AUD/USD "The Aussie" Forex Bank Bearish Heist Plan (Swing/Day)🌟Hi! Hola! Ola! Bonjour! Hallo! Marhaba!🌟

Dear Money Makers & Robbers, 🤑💰✈️

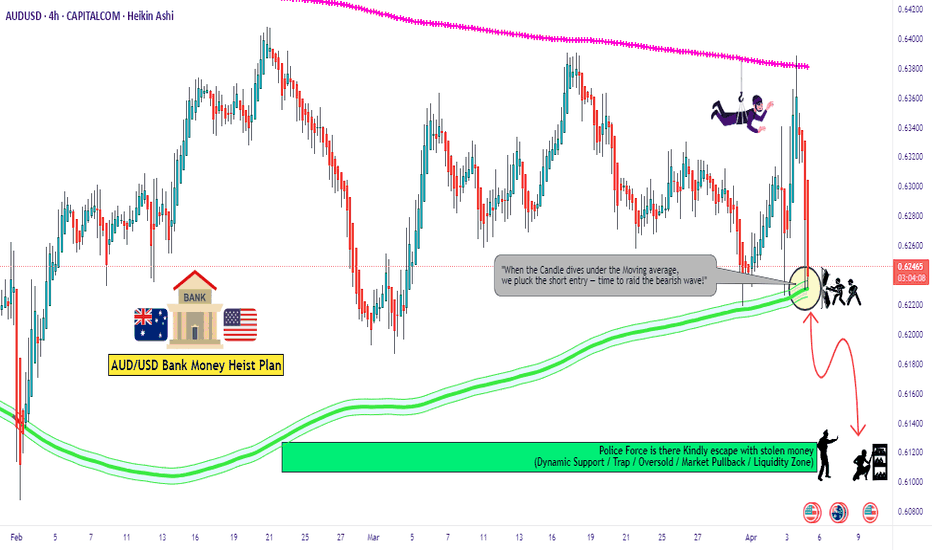

Based on 🔥Thief Trading style technical and fundamental analysis🔥, here is our master plan to heist the AUD/USD "The Aussie" Forex Bank. Please adhere to the strategy I've outlined in the chart, which emphasizes short entry. Our aim is the high-risk Green Zone. Risky level, oversold market, consolidation, trend reversal, trap at the level where traders and bullish robbers are stronger. 🏆💸Book Profits Be wealthy and safe trade.💪🏆🎉

Entry 📈 : "The heist is on! Wait for the MA breakout then make your move at (0.62200) - Bearish profits await!"

however I advise to Place sell stop orders above the Moving average (or) after the MA level Breakout Place sell limit orders within a 15 or 30 minute timeframe most NEAREST (or) SWING low or high level.

📌I strongly advise you to set an "alert (Alarm)" on your chart so you can see when the breakout entry occurs.

Stop Loss 🛑: "🔊 Yo, listen up! 🗣️ If you're lookin' to get in on a sell stop order, don't even think about settin' that stop loss till after the breakout 🚀. You feel me? Now, if you're smart, you'll place that stop loss where I told you to 📍, but if you're a rebel, you can put it wherever you like 🤪 - just don't say I didn't warn you ⚠️. You're playin' with fire 🔥, and it's your risk, not mine 👊."

📌Thief SL placed at the nearest/swing High or Low level Using the 4H timeframe (1.42800) Day/Swing trade basis.

📌SL is based on your risk of the trade, lot size and how many multiple orders you have to take.

Target 🎯: 0.62900 (or) Escape Before the Target

🧲Scalpers, take note 👀 : only scalp on the Short side. If you have a lot of money, you can go straight away; if not, you can join swing traders and carry out the robbery plan. Use trailing SL to safeguard your money 💰.

💸💵AUD/USD "The Aussie" Forex Bank Heist Plan (Swing/Day Trade) is currently experiencing a bearishness,., driven by several key factors.👇

📰🗞️Get & Read the Fundamental, Macro, COT Report, Quantitative Analysis, Sentimental Outlook, Intermarket Analysis, Future trend targets.. go ahead to check 👉👉👉🔗

⚠️Trading Alert : News Releases and Position Management 📰 🗞️ 🚫🚏

As a reminder, news releases can have a significant impact on market prices and volatility. To minimize potential losses and protect your running positions,

we recommend the following:

Avoid taking new trades during news releases

Use trailing stop-loss orders to protect your running positions and lock in profits

💖Supporting our robbery plan 💥Hit the Boost Button💥 will enable us to effortlessly make and steal money 💰💵. Boost the strength of our robbery team. Every day in this market make money with ease by using the Thief Trading Style.🏆💪🤝❤️🎉🚀

I'll see you soon with another heist plan, so stay tuned 🤑🐱👤🤗🤩

Audusdbearish

SHORT AUDUSDI'm looking for further movement to the downside on AUDUSD, targeting a price level of 0.59784. Price has been bearish since October of last year. There is still a key level residing below 0.59815 that would be of interest to seek out if downside momentum continues. Volume has been decreasing as price started its retracement from 0.61311, price traded back into a fair value gap and proceeded to close below it. I'm currently in a short position, this is a swing trade. Patience is all is takes, let's see if price continues to trend bearish. Let me know your thoughts if it differs from my perspective.

Bearish Pattern Plays Out: AUD/USD Breakdown ConfirmedAUD/USD is currently moving in a classical bearish pattern, with the price taking temporary support at the lower trendline. However, this support appears weak and, as anticipated, has now broken down, confirming further downside momentum.

The structure remains in favor of sellers, and more bearish movement is expected as the breakdown reinforces the selling pressure.

AUD/USD "The Aussie" Forex Market Heist Plan on Bearish Side🌟Hi! Hola! Ola! Bonjour! Hallo!🌟

Dear Money Makers & Robbers, 🤑 💰

Based on 🔥Thief Trading style technical analysis🔥, here is our master plan to heist the AUD/USD "The Aussie" Forex market. Please adhere to the strategy I've outlined in the chart, which emphasizes short entry. Our aim is the high-risk Green Zone. Risky level, oversold market, consolidation, trend reversal, trap at the level where traders and bullish robbers are stronger. 👀 So Be Careful, wealthy and safe trade.💪🏆🎉

Entry 📉 : You can enter a short trade anywhere,

however I advise placing sell limit orders within a 15 or 30 minute timeframe. Entry from the most recent or closest high level should be in retest.

Stop Loss 🛑: Using the 2H period, the recent / nearest high level.

Goal 🎯: 0.62800

Scalpers, take note : only scalp on the Short side. If you have a lot of money, you can go straight away; if not, you can join swing traders and carry out the robbery plan. Use trailing SL to safeguard your money 💰.

Warning⚠️ : Our heist strategy is incompatible with Fundamental Analysis news 📰 🗞️. We'll wreck our plan by smashing the Stop Loss 🚫🚏. Avoid entering the market right after the news release.

Take advantage of the target and get away 🎯 Swing Traders Please reserve the half amount of money and watch for the next dynamic level or order block breakout. Once it is resolved, we can go on to the next new target in our heist plan.

💖Supporting our robbery plan will enable us to effortlessly make and steal money 💰💵 Tell your friends, Colleagues and family to follow, like, and share. Boost the strength of our robbery team. Every day in this market make money with ease by using the Thief Trading Style.🏆💪🤝❤️🎉🚀

I'll see you soon with another heist plan, so stay tuned 🫂

AUD/USD: The Bear is Lurking – A Breakdown in the Making?Hey Forex fam! 🌍✨ Let’s talk about the Aussie Dollar (AUD) versus the Greenback (USD) – the pair that's been stuck in a battle royale of consolidation! 🧐 But here’s the scoop: the bears are sharpening their claws 🐻, and we might just be on the edge of a big breakdown! 🚨

🔍 The Setup: A Symmetrical Triangle (Bearish Edition!)

📉 Chart pattern: For the last few years, AUD/USD has been dancing between two trendlines, forming a symmetrical triangle – a classic consolidation pattern. Think of it like a coiled spring, ready to pop... but in the bearish direction! 👇

👀 Why bearish?

1️⃣ The triangle is following a long-term downtrend. The pair has been sliding since 2013, and this consolidation looks like a classic continuation pattern.

2️⃣ Momentum is fizzling out as we approach the apex of the triangle – suggesting that a downside breakout could be just around the corner.

📉 Levels to Watch: The Bear's Roadmap

Support to break: 0.63 – the bottom of the triangle and a critical level to confirm the bearish breakdown.

Next bearish targets:

0.60: A psychological barrier.

0.56: The low not seen since 2008 (ouch!).

💡 Why is the Bear in Control?

1️⃣ Fundamentals 📰: With the Federal Reserve still hawkish 💵 and China’s economic recovery slowing 🐢 (a key driver of AUD strength), the Aussie is under pressure.

2️⃣ Risk sentiment 😬: Investors are flocking to safe-havens like the USD in uncertain markets, leaving the AUD vulnerable.

⏳ Timing the Breakdown

⚡ Be ready for action! The pair is sitting right at the edge of the triangle. A daily close below 0.63 could trigger an avalanche of selling pressure. But remember: wait for confirmation – false breakouts can wreck your P&L! 🚨

🔥 Pro Tips for Trading the Breakdown

✅ Trade the breakout: Short AUD/USD once it closes below 0.63, and target 0.60 or lower.

✅ Set stop-losses: Place them slightly above the triangle (~0.64) to protect against fakeouts.

✅ Patience is key: Don’t rush in – let the price action confirm the direction.

The Bearish Bottom Line 🐻

AUD/USD is playing a waiting game, but the technicals and fundamentals both scream downtrend continuation. If the bears break through 0.63, get ready for a dive that could take us to 2008 levels! 📉

Are you ready to ride the bear? 🐻💥 Let me know your thoughts below, and as always, trade safe! 💪✨

Intraday the Aussie might lift but beating USD% D, W, TF? No

On Friday AUDUSD looked to me a very strong case for long positions, at least going forwards a few days to a week. I took the trade Long, knowing the USD$ was strong, because that's what the charts were telling me on Friday, but today it's a difference story. The Aussie likely to get a small bounce now and further selling to then take hold later in Tuesday.

But that has all changed with the Gold price selling off yesterday Monday, Gold selling and correcting in a bigger manner puts the US Dollar in a position of strength. Yesterday, I wrote how the US Dollar broke out with Bitcoin last week.

But at some point, very soon I imagine, the USD$ will not be able to outperform and be in alignment with Bitcoin's continued outbreak upwards.

But stranger things have happened, for now the USD$ is back and showing its strength against other currency's.

AUD/USD "Aussie" Bank Money Heist Plan on Bearish Side.Ola! Ola! My Dear Robbers / Money Makers & Losers, 🤑💰

This is our master plan to Heist AUD/USD "Aussie" Bank based on Thief Trading style Technical Analysis.. kindly please follow the plan I have mentioned in the chart focus on Short entry. Our target is Green Zone that is High risk Dangerous level, market is oversold / Consolidation / Trend Reversal / Trap at the level Bullish Robbers / Traders gain the strength. Be safe and be careful and Be rich 💰.

Entry : Can be taken Anywhere, What I suggest you to Place Sell Limit Orders in 15mins Timeframe, Recent / Nearest High Point.

Stop Loss 🛑: Recent Swing High using 3h timeframe

Attention for Scalpers : Focus to scalp only on Short side, If you've got a money you can get out right away otherwise you can join with a swing trade robbers and continue the heist plan, Use Trailing SL to protect our money 💰.

Warning : Fundamental Analysis news 📰 🗞️ comes against our robbery plan. our plan will be ruined smash the Stop Loss 🚫🚏. Don't Enter the market at the news update.

Loot and escape on the target 🎯 Swing Traders Plz Book the partial sum of money and wait for next breakout of dynamic level / Order block, Once it is cleared we can continue our heist plan to next new target.

Support our Robbery plan we can easily make money & take money 💰💵 Follow, Like & Share with your friends and Lovers. Make our Robbery Team Very Strong Join Ur hands with US. Loot Everything in this market everyday make money easily with Thief Trading Style.

Stay tuned with me and see you again with another Heist Plan..... 🫂

AUD/USD rises for fifth day (but resistance looms)The Aussie has risen for a fifth day, but it is worth noting that minor rallies tend to peter out around the 5-6 day mark. Price action on the 1-hour chart also suggests the rally could be corrective, against its drop from 65c-63c.

Given a bearish RSI divergence is forming on the 1-hour RSI (14) and the 50-day EMA resides around the weekly R1 pivot, we're looking for evidence of a swing high and for momentum to turn lower.

Bearish Outlook on AUDUSD - 23 Jun 2023The price on the H4 timeframe has recently breached the consolidation range of 0.6750 and 0.6800, indicating a breakout. A throwback to the resistance zone at 0.6750 could provide the bearish acceleration towards key resistance-turned-support zone at 0.6650, which coincides with the 227.2% fibonacci extension level. Price is hovering below our ichimoku cloud and 20 EMA, supporting our bearish bias.

AUD/USD still to decline? AUD/USD hit a six-month low at 0.6525, the broken neckline of the inverse head and shoulders pattern.

Technical indicators suggest further downward movement, with the RSI and Stochastic oscillator indicating oversold conditions. The MACD is negative, signaling a bearish trend.

The price has dropped below its moving averages and violated the short-term range floor at 0.6565. If sellers break the 0.6525 support, the pair may test the 61.8% Fibonacci retracement at 0.6483, followed by a decline towards 0.6420 and potentially the 0.6370-0.6340 zone.

Overall, AUD/USD is expected to see more selling if the 0.6525 level breaks.

Bearish Outlook on AUDUSD- 19 May 2023On the 4H timeframe, there is bearish order flow, forming lower highs and lower lows. A pullback to key resistance zone at 0.67, which is in line with the 50% Fibonacci retracement level, and a break below downside confirmation level at 0.6580 could provide the bearish acceleration to the support zone at 0.6420, which coincides with the 161.8% Fibonacci extension level. Price is hovering below the 20 EMA and ichimoku cloud, supporting our bearish bias.

AUDUSD 15M: Bearish outlook seen, further downside below 0.6665On the 15M timeframe, price is showing strong bearish correction. A pullback to the resistance zone at 0.6700, which coincides with the 61.8% Fibonacci retracement, and a break below downside confirmation at 0.6680 could present an opportunity to play the drop to the resistance-turned-support zone at 0.6665. Price is holding below ichimoku clouds and 20 EMA, supporting our bearish bias.

AUDUSD Strong Bearish Trend 1H TFAUDUSD shows strong bearish trend in spite of bullish divergence. Previous LL also broken by the current price action. There is strong bias of bearish. TP1 is right above support. It is likely to get hit. However, TP2 is under two major support. Not likely to get hit. However, initiated two short trades with 1% risk and 2% reward.

Bearish outlook on AUDUSD - 14 April 2023Price is testing a key resistance zone at 0.6780 on the H1 timeframe, which is in line with the 78.6% Fibonacci extension level. A pullback to this zone could present the opportunity to play the drop to the support zone at 0.6720, which coincides with the 23.6% Fibonacci retracement level. Price is hovering below the 20 EMA and MACD is showing bearish momentum, supporting our bearish bias.

AUD could retest the March lows if the Fed are not that dovishAUD/USD is hinting at a potential swing high on the daily chart. And if my hunch that the Fed won’t be as dovish as market pricing currently suggest, it leaves room for USD strength and a lower Aussie.

AUD/USD seems to have completed a 3-wave retracement which perfectly respected a 38.2% Fibonacci ratio. Our bias remains bearish beneath the cycle highs, and we anticipate a move back to the March lows should the Fed stick to their hawkish guns, given the RBA delivered a dovish hike and dovish minutes this month.

AUDUSD Trading Plan - 20/Mar/2023Hello Traders,

Hope you all are doing good!!

I expect AUDUSD to go Down after finishing the correction.

Look for your SELL setups.

Please follow me and like if you agree or this idea helps you out in your trading plan.

Disclaimer: This is just an idea. Please do your own analysis before opening a position. Always use SL & proper risk management.

Market can evolve anytime, hence, always do your analysis and learn trade management before following any idea.