Audusdforecast

Market Analysis: AUD/USD Climbs as Dollar WeakensMarket Analysis: AUD/USD Climbs as Dollar Weakens

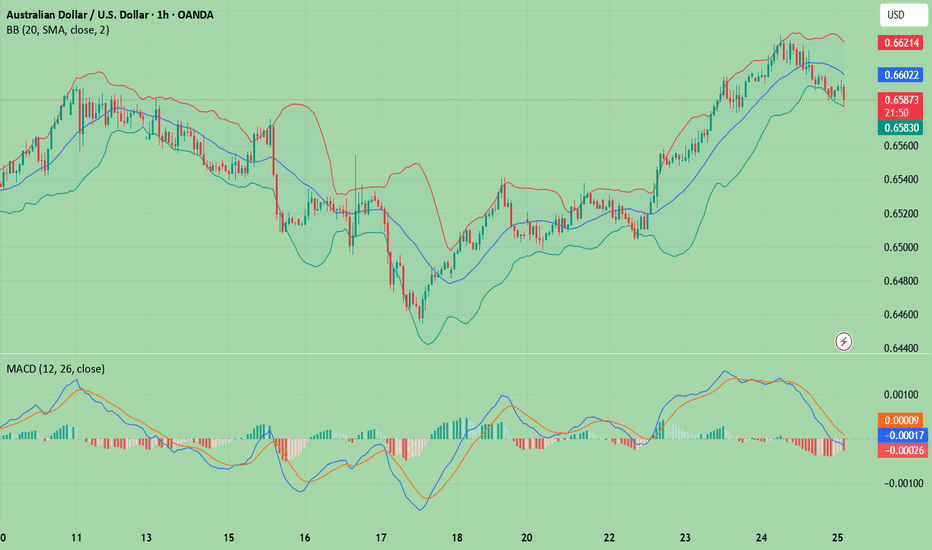

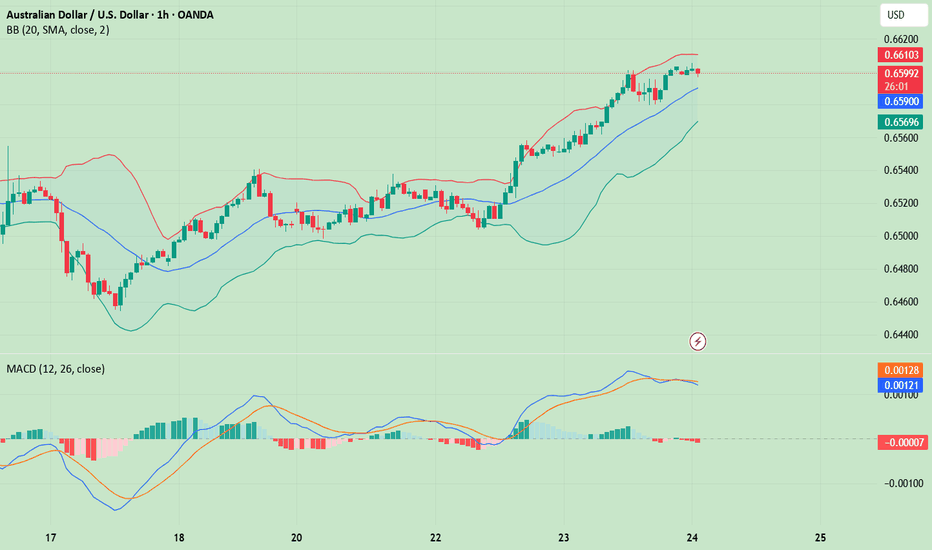

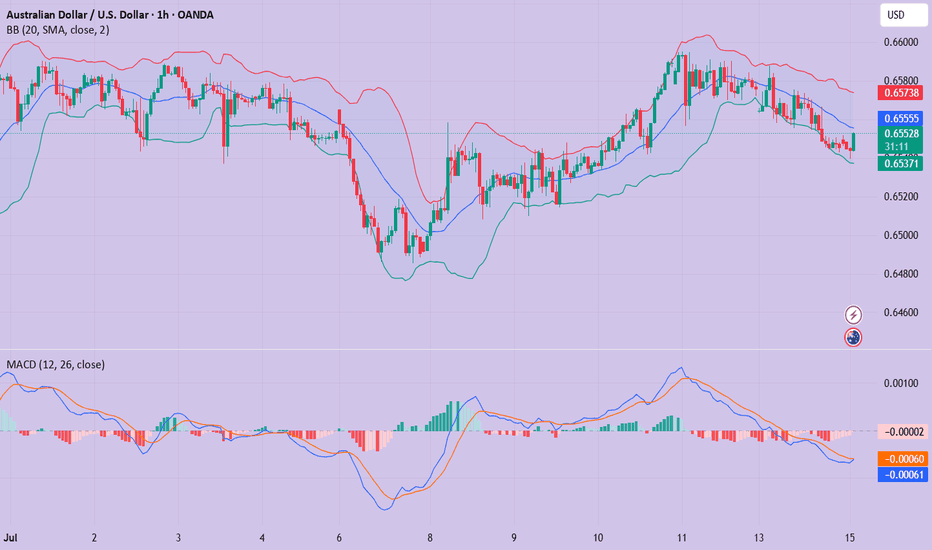

AUD/USD started a decent increase above the 0.6520 level.

Important Takeaways for AUD/USD Analysis Today

- The Aussie Dollar rebounded after forming a base above the 0.6450 level against the US Dollar.

- There is a connecting bullish trend line forming with support at 0.6540 on the hourly chart of AUD/USD.

AUD/USD Technical Analysis

On the hourly chart of AUD/USD at FXOpen, the pair started a fresh increase from the 0.6450 support. The Aussie Dollar was able to clear the 0.6500 resistance to move into a positive zone against the US Dollar.

There was a close above the 0.6550 resistance and the 50-hour simple moving average. Finally, the pair tested the 0.6565 zone. A high was formed near 0.6564 and the pair recently started a consolidation phase.

On the downside, initial support is near the 0.6540 level. There is also a connecting bullish trend line forming with support at 0.6540. It is close to the 23.6% Fib retracement level of the upward move from the 0.6454 swing low to the 0.6564 high.

The next major support is near the 0.6495 zone. If there is a downside break below it, the pair could extend its decline toward the 0.6480 level. It is close to the 76.4% Fib retracement level.

Any more losses might signal a move toward 0.6450. On the upside, the AUD/USD chart indicates that the pair is now facing resistance near 0.6565. The first major resistance might be 0.6575. An upside break above the 0.6575 resistance might send the pair further higher.

The next major resistance is near the 0.6600 level. Any more gains could clear the path for a move toward the 0.6650 resistance zone.

This article represents the opinion of the Companies operating under the FXOpen brand only. It is not to be construed as an offer, solicitation, or recommendation with respect to products and services provided by the Companies operating under the FXOpen brand, nor is it to be considered financial advice.

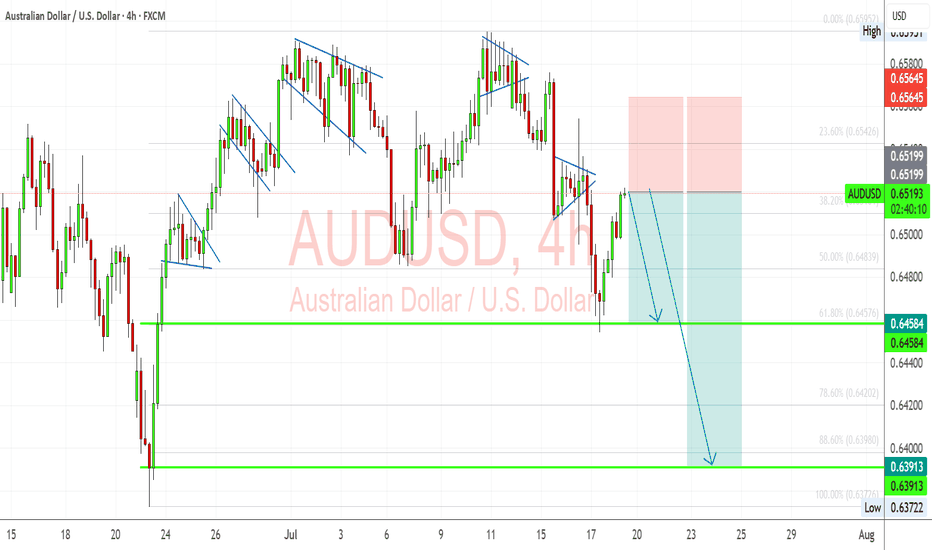

AUDUSD: Bearish Flag Retest Within Macro HeadwindsAUDUSD is developing a clean bearish technical setup just as macro fundamentals increasingly weigh on the Australian dollar. The pair recently completed a rising wedge breakout and is now retesting broken structure within a larger downtrend. With risk sentiment shaky due to U.S. tariff threats and dovish repricing of the RBA’s outlook, Aussie bulls may struggle to sustain momentum. A confirmed breakdown below 0.6458 could open the door toward June’s swing low near 0.6390.

🧠 Technical Breakdown:

✅ Bearish Flag Structure:

The chart shows a sequence of bearish flags and rising wedges, all of which have historically broken lower. The latest breakout to the downside was sharp, and the current rally appears corrective.

✅ Fib Levels & Confluence:

Price is hovering near the 38.2% retracement (0.6510) from the last leg down. The invalidation zone around 0.6565 aligns with a supply zone, making it an ideal SL area.

✅ Target Zones:

First support: 0.6458

Measured move: 0.6390 - 0.6370

These coincide with Fib 61.8% & 100%, adding technical confluence.

📉 Fundamental Drivers:

Dovish RBA Signals: Labour data missed expectations, and June inflation slowed (4.8% vs. 4.9% expected), softening the RBA’s hawkish stance.

Stronger USD Outlook: Powell’s reappointment risk and rate-cut delay pricing have supported the dollar. U.S. data (Retail Sales, CPI) still signal sticky inflation and strong labor.

Tariff Risk from Trump: With the U.S. floating global 10% tariffs, risk assets like AUD (a high-beta currency) face downside pressure.

⚠️ Risks to Bearish Bias:

Stronger-than-expected China stimulus could support AUD as a proxy.

A dovish Fed pivot or soft U.S. data might undercut USD strength.

audusd sell signal. Don't forget about stop-loss.

Write in the comments all your questions and instruments analysis of which you want to see.

Friends, push the like button, write a comment, and share with your mates - that would be the best THANK YOU.

P.S. I personally will open entry if the price will show it according to my strategy.

Always make your analysis before a trade

AUDUSD(20250725)Today's AnalysisMarket news:

The European Central Bank announced that it would maintain the three key interest rates unchanged, reiterated data dependence, warned that the external environment is highly uncertain, and President Lagarde did not rule out the possibility of future rate hikes. Traders reduced their bets on ECB rate cuts.

Technical analysis:

Today's buying and selling boundaries:

0.6598

Support and resistance levels:

0.6638

0.6623

0.6613

0.6583

0.6573

0.6559

Trading strategy:

If the price breaks through 0.6598, consider buying in, with the first target price of 0.6613

If the price breaks through 0.6583, consider selling in, with the first target price of 0.6573

AUDUSD(20250724)Today's AnalysisMarket news:

U.S. President Trump continued to lash out at the Federal Reserve on Tuesday, but seemed to back off from the remaining plan to fire Chairman Powell. "I think he's doing a bad job, but he's going to be out of office soon anyway," Trump said in an exchange with reporters at the White House. "In eight months, he'll be out of office."

Technical analysis:

Today's buying and selling boundaries:

0.6580

Support and resistance levels:

0.6639

0.6617

0.6603

0.6558

0.6543

0.6521

Trading strategy:

Upward breakthrough of 0.6603, consider entering the market to buy, the first target price is 0.6617

Downward breakthrough of 0.6580, consider entering the market to sell, the first target price is 0.6558

AUDUSD(20250721)Today's AnalysisMarket news:

Waller refused to comment on whether he would dissent at the July meeting, saying that the private sector was not performing as well as people thought, and said that if the president asked him to be the chairman of the Federal Reserve, he would agree.

Technical analysis:

Today's buying and selling boundaries:

0.6506

Support and resistance levels:

0.6572

0.6547

0.6531

0.6481

0.6466

0.6441

Trading strategy:

If the price breaks through 0.6531, consider buying, and the first target price is 0.6547

If the price breaks through 0.6506, consider selling, and the first target price is 0.6481

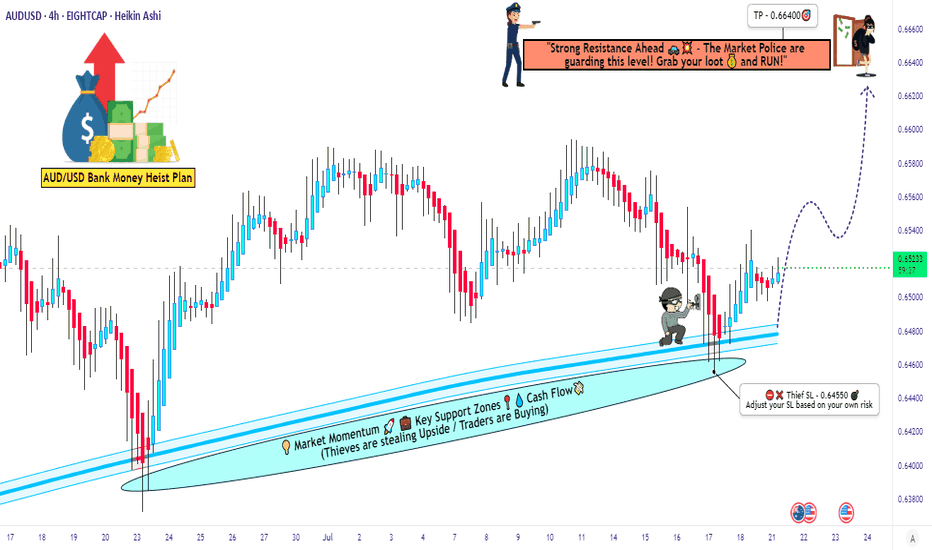

Ready for the Aussie Heist? Is This the Perfect Entry?🚨💰 - "The Aussie Vault Raid: Bullish Robbery in Progress!" 💰🚨

AUD/USD Forex Trade Idea (Thief Style Swing/Day Plan)

📈🔥 Designed for Thief Traders, Market Robbers & Money Makers Worldwide 🤑🐱👤💸

🌍 Hello Global Robbers!

🌟 Hola! Ola! Bonjour! Hallo! Salaam! Konnichiwa! 🌟

Welcome to another bold heist plan from the Thief Trading Crew. This one’s a high-stakes raid on the AUD/USD — "The Aussie" — using our signature Thief Trading Style, combining raw technical setups with real macro/fundamental edge. We're eyeing the Bullish Vault Breakout, so tighten up your gloves — it’s time to rob smart, not hard.

🔓💸 ENTRY PLAN – “The Vault is Unlocked!”

Grab the bullish loot at any valid price zone — but here’s how real thieves move:

📍 Recommended Entry Style:

Use Buy Limit Orders near local swing lows, demand zones, or key pullback entries on the 15m to 30m chart.

Execute DCA (Dollar Cost Averaging) / Layered Orders for more precision.

Align with your MA lines & candle structures for max confirmation.

🛑 STOP LOSS – “Escape Route Secured”

📍 SL hidden beneath recent swing lows below MA (on 4H):

🎯 Suggested Level: 0.64550

💡 Custom-fit your SL based on:

Trade size

Number of active positions

Account risk strategy

🎯 PROFIT TARGET – “Cash Out Before the Cops Show!”

🏴☠️ Take-Profit Zone: 0.66400

This is our bullish breakout reward zone — a high-value zone where profit meets safety.

🔍 MARKET OUTLOOK – "Cops Are Watching, but We're Ahead..."

📈 The AUD/USD market is flashing bullish momentum, supported by:

✅ Risk sentiment flow

✅ US Dollar weakness and rate expectations

✅ Intermarket signals from commodities (Gold/Iron)

✅ Positive macro positioning from smart money (via COT)

✅ Technical demand forming reversal patterns from oversold zones

📎 For a deeper breakdown —

📰 Fundamentals | COT Reports | Sentiment | Intermarket Analysis — Check Klick 🔗

⚠️ THIEF ALERT – “Avoid Sirens. Watch the News.”

Stay out of trouble by following these protocols during major news events:

🚫 Don’t enter trades blindly before/after big news

📍 Use trailing stops to protect gains

🔄 Adjust SL/TP if price nears breakout points during volatility

💥 SUPPORT THE CREW – “Smash That Boost Button!”

Love the plan? Then Boost this chart to show love for the Thief Trading Movement.

Every like, comment, and boost adds power to our robbery network across the globe. 🌍❤️💰

⚖️ DISCLAIMER – “Not Financial Advice, Just Thief Vibes”

📌 This analysis is for educational and entertainment purposes only.

📌 Trade at your own risk and always do your own analysis.

📌 Market moves fast — stay sharp, stay stealthy.

**🎭 See you at the next heist.

Until then, trade rich. Rob wise.

Thief Trader out. 🐱👤💰📉📈**

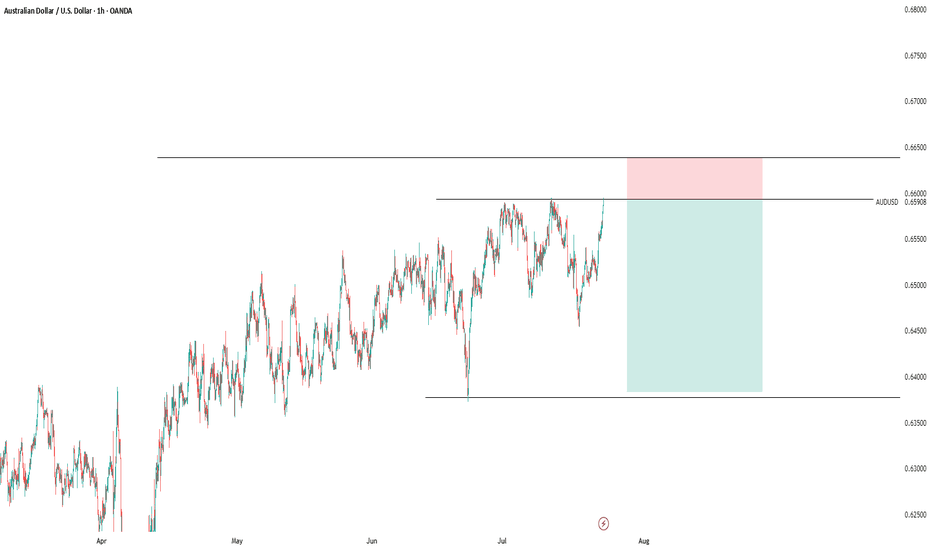

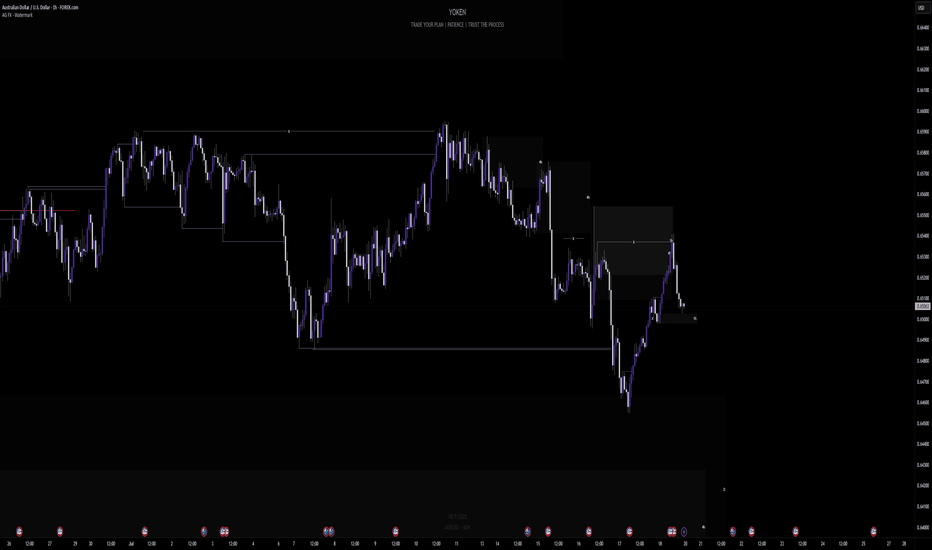

Week of 7/20/25: AUDUSD AnalysisLast week's price action was bearish and this week I will follow bearish order flow unless internal 1h structure continues to be bullish. I'm going to look for shorts after 1h internal structure is broken as confirmation, then take trades down to the daily demand zone and then look for bullish signals.

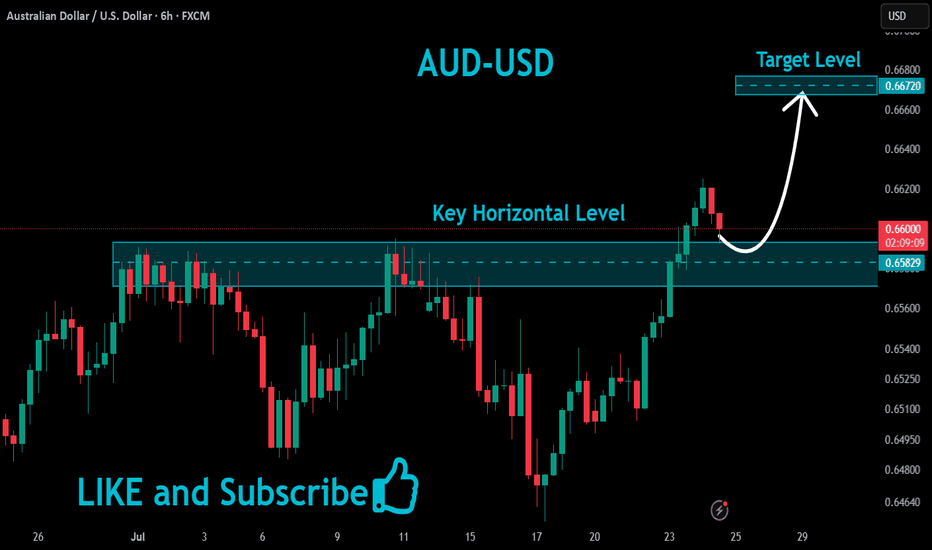

AUDUSD Bearish Breakout!

HI,Traders !

AUD-USD is trading in a sideways trend

and the pair

Made a breakout of the

Key horizontal level

Of 0.8149 which is now

A resistance and the pair

Is now making a retest

Of the level so as we are

Bearish biased we will

Be expecting a pullback

And a further bearish

Move down !

Comment and subscribe to help us grow !

AUDUSD(20250715)Today's AnalysisMarket news:

Sources said that after Trump's latest trade tax threat, the European Central Bank will discuss a more negative scenario next week than expected in June. The ECB is still expected to keep interest rates unchanged at its meeting on July 24. Discussions on rate cuts are still postponed to September.

Technical analysis:

Today's buying and selling boundaries:

0.6557

Support and resistance levels:

0.6602

0.6585

0.6574

0.6539

0.6528

0.6511

Trading strategy:

If it breaks through 0.6557, consider buying in, the first target price is 0.6574

If it breaks through 0.6539, consider selling in, the first target price is 0.6528

AUDUSD Selling Trading IdeaHello Traders

In This Chart AUDUSD HOURLY Forex Forecast By FOREX PLANET

today AUDUSD analysis 👆

🟢This Chart includes_ (AUDUSD market update)

🟢What is The Next Opportunity on AUDUSD Market

🟢how to Enter to the Valid Entry With Assurance Profit

This CHART is For Trader's that Want to Improve Their Technical Analysis Skills and Their Trading By Understanding How To Analyze The Market Using Multiple Timeframes and Understanding The Bigger Picture on the Chart

Week of 7/13/25: AUDUSD AnalysisLast week pushed bullish and demand is still in control on all time frames, so we are going to follow bullish order flow.

Looking for bottom liquidity to be taken in the local range before getting in on a long.

Major News:

Tuesday - CPI

Wednesday - PPI

Thursday - Unemployment

AUSSIE BANK ROBBERY: AUD/USD Bullish Breakout Confirmed!🔥 AUD/USD BANK HEIST: The Ultimate Bullish Robbery Plan (Thief Trading Style) 🔥

🌟 ATTENTION, MONEY MAKERS & MARKET ROBBERS! 🌟

💸 MISSION BRIEF:

Based on Thief Trading Style (technical + fundamental analysis), we’re executing a bullish heist on AUD/USD ("The Aussie")—time to steal those pips like a pro!

📈 ENTRY STRATEGY (The Heist Begins!)

Long Entry Trigger: Wait for Dynamic Resistance MA crossover + candle close above 0.65300 (bullish confirmation).

Pro Tip: Use Buy Stop orders above MA or Buy Limit orders on pullbacks (15m/30m timeframe).

🔔 SET AN ALERT! Don’t miss the breakout—alert up, gloves on!

🛑 STOP LOSS (Protect Your Loot!)

"Yo, rookie! 🗣️ If you’re entering on breakout, DO NOT set SL before confirmation!

📍 Thief SL Placement: Nearest 4H swing low (0.64800)—adjust based on your risk, lot size, & trade multiples.

⚠️ Warning: Deviate at your own peril—your risk, your rules!

🎯 TARGET (Cash Out & Run!)

Take Profit Zone: 0.65800

Scalpers: Long-only plays! Use trailing SL to lock profits.

Swing Traders: Ride the wave—big money moves require patience!

📰 FUNDAMENTAL BACKUP (Know Why We Robbin’!)

Bullish momentum fueled by macro trends, COT data, sentiment shifts.

🚨 Breaking News Alert: Avoid high-impact news spikes—trail SL or stay out!

💥 BOOST THE HEIST!

Hit 👍 LIKE, 🔄 SHARE & 🚀 BOOST—strengthen the robbery squad! More heists = more profits!

🤑 NEXT HEIST COMING SOON… STAY TUNED! 🐱👤

Market Analysis: AUD/USD Attempts Fresh ClimbMarket Analysis: AUD/USD Attempts Fresh Climb

AUD/USD is attempting a fresh increase from the 0.6485 support.

Important Takeaways for AUD/USD Analysis Today

- The Aussie Dollar found support at 0.6485 and recovered against the US Dollar.

- There is a key bearish trend line forming with resistance at 0.6535 on the hourly chart of AUD/USD at FXOpen.

AUD/USD Technical Analysis

On the hourly chart of AUD/USD at FXOpen, the pair started a fresh increase above 0.6550. The Aussie Dollar tested the 0.6585 zone before the bears appeared and pushed it lower against the US Dollar.

The pair declined below the 0.6560 and 0.6550 support levels. The recent low was formed at 0.6485 and the pair is rising again. The bulls pushed it above the 50% Fib retracement level of the downward move from the 0.6588 swing high to the 0.6485 low.

The pair is now consolidating above the 50-hour simple moving average. On the upside, the AUD/USD chart indicates that the resistance is near the 0.6535 zone. There is also a key bearish trend line forming at 0.6535.

The first major resistance might be 0.6550 and the 61.8% Fib retracement level. An upside break above it might send the pair further higher. The next major resistance is near the 0.6560 level. Any more gains could clear the path for a move toward the 0.6585 resistance zone.

If not, the pair might correct lower. Immediate support sits near the 0.6510 level. The next support could be 0.6485. If there is a downside break below 0.6485, the pair could extend its decline toward the 0.6440 zone. Any more losses might signal a move toward 0.6420.

This article represents the opinion of the Companies operating under the FXOpen brand only. It is not to be construed as an offer, solicitation, or recommendation with respect to products and services provided by the Companies operating under the FXOpen brand, nor is it to be considered financial advice.

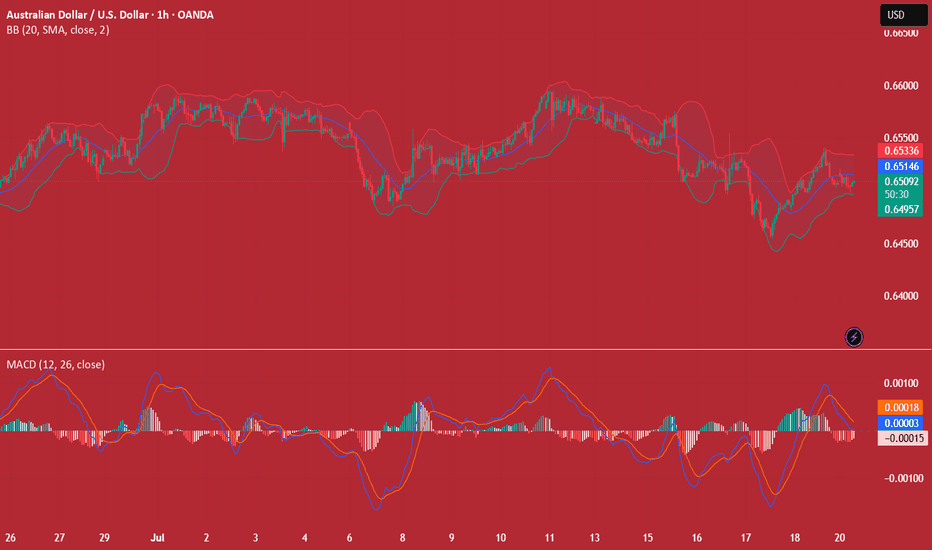

Australian Dollar Strengthens Following RBA DecisionAustralian Dollar Strengthens Following RBA Decision

Today, the AUD/USD pair experienced a spike in volatility. According to ForexFactory, analysts had forecast that the Reserve Bank of Australia (RBA) would cut interest rates from 3.85% to 3.60%. However, the market was caught off guard as the central bank opted to keep rates unchanged.

The RBA stated the following:

→ It remains cautious in its inflation outlook and awaits further evidence confirming that inflation is on track to return to the 2.5% target.

→ The decision to hold the rate was made by a vote of six to three — a rare instance of a split opinion among committee members.

The initial market reaction to the RBA’s unexpected move was a sharp appreciation of the Australian dollar. However, this was followed by a quick pullback in the minutes that followed (as indicated by the arrows).

Technical Analysis of the AUD/USD Chart

Since early July, price action in AUD/USD has been forming a descending channel (marked in red). In this context:

→ Today’s sharp rally and subsequent retracement underscored the significance of the upper boundary of the channel;

→ The pair tested a previously broken ascending trendline (the lower line of the blue channel);

→ Although the price briefly rose above the 0.65450 level, this area may now act as resistance going forward.

There is a possibility that, as forex trading unfolds throughout the day, AUD/USD could retreat towards the median line of the descending channel. Such a move could be interpreted as follows:

→ The initial reaction to the RBA decision may have been premature;

→ Selling pressure persists, which might trigger a move towards the support zone near 0.64850.

Looking ahead, the trajectory of AUD/USD in July 2025 will be largely influenced by developments surrounding a potential trade agreement between the United States and other countries, including Australia.

This article represents the opinion of the Companies operating under the FXOpen brand only. It is not to be construed as an offer, solicitation, or recommendation with respect to products and services provided by the Companies operating under the FXOpen brand, nor is it to be considered financial advice.

AUDUSD SHORT & LONG FORECAST Q3 W28 Y25AUDUSD SHORT & LONG FORECAST Q3 W28 Y25

Professional Risk Managers👋

Welcome back to another FRGNT chart update📈

Diving into some Forex setups using predominantly higher time frame order blocks alongside confirmation breaks of structure.

Let’s see what price action is telling us today! 👀

💡Here are some trade confluences📝

✅Daily Order block identified

✅4H Order Block identified

✅1H Order Block identified

🔑 Remember, to participate in trading comes always with a degree of risk, therefore as professional risk managers it remains vital that we stick to our risk management plan as well as our trading strategies.

📈The rest, we leave to the balance of probabilities.

💡Fail to plan. Plan to fail.

🏆It has always been that simple.

❤️Good luck with your trading journey, I shall see you at the very top.

🎯Trade consistent, FRGNT X

#AUDUSD:We are yet to see weaken USD! AUDUSD to make yearly highAUDUSD hasn’t seen strong bullish volume yet, but tomorrow’s NFP will be crucial for determining the future trend of the AUDUSD. Based on your analysis, you can set multiple targets.

If you like our work and want to support us, you can do so by following us:

-Liking our ideas

-Commenting on our ideas

-Sharing

Team Setupsfx_

❤️🚀

AUDUSD WEEKLY HIGHER TIME FRAME FORECAST Q3 W27 Y25AUDUSD WEEKLY HIGHER TIME FRAME FORECAST Q3 W27 Y25

Professional Risk Managers👋

Welcome back to another FRGNT chart update📈

Diving into some Forex setups using predominantly higher time frame order blocks alongside confirmation breaks of structure.

Let’s see what price action is telling us today! 👀

💡Here are some trade confluences📝

✅Weekly 50EMA Rejection

✅Daily Order block identified

✅4H Order Block identified

🔑 Remember, to participate in trading comes always with a degree of risk, therefore as professional risk managers it remains vital that we stick to our risk management plan as well as our trading strategies.

📈The rest, we leave to the balance of probabilities.

💡Fail to plan. Plan to fail.

🏆It has always been that simple.

❤️Good luck with your trading journey, I shall see you at the very top.

🎯Trade consistent, FRGNT X

AUD/USD Bearish Reversal SetupAUD/USD Bearish Setup:

Price is showing rejection near resistance around 0.65600 and has broken below the rising channel. A retest of the broken trendline may lead to a drop towards the support zone at 0.65307, and potentially further to the demand zone around 0.65057–0.65000.

The Aussie Dollar Heist Blueprint: "AUD/USD" Long Setup!?🌍 Hello, Global Wealth Warriors! Ciao, Salut, Guten Tag, Ola! 🌟

Fellow Profit Pirates & Market Mavericks, 💸⚡

Unveiling our cunning blueprint to plunder the AUD/USD (The Aussie) forex market, crafted with 🔥Thief Trading’s razor-sharp technical and fundamental insights🔥. Stick to the chart’s game plan, zoned in on a long entry. Our mission? Slip out near the high-stakes RED Zone Level—a perilous spot with overbought vibes, consolidation, trend flips, and traps where bearish bandits lurk. 🏴☠️💰 Celebrate your wins, traders—you’ve earned it! 🎉

Entry 📈 : "The heist is on! Wait for the MA line breakout (0.65200) then make your move - Bullish profits await!"

however I advise to Place Buy stop orders above the ATR line (or) Place buy limit orders within a 15 or 30 minute timeframe most recent or swing, low or high level for Pullback entries.

📌I strongly advise you to set an "alert (Alarm)" on your chart so you can see when the breakout entry occurs.

🛑 **Stop Loss**:

📍 Thief SL parked at the recent/swing low on the 4H timeframe (0.64600) for day/swing trades.

📍 Tailor your SL to your risk appetite, lot size, and number of orders. Stay sharp!

🎯 **Target**: Aim for 0.66300 or make a swift exit just before.

👀 **Scalpers, Listen Up**: Stick to long-side scalping. Got deep pockets? Dive in now! Otherwise, join swing traders for the grand heist. Use trailing SL to shield your loot. 💰

💹 **Market Pulse**: The AUD/USD (The Aussie) forex market is in a ATR Dynamic Resistance zone but leaning bullish, fueled by key drivers. ☝

🌐 Dive into Fundamentals, Macro Insights, COT Reports, Quantitative Analysis, Sentiment Outlook, Intermarket Trends, Future Targets & Overall score.. Check the linkss for the full scoop! 🔗🌍

⚠️ **Trading Alert**: News can shake the market! 📰

🔐 Protect your positions:

- Pause new trades during news releases.

- Use trailing stop-loss to lock in gains.

💪 **Join the Heist**: Smash the Boost Button to supercharge our robbery squad! 💥 With Thief Trading Style, we rake in profits daily with ease. 🚀 Your support fuels our market conquests. 🤝❤️

Stay tuned for the next daring heist, money makers! 🤑🐱👤🎯

#AUDUSD 4H 📉#AUDUSD 4H Sell Setup – Bearish Shift in Play

AUDUSD has tapped into buy-side liquidity at 0.65713, triggering a sharp rejection and signaling a potential Market Structure Reversal (MSR). Price is now approaching a key Order Block (OB) zone, aligning with prevailing bearish order flow.

🔻 Sell Zone: 0.65400 – 0.65000

❌ Stop Loss: Above 0.65713 (Liquidity Level)

🎯 Target: 0.6432

This setup reflects strong rejection from premium pricing and confirmation of bearish momentum. Smart money dynamics suggest a continuation to the downside as price respects resistance and structure.

AUD/USD Shows Bullish Hints, Can Gains Be Sustained?Market Analysis: AUD/USD Shows Bullish Hints, Can Gains Be Sustained?

AUD/USD started a decent increase above the 0.6440 and 0.6465 levels.

Important Takeaways for AUD/USD Analysis Today

- The Aussie Dollar rebounded after forming a base above the 0.6370 level against the US Dollar.

- There was a break above a key bearish trend line with resistance at 0.6470 on the hourly chart of AUD/USD at FXOpen.

AUD/USD Technical Analysis

On the hourly chart of AUD/USD at FXOpen, the pair started a fresh increase from the 0.6370 support. The Aussie Dollar was able to clear the 0.6400 resistance to move into a positive zone against the US Dollar.

There was a close above the 0.6440 resistance and the 50-hour simple moving average. There was a break above a key bearish trend line with resistance at 0.6470. Finally, the pair tested the 0.6520 zone. A high was formed near 0.6519 and the pair recently started a consolidation phase.

The pair dipped and tested the 23.6% Fib retracement level of the upward move from the 0.6372 swing low to the 0.6519 high.

On the downside, initial support is near the 0.6485 level. The next major support is near the 0.6465 zone. If there is a downside break below the 0.6465 support, the pair could extend its decline toward the 0.6445 level. It is close to the 50% Fib retracement level.

Any more losses might signal a move toward 0.6405. On the upside, the AUD/USD chart indicates that the pair is now facing resistance near 0.6520. The first major resistance might be 0.6550. An upside break above 0.6580 might send the pair further higher.

The next major resistance is near the 0.6600 level. Any more gains could clear the path for a move toward 0.6650.

This article represents the opinion of the Companies operating under the FXOpen brand only. It is not to be construed as an offer, solicitation, or recommendation with respect to products and services provided by the Companies operating under the FXOpen brand, nor is it to be considered financial advice.