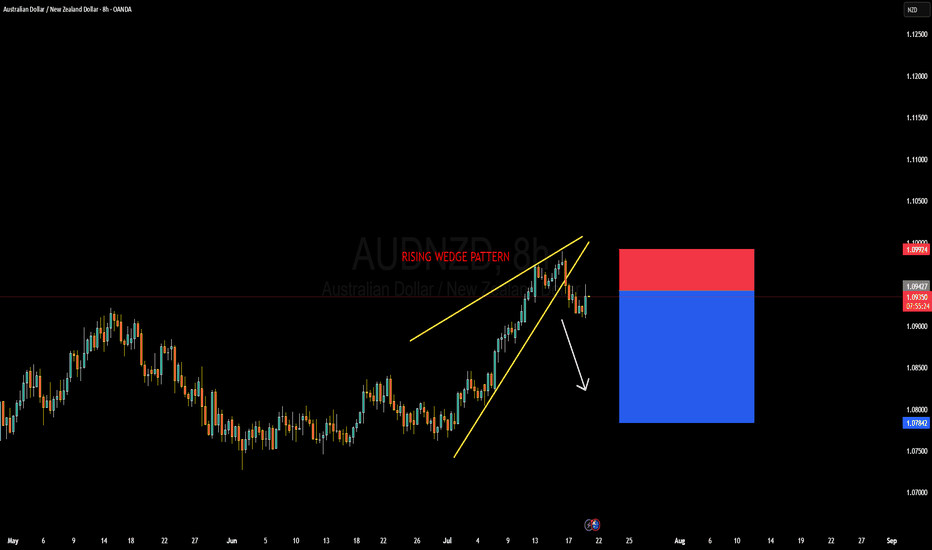

AUDNZD Forming Rising Wedge PatternAUDNZD has formed a textbook rising wedge pattern on the 8H chart and has now broken to the downside, signaling potential bearish continuation. This setup typically indicates a loss of momentum in the prevailing bullish trend, and with the clean structure break now confirmed, the bears seem ready to take control. I’ve already entered short positions from the top edge of the pattern and am currently floating in profit, anticipating further downside toward the 1.0780–1.0800 zone.

From a fundamental perspective, the Australian dollar has been relatively stable but lacks a strong bullish catalyst at this point. The Reserve Bank of Australia is holding a cautious tone amid mixed inflation signals, while New Zealand’s economy is showing signs of potential resilience. The RBNZ remains committed to tighter monetary conditions for longer as inflation continues to hover above their comfort zone, which provides some support to NZD in the near term.

Technically, the break of the lower wedge support is significant. Price failed to sustain higher highs near 1.1000 and quickly retraced, showing bearish rejection. With the RSI diverging and volume fading near the top of the wedge, this was a high-probability reversal zone. As long as price stays below 1.0950, the bias remains bearish, and further sell pressure is expected.

I'm targeting 1.0780 as the next key liquidity level. It aligns with previous structure support and provides a favorable risk-to-reward setup. This setup is a clear example of price-action-driven reversal trading, paired with macroeconomic alignment. I’ll continue to trail stops as price progresses, but so far, AUDNZD is playing out exactly as anticipated.

Audnzdlong

AUD/USD at Critical Resistance — Bearish Outlook Below 0.65381. Major Resistance Zone: 0.65380

Price is currently testing a strong horizontal resistance level at 0.65380, a level that has been tested multiple times (as shown by the pink circles).

This level has acted as a historical turning point, which increases its significance.

2. Price Structure: Lower Highs and Equal Highs

The chart reveals a potential double top or distribution pattern, forming under the 0.65380 resistance.

This suggests weakening bullish momentum and increases the probability of a bearish reversal.

3. Projected Bearish Path (White Dotted Lines):

If price fails to break above 0.65380 decisively, the expected move is a stepwise decline.

The projected path targets several support levels:

0.65003

0.64647

0.64213

0.63957

Final target: 0.63627, a key support from early May.

4. Support & Resistance Zones:

Resistance Levels:

0.65380 (Major)

0.65003

Support Levels (Sequential Targets):

0.64647

0.64213

0.63957

0.63627

5. Confluence with Fundamentals:

U.S. economic events (highlighted at the bottom with calendar icons) may act as volatility triggers, potentially accelerating this move.

✅ Summary & Trading Implications:

Bias: Bearish below 0.65380

Trade Idea: Watch for rejection at resistance or break below 0.65003 for confirmation.

Bearish Targets: Gradual move toward 0.63627 with key pauses at intermediate support levels.

Invalidation: Daily close above 0.65380 would negate the bearish setup and open potential for new highs.

Watch This Wedge! AUDNZD Primed for Upside PushThe AUDNZD pair forms a falling wedge pattern, a bullish reversal formation that typically occurs after a downtrend. The price action is being squeezed between a descending resistance line and a descending support line, creating a narrowing range. The market is now attempting to break out of the wedge, with the current price testing the resistance line. A breakout and close above this trendline would signal bullish strength and could lead to a reversal of the recent downtrend.

Targets:

TP1: 1.07605

TP2: 1.07922

Stop Loss: Below the recent low at 1.06542

AUDNZD Rejected – CPI & RBA Dovish Bias Pressures AussieKey Resistance Zone: 1.0780 – 1.0800

The pair tested this area twice and failed to break above, forming a clear double-top pattern. This is a bearish signal suggesting buyers are exhausted.

Price Action:

A strong bearish rejection candle followed the second resistance test, aligning with historical resistance and structure. The pair is now showing signs of reversal.

Support Levels to Watch:

🥅 Target 1: 1.0707 – Previous consolidation zone

🥅 Target 2: 1.0677 – Key swing low

📉 Stop Loss: Above 1.0800

Pattern: Rising wedge structure breaking down, signaling downside continuation.

🔍 Fundamental Analysis

🇦🇺 Australia (AUD) – Weakness Potential

RBA’s Dovish Leaning:

RBA Assistant Governor Kent emphasized external FX market risks and cautious positioning on monetary tightening, which dampens rate hike expectations【source: RBA speech】.

Key Data Incoming:

April 30: Quarterly CPI data

Forecasts suggest core inflation might ease, reducing pressure on the RBA to act. If CPI undershoots, it could trigger AUD selling.

AUD also faces pressure from global growth fears and risk-off sentiment.

🇳🇿 New Zealand (NZD) – Relative Strength

While the RBNZ has already started easing, the NZD has shown resilience amid improving trade balance and stable economic performance.

NZ Business Confidence is also due, which could influence near-term NZD moves, but broader positioning supports the Kiwi.

🧠 Sentiment Overview

The risk-reward favors shorts here:

Clear technical rejection

Bearish macro backdrop for AUD

Relative NZD strength

CPI data will be the key catalyst, and positioning ahead of it looks justified given current chart structure.

📝 Conclusion:

AUDNZD looks primed for a downside correction after repeated rejections at a major resistance zone. With dovish RBA commentary and potential soft inflation data ahead, short setups are favored with targets at 1.0707 and 1.0677.

AUD/NZD "Aussie-Kiwi" Forex Bank Heist Plan (Swing/Day)🌟Hi! Hola! Ola! Bonjour! Hallo! Marhaba!🌟

Dear Money Makers & Robbers, 🤑 💰💸✈️

Based on 🔥Thief Trading style technical and fundamental analysis🔥, here is our master plan to heist the AUD/NZD "Aussie-Kiwi" Forex Bank. Please adhere to the strategy I've outlined in the chart, which emphasizes long entry. Our aim is the high-risk ATR Red Zone. It's Risky level, overbought market, consolidation, trend reversal, trap at the level where traders and bearish robbers are stronger. 🏆💸"Take profit and treat yourself, traders. You deserve it!💪🏆🎉

Entry 📈 : "The heist is on! Wait for the MA breakout then make your move - Bullish profits await!"

however I advise to Place Buy stop orders above the Moving average 1.10400 (or) Place buy limit orders within a 15 or 30 minute timeframe most recent or swing, low or high level.

📌I strongly advise you to set an "alert (Alarm)" on your chart so you can see when the breakout entry occurs.

Stop Loss 🛑:

Thief SL placed at the nearest / swing low level Using the 4H timeframe (1.09700) Day / swing trade basis.

SL is based on your risk of the trade, lot size and how many multiple orders you have to take.

🏴☠️Target 🎯: 1.11700 (or) Escape Before the Target

🧲Scalpers, take note 👀 : only scalp on the Long side. If you have a lot of money, you can go straight away; if not, you can join swing traders and carry out the robbery plan. Use trailing SL to safeguard your money 💰.

💵💰AUD/NZD "Aussie-Kiwi" Forex Bank Heist Plan (Swing / Day Trade) is currently experiencing a bullishness,., driven by several key factors.

📰🗞️Get & Read the Fundamental, Macro, COT Report, Quantitative Analysis, Sentimental Outlook, Intermarket Analysis, Future trend targets.... go ahead to check 👉👉👉🔗

⚠️Trading Alert : News Releases and Position Management 📰 🗞️ 🚫🚏

As a reminder, news releases can have a significant impact on market prices and volatility. To minimize potential losses and protect your running positions,

we recommend the following:

Avoid taking new trades during news releases

Use trailing stop-loss orders to protect your running positions and lock in profits

💖Supporting our robbery plan 💥Hit the Boost Button💥 will enable us to effortlessly make and steal money 💰💵. Boost the strength of our robbery team. Every day in this market make money with ease by using the Thief Trading Style.🏆💪🤝❤️🎉🚀

I'll see you soon with another heist plan, so stay tuned 🤑🐱👤🤗🤩

We’re bullish on AUDUSDTechnical Analysis

AUDUSD lies below 50 - period SMA (0.6324, declining) and 100 - day SMA (0.6512, falling), indicating a downward trend yet short - term upside potential. January 2025 RSI bullish divergence shows weakening downward momentum. Break above 0.6340 could push it to 0.6400; otherwise, it may range 0.6131 - 0.6302.

Economic Fundamentals

Australia: Its economic growth, inflation and export prices affect the Aussie. Growth aids appreciation; inflation undermines it. Higher resource prices boost the currency.

US: Strong US data strengthens the dollar, weakening AUD/USD; weak data has the opposite effect.

Market & Geopolitical Factors

High risk appetite benefits the Aussie; low appetite favors the dollar. Geopolitical tensions prompt a flight to the dollar, hurting the Aussie.

💎💎💎 AUDUSD 💎💎💎

🎁 Buy@0.62500 - 0.62800

🎁 TP 0.63500 - 0.64000

The market has been extremely volatile lately. If you can't figure out the market's direction, you'll only be a cash dispenser for others. If you also want to succeed,Follow the link below to get my daily strategy updates

AUD/NZD Made Double Bottom , Long Setup To Get 150 Pips !This Is An Educational + Analytic Content That Will Teach Why And How To Enter A Trade

Make Sure You Watch The Price Action Closely In Each Analysis As This Is A Very Important Part Of Our Method

Disclaimer : This Analysis Can Change At Anytime Without Notice And It Is Only For The Purpose Of Assisting Traders To Make Independent Investments Decisions.

AUDNZD at Key Support Level - Rebound Towards 1.10100?OANDA:AUDNZD has reached a significant support zone, highlighted by previous price reactions and strong buying interest. This area has previously acted as a key demand zone, increasing the likelihood of a bounce if buyers step in.

The current market structure suggests that if the price confirms support within this zone, we could see a bullish reversal. A successful rebound could push the pair toward the 1.10100 level, a logical target based on previous price behavior and current market dynamics. Monitoring candlestick patterns and volume at this critical zone is essential for identifying buying opportunities.

Just my take on support and resistance zones, not financial advice. Always confirm your setups and trade with solid risk management.

Best of luck!

AUDNZD – Potential Long from Key Support ZoneOANDA:AUDNZD is approaching a key demand zone, which has previously led to bullish reversals. The recent downward move brings price into this support area, signaling a potential opportunity for buyers to step in.

A bullish confirmation, such as a strong rejection pattern, bullish engulfing candle, or long lower wick, would support the likelihood of an upward move. If buyers regain control, the price could rally toward 1.10500.

This is not financial advice but rather how I approach support/resistance zones. Remember, always wait for confirmation, like a rejection candle or volume spike before jumping in.

Please boost this post, every like and comment drives me to bring you more ideas! I’d love to hear your perspective in the comments.

Best of luck , TrendDiva

AUDNZD is in The Bearish DirectionHello Traders

In This Chart AUDNZD 4 HOURLY Forex Forecast By FOREX PLANET

today AUDNZD analysis 👆

🟢This Chart includes AUDNZD market update)

🟢What is The Next Opportunity on AUDNZD Market

🟢how to Enter to the Valid Entry With Assurance Profit

This CHART is For Trader's that Want to Improve Their Technical Analysis Skills and Their Trading By Understanding How To Analyze The Market Using Multiple Timeframes and Understanding The Bigger Picture on the Charts

AUDNZD: An Active Buy Opportunity BreakdownIn this video, we dive into the AUDNZD pair to showcase an active trade setup and the reasoning behind it. This is more than just a trade—it’s about understanding the bigger picture and how the market behaves in consolidation.

📊 Key Breakdown Highlights:

• Higher Timeframe View: AUDNZD has been consolidating within a range from 1.1091 to 1.0963, with clear liquidity sweeps on both ends.

• Daily Market Structure: Recent higher lows indicate bullish momentum, with strong support forming around 1.1042. Liquidity sweeps at 1.0969 and 1.0935 have set the stage for a potential upward move.

• Lower Timeframe Entry: The M30 and H4 charts confirm strong volume and impulse moves, breaking above key resistance levels at 1.1064 and retesting for continuation.

• Targeting Liquidity Zones: The trade is currently targeting 1.1092, with potential to climb further toward 1.1173 based on overall market structure.

🎯 Key Lessons:

• Markets often range 75-80% of the time—your edge lies in recognizing structure within consolidation.

• The market always seeks liquidity; understanding this dynamic can give you an advantage in trade placement and execution.

• Volume and structure alignment are crucial for confident trade decisions.

Do you have the patience to identify and execute trades like this, or are you still chasing every impulse? Watch the full breakdown to level up your understanding.

👉 Watch the full video and share your thoughts in the comments below. Let’s trade smarter, not harder.

AUD/NZD "Aussie vs Kiwi" Forex Market Heist Plan on Bullish🌟Hi! Hola! Ola! Bonjour! Hallo!🌟

Dear Money Makers & Robbers, 🤑 💰

Based on 🔥Thief Trading style technical and fundamental analysis🔥, here is our master plan to heist the AUD/NZD "Aussie vs Kiwi" Forex market. Please adhere to the strategy I've outlined in the chart, which emphasizes long entry. Our aim is the high-risk Red Zone. Risky level, overbought market, consolidation, trend reversal, trap at the level where traders and bearish robbers are stronger. 👀 Be wealthy and safe trade.💪🏆🎉

Entry 📈 : You can enter a Bull trade at any point,

however I advise placing Buy limit orders within a 15 or 30 minute timeframe. Entry from the most recent or closest low or high level should be in retest.

Stop Loss 🛑: Using the 2h period, the recent / nearest low or high level.

Goal 🎯: 1.11370 (or) Escape before the target

Scalpers, take note : only scalp on the Long side. If you have a lot of money, you can go straight away; if not, you can join swing traders and carry out the robbery plan. Use trailing SL to safeguard your money 💰.

Warning⚠️ : Our heist strategy is incompatible with Fundamental Analysis news 📰 🗞️. We'll wreck our plan by smashing the Stop Loss 🚫🚏. Avoid entering the market right after the news release.

Fundamental Outlook 📰🗞️

Based on the fundamental analysis, I would conclude that the AUD/NZD (Australian Dollar/New Zealand Dollar) pair is : Bullish

Reasons:

Australian economic growth: Australia's economy is expected to grow at a rate of 2.5% in 2023, driven by a strong labor market, increasing business investment, and a rebound in the housing market.

Commodity prices: Australia is a major exporter of commodities such as iron ore, coal, and gold, and increasing prices for these commodities are expected to support the Australian dollar.

Interest rate differential: The Reserve Bank of Australia (RBA) has kept interest rates at a relatively high level of 1.5%, while the Reserve Bank of New Zealand (RBNZ) has kept interest rates at a low level of 1.0%, which could lead to a stronger Australian dollar.

New Zealand economic slowdown: New Zealand's economy is expected to slow down in 2023, due to a decline in dairy prices and a decrease in consumer spending.

Trade agreements: Australia has been signing trade agreements with other countries, which could improve the country's trade balance and support the Australian dollar.

However, it's essential to consider the following risks:

Global economic slowdown: A slowdown in global economic growth could reduce demand for the Australian dollar and drive down the pair.

China's economic slowdown: China is Australia's largest trading partner, and a slowdown in China's economy could impact Australia's economy and the Australian dollar.

New Zealand economic growth: If New Zealand's economy grows more quickly than expected, it could lead to a stronger New Zealand dollar and a weaker Australian dollar.

Bullish Factors:

Increasing demand for the Australian dollar, driven by growing investment demand and commodity prices.

Decreasing demand for the New Zealand dollar, driven by declining dairy prices and weak consumer spending.

Potential for a decline in the New Zealand dollar, driven by a dovish Reserve Bank of New Zealand and weak economic growth.

Strong Australian economic growth, driven by strong commodity prices and investment.

Diversification benefits of investing in the Australian market, which can reduce portfolio risk and increase returns.

Market Sentiment:

Bullish sentiment: 75%

Bearish sentiment: 25%

Neutral sentiment: 0%

Please note that this is a general analysis and not personalized investment advice. It's essential to consider your own risk tolerance and market analysis before making any investment decisions.

Take advantage of the target and get away 🎯 Swing Traders Please reserve the half amount of money and watch for the next dynamic level or order block breakout. Once it is resolved, we can go on to the next new target in our heist plan.

Keep in mind that these factors can change rapidly, and it's essential to stay up-to-date with market developments and adjust your analysis accordingly.

💖Supporting our robbery plan will enable us to effortlessly make and steal money 💰💵 Tell your friends, Colleagues and family to follow, like, and share. Boost the strength of our robbery team. Every day in this market make money with ease by using the Thief Trading Style.🏆💪🤝❤️🎉🚀

I'll see you soon with another heist plan, so stay tuned 🫂

AUDNZD Scenario 2.1.2025We have two scenarios here so far if it doesn't break through resistance, we could think about sfp above high and then short direction or we break through this resistance at price 1.109280 and if the market creates sfp below low at this price, a long setup is possible, but considering that I have predictions for aud and nzd bullish, I'm waiting.

AUDNZD - Look for a short !!Hello traders!

‼️ This is my perspective on AUDNZD.

Technical analysis: Here we are in a bearish market structure from 4H timeframe perspective, so I look for a short. My point of interest is imbalance filled + rejection from bearish OB.

Like, comment and subscribe to be in touch with my content!

AUDNZD Analysis - Bullish - Trade 07AUDNZD Analysis Overview

---

1. Seasonality

AUD: Strong **buy** signal for the first week of December, suggesting upward momentum.

NZD: Range-bound signal, indicating weaker performance compared to AUD.

Seasonality Bias: Buy AUDNZD.

---

2. COT Report

AUD:

COT RSI : Decreasing from the top but still indicates bullish positioning.

COT Index : Near the top, signaling strong institutional interest in AUD.

Net Non-Commercial : Increasing, aligning with a buy sentiment.

NZD :

COT RSI : At the bottom (0%), but overall positioning is weak.

COT Index : Bottomed at 0%, reflecting limited institutional support for NZD.

Net Non-Commercial : Decreasing, suggesting bearish momentum.

COT Bias: Buy AUDNZD.

---

3. Fundamental Analysis

Leading Economic Indicators (LEI) :

AUD : Increasing, pointing to improving economic conditions.

NZD : Increasing, but weaker overall impact compared to AUD.

Endogenous Factors:

AUD : Mix to decreasing, but seasonal strength supports AUD’s buy case.

NZD : Increasing, but weaker compared to AUD.

Exogenous Factors :

AUDNZD exogenous signal supports a buy AUD, sell NZD bias.

Fundamental Bias: Buy AUDNZD.

---

4. Technical Analysis

RSI Divergence: Bullish divergence spotted on the 4H timeframe, signaling potential upward movement.

Parallel Channel : Price is at the bottom of a bearish parallel channel, indicating possible reversal to the upside.

Daily Support : Currently holding above a strong daily support zone, reinforcing the bullish setup.

Technical Bias: Buy AUDNZD.

---

Final Bias: Buy AUDNZD

All factors—seasonality, COT data, fundamentals, and technicals—align in favor of a BUY setup for AUDNZD. This pair shows potential for upward movement, supported by strong economic and technical signals.