Audusdanalysis

AUDUSD(20250807)Today's AnalysisMarket News:

Federal Reserve Chairman Neel Kashkari: A rate cut may be appropriate in the short term, and two rate cuts this year are reasonable. Trump: The new Fed governor will likely be temporary, and the appointment will be announced within 2-3 days.

Technical Analysis:

Today's Buy/Sell Levels:

0.6489

Support and Resistance Levels:

0.6538

0.6520

0.6508

0.6470

0.6458

0.6440

Trading Strategy:

If the price breaks above 0.6508, consider a buy entry, with the first target at 0.6520. If the price breaks below 0.6489, consider a sell entry, with the first target at 0.6470

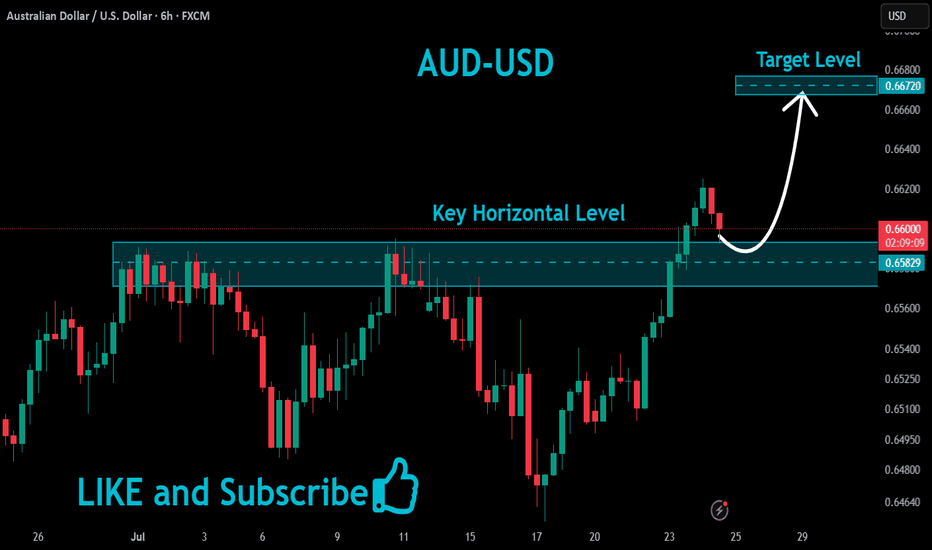

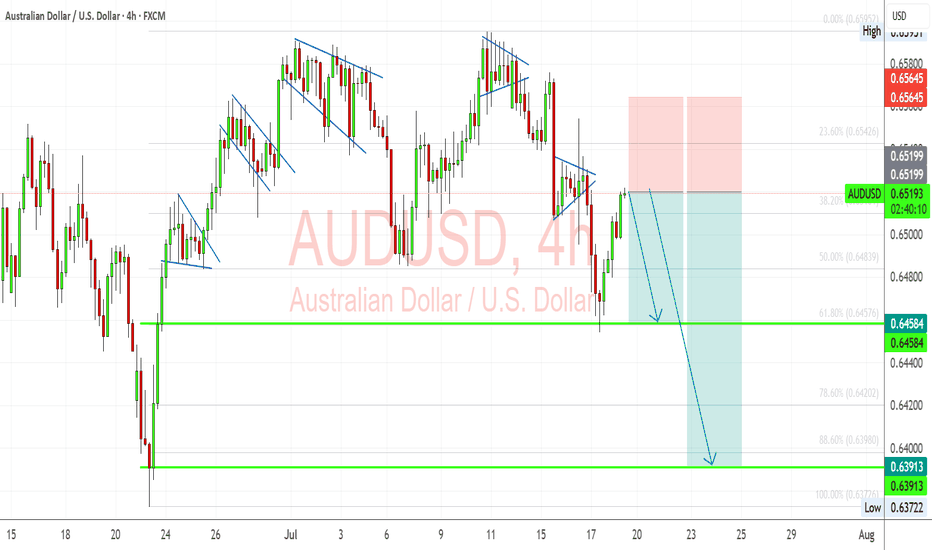

AUD/USD Bearish Setup-Trendline Breakout Signals Potential Drop📉 AUD/USD Bearish Setup – Trendline Breakout Signals Potential Drop!

The AUD/USD pair has broken below a key ascending trendline, signaling a shift in momentum from bullish to bearish.

🔍 Key Highlights:

Price was previously trading within an ascending channel.

Strong resistance was confirmed around the 0.6619 level.

A decisive break of the trendline and the key support zone (0.6500) now points to increased bearish pressure.

Market is currently retesting the broken support zone, which may act as new resistance before the next leg down.

🎯 Target Point: 0.6371

If bearish momentum continues, we anticipate price to move toward the target support zone near 0.6371, offering a solid risk-reward setup.

📌 Watch For: Bearish confirmation on retest + momentum indicators aligning to the downside.

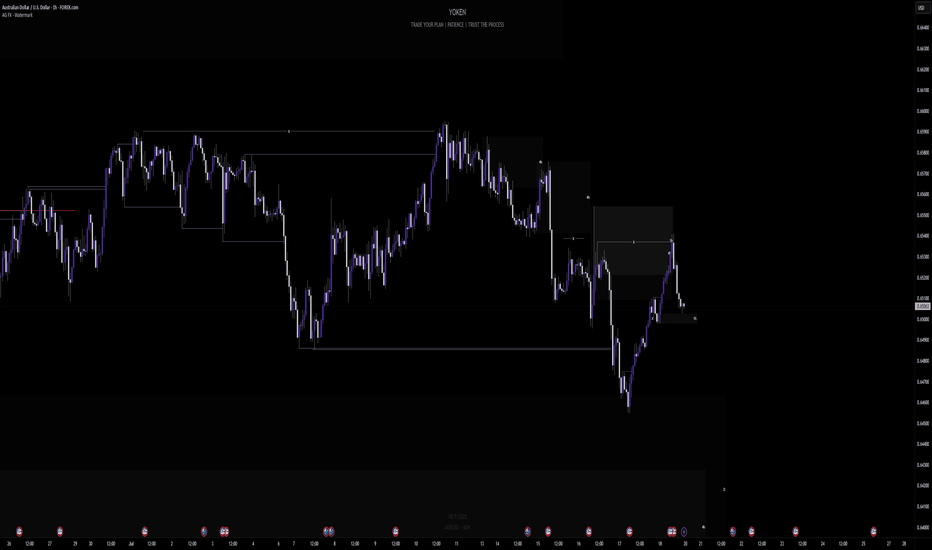

AUDUSD – SHORT POSITION TRADE BREAKDOWN Q3 | W32 | D6 | Y25📊 AUDUSD – SHORT POSITION TRADE BREAKDOWN

Q3 | W32 | D6 | Y25

Daily Forecast 🔍📅

Here’s a short diagnosis of the current chart setup 🧠📈

Higher time frame order blocks have been identified — these are our patient points of interest 🎯🧭.

It’s crucial to wait for a confirmed break of structure 🧱✅ before forming a directional bias.

This keeps us disciplined and aligned with what price action is truly telling us.

📈 Risk Management Protocols

🔑 Core principles:

Max 1% risk per trade

Only execute at pre-identified levels

Use alerts, not emotion

Stick to your RR plan — minimum 1:2

🧠 You’re not paid for how many trades you take, you’re paid for how well you manage risk.

🧠 Weekly FRGNT Insight

"Trade what the market gives, not what your ego wants."

Stay mechanical. Stay focused. Let the probabilities work.

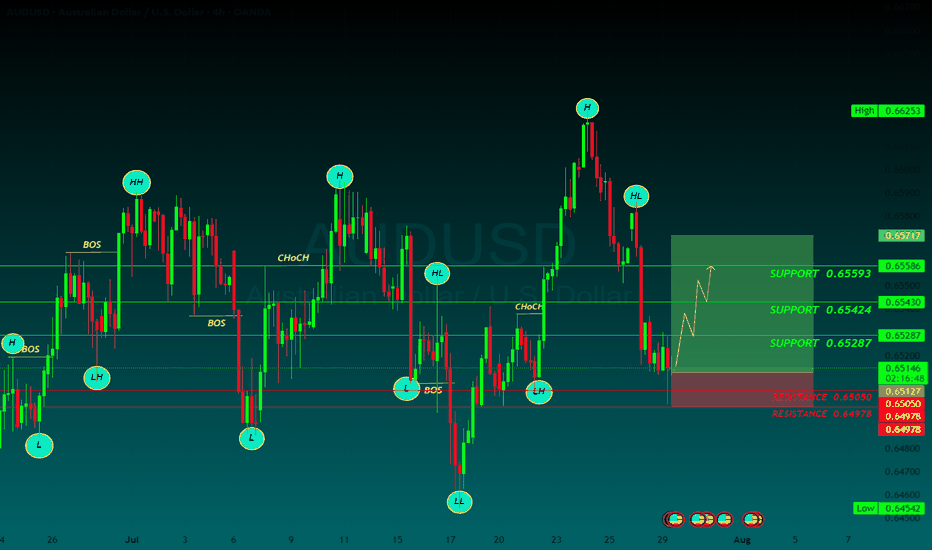

AUD/USD) Bearish Trend Read The captionSMC Trading point update

Technical analysis of AUD/USD (Australian Dollar / U.S. Dollar) on the 4-hour timeframe, with a likely setup for further downside. Here's a breakdown of the idea:

---

Technical Summary

Pair: AUD/USD

Timeframe: 4H

Current Price: 0.64688

EMA 200: 0.65140 (price is below = bearish bias)

RSI (14): 48.23 (neutral to slightly bearish)

--

Key Observations

1. Break of Trendline:

The previous ascending trendline (black) was broken to the downside.

This indicates a shift in market structure from bullish to bearish.

2. Resistance Rejection Zone:

Price recently retested a strong supply/resistance zone (yellow box near 0.65140) and was rejected.

This aligns with the 200 EMA → strong confluence for a sell setup.

3. Market Structure:

Price is forming lower highs, indicating sellers are gaining control.

The chart shows a projection of a bearish continuation pattern (zig-zag decline).

4. Target Zone:

Final target marked near 0.63700–0.63699, a previous support level.

This gives the setup a decent risk-reward ratio if the rejection holds.

5. RSI:

RSI is below 50, suggesting bearish momentum, but not oversold—still room to move down.

Mr SMC Trading point

---

Conclusion & Trade Idea

Bias: Bearish

Sell Zone: Near the resistance area (0.65000–0.65150)

Target: 0.63700 zone

Stop Loss: Likely above 0.65200 (above resistance and EMA 200)

Confirmation: Price action forming lower highs and staying below EMA 200

Please support boost 🚀 this analysis)

AUDUSD BUY

AUD/USD rises to near 0.6480 as accelerating Fed dovish bets weigh on US Dollar

The AUD/USD pair moves higher to near 0.6480 during the European trading session on Monday. The Aussie pair gains as demand for risk-perceived assets has increased, following an increase in market expectations that the Fed could resume its monetary expansion cycle in the September meeting

The AUD/USD currency pair, commonly known as the “Aussie”, represents how many US dollars (the quote currency) are needed to purchase one Australian dollar (the base currency). Alongside the New Zealand Dollar (NZD) and the Canadian Dollar (CAD), the AUD is considered a commodity currency due to Australia’s significant exports of raw materials such as precious metals, Oil, and agricultural products.

The Reserve Bank of Australia (RBA) has historically maintained higher interest rates compared to other industrialized nations. Combined with the relatively high liquidity of the AUD, this has made the AUD attractive for carry traders looking for higher yields.

SUPPORT 0.64852

SUPPORT 0.65074

SUPPORT 0.65285

RESISTANCE 0.64498

AUDUSD(20250805)Today's AnalysisMarket News:

Goldman Sachs: The Federal Reserve is expected to cut interest rates by 25 basis points three times starting in September; a 50 basis point cut is possible if the unemployment rate rises further.

Technical Analysis:

Today's Buy/Sell Levels:

0.6470

Support and Resistance Levels:

0.6500

0.6489

0.6482

0.6459

0.6451

0.6440

Trading Strategy:

If the price breaks above 0.6470, consider buying, with the first target price at 0.6489. If the price breaks below 0.6459, consider selling, with the first target price at 0.6440.

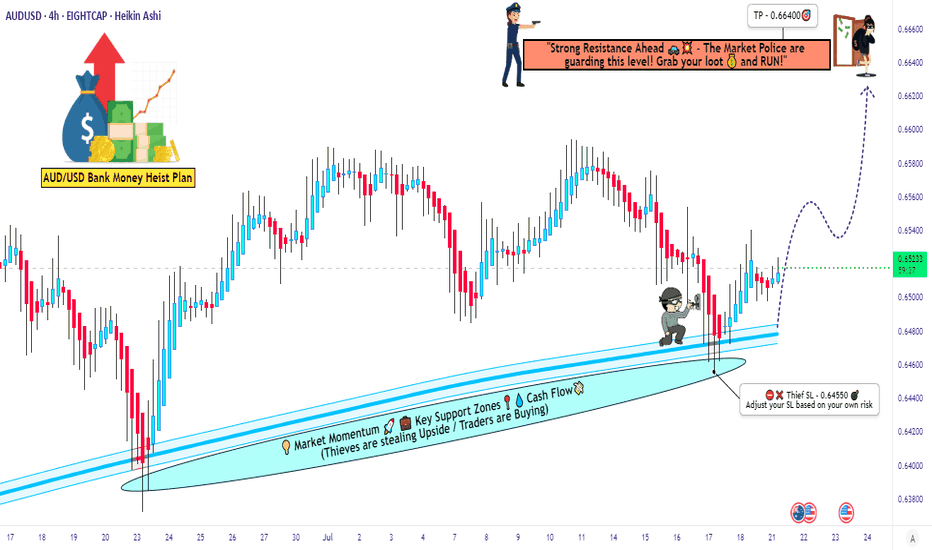

Ready for the Aussie Heist? Is This the Perfect Entry?🚨💰 - "The Aussie Vault Raid: Bullish Robbery in Progress!" 💰🚨

AUD/USD Forex Trade Idea (Thief Style Swing/Day Plan)

📈🔥 Designed for Thief Traders, Market Robbers & Money Makers Worldwide 🤑🐱👤💸

🌍 Hello Global Robbers!

🌟 Hola! Ola! Bonjour! Hallo! Salaam! Konnichiwa! 🌟

Welcome to another bold heist plan from the Thief Trading Crew. This one’s a high-stakes raid on the AUD/USD — "The Aussie" — using our signature Thief Trading Style, combining raw technical setups with real macro/fundamental edge. We're eyeing the Bullish Vault Breakout, so tighten up your gloves — it’s time to rob smart, not hard.

🔓💸 ENTRY PLAN – “The Vault is Unlocked!”

Grab the bullish loot at any valid price zone — but here’s how real thieves move:

📍 Recommended Entry Style:

Use Buy Limit Orders near local swing lows, demand zones, or key pullback entries on the 15m to 30m chart.

Execute DCA (Dollar Cost Averaging) / Layered Orders for more precision.

Align with your MA lines & candle structures for max confirmation.

🛑 STOP LOSS – “Escape Route Secured”

📍 SL hidden beneath recent swing lows below MA (on 4H):

🎯 Suggested Level: 0.64170

💡 Custom-fit your SL based on:

Trade size

Number of active positions

Account risk strategy

🎯 PROFIT TARGET – “Cash Out Before the Cops Show!”

🏴☠️ Take-Profit Zone: 0.66400

This is our bullish breakout reward zone — a high-value zone where profit meets safety.

🔍 MARKET OUTLOOK – "Cops Are Watching, but We're Ahead..."

📈 The AUD/USD market is flashing bullish momentum, supported by:

✅ Risk sentiment flow

✅ US Dollar weakness and rate expectations

✅ Intermarket signals from commodities (Gold/Iron)

✅ Positive macro positioning from smart money (via COT)

✅ Technical demand forming reversal patterns from oversold zones

📎 For a deeper breakdown —

📰 Fundamentals | COT Reports | Sentiment | Intermarket Analysis — Check Klick 🔗

⚠️ THIEF ALERT – “Avoid Sirens. Watch the News.”

Stay out of trouble by following these protocols during major news events:

🚫 Don’t enter trades blindly before/after big news

📍 Use trailing stops to protect gains

🔄 Adjust SL/TP if price nears breakout points during volatility

💥 SUPPORT THE CREW – “Smash That Boost Button!”

Love the plan? Then Boost this chart to show love for the Thief Trading Movement.

Every like, comment, and boost adds power to our robbery network across the globe. 🌍❤️💰

⚖️ DISCLAIMER – “Not Financial Advice, Just Thief Vibes”

📌 This analysis is for educational and entertainment purposes only.

📌 Trade at your own risk and always do your own analysis.

📌 Market moves fast — stay sharp, stay stealthy.

**🎭 See you at the next heist.

Until then, trade rich. Rob wise.

Thief Trader out. 🐱👤💰📉📈**

AUDUSD: Dropping To the Weekly FVG, As Expected!In this video, we will analyze the following FX market for July 31 - Aug 1st.

AUDUSD

Been waiting and watching for this move, and we've tracked it for weeks! It's happening now!

Look for it to continue until we reach the +FVG!

Enjoy!

May profits be upon you.

Leave any questions or comments in the comment section.

I appreciate any feedback from my viewers!

Like and/or subscribe if you want more accurate analysis.

Thank you so much!

Disclaimer:

I do not provide personal investment advice and I am not a qualified licensed investment advisor.

All information found here, including any ideas, opinions, views, predictions, forecasts, commentaries, suggestions, expressed or implied herein, are for informational, entertainment or educational purposes only and should not be construed as personal investment advice. While the information provided is believed to be accurate, it may include errors or inaccuracies.

I will not and cannot be held liable for any actions you take as a result of anything you read here.

Conduct your own due diligence, or consult a licensed financial advisor or broker before making any and all investment decisions. Any investments, trades, speculations, or decisions made on the basis of any information found on this channel, expressed or implied herein, are committed at your own risk, financial or otherwise.

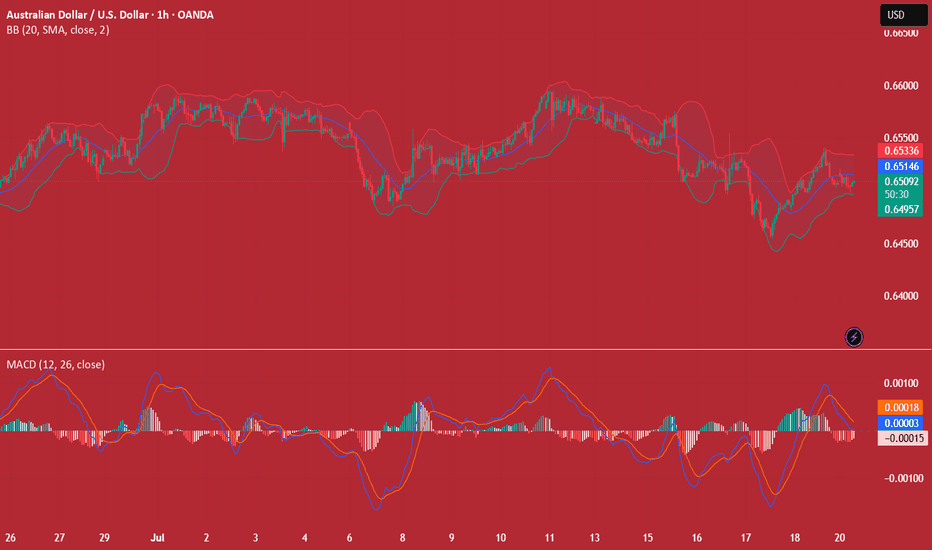

AUDUSD Will Keep Falling!

HI,Traders !

#AUDUSD keeps falling down

And the pair made a strong

Bearish breakout of the key

Horizontal key level of 0.64796

And the breakout is confirmed

So we are bearish biased and

We will be expecting a further

Bearish move down !

Comment and subscribe to help us grow !

AUDUSD 2 step liquidity grab and drop?AUDUSD 4h has rejected twice from a key area after yesterday's massive breakdown with AUD negative data. Price has done a narrow pullback then this session is rejecting again with a stronger momentum could continue to drop to support. As 4h price action showing strong bearish move we may see continuation of the down trend!

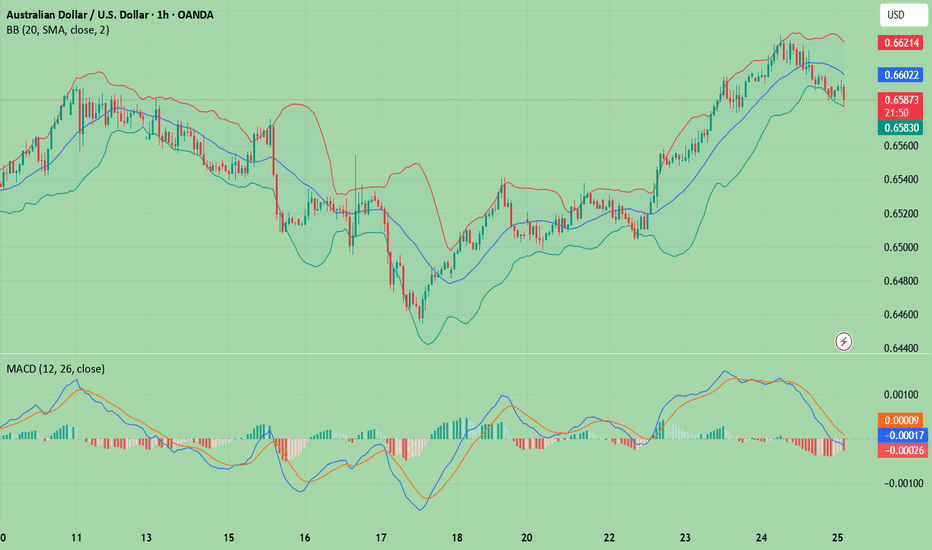

AUDUSD BUYThe AUD/USD pair is trading around 0.6520 on Tuesday. The daily chart’s technical analysis indicates a prevailing bullish bias as the pair remains within the ascending channel pattern. However, the 14-day Relative Strength Index (RSI) has moved below the 50 mark, indicating that a bearish bias is active. Additionally, the pair is positioned below the nine-day Exponential Moving Average (EMA), indicating that short-term price momentum is weaker.

The US and EU reached a framework trade agreement on Sunday that sets 15% tariffs on most European goods, taking effect on August 1. This deal has ended a months-long stand-off, per Bloomberg.

Traders keep their eyes on further developments in the US-China trade talks. The discussions are set to resume on Tuesday after top economic officials from both nations held over five hours of negotiations in Stockholm on Monday. The purpose of this meeting is to resolve ongoing disputes and extend their trade truce by another three months.

US Treasury Chief Scott Bessent met with China’s Vice Premier He Lifeng at Sweden’s Rosenbad government offices. The meeting comes ahead of an August 12 deadline to finalize a long-term tariff agreement with the Trump administration, building on preliminary deals reached in May and June that had helped ease tensions.

The US Federal Reserve (Fed) is widely expected to keep the benchmark interest rate steady between 4.25% and 4.50% at its July meeting. The FOMC press conference will be observed for any signs that rate cuts may start in September.

The Reserve Bank of Australia (RBA) is expected to closely watch the June labor force data and second-quarter inflation figures before deciding on a potential rate cut. Both the monthly and quarterly CPI reports are scheduled for release later this week.

SUPPORT 0.65593

SUPPORT 0.65424

SUPPORT 0.65593

RESISTSNCE 0.65050

RESISTANCE 0.64973

AUDUSD(20250729)Today's AnalysisMarket news:

After gold prices soared to an all-time high of more than $3,500 an ounce in April, the latest report from the Commodity Futures Trading Commission (CFTC) showed that fund managers have increased their bullish bets to the highest level in 16 weeks.

Technical analysis:

Today's buy and sell boundaries:

0.6538

Support and resistance levels:

0.6610

0.6583

0.6566

0.6511

0.6493

0.6466

Trading strategy:

If the price breaks through 0.6538, consider buying, the first target price is 0.6566

If the price breaks through 0.6511, consider selling, the first target price is 0.6493

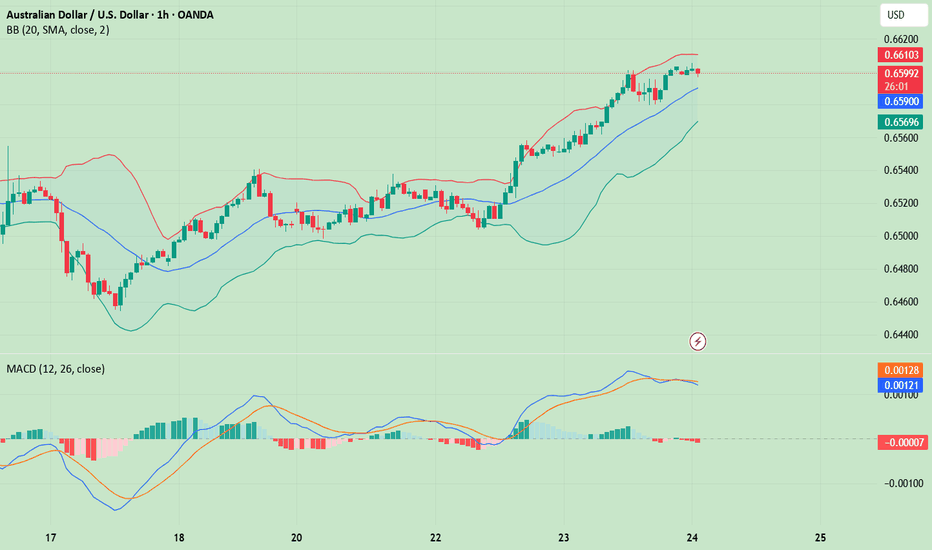

AUDUSD(20250725)Today's AnalysisMarket news:

The European Central Bank announced that it would maintain the three key interest rates unchanged, reiterated data dependence, warned that the external environment is highly uncertain, and President Lagarde did not rule out the possibility of future rate hikes. Traders reduced their bets on ECB rate cuts.

Technical analysis:

Today's buying and selling boundaries:

0.6598

Support and resistance levels:

0.6638

0.6623

0.6613

0.6583

0.6573

0.6559

Trading strategy:

If the price breaks through 0.6598, consider buying in, with the first target price of 0.6613

If the price breaks through 0.6583, consider selling in, with the first target price of 0.6573

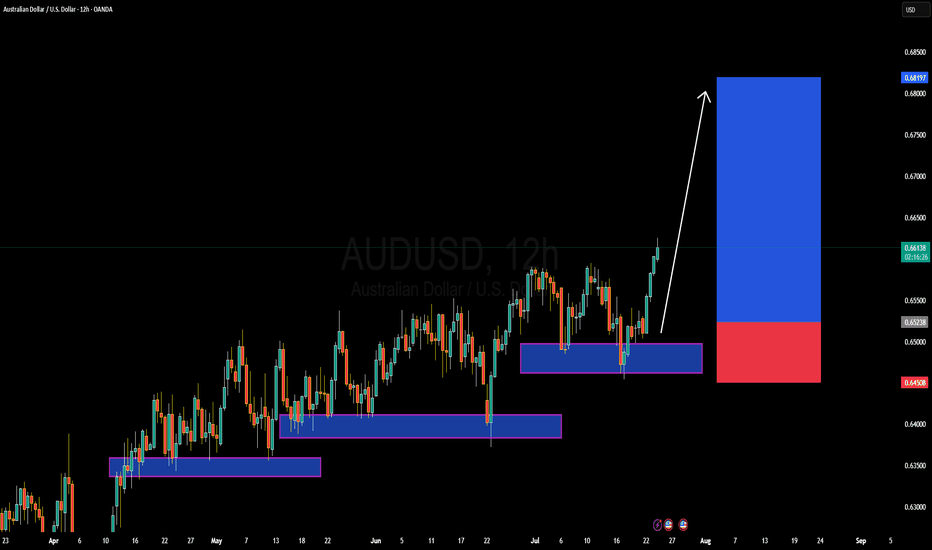

AUDUSD Forming Strong Bullish MomentumAUDUSD is currently showing strong bullish momentum, confirming a key breakout from recent consolidation. After multiple rejections at support zones, price action has now surged through previous resistance levels around 0.6600, signaling a bullish trend continuation. As seen on the 12H chart, the pair is respecting a series of higher lows and forming a clean ascending structure, with a fresh impulse wave now aiming toward the 0.6800–0.6820 target zone.

On the fundamental front, the Australian dollar is gaining strength as recent macro data supports a more optimistic economic outlook. Australia’s labor market remains tight, and inflation prints have come in hotter than expected, increasing speculation that the RBA may maintain a hawkish tone. Meanwhile, the US dollar is under pressure as markets continue to price in a potential Fed rate cut in the coming months, especially amid signs of slowing economic momentum and easing CPI. This divergence is helping AUDUSD push higher.

Technically, buyers are clearly in control. Each dip into demand zones has been aggressively bought, and the current price action confirms continuation. The recent break above 0.6600 is a significant technical development, and as long as price holds above the 0.6520–0.6500 support zone, I expect the pair to grind higher toward 0.6819 and beyond. Risk-reward remains favorable for buyers with a clear bullish structure intact.

With strong bullish confluence both fundamentally and technically, AUDUSD offers a high-probability long opportunity. I’ll be looking for continuation setups on lower timeframes while managing risk below key support. The trend is your friend here—stay with the bulls as the market positions ahead of upcoming US economic releases.

AUDUSD(20250724)Today's AnalysisMarket news:

U.S. President Trump continued to lash out at the Federal Reserve on Tuesday, but seemed to back off from the remaining plan to fire Chairman Powell. "I think he's doing a bad job, but he's going to be out of office soon anyway," Trump said in an exchange with reporters at the White House. "In eight months, he'll be out of office."

Technical analysis:

Today's buying and selling boundaries:

0.6580

Support and resistance levels:

0.6639

0.6617

0.6603

0.6558

0.6543

0.6521

Trading strategy:

Upward breakthrough of 0.6603, consider entering the market to buy, the first target price is 0.6617

Downward breakthrough of 0.6580, consider entering the market to sell, the first target price is 0.6558

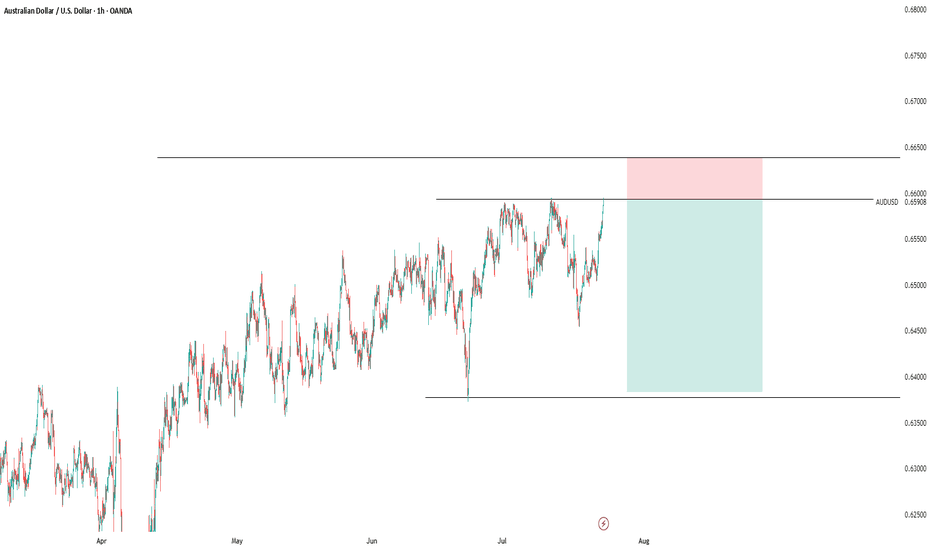

AUDUSD: Bearish Flag Retest Within Macro HeadwindsAUDUSD is developing a clean bearish technical setup just as macro fundamentals increasingly weigh on the Australian dollar. The pair recently completed a rising wedge breakout and is now retesting broken structure within a larger downtrend. With risk sentiment shaky due to U.S. tariff threats and dovish repricing of the RBA’s outlook, Aussie bulls may struggle to sustain momentum. A confirmed breakdown below 0.6458 could open the door toward June’s swing low near 0.6390.

🧠 Technical Breakdown:

✅ Bearish Flag Structure:

The chart shows a sequence of bearish flags and rising wedges, all of which have historically broken lower. The latest breakout to the downside was sharp, and the current rally appears corrective.

✅ Fib Levels & Confluence:

Price is hovering near the 38.2% retracement (0.6510) from the last leg down. The invalidation zone around 0.6565 aligns with a supply zone, making it an ideal SL area.

✅ Target Zones:

First support: 0.6458

Measured move: 0.6390 - 0.6370

These coincide with Fib 61.8% & 100%, adding technical confluence.

📉 Fundamental Drivers:

Dovish RBA Signals: Labour data missed expectations, and June inflation slowed (4.8% vs. 4.9% expected), softening the RBA’s hawkish stance.

Stronger USD Outlook: Powell’s reappointment risk and rate-cut delay pricing have supported the dollar. U.S. data (Retail Sales, CPI) still signal sticky inflation and strong labor.

Tariff Risk from Trump: With the U.S. floating global 10% tariffs, risk assets like AUD (a high-beta currency) face downside pressure.

⚠️ Risks to Bearish Bias:

Stronger-than-expected China stimulus could support AUD as a proxy.

A dovish Fed pivot or soft U.S. data might undercut USD strength.

audusd sell signal. Don't forget about stop-loss.

Write in the comments all your questions and instruments analysis of which you want to see.

Friends, push the like button, write a comment, and share with your mates - that would be the best THANK YOU.

P.S. I personally will open entry if the price will show it according to my strategy.

Always make your analysis before a trade

Market Analysis: AUD/USD Climbs as Dollar WeakensMarket Analysis: AUD/USD Climbs as Dollar Weakens

AUD/USD started a decent increase above the 0.6520 level.

Important Takeaways for AUD/USD Analysis Today

- The Aussie Dollar rebounded after forming a base above the 0.6450 level against the US Dollar.

- There is a connecting bullish trend line forming with support at 0.6540 on the hourly chart of AUD/USD.

AUD/USD Technical Analysis

On the hourly chart of AUD/USD at FXOpen, the pair started a fresh increase from the 0.6450 support. The Aussie Dollar was able to clear the 0.6500 resistance to move into a positive zone against the US Dollar.

There was a close above the 0.6550 resistance and the 50-hour simple moving average. Finally, the pair tested the 0.6565 zone. A high was formed near 0.6564 and the pair recently started a consolidation phase.

On the downside, initial support is near the 0.6540 level. There is also a connecting bullish trend line forming with support at 0.6540. It is close to the 23.6% Fib retracement level of the upward move from the 0.6454 swing low to the 0.6564 high.

The next major support is near the 0.6495 zone. If there is a downside break below it, the pair could extend its decline toward the 0.6480 level. It is close to the 76.4% Fib retracement level.

Any more losses might signal a move toward 0.6450. On the upside, the AUD/USD chart indicates that the pair is now facing resistance near 0.6565. The first major resistance might be 0.6575. An upside break above the 0.6575 resistance might send the pair further higher.

The next major resistance is near the 0.6600 level. Any more gains could clear the path for a move toward the 0.6650 resistance zone.

This article represents the opinion of the Companies operating under the FXOpen brand only. It is not to be construed as an offer, solicitation, or recommendation with respect to products and services provided by the Companies operating under the FXOpen brand, nor is it to be considered financial advice.

AUDUSD(20250721)Today's AnalysisMarket news:

Waller refused to comment on whether he would dissent at the July meeting, saying that the private sector was not performing as well as people thought, and said that if the president asked him to be the chairman of the Federal Reserve, he would agree.

Technical analysis:

Today's buying and selling boundaries:

0.6506

Support and resistance levels:

0.6572

0.6547

0.6531

0.6481

0.6466

0.6441

Trading strategy:

If the price breaks through 0.6531, consider buying, and the first target price is 0.6547

If the price breaks through 0.6506, consider selling, and the first target price is 0.6481

Ready for the Aussie Heist? Is This the Perfect Entry?🚨💰 - "The Aussie Vault Raid: Bullish Robbery in Progress!" 💰🚨

AUD/USD Forex Trade Idea (Thief Style Swing/Day Plan)

📈🔥 Designed for Thief Traders, Market Robbers & Money Makers Worldwide 🤑🐱👤💸

🌍 Hello Global Robbers!

🌟 Hola! Ola! Bonjour! Hallo! Salaam! Konnichiwa! 🌟

Welcome to another bold heist plan from the Thief Trading Crew. This one’s a high-stakes raid on the AUD/USD — "The Aussie" — using our signature Thief Trading Style, combining raw technical setups with real macro/fundamental edge. We're eyeing the Bullish Vault Breakout, so tighten up your gloves — it’s time to rob smart, not hard.

🔓💸 ENTRY PLAN – “The Vault is Unlocked!”

Grab the bullish loot at any valid price zone — but here’s how real thieves move:

📍 Recommended Entry Style:

Use Buy Limit Orders near local swing lows, demand zones, or key pullback entries on the 15m to 30m chart.

Execute DCA (Dollar Cost Averaging) / Layered Orders for more precision.

Align with your MA lines & candle structures for max confirmation.

🛑 STOP LOSS – “Escape Route Secured”

📍 SL hidden beneath recent swing lows below MA (on 4H):

🎯 Suggested Level: 0.64550

💡 Custom-fit your SL based on:

Trade size

Number of active positions

Account risk strategy

🎯 PROFIT TARGET – “Cash Out Before the Cops Show!”

🏴☠️ Take-Profit Zone: 0.66400

This is our bullish breakout reward zone — a high-value zone where profit meets safety.

🔍 MARKET OUTLOOK – "Cops Are Watching, but We're Ahead..."

📈 The AUD/USD market is flashing bullish momentum, supported by:

✅ Risk sentiment flow

✅ US Dollar weakness and rate expectations

✅ Intermarket signals from commodities (Gold/Iron)

✅ Positive macro positioning from smart money (via COT)

✅ Technical demand forming reversal patterns from oversold zones

📎 For a deeper breakdown —

📰 Fundamentals | COT Reports | Sentiment | Intermarket Analysis — Check Klick 🔗

⚠️ THIEF ALERT – “Avoid Sirens. Watch the News.”

Stay out of trouble by following these protocols during major news events:

🚫 Don’t enter trades blindly before/after big news

📍 Use trailing stops to protect gains

🔄 Adjust SL/TP if price nears breakout points during volatility

💥 SUPPORT THE CREW – “Smash That Boost Button!”

Love the plan? Then Boost this chart to show love for the Thief Trading Movement.

Every like, comment, and boost adds power to our robbery network across the globe. 🌍❤️💰

⚖️ DISCLAIMER – “Not Financial Advice, Just Thief Vibes”

📌 This analysis is for educational and entertainment purposes only.

📌 Trade at your own risk and always do your own analysis.

📌 Market moves fast — stay sharp, stay stealthy.

**🎭 See you at the next heist.

Until then, trade rich. Rob wise.

Thief Trader out. 🐱👤💰📉📈**

Week of 7/20/25: AUDUSD AnalysisLast week's price action was bearish and this week I will follow bearish order flow unless internal 1h structure continues to be bullish. I'm going to look for shorts after 1h internal structure is broken as confirmation, then take trades down to the daily demand zone and then look for bullish signals.