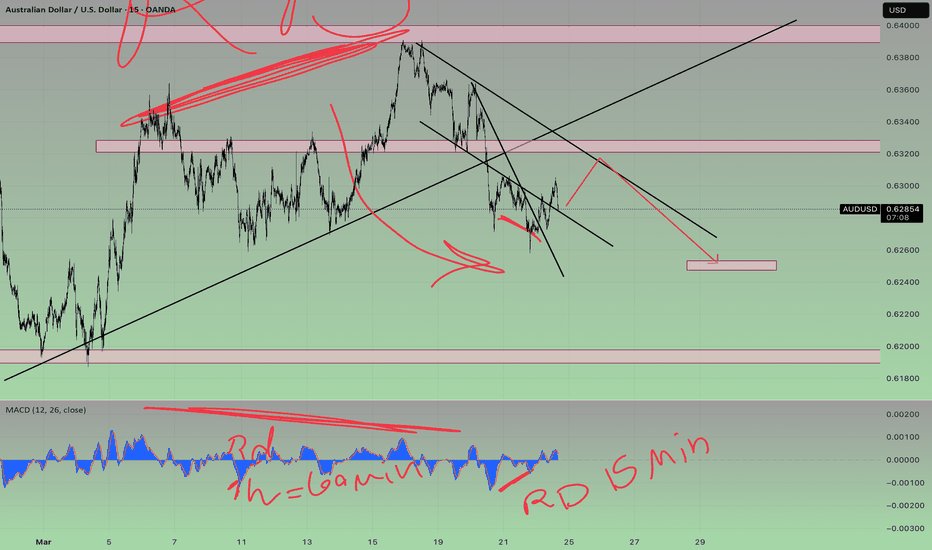

AUDUSD BUYWe have a specific type of divergence on the 1-hour timeframe ⏳, indicating a potential drop 📉 in the higher timeframe. On the other hand, the lower 15-minute timeframe 🕒 gives us a buying perspective 📈. So, the analysis will be as shown in the image.

#audusd #ForexTrading #PriceAction #ForexSignals #TradingAnalysis 💹

Audusdlong

Setup #006 - AUDUSD - Long (Not the cleanest)Trade entered. I used the 5 min for entry but Tradingview doesn't let me post it on a small time frame.

We should find out if this is a winner or loser during the rest of US/UK overlap. I personally think price wants to drop more, but my strategy says to buy, so I'm listening to the strategy, plus there is a nice risk to reward for this trade.

Confluences:

✅ Bullish overall bias

✅ Bulllish demand zone

✅ Bullish ABCD on 15 min chart, bullish impulse crab on H4

✅ Bullish divergence in price reversal zone

✅ Buillish break of structure

✅ Entering NY open

✅ Break of structure confirmed

✅ Required risk:reward met

USDJPY and AUDUSD Top-down analysis Hello traders, this is a complete multiple timeframe analysis of this pair. We see could find significant trading opportunities as per analysis upon price action confirmation we may take this trade. Smash the like button if you find value in this analysis and drop a comment if you have any questions or let me know which pair to cover in my next analysis.

audusd buy signal. Don't forget about stop-loss.

Write in the comments all your questions and instruments analysis of which you want to see.

Friends, push the like button, write a comment, and share with your mates - that would be the best THANK YOU.

P.S. I personally will open entry if the price will show it according to my strategy.

Always make your analysis before a trade

AUDUSD – LONGAUDUSD – LONG

ENTRY PRICE - 0.62850

SL - 0.61800

TP - 0.64900

Always follow the 6 Golden Rules of Money Management:

1. Protect your gains and never enter into a position without setting a stop loss.

2. Always trade with a Risk-Reward Ratio of 1 to 1.5 or better.

3. Never over-leverage your account.

4. Accept your losses, move on to the next trade and trust the software.

5. Make realistic goals that can be achieved within reason.

6. Always trade with money you can afford to lose.

Please leave your comment and support me with like if you agree with my idea. If you have a different view, please also share with me your idea in the comments.

Have a nice day!

AUDUSD BUY signal. Don't forget about stop-loss.

Write in the comments all your questions and instruments analysis of which you want to see.

Friends, push the like button, write a comment, and share with your mates - that would be the best THANK YOU.

P.S. I personally will open entry if the price will show it according to my strategy.

Always make your analysis before a trade

#AUDUSD 1DAYAUDUSD (1D Timeframe) Analysis

Market Structure:

The price has successfully broken above the trendline resistance, indicating a potential shift towards bullish momentum. This breakout suggests that buyers are gaining strength and further upward movement can be expected.

Forecast:

A buy opportunity may arise as long as the price sustains above the broken trendline, confirming the breakout.

Key Levels to Watch:

- Entry Zone: Consider a buy position after a successful retest of the broken trendline or upon confirmation of bullish momentum.

- Risk Management:

- Stop Loss: Placed below the retest level or recent swing low to manage risk.

- Take Profit: Targeting key resistance levels based on historical price action.

Market Sentiment:

The breakout above the trendline resistance signals a positive market sentiment. A retest and sustained move above the breakout level can strengthen the bullish outlook.

AUDUSD: Wait for AB=CD pattern to get completed before buying! AUDUSD is currently making AB=CD pattern where AB pattern already formed, however, for CD pattern to be completed we need to wait NFP data to be published which will give inside data of future trend.

Like and comment for more

Thank you

❤️

AUD/USD "The Aussie" Forex Market Heist Plan🌟Hi! Hola! Ola! Bonjour! Hallo! Marhaba!🌟

Dear Money Makers & Robbers, 🤑💰🐱👤🐱🏍

Based on 🔥Thief Trading style technical and fundamental analysis🔥, here is our master plan to heist the AUD/USD "The Aussie" Forex market. Please adhere to the strategy I've outlined in the chart, which emphasizes long entry. Our aim is the high-risk Red Zone. Risky level, overbought market, consolidation, trend reversal, trap at the level where traders and bearish robbers are stronger. 🏆💸Book Profits Be wealthy and safe trade.💪🏆🎉

Entry 📈 : "The vault is wide open! Swipe the Bullish loot at any price - the heist is on!

however I advise to Place buy limit orders within a 15 or 30 minute timeframe most recent or swing, low or high level. I Highly recommended you to put alert in your chart.

Stop Loss 🛑:

Thief SL placed at the recent / swing low level Using the 4H timeframe (0.62000) swing trade basis.

SL is based on your risk of the trade, lot size and how many multiple orders you have to take.

Target 🎯:

Primary Target - 0.64500 (or) Escape Before the Target

Secondary Target - 0.66000 (or) Escape Before the Target

🧲Scalpers, take note 👀 : only scalp on the Long side. If you have a lot of money, you can go straight away; if not, you can join swing traders and carry out the robbery plan. Use trailing SL to safeguard your money 💰.

📰🗞️Read the Fundamental, Macro, COT Report, Quantitative Analysis, Intermarket Analysis, Sentimental Outlook before start the plan.

AUD/USD "The Aussie" Forex Market market is currently experiencing a bullish trend,., driven by several key factors.

🟠Fundamental Analysis

Australian Economic Growth: Australia's economic growth is expected to remain steady, driven by the country's strong mining sector.

US Economic Growth: The US economic growth is expected to slow down, due to the ongoing trade tensions and weak domestic demand.

Interest Rate Differential: The interest rate differential between Australia and the US is expected to narrow, with Australia's interest rate at 3.1% and the US interest rate at 5.25%.

🟣Macro Economics

Inflation Rate: Australia's inflation rate is expected to remain steady at 2.5%, while the US inflation rate is expected to decrease to 2.2%.

Unemployment Rate: Australia's unemployment rate is expected to remain steady at 3.7%, while the US unemployment rate is expected to increase to 3.7%.

Global Trade: The ongoing trade tensions between the US and China are expected to have a minimal impact on the AUD/USD market.

🟡Global Market Analysis

Forex Market: The global forex market is experiencing a moderate increase in volatility, with the AUD/USD pair experiencing a 0.5% increase in the last 24 hours.

Commodity Market: The global commodity market is experiencing a moderate increase, with iron ore prices increasing by 1.2% in the last 24 hours.

Stock Market: The global stock market is experiencing a moderate decrease, with the S&P 500 index decreasing by 0.3% in the last 24 hours.

🔵COT Data

Speculators (Non-Commercials): 60,000 long positions and 40,000 short positions.

Hedgers (Commercials): 40,000 long positions and 60,000 short positions.

🟠Intermarket Analysis

Correlation with NZD/USD: AUD/USD has a positive correlation with NZD/USD, indicating that a strong New Zealand dollar could boost AUD/USD prices.

Correlation with Commodities: AUD/USD has a positive correlation with commodities, indicating that an increase in commodity prices could boost AUD/USD prices.

🟣Quantitative Analysis

Moving Averages: The 50-day moving average is at 0.62600, and the 200-day moving average is at 0.61800.

Relative Strength Index (RSI): The RSI is at 54, indicating a neutral market sentiment.

🔴Market Sentiment Analysis

The overall sentiment for AUD/USD is neutral, with a mix of positive and negative predictions.

58% of client accounts are long on this market, indicating a bullish sentiment.

🟢Positioning

The long/short ratio for AUD/USD is currently 1.2.

The open interest for AUD/USD is approximately 150,000 contracts.

🟡Next Trend Move

Bullish Prediction: Some analysts predict a potential bullish move, targeting 0.64000 and 0.64500, due to the interest rate differential and the weak dollar.

Bearish Prediction: Others predict a potential bearish move, targeting 0.62500 and 0.62000, due to the ongoing trade tensions and the strong dollar.

🔵Real-Time Market Feed

As of the current time, AUD/USD is trading at 0.63300, with a 0.5% increase in the last 24 hours.

⚪Future Prediction

Short-Term: Bullish: 0.63800-0.64300, Bearish: 0.62800-0.62300

Medium-Term: Bullish: 0.64800-0.65300, Bearish: 0.61800-0.61300

Long-Term: Bullish: 0.66300-0.66800, Bearish: 0.60300-0.59800

🟤Overall Summary Outlook

The market is expected to experience a moderate fluctuation, with some analysts predicting a potential bullish move targeting 0.64000 and 0.64500.

📌Keep in mind that these factors can change rapidly, and it's essential to stay up-to-date with market developments and adjust your analysis accordingly.

⚠️Trading Alert : News Releases and Position Management 📰 🗞️ 🚫🚏

As a reminder, news releases can have a significant impact on market prices and volatility. To minimize potential losses and protect your running positions,

we recommend the following:

Avoid taking new trades during news releases

Use trailing stop-loss orders to protect your running positions and lock in profits

💖Supporting our robbery plan 💥Hit the Boost Button💥 will enable us to effortlessly make and steal money 💰💵. Boost the strength of our robbery team. Every day in this market make money with ease by using the Thief Trading Style.🏆💪🤝❤️🎉🚀

I'll see you soon with another heist plan, so stay tuned 🤑🐱👤🤗🤩

Thu 6th Mar 2025 Daily Forex Charts: 4x New Trade SetupsGood morning fellow traders. On my Daily Forex charts using the High Probability & Divergence trading methods from my books, I have identified 4x new trade setups this morning. As usual, you can read my notes on the charts for my thoughts on these setups. The trades being a AUD/USD Buy, AUD/CHF Buy, NZD/USD Buy & a USD/CAD Sell. I also discuss some trade management. Enjoy the day all. Cheers. Jim

AUDUSD Top-down analysis Hello traders, this is a complete multiple timeframe analysis of this pair. We see could find significant trading opportunities as per analysis upon price action confirmation we may take this trade. Smash the like button if you find value in this analysis and drop a comment if you have any questions or let me know which pair to cover in my next analysis.

EURUSD, AUDUSD and GBPUSD Analysis todayHello traders, this is a complete multiple timeframe analysis of this pair. We see could find significant trading opportunities as per analysis upon price action confirmation we may take this trade. Smash the like button if you find value in this analysis and drop a comment if you have any questions or let me know which pair to cover in my next analysis.

"AUD/USD Bullish Setup: Key Levels to Watch"🔹 Technical Analysis of AUD/USD (4H Chart)

🔹 Market Structure & Trend Analysis

▪️ The price is currently in an uptrend, respecting a rising trendline that has acted as dynamic support.

▪️ Multiple rejections from the trendline indicate strong bullish sentiment.

▪️ The market has broken past key resistance zones, turning them into support.

🔹 Key Support & Resistance Levels

▪️ Support Zones:

▪️ Point of Interest (POI) at 0.62900: A significant demand area where price is expected to react.

▪️ Lower Support at 0.62500: Potential fallback level if the POI fails to hold.

▪️ Resistance Zones:

- 1st Target at 0.64411: Next major resistance where sellers might step in.

- 2nd Target at 0.64972: A higher resistance level for extended bullish targets.

🔹 Price Action & Gaps

- A previous gap in price was filled, confirming strong bullish momentum.

- Retests of previous breakout zones suggest market structure is holding.

🔹 Expected Market Movement

▪️ Bullish Scenario:

- A potential pullback to the trendline & POI is expected before a continuation upward.

- If support holds, price may rally towards 0.64411 (1st Target) and then 0.64972 (2nd Target).

▪️ Bearish Scenario:

- If the price breaks below the trendline, a move towards 0.62500 support may occur.

- Further downside could invalidate the bullish bias.

🔹 Conclusion

▪️ Overall bias remains bullish unless the price breaks below the trendline support.

▪️ Watching the POI zone reaction will be crucial for potential buy opportunities.

▪️ Targets remain at 0.64411 and 0.64972 if bullish momentum continues.

😊 Don't Forget To Hit The Like Button & Share Your Ideas In Comments.

audusd buy signal. Don't forget about stop-loss.

Write in the comments all your questions and instruments analysis of which you want to see.

Friends, push the like button, write a comment, and share with your mates - that would be the best THANK YOU.

P.S. I personally will open entry if the price will show it according to my strategy.

Always make your analysis before a trade

Ghost's AUD/USD Long Setup (Shorter Term Targets)AUD/USD has now seen a 350+ rally off the lows with no substantial pullback. A lot of the time this kind of price action occurs on AU, it tends to extend a lot further than most traders predict but also not to the overly bullish targets retail traders will spout off like 70+ cents.

While I think a revisit to the lows before a long-term bullrun can be seen for AU is likely, I'm aware that price is indicating it's looking for a healthy correction before target the .65 zone, which is the POC for the higher time frames we broke down from weeks ago with no retest.

For these reason and the general understanding of price action and market structure I see a lot on AUD/USD, I'm bullish in the short-term if we can get a steeper pullback to the .629 area after taking profits on my shorts for 50+ pips around .635.

Best of luck team, Ghost Traders FX now for the year of 2025 has 25 wins in a row, almost 500+ pips gained, 0 losses, improving our overall core strategy results to 135 Wins, 18 Breakevens, 7 losses pulling our WR back to 95%+

Feel good to be trading at my best agian.

AUD/USD: Smart Money Loading Up or Another Trap?AUD/USD – Bullish Momentum or Liquidity Grab?

Technical Breakdown:

The Australian Dollar vs. US Dollar (AUD/USD) is showing an interesting setup, with price action hinting at potential continuation to the upside. Let’s dive into the analysis across multiple timeframes to see if buyers are in control or if we’re facing another liquidity trap.

Weekly Timeframe:

• AUD/USD experienced a strong bearish move after reaching 0.6938 in September 2024, followed by a relentless downtrend to 0.6085 by mid-November.

• Since then, we’ve seen a three-week bullish push off the lows, suggesting a potential shift in sentiment.

• A higher low has been established, but the key question remains: Will buyers maintain control?

Daily Timeframe:

• A structural break above 0.6311 signals bullish intent.

• The market previously swept early buyers, forming a double bottom, before pushing back above resistance.

• Current price action is retesting this level, potentially building liquidity for the next leg up.

H4 Timeframe (Trade Execution Level):

• Price printed a higher low at 0.6371, and bullish momentum is attempting to reclaim the recent highs.

• A strong bearish retracement provided a potential early buy entry, setting up a high reward-to-risk trade.

• If price holds above the 0.6359 entry zone, we could see further upside targets.

Entry & Risk Management:

• Entry: 0.6359

• Stop Loss: 0.6371 (tight 5-pip stop)

• First Target: 0.6408 (1:6 RR)

• Final Target: 0.6446 (1:9-1:10 RR)

Market Psychology & Liquidity Play:

• Many traders chased the highs and placed stop losses below local support—these were swept out.

• A large bullish volume candle remains significant, hinting at strength in buyers.

• If the market sustains momentum, we could see a move toward higher resistance at 0.6446.

Conclusion:

AUD/USD is setting up for a potential bullish breakout, but traders must watch for confirmations on lower timeframes. If price structure holds, this could be a highly profitable swing trade.

Like this breakdown? Follow, boost the post, and drop your thoughts in the comments! Let’s see where AUD/USD heads next.

AUD/USD Bullish Breakout Signals Further UpsideAUD/USD has broken out of a bullish flag pattern on the 4-hour timeframe, suggesting continued upward momentum. A buy entry is recommended at a retest of the former resistance level near 0.63700, now acting as support, aligning with a key bullish trendline.

Technical Observations:

Higher High Formation: The AUD/USD pair has established a higher high on the 4-hour chart, confirming an ongoing bullish trend.

Bullish Flag Breakout: Price has decisively broken above a well-defined bullish flag pattern, typically a continuation pattern that signals further upside.

Support Confirmation: The 0.63700 level, previously acting as resistance, is anticipated to act as support upon a retest.

Trendline Confluence: A bullish trendline further reinforces the support zone near the 0.63700 level.

Trading Recommendation:

Entry Point: Buy AUD/USD near the retest of the 0.63700 level.

Stop Loss: Place a stop loss at 0.63200 to manage risk.

Take Profit 1: 0.64200

Take Profit 2: 0.64700

Disclaimer:

This analysis is for informational purposes only and does not constitute financial advice. Trading involves risk, and you should carefully consider your risk tolerance before making any investment decisions.