AUDNZD Technical + Fundamental Align for DownsideToday I want to analyze a short position on the AUDNZD ( OANDA:AUDNZD ) pair, first, let's look at it from a fundamental analysis perspective .

Fundamental View on AUDNZD

Key reasons to short AUDNZD:

Australian weakness:

Recent data show weakening consumer sentiment and declining building approvals. The RBA seems hesitant to hike further, putting pressure on the Aussie.

New Zealand resilience:

The RBNZ maintains a relatively hawkish stance. Inflation is still a concern, and the central bank is committed to keeping rates high, supporting NZD strength.

Monetary policy divergence:

The divergence between RBA’s dovish stance and RBNZ’s hawkish approach supports further downside in AUDNZD.

----------------------

Now let's take a look at AUDNZD from a technical analysis perspective on the 4-hour timeframe .

AUDNZD is currently trading in a Heavy Resistance zone(1.0963 NZD-1.0870 NZD) near the upper line of the Range Channel , Potential Reversal Zone(PRZ) and Yearly Pivot Point .

In terms of Elliott Wave theory , AUDNZD appears to be completing microwave B of microwave Y of the main wave 4 .

I expect AUDNZD to drop to at least 1.0904 NZD(First Target) based on the above explanation .

Second Target: 1.0886 NZD

Note: Stop Loss(SL): 1.0963 NZD

Please respect each other's ideas and express them politely if you agree or disagree.

Australian Dollar/New Zealand Dollar Analyze (AUDNZD), 4-hour time frame.

Be sure to follow the updated ideas.

Do not forget to put a Stop loss for your positions (For every position you want to open).

Please follow your strategy and updates; this is just my Idea, and I will gladly see your ideas in this post.

Please do not forget the ✅' like '✅ button 🙏😊 & Share it with your friends; thanks, and Trade safe.

Audnzdanalysis

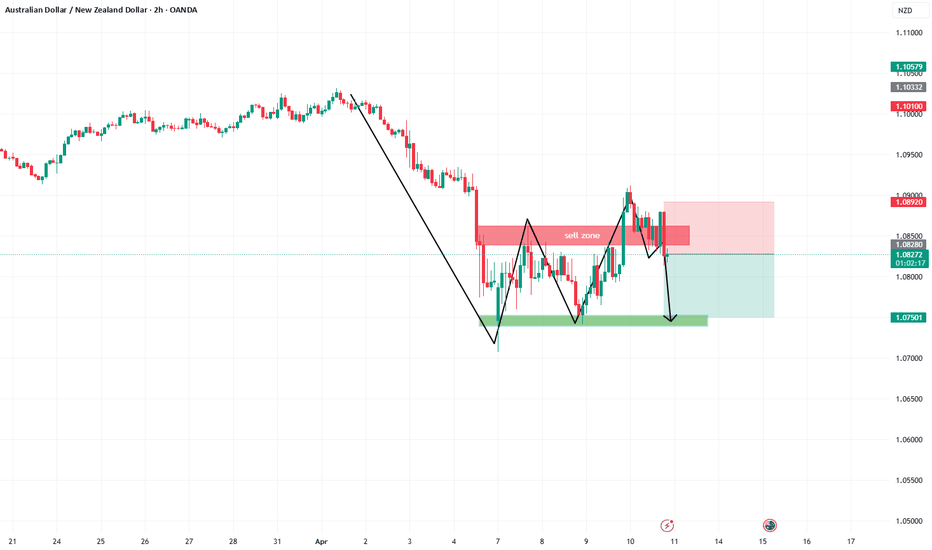

AUD/NZD Analysis is Ready Move Will Be Fly This AUD/NZD 30-minute chart shows a bullish setup with entry around 1.09216. The first target is near 1.09400 and the second target is at 1.09521. A stop loss is placed below support at 1.09063. The analysis suggests a potential upward move after a breakout.

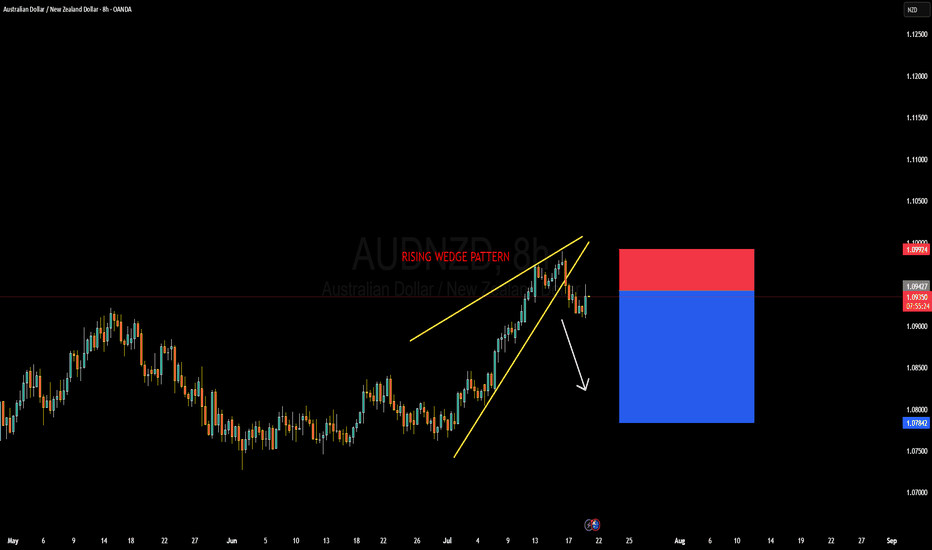

AUDNZD Forming Rising Wedge PatternAUDNZD has formed a textbook rising wedge pattern on the 8H chart and has now broken to the downside, signaling potential bearish continuation. This setup typically indicates a loss of momentum in the prevailing bullish trend, and with the clean structure break now confirmed, the bears seem ready to take control. I’ve already entered short positions from the top edge of the pattern and am currently floating in profit, anticipating further downside toward the 1.0780–1.0800 zone.

From a fundamental perspective, the Australian dollar has been relatively stable but lacks a strong bullish catalyst at this point. The Reserve Bank of Australia is holding a cautious tone amid mixed inflation signals, while New Zealand’s economy is showing signs of potential resilience. The RBNZ remains committed to tighter monetary conditions for longer as inflation continues to hover above their comfort zone, which provides some support to NZD in the near term.

Technically, the break of the lower wedge support is significant. Price failed to sustain higher highs near 1.1000 and quickly retraced, showing bearish rejection. With the RSI diverging and volume fading near the top of the wedge, this was a high-probability reversal zone. As long as price stays below 1.0950, the bias remains bearish, and further sell pressure is expected.

I'm targeting 1.0780 as the next key liquidity level. It aligns with previous structure support and provides a favorable risk-to-reward setup. This setup is a clear example of price-action-driven reversal trading, paired with macroeconomic alignment. I’ll continue to trail stops as price progresses, but so far, AUDNZD is playing out exactly as anticipated.

AUDNZD Breakout: Long Opportunity in Ascending ChannelToday I want to share with you a Long position opportunity in AUDNZD ( OANDA:AUDNZD ).

Let's first take a brief look at the AUDNZD fundamentals .

RBNZ kept rates at 3.25% , signaling likely further cuts in August.

RBA paused at 3.60% , but dovish bias remains; markets expect more easing ahead.

As NZD is more pressured by immediate rate cuts than AUD, the fundamental setup favors a bullish AUDNZD.

Now let's find a long position for AUDNZD using technical analysis .

AUDNZD seems to have managed to break through the Heavy Resistance zone(1.0963 NZD-1.0870 NZD) and is moving near the Support zone(1.0964 NZD-1.0954 NZD) on the 1-hour time frame .

AUDNNZD is also moving in an Ascending Channel .

I expect AUDNZD to rise at least to the Resistance lines , the second target is the Resistance zone(1.103 NZD-1.0993 NZD).

Note: Stop Loss(SL): 1.0944 NZD

Please respect each other's ideas and express them politely if you agree or disagree.

Australian Dollar/New Zealand Dollar Analyze (AUDNZD), 1-hour time frame.

Be sure to follow the updated ideas.

Do not forget to put a Stop loss for your positions (For every position you want to open).

Please follow your strategy and updates; this is just my Idea, and I will gladly see your ideas in this post.

Please do not forget the ✅' like '✅ button 🙏😊 & Share it with your friends; thanks, and Trade safe.

Stealing Pips Like a Pro – AUD/NZD Long Heist, MA Breakout Setup🎯 AUD/NZD Heist: Bullish Bank Robbery 🚀💰 (Thief Trading Style)

🌟 Hi! Hola! Ola! Bonjour! Hallo! Marhaba! 🌟

Dear Money Makers & Robbers, 🤑💸✈️

Based on 🔥Thief Trading Style🔥 (technical + fundamental analysis), here’s our master plan to loot the AUD/NZD "Aussie vs Kiwi" Forex Bank!

🔎 The Heist Setup (Long Entry Focus)

🐂 Bullish Breakout Strategy:

Entry: Wait for MA breakout (1.08150) then strike!

Alternative Entry: Place Buy Stop above MA OR Buy Limit near pullback zones (15-30min timeframe).

Pro Tip: Set an ALERT for breakout confirmation!

🛑 Stop Loss (Thief’s Safety Net):

"Yo, listen up! 🗣️ If you're entering via Buy Stop, don’t set SL until after breakout!

Thief’s SL Zone: Nearest swing low (1.07500 – 3H timeframe).

Adjust SL based on your risk, lot size, and trade plan.

🎯 Profit Targets:

1st Target: 1.08600 (or escape earlier if cops lurk!).

Scalpers: Only scalp LONG! Use trailing SL to protect gains.

⚠️ Critical Heist Rules:

Avoid news chaos! 🚨 No new trades during high-impact news.

Lock profits with trailing stops.

Cops (Bears) are strong near resistance – don’t get caught!

💥 Boost the Heist!

💖 Hit the "Boost" button to strengthen our robbery squad! More likes = more 💰easy money heists!

Stay tuned for the next big steal! 🏆🚀🐱👤

AUD/NZD "Aussie vs Kiwi" Forex Bank Heist Plan (Day/Swing Trade)🌟Hi! Hola! Ola! Bonjour! Hallo! Marhaba!🌟

Dear Money Makers & Robbers, 🤑 💰💸✈️

Based on 🔥Thief Trading style technical and fundamental analysis🔥, here is our master plan to heist the AUD/NZD "Aussie vs Kiwi" Forex Bank. Please adhere to the strategy I've outlined in the chart, which emphasizes long entry. Our aim is to escape near the high-risk Red Zone. Risky level, overbought market, consolidation, trend reversal, trap at the level where traders and bearish robbers are stronger. 🏆💸"Take profit and treat yourself, traders. You deserve it!💪🏆🎉

Entry 📈 : "The heist is on! Wait for the MA breakout (1.07300) then make your move - Bullish profits await!"

however I advise to Place Buy stop orders above the Moving average (or) Place buy limit orders within a 15 or 30 minute timeframe most recent or swing, low or high level for Pullback entries.

📌I strongly advise you to set an "alert (Alarm)" on your chart so you can see when the breakout entry occurs.

Stop Loss 🛑: "🔊 Yo, listen up! 🗣️ If you're lookin' to get in on a buy stop order, don't even think about settin' that stop loss till after the breakout 🚀. You feel me? Now, if you're smart, you'll place that stop loss where I told you to 📍, but if you're a rebel, you can put it wherever you like 🤪 - just don't say I didn't warn you ⚠️. You're playin' with fire 🔥, and it's your risk, not mine 👊."

📍 Thief SL placed at the nearest/swing low level Using the 1H timeframe (1.06700) Day / Swing trade basis.

📍 SL is based on your risk of the trade, lot size and how many multiple orders you have to take.

🏴☠️Target 🎯: 1.08600 (or) Escape Before the Target

🧲Scalpers, take note 👀 : only scalp on the Long side. If you have a lot of money, you can go straight away; if not, you can join swing traders and carry out the robbery plan. Use trailing SL to safeguard your money 💰.

💰💵💴💸AUD/NZD "Aussie vs Kiwi" Forex Bank Heist Plan (Day / Swing Trade) is currently experiencing a bullishness🐂.., driven by several key factors.☝☝☝

📰🗞️Get & Read the Fundamental, Macro Economics, COT Report, Quantitative Analysis, Sentimental Outlook, Intermarket Analysis, Future trend targets... go ahead to check 👉👉👉🔗🔗

⚠️Trading Alert : News Releases and Position Management 📰🗞️🚫🚏

As a reminder, news releases can have a significant impact on market prices and volatility. To minimize potential losses and protect your running positions,

we recommend the following:

Avoid taking new trades during news releases

Use trailing stop-loss orders to protect your running positions and lock in profits

💖Supporting our robbery plan 💥Hit the Boost Button💥 will enable us to effortlessly make and steal money 💰💵. Boost the strength of our robbery team. Every day in this market make money with ease by using the Thief Trading Style.🏆💪🤝❤️🎉🚀

I'll see you soon with another heist plan, so stay tuned 🤑🐱👤🤗🤩

BREAKOUT OR REJECTION? WATCH 0.64137 KEY ZONE CLOSELY! AUDUSD 22/05 – BREAKOUT OR REJECTION? WATCH 0.64137 KEY ZONE CLOSELY!

🌐 MACRO OVERVIEW

DXY is starting to lose momentum after a sharp rally fueled by the Fed’s hawkish stance. However, there’s still no clear signal of an imminent rate cut.

Meanwhile, the RBA (Reserve Bank of Australia) maintains a steady policy, offering short-term support for AUD. While rates remain unchanged, the central bank’s cautious tone adds a defensive layer for the Aussie.

On the trade front, Australia has seen marginal recovery in commodity prices, though ongoing concerns about Chinese economic slowdown continue to weigh on sentiment.

📊 TECHNICAL ANALYSIS (Timeframes: H1 – H4)

AUDUSD is forming a tight symmetrical triangle, with lower highs and higher lows — a typical precursor to a breakout.

The current price at 0.6418 is sitting right along the lower trendline. Price action here is critical to determine today’s direction.

🔍 Scenario A – Upside Breakout (30% probability):

If price breaks and closes above 0.64700–0.64910, we could see bullish continuation toward the 0.65134 resistance zone.

🔍 Scenario B – Breakdown (70% probability):

A strong break below 0.64137 could trigger a move toward 0.63964 and potentially deeper into the 0.63640 liquidity zone.

🎯 TODAY'S TRADE PLAN

🔵 BUY SCALP (only if price reacts strongly at trendline support)

Entry: 0.6414 – 0.6416

SL: 0.6408

TP Targets: 0.6445 → 0.6470 → 0.6490

🔴 SELL SETUP (if triangle is broken to the downside)

Entry: 0.6405 – 0.6396

SL: 0.6420

TP Targets: 0.6364 → 0.6340

⚠️ IMPORTANT NOTES

Expect high volatility during the U.S. session as PMI and Unemployment Claims data are released.

Stick to your TP/SL levels with discipline — the market may sweep liquidity on both sides before choosing a direction.

📌 SUMMARY:

AUDUSD is consolidating in a clean technical pattern while macro uncertainty looms. Whether we break up or down, the key is to trade what the market gives — not what we think. React to confirmation, not prediction.

AUD/NZD Forex Ambush: Thief Trading’s Profit-Grabbing Plan!🌟 AUD/NZD Forex Heist: Snag Profits with the Thief Trading Plan! 🚀💰

Hey there, wealth hunters and market bandits! 🤑💸

Welcome to the Thief Trading blueprint for cracking the AUD/NZD "Aussie vs Kiwi" Forex vault! 🏦🔥 This plan fuses sharp technicals 📊 with gritty fundamentals 📈 to score big loot. Follow the charted strategy, leaning into long entries, and aim to cash out near the high-risk Yellow Moving Average Zone 🎯—a hotspot for overbought vibes, consolidation, or trend flips where bearish bandits prowl 🐻. Grab your profits and treat yourself—you’ve earned it! 💪🎉

Entry Signals 🔑:

Bullish Ambush 🚀: Jump in on a pullback to the Blue MA at 1.08600 or Green MA at 1.07600. 📈

Bearish Blitz ⚡: Go short on a break below the Blue MA at 1.08200, riding the downward wave. 📉

Set a chart alert 🔔 to catch the breakout entry in real-time!

Stop Loss Tactics 🛑:

For buy stop orders, wait for the breakout to confirm before setting your stop. 📍 Place it at 1.07800 for Blue MA bullish entries or 1.06800 for Green MA entries on swing trades. Adjust based on your risk, lot size, and number of orders—play smart, not wild! 😎🔥

Profit Targets 🎯:

Bullish Raiders 🏴☠️: Shoot for 1.09700 or bail early if the market shifts.

Bearish Thieves 🕵️: Target 1.07600.

Scalpers 👀: Stick to long-side scalps. Big players can dive in; smaller traders, join the swing crew and execute the heist with a trailing stop loss to guard your gains! 💰🛡️

The AUD/NZD Forex Bank Heist (Day/Swing Trade) is riding a bullish surge 🐂, driven by key fundamentals. 📜 Dig into the COT Report, macroeconomics, sentiment analysis, intermarket trends, and future price targets for the full scoop—check those links! 🔗👉

Trading Alert: News & Position Management 🚨

News drops can shake the market! 📰 To protect your stash:

Avoid new trades during news events. 🚫

Use trailing stops to lock in profits on open positions. 🔒

Support the heist! Hit that Boost Button 🚀 to power up our robbery squad. With the Thief Trading Style, stacking profits daily is a breeze! 🌟 Stay sharp for the next heist—catch you in the markets! 🤑🐱👤🤝.

RBA Cuts Rates. AUD DeclinesRBA Cuts Rates. AUD Declines

Today, the Reserve Bank of Australia (RBA) decided to cut the interest rate from 4.10% to 3.85%, continuing its easing policy after a previous cut from 4.35% in February.

According to Reuters, the RBA today cited:

→ progress made in bringing inflation under control;

→ economic risks linked to the ongoing global trade war.

Although the RBA’s decision was widely expected, the Australian dollar weakened noticeably against other currencies — including the New Zealand dollar. The AUD/NZD rate fell to its lowest level in nearly two weeks.

Technical Analysis of the AUD/NZD Chart

From a technical perspective, a bearish breakout occurred:

→ below the lower boundary of the upward trend channel that began in April;

→ and below the 1.087 level, which had served as support in mid-May.

It is possible that:

→ the decline may slow around the 1.083 support zone, where strong demand was evident in the long lower wicks of the 9 May candles (marked with an arrow);

→ the 1.0870–1.0880 area will act as resistance going forward, potentially leading to a retest of the bearish breakout zone on the AUD/NZD chart.

As the market continues to price in the RBA’s decision, attention will turn to the Reserve Bank of New Zealand meeting on 28 May, where a similar rate cut could be on the table.

This article represents the opinion of the Companies operating under the FXOpen brand only. It is not to be construed as an offer, solicitation, or recommendation with respect to products and services provided by the Companies operating under the FXOpen brand, nor is it to be considered financial advice.

AUD/USD) Technical Analysis Read The ChaptianSMC-Trading Point update

Technical analysis of the AUD/USD currency pair on the 1-hour timeframe. Here's the idea behind the analysis:

Key Elements:

1. Support and Resistance Levels:

Resistance zone: Around 0.64350–0.64450

Support zone: Around 0.63450–0.63550

2. EMA (200):

The price is currently below the 200 EMA (0.64259), indicating bearish momentum.

3. RSI (Relative Strength Index):

RSI is around 50, indicating neutral momentum, but recently crossed down, hinting potential bearish continuation.

4. Two Scenarios Proposed:

Bullish Scenario:

If the price breaks above the resistance zone (~0.64400), a bullish rally toward the upper target at 0.65139 is expected.

Bearish Scenario:

If the price gets rejected from the resistance and breaks below the current support zone, a bearish move toward 0.63461 is expected.

5. Current Bias:

Slight bearish bias as the price is below both the resistance zone and the 200 EMA, with a possible setup for a breakdown.

Mr SMC Trading point

Conclusion:

This is a classic breakout or breakdown setup. The price is near a decision point, and the next move will likely depend on whether it breaks above the resistance or below the support zone.

Pales support boost 🚀 analysis follow

AUDNZD possible short, patience required The daily candle has not yet closed but we could have an inside bar setup later today.

Price is below the 200dma and the price action today seems indicative of a bearish breakout that could happen tomorrow.

I am not advising jumping the gun, instead wait and see how it all plays out.

This is not a trade recommendation; it’s merely my own analysis. Trading carries a high level of risk, carefully manage your capital and risk. If you like my idea, please give a “boost” and follow me to get even more.

It’s not whether you are right or wrong, but how much money you make when you are right and how much you lose when you are wrong – George Soros

AUDNZD Rejected – CPI & RBA Dovish Bias Pressures AussieKey Resistance Zone: 1.0780 – 1.0800

The pair tested this area twice and failed to break above, forming a clear double-top pattern. This is a bearish signal suggesting buyers are exhausted.

Price Action:

A strong bearish rejection candle followed the second resistance test, aligning with historical resistance and structure. The pair is now showing signs of reversal.

Support Levels to Watch:

🥅 Target 1: 1.0707 – Previous consolidation zone

🥅 Target 2: 1.0677 – Key swing low

📉 Stop Loss: Above 1.0800

Pattern: Rising wedge structure breaking down, signaling downside continuation.

🔍 Fundamental Analysis

🇦🇺 Australia (AUD) – Weakness Potential

RBA’s Dovish Leaning:

RBA Assistant Governor Kent emphasized external FX market risks and cautious positioning on monetary tightening, which dampens rate hike expectations【source: RBA speech】.

Key Data Incoming:

April 30: Quarterly CPI data

Forecasts suggest core inflation might ease, reducing pressure on the RBA to act. If CPI undershoots, it could trigger AUD selling.

AUD also faces pressure from global growth fears and risk-off sentiment.

🇳🇿 New Zealand (NZD) – Relative Strength

While the RBNZ has already started easing, the NZD has shown resilience amid improving trade balance and stable economic performance.

NZ Business Confidence is also due, which could influence near-term NZD moves, but broader positioning supports the Kiwi.

🧠 Sentiment Overview

The risk-reward favors shorts here:

Clear technical rejection

Bearish macro backdrop for AUD

Relative NZD strength

CPI data will be the key catalyst, and positioning ahead of it looks justified given current chart structure.

📝 Conclusion:

AUDNZD looks primed for a downside correction after repeated rejections at a major resistance zone. With dovish RBA commentary and potential soft inflation data ahead, short setups are favored with targets at 1.0707 and 1.0677.

AUDUSD SHORT FORECAST Q2 W16 D17 Y25AUDUSD SHORT FORECAST Q2 W16 D17 Y25

GM GM.

Summary

+ Daily high rejection

+ Weekly order block rejection

+ Weekly 50 EMA edging closer to price action

+ 4H bearish close

+ 1H continued short

+ 15' intraday breaks of structure

Just a few confluences mentioned.

Entry Model

Tap

Lower time frame break of structure/ Bearish candle stick formation from point of interest.

FRGNT X

AUD/NZD "Aussie vs Kiwi" Forex Bank Heist Plan (Scalping/Day)🌟Hi! Hola! Ola! Bonjour! Hallo! Marhaba!🌟

Dear Money Makers & Robbers, 🤑💰✈️

Based on 🔥Thief Trading style technical and fundamental analysis🔥, here is our master plan to heist the AUD/NZD "Aussie vs Kiwi" Forex Market. Please adhere to the strategy I've outlined in the chart, which emphasizes short entry. Our aim is the high-risk GREEN Zone. Risky level, oversold market, consolidation, trend reversal, trap at the level where traders and bullish robbers are stronger. 🏆💸"Take profit and treat yourself, traders. You deserve it!💪🏆🎉

Entry 📈 : "The heist is on! Wait for the breakout then make your move at (1.07300) - Bearish profits await!"

however I advise to Place sell stop orders below the Breakout level (or) after the breakout of Support level Place sell limit orders within a 15 or 30 minute timeframe most NEAREST (or) SWING low or high level for Pullback entries.

📌I strongly advise you to set an "alert (Alarm)" on your chart so you can see when the breakout entry occurs.

Stop Loss 🛑: "🔊 Yo, listen up! 🗣️ If you're lookin' to get in on a sell stop order, don't even think about settin' that stop loss till after the breakout 🚀. You feel me? Now, if you're smart, you'll place that stop loss where I told you to 📍, but if you're a rebel, you can put it wherever you like 🤪 - just don't say I didn't warn you ⚠️. You're playin' with fire 🔥, and it's your risk, not mine 👊."

📌Thief SL placed at the nearest/swing High or Low level Using the 4H timeframe (1.07800) Day/Scalping trade basis.

📌SL is based on your risk of the trade, lot size and how many multiple orders you have to take.

Target 🎯: 1.06600

💰💵💸AUD/NZD "Aussie vs Kiwi" Forex Market Heist Plan (Scalping/Day Trade) is currently experiencing a Bearish trend.., driven by several key factors.👇👇👇

📰🗞️Get & Read the Fundamental, Macro, COT Report, Quantitative Analysis, Sentimental Outlook, Intermarket Analysis, Future trend targets... go ahead to check 👉👉👉🔗🔗

⚠️Trading Alert : News Releases and Position Management 📰 🗞️ 🚫🚏

As a reminder, news releases can have a significant impact on market prices and volatility. To minimize potential losses and protect your running positions,

we recommend the following:

Avoid taking new trades during news releases

Use trailing stop-loss orders to protect your running positions and lock in profits

💖Supporting our robbery plan 💥Hit the Boost Button💥 will enable us to effortlessly make and steal money 💰💵. Boost the strength of our robbery team. Every day in this market make money with ease by using the Thief Trading Style.🏆💪🤝❤️🎉🚀

I'll see you soon with another heist plan, so stay tuned 🤑🐱👤🤗🤩

AUD/NZD "Aussie-Kiwi" Forex Bank Heist Plan (Swing/Day)🌟Hi! Hola! Ola! Bonjour! Hallo! Marhaba!🌟

Dear Money Makers & Robbers, 🤑 💰💸✈️

Based on 🔥Thief Trading style technical and fundamental analysis🔥, here is our master plan to heist the AUD/NZD "Aussie-Kiwi" Forex Bank. Please adhere to the strategy I've outlined in the chart, which emphasizes long entry. Our aim is the high-risk ATR Red Zone. It's Risky level, overbought market, consolidation, trend reversal, trap at the level where traders and bearish robbers are stronger. 🏆💸"Take profit and treat yourself, traders. You deserve it!💪🏆🎉

Entry 📈 : "The heist is on! Wait for the MA breakout then make your move - Bullish profits await!"

however I advise to Place Buy stop orders above the Moving average 1.10400 (or) Place buy limit orders within a 15 or 30 minute timeframe most recent or swing, low or high level.

📌I strongly advise you to set an "alert (Alarm)" on your chart so you can see when the breakout entry occurs.

Stop Loss 🛑:

Thief SL placed at the nearest / swing low level Using the 4H timeframe (1.09700) Day / swing trade basis.

SL is based on your risk of the trade, lot size and how many multiple orders you have to take.

🏴☠️Target 🎯: 1.11700 (or) Escape Before the Target

🧲Scalpers, take note 👀 : only scalp on the Long side. If you have a lot of money, you can go straight away; if not, you can join swing traders and carry out the robbery plan. Use trailing SL to safeguard your money 💰.

💵💰AUD/NZD "Aussie-Kiwi" Forex Bank Heist Plan (Swing / Day Trade) is currently experiencing a bullishness,., driven by several key factors.

📰🗞️Get & Read the Fundamental, Macro, COT Report, Quantitative Analysis, Sentimental Outlook, Intermarket Analysis, Future trend targets.... go ahead to check 👉👉👉🔗

⚠️Trading Alert : News Releases and Position Management 📰 🗞️ 🚫🚏

As a reminder, news releases can have a significant impact on market prices and volatility. To minimize potential losses and protect your running positions,

we recommend the following:

Avoid taking new trades during news releases

Use trailing stop-loss orders to protect your running positions and lock in profits

💖Supporting our robbery plan 💥Hit the Boost Button💥 will enable us to effortlessly make and steal money 💰💵. Boost the strength of our robbery team. Every day in this market make money with ease by using the Thief Trading Style.🏆💪🤝❤️🎉🚀

I'll see you soon with another heist plan, so stay tuned 🤑🐱👤🤗🤩

Bullish Setup on AUD/USD – Are You In?Hi traders ! , Analyzing AUD/USD on the 1H timeframe, spotting a potential long entry :

🔹 Entry: 0.62851

🔹 TP: 0.63934 🎯

🔹 SL: 0.61863 🔻

AUD/USD is respecting the lower boundary of the ascending channel and bouncing off support. If this trend continues, we could see a push toward 0.63934. RSI is neutral, leaving room for further upside.

⚠️ DISCLAIMER: This is not financial advice. Every trader makes their own decision.

We’re bullish on AUDUSDTechnical Analysis

AUDUSD lies below 50 - period SMA (0.6324, declining) and 100 - day SMA (0.6512, falling), indicating a downward trend yet short - term upside potential. January 2025 RSI bullish divergence shows weakening downward momentum. Break above 0.6340 could push it to 0.6400; otherwise, it may range 0.6131 - 0.6302.

Economic Fundamentals

Australia: Its economic growth, inflation and export prices affect the Aussie. Growth aids appreciation; inflation undermines it. Higher resource prices boost the currency.

US: Strong US data strengthens the dollar, weakening AUD/USD; weak data has the opposite effect.

Market & Geopolitical Factors

High risk appetite benefits the Aussie; low appetite favors the dollar. Geopolitical tensions prompt a flight to the dollar, hurting the Aussie.

💎💎💎 AUDUSD 💎💎💎

🎁 Buy@0.62500 - 0.62800

🎁 TP 0.63500 - 0.64000

The market has been extremely volatile lately. If you can't figure out the market's direction, you'll only be a cash dispenser for others. If you also want to succeed,Follow the link below to get my daily strategy updates

AUD/NZD Made Double Bottom , Long Setup To Get 150 Pips !This Is An Educational + Analytic Content That Will Teach Why And How To Enter A Trade

Make Sure You Watch The Price Action Closely In Each Analysis As This Is A Very Important Part Of Our Method

Disclaimer : This Analysis Can Change At Anytime Without Notice And It Is Only For The Purpose Of Assisting Traders To Make Independent Investments Decisions.

AUD/NZD "Aussie vs Kiwi" Forex Market Heist Plan🌟Hi! Hola! Ola! Bonjour! Hallo! Marhaba!🌟

⚔Dear Money Makers & Thieves, 🤑 💰✈️

Based on 🔥Thief Trading style technical and fundamental analysis🔥, here is our master plan to heist the AUD/NZD "Aussie vs Kiwi" Forex Market. Please adhere to the strategy I've outlined in the chart, which emphasizes short entry. Our aim is the high-risk Green Zone. Risky level, oversold market, consolidation, trend reversal, trap at the level where traders and bullish thieves are getting stronger. 🏆💸Book Profits Be wealthy and safe trade.💪🏆🎉

Entry 📈 : "The heist is on! Wait for the breakout (1.09900) then make your move - Bearish profits await!" however I advise placing Sell Stop Orders below the breakout MA or Place Sell limit orders within a 15 or 30 minute timeframe. Entry from the most recent or Swing high or low level should be in retest.

📌I strongly advise you to set an alert on your chart so you can see when the breakout entry occurs.

Stop Loss 🛑: Thief SL placed at (1.10500) swing Trade Basis Using the 4H period, the recent / swing high or low level.

SL is based on your risk of the trade, lot size and how many multiple orders you have to take.

🏴☠️Target 🎯: 1.09400 (or) Escape Before the Target

🧲Scalpers, take note 👀 : only scalp on the Short side. If you have a lot of money, you can go straight away; if not, you can join swing traders and carry out the robbery plan. Use trailing SL to safeguard your money 💰.

AUD/NZD "Aussie vs Kiwi" Forex Market is currently experiencing a Neutral trend (higher chance to 🐻🐼Bearishness)., driven by several key factors.

📰🗞️Get & Read the Fundamental, Macro Economics, COT Report, Quantitative Analysis, Intermarket Analysis, Sentimental Outlook, Future Trend Move:

Before start the heist plan read it.👉👉👉

📌Keep in mind that these factors can change rapidly, and it's essential to stay up-to-date with market developments and adjust your analysis accordingly.

⚠️Trading Alert : News Releases and Position Management 📰 🗞️ 🚫🚏

As a reminder, news releases can have a significant impact on market prices and volatility. To minimize potential losses and protect your running positions,

we recommend the following:

Avoid taking new trades during news releases

Use trailing stop-loss orders to protect your running positions and lock in profits

💖Supporting our robbery plan 💥Hit the Boost Button💥 will enable us to effortlessly make and steal money 💰💵. Boost the strength of our robbery team. Every day in this market make money with ease by using the Thief Trading Style.🏆💪🤝❤️🎉🚀

I'll see you soon with another heist plan, so stay tuned 🤑🐱👤🤗🤩