'll see you soon with another heist plan, so stay tuned 🫂

AUD/JPY "Aussie vs Japanese" Forex Market Bullish Heist Plan🌟Hi! Hola! Ola! Bonjour! Hallo!🌟

Dear Money Makers & Robbers, 🤑 💰

Based on 🔥Thief Trading style technical and fundamental analysis🔥, here is our master plan to heist the AUD/JPY "Aussie vs Japanese" Forex market. Please adhere to the strategy I've outlined in the chart, which emphasizes long entry. Our aim is the high-risk Red Zone. Risky level, overbought market, consolidation, trend reversal, trap at the level where traders and bearish robbers are stronger. 👀 So Be Careful, wealthy and safe trade.💪🏆🎉

Entry 📈 : You can enter a Bull trade at any point,

however I advise placing Buy limit orders within a 15 or 30 minute timeframe. Entry from the most recent or closest low or high level should be in retest.

Stop Loss 🛑: Using the 2H period, the recent / nearest low or high level.

Goal 🎯: 101.000

Scalpers, take note : only scalp on the Long side. If you have a lot of money, you can go straight away; if not, you can join swing traders and carry out the robbery plan. Use trailing SL to safeguard your money 💰.

Fundamental Outlook 📰 Economic Factors:

Australia's Economic Resilience: Despite slowing growth, Australia's economy has shown resilience, with a strong labor market and steady consumer spending.

Japan's Economic Challenges: Japan's economy faces challenges, including an aging population, low birth rates, and stagnant productivity growth.

Interest Rate Differential: The interest rate differential between Australia and Japan remains significant, with Australian interest rates higher than Japanese rates. This could attract investors seeking higher returns.

Sentiment Analysis:

Risk Appetite: A rise in risk appetite among investors could lead to a shift towards higher-yielding currencies like the AUD.

Yen Weakness: The Japanese yen has been weakening due to the BoJ's dovish stance, which could support the AUD/JPY pair.

Keep in mind that these factors can change rapidly, and it's essential to stay up-to-date with market developments and adjust your analysis accordingly.

Warning⚠️ : Our heist strategy is incompatible with Fundamental Analysis news 📰 🗞️. We'll wreck our plan by smashing the Stop Loss 🚫🚏. Avoid entering the market right after the news release.

Take advantage of the target and get away 🎯 Swing Traders Please reserve the half amount of money and watch for the next dynamic level or order block breakout. Once it is resolved, we can go on to the next new target in our heist plan.

💖Supporting our robbery plan will enable us to effortlessly make and steal money 💰💵 Tell your friends, Colleagues and family to follow, like, and share. Boost the strength of our robbery team. Every day in this market make money with ease by using the Thief Trading Style.🏆💪🤝❤️🎉🚀

I'll see you soon with another heist plan, so stay tuned 🫂

AUD/JPY "Aussie vs Japanese" Forex Market Bullish Heist Plan🌟Hi! Hola! Ola! Bonjour! Hallo!🌟

Dear Money Makers & Robbers, 🤑 💰

Based on 🔥Thief Trading style technical analysis🔥, here is our master plan to heist the AUD/JPY "Aussie vs Japanese" Forex market. Please adhere to the strategy I've outlined in the chart, which emphasizes long entry. Our aim is the high-risk Red Zone. Risky level, overbought market, consolidation, trend reversal, trap at the level where traders and bearish robbers are stronger. 👀 So Be Careful, wealthy and safe trade.💪🏆🎉

Entry 📈 : You can enter a Bull trade at any point,

however I advise placing Buy limit orders within a 15 or 30 minute timeframe. Entry from the most recent or closest low level should be in retest.

Stop Loss 🛑: Using the 2H period, the recent / nearest low or high level.

Goal 🎯: 99.500

Scalpers, take note : only scalp on the Short side. If you have a lot of money, you can go straight away; if not, you can join swing traders and carry out the robbery plan. Use trailing SL to safeguard your money 💰.

Warning⚠️ : Our heist strategy is incompatible with Fundamental Analysis news 📰 🗞️. We'll wreck our plan by smashing the Stop Loss 🚫🚏. Avoid entering the market right after the news release.

Take advantage of the target and get away 🎯 Swing Traders Please reserve the half amount of money and watch for the next dynamic level or order block breakout. Once it is resolved, we can go on to the next new target in our heist plan.

💖Supporting our robbery plan will enable us to effortlessly make and steal money 💰💵 Tell your friends, Colleagues and family to follow, like, and share. Boost the strength of our robbery team. Every day in this market make money with ease by using the Thief Trading Style.🏆💪🤝❤️🎉🚀

I'll see you soon with another heist plan, so stay tuned 🫂

AUDJPY Potentially BullishOANDA:AUDJPY did beyond my expectations on the sell and right now, we are looking at the bulls attempting a come back in the market. A break above the 97.461 area and its retest will give me a confirmation to go long, other wise, we just might see price pushing lower. Until then, fingers crossed.

Disclaimer: Results are not typical, past results does not guarantee future results. Do your due diligence

AUDJPY Potentially bearishOANDA:AUDJPY had a cool bullish run on the H4. Looking at it from the TA angle, we have seen a sharp drop around the daily key resistance area plus we have seen some shift with the new lower highs and lower lows gradually setting in. #AUDJPY just might drop to the 104.639 area.

AUD JPY SHORTRisk 0.5%

TP1 = 1:2.6 RR

Disclaimer:

The contents in this Idea are intended for information purpose only and do not constitute investment recommendation or advice. Nor are they used to promote any specific products or services. They serve as an integral part of a case study to demonstrate fundamental concepts in risk management under given market scenarios. A full version of the disclaimer is available in our profile description.

AUDJPY Top-down analysis Hello traders, this is a complete multiple timeframe analysis of this pair. We see could find significant trading opportunities as per analysis upon price action confirmation we may take this trade. Smash the like button if you find value in this analysis and drop a comment if you have any questions or let me know which pair to cover in my next analysis.

AUDJPY - FUNDAMENTAL + TECHNICAL BIAS#AUDJPY

These days, AUDJPY is slightly UP due to MARKET RISK ON. The reason for that was that the MARKET SENTIMENT was somewhat POSITIVE with FED UPDATES. JPY WEAK AFTER BOJ MEETING.

Because of that, XXXJPY CURRENCIES went UP very fast. It still has an effect. Anyway, they said that the BOJ MONETARY POLICY will be relaxed even more.

Therefore, after JPY becomes PRICE, XXXJPY PRICES may be UP in the future. Even now, we see that the MARKET is somewhat MARKET RISK ON. We expect AUDJPY to RETRACE to higher resistance. Anyway, if the AUDJPY goes upside down again, the VIX should go down and the JPY should go up, and STOCKS should go up. The dollar should continue to strengthen as it has in recent days.

AUDJPY can definitely SELL at 92.00 LEVEL. But somehow, after that, AUDJPY may go UP to 95.54 LEVEL. Anyway, if JPY becomes WEAK, if the UP SIDE STRUCTURE is BREAK, there is a very good situation to BUY AUDJPY.

AUDJPY - FUNDAMENTAL + TECHNICAL BIAS#AUDJPY

These days, AUDJPY is slightly UP due to MARKET RISK ON. The reason for that was that the MARKET SENTIMENT was somewhat POSITIVE with FED UPDATES. JPY WEAK AFTER BOJ MEETING.

Because of that, XXXJPY CURRENCIES went UP very fast. It still has an effect. Anyway, they said that the BOJ MONETARY POLICY will be relaxed even more.

Therefore, after JPY becomes PRICE, XXXJPY PRICES may be UP in the future. Even now, we see that the MARKET is somewhat MARKET RISK ON. We expect AUDJPY to RETRACE to higher resistance. Anyway, if the AUDJPY goes upside down again, the VIX should go down and the JPY should go up, and STOCKS should go up. The dollar should continue to strengthen as it has in recent days.

AUDJPY can definitely SELL at 87.47 LEVEL. But somehow, after that, AUDJPY may go UP to 95.54 LEVEL. Anyway, if JPY becomes WEAK, if the UP SIDE STRUCTURE is BREAK, there is a very good situation to BUY AUDJPY.

AUDJPY - FUNDAMENTAL + TECHNICAL BIAS#AUDJPY

These days, AUDJPY is slightly UP due to MARKET RISK ON. The reason for that was that the MARKET SENTIMENT was somewhat POSITIVE with FED UPDATES. JPY WEAK AFTER BOJ MEETING.

Because of that, XXXJPY CURRENCIES went UP very fast. It still has an effect. Anyway, they said that the BOJ MONETARY POLICY will be relaxed even more.

Therefore, after JPY becomes PRICE, XXXJPY PRICES may be UP in the future. Even now, we see that the MARKET is somewhat MARKET RISK ON. We expect AUDJPY to RETRACE to higher resistance. Anyway, if the AUDJPY goes upside down again, the VIX should go down and the JPY should go up, and STOCKS should go up. The dollar should continue to strengthen as it has in recent days.

AUDJPY can definitely SELL at 89.26 LEVEL. But somehow, after that, AUDJPY may go UP to 95.54 LEVEL. Anyway, if JPY becomes WEAK, if the UP SIDE STRUCTURE is BREAK, there is a very good situation to BUY AUDJPY.

AUDJPY - FUNDAMENTAL + TECHNICAL BIAS#AUDJPY

These days, AUDJPY is slightly UP due to MARKET RISK ON. The reason for that was that the MARKET SENTIMENT was somewhat POSITIVE with FED UPDATES. JPY WEAK AFTER BOJ MEETING.

Because of that, XXXJPY CURRENCIES went UP very fast. It still has an effect. Anyway, they said that the BOJ MONETARY POLICY will be relaxed even more.

Therefore, after JPY becomes PRICE, XXXJPY PRICES may be UP in the future. Even now, we see that the MARKET is somewhat MARKET RISK ON. We expect AUDJPY to RETRACE to higher resistance. Anyway, if the AUDJPY goes upside down again, the VIX should go down and the JPY should go up, and STOCKS should go up. The dollar should continue to strengthen as it has in recent days.

AUDJPY can definitely SELL at 89.26 LEVEL. But somehow after that, AUDJPY may go UP to 95.50 LEVEL. Anyway, if JPY becomes WEAK, if the UP SIDE STRUCTURE is BREAK, there is a very good situation to BUY AUDJPY.

AUDJPY - FUNDAMENTAL + TECHNICAL BIAS#AUDJPY

These days, AUDJPY is becoming somewhat DOW due to MARKET RISK OFF. The reason for that was that the MARKET SENTIMENT was somewhat NEGATIVE with FED UPDATES. The YEILD of JPY 10Y BOND was increased at today's BOJ MEETING. Because of that, XXXJPY CURRENCIES went down very fast. It still has an effect. Anyway, they said that the BOJ MONETARY POLICY will be relaxed even more. Therefore, after JPY becomes PRICE, XXXJPY PRICES may be UP in the future. Even now, we see that the MARKET has somewhat MARKET RISK OFF. We expect AUDJPY to RETRACE to higher resistance.

Anyway, if the AUDJPY goes upside down again, the VIX should go down and the JPY should go up, and STOCKS should go up. The dollar should continue to strengthen as it has in recent days. If the MARKET RISK continues to be OFF, you can definitely SELL at 88.02 LEVEL. But somehow, after that, AUDJPY may go up to 92.90 LEVEL. Anyway, if JPY becomes WEAK, if the UP SIDE STRUCTURE is BREAK, there is a very good situation to BUY AUDJPY.

To buy AUDJPY, VIX must be DOWN and SNP500 must be UP. Further, the TREND LINE should be BREAK. And COMMODITIES should definitely be UP. We are waiting for the change in the above mentioned MARKETS.

If the dollar is strengthened by the FED, MARKETS RISK should be off. Then after JPY STRONG, AUDJPY can be LONG TERM BUY.

AUDJPY 6h shortDear friends,

Welcome to another analysis.

Here I'd like to short my AUDJPY pairs. Currently the price is travelling in a downtrend. Price is in the verge of a breakout. But the down trendline is very strong. Chances of breakout failure is high. Now all the AUD currency is at the resistance. So, the price is likely to fall further after the US market opens.

If you look at this chart the price has a strong resistance to retest to go to the downside. Price is constantly testing the down trendline on the upside but unable to break it. So, it is likely to fall further. 1:2 RR is more than enough for a profitable trade. But more than 1:2 can be expected. Till 88.470 there is no support.

Price has formed the double bottom at the end of the down trendline. A little bit of chance that this double bottom can hold this down trend fall. Currently there is a normal buying pressure. So, sellers can open their short position.

Look at the chart attached for a better clarity. Avoid buying in breakout as there is a resistance. So, buyers can be trapped easily.

But it is wise to follow your risk management before taking entry.

I love to share my ideas. Feel free to revise the text and provide feedback. It makes it so personal and improve us in better ways.

Thanks & Regards,

Alpha Trading Station

Disclaimer: This view is for educational purpose only & any stock mentioned here should not be taken as a trading/investing advice. We may or may not have position in the stocks mentioned here. Please consult your financial advisor before investing. Because Price is the "King of Market".

AUDJPY - FUNDAMENTAL + TECHNICAL BIAS#AUDJPY

These days, AUDJPY is becoming somewhat DOW due to MARKET RISK OFF. The reason for that was that the MARKET SENTIMENT was somewhat NEGATIVE with FED UPDATES. The YEILD of JPY 10Y BOND was increased at today's BOJ MEETING. Because of that, XXXJPY CURRENCIES went down very fast. It still has an effect. Anyway, they said that the BOJ MONETARY POLICY will be relaxed even more. Therefore, after JPY becomes PRICE, XXXJPY PRICES may be UP in the future. Even now, we see that the MARKET has somewhat MARKET RISK OFF. We expect AUDJPY to RETRACE to higher resistance.

Anyway, if the AUDJPY goes upside down again, the VIX should go down and the JPY should go up, and STOCKS should go up. The dollar should continue to strengthen as it has in recent days. If MARKET RISK continues to be OFF, you can definitely SELL at 89.26 LEVEL. But somehow after that, AUDJPY may go UP to 95.04 LEVEL. Anyway, if JPY becomes WEAK, if the UP SIDE STRUCTURE is BREAK, there is a very good situation to BUY AUDJPY.

To buy AUDJPY, VIX must be DOWN and SNP500 must be UP. Further, the TREND LINE should be BREAK. And COMMODITIES should definitely be UP. We are waiting for the change in the above mentioned MARKETS.

If the dollar is strengthened by the FED, MARKETS RISK should be off. Then after JPY STRONG, AUDJPY can be LONG TERM BUY.

AUDJPY - FUNDAMENTAL + TECHNICAL BIAS#AUDJPY

These days, AUDJPY is becoming somewhat DOW due to MARKET RISK OFF. The reason for that was that the MARKET SENTIMENT was somewhat NEGATIVE with FED UPDATES. The YEILD of JPY 10Y BOND was increased at today's BOJ MEETING. Because of that, XXXJPY CURRENCIES went down very fast. It still has an effect. Anyway, they said that the BOJ MONETARY POLICY will be relaxed even more. Therefore, after JPY becomes PRICE, XXXJPY PRICES may be UP in the future. Even now, we see that the MARKET has somewhat MARKET RISK OFF. We expect AUDJPY to RETRACE to higher resistance.

Anyway, if the AUDJPY goes upside down again, the VIX should go down and the JPY should go up, and STOCKS should go up. The dollar should continue to strengthen as it has in recent days. If MARKET RISK continues to be OFF, you can definitely SELL at 85.96 LEVEL. But somehow, after that, AUDJPY may go up to 92.90 LEVEL. Anyway, if JPY becomes WEAK, if the UP SIDE STRUCTURE is BREAK, there is a very good situation to BUY AUDJPY.

To buy AUDJPY, VIX must be DOWN and SNP500 must be UP. Further, the TREND LINE should be BREAK. And COMMODITIES should definitely be UP. We are waiting for the change in the above mentioned MARKETS.

If the dollar is strengthened by the FED, MARKETS RISK should be off. Then after JPY STRONG, AUDJPY can be LONG TERM BUY.

AUDJPY - FUNDAMENTAL + TECHNICAL BIAS#AUDJPY

These days, AUDJPY is slightly UP due to MARKET RISK ON. In recent days, JPY became somewhat STRONG because of the BOJ INTERVENTION and the drop in US INFLATION. Even now, we see that the MARKET has somewhat MARKET RISK OFF. We expect AUDJPY to RETRACE to higher resistance.

Anyway, if AUDJPY goes DOWNSIDE again, VIX should go up, JPY should go up, and STOCKS should go down. The dollar should continue to strengthen as it has in recent days. FOMC UPDATE MUST BE HAWKISH FOR THAT. If MARKET RISK continues to be ON again, you can definitely BUY at 95.041 LEVEL. But somehow it may go down to the 90.50 level before going up. After that, AUDJPY may go up to 95.04 LEVEL. Anyway, if JPY continues to be WEAK, if the UP SIDE STRUCTURE is BREAKED, AUDJPY has a very good situation to BUY.

To buy AUDJPY, VIX must be DOWN and SNP500 must be UP. Further, the TREND LINE should be BREAK. And COMMODITIES should definitely be UP. We are waiting for the change in the above mentioned MARKETS.

If the dollar is strengthened by the FED, MARKETS RISK should be off. Then after JPY STRONG, AUDJPY can be LONG TERM BUY.

AUDJPY - FUNDAMENTAL + TECHNICAL BIAS#AUDJPY

These days, AUDJPY is slightly UP due to MARKET RISK ON. In recent days, JPY became somewhat STRONG because of the BOJ INTERVENTION and the drop in US INFLATION. Even now, we see that the MARKET has somewhat MARKET RISK OFF. We expect AUDJPY to RETRACE to higher resistance.

Anyway, if AUDJPY goes DOWNSIDE again, VIX should go up, JPY should go up, and STOCKS should go down. The dollar should continue to strengthen as it has in recent days. FOMC UPDATE MUST BE HAWKISH FOR THAT. If MARKET RISK continues to be ON again, you can definitely BUY at 97.50 LEVEL. But somehow it may go down to 92.90 LEVEL before going UP. After that, AUDJPY may go up to 97.50 LEVEL. Anyway, if JPY continues to be WEAK, if the UP SIDE STRUCTURE is BREAKED, AUDJPY has a very good situation to BUY.

To buy AUDJPY, VIX must be DOWN and SNP500 must be UP. Further, the TREND LINE should be BREAK. And COMMODITIES should definitely be UP. We are waiting for the change in the above mentioned MARKETS.

If the dollar is strengthened by the FED, MARKETS RISK should be off. Then after JPY STRONG, AUDJPY can be LONG TERM BUY. audjpy